A mortgage prepayment schedule Excel template offers a structured way to analyze and plan for early mortgage payments. This template typically includes columns for the payment date, payment amount, remaining balance, interest savings, and total savings. By visualizing your potential prepayments, you can make informed financial decisions to reduce overall interest costs and shorten the loan term.

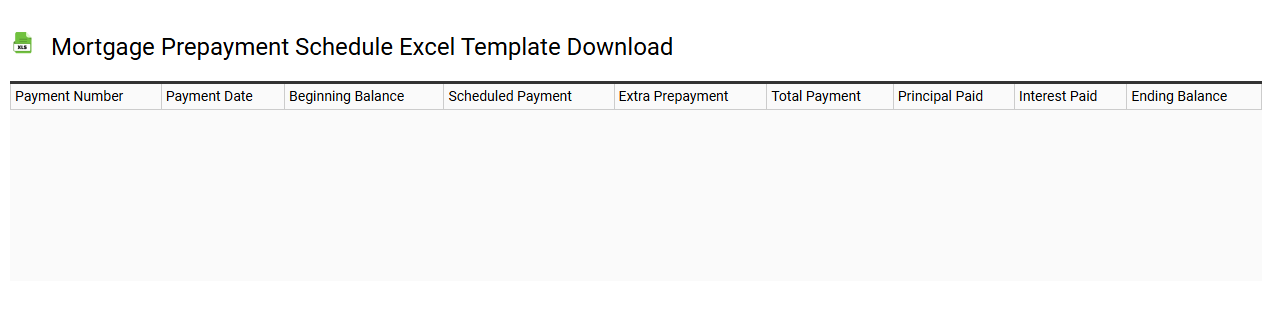

Mortgage prepayment schedule Excel template download

💾 Mortgage prepayment schedule Excel template download template .xls

A mortgage prepayment schedule Excel template serves as a practical tool for homeowners looking to analyze the potential effects of making extra payments on their mortgage. This template typically features columns for original loan details such as principal amount, interest rate, term, and monthly payment, alongside fields for additional prepayments. You can input various scenarios to see how different prepayment amounts can reduce total interest paid and shorten the loan term. Understanding this schedule can help you make informed financial decisions and strategize for future needs like refinancing or investment opportunities.

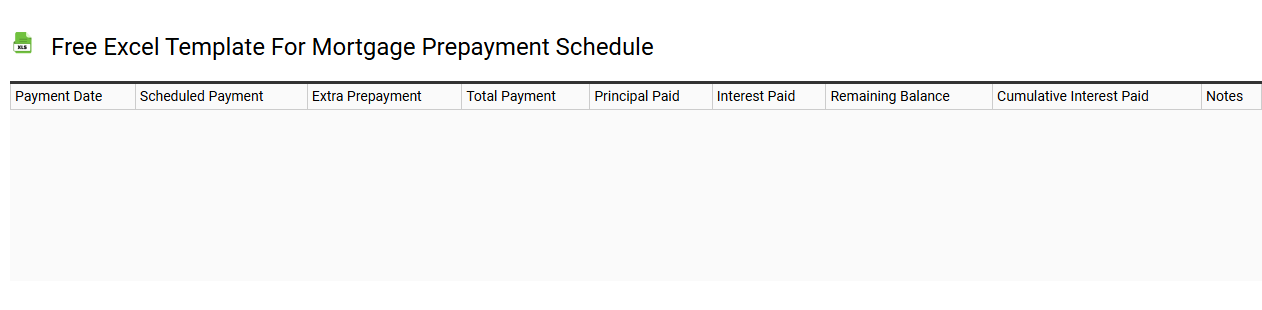

Free Excel template for mortgage prepayment schedule

💾 Free Excel template for mortgage prepayment schedule template .xls

A Free Excel template for a mortgage prepayment schedule is a handy tool designed to help homeowners track and manage their mortgage repayments effectively. This template allows you to input your loan details, such as principal amount, interest rate, and repayment term, enabling you to visualize how extra payments can reduce your overall interest costs and payoff time. You can customize the schedule by adding varying prepayment amounts, making it easier to see the impact of additional contributions towards your mortgage. This tool can be basic yet evolves into advanced financial modeling, helping you predict potential savings and strategize future financial decisions, such as refinancing or investment opportunities.

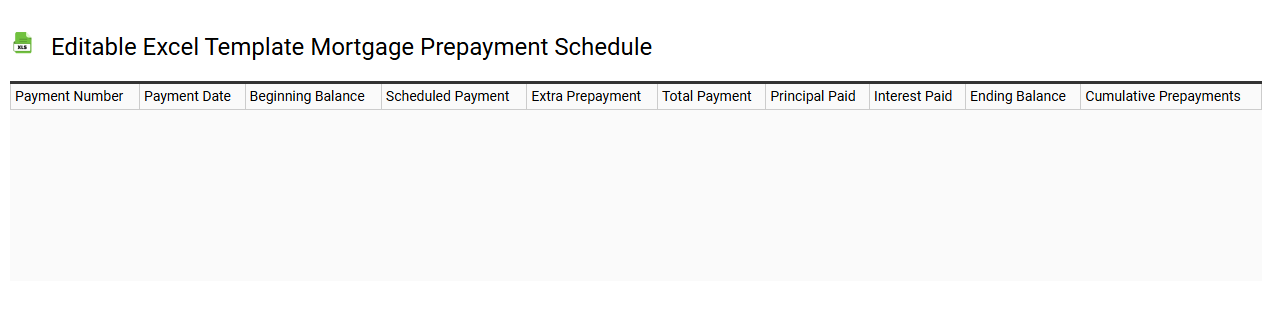

Editable Excel template mortgage prepayment schedule

💾 Editable Excel template mortgage prepayment schedule template .xls

An editable Excel template for a mortgage prepayment schedule is a customizable spreadsheet designed to help you track and manage extra payments towards your mortgage. It typically includes sections for inputting your original loan amount, interest rate, monthly payments, and any additional prepayments you plan to make. As you adjust these figures, the template calculates the effect of your prepayments on the loan balance, interest savings, and the potential to pay off your mortgage sooner. Such templates often support basic usage for tracking, but can also be modified for more advanced financial analysis, like amortization schedules or investment growth projections.

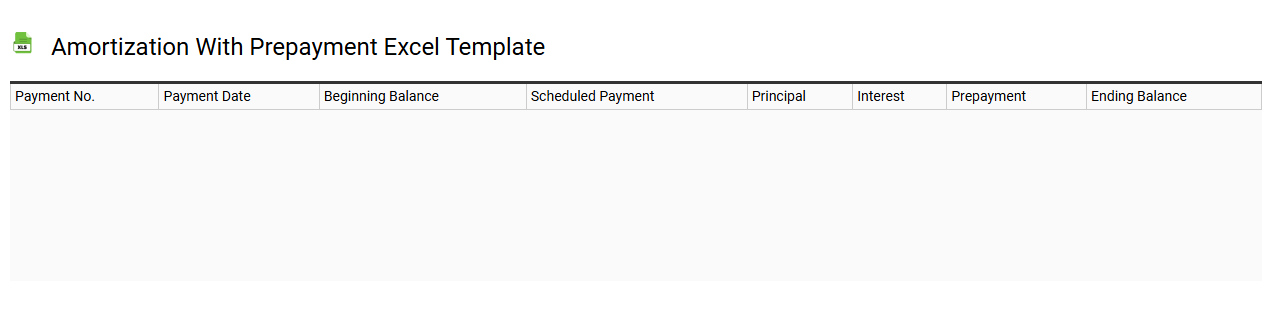

Amortization with prepayment Excel template

💾 Amortization with prepayment Excel template template .xls

Amortization refers to the gradual repayment of a loan over time through regular payments that cover both principal and interest. In an Excel template designed for amortization with prepayment options, you can track monthly payments, outstanding balances, and the impact of making extra payments toward the principal. This tool allows you to visualize how prepayments can significantly reduce the life of the loan and the total interest paid. Understanding these calculations can help you optimize your financial decisions, whether for personal loans or business financing strategies, while exploring advanced concepts like net present value and internal rate of return for deeper financial insights.

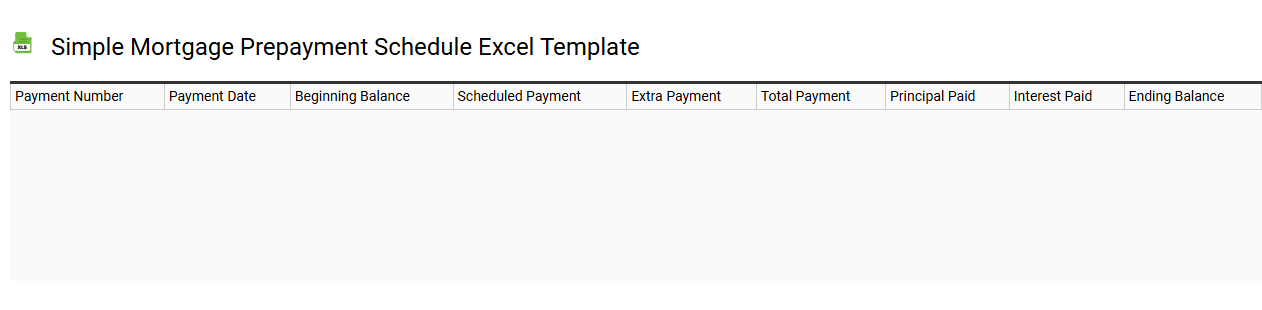

Simple mortgage prepayment schedule Excel template

💾 Simple mortgage prepayment schedule Excel template template .xls

A simple mortgage prepayment schedule Excel template is a tool designed to help you understand the impact of making extra payments on your mortgage. This template typically outlines your original loan details, including the principal amount, interest rate, and term, while allowing you to input additional payment amounts and frequencies. It calculates the new total interest paid, the time saved on your mortgage, and the resulting payoff date. You can customize this template to explore various scenarios, from occasional prepayments to more aggressive strategies, enhancing your financial planning and debt repayment strategy.

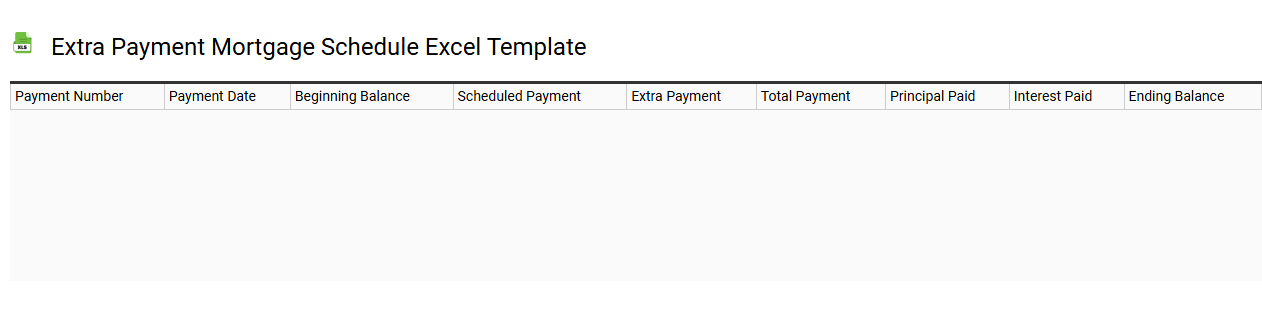

Extra payment mortgage schedule Excel template

💾 Extra payment mortgage schedule Excel template template .xls

An extra payment mortgage schedule Excel template helps homeowners visualize the impact of making additional payments toward their mortgage. This tool allows you to input your loan amount, interest rate, and term length, creating a comprehensive breakdown of monthly payments and balances over time. By adjusting the extra payment amounts, you can see potential savings on interest and the reduced term of the loan. Such templates can also provide insights into further financial planning, including investments, refinancing options, and amortization calculations.

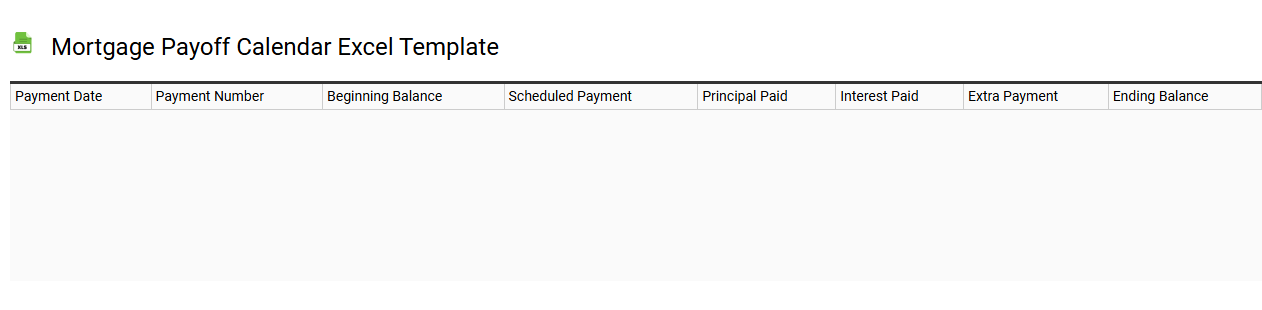

Mortgage payoff calendar Excel template

💾 Mortgage payoff calendar Excel template template .xls

A Mortgage Payoff Calendar Excel template is a customizable spreadsheet designed to help homeowners track their mortgage payments and visualize the timeline until the loan is fully paid off. You can input your mortgage details, such as the loan amount, interest rate, payment frequency, and additional payments. The template generates a detailed amortization schedule, illustrating how each payment reduces the principal balance over time. Features such as color-coded entries and graphs provide insights into your mortgage progress, while the potential to incorporate extra payments demonstrates how you can significantly shorten your loan term and reduce interest costs.

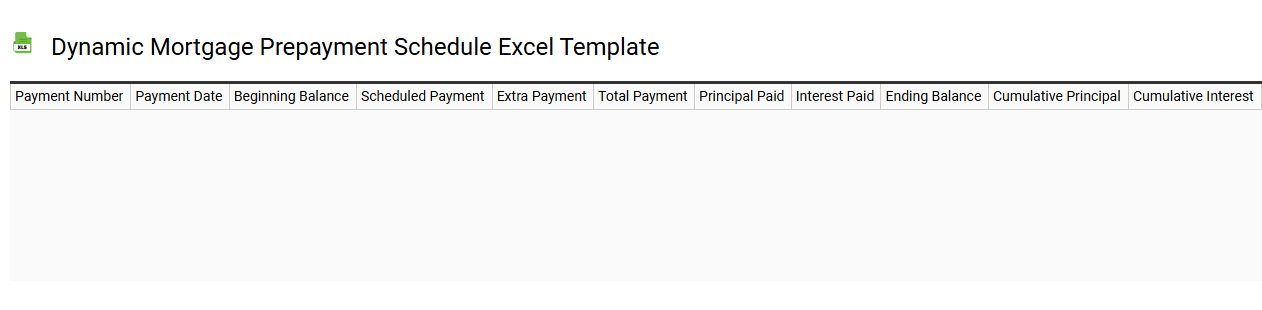

Dynamic mortgage prepayment schedule Excel template

💾 Dynamic mortgage prepayment schedule Excel template template .xls

A Dynamic Mortgage Prepayment Schedule Excel template is a financial tool designed to help homeowners and investors analyze the impact of prepaying their mortgage. The template allows users to input various parameters such as loan amount, interest rate, period of the loan, and additional prepayment amounts. By dynamically adjusting these inputs, you can visualize how different prepayment scenarios affect the total interest paid and the loan payoff timeline. This tool not only aids in basic mortgage management but also enables advanced analyses like sensitivity testing and scenario modeling for more informed decision-making.

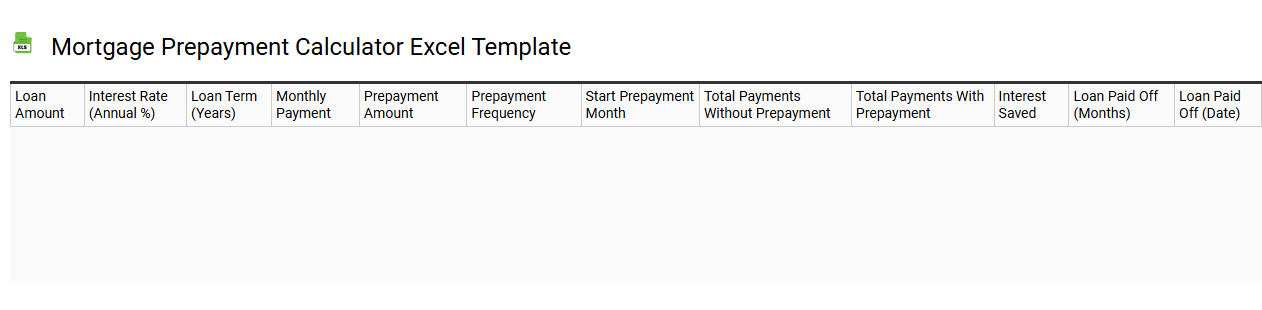

Mortgage prepayment calculator Excel template

💾 Mortgage prepayment calculator Excel template template .xls

A Mortgage prepayment calculator Excel template enables you to analyze the financial impact of paying off your mortgage early. This template typically includes fields such as loan amount, interest rate, remaining term, and initial monthly payment, allowing you to input your loan specifics seamlessly. By modifying prepayment amounts and frequencies, you can visualize potential interest savings and changes in loan duration. This tool can provide valuable insights and help you decide between basic prepayment options and more advanced strategies like refinancing or biweekly payment schedules.

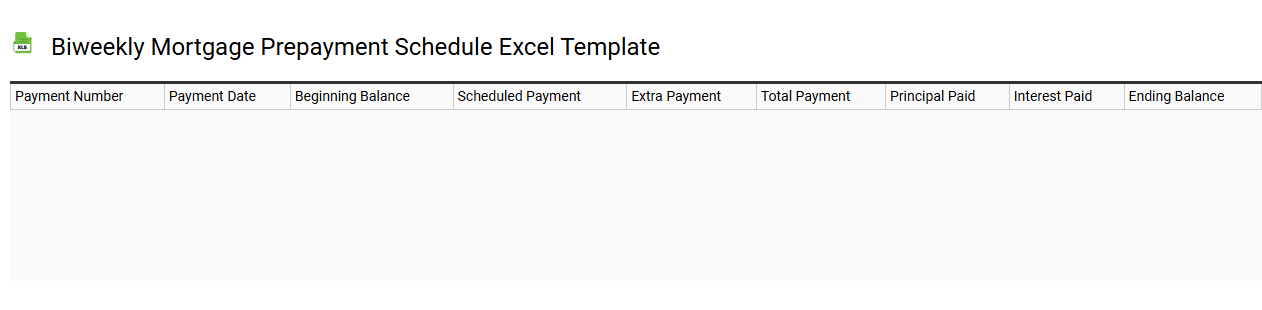

Biweekly mortgage prepayment schedule Excel template

💾 Biweekly mortgage prepayment schedule Excel template template .xls

A biweekly mortgage prepayment schedule Excel template serves as a financial tool to help you understand how much you could save on interest over the life of your mortgage by making biweekly payments instead of monthly ones. This template typically outlines payment dates, principal and interest portions, and the remaining balance for each payment period. With this organized structure, you can visualize your savings, monitor the reduction in loan principal, and track the impact of additional prepayments. For your potential needs, consider advanced features like amortization displays or interest-saving calculators to enhance your financial strategy.