Explore a selection of free Excel templates designed for mortgage amortization over 27 and 30 years. These user-friendly spreadsheets allow you to input loan details, such as principal amount, interest rate, and loan term, making it easy to visualize your monthly payments and total interest over time. With features like automatic calculation of amortization schedules, you can gain valuable insights into your mortgage repayments and financial planning.

27 year mortgage amortization Excel template with extra payments

💾 27 year mortgage amortization Excel template with extra payments template .xls

A 27-year mortgage amortization Excel template with extra payments allows you to visualize and track your mortgage repayment schedule while incorporating additional payments. This template typically includes columns for the payment date, principal and interest amounts, remaining balance, and any extra payments you make towards the principal. By entering your loan amount, interest rate, and any extra contributions, you can see how these extra payments reduce the overall interest paid and shorten the loan term. You might find this useful for planning your financial strategy, allowing you to explore sophisticated calculations like loan-to-value ratio adjustments or the impact of prepayment penalties.

30 year mortgage amortization schedule Excel template

💾 30 year mortgage amortization schedule Excel template template .xls

A 30-year mortgage amortization schedule Excel template is a financial tool that outlines the repayment structure of a mortgage loan over 30 years. This template typically includes details such as the loan amount, interest rate, monthly payment, and the total interest paid over the life of the loan. Each row represents a monthly payment, breaking down the principal and interest portions, while showing the remaining balance after each payment. You can customize the template for various scenarios, such as comparing fixed-rate vs. adjustable-rate mortgages, or evaluating the impact of additional principal payments on the amortization timeline. This Excel template can help you effectively plan your mortgage payments, manage your budget, and explore advanced financial strategies like refinancing or making prepayments to shorten the loan term.

27 year mortgage payment calculator Excel template

💾 27 year mortgage payment calculator Excel template template .xls

A 27-year mortgage payment calculator Excel template is a useful financial tool designed to help you estimate your monthly mortgage payments over a span of 27 years. This template typically includes fields for entering the loan amount, interest rate, and any additional fees or points. You can easily see how these variables affect your monthly payment and the total amount paid over the life of the loan. Utilizing this template can aid in budgeting and planning for further financial needs, such as calculating amortization schedules or exploring refinancing options.

30 year fixed rate mortgage Excel template

💾 30 year fixed rate mortgage Excel template template .xls

A 30-year fixed-rate mortgage Excel template is a spreadsheet designed to help you easily calculate monthly mortgage payments for a home with a fixed interest rate over 30 years. This tool typically includes fields for loan amount, interest rate, and the total number of payments, allowing for quick input and instant results. You can visually track how your payments are divided between principal and interest throughout the loan term, aiding in budgeting and financial planning. With such a template, you can also assess potential scenarios like extra payments or refinancing options while considering advanced concepts like amortization schedules and total interest paid over the life of the loan.

27 year loan amortization chart Excel template

💾 27 year loan amortization chart Excel template template .xls

A 27-year loan amortization chart Excel template provides a structured way to understand the repayment schedule for a loan over 27 years. This template typically includes detailed entries for each month, displaying principal and interest payments along with the remaining balance. The user-friendly format allows for easy modifications, enabling you to adjust variables such as interest rates or loan amounts. Essential for financial planning, this tool serves as a foundational resource, while your advanced needs may include integration with financial modeling software or sensitivity analysis for different payment strategies.

30 year mortgage amortization table Excel template

💾 30 year mortgage amortization table Excel template template .xls

A 30-year mortgage amortization table Excel template is a financial tool designed to help you visualize and understand your mortgage payments over the life of a loan. This table typically includes columns for each payment period, including the payment number, total payment amount, interest paid, principal paid, and remaining balance. Each row represents a month in the 30-year term, allowing you to track how much of your payment goes toward interest versus how much is applied to the principal. By utilizing this template, you can easily calculate monthly payments, compare different interest rates, and explore future potential needs like refinancing or extra payments for accelerated amortization.

27 year mortgage payoff tracker Excel template

![]()

💾 27 year mortgage payoff tracker Excel template template .xls

A 27-year mortgage payoff tracker Excel template is a customizable spreadsheet designed to help homeowners monitor their mortgage payments over a 27-year term. This template typically features fields for inputting the loan amount, interest rate, monthly payment, and remaining balance, allowing you to visualize your progress. Monthly amortization schedules are included, displaying how much of each payment goes toward principal and interest, helping you understand how equity in your home increases over time. You can use this tool not only to track your payments, but also to explore advanced strategies like making additional payments or refinancing, enhancing your overall financial strategy.

30 year adjustable mortgage Excel template

💾 30 year adjustable mortgage Excel template template .xls

A 30-year adjustable mortgage Excel template is a financial tool designed to help you analyze adjustable-rate mortgages over a 30-year period. This template typically includes fields for inputting loan amounts, initial interest rates, adjustment periods, and projected future interest rates. With visually organized tables and charts, it allows you to track your payment schedules, principal balances, and interest costs throughout the loan's life. Such a template can assist you in understanding your current mortgage payments while evaluating the potential impact of rate changes, enabling you to make informed financial decisions regarding refinancing or budgeting strategies.

27 year refinance mortgage Excel template

💾 27 year refinance mortgage Excel template template .xls

A 27-year refinance mortgage Excel template is a customizable spreadsheet designed to help homeowners evaluate and manage their refinancing options over a 27-year period. This tool typically includes fields for entering key financial data such as loan amount, interest rate, monthly payment, and the duration of refinancing. It allows you to visualize potential savings, compare current and new mortgage terms, and assess overall financial impact. You can adapt this template further to include advanced features like amortization schedules, equity calculations, and tax implications, meeting various financial planning needs.

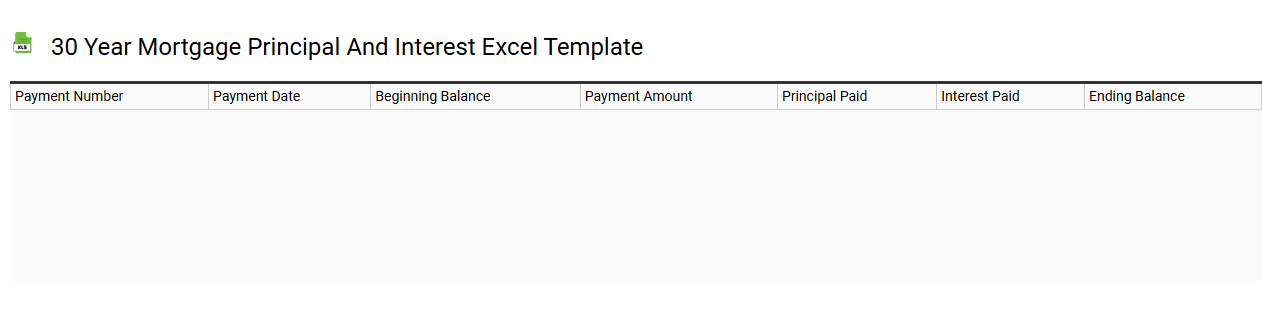

30 year mortgage principal and interest Excel template

💾 30 year mortgage principal and interest Excel template template .xls

A 30-year mortgage principal and interest Excel template is a spreadsheet designed to help you calculate and visualize your mortgage payments over a 30-year term. It typically includes fields for the loan amount, interest rate, and payment frequency, allowing for easy adjustments based on your financial situation. The template generates an amortization schedule that breaks down each monthly payment into principal and interest components, helping you understand how your loan balance decreases over time. You can further customize this template to explore scenarios such as prepayments or adjustments to interest rates, enhancing your financial planning and decision-making processes.