Explore a variety of free XLS templates designed specifically for tracking loan applications. These templates allow you to input essential information such as applicant details, loan amounts, interest rates, and application statuses. Features like filters and conditional formatting enhance usability, enabling you to effortlessly monitor and manage multiple loan applications in one comprehensive spreadsheet.

Loan application tracker Excel template for small business

![]()

💾 Loan application tracker Excel template for small business template .xls

Loan application tracker Excel templates for small businesses help streamline the process of applying for loans by organizing essential information in a user-friendly format. This template typically includes sections for tracking lender details, application statuses, required documentation, and deadlines. You can easily input data specific to each loan application, allowing for better management of multiple applications simultaneously. These templates not only promote efficiency but also serve as a reference point for basic loan management needs, with potential for advanced financial modeling, forecasting, and analysis in the context of business growth strategies.

Personal loan application tracker Excel template

![]()

💾 Personal loan application tracker Excel template template .xls

A personal loan application tracker Excel template is a structured spreadsheet designed to help individuals manage and monitor their loan applications efficiently. It typically includes columns for essential information such as lender names, application dates, loan amounts, interest rates, and application statuses. You can also track follow-up dates, required documents, and any notes regarding specific lenders. This organized approach not only streamlines the loan application process but also assists in comparing different loan offers, ensuring you make informed decisions as you navigate financing options. Using such a template can lay the groundwork for more advanced financial management tools, such as integrating it with budgeting software or automating investment tracking systems.

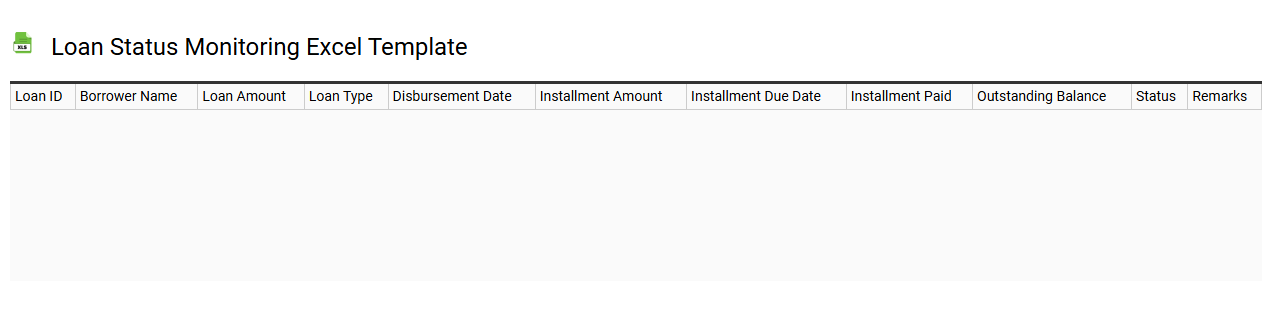

Loan status monitoring Excel template

💾 Loan status monitoring Excel template template .xls

A Loan Status Monitoring Excel template is a structured tool designed to help individuals or financial institutions track and manage loans effectively. This template typically includes columns for essential loan details such as the borrower's name, loan amount, interest rate, payment due dates, and outstanding balance. Visual aids like color-coded indicators or graphs enhance clarity, allowing you to quickly assess the status of multiple loans at a glance. Employing this template facilitates effective financial management while offering potential for customization to incorporate advanced features like automated reminders or integration with financial forecasting models.

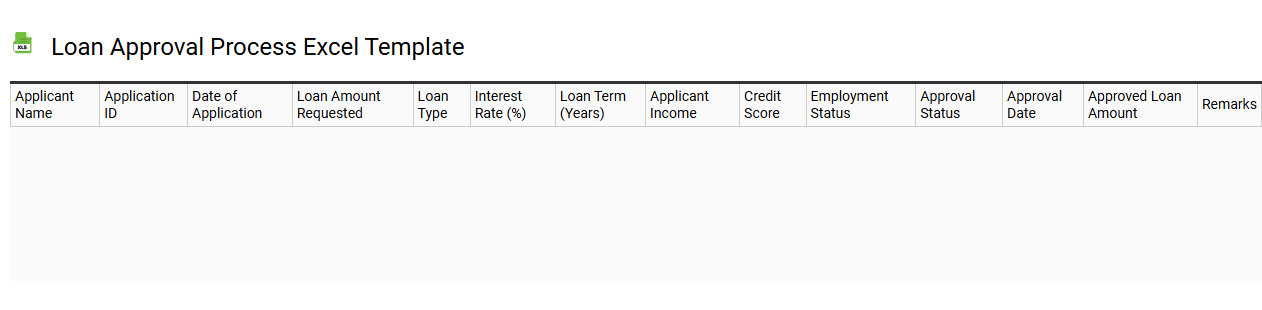

Loan approval process Excel template

💾 Loan approval process Excel template template .xls

A Loan Approval Process Excel template streamlines the evaluation and approval of loan applications, helping financial institutions manage data efficiently. The template typically consists of sections for applicant information, loan details, credit history, income verification, and risk assessment metrics. Visual elements like charts and graphs may be included to aid decision-makers in quickly reviewing financial health and repayment capability. This structured approach enhances accuracy and reduces processing time, while also allowing for customization to fit specific needs, such as integrating advanced modeling techniques for risk analysis or ROI calculations.

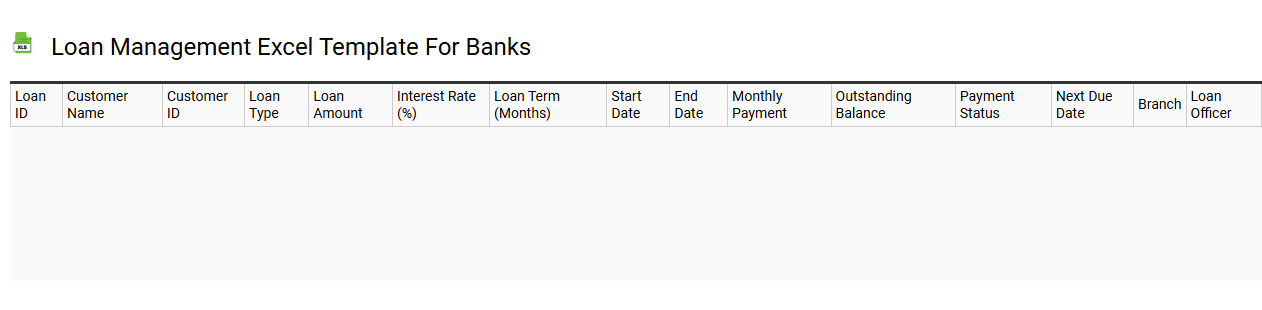

Loan management Excel template for banks

💾 Loan management Excel template for banks template .xls

A Loan Management Excel template for banks is a structured spreadsheet designed to facilitate the tracking and management of loans. This template typically includes sections for loan details, borrower information, interest rates, payment schedules, and outstanding balances. Each entry allows for easy calculation of monthly payments and interest accruals, helping bankers maintain accurate records and ensure timely follow-ups. You can customize this template further to accommodate advanced analysis, such as risk assessment, performance metrics, and forecasting loan default rates.

Home loan tracker Excel template

![]()

💾 Home loan tracker Excel template template .xls

A Home Loan Tracker Excel template is a specialized spreadsheet designed to help you effectively monitor your home loan payments and manage financial details. It typically includes features such as loan balance calculations, payment schedules, interest rate tracking, and total interest paid over time. You can input various loan terms like principal amount, duration, and interest rates to visualize your payment progress and outstanding balance. This tool simplifies tracking and can be a foundation for more advanced analyses, such as cash flow forecasting or investment impact assessments.

Business loan application tracker Excel template

![]()

💾 Business loan application tracker Excel template template .xls

A Business Loan Application Tracker Excel template is a specialized spreadsheet designed to help you monitor the progress of your loan application process. This tool typically includes key columns for lender names, application dates, loan amounts requested, interest rates, and approval status. You can input supporting documentation deadlines and critical follow-up dates, making it easier to stay organized throughout the process. As you track your application, consider expanding your template to include sections for repayment schedules and cash flow projections to meet advanced financial planning needs.