Explore a collection of free Excel templates specifically designed for payroll reconciliation, allowing you to streamline your payroll processes efficiently. These templates include comprehensive features such as automated calculation fields, detailed employee breakdowns, and customizable expense categories. You can easily track discrepancies and ensure accuracy in your payroll records, making financial management more manageable and effective for your business.

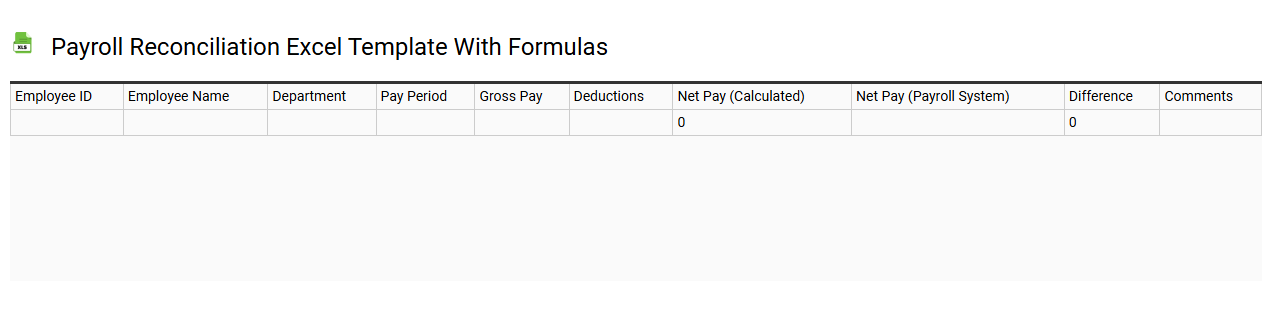

Payroll reconciliation Excel template with formulas

💾 Payroll reconciliation Excel template with formulas template .xls

Payroll reconciliation Excel templates streamline the process of aligning payroll records with actual payments made to employees. These templates typically include formulas that automate calculations, ensuring accuracy by verifying gross pay, deductions, and net pay against bank statements. You can easily input figures related to wages, taxes, and deductions, allowing for a clear summary of discrepancies if they arise. Basic usage involves tracking payroll expenses, but advanced functionalities could integrate complex data analytics and forecasting models to optimize payroll management and improve financial oversight.

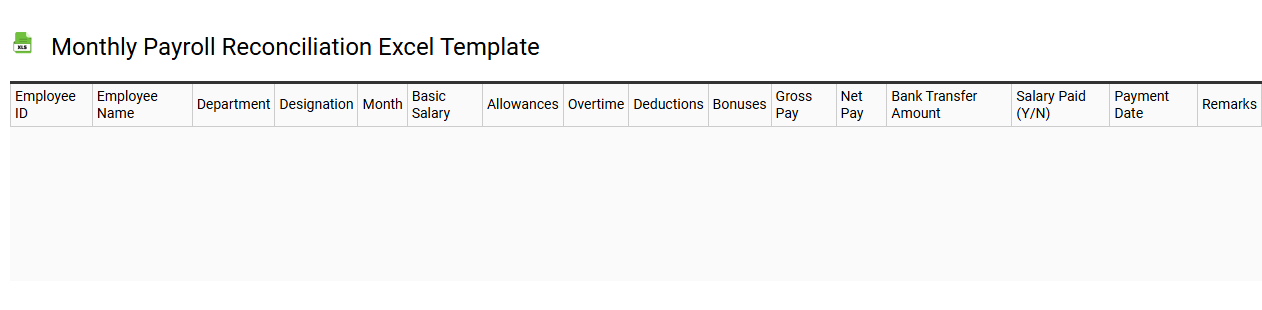

Monthly payroll reconciliation Excel template

💾 Monthly payroll reconciliation Excel template template .xls

A monthly payroll reconciliation Excel template serves as a structured tool to verify that all payroll figures align with company records and financial statements. This template typically includes columns for employee names, hours worked, gross pay, deductions, and net pay, allowing for a straightforward comparison of figures. Users can easily spot discrepancies, such as incorrect hours or misapplied deductions, enhancing accuracy in financial reporting. Beyond basic payroll auditing, advanced users may explore functionalities like pivot tables or macros for streamlining complex reconciliation processes.

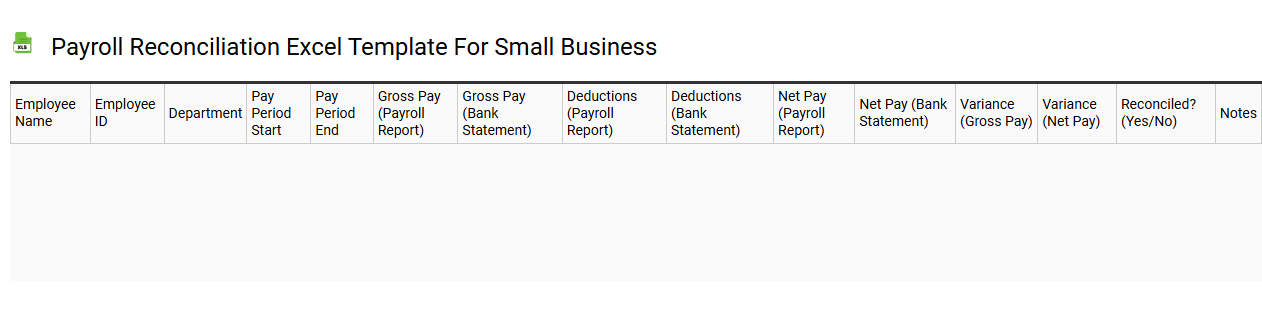

Payroll reconciliation Excel template for small business

💾 Payroll reconciliation Excel template for small business template .xls

A Payroll reconciliation Excel template for small businesses serves as an essential tool for ensuring accuracy in employee payment records. It typically includes columns for employee names, hours worked, pay rates, deductions, and net pay, enabling you to easily track payroll expenses. Additionally, it captures relevant tax information, providing a comprehensive overview of payroll liabilities and their alignment with actual expenditures. This template not only simplifies the payroll management process but also helps you identify discrepancies, offering potential for integrating more advanced features like automated calculations and real-time reporting for larger datasets.

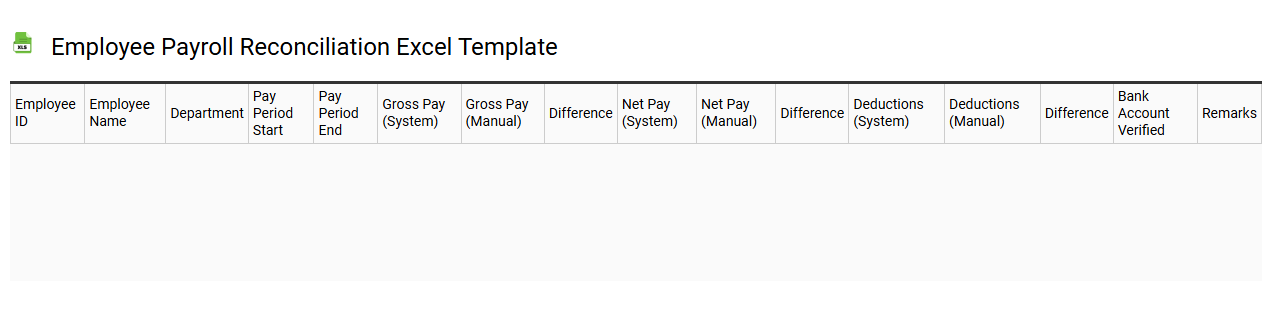

Employee payroll reconciliation Excel template

💾 Employee payroll reconciliation Excel template template .xls

An Employee payroll reconciliation Excel template is a structured tool that helps organizations verify and align their payroll records with actual payments made to employees. It typically includes sections for employee names, hours worked, gross pay, deductions, and net pay, making it easy to identify discrepancies. This template streamlines the process of ensuring that all payroll data is accurate and that every employee is compensated correctly for their work. You can customize the template to meet advanced requirements such as tax calculations, benefits tracking, and compliance monitoring for regulatory needs.

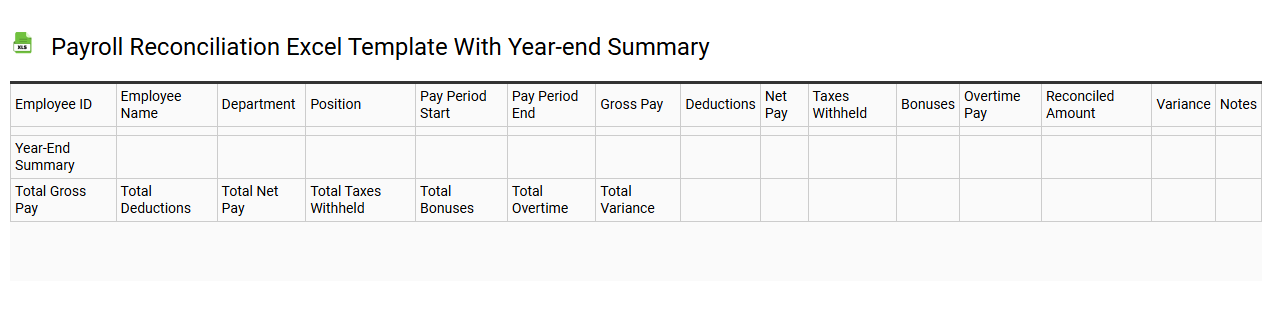

Payroll reconciliation Excel template with year-end summary

💾 Payroll reconciliation Excel template with year-end summary template .xls

A Payroll reconciliation Excel template with year-end summary is a structured tool designed to accurately track and verify payroll expenses against recorded data. It typically includes sections for employee details, gross wages, deductions, and net pay, providing a comprehensive view of payroll information. The year-end summary consolidates all payroll records over a fiscal year, making it easier to ensure compliance with tax regulations and identify discrepancies. This template can serve as a foundational resource for your payroll management needs while allowing for further customization, such as incorporating advanced features like automated calculations or integration with accounting software for enhanced reporting.

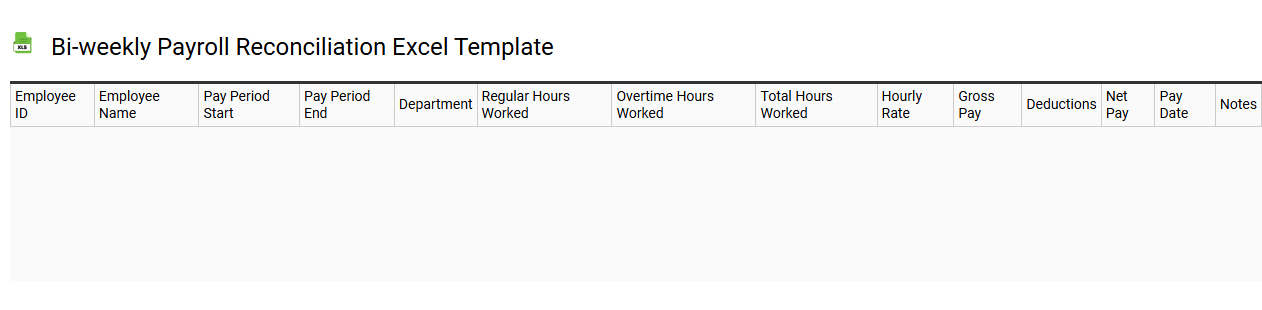

Bi-weekly payroll reconciliation Excel template

💾 Bi-weekly payroll reconciliation Excel template template .xls

A bi-weekly payroll reconciliation Excel template is a structured tool designed to streamline the management of payroll data over a two-week cycle. This template typically includes sections for employee details, hours worked, gross pay, deductions, and net pay, allowing for quick calculations and verifications. You can easily compare actual payroll expenses with budgeted figures, ensuring that discrepancies are promptly addressed. Such a template aids in basic payroll processing, while further potential needs may involve integrating advanced financial analysis or automation features for enhanced efficiency.

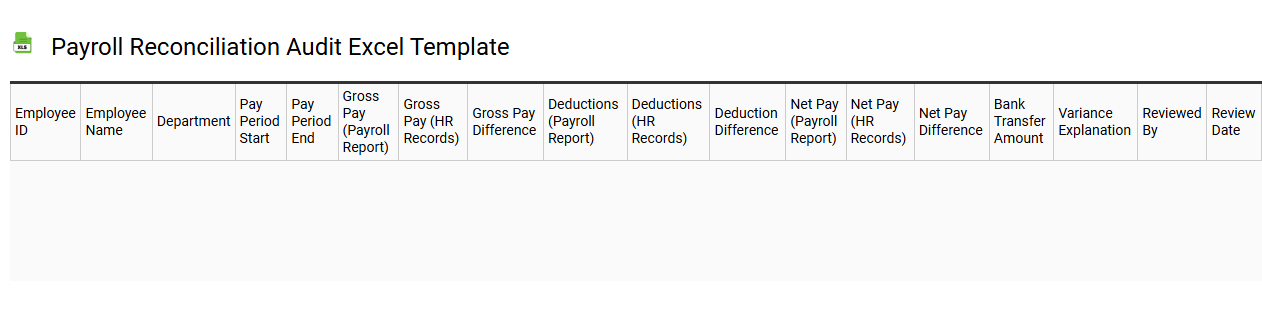

Payroll reconciliation audit Excel template

💾 Payroll reconciliation audit Excel template template .xls

Payroll reconciliation audit Excel templates streamline the process of comparing payroll data against various financial records to ensure accuracy. These templates typically include sections for inputting employee information, earnings, deductions, and net pay, making it easy to identify discrepancies. With built-in formulas and formatting, users can quickly calculate totals and review variances, simplifying the audit process. For your organization, understanding its basic functioning can also lead to more advanced applications like integrating it with payroll software or employing it for financial forecasting.

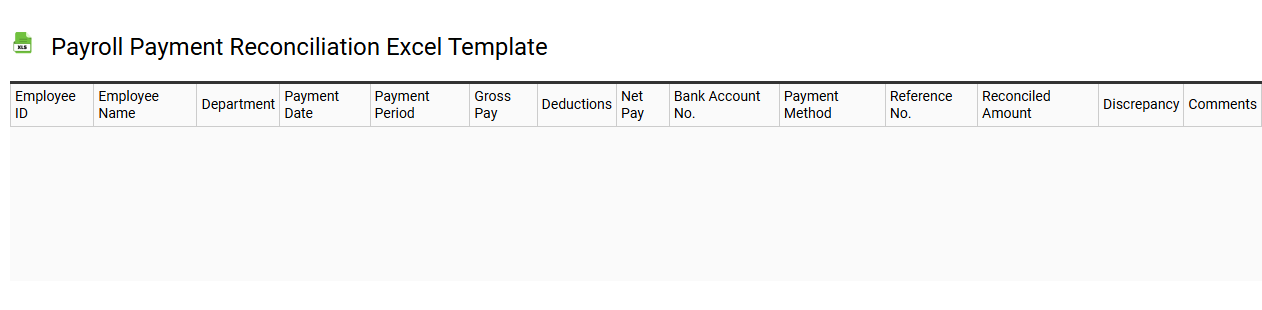

Payroll payment reconciliation Excel template

💾 Payroll payment reconciliation Excel template template .xls

A Payroll Payment Reconciliation Excel template is a structured spreadsheet designed to streamline the process of verifying payroll transactions against company records. This template typically includes columns for employee names, hours worked, wages, taxes withheld, and net pay, allowing for easy data entry and comparison. Charts or summaries may be included for a visual representation of discrepancies, offering a clear overview of payroll accuracy. You can use this template to ensure timely payments and prepare for potential audits, and consider integrating advanced functions like VLOOKUP or pivot tables for enhanced data analysis.

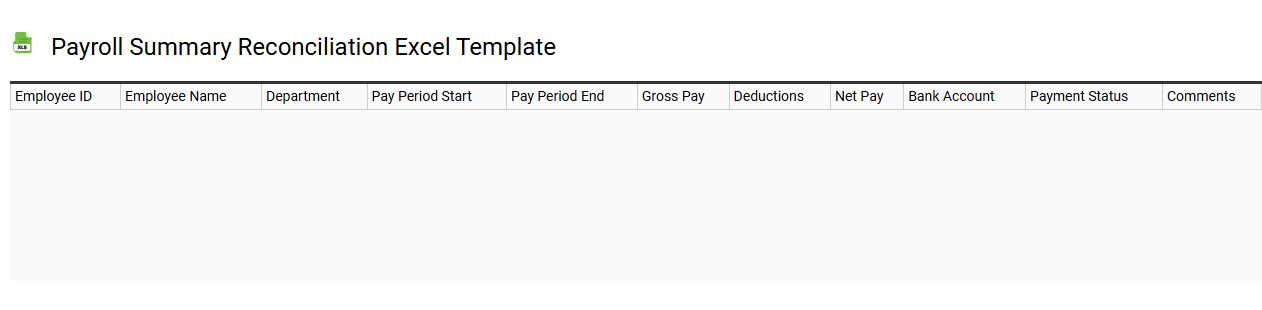

Payroll summary reconciliation Excel template

💾 Payroll summary reconciliation Excel template template .xls

A Payroll Summary Reconciliation Excel template is a structured tool designed to help businesses accurately track and balance payroll expenses. It typically includes sections for employee details, gross earnings, deductions, and net pay, facilitating a comprehensive overview of payroll data. You can easily compare figures from various periods or departments, ensuring that all entries align with financial records. Such a template can streamline your payroll processes, with further potential needs involving complex calculations, integration with accounting software, and compliance with regulatory standards.

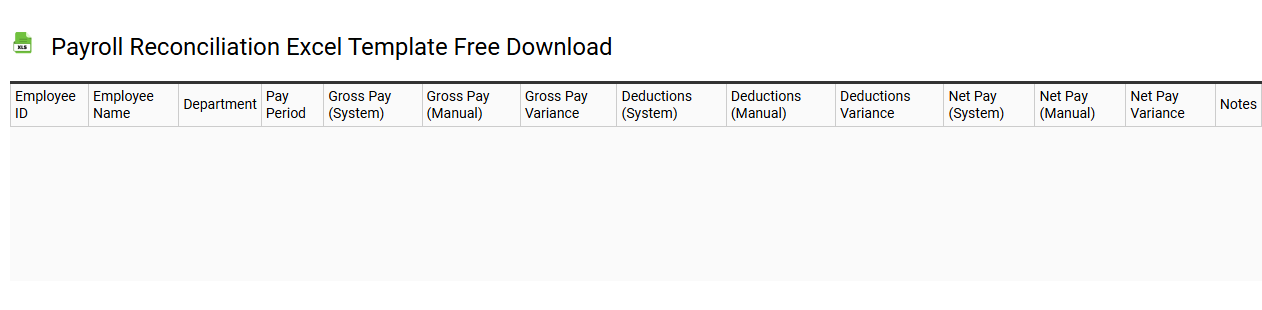

Payroll reconciliation Excel template free download

💾 Payroll reconciliation Excel template free download template .xls

A Payroll reconciliation Excel template is a structured spreadsheet designed to assist businesses in ensuring that their payroll records match with financial statements and accounts. This template typically includes sections for employee details, gross wages, deductions, taxes, and net pay, which enables you to easily verify accuracy and compliance with regulations. Users can also track discrepancies, ensuring that all payroll entries align with accounting records effectively. Using such a template not only simplifies regular payroll processing but also lays the groundwork for potential future needs in payroll auditing or financial analysis through more advanced data visualization tools and macros.

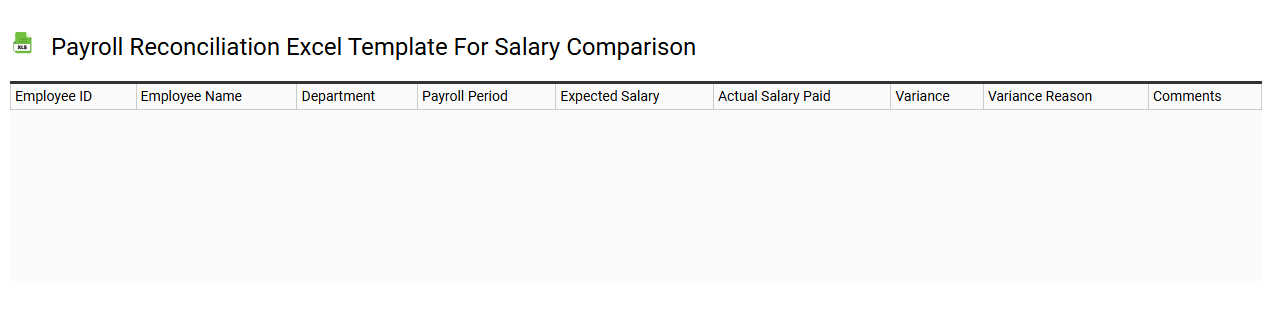

Payroll reconciliation Excel template for salary comparison

💾 Payroll reconciliation Excel template for salary comparison template .xls

A Payroll reconciliation Excel template for salary comparison serves as a powerful tool to ensure accurate payroll processing and salary alignment within an organization. This template typically includes columns for employee names, positions, salaries, deductions, and net pay, enabling you to compare actual payments against expected compensation. By tracking discrepancies, it highlights anomalies in payroll disbursements, making it easier to identify errors or potential fraud. An effective template can also accommodate complex calculations involving overtime, bonuses, and tax withholdings, catering to both basic payroll needs and more advanced analytical approaches like forecasting and compliance audits.

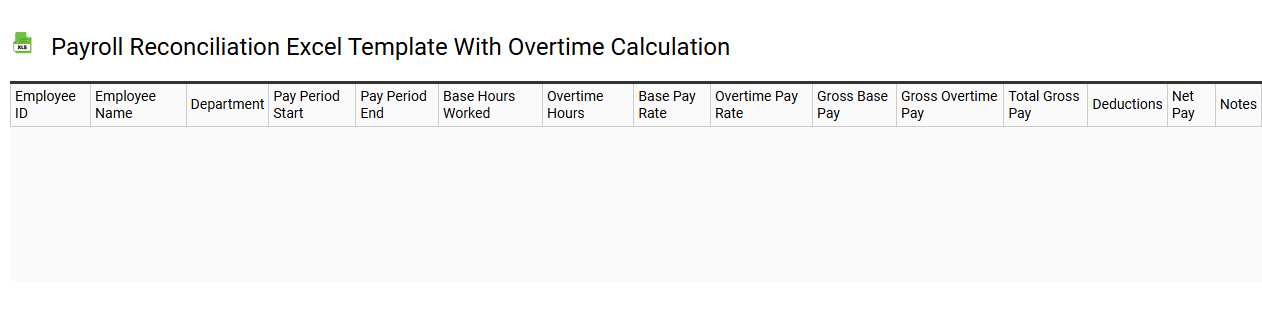

Payroll reconciliation Excel template with overtime calculation

💾 Payroll reconciliation Excel template with overtime calculation template .xls

A Payroll Reconciliation Excel template is a structured tool designed to ensure that payroll records align with financial statements and employee payments. It typically includes sections for hourly wages, overtime calculations, deductions, and net pay, making it easier to track discrepancies. Features such as formulas for calculating overtime pay, which often adheres to a specific multiplier of the regular wage, streamline the process of verifying employee compensation. You can use this template for basic payroll tasks, while more advanced applications may involve integrating payroll data with accounting software for comprehensive financial reporting and analytics.

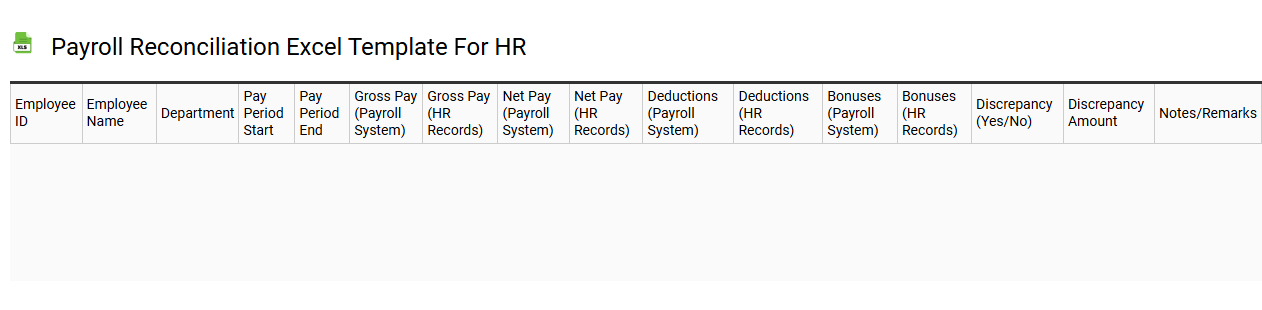

Payroll reconciliation Excel template for HR

💾 Payroll reconciliation Excel template for HR template .xls

A Payroll reconciliation Excel template serves as a critical tool for Human Resources departments, streamlining the process of ensuring that payroll records align with various financial documents and databases. This template typically features a structured layout, including sections for employee details, hours worked, wages, taxes withheld, and net pay, allowing for clear comparisons between reported and actual figures. By organizing this data, HR can quickly identify discrepancies or errors in payroll calculations, ensuring compliance and accuracy. Such templates provide basic functionality for regular audits, while advanced users may expand their use to integrate complex financial reporting and analytics features for deeper insights into payroll trends and anomalies.

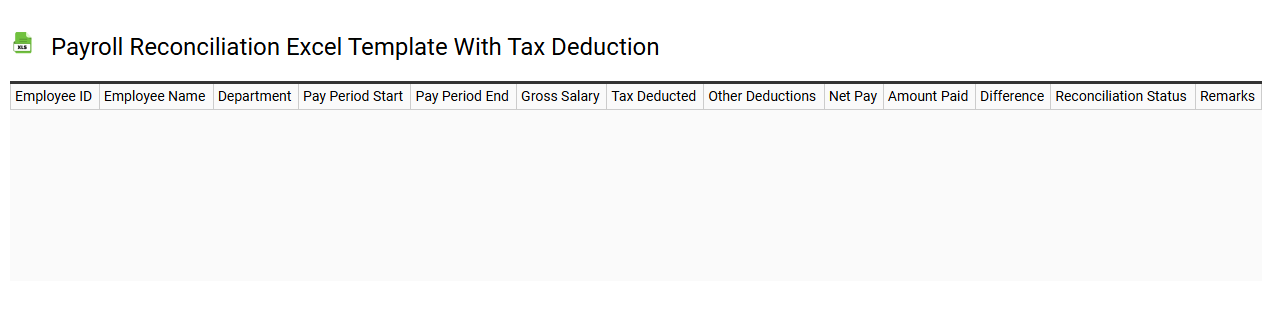

Payroll reconciliation Excel template with tax deduction

💾 Payroll reconciliation Excel template with tax deduction template .xls

A Payroll reconciliation Excel template with tax deduction is a comprehensive tool designed to streamline and accurately manage employee payroll records. This template includes essential columns for employee details, hours worked, gross pay, and specific tax deductions such as federal and state income taxes, Social Security, and Medicare contributions. You can easily compare the totals from your payroll register with bank statements to ensure that all payments are correctly disbursed and accounted for. This format not only simplifies the monthly reconciliation process but can also be further customized for advanced financial reporting and forecasting needs, incorporating functions like pivot tables and complex formulas to enhance data analysis.

Payroll reconciliation Excel template with attendance tracking

![]()

💾 Payroll reconciliation Excel template with attendance tracking template .xls

A Payroll reconciliation Excel template with attendance tracking consolidates essential employee data, ensuring accurate payments and compliance. It typically includes sections for employee names, hours worked, attendance records, overtime calculations, and deductions, making it easier to identify discrepancies. This template often features conditional formatting, enabling you to quickly visualize attendance patterns and flag inconsistencies. By implementing such a tool, you address basic payroll needs while setting a foundation for more advanced payroll management techniques, such as automated calculations and integration with HR software.