A mortgage payoff schedule Excel template helps you effectively track your payments over the life of the loan. This template typically includes columns for payment dates, principal amounts, interest amounts, and remaining balances. Utilizing this tool allows you to visualize your progress and plan additional payments for faster loan payoff.

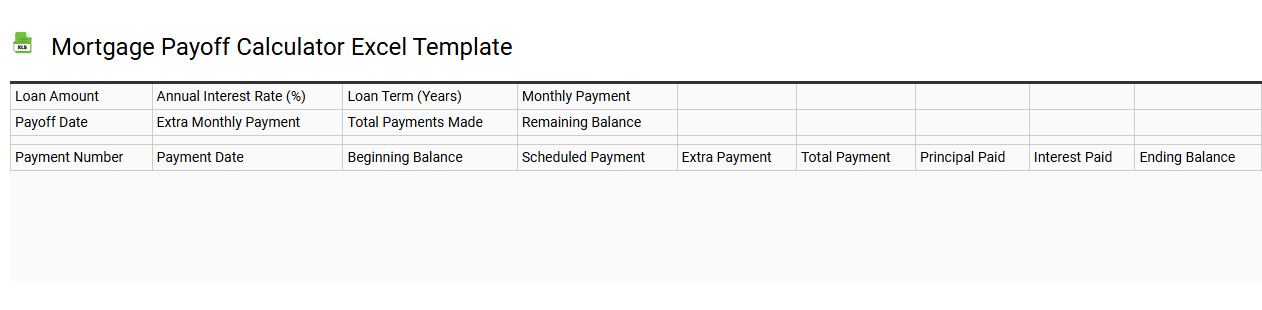

Mortgage payoff calculator Excel template

💾 Mortgage payoff calculator Excel template template .xls

A Mortgage Payoff Calculator Excel template is a versatile tool designed to help homeowners track and manage their mortgage payments. By inputting key data such as loan amount, interest rate, term, and payment frequency, you can visualize your payment schedule over time. This template can also allow you to experiment with different repayment scenarios, enabling you to see how extra payments or refinancing could impact your payoff timeline. Basic usage will help you understand your current mortgage status, while advanced features like amortization schedules and interest savings analysis can cater to more complex financial needs.

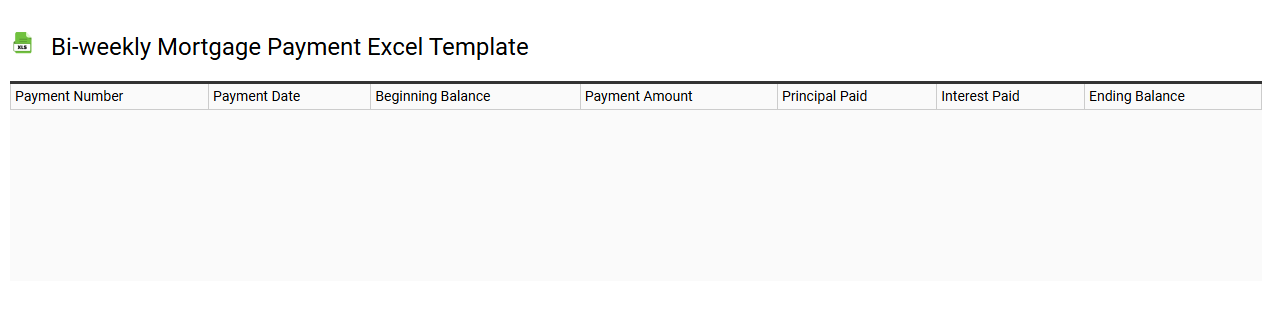

Bi-weekly mortgage payment Excel template

💾 Bi-weekly mortgage payment Excel template template .xls

A bi-weekly mortgage payment Excel template is a financial tool designed to help homeowners manage their mortgage payments effectively by allowing them to set up a bi-weekly payment schedule. This template typically includes fields for loan amount, interest rate, loan term, and existing monthly payment, enabling the user to calculate how bi-weekly payments can impact the total interest paid and loan duration. With this structure, you can easily visualize savings that accrue over time as you make more frequent payments. You may find it useful for not only tracking current payment schedules but also for exploring advanced options like extra principal payments and their effects on loan amortization.

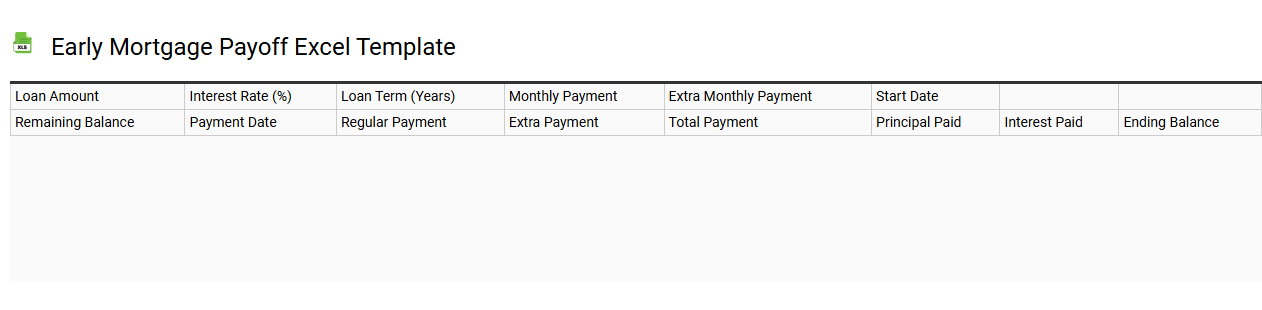

Early mortgage payoff Excel template

💾 Early mortgage payoff Excel template template .xls

An Early Mortgage Payoff Excel template is a financial tool designed to help homeowners visualize and calculate the impact of making extra payments towards their mortgage. This template allows users to input their current mortgage balance, interest rate, monthly payment, and any additional payment amounts. It generates detailed amortization schedules that show how early payments can reduce the overall interest paid and shorten the loan term. By using this template, you can identify potential savings and establish strategies for mortgage repayment, potentially leading to advanced analyses like total interest savings and cash flow projections.

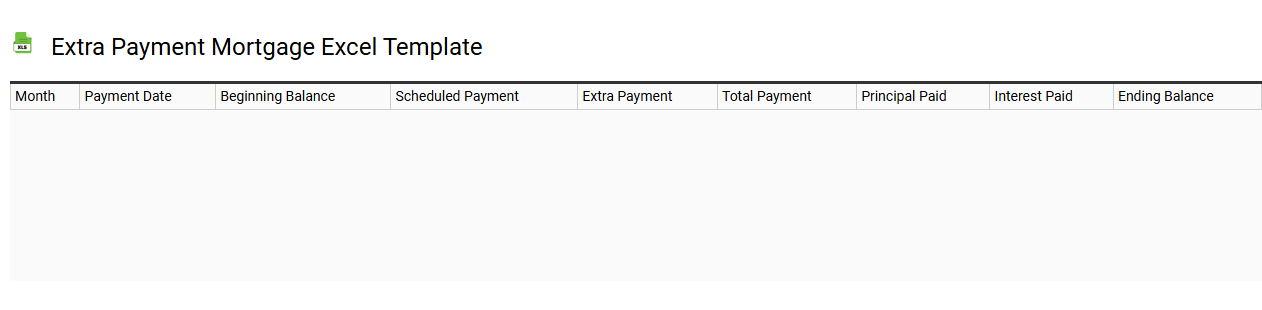

Extra payment mortgage Excel template

💾 Extra payment mortgage Excel template template .xls

An Extra Payment Mortgage Excel template is a tool designed to help homeowners visualize the impact of making additional payments towards their mortgage. This template typically includes fields for the original loan amount, interest rate, loan term, and any extra payment amounts you plan to contribute monthly or annually. With built-in formulas, it calculates potential savings on interest and reduces the total loan term, enabling you to see how much quicker you can pay off your mortgage. Such templates can be useful for budgeting purposes and assessing your financial goals, along with exploring advanced payment strategies like biweekly payments or lump-sum contributions to optimize your mortgage repayment plan.

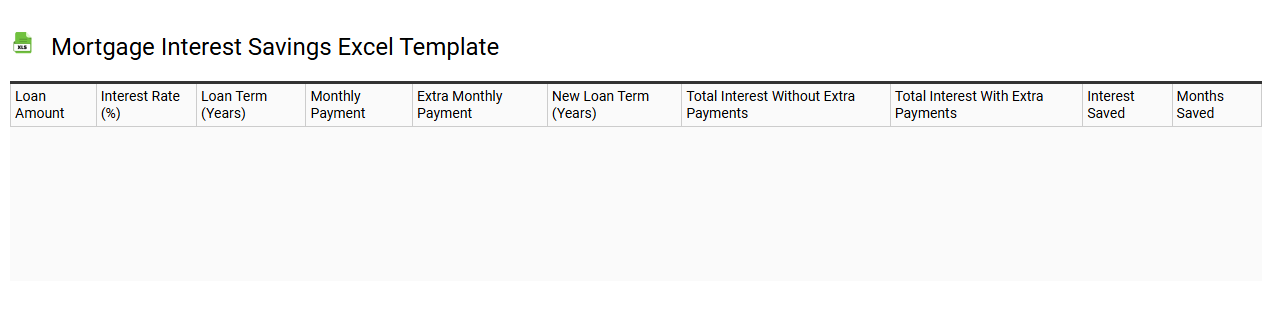

Mortgage interest savings Excel template

💾 Mortgage interest savings Excel template template .xls

A Mortgage Interest Savings Excel template is a specialized financial tool designed to help homeowners analyze and project their savings by paying down their mortgage earlier than scheduled. This template typically includes fields for inputting loan amount, interest rate, loan term, and prepayment amounts, allowing you to visualize the impact of additional payments on overall interest paid and loan duration. You can see detailed charts and tables that illustrate potential savings over time, making it easier to decide if prepaying your mortgage is a financially sound choice. Such templates may also incorporate advanced functions like amortization schedules and net present value calculations, offering insights into both basic budgeting and more complex financial strategies.

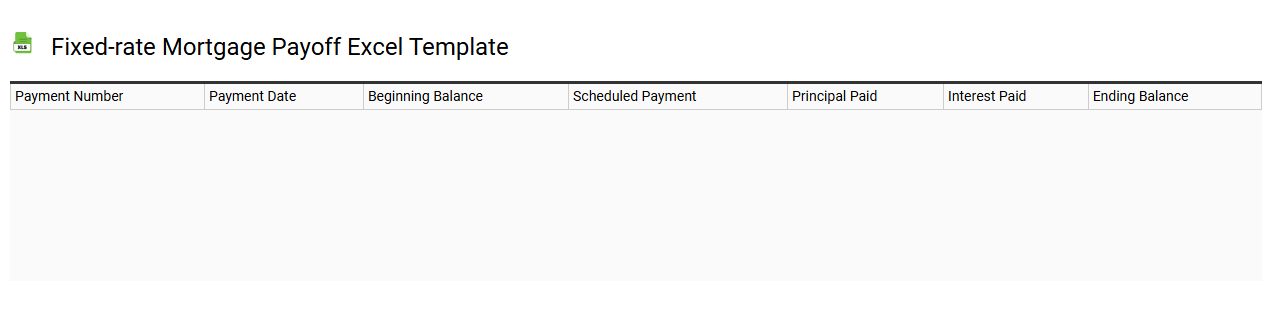

Fixed-rate mortgage payoff Excel template

💾 Fixed-rate mortgage payoff Excel template template .xls

A Fixed-rate mortgage payoff Excel template serves as a financial tool to help homeowners track their mortgage payments and understand how those payments impact the principal balance over time. It typically includes various columns for inputting data such as loan amount, interest rate, loan term, and payment frequency. The template calculates monthly payments and displays an amortization schedule, breaking down the interest and principal portions of each payment. For enhanced analysis, you can customize it to account for additional payments or varying tax implications, aiding in exploring more complex financial scenarios involving equity accumulation or refinancing strategies.

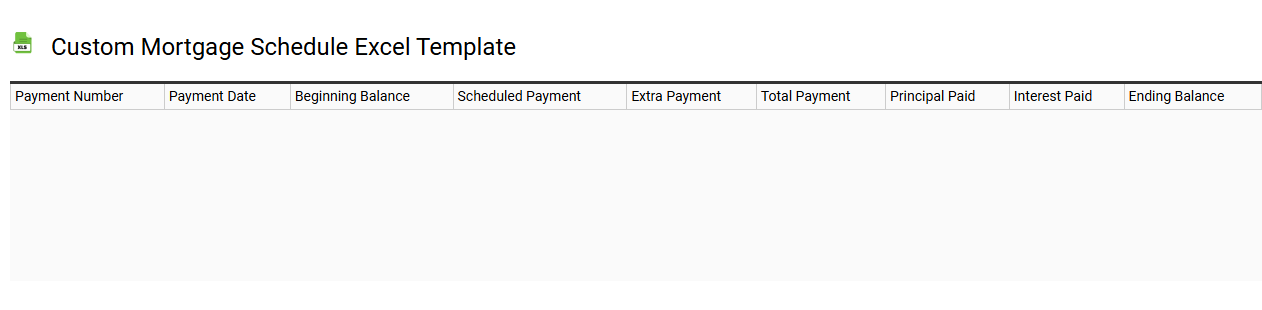

Custom mortgage schedule Excel template

💾 Custom mortgage schedule Excel template template .xls

A Custom Mortgage Schedule Excel template is a pre-designed spreadsheet that allows users to create an amortization schedule tailored to specific mortgage parameters. This tool helps you visualize loan repayment over time, detailing monthly payments, interest, principal reduction, and remaining balance. Users can input various loan amounts, interest rates, and repayment terms to generate a customized repayment plan. Beyond basic calculation needs, this template can also track additional payments, refine tax implications, and analyze potential refinancing scenarios with advanced financial functions.