Explore a range of free XLS templates designed for custom loan calculations. These templates typically include sections for inputting loan amount, interest rate, loan term, and monthly payment calculations. Easy-to-use formulas provide instant results, helping you visualize total repayment costs, interest accrued, and amortization schedules effectively.

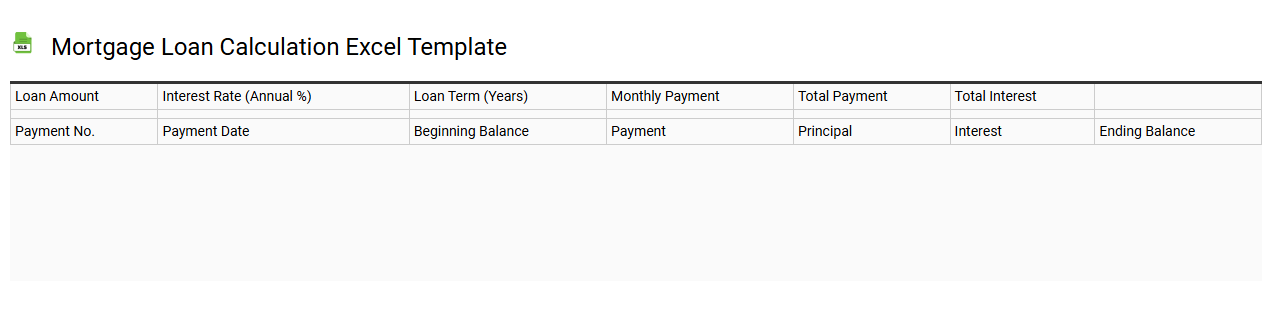

Mortgage loan calculation Excel template

💾 Mortgage loan calculation Excel template template .xls

A Mortgage loan calculation Excel template is a user-friendly spreadsheet designed to help you estimate mortgage payments based on various parameters. It typically includes fields for principal amount, interest rate, loan term, and additional costs such as property taxes and insurance. Formulas within the template automatically calculate monthly payments, total interest paid over the life of the loan, and remaining balance at any point in time. This basic tool can expand into more complex analyses, allowing you to explore advanced topics such as amortization schedules and the impact of changing interest rates on your financial strategy.

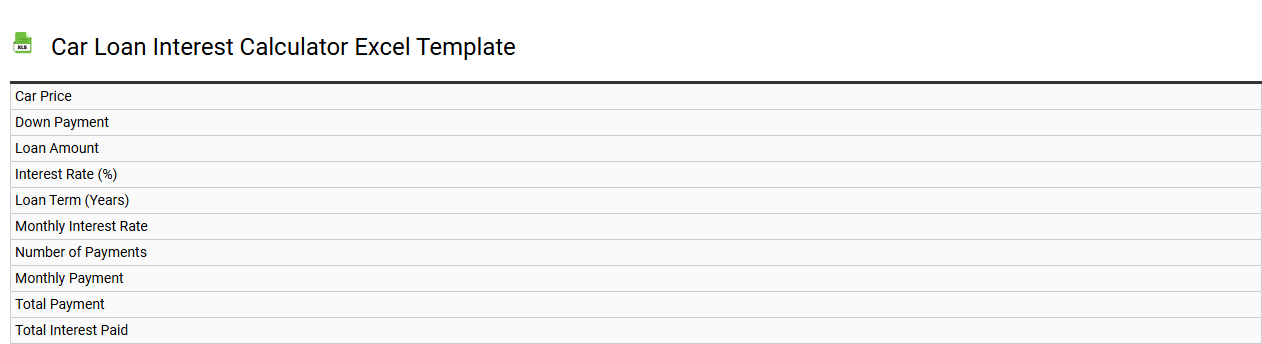

Car loan interest calculator Excel template

💾 Car loan interest calculator Excel template template .xls

A Car Loan Interest Calculator Excel template is a pre-designed spreadsheet that enables you to estimate the costs associated with financing a vehicle. This tool helps you input essential data including loan amount, interest rate, loan term, and monthly payments, allowing you to visualize the financial implications before committing to a loan. You can see how different interest rates or loan amounts may affect your monthly payments and the total cost of the loan over time. For advanced usage, consider incorporating features like amortization schedules or adjustable interest rates to tailor your financial planning further.

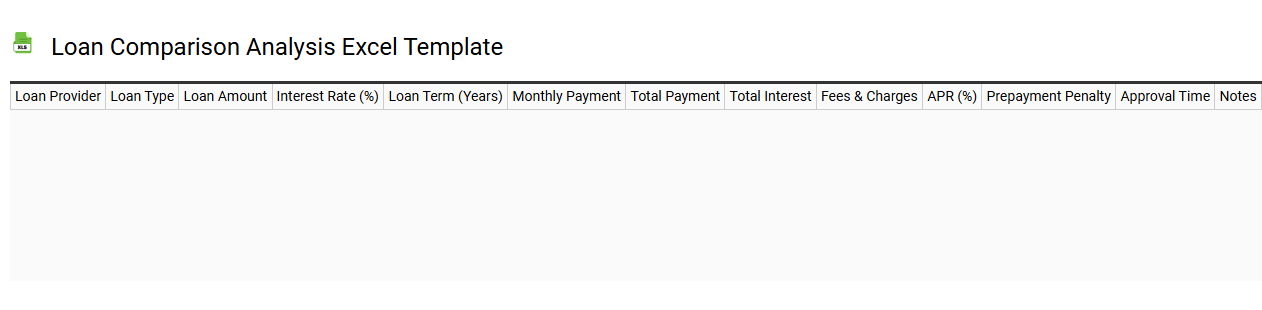

Loan comparison analysis Excel template

💾 Loan comparison analysis Excel template template .xls

A loan comparison analysis Excel template enables you to evaluate different loan options side by side. This template typically includes columns for loan amount, interest rate, term length, monthly payment, and total interest paid over the life of the loan. You can easily visualize how varying interest rates or loan lengths impact your financial commitments. For basic usage, this tool is invaluable for making informed borrowing decisions, while advanced features could include amortization schedules and sensitivity analysis to assess how changes in terms affect your repayment plan.

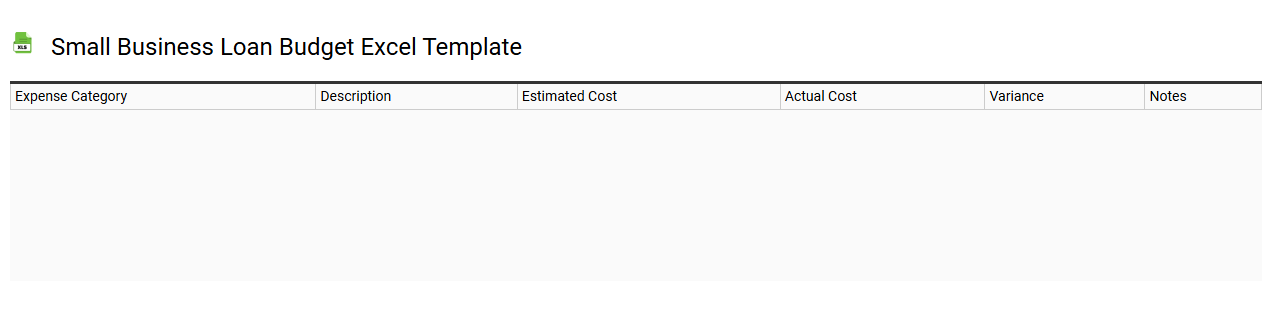

Small business loan budget Excel template

💾 Small business loan budget Excel template template .xls

A Small Business Loan Budget Excel template is a financial planning tool designed to help business owners manage their loan funds and expenditures effectively. This template typically includes sections for tracking loan amounts, interest rates, monthly payments, and associated costs, allowing you to visualize cash flow and budget allocation. You can input your income and expenses to project your financial standing over time, making it easier to determine the sustainability of your loan commitments. As your business grows, you may find advanced features like scenario analysis or integrated financial forecasting beneficial in optimizing funding strategies and planning for future investments.

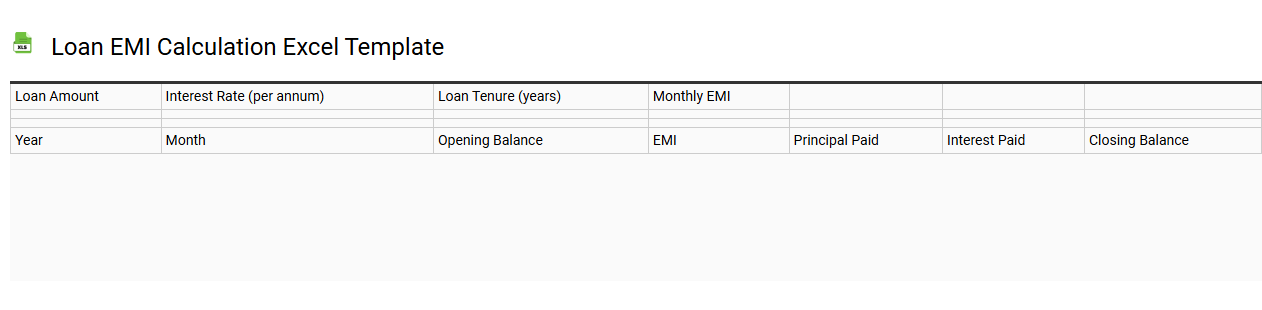

Loan EMI calculation Excel template

💾 Loan EMI calculation Excel template template .xls

A Loan EMI calculation Excel template is a pre-designed spreadsheet that aids you in determining the Equated Monthly Installment (EMI) for loans such as personal loans, home loans, or car loans. It typically includes fields for entering loan amount, interest rate, and loan tenure, allowing you to visualize the monthly repayment structure instantly. Users can modify variables easily to see how changes in principal, rate, or term affect the EMI, enhancing understanding of financial commitments. This tool serves basic purposes, but can also be expanded to include amortization schedules, prepayment options, or graphical representations of payment breakdowns.

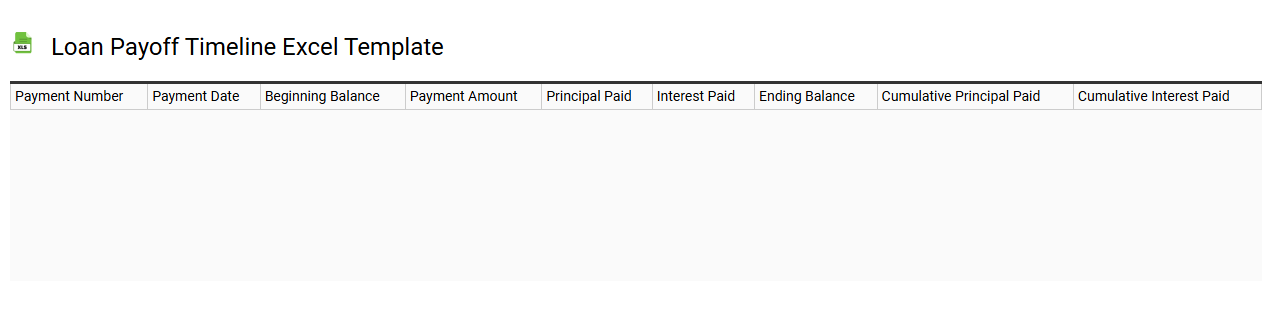

Loan payoff timeline Excel template

💾 Loan payoff timeline Excel template template .xls

A Loan payoff timeline Excel template is a structured spreadsheet designed to help individuals track their loan repayment progress. This tool typically includes key information like the loan amount, interest rate, payment frequency, and due dates. Users can visualize their payments over time, seeing how much principal and interest are paid with each installment, as well as the remaining balance after each payment. Beyond basic loan tracking, this template can also be adapted for complex scenarios, including multiple loans, varying interest rates, or strategies for accelerated payoff through additional payments.

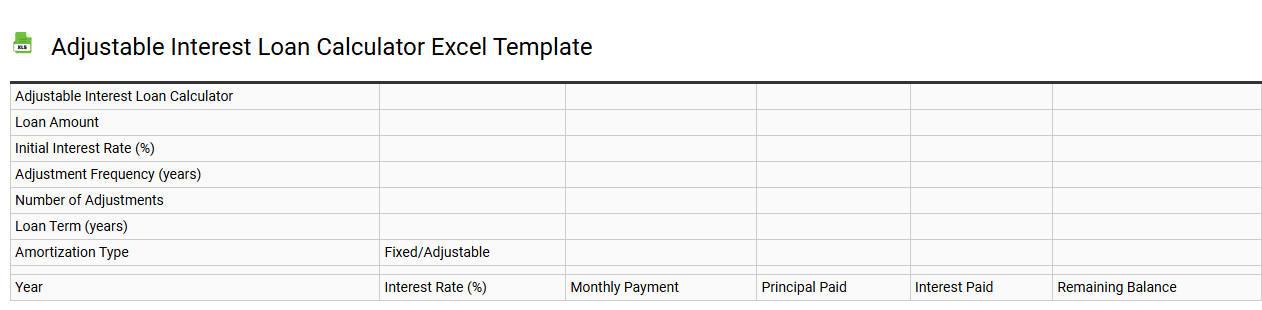

Adjustable interest loan calculator Excel template

💾 Adjustable interest loan calculator Excel template template .xls

An Adjustable Interest Loan Calculator Excel template is a spreadsheet designed to help users calculate mortgage payments or loans where interest rates can fluctuate over time. This template typically includes input fields for principal amount, initial interest rate, adjustment periods, and adjustment caps. As you input your data, the spreadsheet automatically calculates monthly payments, total interest paid, and remaining balance after each adjustment period. This tool is essential for understanding the financial implications of loans that are subject to rate changes and can be tailored for advanced financial modeling needs, such as scenarios involving varying interest rates or complex amortization schedules.