Explore a diverse array of free Excel templates designed specifically for mortgage calculations. The 15-year mortgage calculator template allows you to input your loan amount, interest rate, and start date to quickly assess monthly payments and total interest paid over the life of the loan. This user-friendly tool enhances your financial planning by providing clear visuals and breakdowns of your mortgage repayment schedule.

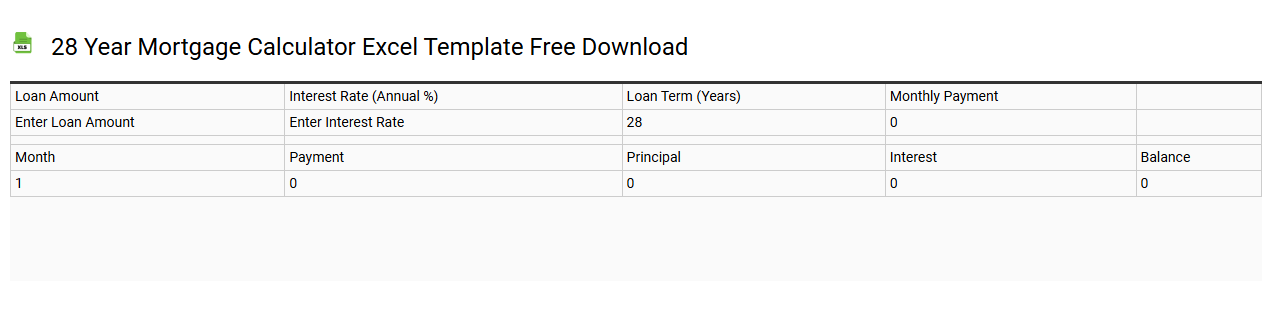

28 year mortgage calculator Excel template free download

💾 28 year mortgage calculator Excel template free download template .xls

A 28-year mortgage calculator Excel template provides a user-friendly tool for estimating monthly mortgage payments over a 28-year term. This template typically includes fields for mortgage amount, interest rate, and down payment, allowing you to see how these variables affect monthly payments. You can easily manipulate calculations to explore different scenarios, helping you make informed financial decisions. Such templates can also serve as a foundation for more complex analyses, including amortization schedules or comparisons between various mortgage products.

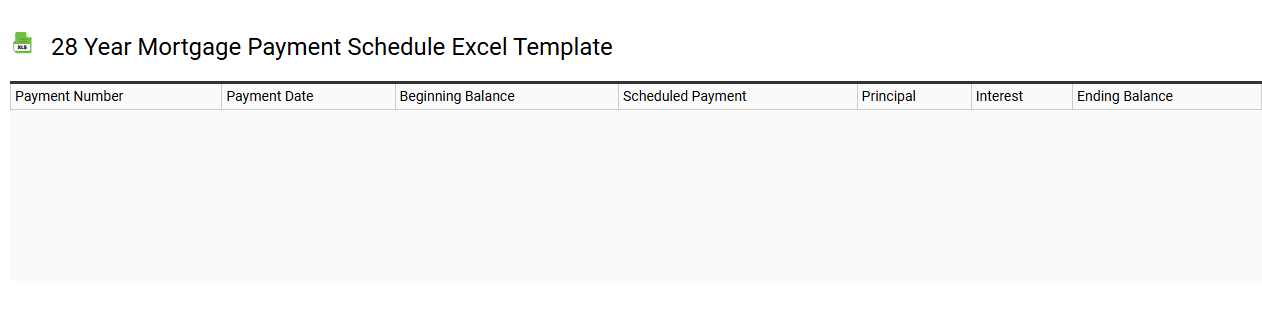

28 year mortgage payment schedule Excel template

💾 28 year mortgage payment schedule Excel template template .xls

A 28-year mortgage payment schedule Excel template provides you with a detailed breakdown of your mortgage payments over the life of the loan. This template typically includes columns for payment number, payment amount, interest paid, principal paid, and remaining balance, allowing you to track your progress and understand how much equity you build over time. You can customize this spreadsheet by inputting your loan amount, interest rate, and specific payment frequency to generate accurate projections tailored to your financial situation. Utilizing such a template can guide you in budgeting, planning for possible additional payments, or exploring advanced options like refinancing or prepayment strategies.

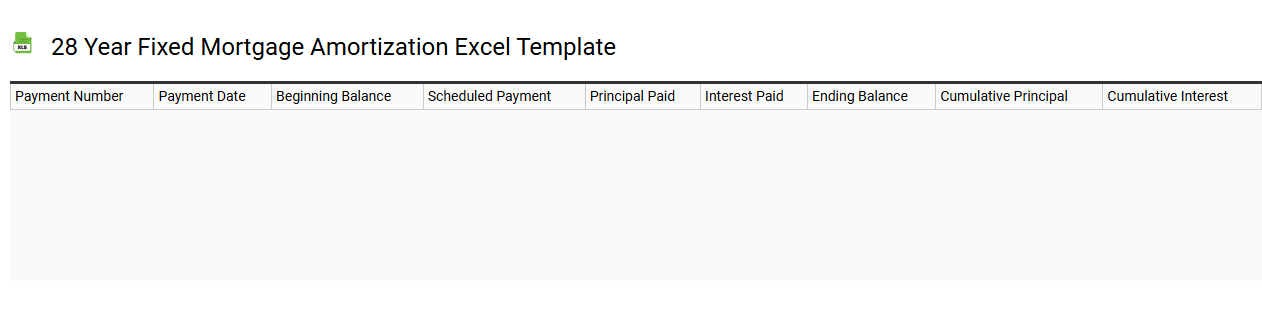

28 year fixed mortgage amortization Excel template

💾 28 year fixed mortgage amortization Excel template template .xls

A 28-year fixed mortgage amortization Excel template is a spreadsheet designed to help you calculate and visualize the repayment schedule of a fixed-rate mortgage over 28 years. This template provides clear breakdowns of monthly payments, principal and interest portions, and remaining balance over time. Users can input loan amount, interest rate, and start date, enabling personalized financial planning. Such templates can support basic budgeting needs while offering potential for deeper analysis, including loan comparison and total interest calculations.

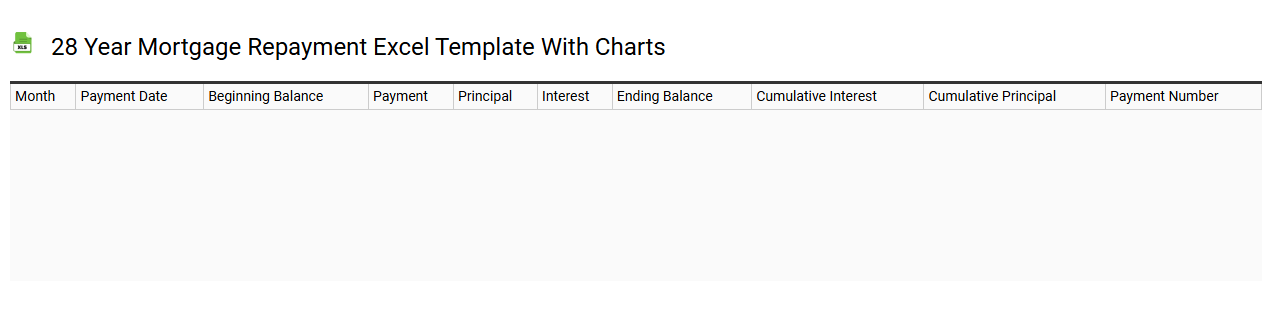

28 year mortgage repayment Excel template with charts

💾 28 year mortgage repayment Excel template with charts template .xls

A 28-year mortgage repayment Excel template with charts is a powerful tool designed to visualize and calculate mortgage payments over a 28-year term. This template typically includes sections for entering the loan amount, interest rate, and any additional payments you might make. Charts embedded in the template provide a clear graphical representation of your repayment schedule, showing how much interest and principal are paid over time. Such functionality allows you to analyze your payment strategy and assess further needs, like optimizing loan terms or exploring refinancing options, using advanced financial metrics such as amortization schedules and cash flow projections.

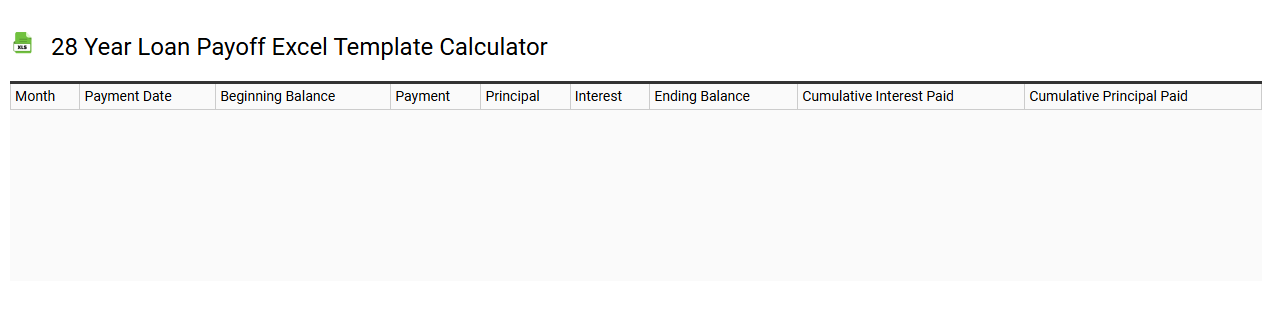

28 year loan payoff Excel template calculator

💾 28 year loan payoff Excel template calculator template .xls

A 28-year loan payoff Excel template calculator is a financial tool designed to help you visualize and manage the repayment of a loan over a 28-year period. It allows you to input key variables such as the loan amount, interest rate, and payment frequency to calculate monthly payments and total interest paid. This template can generate amortization schedules, illustrating how much of each payment goes toward principal and interest over time. You might use it for mortgages or other long-term loans, and you can customize it for scenarios involving extra payments or changes in interest rates as you explore advanced financial strategies.

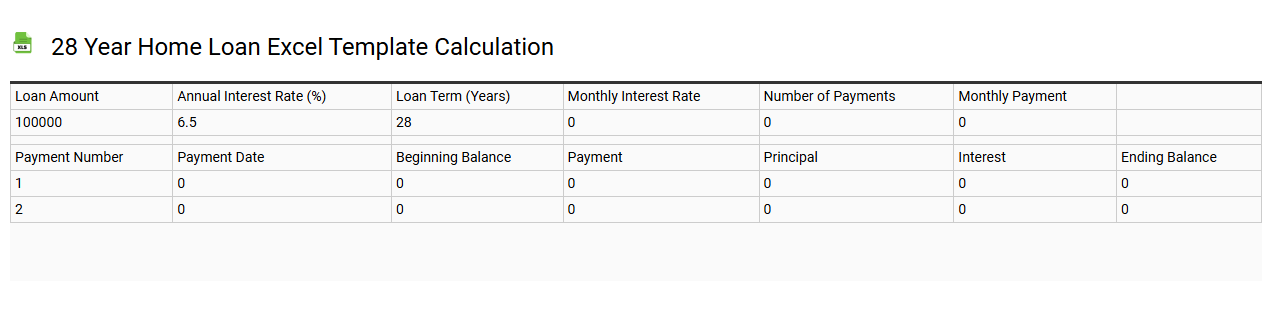

28 year home loan Excel template calculation

💾 28 year home loan Excel template calculation template .xls

A 28-year home loan Excel template provides a structured way to manage and calculate mortgage payments over the loan's duration. This template typically includes input fields for loan amount, interest rate, and property tax, allowing for precise monthly payment calculations. Utilizing built-in formulas helps you visualize the amortization schedule, showing how much of each payment goes toward the principal versus interest over time. With this tool, you can easily assess your financial commitments and explore options like early payment strategies or refinancing scenarios to enhance your financial planning.

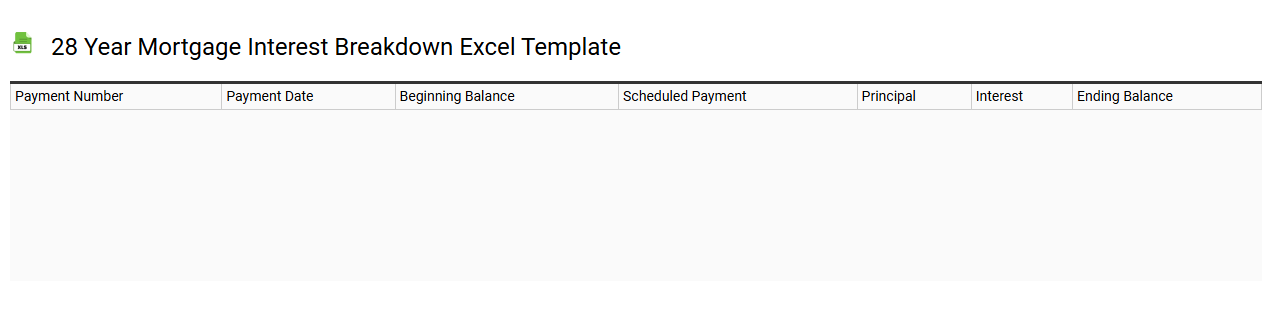

28 year mortgage interest breakdown Excel template

💾 28 year mortgage interest breakdown Excel template template .xls

A 28-year mortgage interest breakdown Excel template allows you to visualize the allocation of your monthly payments towards principal and interest throughout the life of the loan. Each row in the spreadsheet typically represents a monthly payment, showing the remaining balance of the mortgage after each payment. The template breaks down how much of each payment is applied to interest compared to what reduces the principal. For homeowners tracking their finances, mastering this tool can clarify overall payment structure, assist in budget planning, and open avenues for advanced amortization schedules and interest calculations if you decide to delve deeper.

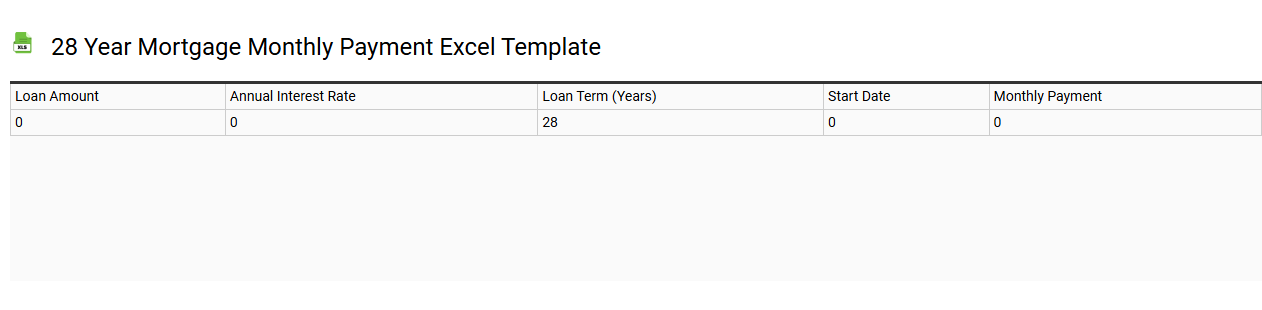

28 year mortgage monthly payment Excel template

💾 28 year mortgage monthly payment Excel template template .xls

A 28-year mortgage monthly payment Excel template calculates your monthly mortgage payments based on the principal loan amount, interest rate, and loan term. It typically includes input fields for loan details, such as the total amount borrowed, annual interest rate, and the duration of the loan in years. The template utilizes the PMT function, allowing you to quickly see how different interest rates or loan amounts impact your monthly obligations. You can easily adjust your inputs for scenarios like refinancing or evaluating future property investments. Further potential needs might involve advanced financial modeling techniques, including amortization schedules or sensitivity analysis.

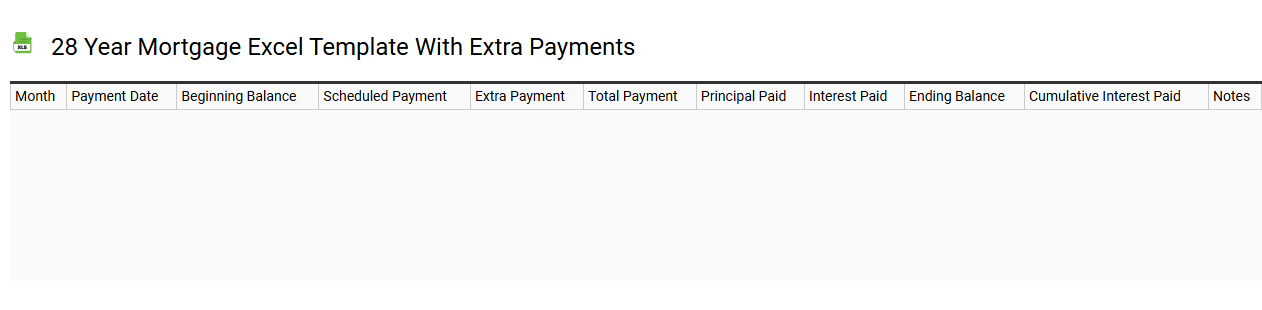

28 year mortgage Excel template with extra payments

💾 28 year mortgage Excel template with extra payments template .xls

A 28-year mortgage Excel template with extra payments allows borrowers to visualize and manage their mortgage repayment process, detailing the impact of additional payments on their loan balance. This template typically includes fields for key information such as mortgage amount, interest rate, monthly payment, and extra payment amounts. Users can see how making extra payments affects the total interest paid over the life of the loan, as well as how it reduces the payoff timeline. Understanding these calculations can help you optimize your mortgage strategy, whether considering refinancing options or evaluating the benefits of adjustable-rate loans and amortization schedules.

28 year mortgage balance tracker Excel template

![]()

💾 28 year mortgage balance tracker Excel template template .xls

The 28-year mortgage balance tracker Excel template is a financial tool designed to help you monitor the remaining balance of your mortgage over time. It typically includes rows for each month, allowing you to input your payments and interest to see how they affect your principal balance. The template can also feature formulas that automatically calculate total interest paid and remaining principal as you update your payments. This basic usage can further accommodate advanced features like amortization schedules, scenario analysis, and customized interest rates to tackle various financial planning needs.

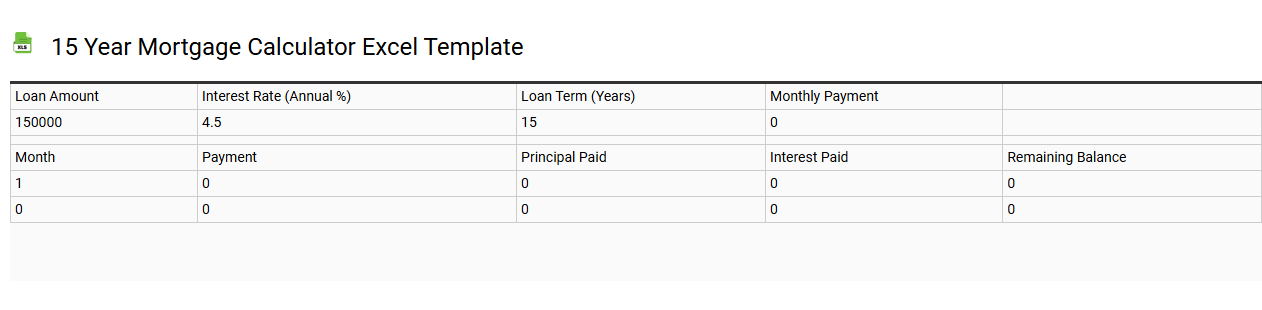

15 year mortgage calculator Excel template

💾 15 year mortgage calculator Excel template template .xls

A 15-year mortgage calculator Excel template allows you to easily compute monthly payments and total interest for a mortgage over a 15-year period. Users can input essential data such as loan amount, interest rate, and start date to generate an amortization schedule. The template clearly outlines each payment, showcasing the principal and interest components alongside the remaining balance. This tool can help you assess affordability and gauge how overpaying or making extra payments could impact your long-term financial goals, while also offering possibilities for advanced financial analyses like scenario modeling or tax implications.

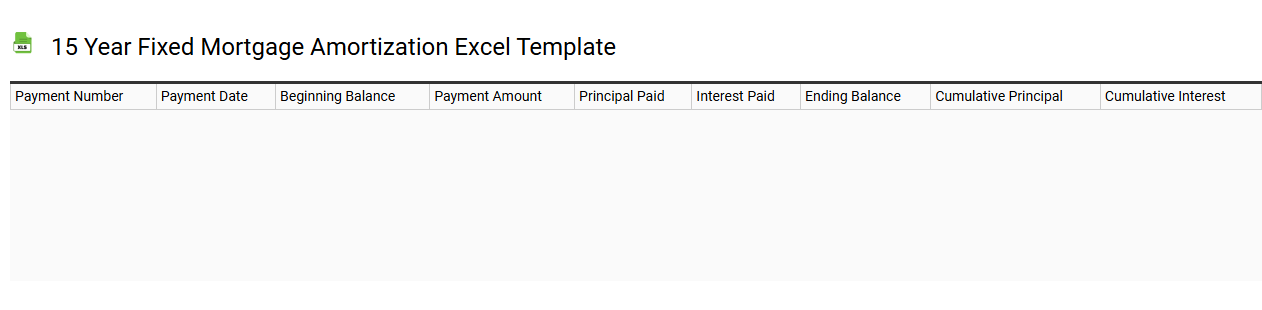

15 year fixed mortgage amortization Excel template

💾 15 year fixed mortgage amortization Excel template template .xls

A 15-year fixed mortgage amortization Excel template is a financial tool designed to help you visualize and manage the repayment schedule of a mortgage fixed over a 15-year term. This template typically includes essential data such as loan amount, interest rate, and monthly payment calculations, providing a clear breakdown of principal and interest over the loan's life. You can dynamically adjust variables to see how changes in loan terms or interest rates affect monthly payments and total interest paid. This type of template not only aids in basic budgeting but can also serve advanced needs, such as scenario analysis and graphical representations of amortization schedules.

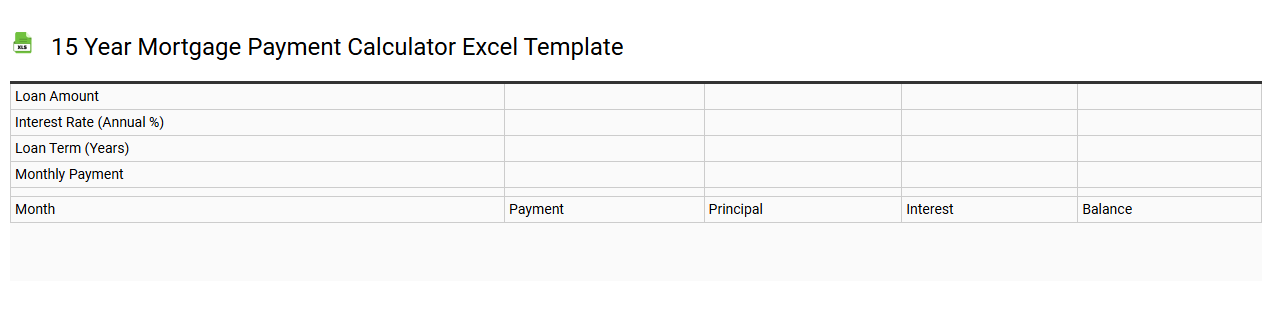

15 year mortgage payment calculator Excel template

💾 15 year mortgage payment calculator Excel template template .xls

A 15-year mortgage payment calculator Excel template is a tool that allows users to estimate monthly mortgage payments for a loan term of 15 years. This spreadsheet typically requires inputs such as loan amount, interest rate, and any additional fees, which then calculate the principal and interest owed on the mortgage. You can visualize amortization schedules and total interest paid over the loan term. This template serves basic budgeting needs while also offering deeper insights into potential refinancing options and advanced interest calculations.

15 year loan schedule Excel template free

💾 15 year loan schedule Excel template free template .xls

A 15-year loan schedule Excel template is a financial tool designed to help you manage and visualize your loan repayment over a period of 15 years. It typically includes rows for each payment, detailing the principal, interest, and remaining balance after every installment. You can easily customize this template by inputting your loan amount, interest rate, and payment frequency to generate an amortization schedule tailored to your needs. For users seeking to further analyze their financial situation, advanced features might include sensitivity analysis and refinancing options to explore various repayment strategies.

15 year mortgage payoff Excel template

💾 15 year mortgage payoff Excel template template .xls

A 15-year mortgage payoff Excel template is a financial tool designed to help you visualize and manage your mortgage repayment plan over a 15-year period. This template typically includes sections for inputting loan amount, interest rate, and monthly payment calculations, allowing you to see how much interest you will pay over the life of the loan versus how quickly you can pay it off. Graphs and charts may be included to visually represent your balance over time, making it easier to understand your financial trajectory. You can also customize this template to explore various scenarios, such as making extra payments or refinancing options, which can reveal advanced strategies for optimizing your mortgage payoff.

15 year mortgage principal and interest Excel template

💾 15 year mortgage principal and interest Excel template template .xls

A 15-year mortgage principal and interest Excel template helps you assess your monthly payments and total interest over the life of the loan. The template typically includes inputs for loan amount, interest rate, and start date, generating a clear amortization schedule that outlines how much of each payment goes toward principal versus interest. By visualizing the amortization process, you can easily track your loan balance over time and understand the impact of extra payments. This tool can serve basic budgeting needs, while advanced users might explore features that incorporate escrow calculations or refinancing scenarios.

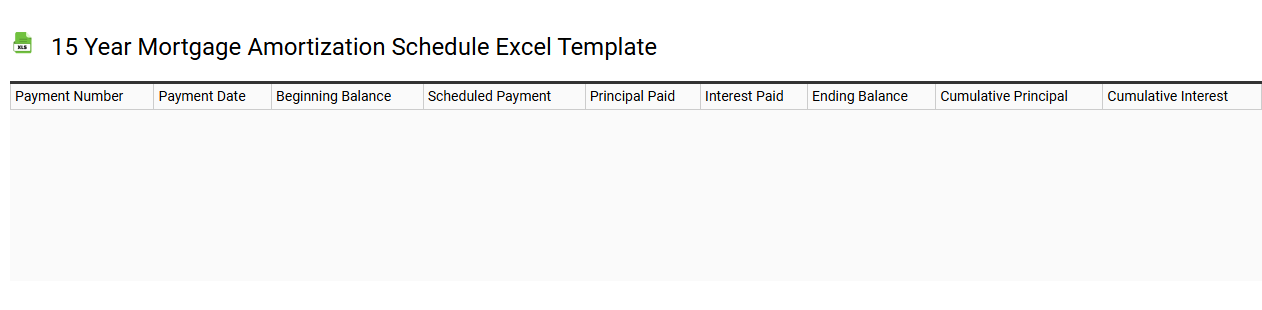

15 year mortgage amortization schedule Excel template

💾 15 year mortgage amortization schedule Excel template template .xls

A 15-year mortgage amortization schedule Excel template is a financial tool that outlines how each monthly payment contributes to principal and interest over the life of the loan. Each row typically represents one month of payments, displaying the total payment amount, the portion applied toward interest, and the remaining balance after each payment. Users can customize variables such as loan amount, interest rate, and start date to see how changes affect their payment structure. This template can serve your basic budgeting needs, while advanced users might explore incorporating features like varying interest rates, extra payments, or prepayment options.

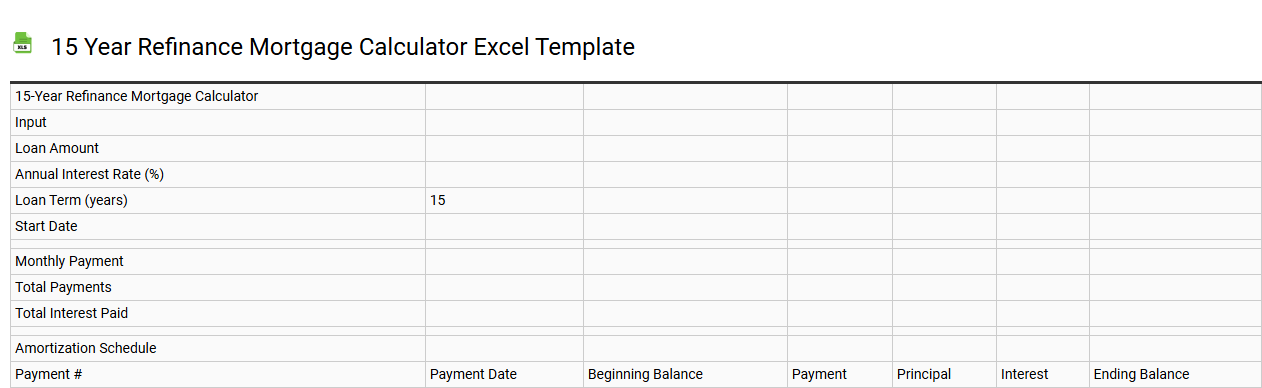

15 year refinance mortgage calculator Excel template

💾 15 year refinance mortgage calculator Excel template template .xls

A 15-year refinance mortgage calculator Excel template is a tool designed to help you evaluate the financial implications of refinancing your current mortgage into a 15-year loan. This template typically includes fields for entering your current mortgage balance, interest rate, new loan interest rate, and closing costs. Inputting these variables allows you to calculate potential monthly payments, total interest saved over the life of the loan, and break-even points for recouping refinancing costs. You can customize it further to explore various scenarios, including adjusting payoffs or enabling advanced calculations like amortization schedules and tax implications.

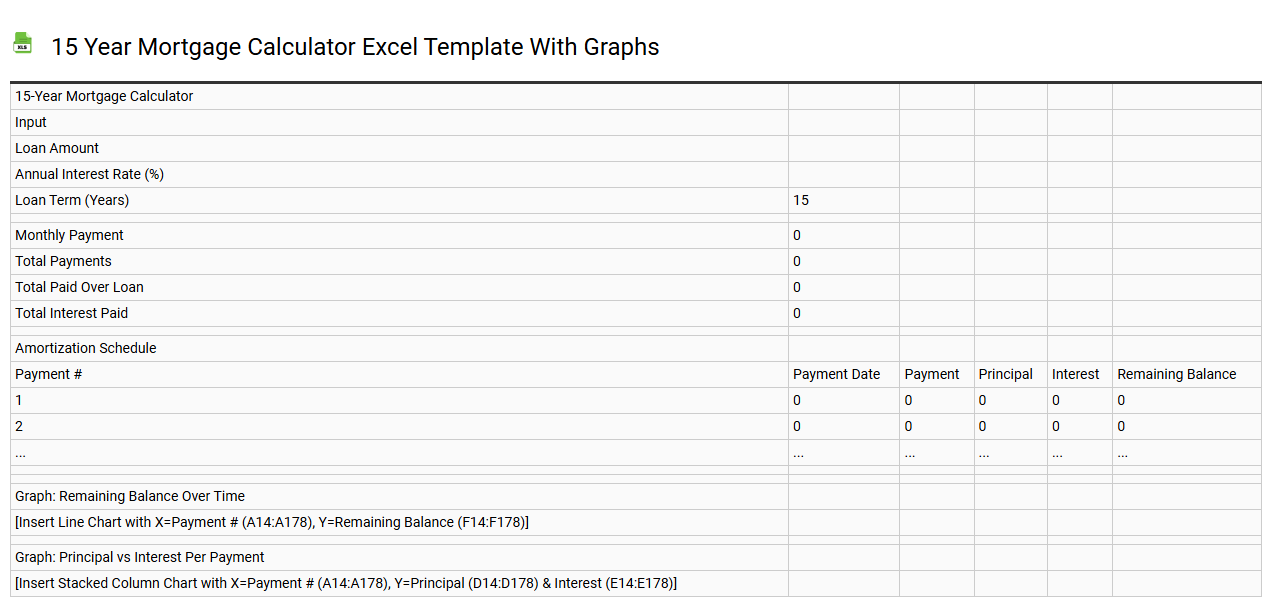

15 year mortgage calculator Excel template with graphs

💾 15 year mortgage calculator Excel template with graphs template .xls

A 15-year mortgage calculator Excel template helps you visualize and understand your mortgage payment schedule and overall financial commitment over a 15-year term. It includes key components such as principal balance, interest rate, monthly payments, and amortization graphs that illustrate how your payments evolve over time. You can input variables like loan amount and interest rate to see real-time updates on monthly payments and total interest paid. This tool is beneficial for identifying potential costs and planning for advanced financial strategies, such as refinancing or accelerating principal payments.

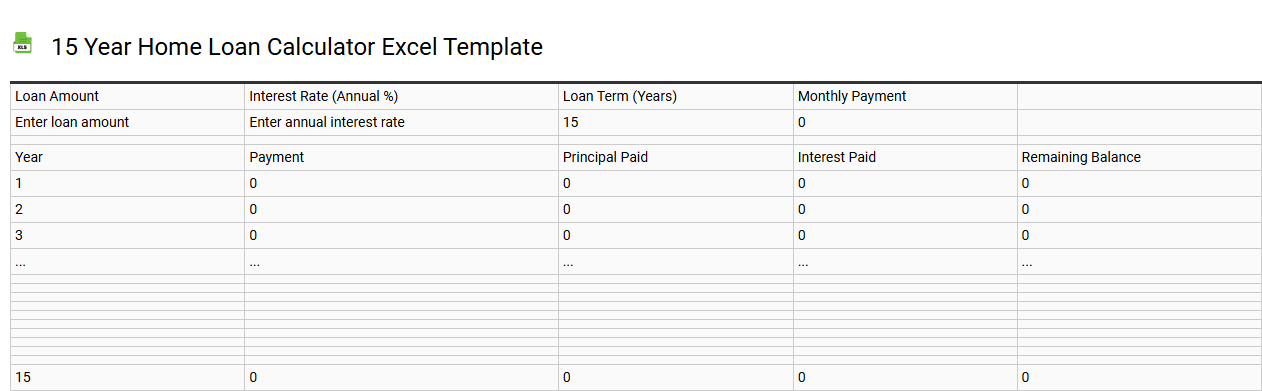

15 year home loan calculator Excel template

💾 15 year home loan calculator Excel template template .xls

A 15-year home loan calculator Excel template is a spreadsheet designed to help you estimate your monthly mortgage payments over a 15-year period. This template typically includes fields for inputting the loan amount, interest rate, and any applicable taxes or insurance. You can visually see how much of your payment contributes to the principal versus interest over time. With this tool, you can quickly assess your financial landscape and plan for potential additional costs, such as closing fees or maintenance expenses, while considering more advanced options like refinancing or adjusting payment frequencies.