Explore a range of free XLS templates specifically designed for monthly payroll management in Excel. These templates typically include sections for employee details, hours worked, wage rates, and deductions, streamlining the payroll process. With automated calculations, you can ensure accuracy in your payroll, making it easy to track payments, bonuses, and other financial details for each employee.

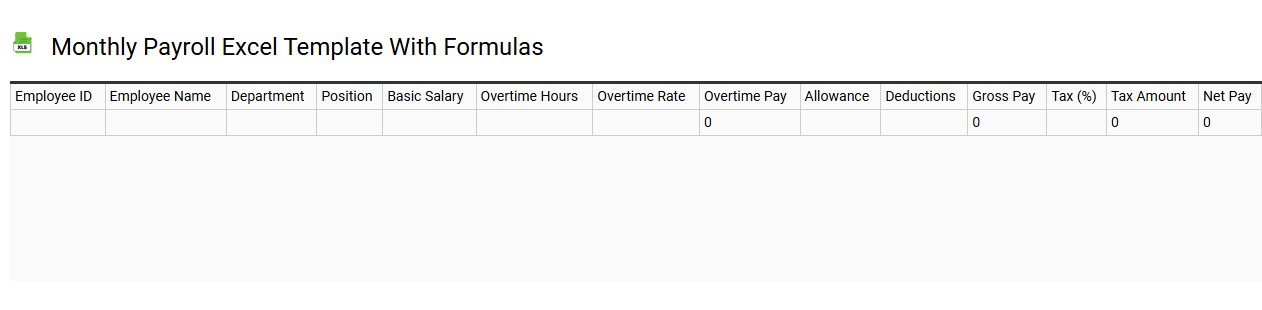

Monthly payroll Excel template with formulas

💾 Monthly payroll Excel template with formulas template .xls

A Monthly Payroll Excel template with formulas is a pre-designed spreadsheet that simplifies the calculation of employee salaries for a specific month. It typically includes essential fields such as employee names, hours worked, hourly rates, deductions, and bonuses. Formulas embedded in the template automatically compute total earnings, tax deductions, and net pay, ensuring accuracy and time efficiency. This tool not only streamlines payroll processing but also can be customized to accommodate future needs such as overtime calculations, benefits, or advanced analytics like payroll forecasting.

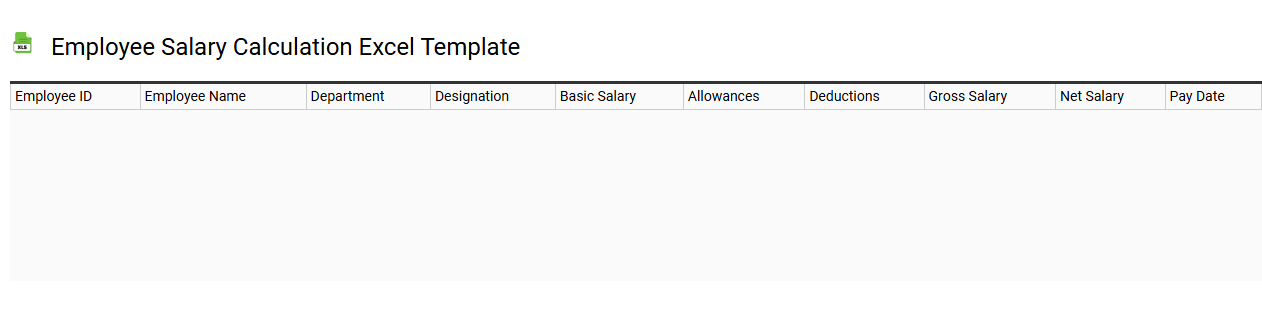

Employee salary calculation Excel template

💾 Employee salary calculation Excel template template .xls

An Employee Salary Calculation Excel template is a structured spreadsheet designed to simplify the computation of employee wages, deductions, and net pay. It typically includes fields for inputting employee details, such as name, designation, attendance, and hours worked, alongside fixed components like basic salary, bonuses, and allowances. Calculations for various deductions, including taxes and health insurance, are automatically generated based on predefined formulas, ensuring accuracy and efficiency. This template not only streamlines payroll processing but also serves as a foundation for more complex financial forecasts, such as budgeting and compensation modeling.

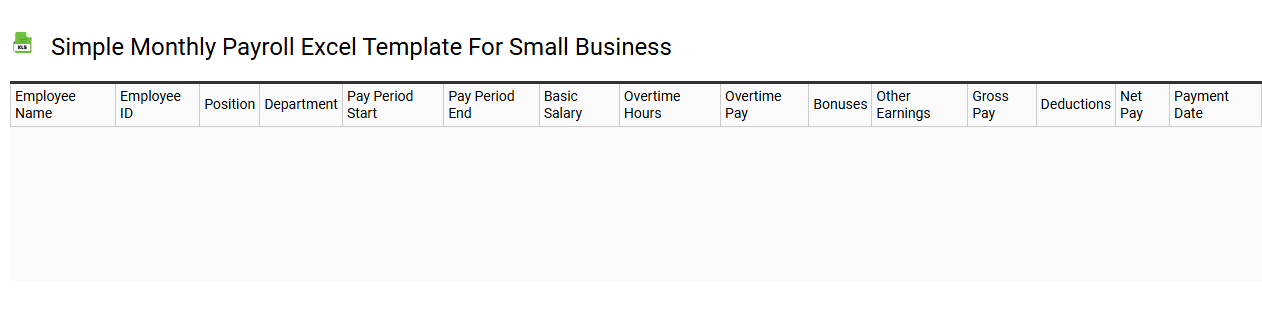

Simple monthly payroll Excel template for small business

💾 Simple monthly payroll Excel template for small business template .xls

A Simple monthly payroll Excel template for small businesses organizes employee payment details efficiently. It typically includes sections for employee names, hours worked, hourly rates, deductions, and total wages, ensuring clarity and accuracy. You can easily customize this template to include fields for bonuses, overtime, and tax calculations, streamlining your payroll processing. This essential tool can cater to your basic payroll needs and has the potential to integrate advanced features like automated tax updates and reporting metrics for future enhancements.

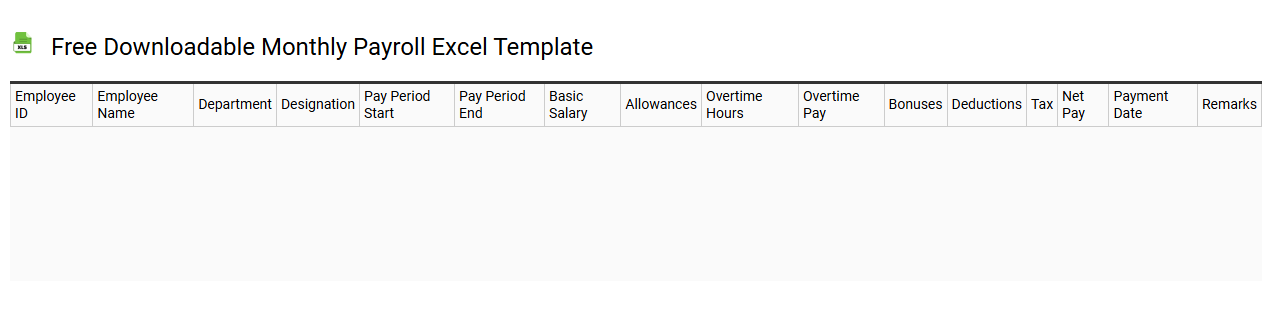

Free downloadable monthly payroll Excel template

💾 Free downloadable monthly payroll Excel template template .xls

A free downloadable monthly payroll Excel template is a pre-designed spreadsheet that helps businesses and individuals efficiently manage employee paychecks on a monthly basis. It typically includes essential columns like employee names, hours worked, gross pay, deductions, and net pay, allowing for streamlined calculations. Users can customize these templates to fit specific payroll requirements, ensuring accuracy and saving time on manual entries. Beyond basic payroll needs, these templates can be enhanced to incorporate advanced features such as tax calculations, overtime tracking, or integration with accounting software.

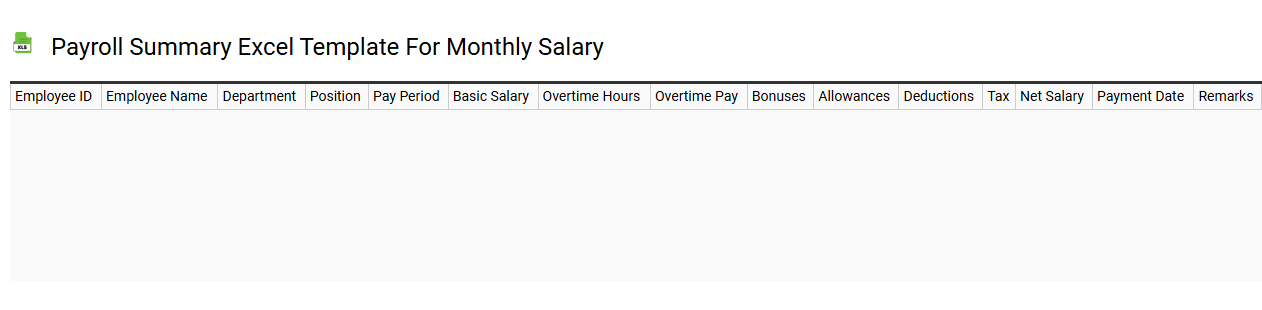

Payroll summary Excel template for monthly salary

💾 Payroll summary Excel template for monthly salary template .xls

A Payroll summary Excel template for monthly salary provides an organized framework to track employee salaries, deductions, bonuses, and taxes. You can easily enter employee details, including names, positions, and pay rates, enabling straightforward calculations of gross and net salaries. The template often includes sections for health benefits, retirement contributions, and any other deductions, ensuring all necessary data is summarized concisely. This tool allows you to manage payroll efficiently, offering further potential needs such as advanced analytics for payroll forecasting and compliance upkeep.

Monthly payroll Excel template with attendance tracking

![]()

💾 Monthly payroll Excel template with attendance tracking template .xls

A monthly payroll Excel template with attendance tracking consolidates employee attendance records alongside payroll calculations. This template typically includes fields for employee names, hours worked, overtime, and deductions, making it easier to compute total earnings. Integrated attendance tracking allows you to input sick days, vacations, and late arrivals, ensuring accurate payroll processing. You can streamline payroll management, while also exploring advanced functionalities such as automatic tax calculations and integration with HR software for enhanced data analysis.

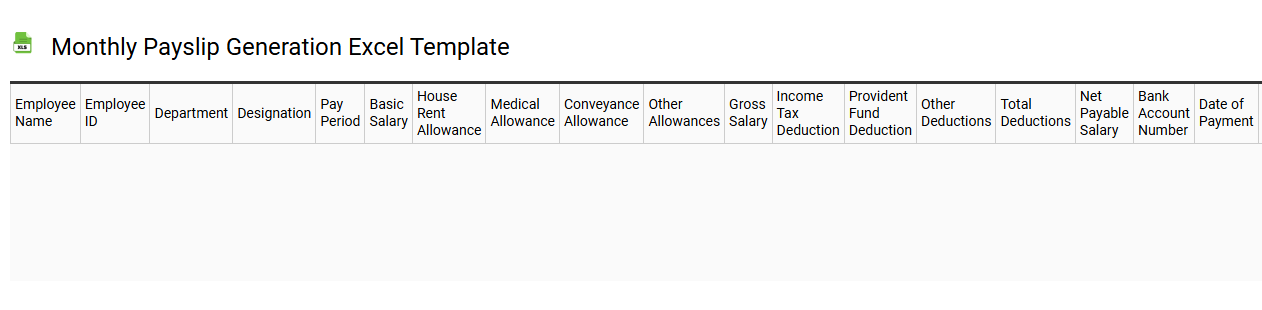

Monthly payslip generation Excel template

💾 Monthly payslip generation Excel template template .xls

A Monthly payslip generation Excel template is a pre-designed spreadsheet that automates the process of creating payslips for employees. This template typically includes essential fields such as employee name, job title, pay period, gross salary, deductions, and net pay. User-friendly features like formulas and drop-down menus streamline data entry, ensuring accuracy and saving time. This basic tool can evolve into more complex payroll systems that integrate tax calculations, benefits, and compliance reporting for various jurisdictions.

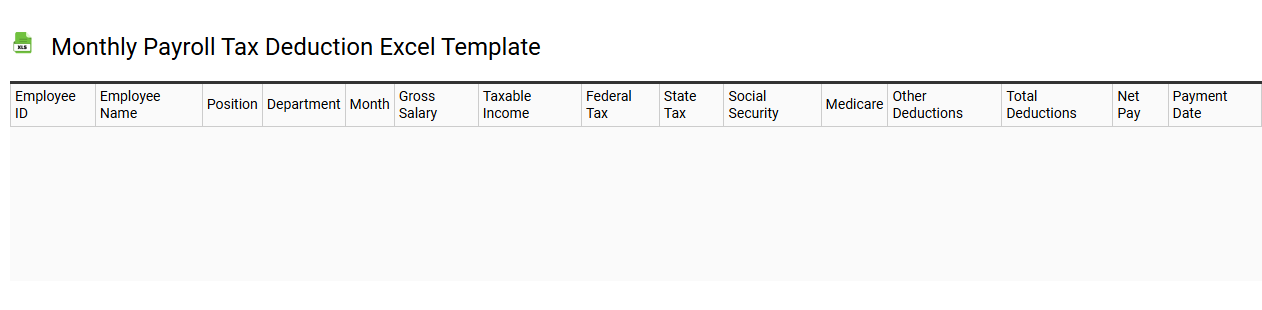

Monthly payroll tax deduction Excel template

💾 Monthly payroll tax deduction Excel template template .xls

A Monthly Payroll Tax Deduction Excel template is a pre-designed spreadsheet that simplifies the process of calculating employee payroll taxes for a given month. This tool typically includes various sections for inputting employee information, gross pay, tax rates, and deductions, making it easier to compute net pay accurately. The template may incorporate formulas that automate calculations, ensuring that all applicable federal, state, and local taxes are included. As you use this template for basic payroll management, it also lays the groundwork for potential expansions into advanced payroll systems, such as integrating real-time tax updates or employee benefits calculations.

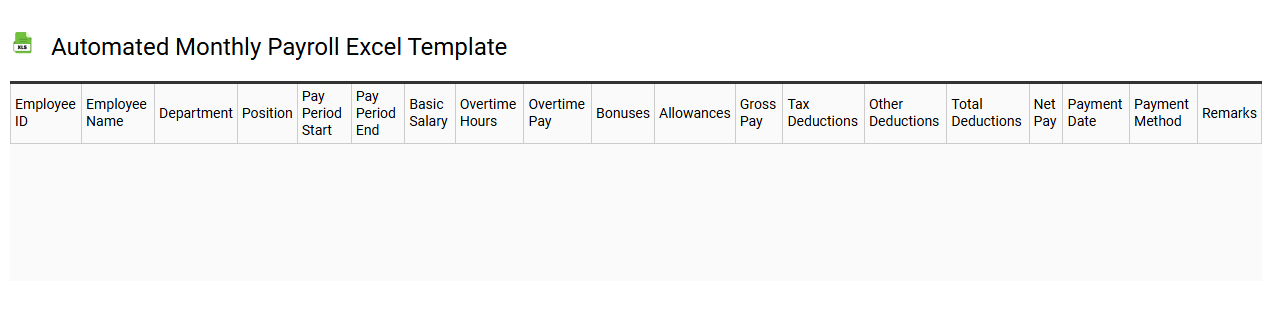

Automated monthly payroll Excel template

💾 Automated monthly payroll Excel template template .xls

An Automated monthly payroll Excel template streamlines the payroll process by incorporating formulas and functions to calculate employee wages, tax deductions, and other deductions automatically. This template typically includes sections for employee details, hours worked, pay rates, and any bonuses or overtime, ensuring accuracy and efficiency in payroll management. You can customize the template to suit the specific needs of your organization, whether small or large. Understanding basic usage can assist in managing payroll effectively, while further exploration might lead to advanced automation features such as integration with accounting software or real-time data analytics.

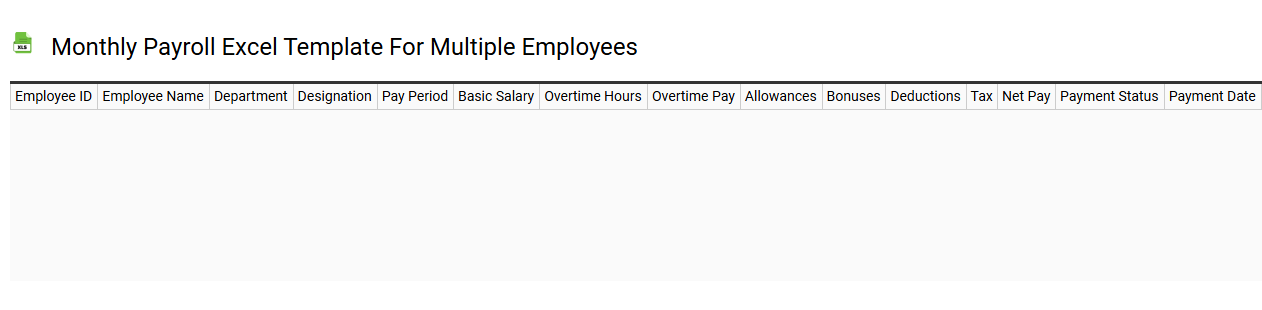

Monthly payroll Excel template for multiple employees

💾 Monthly payroll Excel template for multiple employees template .xls

A monthly payroll Excel template for multiple employees simplifies the process of tracking and calculating wages, deductions, and net pay for each worker. This organized spreadsheet allows you to input employee names, hours worked, hourly rates, and any bonuses or deductions. Formulas automate calculations, ensuring accuracy while providing an easy-to-read format. This tool not only meets basic payroll needs but can also be expanded with advanced features like automatic tax calculations and integration with accounting software.