Explore a selection of free XLS templates designed specifically for biweekly payroll management. These templates include pre-built formulas for calculating wages, deductions, and taxes, ensuring accurate payroll processing. User-friendly layouts allow easy input of employee information, hours worked, and payment rates, streamlining your payroll tasks effectively.

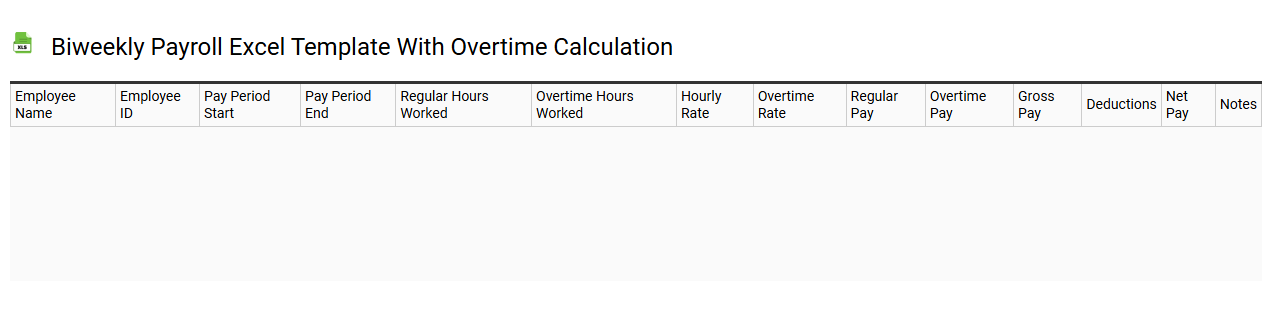

Biweekly payroll Excel template with overtime calculation

💾 Biweekly payroll Excel template with overtime calculation template .xls

A Biweekly payroll Excel template provides a structured format for managing employee payments every two weeks, ensuring accurate tracking of hours worked and wages owed. This template typically includes sections for regular hours, overtime hours, and different pay rates, allowing for clear visibility over earnings. Users can input employee names, hours worked, and any applicable deductions to automatically calculate total pay. This tool serves basic payroll needs while offering potential for advanced functions like tax calculations and benefits tracking.

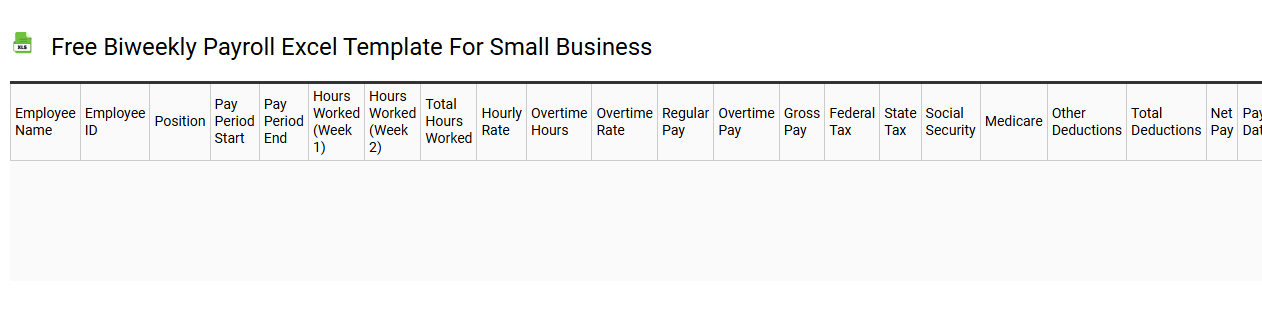

Free biweekly payroll Excel template for small business

💾 Free biweekly payroll Excel template for small business template .xls

A Free biweekly payroll Excel template for small businesses is a customizable tool designed to simplify the payroll process. This template enables business owners to easily input employee hours, calculate wages, and manage deductions like taxes and benefits. It often includes sections for tracking overtime, leave balances, and tips, making it comprehensive for diverse payroll needs. Using this template can streamline your payroll management, but for advanced options, consider features like automated tax calculations or integration with accounting software.

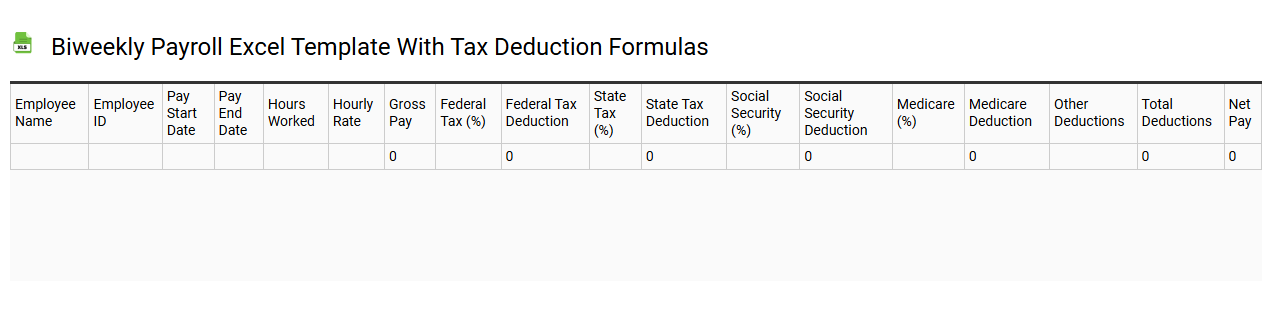

Biweekly payroll Excel template with tax deduction formulas

💾 Biweekly payroll Excel template with tax deduction formulas template .xls

A biweekly payroll Excel template is a structured spreadsheet designed to simplify payroll processing every two weeks. It includes essential fields such as employee names, hours worked, hourly rates, and calculation sections for gross pay and deductions. Formulas are integrated to automatically compute tax deductions based on applicable rates, ensuring accuracy in payroll calculations. This template not only streamlines payroll management but also caters to potential advanced needs like overtime calculations, benefits administration, and compliance tracking.

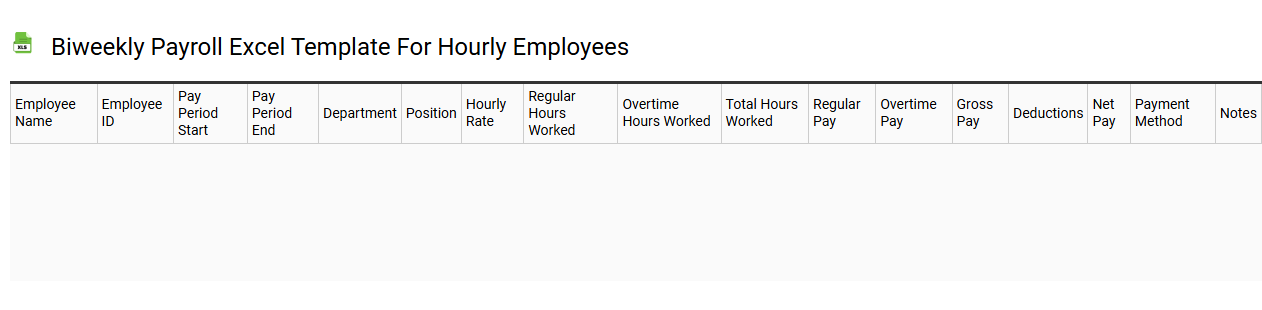

Biweekly payroll Excel template for hourly employees

💾 Biweekly payroll Excel template for hourly employees template .xls

A biweekly payroll Excel template for hourly employees streamlines the process of calculating wages every two weeks. This template typically includes columns for employee names, hours worked, pay rates, and automatic calculations of gross wages, deductions, and net pay. Easy visualization features allow you to track overtime hours and benefits, ensuring accurate payroll management. Understanding this template can facilitate basic payroll functions, while advanced features such as macros or data visualization can optimize larger-scale payroll systems.

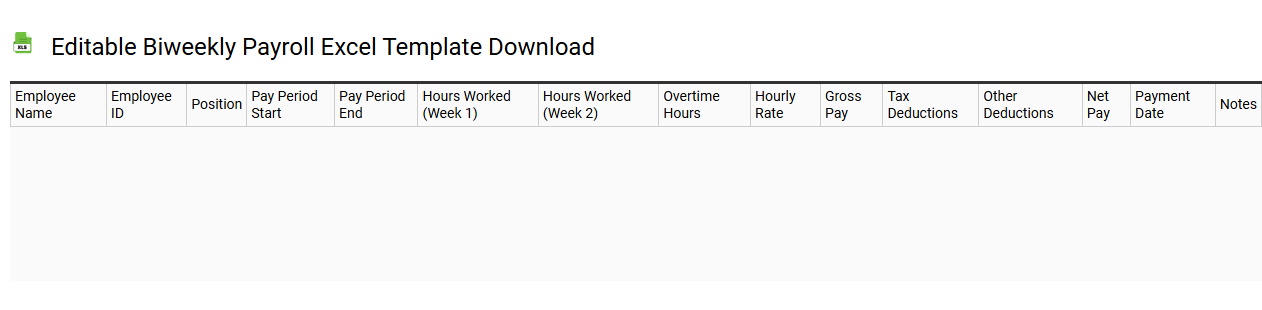

Editable biweekly payroll Excel template download

💾 Editable biweekly payroll Excel template download template .xls

An editable biweekly payroll Excel template is a user-friendly spreadsheet designed to streamline the payroll process for businesses that pay employees every two weeks. This template typically includes fields for employee names, hourly rates, hours worked, deductions, and net pay calculations, making it straightforward to input and manage payroll data. You can modify these fields to suit your specific business needs, allowing for seamless adjustments as your team grows or compensation structures change. This basic tool can be expanded with advanced features like automated calculations, multi-tiered tax computations, and integration with accounting software, enhancing overall payroll efficiency and accuracy.

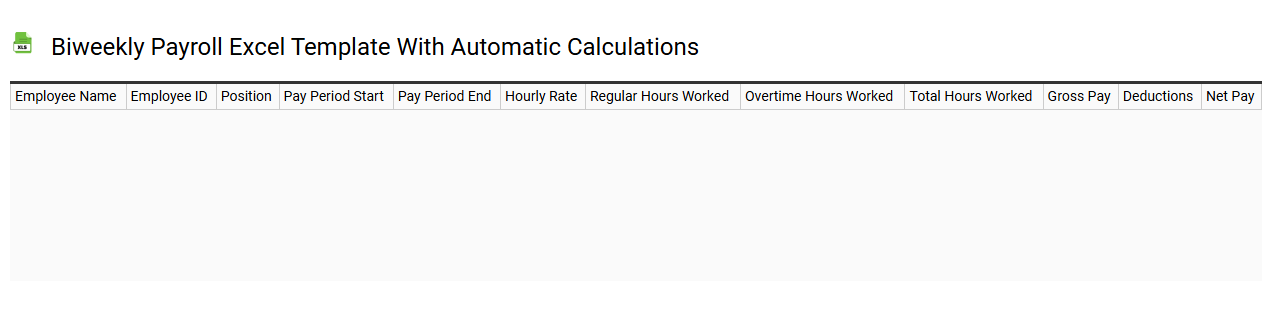

Biweekly payroll Excel template with automatic calculations

💾 Biweekly payroll Excel template with automatic calculations template .xls

A biweekly payroll Excel template streamlines the payroll process by allowing businesses to manage salary calculations for employees paid every two weeks. This template typically includes fields for hours worked, hourly rates, deductions, and taxes, ensuring accurate computation of gross and net pay. Users can enter employee information seamlessly, while formulas automatically adjust totals, minimizing manual errors and saving time. As your payroll needs evolve, you might explore advanced features like macros or integration with payroll software for even greater efficiency.

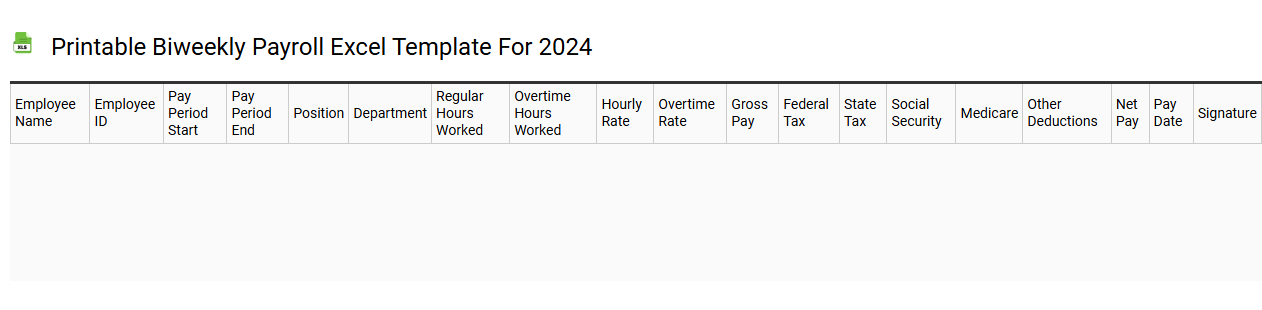

Printable biweekly payroll Excel template for 2024

💾 Printable biweekly payroll Excel template for 2024 template .xls

The Printable Biweekly Payroll Excel Template for 2024 is an organized spreadsheet designed to facilitate payroll management every two weeks. It features essential fields for employee information, including names, hours worked, pay rates, and deductions, ensuring a streamlined calculation of total earnings. You can input overtime, bonuses, and tax withholding amounts, making it suitable for various payroll scenarios. This tool serves basic payroll needs while offering the potential for enhancement through advanced financial modeling or integration with accounting software.

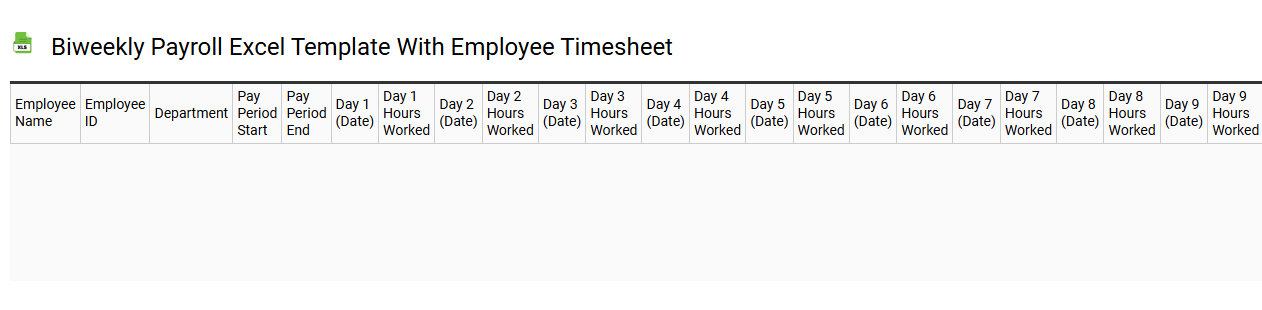

Biweekly payroll Excel template with employee timesheet

💾 Biweekly payroll Excel template with employee timesheet template .xls

A biweekly payroll Excel template with an employee timesheet is a structured tool designed to streamline payroll processing on a two-week schedule. This template typically includes sections for employee details, hours worked, overtime, and deductions, allowing for accurate calculations of gross pay and net pay. You can easily input employee work hours, track attendance, and calculate earnings using formulas embedded in the spreadsheet. Such a template can assist in managing payroll effectively while providing the groundwork for more advanced features like integrating tax calculations and compliance reporting in the future.

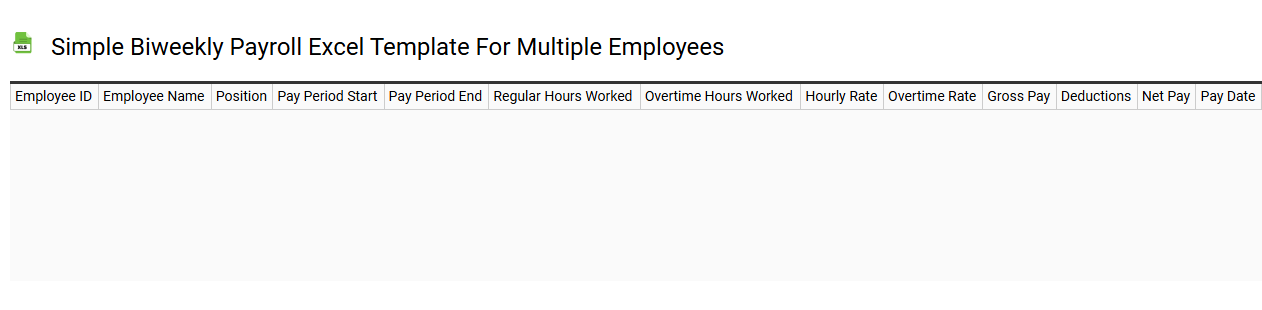

Simple biweekly payroll Excel template for multiple employees

💾 Simple biweekly payroll Excel template for multiple employees template .xls

A simple biweekly payroll Excel template for multiple employees streamlines salary calculations by organizing essential data fields such as employee names, hourly rates, hours worked, and overtime hours. The template allows you to input employee-specific information alongside automatic calculations for gross pay, deductions, and net pay, ensuring accuracy while saving time. You can customize the layout to fit your organization's needs, incorporating additional columns for taxes, benefits, or bonus calculations. This flexible tool is not only ideal for immediate payroll processing but can also accommodate advanced functionalities like real-time reporting and integration with accounting software as your payroll needs evolve.

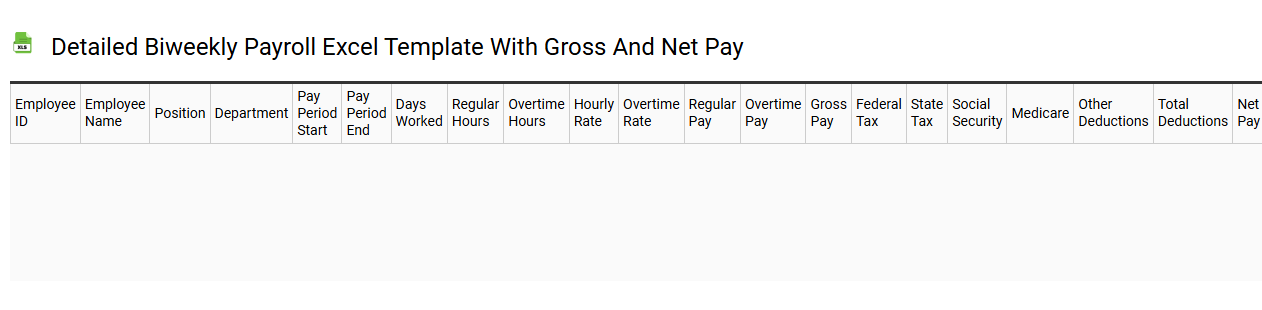

Detailed biweekly payroll Excel template with gross and net pay

💾 Detailed biweekly payroll Excel template with gross and net pay template .xls

A detailed biweekly payroll Excel template organizes employee pay information comprehensively. It typically includes columns for employee names, hours worked, gross pay, deductions, taxes, and net pay. Each section allows you to easily input necessary data, ensuring accurate calculations for payroll processing. This template can also accommodate advanced calculations, such as overtime rates, bonus structures, and benefits deductions, catering to any complex payroll requirements you may encounter.