Discover a variety of free Excel templates tailored for calculating and tracking your mortgage interest deductions. These user-friendly templates simplify the process, allowing you to input essential data such as loan amount, interest rate, and payment history. With organized layouts and clear formulas, managing your deductions becomes effortless, ensuring you optimize your financial benefits come tax time.

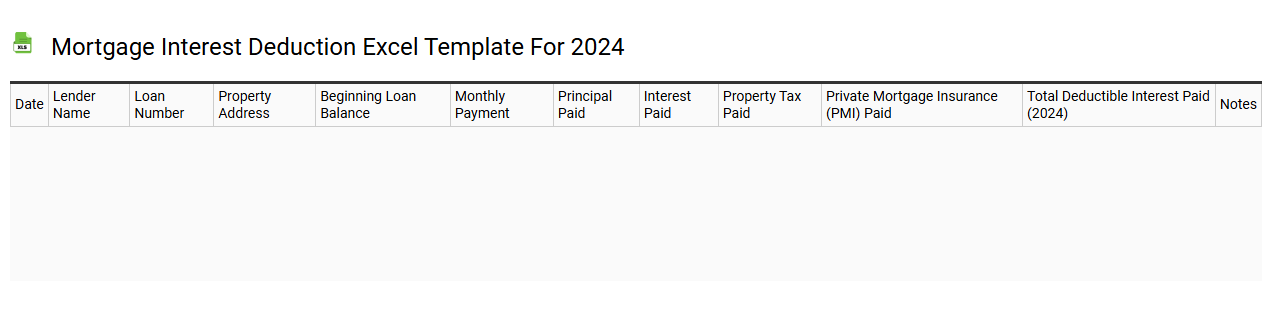

Mortgage interest deduction Excel template for 2024

💾 Mortgage interest deduction Excel template for 2024 template .xls

A Mortgage Interest Deduction Excel template for 2024 is a customizable spreadsheet designed to help homeowners calculate and track the interest paid on their mortgage throughout the year. This tool typically includes sections for inputting loan details, interest rates, and monthly payments, enabling users to monitor their potential tax deductions efficiently. By organizing this information, you can easily determine how much of your mortgage interest is deductible when filing taxes, ensuring you maximize your savings. Understanding this basic calculation can pave the way for more advanced financial analysis, such as forecasting tax implications with variable interest rates or integrating it with overall investment strategies.

Mortgage interest deduction tracking Excel template

![]()

💾 Mortgage interest deduction tracking Excel template template .xls

A Mortgage Interest Deduction Tracking Excel template is a customizable tool designed to help you organize and monitor the mortgage interest payments made over the course of a tax year. This template typically includes fields for the date of payment, the amount of interest paid, property details, and tax identification, facilitating easy calculations for tax returns. By accurately tracking this information, you can maximize your deductions and ensure compliance with IRS regulations. For individuals seeking deeper financial insights, the template can be expanded to incorporate advanced features like amortization schedules and investment property analysis.

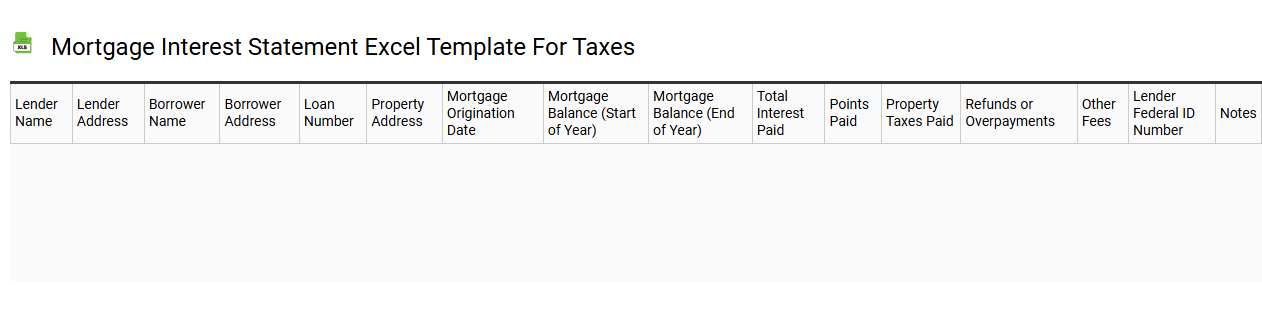

Mortgage interest statement Excel template for taxes

💾 Mortgage interest statement Excel template for taxes template .xls

A Mortgage Interest Statement Excel template for taxes is a structured spreadsheet that helps you organize and calculate mortgage interest paid throughout the year. This template typically includes fields for entry of loan information, payment dates, amounts paid, and corresponding tax deductions. You can easily customize it to reflect your unique mortgage details, enabling a more streamlined tax preparation process. This tool not only simplifies the basic task of documenting mortgage interest for your tax return but also allows for the potential analysis of interest trends or future financial planning using advanced formulas and pivot tables.

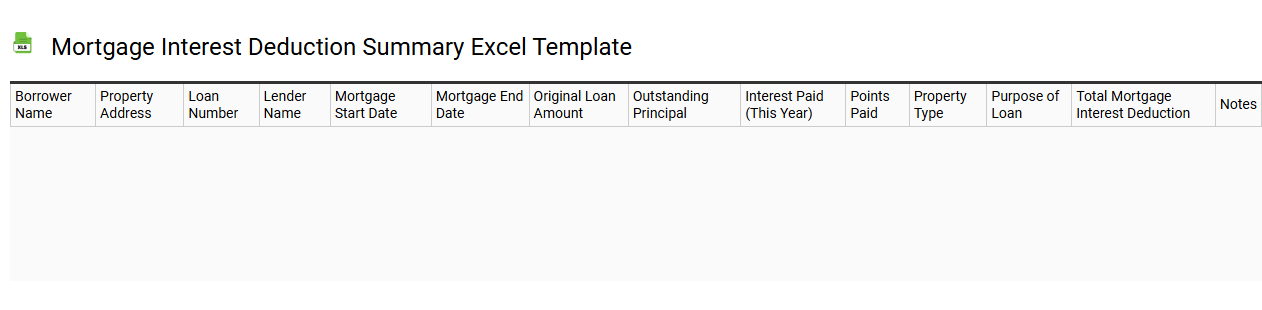

Mortgage interest deduction summary Excel template

💾 Mortgage interest deduction summary Excel template template .xls

A Mortgage Interest Deduction Summary Excel template is a tool designed to help homeowners track and calculate their mortgage interest for tax purposes. This template typically includes fields for the mortgage amount, interest paid, property taxes, and loan origination date. Users can easily input their financial data, which allows for straightforward calculations of potential tax savings. Beyond basic usage, this template can also assist with advanced tax planning strategies, such as leveraging itemized deductions and understanding the implications of refinancing or home equity loans.

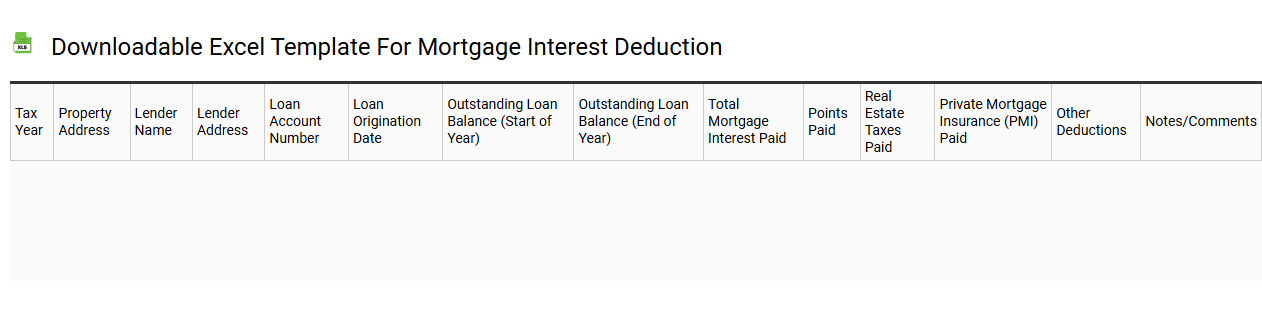

Downloadable Excel template for mortgage interest deduction

💾 Downloadable Excel template for mortgage interest deduction template .xls

A downloadable Excel template for mortgage interest deduction streamlines your financial record-keeping by allowing you to easily track and calculate your mortgage interest payments for tax purposes. This template typically includes pre-formatted fields where you can input your monthly payments, loan amounts, and rates, automatically generating totals and summaries. You can customize it to match your specific mortgage details, making it an essential tool for maximizing your tax deductions. Understanding the template's basic functions can lead to further exploration of advanced financial modeling techniques, such as amortization schedules and capital gains projections.

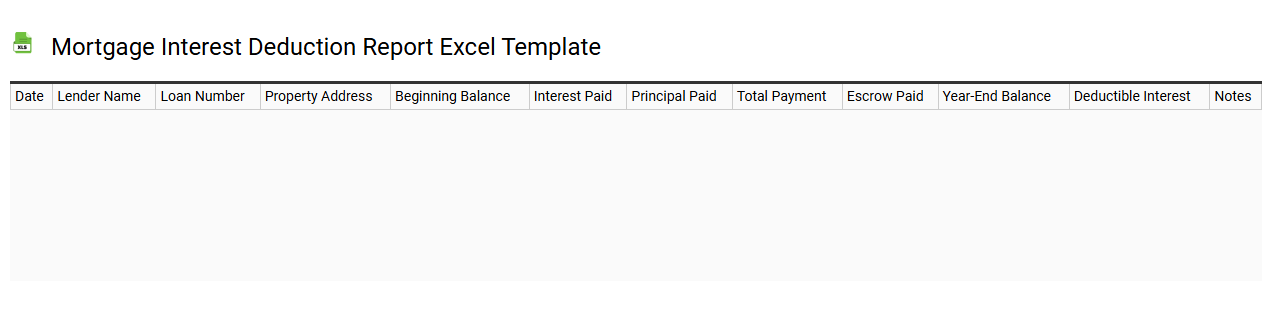

Mortgage interest deduction report Excel template

💾 Mortgage interest deduction report Excel template template .xls

A Mortgage Interest Deduction Report Excel template is a streamlined tool designed to help homeowners track and organize their mortgage interest payments for tax reporting purposes. This template typically includes sections for inputting loan details, interest rates, and payment dates, allowing for easy calculations of the deductible interest amount. Users can analyze their mortgage interest over the year, making tax preparation more efficient and accurate. Such a template supports basic calculations but can be customized further for advanced scenarios like amortization schedules or tax forecasting.

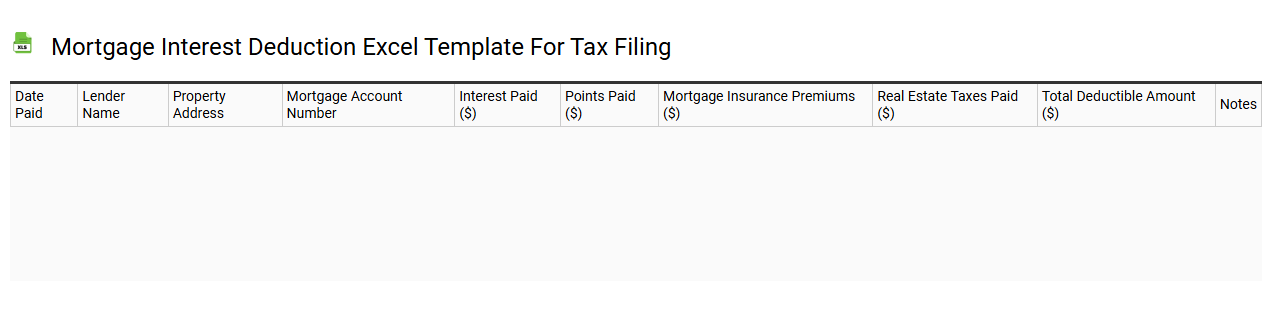

Mortgage interest deduction Excel template for tax filing

💾 Mortgage interest deduction Excel template for tax filing template .xls

The Mortgage Interest Deduction Excel template is a tool designed to simplify the process of calculating tax deductions related to mortgage interest payments. This template allows you to input relevant data such as loan amounts, interest rates, and payment schedules, providing a clear breakdown of how much interest paid can be deducted from your taxable income. Visual charts and tables help you track your payments over time and understand potential tax savings, ensuring you have a comprehensive view of your mortgage interest throughout the year. You can further enhance your financial planning with advanced features like amortization schedules or integration with additional financial data for a holistic approach to your tax strategy.

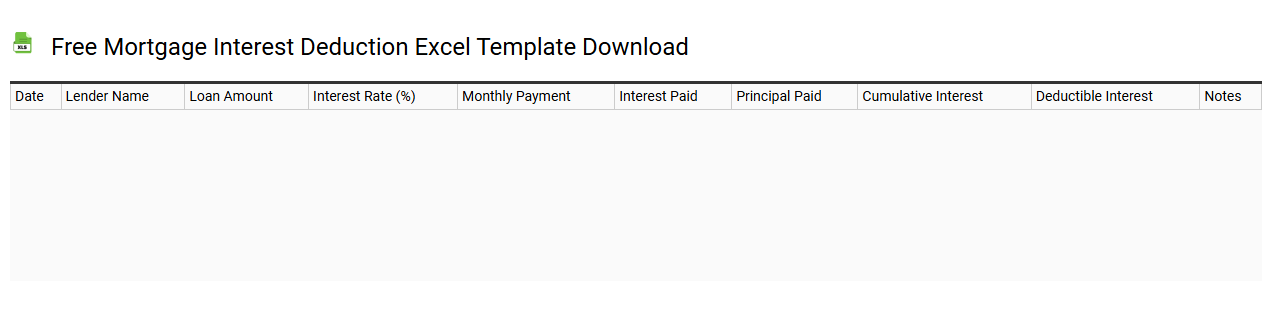

Free mortgage interest deduction Excel template download

💾 Free mortgage interest deduction Excel template download template .xls

A Free mortgage interest deduction Excel template serves as a practical tool designed to help you track and calculate the deductible interest on your mortgage payments for tax purposes. This user-friendly spreadsheet allows you to input various details such as your loan amount, interest rate, and payment frequency, enabling accurate calculations of potential tax savings. Customizable features ensure that you can adapt the template to your specific financial situation, making tax preparation more streamlined. As you utilize this template, consider its basic purpose or explore advanced functionalities, like integration with financial forecasting or tax planning strategies.

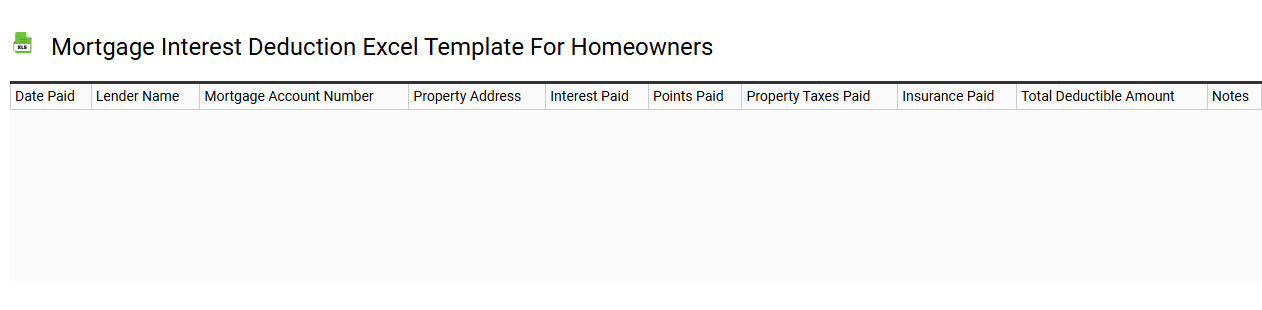

Mortgage interest deduction Excel template for homeowners

💾 Mortgage interest deduction Excel template for homeowners template .xls

A Mortgage Interest Deduction Excel template for homeowners is a structured spreadsheet designed to help you track and calculate the tax benefits associated with mortgage interest payments. It typically includes columns for entering mortgage amounts, payment dates, interest rates, and principal balances, allowing for an organized overview of your monthly contributions. This template can simplify tax preparation by automatically calculating the total interest paid over the year, which can be crucial for maximizing your deductions. For more advanced needs, consider incorporating additional functionalities such as amortization schedules or scenarios for refinancing options.

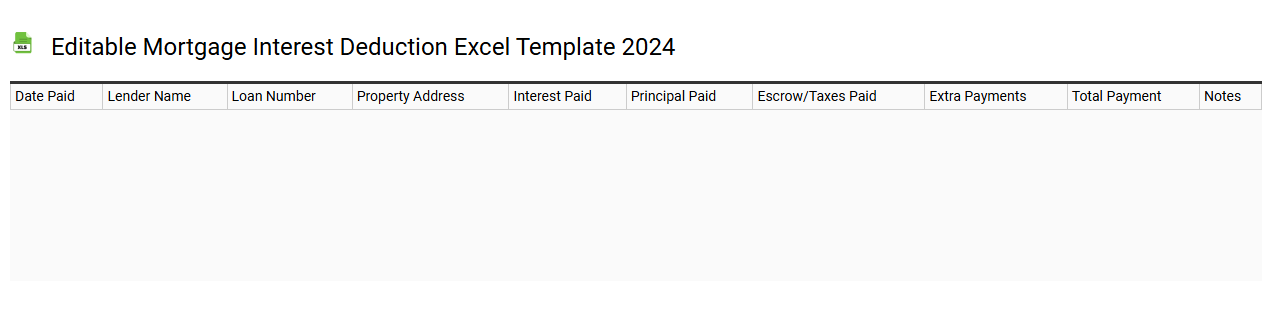

Editable mortgage interest deduction Excel template 2024

💾 Editable mortgage interest deduction Excel template 2024 template .xls

The Editable Mortgage Interest Deduction Excel template for 2024 is a customizable spreadsheet designed to help homeowners track and calculate their mortgage interest deductions for tax purposes. This template allows you to input various details, such as mortgage principal, interest rate, payment dates, and amounts paid throughout the year. You can easily modify the fields to suit your unique financial situation, ensuring accurate documentation for your tax filings. Utilizing this tool not only simplifies your tax preparation but also opens up possibilities for more advanced financial analysis, such as scenario planning and cash flow projections.

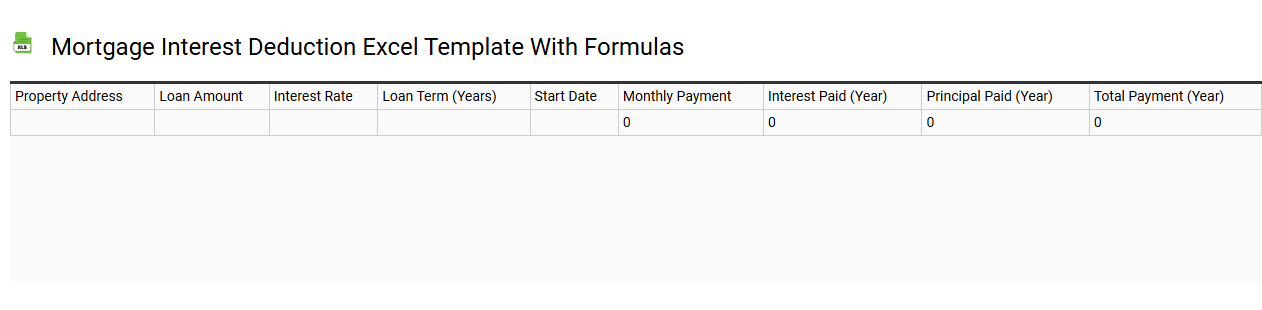

Mortgage interest deduction Excel template with formulas

💾 Mortgage interest deduction Excel template with formulas template .xls

A Mortgage Interest Deduction Excel template is a pre-designed spreadsheet tailored to help you calculate and track the deduction on your mortgage interest payments for tax purposes. This template typically includes formulas to automate calculations, making it easier for you to input data such as loan amounts, interest rates, payment schedules, and total interest paid over specific periods. Features may also encompass amortization schedules that show how much of each payment goes toward interest versus principal, aiding in strategic financial planning. For more advanced usage, consider integrating features like property value appreciation analysis or rent vs. buy decision modeling to maximize your financial insights.

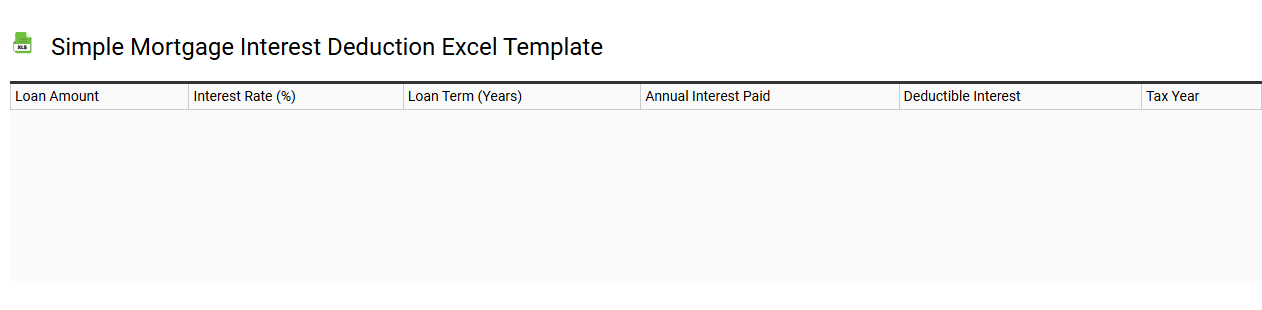

Simple mortgage interest deduction Excel template

💾 Simple mortgage interest deduction Excel template template .xls

A Simple Mortgage Interest Deduction Excel template is an organized spreadsheet that helps homeowners calculate the tax benefits associated with their mortgage interest payments. It typically includes fields for entering the mortgage amount, interest rate, payment frequency, and the total interest paid throughout the year. This user-friendly tool allows you to track your mortgage expenses easily and provides a clear summary of how much interest is eligible for deduction on your tax return. You can leverage this template for basic tax preparation needs, while more advanced users might adapt it for detailed financial modeling or integrate it with other financial software.

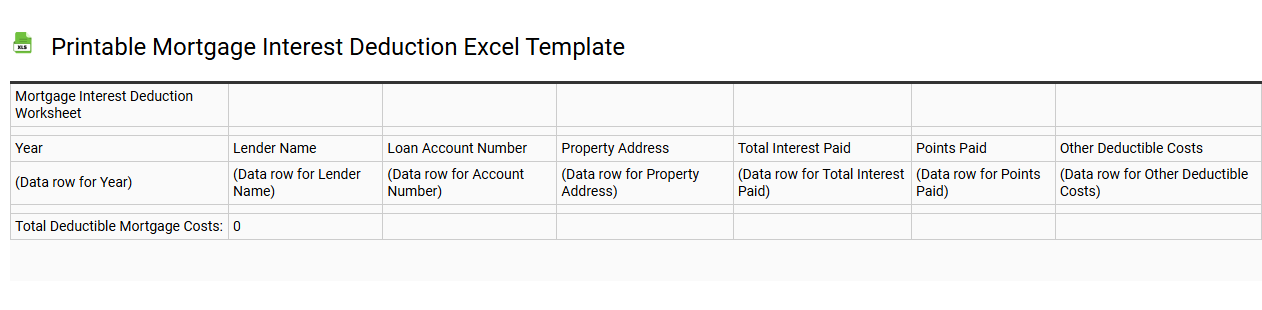

Printable mortgage interest deduction Excel template

💾 Printable mortgage interest deduction Excel template template .xls

A printable mortgage interest deduction Excel template helps homeowners efficiently track and calculate their deductible mortgage interest for tax purposes. This organized spreadsheet typically includes columns for dates, amounts paid, and property details, making it easy for you to compile necessary information. Through clear formatting, users can quickly assess total deductions, ensuring they maximize potential tax benefits. For further potential needs, consider incorporating advanced formulas, pivot tables, or data validation features for a comprehensive financial analysis.

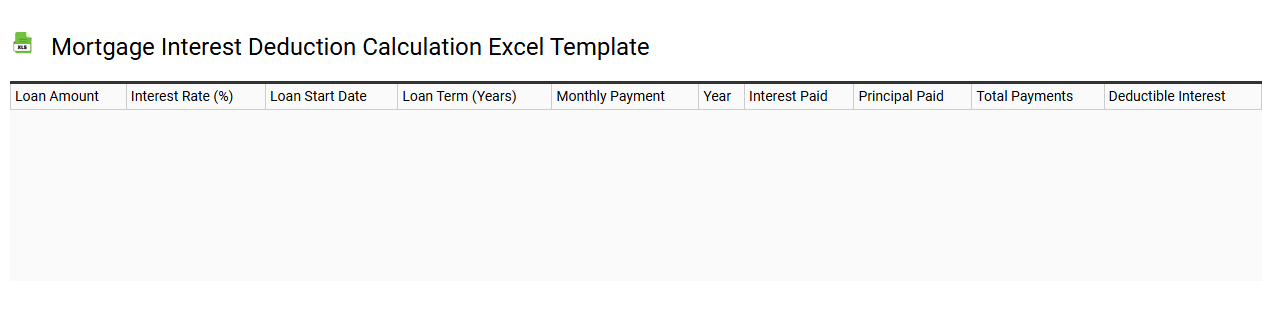

Mortgage interest deduction calculation Excel template

💾 Mortgage interest deduction calculation Excel template template .xls

A Mortgage Interest Deduction Calculation Excel template simplifies the process of determining the amount of mortgage interest you can deduct from your taxable income. This user-friendly spreadsheet typically includes sections for entering loan details, such as the principal amount, interest rate, loan term, and payment schedule. Once you input your mortgage data, the template automatically calculates the total interest paid for the year, applying any necessary tax considerations based on your filing status. You can further expand this template to incorporate advanced features like amortization schedules or tax bracket calculations for strategic financial planning.

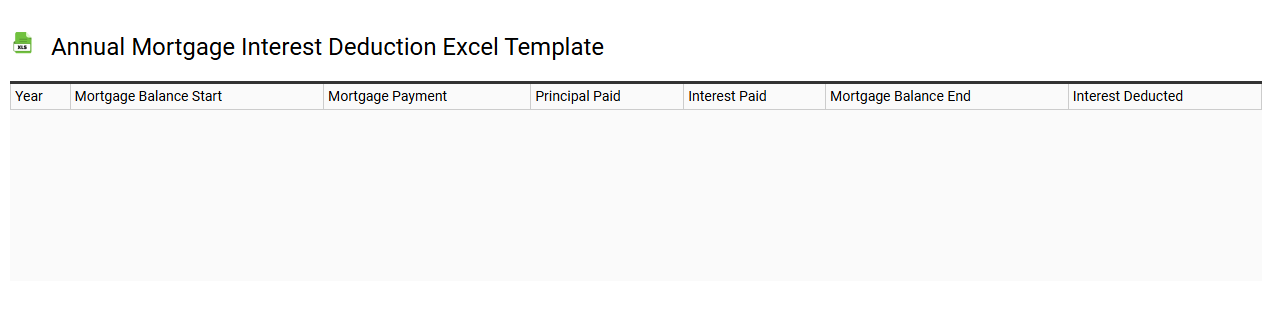

Annual mortgage interest deduction Excel template

💾 Annual mortgage interest deduction Excel template template .xls

An Annual Mortgage Interest Deduction Excel template is a designed spreadsheet that helps homeowners calculate the tax deduction they can claim on the interest paid for their mortgage throughout the year. This template simplifies the tracking of interest payments by allowing you to input the mortgage balance, interest rates, and payment history. It often incorporates formulas that automatically compute the total interest paid, providing an itemized breakdown month by month. This tool assists you in effectively managing your finances and preparing for tax filings, while also allowing for advanced features such as amortization schedules or projections based on varying interest rates and additional payments.