Explore a range of free XLS templates designed specifically for mortgage interest calculation. Each template offers a user-friendly interface, allowing you to input loan amounts, interest rates, and terms efficiently. These customizable options let you visualize your mortgage payments, including principal and interest breakdowns, ensuring you make informed financial decisions.

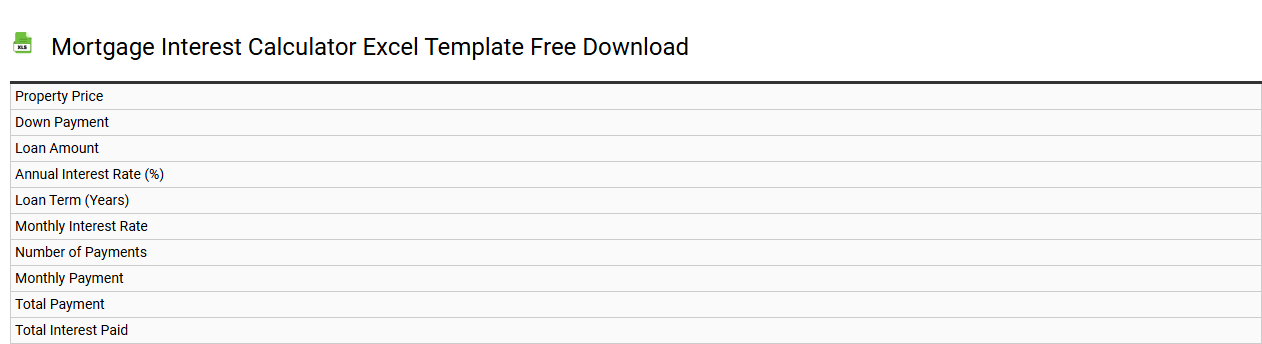

Mortgage interest calculator Excel template free download

💾 Mortgage interest calculator Excel template free download template .xls

A Mortgage Interest Calculator Excel template is a tool designed to help you estimate the interest costs over the life of a mortgage. It allows you to input essential data such as loan amount, interest rate, and loan term, generating insightful calculations on monthly payments and total interest paid. This template often includes features for amortization schedules, helping you visualize how payments are allocated toward principal and interest over time. You can leverage this tool for basic loan analysis and explore advanced scenarios like extra payments or varying interest rates throughout the loan period.

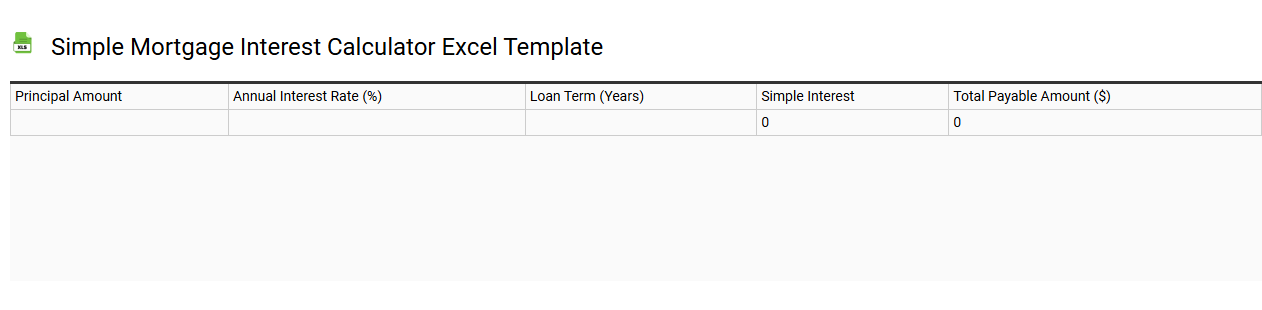

Simple mortgage interest calculator Excel template

💾 Simple mortgage interest calculator Excel template template .xls

A Simple Mortgage Interest Calculator Excel template streamlines the process of calculating mortgage payments, interest accrued, and remaining balances over time. This user-friendly spreadsheet typically includes fields for loan amount, interest rate, duration, and payment frequency, allowing you to input your specific loan terms easily. The template offers formulas that automatically calculate monthly payments, total interest paid, and amortization schedules, providing a clear overview of your mortgage's financial impact. As you gain familiarity with basic functions, you can explore advanced features like sensitivity analysis, cash flow projections, and scenario modeling to enhance your financial planning.

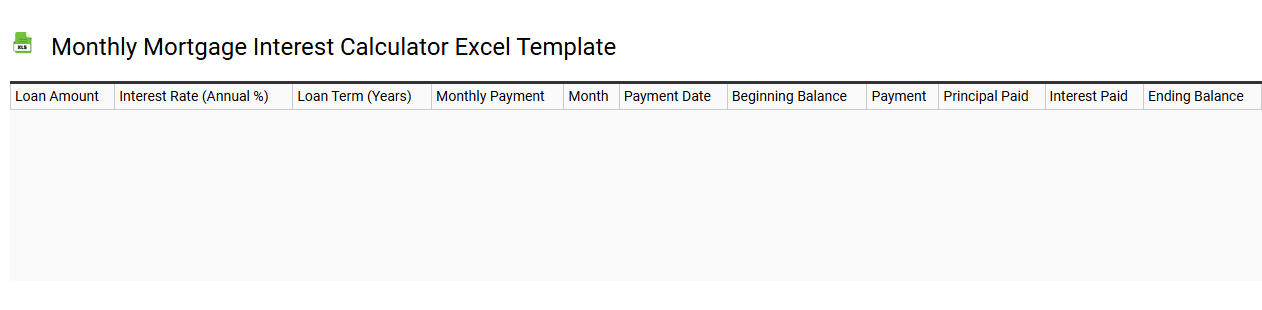

Monthly mortgage interest calculator Excel template

💾 Monthly mortgage interest calculator Excel template template .xls

A Monthly Mortgage Interest Calculator Excel template helps you determine the amount of interest paid on your mortgage each month. This customizable spreadsheet allows users to input loan details such as principal amount, interest rate, and loan term, providing instant calculations. The resulting data shows how payments are allocated between principal and interest over time, helping you visualize your amortization schedule. This basic tool can be expanded with complex scenarios like prepayment options, variable interest rates, or tax implications for advanced financial planning.

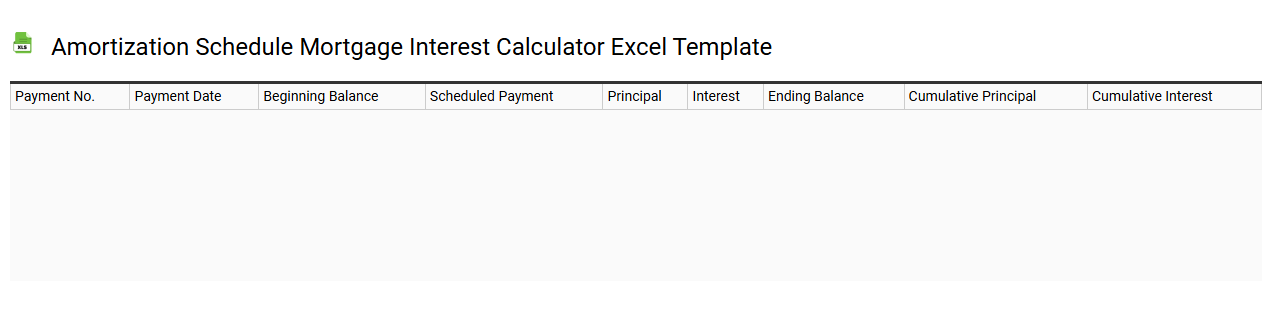

Amortization schedule mortgage interest calculator Excel template

💾 Amortization schedule mortgage interest calculator Excel template template .xls

An amortization schedule mortgage interest calculator Excel template is a tool designed to help you manage your mortgage payments effectively. This template provides a clear breakdown of each payment, showcasing how much goes toward principal versus interest over time. You can input variables like loan amount, interest rate, term length, and frequency of payments to create a personalized payment plan. Such a template not only aids in budgeting but also highlights potential savings strategies, like making extra payments to reduce long-term interest costs, reflecting its functionality for both basic budgeting and deeper analysis such as evaluating refinancing options or investment projections.

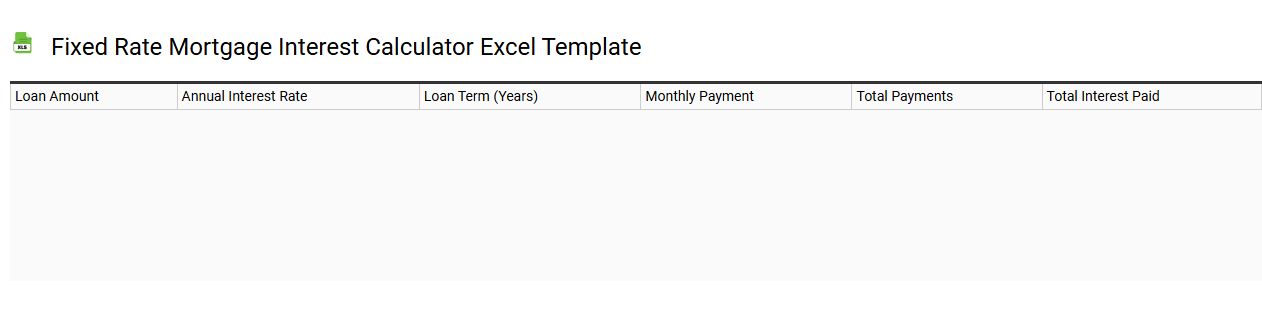

Fixed rate mortgage interest calculator Excel template

💾 Fixed rate mortgage interest calculator Excel template template .xls

A Fixed Rate Mortgage Interest Calculator Excel template is a specialized spreadsheet designed to help you calculate your monthly mortgage payments based on a fixed interest rate. This template typically includes input fields for loan amount, interest rate, loan term, and possibly additional costs like property taxes or insurance. It provides a clear breakdown of the principal and interest components of each payment, allowing for a transparent overview of your financial commitments. You can customize this tool to fit your specific financial scenario, making it valuable not only for personal budgeting but also for long-term financial planning or investment opportunities that may arise. For basic usage, simply input your loan parameters, while advanced features could include sensitivity analysis or amortization schedules to project varying financial outcomes.

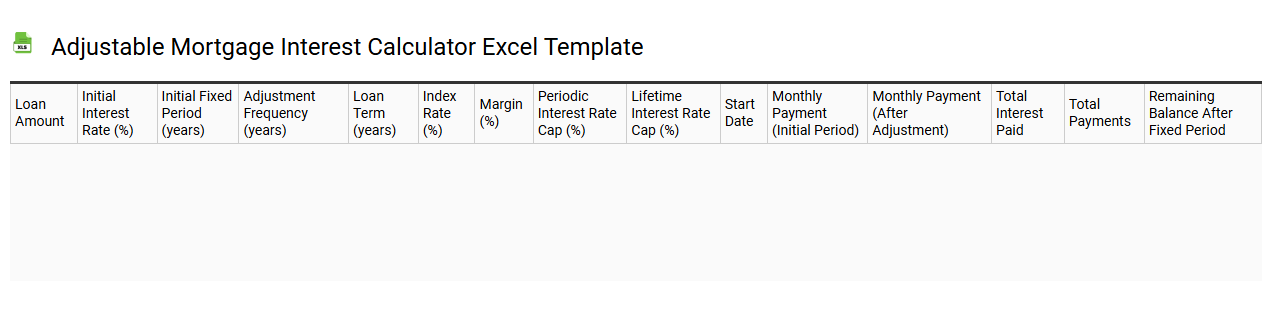

Adjustable mortgage interest calculator Excel template

💾 Adjustable mortgage interest calculator Excel template template .xls

An Adjustable Mortgage Interest Calculator Excel template is a streamlined tool that facilitates the calculation of loan payments for adjustable-rate mortgages. This template allows you to input variables such as the loan amount, interest rates, adjustment periods, and loan duration. By leveraging Excel functions, it generates monthly payment figures and provides a clear overview of how payments fluctuate with changing interest rates. Beyond basic calculations, advanced users can utilize this template to simulate different scenarios, incorporating options like rate caps, payment shocks, or refinancing opportunities.

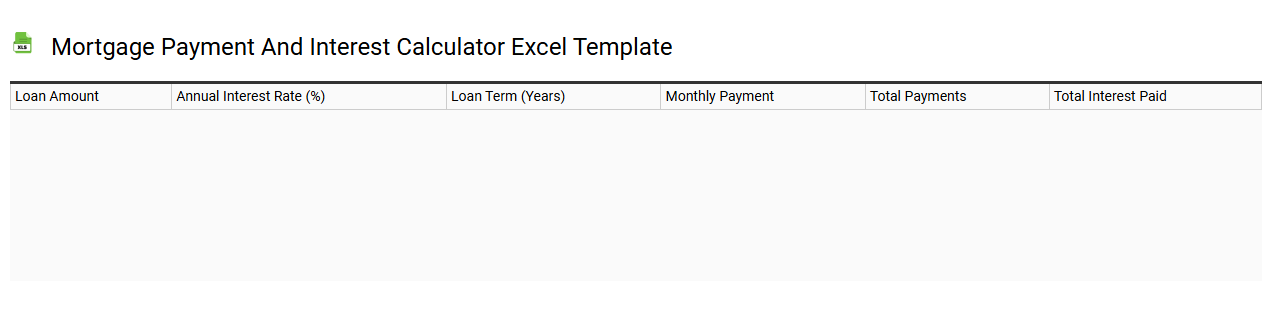

Mortgage payment and interest calculator Excel template

💾 Mortgage payment and interest calculator Excel template template .xls

A mortgage payment and interest calculator Excel template helps you determine your monthly mortgage payments based on the principal amount, interest rate, and loan term. You input variables like loan amount, interest rate, and duration to receive a detailed breakdown of payments across the mortgage lifespan. This tool also shows how much of each payment goes toward interest versus principal reduction, offering insights into how equity builds over time. Beyond basic calculations, you might explore features like amortization schedules, total interest paid, or adjustments for additional payments and fluctuations in interest rates.

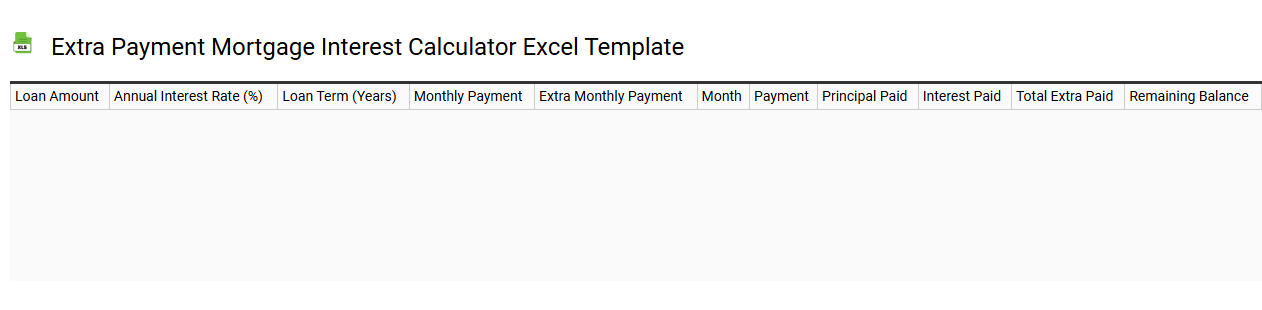

Extra payment mortgage interest calculator Excel template

💾 Extra payment mortgage interest calculator Excel template template .xls

An extra payment mortgage interest calculator Excel template is a specialized tool designed to help homeowners understand the financial implications of making additional payments on their mortgage. This template allows you to input your loan amount, interest rate, and loan term, along with any extra payment amounts you intend to make. It visually displays how these extra payments can reduce the total interest paid over the life of the loan and shorten the loan term. By analyzing the results, you can make informed decisions about your mortgage strategy, whether addressing immediate financial goals or planning long-term savings on interest payments. You can further explore scenarios by incorporating advanced parameters like amortization schedules, varying interest rates, and refinancing options.

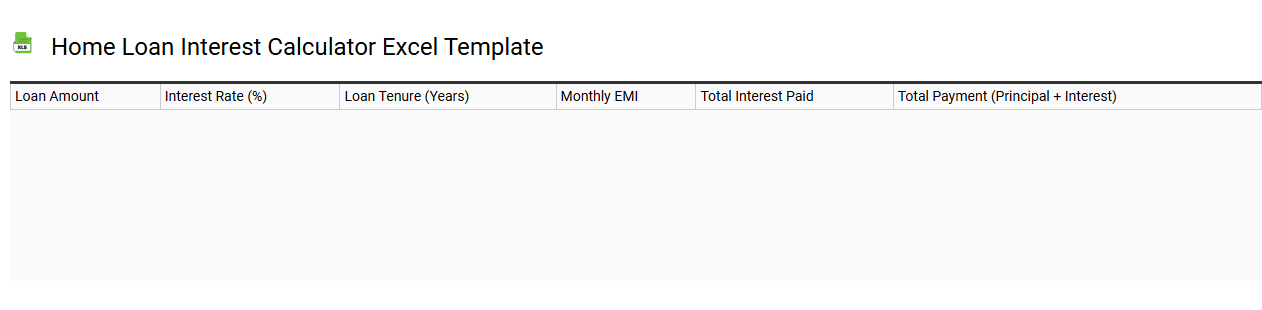

Home loan interest calculator Excel template

💾 Home loan interest calculator Excel template template .xls

A Home Loan Interest Calculator Excel template simplifies the process of understanding your mortgage payments by allowing you to input various loan parameters. This tool typically requires you to enter values such as loan amount, interest rate, and loan term, automatically calculating your monthly payment, total interest paid, and remaining balance. Features may include amortization schedules, which break down each payment into principal and interest components, providing clear insights into the loan's progression over time. Such templates are invaluable for budgeting and financial planning, especially for those aiming to refine their home financing strategies or explore advanced analytical scenarios like refinancing options or investment property evaluations.

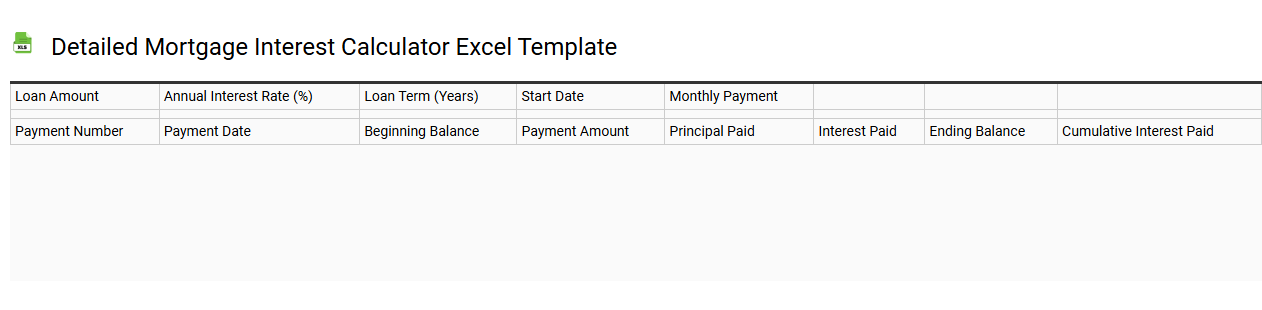

Detailed mortgage interest calculator Excel template

💾 Detailed mortgage interest calculator Excel template template .xls

A detailed mortgage interest calculator Excel template is a powerful tool for anyone looking to understand the financial implications of a mortgage loan. This template allows you to input your loan amount, interest rate, and term, generating an amortization schedule that breaks down principal and interest payments over time. You can visualize the total interest paid, outstanding balance at any point, and the impact of additional payments on reducing the loan term and interest costs. Beyond basic calculations for monthly payments, this template can also accommodate advanced scenarios like adjustable rates, refinancing options, and tax implications, providing a comprehensive financial analysis for your mortgage strategy.