Discover a collection of free XLS templates designed specifically for tracking your monthly loan expenses. Each template features user-friendly layouts, allowing you to easily input your loan details, payment dates, and relevant interest rates. With built-in formulas to calculate total expenses and remaining balances, you can effortlessly monitor your financial commitments and plan your budget more effectively.

Monthly loan expense tracker Excel template

![]()

💾 Monthly loan expense tracker Excel template template .xls

A monthly loan expense tracker Excel template is a dedicated spreadsheet designed to help you monitor and manage your loan repayments systematically. It typically includes sections for inputting loan details such as principal amount, interest rate, and monthly payment due dates, allowing for easy tracking of each transaction. You can visualize your repayment progress with charts and graphs, enhancing clarity in how much you owe and when payments are due. This simple tool can evolve into a comprehensive financial management system by integrating advanced features like amortization schedules and forecasting capabilities.

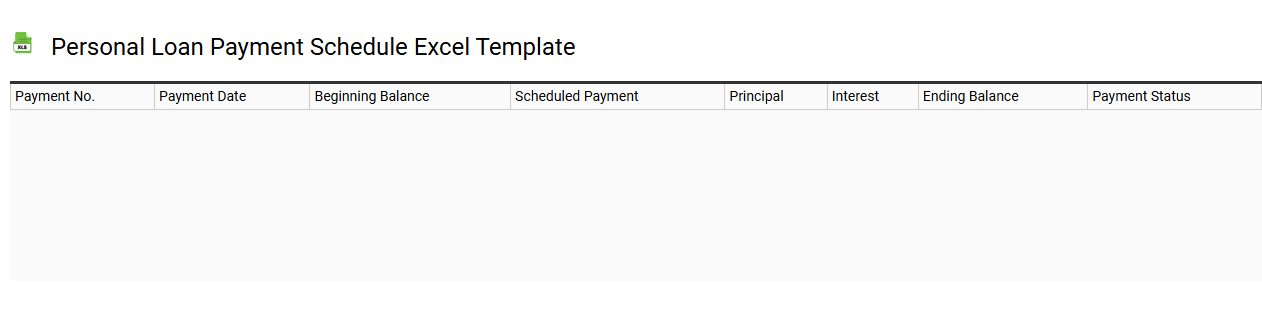

Personal loan payment schedule Excel template

💾 Personal loan payment schedule Excel template template .xls

A Personal loan payment schedule Excel template is a structured tool designed to help you manage and track your loan repayments efficiently. This template typically includes fields for loan amount, interest rate, loan term, and payment frequency, allowing you to visualize your repayment timeline clearly. You can input your loan details, and the spreadsheet automatically calculates monthly payments, shows an amortization table, and tracks outstanding balances over time. With this template, you can easily monitor your progress and comply with your budget, preparing for more advanced financial tracking needs, such as incorporating various loan types or managing multiple debts with detailed analytics.

Home loan repayment tracker Excel template

![]()

💾 Home loan repayment tracker Excel template template .xls

A Home Loan Repayment Tracker Excel template is a structured spreadsheet designed to help you monitor and manage your mortgage payments efficiently. This tool allows you to input details such as the loan amount, interest rate, term length, and payment frequency, enabling you to visualize your repayment schedule over time. You can track your monthly payments, principal and interest breakdowns, and remaining balance, providing a clear overview of your financial progress. For advanced usage, you may also incorporate features like amortization schedules, prepayment calculations, or compare multiple loan scenarios to optimize your repayment strategy.

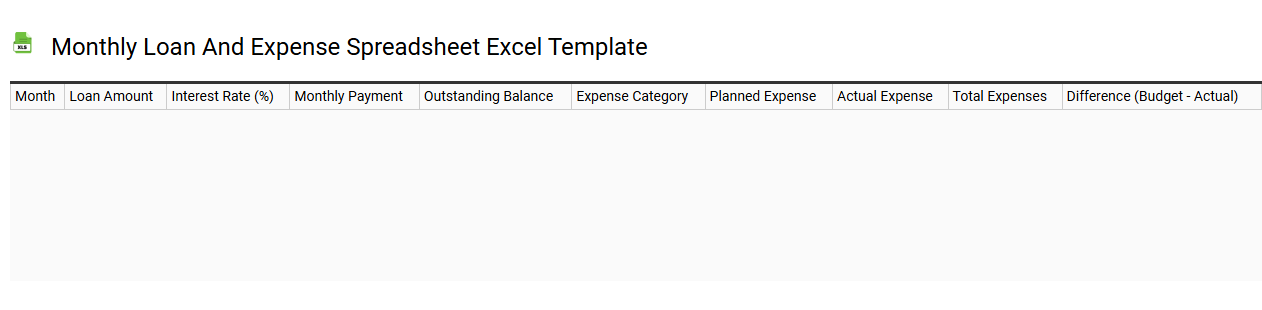

Monthly loan and expense spreadsheet Excel template

💾 Monthly loan and expense spreadsheet Excel template template .xls

A Monthly loan and expense spreadsheet Excel template is a structured toolkit designed to help you track your financial obligations and expenditures. This template allows you to input various loans, detailing principal amounts, interest rates, payment schedules, and due dates, providing a clear overview of your financial commitments. It also incorporates expense tracking features, enabling you to categorize and monitor your spending in real-time across different areas such as housing, utilities, and groceries. For personal finance management or budgeting, this template serves as an essential starting point, with the potential for more advanced uses such as incorporating automated formulas and pivot tables for in-depth data analysis and forecasting.

Small business loan expense tracker Excel template

![]()

💾 Small business loan expense tracker Excel template template .xls

A small business loan expense tracker Excel template is a powerful tool designed to help entrepreneurs monitor and manage expenses related to their business loans. This template typically includes categories such as interest payments, principal repayment, origination fees, and miscellaneous costs, enabling you to maintain a clear overview of your financial obligations. With built-in formulas, it automatically calculates totals and provides visual representations of your expenses, fostering better budgeting and financial planning. As your business grows, such a template can also be expanded to include advanced financial analysis, cash flow projections, and scenario modeling to meet your evolving needs.

Multiple loan tracking Excel template

![]()

💾 Multiple loan tracking Excel template template .xls

A Multiple Loan Tracking Excel template serves as an organized tool for individuals or businesses to monitor various loans simultaneously. This template typically includes sections for loan amounts, interest rates, payment schedules, and outstanding balances. You can customize it to reflect different types of loans, such as mortgages, personal loans, and student loans, making it easier to manage your financial commitments. Such a template not only simplifies regular tracking but also provides insights into potential refinancing opportunities or adjustments for debt management strategies.

Loan repayment tracker Excel template

![]()

💾 Loan repayment tracker Excel template template .xls

A Loan Repayment Tracker Excel template is a structured tool designed to help you monitor and manage your loan payments efficiently. It typically includes columns for loan amount, interest rate, monthly payment, due dates, and payment statuses, allowing you to easily visualize your repayment schedule. You can customize it to track multiple loans simultaneously and see your remaining balance after each payment. This template serves basic budget management needs while also offering potential for advanced financial analysis such as cash flow projections and scenario modeling.

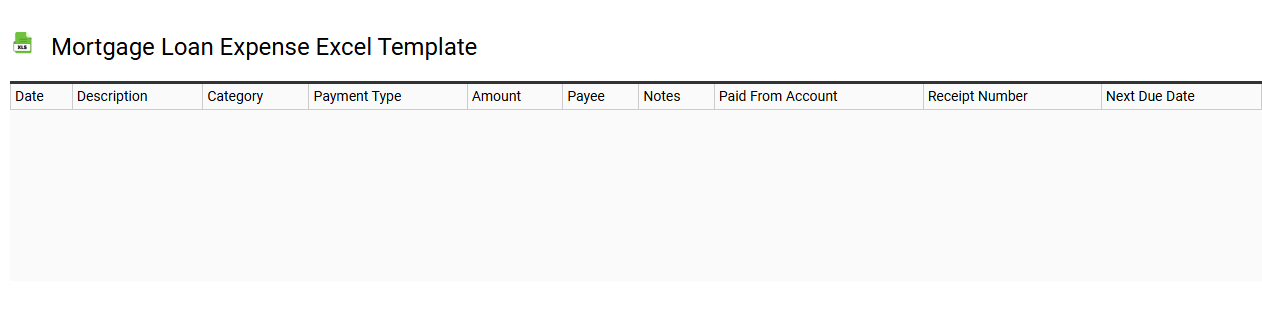

Mortgage loan expense Excel template

💾 Mortgage loan expense Excel template template .xls

A Mortgage Loan Expense Excel template is a practical tool designed to help you track all costs associated with a mortgage loan. This template typically includes sections for principal, interest, property taxes, homeowner's insurance, and any additional fees like PMI or closing costs. You can customize it to input your personal loan details, enabling you to monitor your monthly payments and overall financial commitments. This organized approach facilitates budgeting and can assist you in future needs, such as refinancing or calculating equity growth, incorporating advanced metrics like amortization schedules or interest rate fluctuations.

Business loan tracker Excel template

![]()

💾 Business loan tracker Excel template template .xls

A Business Loan Tracker Excel template is a structured spreadsheet designed to help you monitor and manage your business loans efficiently. It typically includes sections for loan amounts, interest rates, payment schedules, and due dates, allowing you to stay organized and make timely payments. You can also track the remaining balance and total interest paid over time, giving you a clear overview of your financial obligations. With this tool, you can fulfill basic tracking needs while having the capacity to integrate advanced metrics, such as amortization schedules and cash flow analysis, to enhance your financial planning.

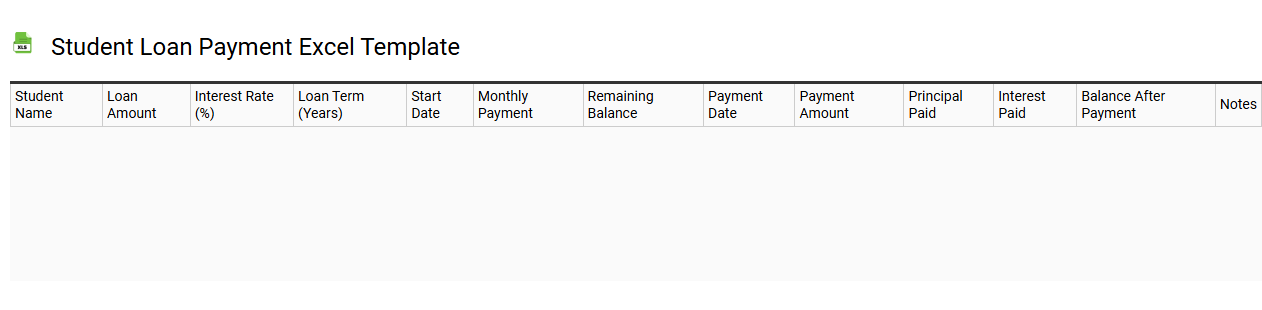

Student loan payment Excel template

💾 Student loan payment Excel template template .xls

A Student Loan Payment Excel template is a customizable spreadsheet designed to help users track their student loan payments efficiently. The template typically includes columns for the loan amount, interest rate, payment due dates, payment history, and remaining balance. By entering your loan details, you can easily visualize your repayment progress and manage your finances. With this tool, you can also calculate how changes in interest rates or payment amounts affect your overall repayment timeline, enabling a more strategic approach to managing your educational debt and planning for potential future financial goals such as refinancing or consolidating loans.

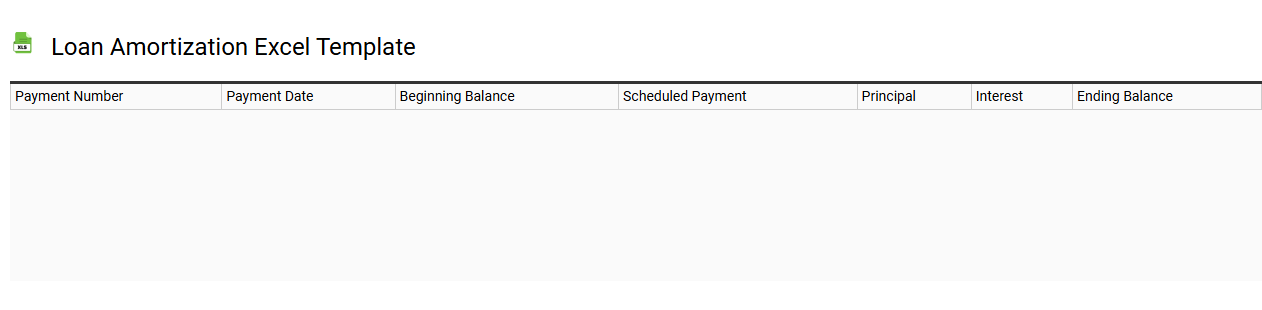

Loan amortization Excel template

💾 Loan amortization Excel template template .xls

A Loan Amortization Excel template is a financial tool designed to help you calculate and visualize the amortization schedule of a loan. It typically includes details such as the principal amount, interest rate, loan term, and payment frequency. The template generates a comprehensive breakdown of each payment, specifying how much goes toward the principal versus the interest over the loan's lifespan. This resource can aid you in managing your budget and understanding payment structures, while further advanced features could include options for variable interest rates and additional payments.

Monthly debt and loan tracker Excel template

![]()

💾 Monthly debt and loan tracker Excel template template .xls

A Monthly Debt and Loan Tracker Excel template is a versatile tool designed to help individuals manage and oversee their debts and loan obligations. The template typically includes fields for inputting different types of loans, such as personal, student, or mortgage loans, alongside details like outstanding balances, interest rates, and due dates. You can also input your monthly payments to monitor progress in reducing debt over time. This template serves not only for tracking basic payments but can be expanded to include projections, amortization schedules, and comparisons of interest rates for strategic financial planning.

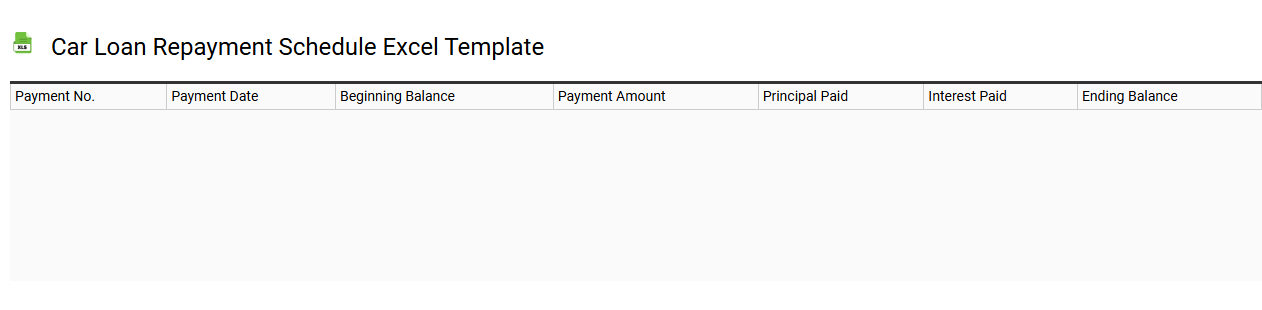

Car loan repayment schedule Excel template

💾 Car loan repayment schedule Excel template template .xls

A Car loan repayment schedule Excel template is a preformatted tool designed to help you track and manage your auto loan payments. This spreadsheet typically includes fields for the loan amount, interest rate, loan term, and monthly payment, allowing you to visualize your repayment plan over time. Each row may detail individual payment dates, the principal and interest components of each payment, and the remaining balance after each installment. Understanding this layout can assist you in budgeting, ensuring timely payments, and preparing for any potential adjustments you may need to make, such as early repayment options or refinancing with more complex interest structures like balloon payments.