A biweekly mortgage calculator Excel template helps you manage and visualize your mortgage payments with ease. It allows you to input your loan amount, interest rate, and term to calculate how biweekly payments can reduce the overall interest paid and shorten the loan term. This tool not only provides an insightful breakdown of payments but also empowers you to make informed decisions about your financial future.

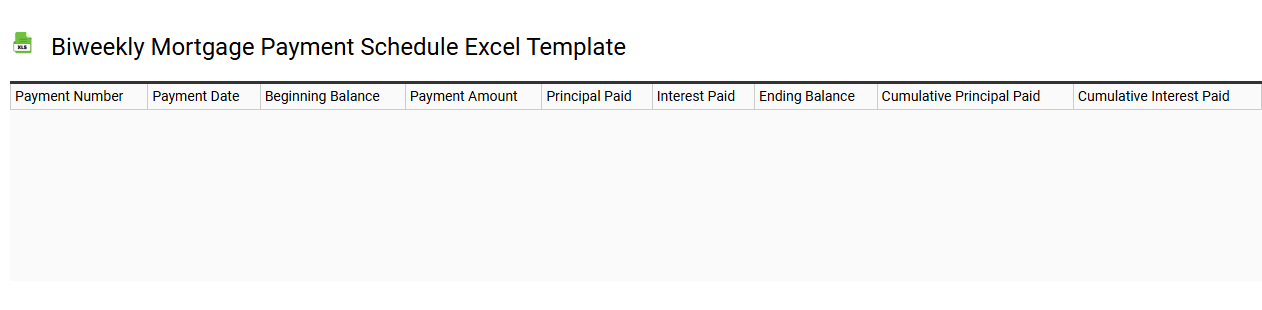

Biweekly mortgage payment schedule Excel template

💾 Biweekly mortgage payment schedule Excel template template .xls

A biweekly mortgage payment schedule Excel template is a structured tool designed to help you manage and visualize your mortgage payments made every two weeks. This template typically includes a breakdown of each payment, detailing the principal and interest components, along with remaining balance calculations over time. Customizable fields allow you to input your loan amount, interest rate, and loan term, making it easy to see how biweekly payments can reduce the total interest paid and shorten the loan term. Such templates may also offer charts and graphs for a clearer understanding and can be edited for advanced scenarios like additional principal payments or varying interest rates over time.

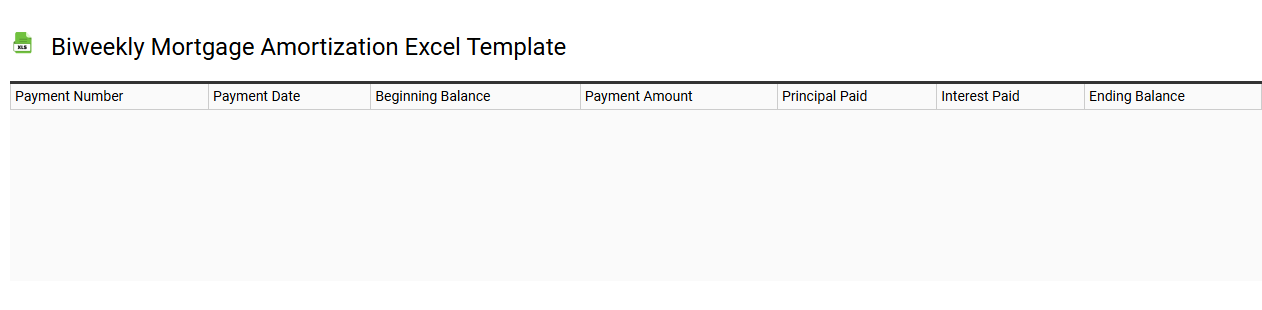

Biweekly mortgage amortization Excel template

💾 Biweekly mortgage amortization Excel template template .xls

A biweekly mortgage amortization Excel template is a financial tool designed to help homeowners manage their mortgage repayments on a biweekly basis. This type of template allows you to input your loan amount, interest rate, and loan term, automatically calculating your biweekly payment and providing a detailed amortization schedule. With this schedule, you can see how much of each payment goes toward principal versus interest over time. By analyzing this data, you can consider strategies for reducing your mortgage balance more quickly, such as making extra payments or adjusting the frequency of your payments for long-term savings. For further needs, exploring advanced terms like "prepayment penalties" or "loan-to-value ratio" can provide deeper insights into mortgage management.

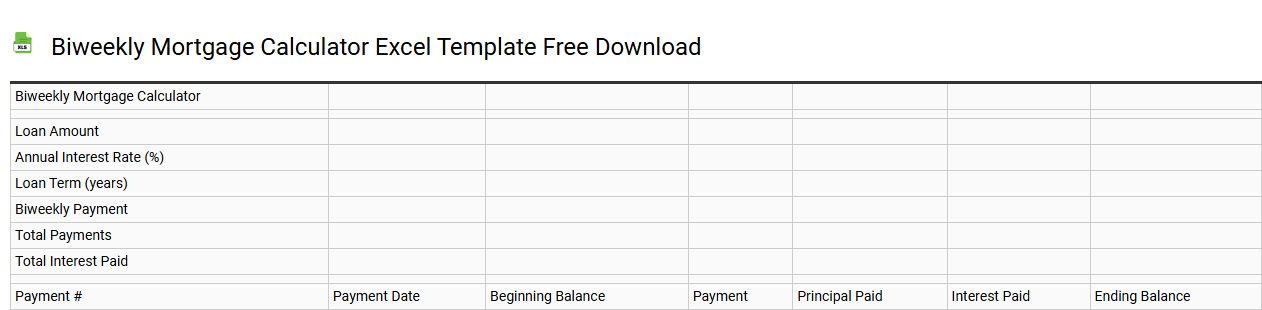

Biweekly mortgage calculator Excel template free download

💾 Biweekly mortgage calculator Excel template free download template .xls

A biweekly mortgage calculator Excel template is a tool designed to help you manage and analyze mortgage payments made every two weeks instead of monthly. This template allows you to input your mortgage details, such as loan amount, interest rate, and term length, providing a clear breakdown of payments over time. You can see how biweekly payments can reduce the total interest paid and shorten the loan term significantly. For those looking to delve deeper into financial planning, advanced features may include amortization schedules, different payment scenarios, and comparisons with other payment frequencies.

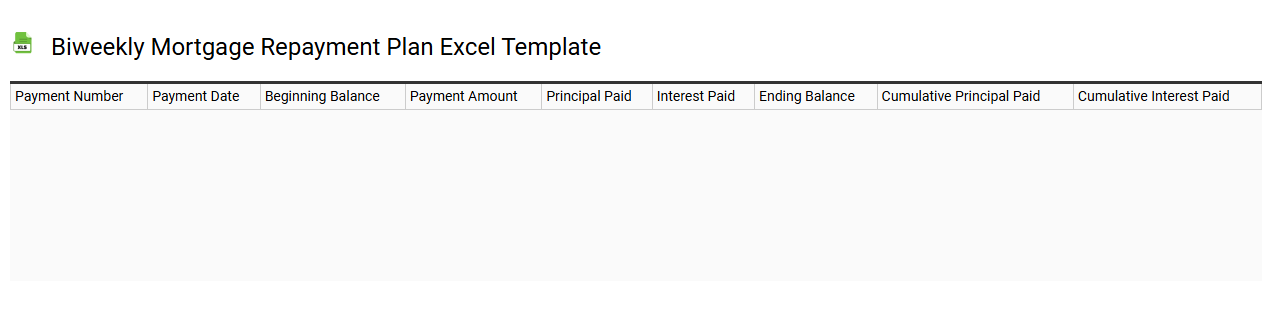

Biweekly mortgage repayment plan Excel template

💾 Biweekly mortgage repayment plan Excel template template .xls

A biweekly mortgage repayment plan Excel template is a financial tool designed to help homeowners manage their mortgage payments more effectively. This template breaks down your total mortgage into biweekly payments, allowing you to see how paying every two weeks can reduce overall interest and shorten the loan term. It typically includes fields for loan amount, interest rate, and term length, automatically calculating payment amounts and total interest saved. As you track your payments, the template can reveal insights into potential extra payments and their effects on your mortgage balance, useful for fine-tuning your repayment strategy and exploring amortization schedules or refinancing options.

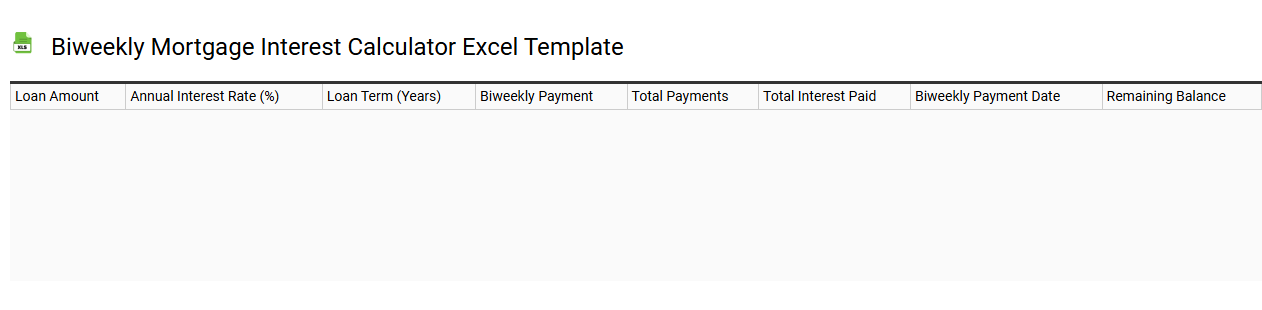

Biweekly mortgage interest calculator Excel template

💾 Biweekly mortgage interest calculator Excel template template .xls

A biweekly mortgage interest calculator Excel template is a tool designed specifically for homeowners seeking to understand the impact of making biweekly mortgage payments instead of monthly payments. This template allows users to input their loan amount, interest rate, and term length, providing a clear comparison of total interest paid and loan payoff time when opting for biweekly payments. It typically includes detailed calculations, visual charts, and amortization schedules that illustrate how biweekly payments can significantly reduce overall mortgage costs and accelerate equity buildup. You can use this template not only for basic calculations but also to explore advanced financial strategies like refinancing options or prepayment scenarios.

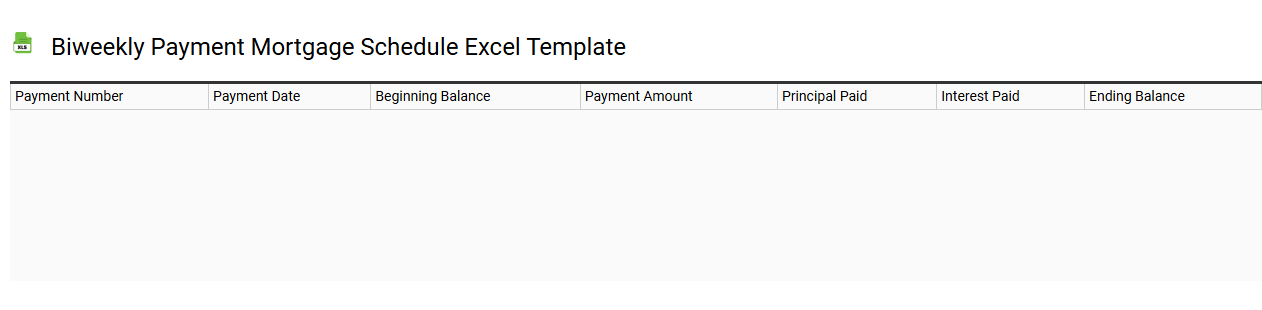

Biweekly payment mortgage schedule Excel template

💾 Biweekly payment mortgage schedule Excel template template .xls

A biweekly payment mortgage schedule Excel template is a tool designed to help homeowners manage their mortgage payments effectively. This template allows you to input your loan amount, interest rate, and term length, generating a detailed payment schedule that shows payments made every two weeks. You can track how much of each payment goes toward principal versus interest, providing insight into your mortgage reduction over time. This tool is particularly useful for anyone looking to understand the impact of biweekly payments on loan payoff and interest savings, while offering further potential needs such as amortization and early payoff strategies.

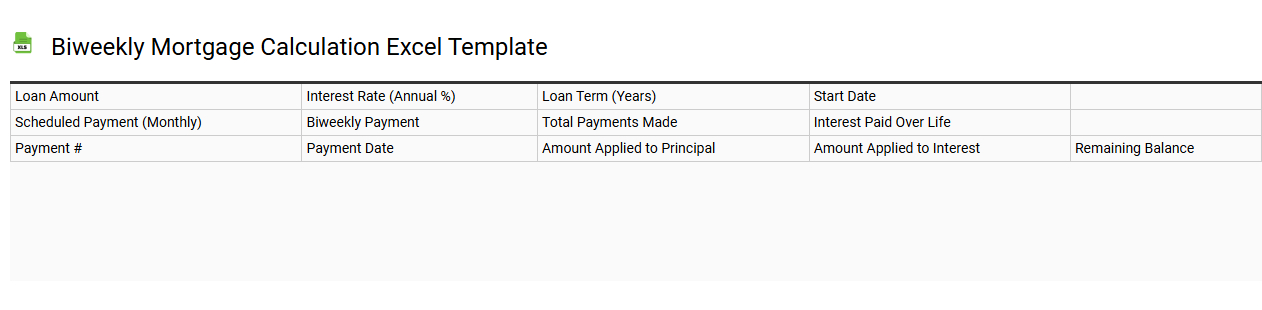

Biweekly mortgage calculation Excel template

💾 Biweekly mortgage calculation Excel template template .xls

A biweekly mortgage calculation Excel template is a tool designed to help homeowners manage and analyze their mortgage payments made every two weeks instead of monthly. This template typically includes fields for inputting your loan amount, interest rate, loan term, and specific biweekly payment amounts. It generates projections showing how biweekly payments can significantly reduce the overall interest paid and shorten the loan term. You can also explore potential refinements to your financial strategy, such as incorporating additional payments or calculating the impact of different interest rates and loan modifications.

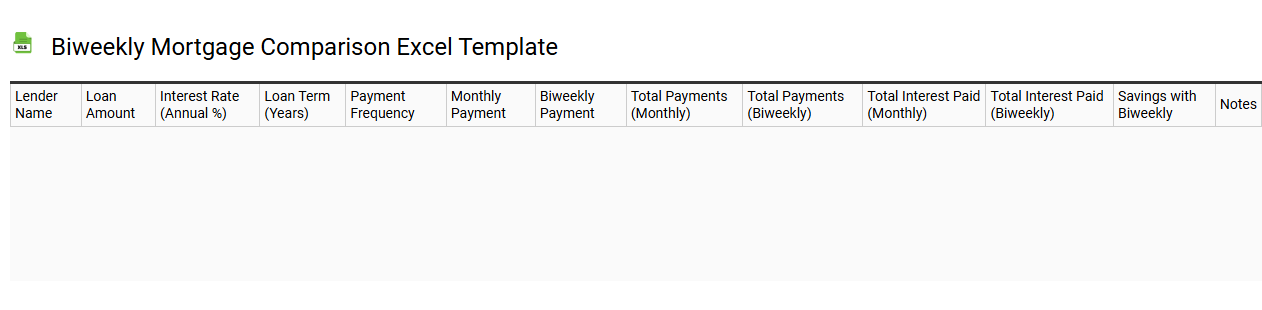

Biweekly mortgage comparison Excel template

💾 Biweekly mortgage comparison Excel template template .xls

A biweekly mortgage comparison Excel template serves as a powerful tool for homeowners seeking to understand the benefits of making biweekly payments on their mortgage. This template typically includes fields for entering your loan amount, interest rate, and loan term, allowing you to calculate potential savings over the life of the loan. The format often showcases a comparison of monthly versus biweekly payments, highlighting the impact on principal reduction and interest savings. Users can further explore advanced features like amortization schedules, total interest paid, and early payoff scenarios for tailored financial planning.

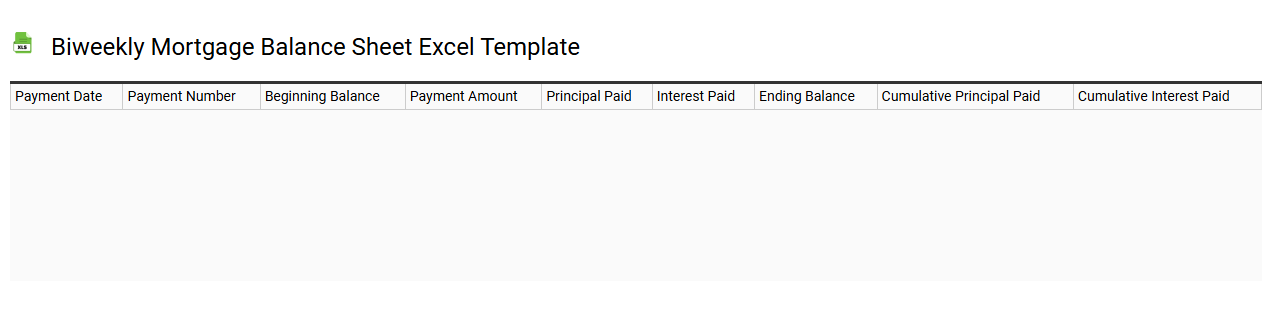

Biweekly mortgage balance sheet Excel template

💾 Biweekly mortgage balance sheet Excel template template .xls

A biweekly mortgage balance sheet Excel template allows you to track your mortgage payments made every two weeks instead of monthly, providing a more accelerated loan repayment structure. This template typically includes sections for inputting your loan details, such as the principal amount, interest rate, payment schedule, and remaining balance. You can visualize your payment history, principal reduction, and interest accumulated over time, helping you to gauge the financial benefits of a biweekly repayment plan. For more advanced analysis, you might explore integration with graphical representations or other financial forecasting tools to visualize your equity growth and long-term savings.