Discover a range of free XLS templates specifically designed for mortgage forecasting, ideal for tracking your loan payments and interest rates. Each template provides comprehensive fields for inputting important details such as loan amount, interest rate, term length, and monthly payment calculations. These resources simplify your financial planning, helping you visualize your mortgage trajectory over time.

Mortgage forecast Excel template for small business

💾 Mortgage forecast Excel template for small business template .xls

A Mortgage Forecast Excel template for small businesses is a powerful tool designed to assist in financial planning and analysis. It allows you to input various loan parameters, such as interest rates, loan amounts, and terms, facilitating the calculation of monthly payments and total interest paid over the loan's duration. This template often includes features like amortization schedules and cash flow projections, ensuring you have a comprehensive view of your mortgage's impact on business finances. You can further customize the tool to analyze advanced scenarios, including refinancing options and investment implications.

30-year mortgage forecast Excel template

💾 30-year mortgage forecast Excel template template .xls

A 30-year mortgage forecast Excel template is a comprehensive tool designed to help you visualize and analyze mortgage payments over a 30-year term. It typically includes features such as an amortization schedule, interest and principal breakdown, and total interest paid throughout the life of the loan. Various inputs, like loan amount, interest rate, and start date, allow for personalized calculations tailored to your financial situation. You can utilize this template not only for budgeting but also for exploring advanced scenarios like refinancing options, early repayment strategies, and the impact of interest rate changes.

Free mortgage forecast Excel template download

💾 Free mortgage forecast Excel template download template .xls

A Free mortgage forecast Excel template is a customizable tool designed to help you analyze future mortgage payments and interest costs. This template typically includes rows for principal amounts, interest rates, and payment schedules, allowing you to input various scenarios and visualize outcomes. User-friendly features, such as clear graphs and automatic calculations, assist in budgeting for home affordability. Beyond basic usage, this template can be adapted for advanced financial modeling, including amortization schedules, sensitivity analysis, or cash flow forecasting.

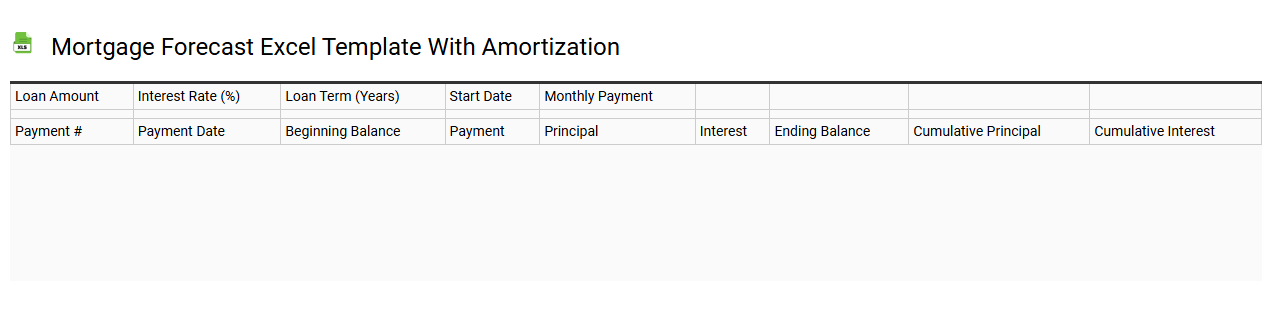

Mortgage forecast Excel template with amortization

💾 Mortgage forecast Excel template with amortization template .xls

A Mortgage Forecast Excel template with amortization helps you predict and analyze your mortgage payments over time. It includes features to calculate principal and interest, providing a clear view of your payment structure and how it changes. You can input variables such as loan amount, interest rate, and term length to see projected monthly payments and total interest paid over the life of the loan. This tool is not only useful for tracking your current mortgage but can also assist in making strategic financial decisions or planning for future investments, including refinancing options and payment optimization strategies.

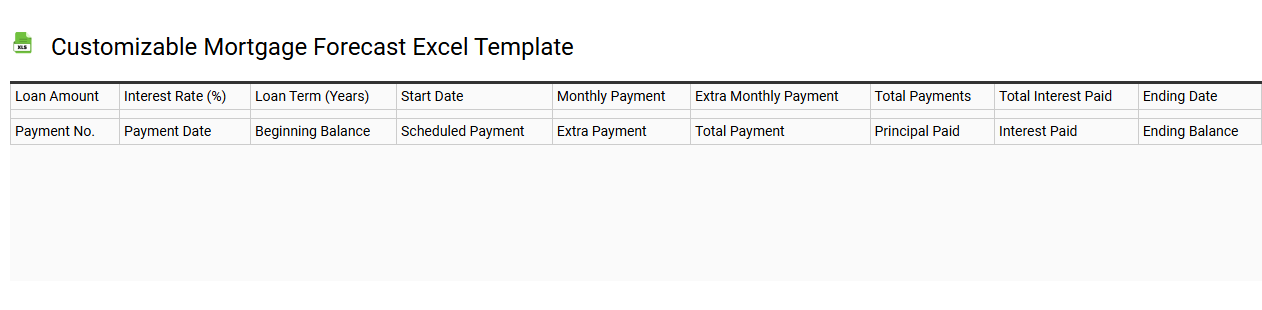

Customizable mortgage forecast Excel template

💾 Customizable mortgage forecast Excel template template .xls

A customizable mortgage forecast Excel template is a specialized tool that allows users to project and analyze their mortgage payments over time. It typically includes fields for inputting loan amount, interest rate, term length, and payment frequency, enabling you to visualize how different variables impact your financial commitments. Users can easily modify parameters to reflect various scenarios, such as refinancing options or additional payments, ensuring accurate forecasting for personal budgeting. This template can also serve as a foundation for more advanced analyses, such as cash flow projections or real estate investment calculations.

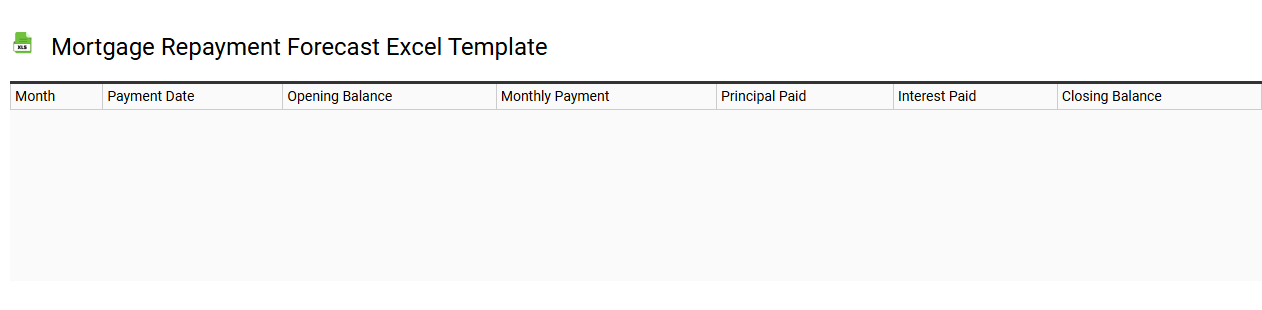

Mortgage repayment forecast Excel template

💾 Mortgage repayment forecast Excel template template .xls

A Mortgage Repayment Forecast Excel Template is a dynamic tool designed to help you visualize and plan your mortgage payments over time. This template allows you to input essential variables such as the loan amount, interest rate, and repayment term, automatically calculating monthly payments and the total interest paid. Various features may include amortization schedules, graphical representations of outstanding balance over time, and options to model extra repayments. This tool not only aids in basic budgeting but also accommodates advanced scenarios like refinancing or making lump-sum payments, enabling a deeper analysis of your mortgage strategy.

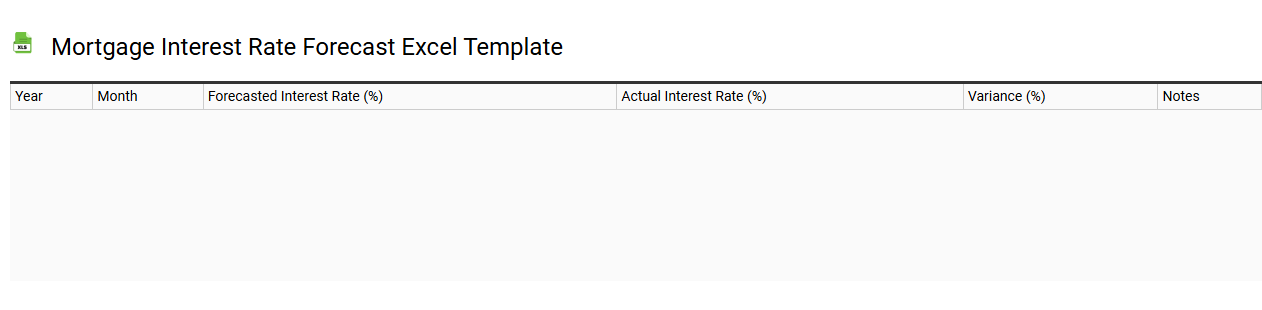

Mortgage interest rate forecast Excel template

💾 Mortgage interest rate forecast Excel template template .xls

A Mortgage Interest Rate Forecast Excel template is a structured tool designed to predict future mortgage interest rates based on historical data and market trends. Users can input various variables, such as economic indicators, loan terms, and historical rates, to generate projections tailored to specific scenarios. This financial model displays results through visually appealing graphs and charts, simplifying complex data analysis and aiding decision-making. Beyond basic forecasting, the template can be enhanced with advanced analytics like regression modeling and sensitivity analysis for more nuanced insights into rate fluctuations and long-term cost implications.

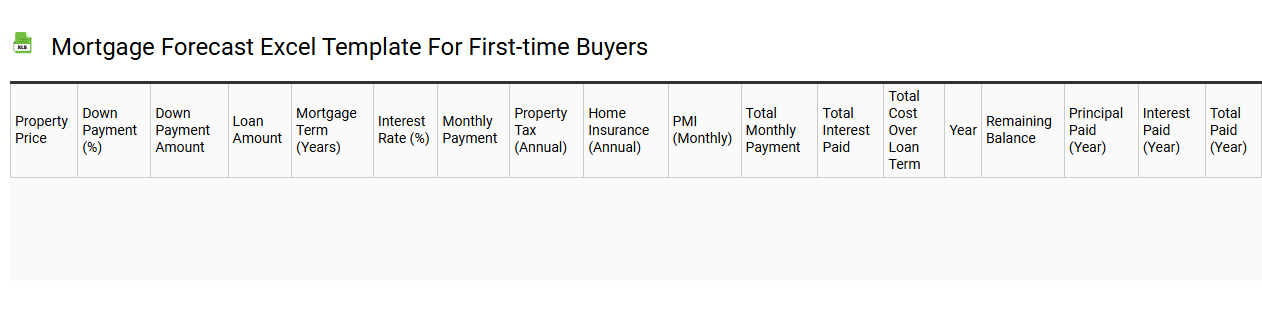

Mortgage forecast Excel template for first-time buyers

💾 Mortgage forecast Excel template for first-time buyers template .xls

A Mortgage Forecast Excel template for first-time buyers serves as an essential tool for managing and predicting financial commitments related to homeownership. This template allows you to input various factors such as loan amount, interest rates, and payment terms, helping you visualize monthly payments and long-term financial implications. You can track additional expenses like property taxes, homeowner's insurance, and maintenance costs, providing a comprehensive view of your potential budget. This approach not only aids in your immediate mortgage calculations but also allows for exploration of advanced features like amortization schedules, equity projections, or scenario modeling for refinancing options.

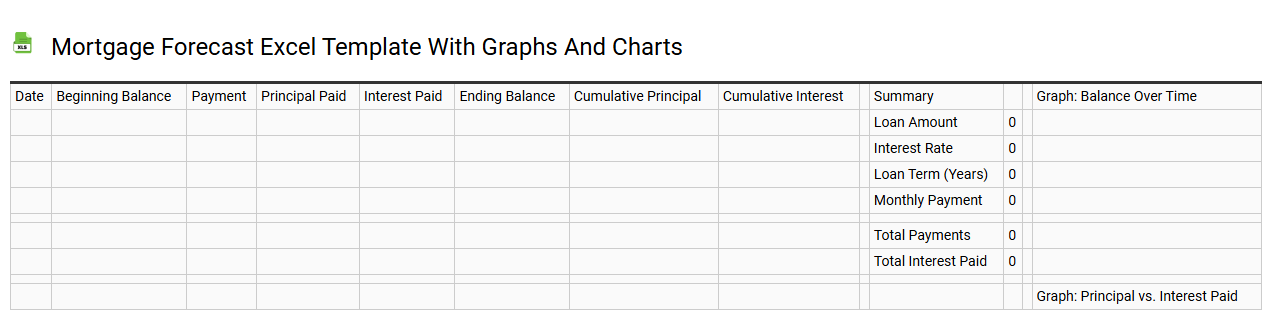

Mortgage forecast Excel template with graphs and charts

💾 Mortgage forecast Excel template with graphs and charts template .xls

A Mortgage forecast Excel template with graphs and charts is a powerful tool designed to streamline the financial planning process for mortgage borrowers and lenders. This template enables users to input key variables such as loan amount, interest rate, term length, and payment frequency, while visually representing data through dynamic graphs and charts. Visualizations like amortization schedules and payment breakdowns allow you to quickly identify trends and assess future financial obligations. This straightforward tool can evolve into more advanced functionalities, including scenario analysis, sensitivity testing, and integration with financial models to further enhance your mortgage forecasting capabilities.