Explore an array of free XLS templates designed for calculating Loan EMI breakdowns. These templates streamline the process of tracking your monthly payments, interest rates, and total repayment amounts, allowing you to visualize your financial commitments clearly. With customizable features, you can easily input your loan details to generate an organized and comprehensive amortization schedule.

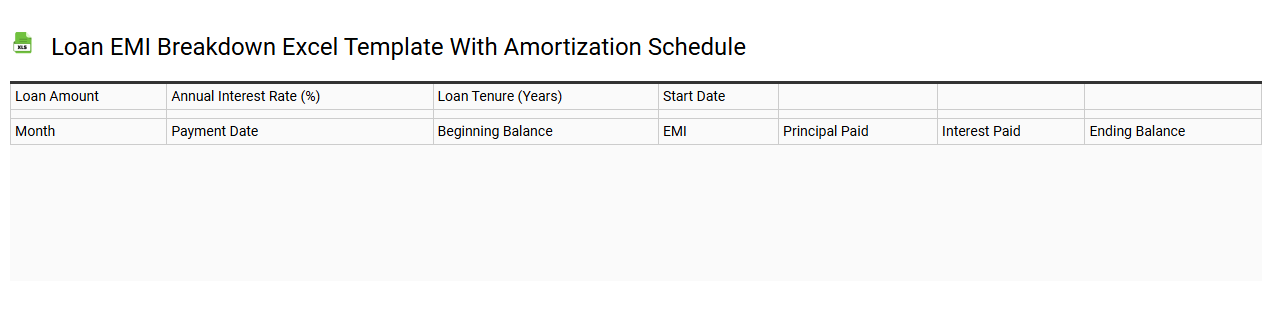

Loan EMI breakdown Excel template with amortization schedule

💾 Loan EMI breakdown Excel template with amortization schedule template .xls

A Loan EMI breakdown Excel template offers a clear and organized way to track your loan repayments, including principal and interest components. Each row typically represents a payment period, detailing the EMI amount due, interest paid, principal repayment, and remaining balance. The amortization schedule visually represents how your loan is being paid down over time, showcasing the decreasing interest portion as the principal reduces. This tool not only aids in managing your current loans but can also assist in modeling different loan scenarios, helping you understand potential impacts of varying interest rates or repayment durations, such as in fixed-rate versus variable-rate loans or advanced debt restructuring strategies.

Personal loan EMI tracker Excel template

![]()

💾 Personal loan EMI tracker Excel template template .xls

A Personal Loan EMI Tracker Excel template is a financial tool designed to help you monitor your Equated Monthly Installments (EMI) for personal loans. This template typically features a user-friendly layout, allowing you to input loan details such as principal amount, interest rate, and loan tenure. It calculates your monthly EMI and provides a breakdown of the interest and principal components over the loan tenure, facilitating easy tracking of payments. You can also customize it with additional details like payment dates and outstanding balances, helping you manage your finances and plan for future needs, including the potential for refinancing or consolidating debt.

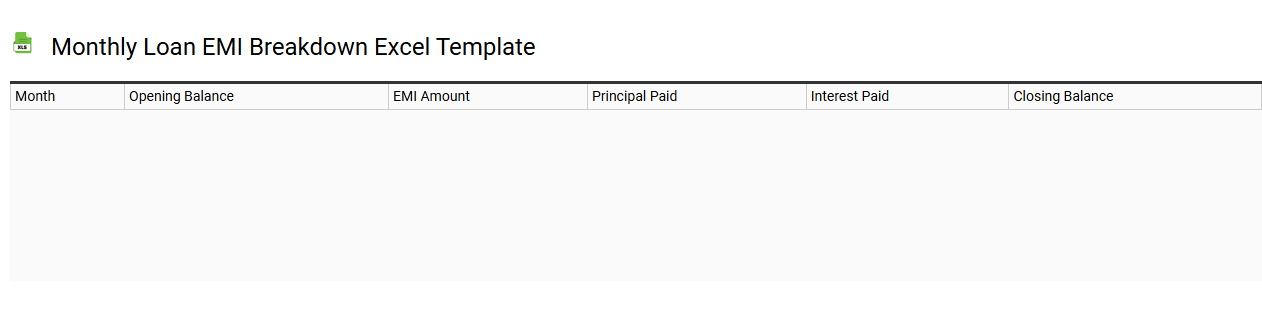

Monthly loan EMI breakdown Excel template

💾 Monthly loan EMI breakdown Excel template template .xls

A Monthly loan EMI (Equated Monthly Installment) breakdown Excel template provides a systematic way to analyze and manage loan repayments. It typically includes columns for principal amount, interest rate, loan tenure, and calculated monthly payments, allowing you to see how much of each payment goes toward the principal and how much is allocated for interest. A user-friendly layout enables quick adjustments to the loan parameters, reflecting changes in interest rates or loan terms promptly. This tool is beneficial not only for tracking current loans but also for planning future borrowing scenarios with the potential for incorporating advanced financial concepts like amortization schedules and cash flow analysis.

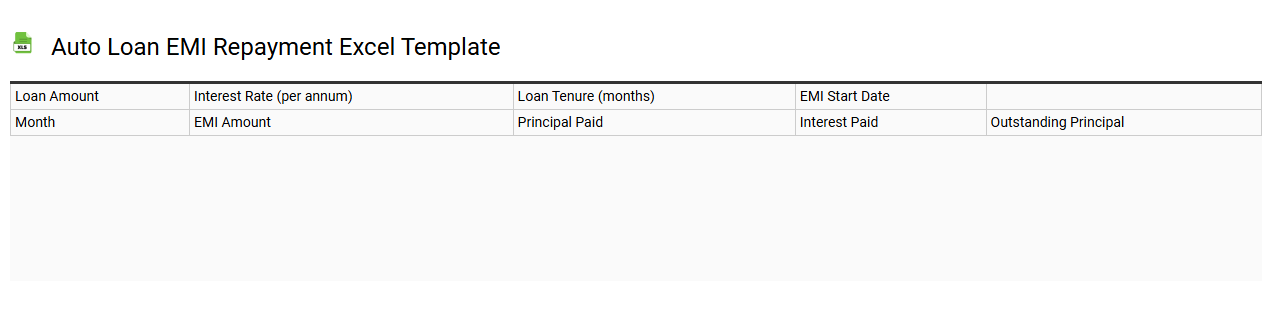

Auto loan EMI repayment Excel template

💾 Auto loan EMI repayment Excel template template .xls

An Auto Loan EMI repayment Excel template is a structured spreadsheet that helps you calculate your Equated Monthly Installments (EMIs) for an auto loan. This tool allows you to input the principal loan amount, interest rate, and loan tenure, automatically generating the monthly payments, total interest payable, and total repayment amount. It visually represents your repayment schedule, making it easier for you to track your financial obligations over time. For users with advanced needs, this template can also incorporate additional features such as amortization schedules, early repayment calculators, and interest fluctuation scenarios.

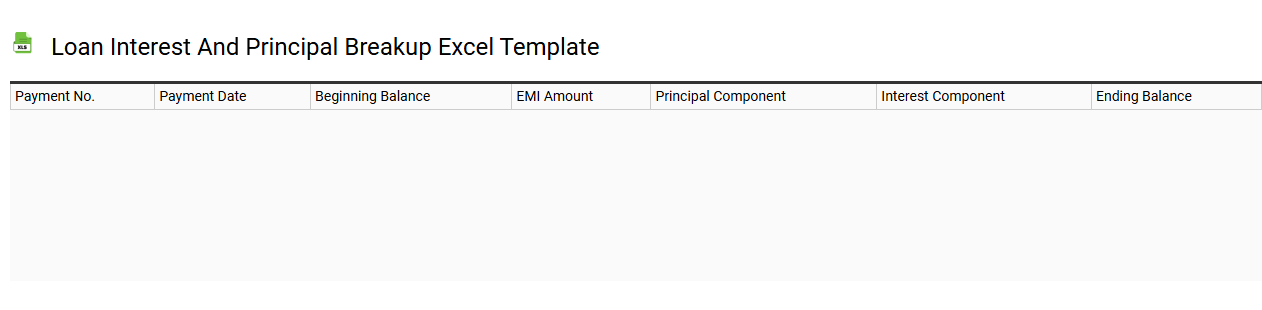

Loan interest and principal breakup Excel template

💾 Loan interest and principal breakup Excel template template .xls

A Loan Interest and Principal Breakup Excel template visually breaks down your loan payments into two primary components: the principal and the interest. The template typically features columns for the payment period, payment amount, the portion allocated to interest, the portion allocated to principal, and the remaining balance after each payment. This clear organization enables you to track how much of your payment reduces the loan balance and how much goes towards interest over time. You can customize this template to accommodate various loan types, repayment schedules, and even advanced calculations like amortization schedules or total payment forecasts to help manage your financial strategy effectively.

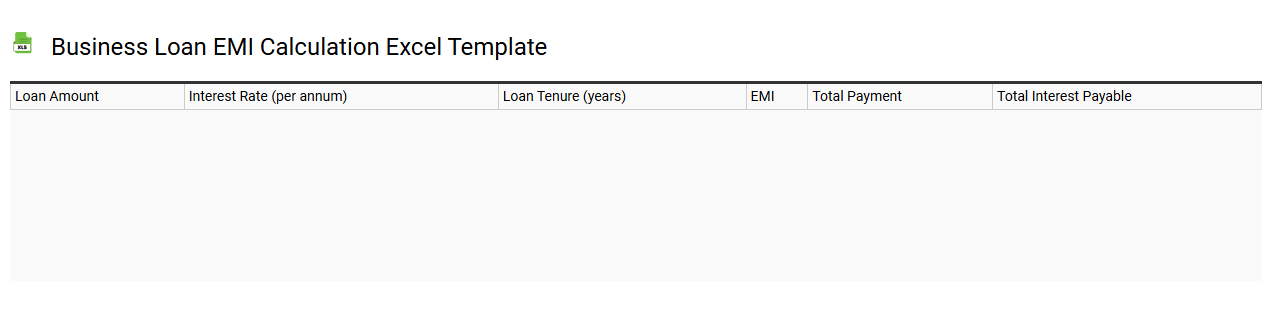

Business loan EMI calculation Excel template

💾 Business loan EMI calculation Excel template template .xls

A Business Loan EMI Calculation Excel template is a specialized spreadsheet designed to help entrepreneurs or business owners determine their monthly loan repayment amounts. This template typically includes fields for entering the principal loan amount, interest rate, and loan tenure, allowing for straightforward calculation of Equated Monthly Installments (EMI). Often, it comes with built-in formulas that calculate not only the EMI but also the total amount to be repaid and the interest payable over the loan term. Understanding how to utilize this template can cater to your immediate financing needs while providing a basis for more complex financial analyses, such as cash flow projections or investment assessments.

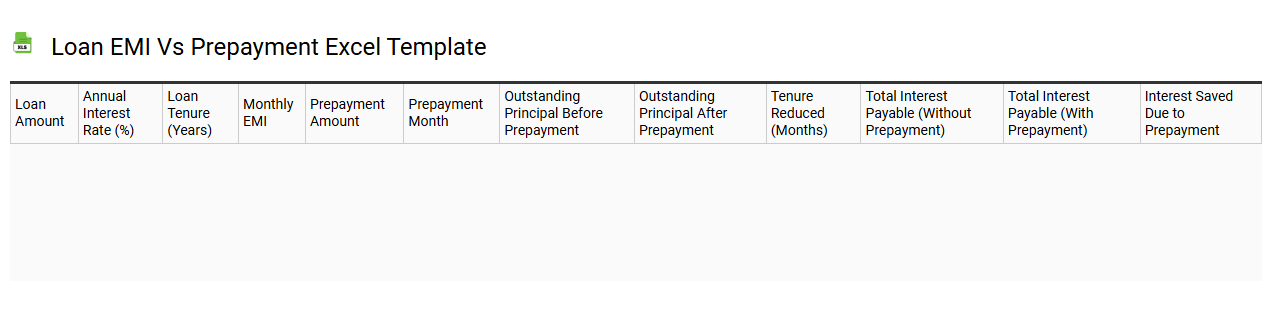

Loan EMI vs prepayment Excel template

💾 Loan EMI vs prepayment Excel template template .xls

A Loan EMI vs. prepayment Excel template helps you visualize the impact of periodic payments and prepayments on your loan. It typically includes sections for entering loan details such as principal amount, interest rate, and tenure, allowing you to calculate your Equated Monthly Installments (EMI). The template may also display how making prepayments can reduce your total interest outgo and overall loan tenure, helping you make informed financial decisions. This tool assists in optimizing your repayment strategy, offering insights for basic loan management and advanced forecasting of potential savings through prepayments.

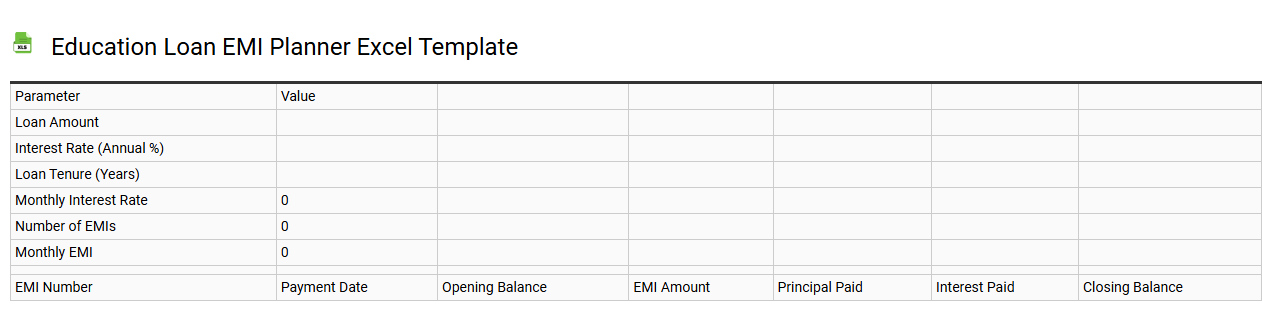

Education loan EMI planner Excel template

💾 Education loan EMI planner Excel template template .xls

An Education Loan EMI Planner Excel template is a structured spreadsheet designed to help you calculate and manage the Equated Monthly Installments (EMIs) for education loans. It typically includes input fields for the loan amount, interest rate, tenure, and processing fees, which automatically generate the monthly payment figure. Features may include graphs to visualize repayment schedules, total interest payable, and an amortization table detailing each month's principal and interest breakdown. This template can facilitate informed financial decisions and budgeting, while more advanced users may delve into scenario analysis or integrate with personal finance management tools for comprehensive insights.

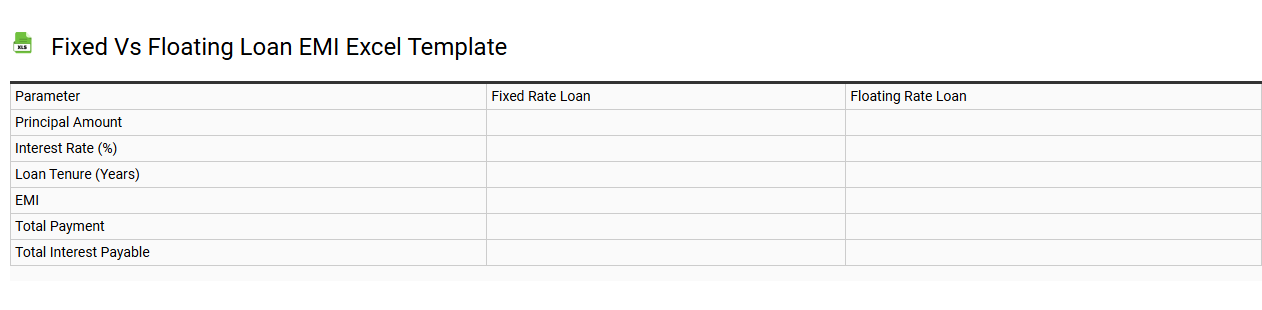

Fixed vs floating loan EMI Excel template

💾 Fixed vs floating loan EMI Excel template template .xls

A Fixed vs Floating Loan EMI Excel template is designed to help you compare two distinct loan types--fixed-rate and floating-rate loans. This tool allows you to input various parameters such as loan amount, interest rates, and tenure, generating a clear breakdown of monthly equated monthly installments (EMIs) for both options. You can visualize how interest fluctuations impact your overall loan costs, making it easier to choose the most suitable financing option for your needs. By understanding the differences in repayment structures, you can enhance your financial planning, whether for your home, vehicle, or business loan, while being equipped to explore further needs such as amortization schedules or sensitivity analysis.