Explore a diverse range of free XLS templates designed specifically for tracking debt. These templates typically feature customizable sections for your creditors, outstanding balances, interest rates, and payment schedules, providing a clear overview of your financial commitments. Utilize simple formulas for automatic calculations and visual charts to help you monitor your progress towards becoming debt-free.

Debt tracking report Excel template free download

![]()

💾 Debt tracking report Excel template free download template .xls

A Debt Tracking Report Excel template offers a structured format for monitoring and managing personal or business debts. This customizable tool allows you to input information such as creditor names, outstanding balances, interest rates, and payment due dates, making it easy to visualize your financial obligations. You can analyze your repayment progress through built-in formulas that compute totals and interest amounts, helping you stay organized and on track. While this basic template simplifies debt management, further enhancements may include advanced functions like conditional formatting, data visualization, and automated alerts for payment reminders.

Personal debt tracking report Excel template

![]()

💾 Personal debt tracking report Excel template template .xls

A Personal Debt Tracking Report Excel template is a designed spreadsheet that helps individuals monitor and manage their debts effectively. This template typically includes sections for listing various debts, such as credit cards, loans, and mortgages, along with associated interest rates, monthly payments, and outstanding balances. Users can easily input data, which allows for real-time tracking of total debts, payment progress, and potential savings from additional payments. You can customize this template to explore advanced financial strategies, like debt snowball or avalanche methods, as well as long-term financial planning and budgeting needs.

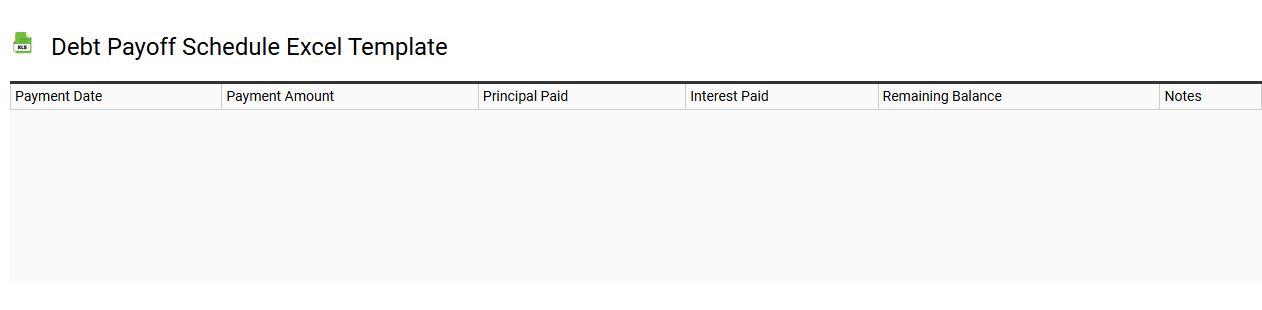

Debt payoff schedule Excel template

💾 Debt payoff schedule Excel template template .xls

A Debt Payoff Schedule Excel template is a customizable tool designed to help individuals or businesses systematically track and manage their debt repayment. This template typically displays your outstanding debts, including balances, interest rates, minimum payments, and due dates, enabling you to visualize your financial obligations. By inputting your specific debt information, you can calculate the payoff timeline, monitor progress, and strategize repayment methods such as the avalanche or snowball approaches. This basic tool can evolve into a comprehensive financial tracker, incorporating advanced elements such as amortization schedules, total interest calculations, and cash flow analysis for optimizing overall financial health.

Monthly debt tracking report Excel template

![]()

💾 Monthly debt tracking report Excel template template .xls

A Monthly Debt Tracking Report Excel template is a structured spreadsheet designed to help you monitor and manage your debts over a specific month. This template typically includes sections for listing creditors, total amounts owed, payment due dates, and any interest rates associated with your loans. Visual elements like charts or graphs may present your debt status, making trends easier to understand at a glance. By using this template, you can effectively track your repayments and identify areas where you may need to adjust your financial strategy, whether you're simply managing expenses or planning for more advanced financial goals like debt consolidation or refinancing options.

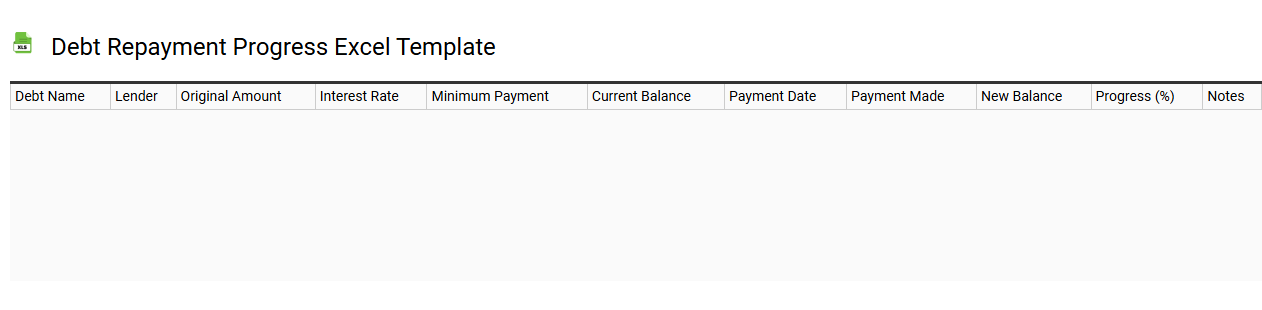

Debt repayment progress Excel template

💾 Debt repayment progress Excel template template .xls

A Debt Repayment Progress Excel template serves as an organized tool to track your debt payments and visualize your repayment journey. It typically includes columns for the total debt amount, interest rates, due dates, minimum payment amounts, and remaining balances. Users can input their payments, which allows for real-time updates on their debt status and helps identify trends, such as if you're accelerating your repayment or facing difficulties meeting deadlines. This template can be adapted for more advanced financial tracking needs, including amortization schedules or detailed scenario analysis.

Family debt tracking report Excel template

![]()

💾 Family debt tracking report Excel template template .xls

A Family Debt Tracking Report Excel template is a customizable spreadsheet designed to help individuals and families monitor their debt levels systematically. This template typically includes fields for various types of debts, such as credit cards, student loans, mortgages, and personal loans, allowing users to input amounts owed, interest rates, and monthly payments. You can categorize debts by priority, track payment dates, and calculate remaining balances, providing a clear overview of your financial obligations. This efficient tool not only aids in managing current debts but can also be adapted for future financial planning and advanced debt reduction strategies, such as snowball or avalanche methods.

Small business debt tracking Excel template

![]()

💾 Small business debt tracking Excel template template .xls

A Small Business Debt Tracking Excel template is a downloadable spreadsheet designed to help small business owners manage and monitor their debts efficiently. It typically includes fields for entering creditor names, loan amounts, interest rates, repayment due dates, and payment history, allowing for easy tracking of obligations over time. You can customize the template to include additional details such as payment schedules and outstanding balances, providing a comprehensive financial overview. This tool can serve as a basic solution for managing debts, with potential expansion into cash flow projections and financial forecasting using advanced features like pivot tables or macros.

Credit card debt tracking report Excel template

![]()

💾 Credit card debt tracking report Excel template template .xls

A Credit Card Debt Tracking Report Excel template provides an organized and efficient way to manage and monitor your credit card balances, interest rates, and payment schedules. This template typically includes categories such as card issuer, outstanding balance, minimum payment due, and due dates, allowing for at-a-glance assessments of your debt situation. Custom formulas can be integrated for calculating interest accrued, payment histories, and total debt owed, enhancing your financial insights. You can utilize this tool for basic tracking or expand its capabilities with more advanced functionalities like budgeting forecasts or debt snowball calculations to optimize your financial strategy.

Multiple loans tracking Excel template

![]()

💾 Multiple loans tracking Excel template template .xls

A Multiple Loans Tracking Excel template is a financial tool designed to help you manage and monitor various loans simultaneously in one organized sheet. This template typically includes vital columns for loan amounts, interest rates, payment due dates, and remaining balances, allowing for quick assessments of your financial obligations. You can easily input data specific to each loan, track payments made, and calculate outstanding amounts to stay on top of your repayment schedules. For more sophisticated management, consider incorporating features like amortization calculations or visual graphs to enhance your tracking efficiency.