Explore a wide range of free XLS templates, specifically designed for mortgage management and financial planning. The mortgage amortization schedule Excel template efficiently breaks down your loan repayment process, clearly outlining principal and interest payments over time. This tool helps you visualize how your payments reduce the loan balance, making it easier for you to plan your budget and understand the long-term financial implications.

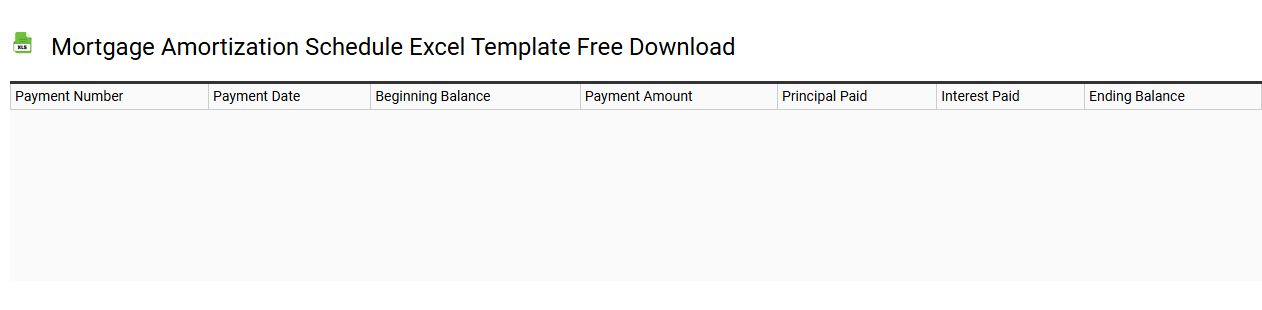

Mortgage amortization schedule Excel template free download

💾 Mortgage amortization schedule Excel template free download template .xls

A mortgage amortization schedule Excel template provides a detailed breakdown of your loan payments over time, showcasing principal and interest components for each period. This template allows you to input your loan amount, interest rate, and term, generating a comprehensive table that outlines how much you owe each month and how your balance decreases. You can easily track cumulative payments, remaining balance, and even extra payments, giving you insights into your repayment progress. This tool is essential for anyone looking to understand their mortgage dynamics or plan for future financial strategies, whether you're managing a simple loan or delving into advanced concepts like refinancing or investment property analysis.

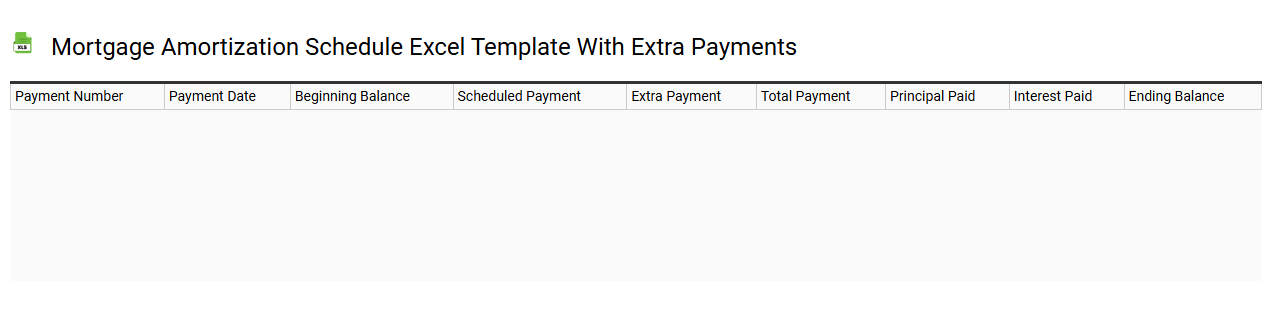

Mortgage amortization schedule Excel template with extra payments

💾 Mortgage amortization schedule Excel template with extra payments template .xls

A Mortgage amortization schedule Excel template with extra payments allows you to calculate and visualize the repayment of a mortgage over time, incorporating additional payments beyond the standard monthly installment. This template includes detailed rows for each payment period, showing how much of each payment goes towards interest and principal, as well as the remaining balance after each payment. You can input your loan amount, interest rate, term length, and specify any extra payment amounts to see the impact on the total interest paid and the duration of the loan. This tool can help you plan for future financial strategies, whether you're considering refinancing options or aiming to pay off your mortgage faster through strategic extra payments.

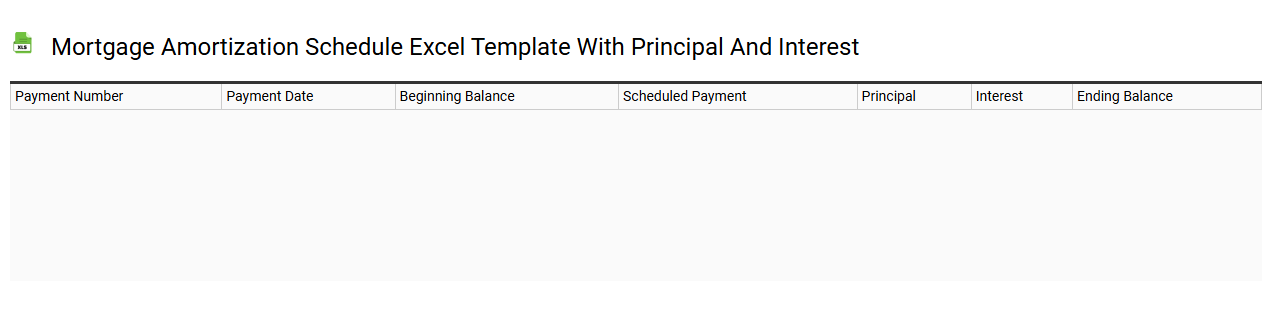

Mortgage amortization schedule Excel template with principal and interest

💾 Mortgage amortization schedule Excel template with principal and interest template .xls

A mortgage amortization schedule in an Excel template provides a detailed breakdown of your loan payments over time, highlighting the principal and interest components. Each row typically includes the payment number, payment amount, interest paid, principal paid, and the remaining balance after each payment. The structured format allows you to easily track how your payments affect your loan balance, making it clear how much interest you pay over the life of the loan. For more advanced financial planning, this schedule can be expanded to include various scenarios, adjustable rates, and additional prepayment calculations tailored to your mortgage needs.

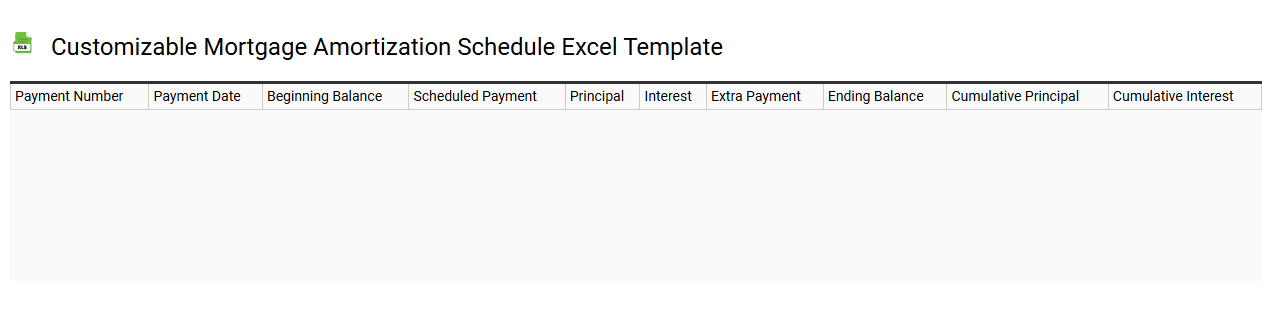

Customizable mortgage amortization schedule Excel template

💾 Customizable mortgage amortization schedule Excel template template .xls

A customizable mortgage amortization schedule Excel template is a pre-designed spreadsheet tool that allows you to input various loan parameters, such as principal amount, interest rate, loan term, and payment frequency. It generates a detailed breakdown of each payment over the life of the loan, showing how much goes towards interest versus principal. You can easily modify variables to see different scenarios, helping you visualize the financial impact of additional payments or varying interest rates. This tool serves basic budgeting needs while also offering potential for advanced financial analysis, including tax implications and investment opportunities.

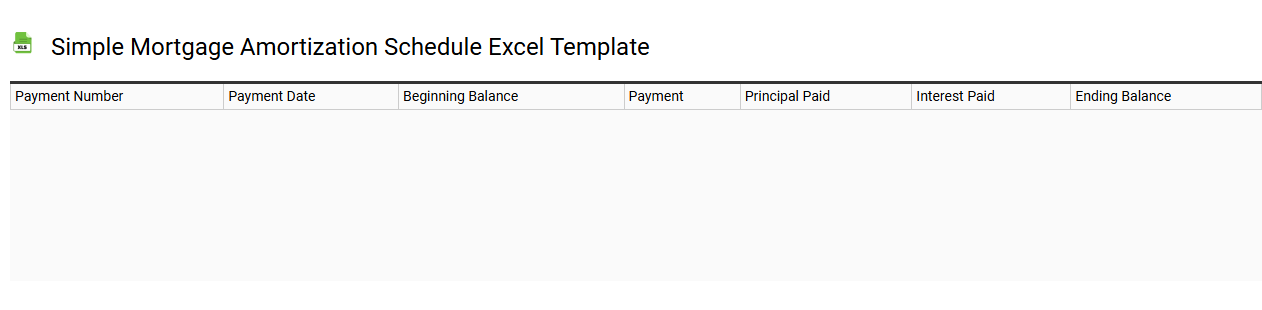

Simple mortgage amortization schedule Excel template

💾 Simple mortgage amortization schedule Excel template template .xls

A Simple Mortgage Amortization Schedule Excel template provides a clear and organized way to track your mortgage payments over time. This template typically includes columns for payment number, payment date, principal payment, interest payment, and remaining balance. Users can easily input their loan amount, interest rate, and loan term to automatically generate a detailed breakdown of each payment. This basic tool not only helps you visualize your payment progress but also allows for advanced functions like prepayment calculations and interest rate adjustments.

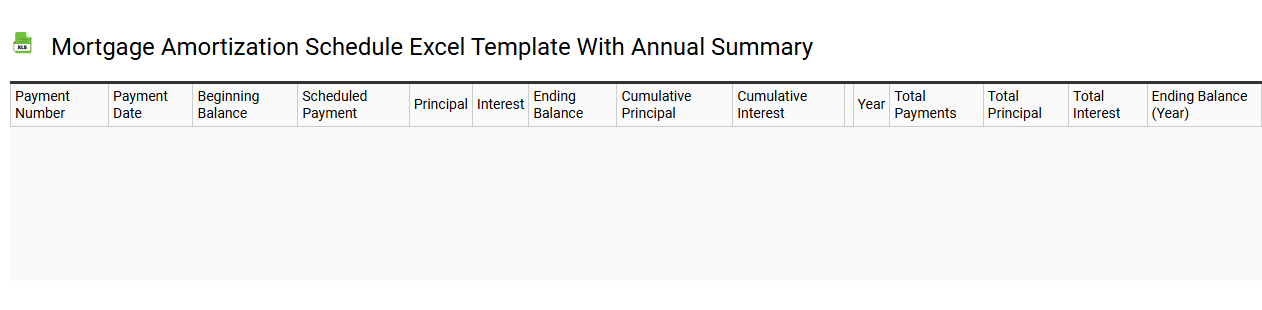

Mortgage amortization schedule Excel template with annual summary

💾 Mortgage amortization schedule Excel template with annual summary template .xls

A mortgage amortization schedule Excel template with an annual summary provides a detailed breakdown of your mortgage payments over the life of the loan. Each row typically outlines the payment number, date, total payment amount, principal and interest components, and remaining balance. The annual summary consolidates these figures, showcasing total payments made, total interest paid, and the outstanding principal at the end of each year. You can utilize this tool for better budgeting and to understand long-term financial obligations, while advanced users may integrate functions for prepayment strategies or sensitivity analysis based on varying interest rates.

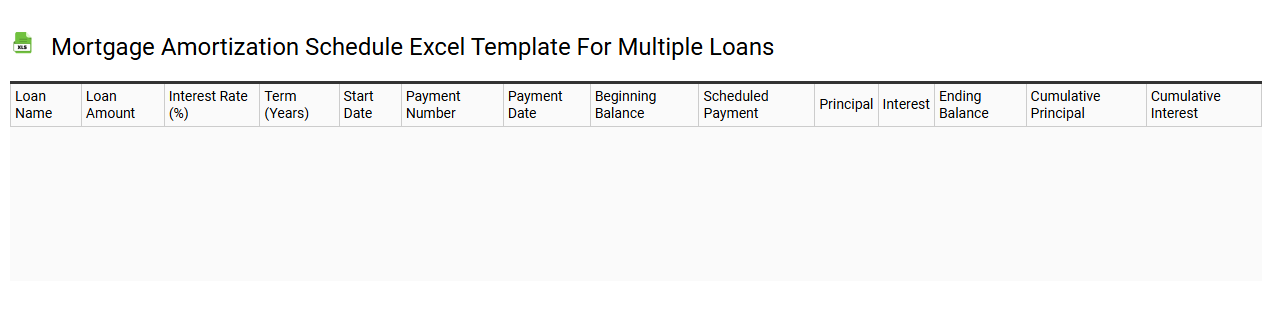

Mortgage amortization schedule Excel template for multiple loans

💾 Mortgage amortization schedule Excel template for multiple loans template .xls

A mortgage amortization schedule is a detailed table that outlines each payment of a loan, breaking down how much goes toward interest and how much reduces the principal balance. An Excel template for multiple loans allows you to input various loan amounts, interest rates, and terms, creating an individual amortization schedule for each loan. This organizational tool helps track your repayment progress and predict when each loan will be paid off, facilitating better financial planning. By utilizing features like charts and formulas, you can explore advanced calculations such as early repayment impacts or total interest payable over the loan's lifetime, meeting diverse financial analysis needs.

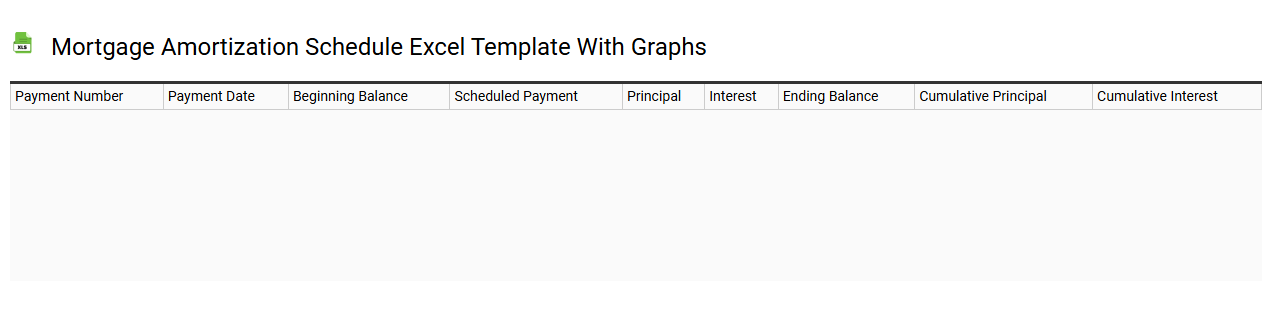

Mortgage amortization schedule Excel template with graphs

💾 Mortgage amortization schedule Excel template with graphs template .xls

A Mortgage amortization schedule Excel template is a tool designed to help you visualize and manage your mortgage payments over time. It typically includes a detailed table outlining each monthly payment, the allocation of principal and interest, and the remaining balance after each payment. Graphs often accompany the schedule, providing a visual representation of how your loan balance decreases and interest costs diminish over the term of the mortgage. This template can serve basic budgeting needs while also offering potential customization for more advanced financial analysis, such as exploring different interest rates and loan terms.

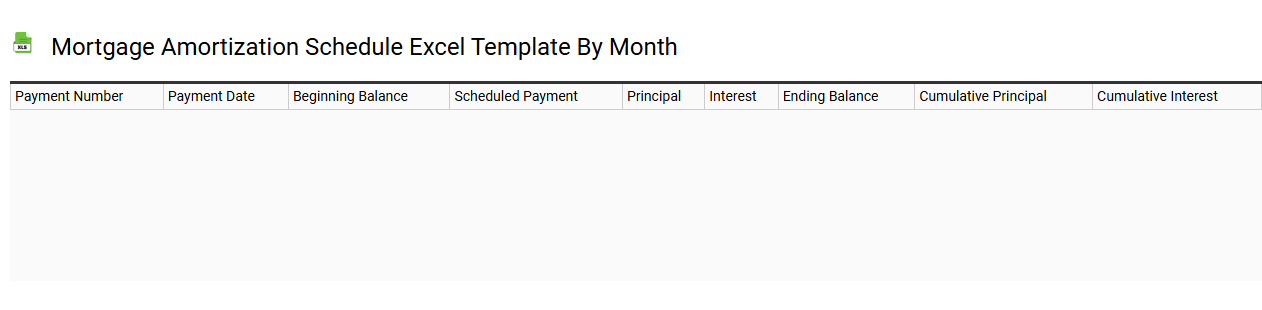

Mortgage amortization schedule Excel template by month

💾 Mortgage amortization schedule Excel template by month template .xls

A Mortgage amortization schedule Excel template by month is a tool that helps you manage your mortgage payments over time. This template breaks down each payment into principal and interest components, providing clarity on how much equity you build with each installment. It presents a detailed view of your remaining balance after every payment, illustrating the gradual reduction in debt. You can easily customize it to fit different loan amounts, interest rates, and terms while being useful for tracking long-term financial planning or exploring options for refinancing and additional payments.

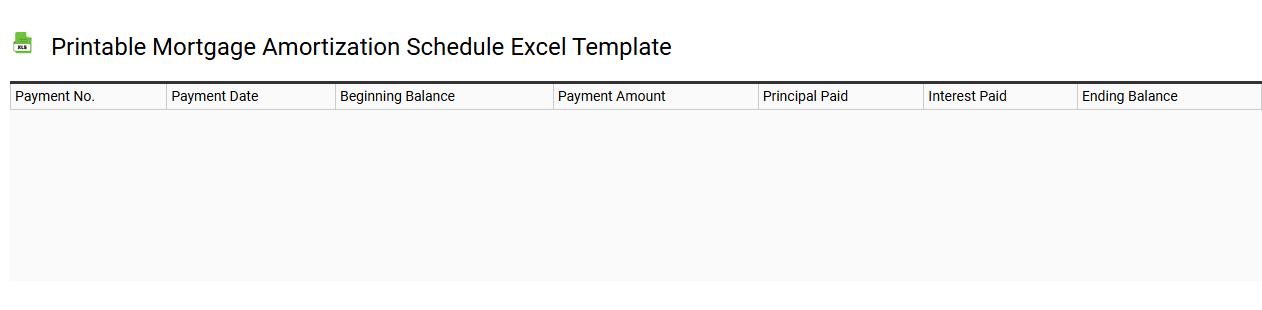

Printable mortgage amortization schedule Excel template

💾 Printable mortgage amortization schedule Excel template template .xls

A printable mortgage amortization schedule Excel template provides a structured tool for tracking mortgage payments over time. It clearly outlines individual payment amounts, principal, interest, and remaining balance for each payment period. Users can easily customize the template by inputting loan details such as principal amount, interest rate, and term, allowing for personalized scheduling. This template is essential for understanding your mortgage obligations and can be adapted for various scenarios, such as extra payments or adjusting interest rates, while providing insights into advanced concepts like accelerated amortization strategies.