Explore a range of free XLS templates designed specifically for loan default monitoring, catering to diverse financial needs. These templates provide structured frameworks that allow you to track borrower information, payment schedules, and default status, enhancing your ability to manage loans effectively. You can customize each template to suit your unique requirements, ensuring that all relevant data is easily accessible and organized for efficient analysis.

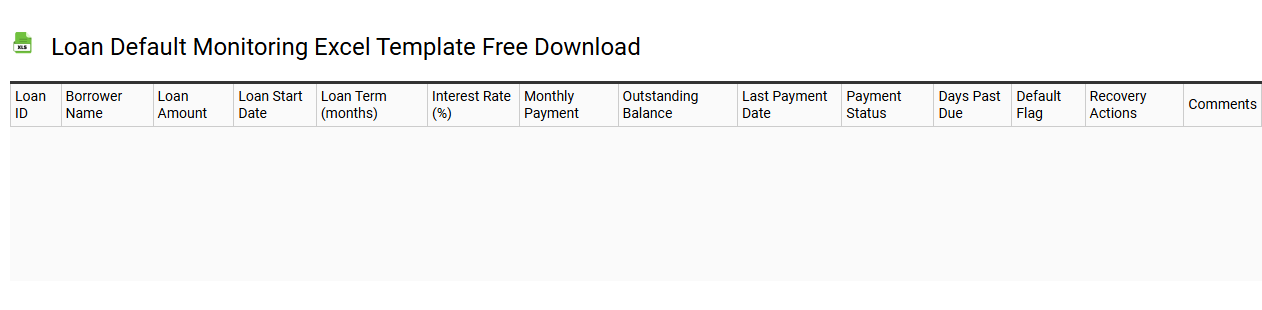

Loan default monitoring Excel template free download

💾 Loan default monitoring Excel template free download template .xls

A Loan Default Monitoring Excel template is a structured tool designed to help individuals and organizations track loan performance and identify potential defaults. This template typically includes fields for essential information such as borrower details, loan amounts, repayment schedules, and payment history. Features like automatic calculations for outstanding balances and visual data representations can facilitate quick assessments of financial health. Basic usage may assist in routine monitoring, while further potential needs might involve advanced analytics such as predictive modeling and risk assessment algorithms.

Loan default tracking Excel template with formulas

![]()

💾 Loan default tracking Excel template with formulas template .xls

A Loan Default Tracking Excel template is a specialized tool designed to monitor and analyze the repayment status of loans. This template typically includes columns for borrower information, loan amounts, repayment schedules, and current status, allowing you to easily identify which loans are overdue. Formulas are embedded to automatically calculate metrics such as total outstanding balances, days overdue, and interest accrued, providing a clear financial overview. For enhanced functionality, you can integrate advanced features such as conditional formatting, pivot tables, and data validation to streamline complex analyses and reporting tasks.

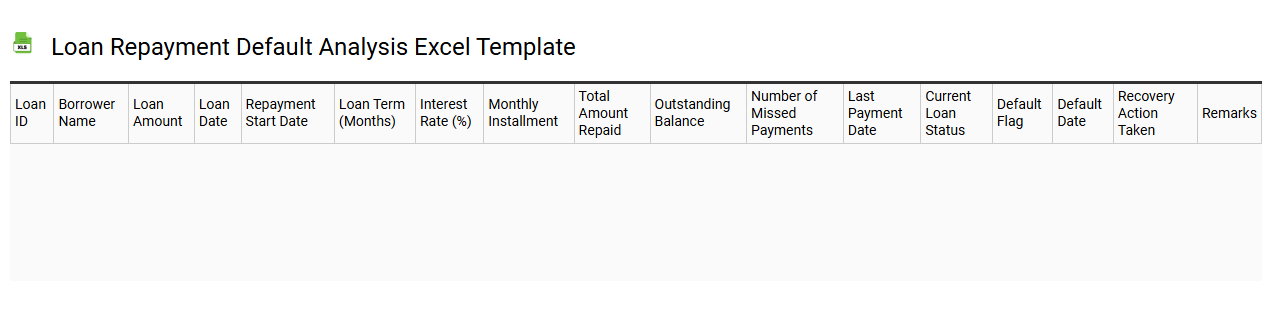

Loan repayment default analysis Excel template

💾 Loan repayment default analysis Excel template template .xls

A Loan Repayment Default Analysis Excel template is a structured tool designed to evaluate the risk of default on loan repayments. It includes fields for borrower information, loan details, and repayment history, allowing you to track payment patterns over time. Key metrics like payment status, outstanding balance, and delinquency rate provide insights into potential defaults. This template enables you to identify at-risk loans, assess borrower behavior, and develop strategies for risk mitigation while considering more advanced analytics such as predictive modeling and credit scoring algorithms for future enhancements.

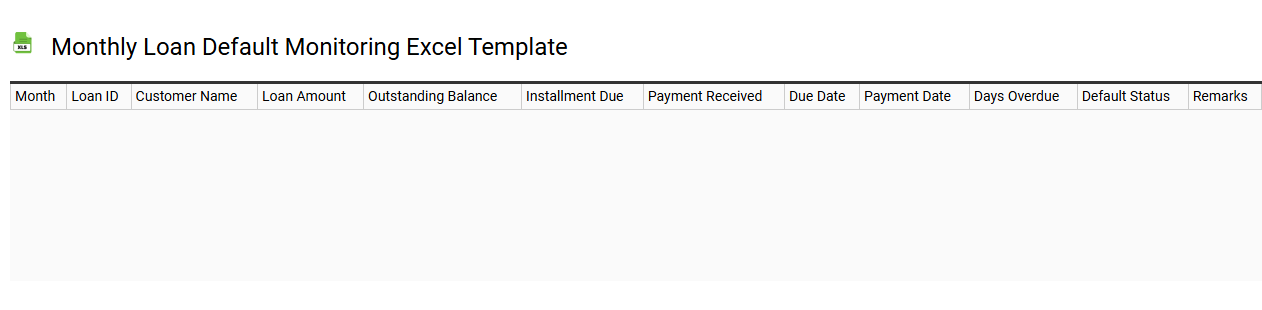

Monthly loan default monitoring Excel template

💾 Monthly loan default monitoring Excel template template .xls

A Monthly Loan Default Monitoring Excel template is a specialized tool designed to track and analyze loan performance data over a month. This template typically includes columns for loan identifiers, borrower information, payment due dates, payment status, and default indicators, allowing for efficient data management. You can visualize key metrics like overdue amounts and default rates through built-in formulas and charts, enhancing your decision-making process. For further advanced needs, consider integrating predictive analytics or machine learning algorithms to forecast defaults based on historical data trends.

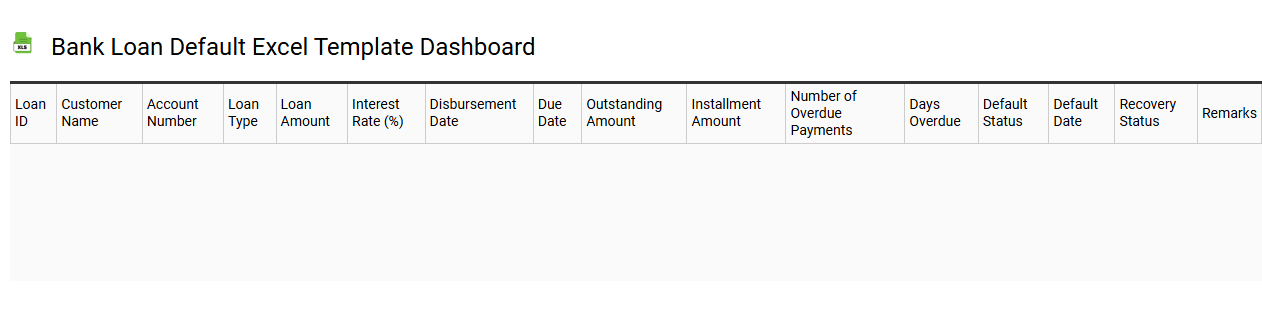

Bank loan default Excel template dashboard

💾 Bank loan default Excel template dashboard template .xls

A Bank loan default Excel template dashboard is an interactive tool designed to help financial analysts, banks, and loan officers assess and visualize the risk of default associated with loans. It typically consolidates key metrics such as borrower credit scores, loan amounts, payment history, and collateral value in an easy-to-navigate format. You can track trends, calculate default probabilities, and analyze the overall health of a loan portfolio using charts and tables. As your needs grow more complex, this tool can expand to incorporate advanced analytics techniques such as machine learning models for predictive analysis and risk assessment.

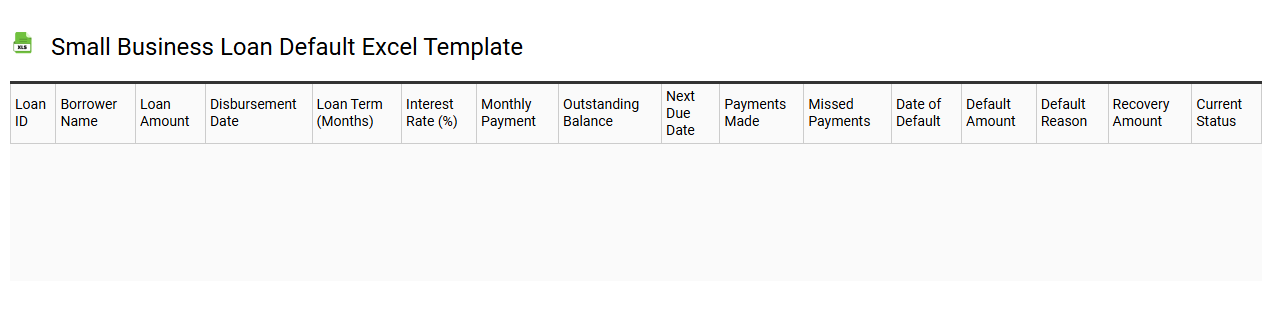

Small business loan default Excel template

💾 Small business loan default Excel template template .xls

A Small Business Loan Default Excel template is a structured tool used to track and evaluate the financial health of a small business concerning its loan obligations. This template typically includes sections for loan amounts, interest rates, payment schedules, and due dates, allowing you to easily monitor compliance with loan terms. By inputting current revenue and cash flow data, you can project potential defaults and identify key areas that may need your attention. Such a template serves as a foundational framework, which can be expanded to include advanced financial modeling, risk assessment, and trend analysis for future financial planning.

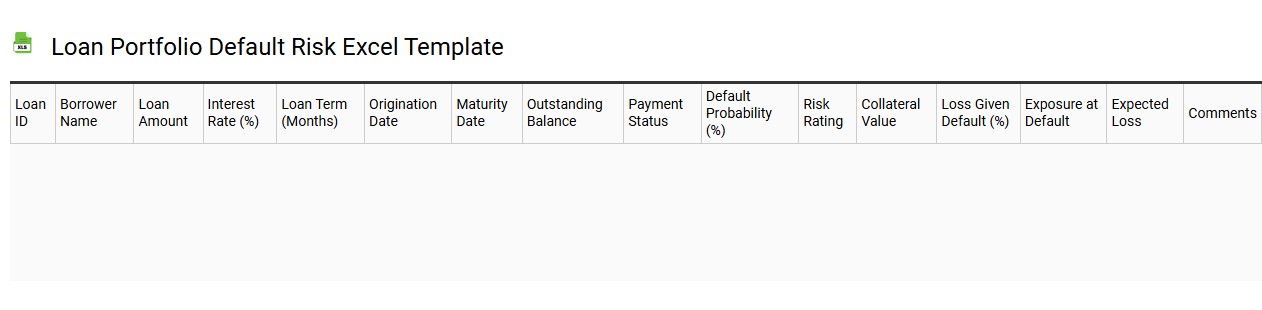

Loan portfolio default risk Excel template

💾 Loan portfolio default risk Excel template template .xls

A Loan Portfolio Default Risk Excel template helps financial institutions assess the likelihood of default within a loan portfolio. This tool typically includes detailed data fields for loan types, borrower credit scores, payment history, and economic indicators affecting borrower reliability. By analyzing these variables, you can gain insights into potential default rates and make informed lending decisions. You can extend its utility by incorporating advanced analytics like machine learning algorithms or stress testing scenarios for sophisticated risk assessments.

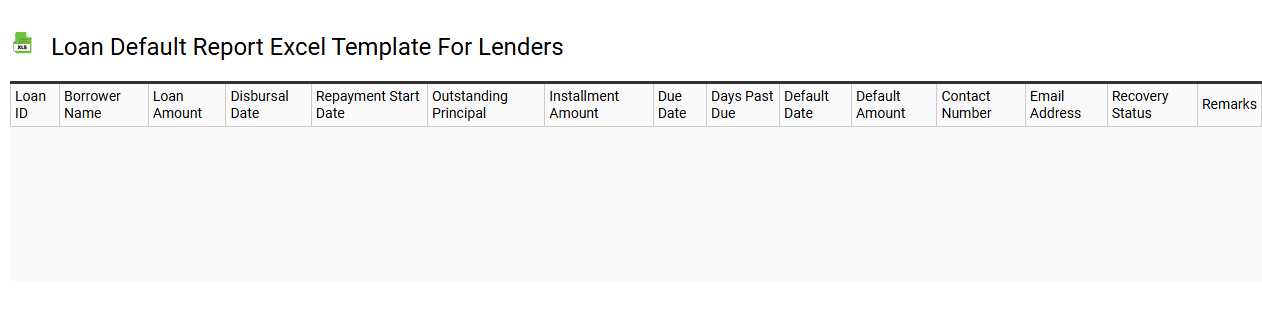

Loan default report Excel template for lenders

💾 Loan default report Excel template for lenders template .xls

A Loan Default Report Excel template serves as a crucial tool for lenders to monitor and manage loan performance. This organized spreadsheet typically includes essential data points such as borrower information, loan amounts, default dates, and outstanding balances, all clearly laid out for easy analysis. With built-in formulas, it enables lenders to calculate important metrics like default rates and recovery forecasts, streamlining the decision-making process. You can utilize this template to identify trends in loan defaults and further adapt your lending strategies using advanced techniques like predictive modeling and risk assessment analytics.

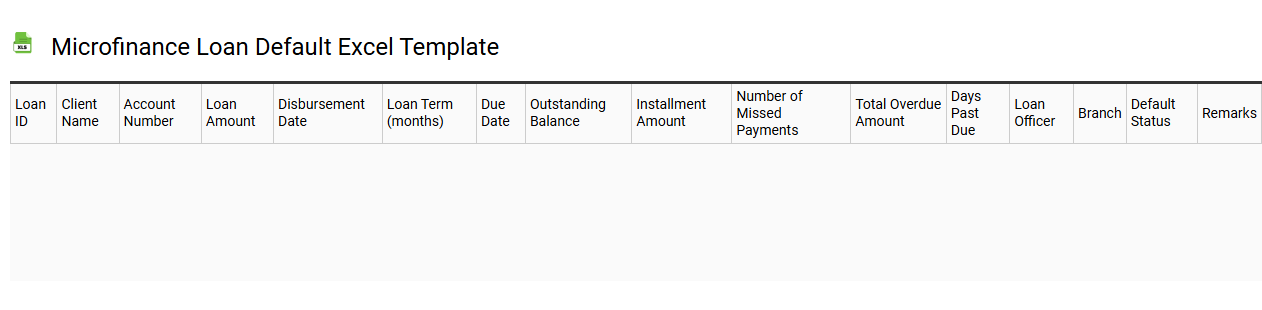

Microfinance loan default Excel template

💾 Microfinance loan default Excel template template .xls

A Microfinance loan default Excel template is a structured spreadsheet designed to track and analyze loan defaults within microfinance initiatives. This template typically includes fields for borrower information, loan amounts, repayment schedules, and default status, enabling you to monitor financial health effectively. Utilizing formulas and graphs, the template provides visual insights into default rates and trends over time. This basic template can be further enhanced to include advanced analytics tools or predictive modeling to assess future risks and inform decision-making strategies.

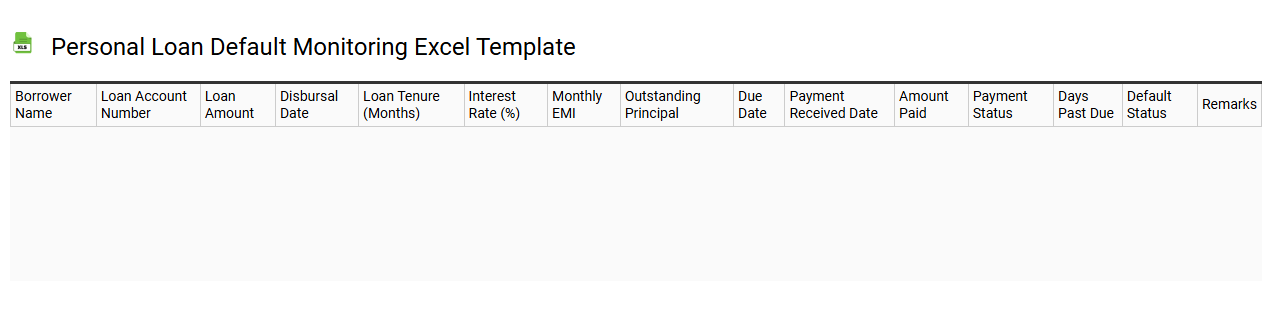

Personal loan default monitoring Excel template

💾 Personal loan default monitoring Excel template template .xls

A Personal Loan Default Monitoring Excel template is a specialized tool designed to track and analyze the performance of personal loans. It typically includes sections for borrower details, loan amounts, interest rates, payment schedules, and status updates, allowing for easy identification of delinquent accounts. This systematic approach helps lenders mitigate risks by providing insights into repayment patterns and defaults. You can customize the template further to incorporate advanced analytics like predictive modeling and risk assessment metrics tailored to enhance your loan management strategies.