Explore a range of free XLS templates designed specifically for financial risk analysis, ideal for helping you assess potential financial uncertainties. These templates typically include key metrics such as value at risk (VaR), scenario analysis, and sensitivity analysis, enabling you to visualize potential impacts on your financial portfolio. You can easily customize these templates to suit your specific needs, allowing for a comprehensive approach to managing your financial risks.

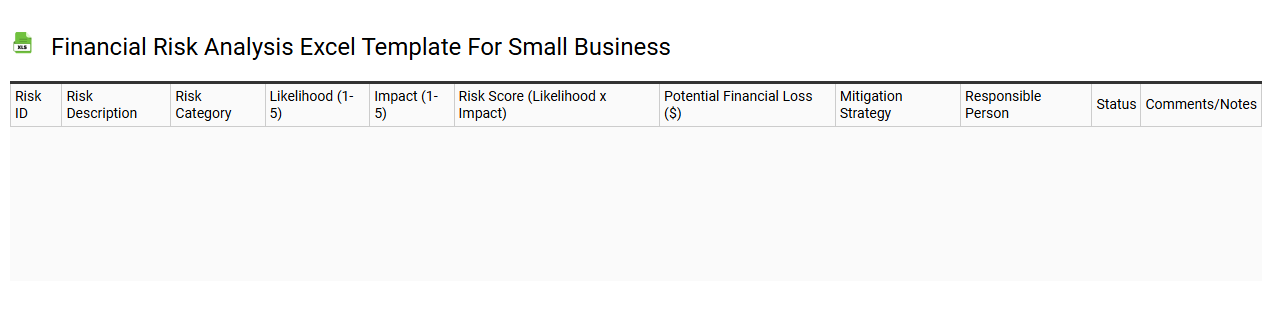

Financial risk analysis Excel template for small business

💾 Financial risk analysis Excel template for small business template .xls

A Financial Risk Analysis Excel template for small businesses provides a structured framework to evaluate potential financial uncertainties affecting your operations. This customizable template includes key components such as cash flow projections, debt obligations, and revenue forecasts, enabling you to assess various scenarios. You can easily input your financial data, and the template will help highlight risks by performing calculations that assess the impact of factors like market volatility and interest rate fluctuations. Beyond basic risk assessment and management, this tool can evolve to incorporate advanced metrics like Value at Risk (VaR) and sensitivity analysis for deeper insights into your business's financial stability.

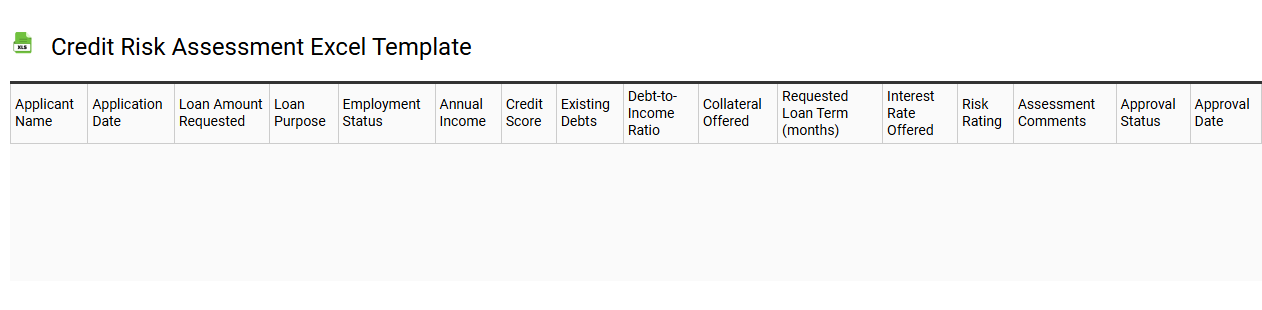

Credit risk assessment Excel template

💾 Credit risk assessment Excel template template .xls

A Credit Risk Assessment Excel template is a structured tool designed to evaluate the creditworthiness of individuals or organizations. This template typically includes sections for inputting financial data, such as income statements, balance sheets, cash flow statements, and credit history information. Users can utilize formulas to analyze ratios, such as debt-to-income and credit utilization, simplifying the comparison between borrowers. For basic usage, it serves to quickly assess risk levels, while advanced applications might involve predictive analytics, machine learning algorithms, or portfolio optimization techniques to enhance decision-making.

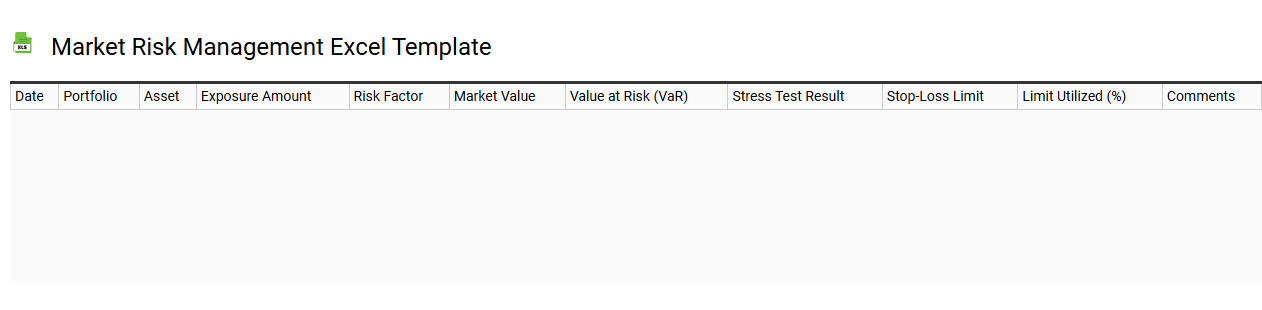

Market risk management Excel template

💾 Market risk management Excel template template .xls

A Market Risk Management Excel template is a structured tool designed to help businesses assess and manage their exposure to market risks such as changes in interest rates, foreign exchange rates, and commodity prices. This template typically includes features for tracking financial metrics, scenario analysis, risk assessments, and data visualizations, enabling you to identify potential vulnerabilities and make informed decisions. By utilizing formulas and pivot tables, the template streamlines the analysis process, providing insights into risk exposure and potential impacts on your portfolio. Basic usage includes inputting data and generating reports, while further potential needs may involve integrating advanced analytics like Value at Risk (VaR) calculations and stress testing scenarios.

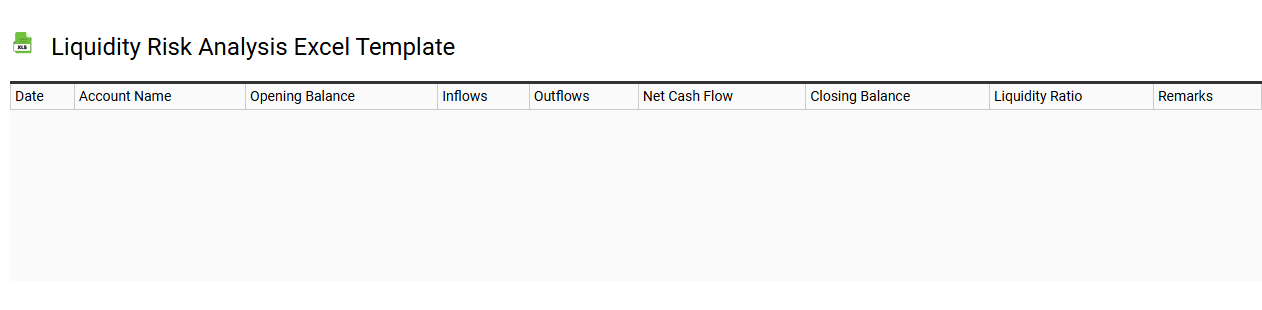

Liquidity risk analysis Excel template

💾 Liquidity risk analysis Excel template template .xls

A Liquidity risk analysis Excel template serves as a structured tool designed to assess an organization's ability to meet its short-term financial obligations. This template typically includes key components such as cash flow forecasts, liquidity ratios, and stress test scenarios to evaluate liquidity positions under various conditions. It allows users to input actual cash inflows and outflows, helping identify potential shortfalls and manage working capital more effectively. You can use this template for ongoing assessments and adapt it to incorporate advanced modeling techniques such as scenario analysis and simulation for more sophisticated liquidity management.

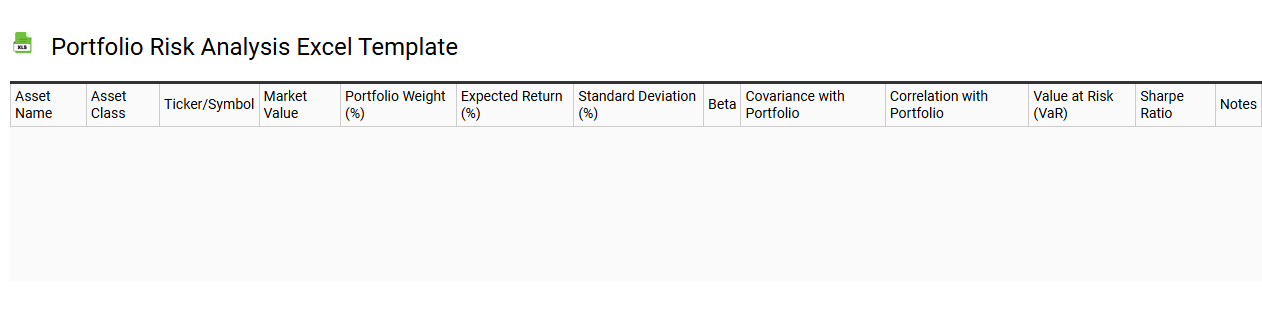

Portfolio risk analysis Excel template

💾 Portfolio risk analysis Excel template template .xls

A Portfolio Risk Analysis Excel template is a structured tool designed to help investors assess the risk associated with their investment portfolios. It typically includes detailed sections for inputting asset data, evaluating historical performance, and calculating potential risks such as value-at-risk (VaR) or standard deviation. You can visualize risk exposure through charts and graphs, making it easier to identify vulnerable assets. This template facilitates basic portfolio management while offering advanced features like Monte Carlo simulations or stress testing for comprehensive risk assessment.

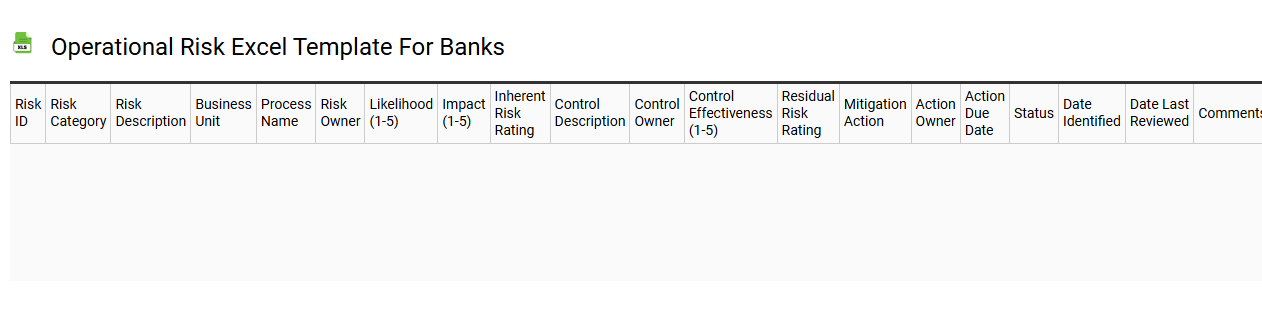

Operational risk Excel template for banks

💾 Operational risk Excel template for banks template .xls

An Operational Risk Excel template for banks serves as a structured tool designed to identify, assess, and manage potential risks that could disrupt bank operations. This template typically includes columns for risk events, categories, impacts, likelihood, and mitigation strategies, allowing users to easily analyze data and implement controls. Users often personalize the template with specific risk metrics, ensuring it aligns with their institution's unique operational environment. It can be utilized for basic risk assessment but also adapted for advanced analyses such as risk scenario modeling and stress testing for more complex risk management needs.

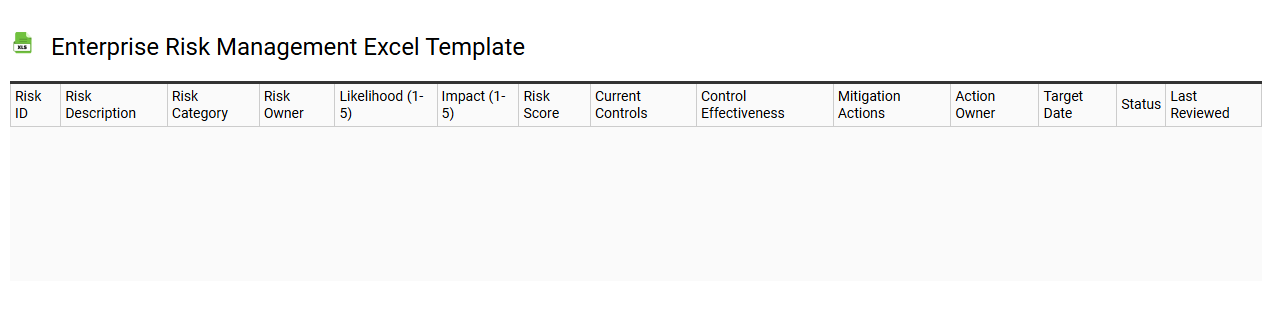

Enterprise risk management Excel template

💾 Enterprise risk management Excel template template .xls

An Enterprise Risk Management (ERM) Excel template serves as a structured tool to help organizations identify, assess, and mitigate risks across various departments. This template typically includes sections for risk identification, risk scoring, and action plans, enabling users to document potential hazards and their impact on business objectives. You can customize fields to reflect specific organizational needs, such as risk categories, likelihood, impact, and responsibility assignments. Basic usage of this template can support routine risk monitoring, while advanced applications might incorporate data analytics, scenario modeling, or real-time risk tracking for more comprehensive insights.

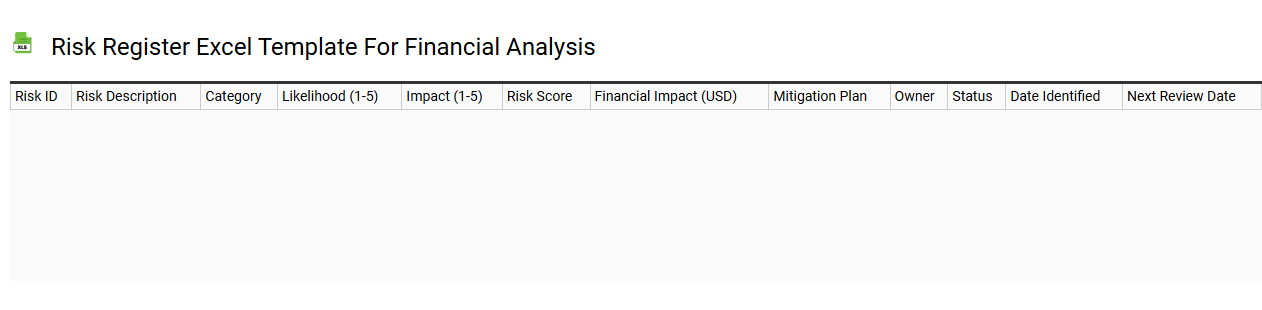

Risk register Excel template for financial analysis

💾 Risk register Excel template for financial analysis template .xls

A Risk Register Excel template for financial analysis provides a structured framework to identify, assess, and prioritize potential risks that could impact financial projects or investments. It typically includes columns for risk descriptions, likelihood of occurrence, potential financial impact, and mitigation strategies. By utilizing this template, you can monitor risks throughout your project lifecycle, ensuring that you take proactive measures to address them. Basic usage focuses on tracking known risks, while advanced applications may involve integrating real-time data analytics and predictive modeling techniques for deeper insights.

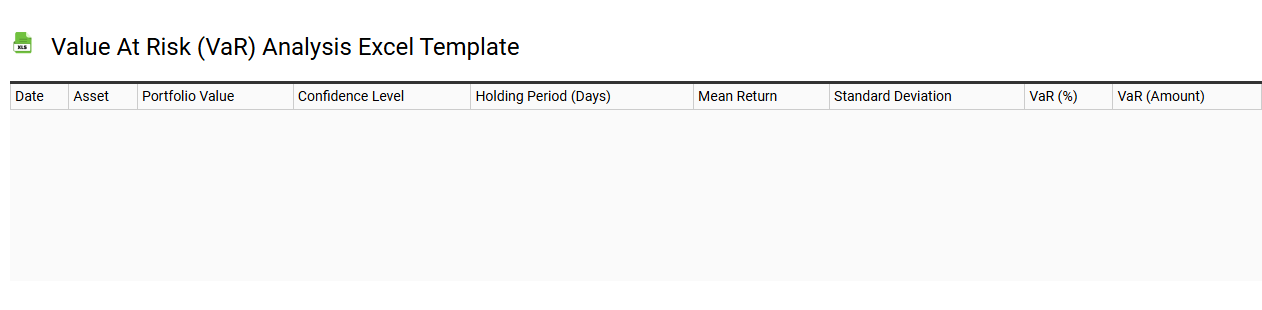

Value at Risk (VaR) analysis Excel template

💾 Value at Risk (VaR) analysis Excel template template .xls

Value at Risk (VaR) analysis in an Excel template quantifies the potential loss in the value of an asset or portfolio over a defined period for a given confidence interval. The template typically includes historical prices, calculations for mean returns, and standard deviations to calculate the risk exposure. By utilizing functions like NORM.INV and statistical analyses, you can efficiently derive the VaR measure, helping you gauge the worst-case loss scenario. Your understanding of risk management and financial metrics can be further enhanced by exploring advanced concepts like Conditional VaR (CVaR) or Stress Testing methodologies.

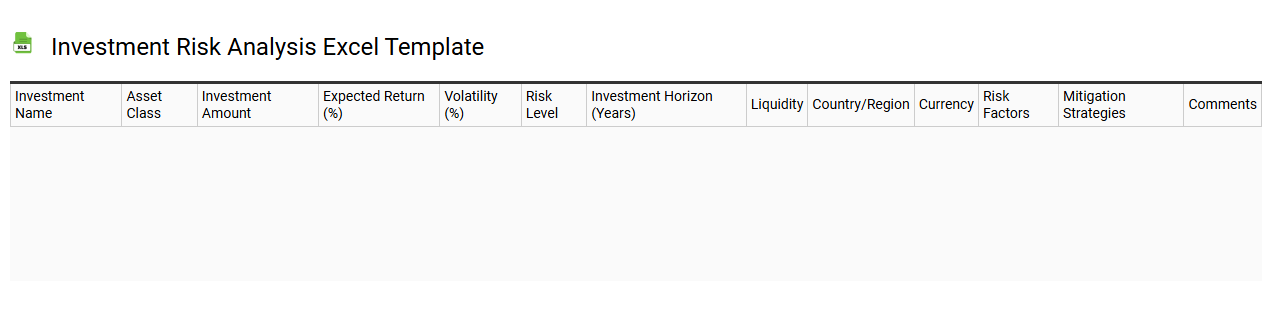

Investment risk analysis Excel template

💾 Investment risk analysis Excel template template .xls

An Investment Risk Analysis Excel template serves as a powerful tool for evaluating the potential risks associated with various investment options. This template typically features built-in formulas and graphs to quantify risk factors, such as volatility, liquidity, and market fluctuations. You can input different investment scenarios to visualize how changes in market conditions might impact your returns. Such templates cater to both novice investors aiming for basic insights and seasoned professionals requiring advanced analytics, including Value at Risk (VaR) and Monte Carlo simulations.