Explore a variety of free XLS templates designed specifically for mortgage calculations. The Split Mortgage Calculator template allows you to input different loan amounts, interest rates, and terms, providing a detailed breakdown of monthly payments and total interest paid. Easily visualize how splitting your mortgage into multiple components can affect your overall financial strategy, making it a valuable resource for effective budgeting and planning.

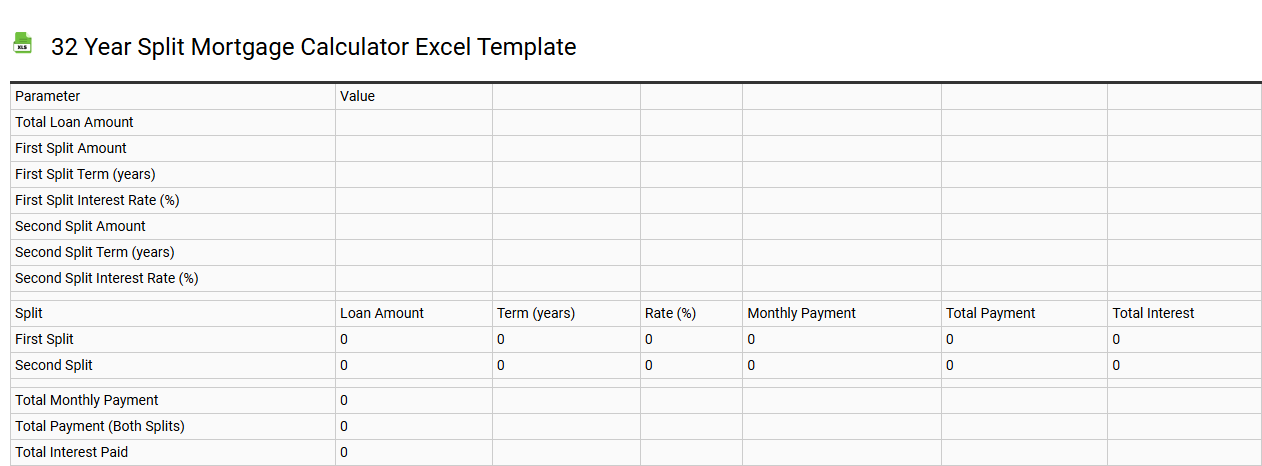

32 year split mortgage calculator Excel template

💾 32 year split mortgage calculator Excel template template .xls

A 32 year split mortgage calculator Excel template is a financial tool that helps you analyze and compare mortgage scenarios over a 32-year period. This template allows you to input various mortgage parameters such as interest rates, loan amounts, and repayment plans to calculate monthly payments and total interest. You can easily visualize amortization schedules and understand how different split structures--like a combination of fixed and adjustable rates--impact your financial outcome. Such a template is beneficial for making informed decisions about your mortgage options and assessing potential savings or higher costs through advanced calculations involving early repayments or changes in interest rates.

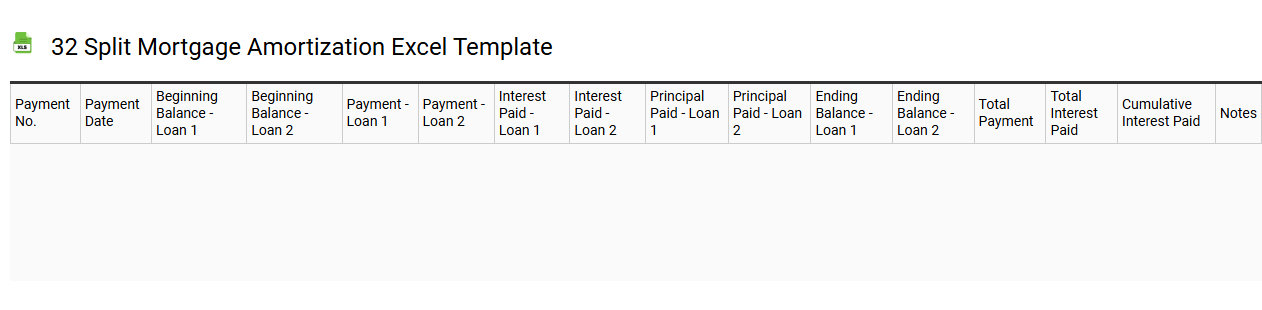

32 split mortgage amortization Excel template

💾 32 split mortgage amortization Excel template template .xls

A 32 split mortgage amortization Excel template provides a structured framework for managing and visualizing loan payments over a 32-year period. This template typically includes customizable fields for loan amount, interest rate, and payment frequency, allowing you to see how payments contribute to both principal and interest over time. Each month's payment breakdown highlights the balance remaining, giving you insight into how your equity builds. Beyond basic mortgage calculations, this template can also accommodate advanced scenarios such as bi-weekly payments and additional principal contributions, helping you assess potential savings and payoff strategies.

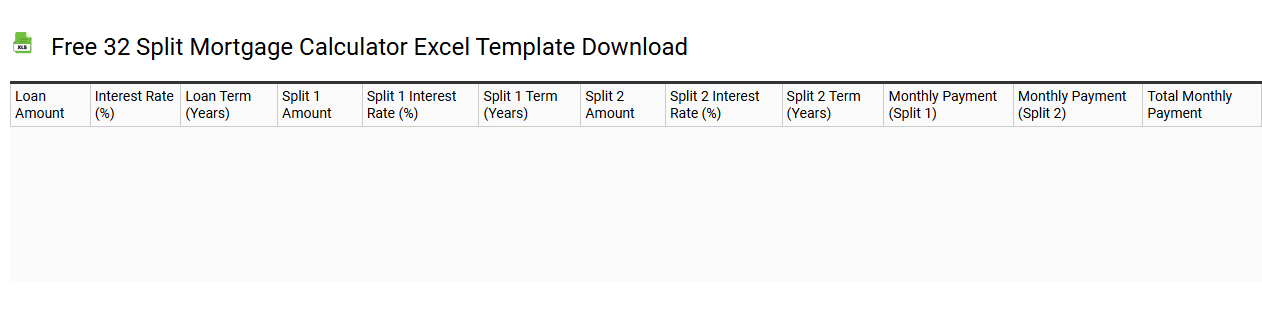

Free 32 split mortgage calculator Excel template download

💾 Free 32 split mortgage calculator Excel template download template .xls

A Free 32 Split Mortgage Calculator Excel template serves as a powerful tool for homeowners and real estate professionals to analyze mortgage conditions effectively. This customizable spreadsheet allows you to input various parameters, such as loan amount, interest rate, and duration, to determine monthly payments swiftly. The "32 split" refers to the layout of the spreadsheet, which neatly separates different scenarios or variables for comparison. With this template, you can easily assess basic mortgage payments while also exploring advanced options like amortization schedules and equity calculations.

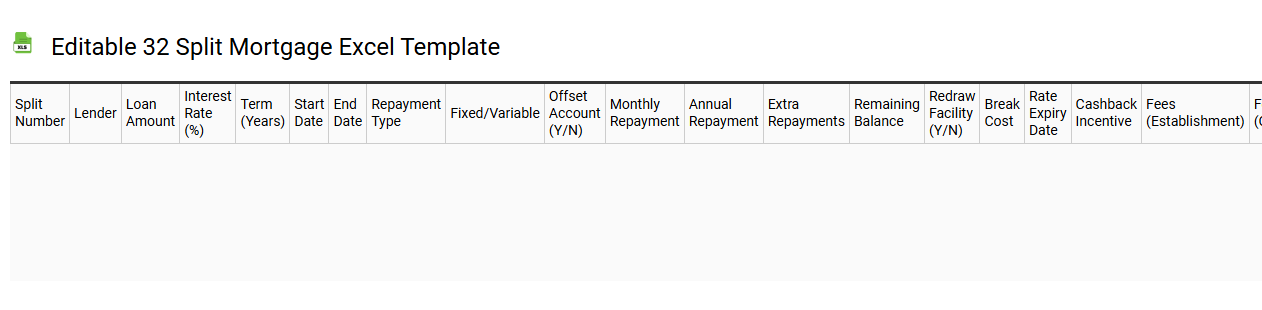

Editable 32 split mortgage Excel template

💾 Editable 32 split mortgage Excel template template .xls

An Editable 32 Split Mortgage Excel template is a customizable financial tool designed to assist users in managing and calculating mortgage payments structured over two distinct periods, often at varying interest rates or loan features. This template typically allows you to input key mortgage details, such as loan amount, interest rates, and term lengths, enabling precise calculations of monthly payments and total interest over time. Features often include automatic formulas that update calculations as you adjust input values, streamlining the mortgage planning process. For further potential needs, you might explore more advanced functionalities like amortization tables, scenario analysis, or integration with financial planning models.

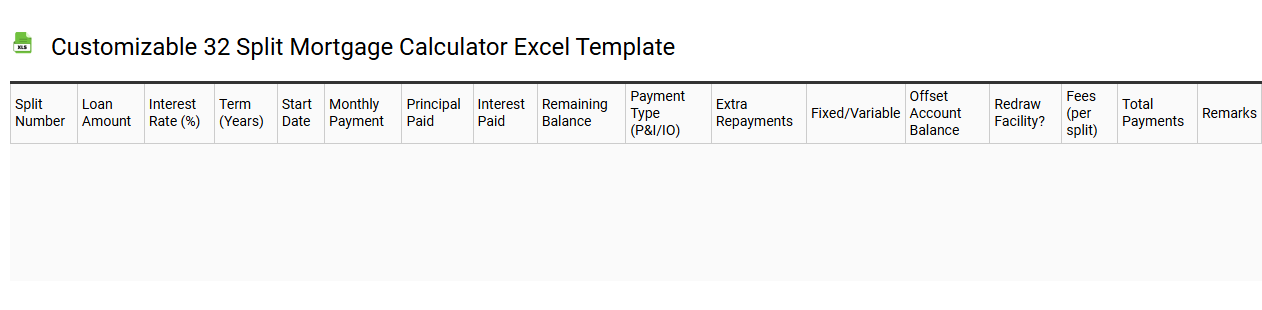

Customizable 32 split mortgage calculator Excel template

💾 Customizable 32 split mortgage calculator Excel template template .xls

A customizable 32 split mortgage calculator Excel template allows users to analyze different aspects of their mortgage, enabling detailed financial planning. This template features various input fields for loan amounts, interest rates, and terms, breaking down payments into 32 segments for comprehensive evaluation. Users can adjust parameters according to their financial situation, providing a tailored experience that reflects personal mortgage conditions. This powerful tool can further accommodate advanced features such as amortization schedules, refinancing scenarios, or variable interest rate projections to meet your evolving financial needs.

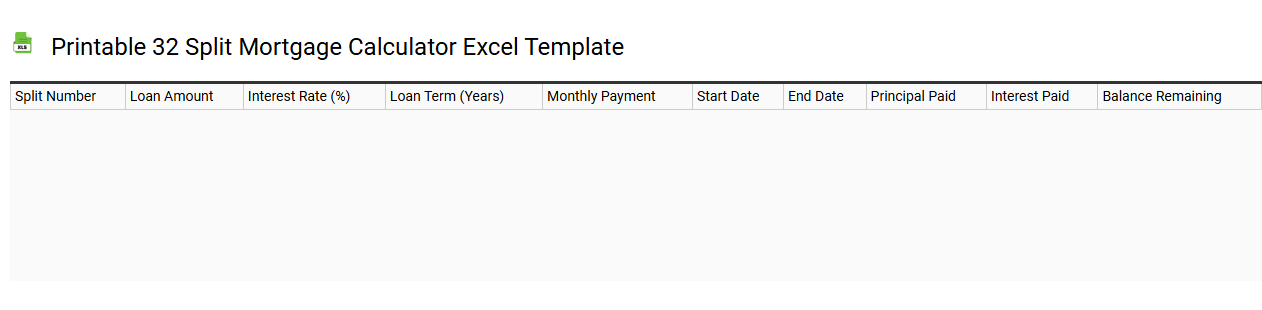

Printable 32 split mortgage calculator Excel template

💾 Printable 32 split mortgage calculator Excel template template .xls

A Printable 32 Split Mortgage Calculator Excel template is a customizable tool designed to help users assess and manage mortgage payments split into 32 separate parts. This template allows you to input parameters such as loan amount, interest rate, and term length, generating an organized breakdown of monthly payments and principal reductions. The format is user-friendly, enabling you to print the calculations for easy reference or further evaluation. For individuals or financial professionals requiring advanced scenarios, this tool can be adapted to incorporate additional variables such as variable interest rates or prepayment options.

32 split mortgage repayment tracker Excel template

![]()

💾 32 split mortgage repayment tracker Excel template template .xls

A 32 split mortgage repayment tracker Excel template is a specialized financial tool designed to help users manage their mortgage payments efficiently. This template allows you to break down your total mortgage repayment into 32 individual segments, making it easier to track both principal and interest separately. Each section of the tracker includes features such as payment dates, outstanding balances, and total interest paid, providing a comprehensive view of your mortgage status over time. By utilizing this template, you can address basic repayment tracking needs and explore advanced features like amortization schedules, refinancing scenarios, or payment optimization strategies.

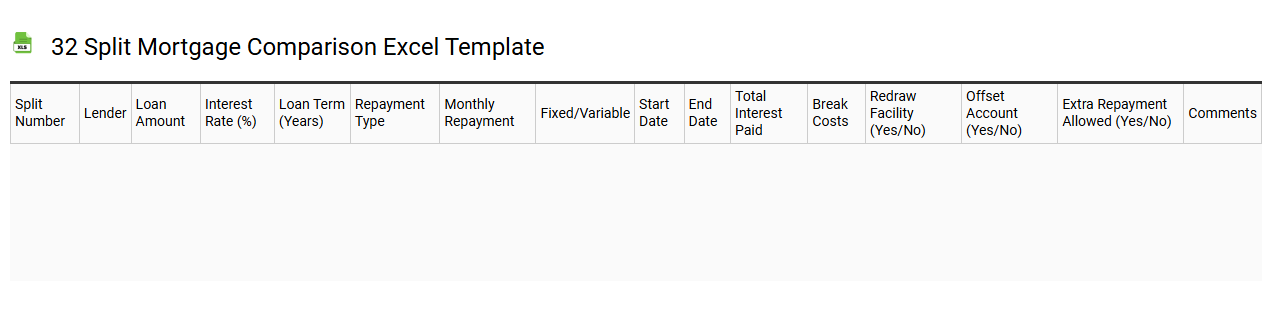

32 split mortgage comparison Excel template

💾 32 split mortgage comparison Excel template template .xls

A 32 split mortgage comparison Excel template is a specialized spreadsheet designed to help you evaluate and compare various mortgage options over a standard 32-year period. This tool allows you to input different loan amounts, interest rates, and terms to visualize potential monthly payments and total costs over time. You can analyze the impact of fixed versus adjustable-rate mortgages, to see how they align with your financial goals. This template is invaluable for assessing both basic mortgage features and more complex scenarios, such as refinancing options or investment properties, guiding you toward informed decisions in your home financing journey.

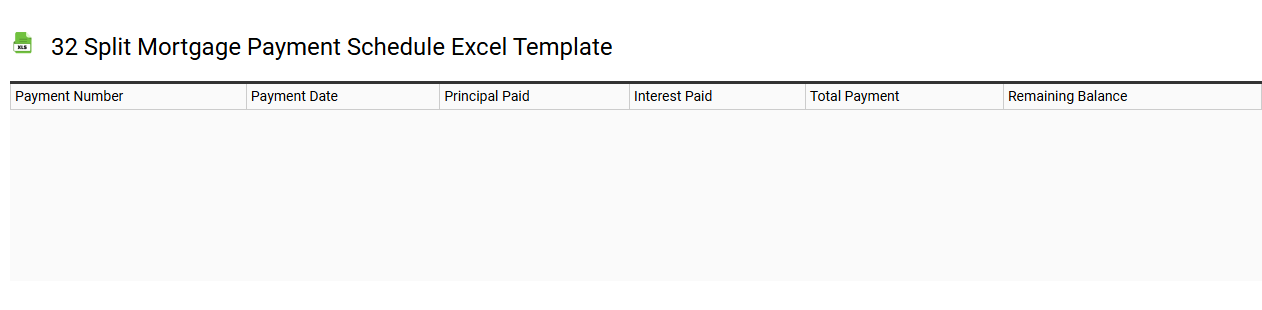

32 split mortgage payment schedule Excel template

💾 32 split mortgage payment schedule Excel template template .xls

A 32 split mortgage payment schedule Excel template provides a detailed structure for organizing your mortgage payments over 32 installments. Each row typically represents a specific payment period, outlining key information such as payment dates, principal amounts, interest rates, and remaining balances. This template allows you to visualize the breakdown of monthly payments, enhancing your understanding of how each payment impacts your loan. You can utilize this tool for basic tracking or expand its functionality to analyze amortization patterns and refine financial planning strategies.

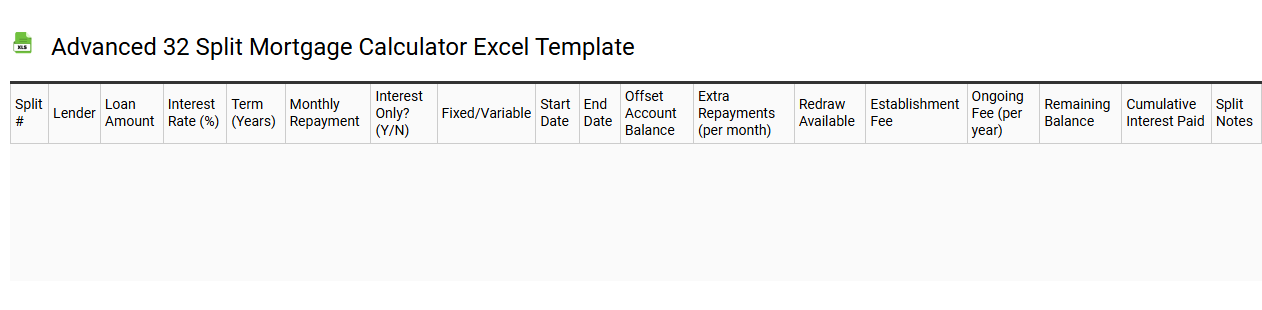

Advanced 32 split mortgage calculator Excel template

💾 Advanced 32 split mortgage calculator Excel template template .xls

The Advanced 32 Split Mortgage Calculator Excel template provides a comprehensive tool for analyzing various mortgage conditions and projections. It allows users to input details such as loan amount, interest rates, and payment frequency, and calculates payments for different mortgage components. This template can accommodate complex scenarios, including split funding options and amortization tables, giving you a clearer view of your mortgage journey. Beyond basic calculations, this tool can meet more advanced financial planning needs, utilizing terms like loan-to-value ratio, prepayment penalties, and refinancing scenarios.