A mortgage repayment tracker Excel template helps you monitor your loan payments over time, providing clarity on your financial obligations. The template typically includes sections for recording payment dates, amounts paid, remaining balance, and interest accrual, allowing you to visualize your progress easily. With customizable fields, it ensures that you can tailor the tracker to fit your specific mortgage terms, making it a valuable tool for managing your housing expenses effectively.

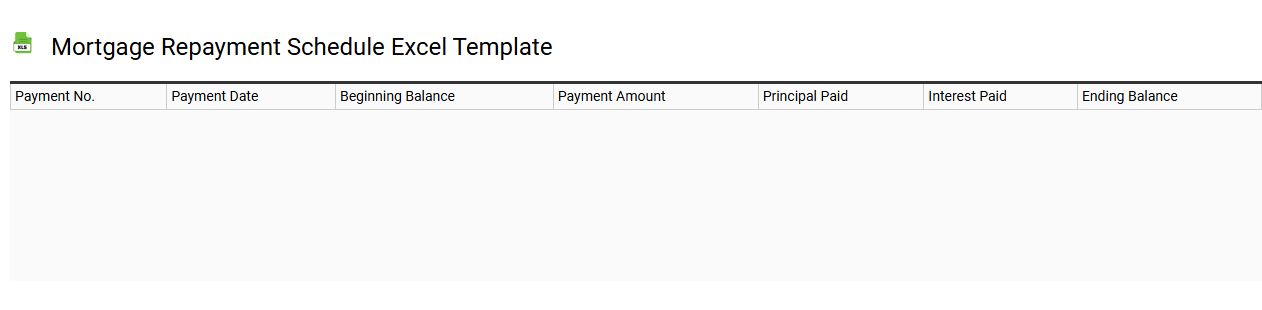

Mortgage repayment schedule Excel template

💾 Mortgage repayment schedule Excel template template .xls

A mortgage repayment schedule Excel template is a useful tool that allows you to track and manage your mortgage payments over time. This template provides a structured layout where you can input the loan amount, interest rate, payment frequency, and term length. Each row typically displays key details such as payment number, due date, principal paid, interest paid, and remaining balance. Monitoring these figures helps you understand your repayment progress and can highlight opportunities for refinancing or making extra payments to save on interest. You might explore advanced options like amortization calculations or integrating graphs for a visual representation of your repayment journey.

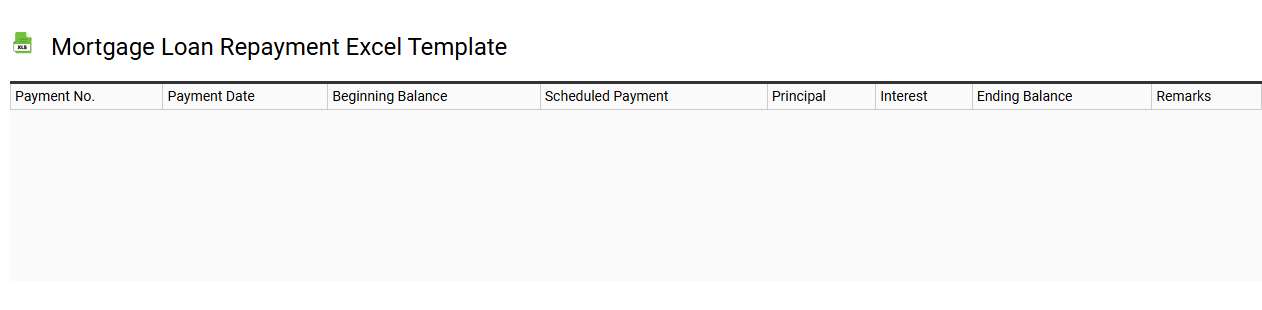

Mortgage loan repayment Excel template

💾 Mortgage loan repayment Excel template template .xls

A Mortgage loan repayment Excel template serves as a practical tool for calculating and tracking mortgage payments over time. It typically includes fields for the loan amount, interest rate, loan term, and payment frequency, allowing you to visualize how each payment impacts the principal and interest balance. The template can generate an amortization schedule, showing how payments are divided between interest and principal throughout the mortgage duration. This enables you to assess your repayment strategy, plan for future financial needs, and identify opportunities for prepayment or refinancing as circumstances evolve.

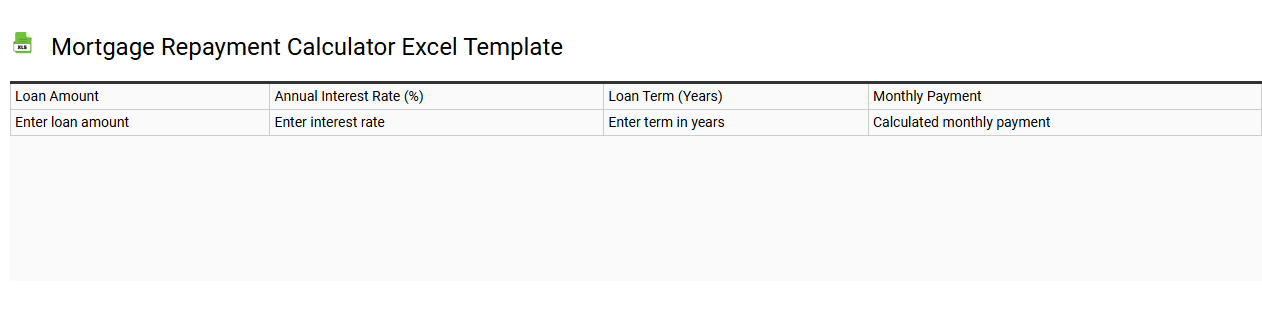

Mortgage repayment calculator Excel template

💾 Mortgage repayment calculator Excel template template .xls

A Mortgage repayment calculator Excel template is a customizable spreadsheet designed to help you easily calculate monthly mortgage payments, interest over time, and amortization schedules. This template typically includes fields for entering loan amount, interest rate, loan term, and additional payments, allowing for personalized financial planning. Visual charts may also be included to depict remaining balances and interest paid over the life of the loan, enhancing your understanding of the mortgage's impact. Such templates can be particularly useful for anyone considering homeownership or refinancing and can be expanded to analyze more complex scenarios involving adjustable-rate mortgages and additional payments.

Mortgage payment tracker Excel template

![]()

💾 Mortgage payment tracker Excel template template .xls

A Mortgage Payment Tracker Excel template is a versatile tool designed to help you monitor and manage your mortgage payments effectively. This template typically includes fields for the loan amount, interest rate, repayment schedule, and remaining balance, allowing for easy tracking of each payment. You can visualize your monthly expenses and assess how much you still owe on your mortgage over time. Using this template not only simplifies your mortgage management but can also be adapted for advanced financial analysis, such as assessing the impact of refinancing options or property appreciation.

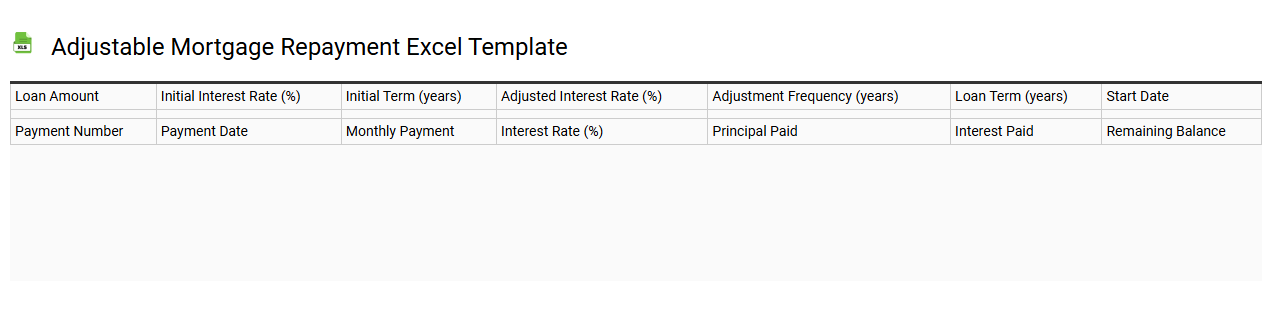

Adjustable mortgage repayment Excel template

💾 Adjustable mortgage repayment Excel template template .xls

An Adjustable Mortgage Repayment Excel template is a financial tool designed to help you calculate and manage the payments associated with an adjustable-rate mortgage (ARM). This template typically allows for inputs such as loan amount, interest rates, adjustment periods, and repayment terms, helping you visualize how changing rates impact your monthly payments. You'll find built-in formulas to compute principal and interest, enabling you to project future payments based on different interest rate scenarios. Understanding the potential fluctuations in your mortgage costs can empower you to plan better, whether you need basic calculations or more advanced modeling for investment strategies or property acquisitions.

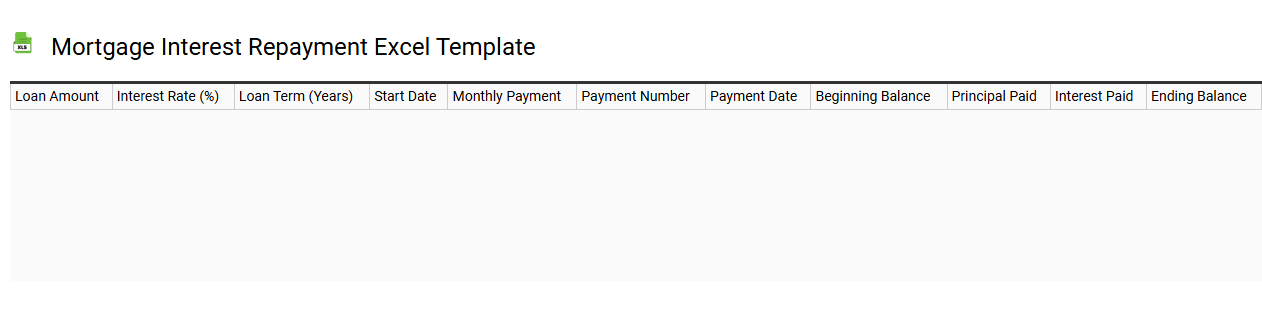

Mortgage interest repayment Excel template

💾 Mortgage interest repayment Excel template template .xls

A Mortgage Interest Repayment Excel template is a structured spreadsheet designed to help you calculate and track the interest paid on your mortgage over time. It typically includes areas for entering loan details, such as principal amount, interest rate, and loan term. The template provides a clear breakdown of monthly payments, showing how much goes toward interest versus the principal. This tool can simplify your budgeting process, while also allowing for more complex analyses like comparing different mortgage options or assessing the impact of additional payments on overall interest savings.

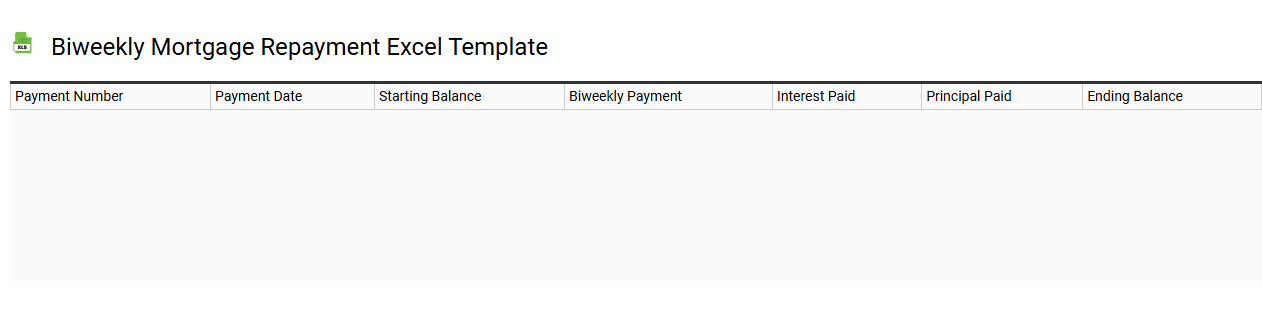

Biweekly mortgage repayment Excel template

💾 Biweekly mortgage repayment Excel template template .xls

A biweekly mortgage repayment Excel template helps homeowners plan and manage their mortgage payments effectively by breaking down repayment schedules into biweekly increments. This template typically includes calculations for payment amounts, interest accrual, and remaining principal balances, allowing you to visualize how your payments impact overall loan costs. You can input your loan details, including the principal amount, interest rate, and term length, which enables you to quickly see how much interest you save over time compared to traditional monthly payments. For basic usage, you can track payments, while advanced features might include amortization schedules and scenarios for accelerated repayment strategies.

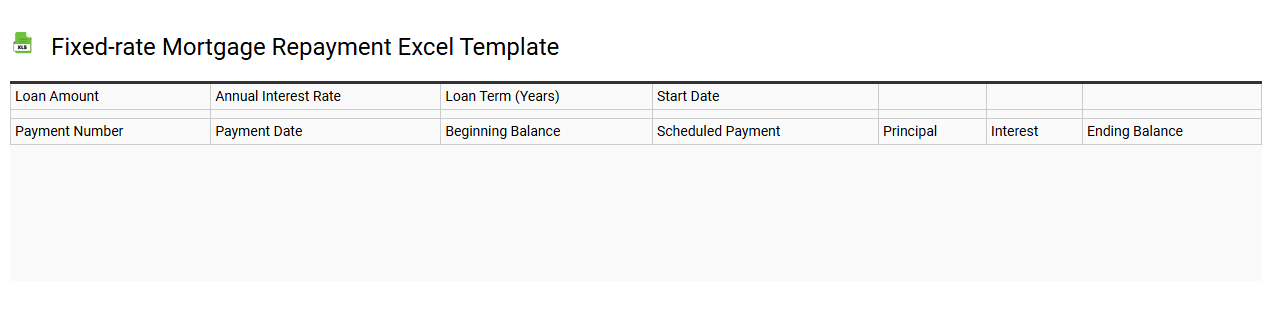

Fixed-rate mortgage repayment Excel template

💾 Fixed-rate mortgage repayment Excel template template .xls

A Fixed-rate mortgage repayment Excel template is a structured spreadsheet designed to help you calculate monthly mortgage payments based on the loan amount, interest rate, and loan term. It typically includes input fields for principal, interest rate, and duration, automatically computing the monthly repayment amount and total interest paid over the loan's life. The template may also feature amortization schedules, allowing you to visualize how your payments break down over time into principal and interest components. This tool can serve as a valuable resource for assessing your financial commitments and planning for future needs like refinancing or loan adjustments.