Explore a range of free XLS templates designed specifically for tracking portfolio risk. These templates offer user-friendly layouts where you can easily input your investment data and monitor potential risks across various assets. Key features often include customizable columns for asset type, investment amounts, and risk assessments to help you manage your portfolio effectively.

Portfolio risk tracker Excel template free download

![]()

💾 Portfolio risk tracker Excel template free download template .xls

A Portfolio Risk Tracker Excel template is a financial tool designed to help you monitor and assess the risk associated with your investment portfolio. This template typically includes sections for inputting asset values, tracking performance metrics, and calculating overall risk exposure through advanced financial ratios. Its user-friendly interface allows for easy data entry as well as visual representations of risk levels, such as graphs and charts. You can use this template for basic monitoring, with further potential to incorporate complex analytics, like Value at Risk (VaR) or Monte Carlo simulations.

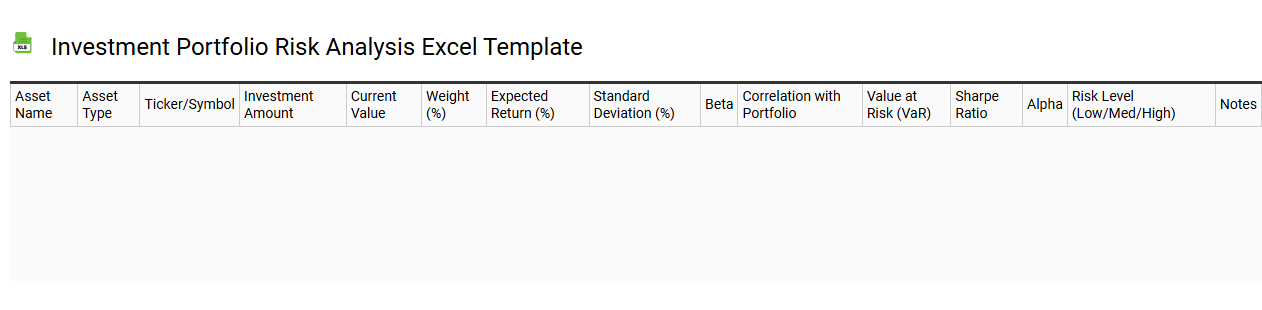

Investment portfolio risk analysis Excel template

💾 Investment portfolio risk analysis Excel template template .xls

An Investment Portfolio Risk Analysis Excel template provides a structured framework for evaluating the risks associated with your investment assets. This template often includes various financial metrics, charts, and risk assessment tools to help you visualize potential losses, volatility, and overall portfolio performance. You can utilize critical data such as asset allocation, historical returns, and market correlations to uncover insights about your investments. Basic usage may involve calculating standard deviation and Value at Risk (VaR), while more advanced applications could introduce concepts like Monte Carlo simulations and stress testing for deeper risk insights.

Stock portfolio risk tracker Excel template

![]()

💾 Stock portfolio risk tracker Excel template template .xls

A Stock Portfolio Risk Tracker Excel template is a tool designed to help investors monitor and assess the risk associated with their stock investments. This template typically includes various features, such as tracking the performance of individual stocks, calculating metrics like volatility and beta, and analyzing overall portfolio diversification. Users can input stock data, allowing the template to automatically generate risk assessments based on changes in market conditions. For those interested in advanced analysis, the template may also include features like Monte Carlo simulations or Value at Risk (VaR) calculations to further enhance risk management strategies.

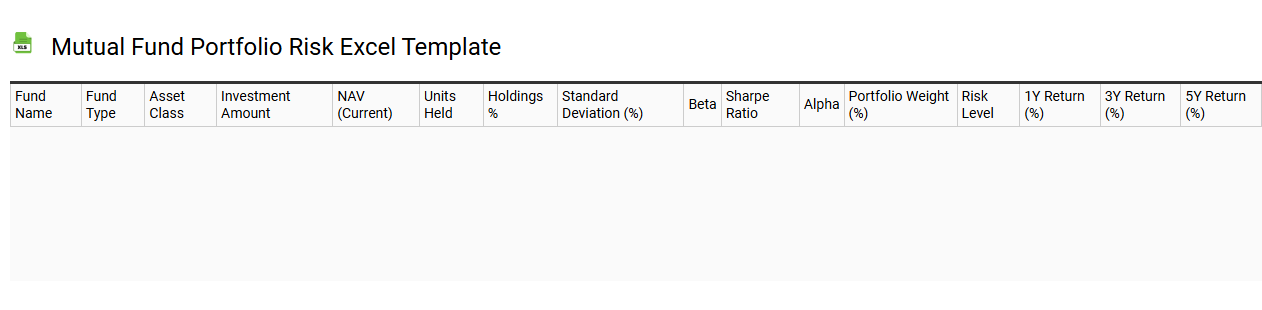

Mutual fund portfolio risk Excel template

💾 Mutual fund portfolio risk Excel template template .xls

A Mutual Fund Portfolio Risk Excel template is a structured tool designed to help you analyze and manage risks associated with your mutual fund investments. This template often includes features like asset allocation charts, performance tracking, and risk assessment metrics. You can input data related to your investments, such as fund types, amounts, and historical returns, which the template will use to calculate risk ratios and overall portfolio risk. Not only does this basic tool facilitate easy monitoring, but you can also explore more advanced functionalities such as value at risk (VaR) analysis or scenario simulations for deeper insights into your investment strategies.

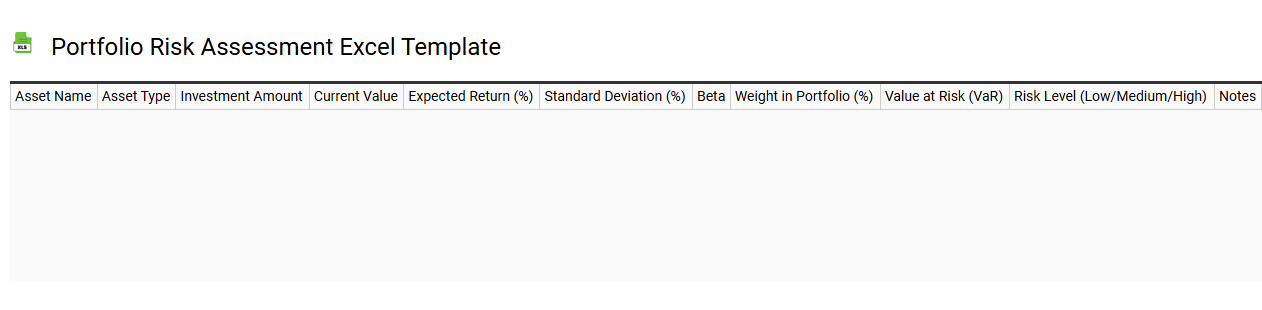

Portfolio risk assessment Excel template

💾 Portfolio risk assessment Excel template template .xls

A Portfolio Risk Assessment Excel template serves as a structured tool for evaluating the financial risk associated with various assets within an investment portfolio. It includes sections for inputting asset types, risk ratings, expected returns, and historical performance data, allowing for in-depth analysis of potential vulnerabilities. You can visualize the risk exposure through charts and graphs, facilitating easier decision-making and strategy adjustments. This template can also lay the groundwork for more advanced analyses, such as Value at Risk (VaR) calculations, scenario modeling, or Monte Carlo simulations, catering to both beginner investors and seasoned professionals.

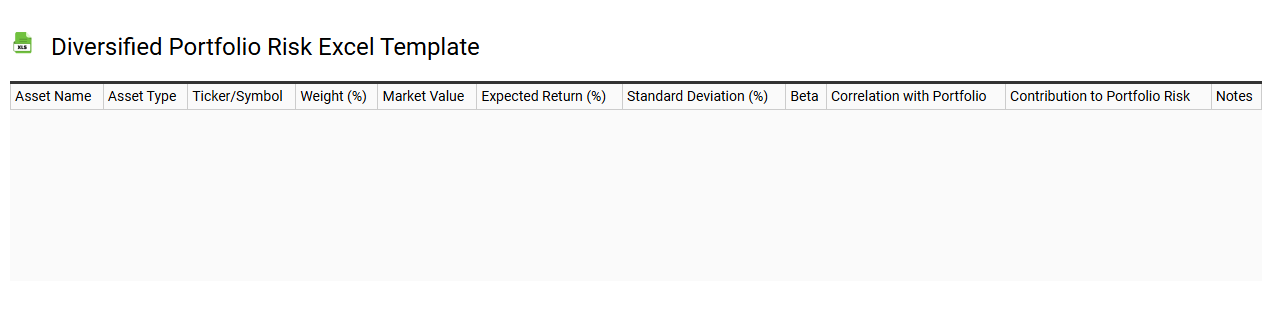

Diversified portfolio risk Excel template

💾 Diversified portfolio risk Excel template template .xls

A Diversified Portfolio Risk Excel template is a tool designed to help investors assess and manage the risk associated with their investment portfolios. This template typically includes features such as asset allocation breakdowns, historical performance metrics, and correlations between different investments. By visually representing these elements, it allows you to spot potential vulnerabilities and make informed decisions to mitigate risk. You can further adapt the template to explore advanced concepts like Value at Risk (VaR), stress testing, or scenario analysis for deeper insights into potential future performance.

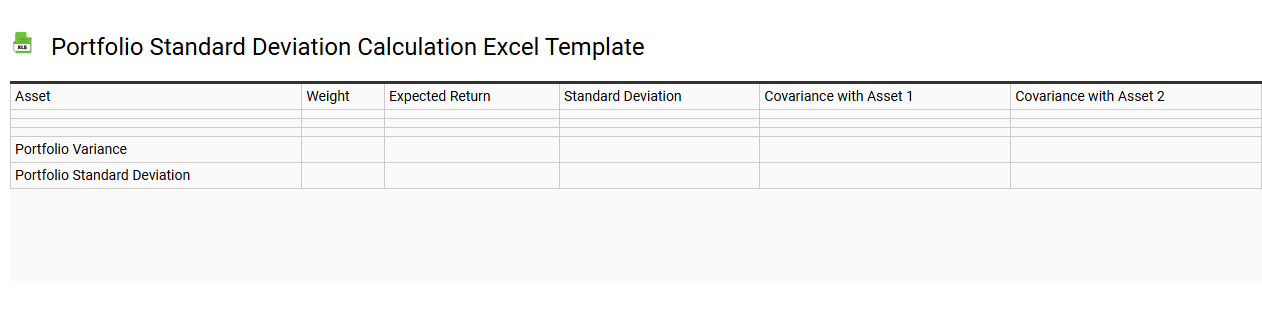

Portfolio standard deviation calculation Excel template

💾 Portfolio standard deviation calculation Excel template template .xls

A Portfolio Standard Deviation calculation Excel template serves as a valuable tool for investors and financial analysts. It allows users to quantify the risk associated with a specific investment portfolio by analyzing the volatility of its returns. The template typically includes formulas for calculating expected returns, variances, covariances, and ultimately, the standard deviation based on the asset weights within the portfolio. Mastering this template can enhance your portfolio management strategy, while further exploration into multivariate analysis and the Capital Asset Pricing Model (CAPM) can provide deeper insights into risk assessment and optimization.

Asset allocation risk tracker Excel template

![]()

💾 Asset allocation risk tracker Excel template template .xls

An Asset Allocation Risk Tracker Excel template is a financial tool designed to help you monitor and analyze the distribution of your investment portfolio across various asset classes such as stocks, bonds, real estate, and cash. This template typically features customizable charts and graphs that visually represent your asset allocation, allowing for easy tracking of performance and risk exposure over time. Built-in formulas can analyze historical data and project future changes in the portfolio's risk profile based on different market conditions. Basic usage of this template can assist with fundamental portfolio management, while advanced integration might involve scenarios like Monte Carlo simulations or VaR (Value at Risk) assessments to further fine-tune investment strategies.

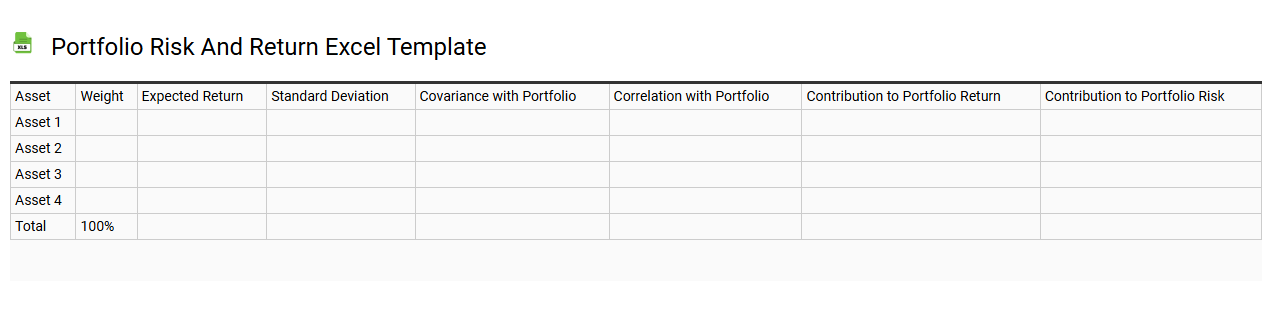

Portfolio risk and return Excel template

💾 Portfolio risk and return Excel template template .xls

A Portfolio Risk and Return Excel template serves as a powerful tool for assessing the performance of your investment portfolio. It allows you to input various assets and their corresponding return rates, enabling calculations of expected returns, volatility, and overall risk. By visualizing asset allocation and correlations, you gain insights into how different investments interact, thus helping you make informed decisions. This kind of template is fundamental for basic portfolio management, with potential needs for advanced quantitative techniques like Value at Risk (VaR) or Monte Carlo simulations for more comprehensive analysis.

Portfolio risk tracker Excel template for stock investments

![]()

💾 Portfolio risk tracker Excel template for stock investments template .xls

A Portfolio Risk Tracker Excel template provides investors with a detailed overview of the risks associated with their stock investments. This tool allows you to input various parameters such as stock prices, volume, market capitalization, and other financial metrics, enabling a comprehensive analysis of portfolio volatility. It often includes features for calculating key performance indicators like beta, standard deviation, and value-at-risk, ensuring you have insights into potential downturns. By utilizing this template, you can expand your financial strategy, assessing not just current holdings but also future allocations, diversification needs, and advanced metrics such as Sharpe ratios and downside risk assessments.

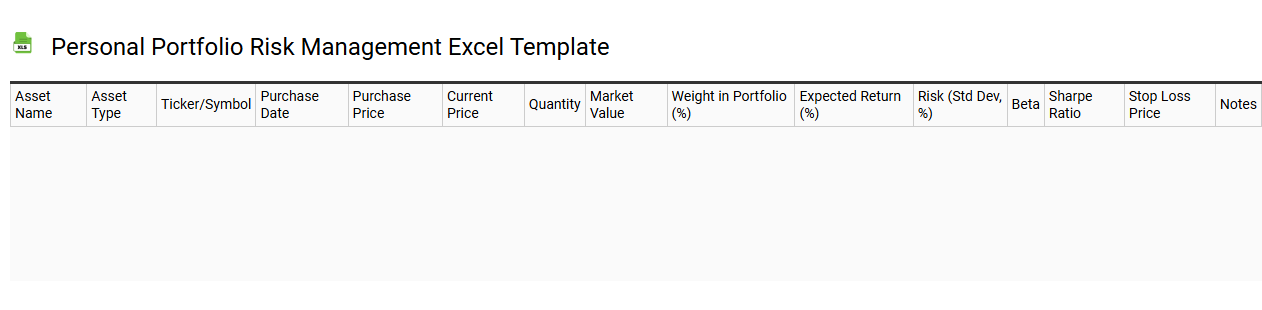

Personal portfolio risk management Excel template

💾 Personal portfolio risk management Excel template template .xls

A Personal Portfolio Risk Management Excel template is a structured tool designed to help investors assess and manage the risk associated with their investment portfolios. It typically includes features like asset allocation charts, risk assessment metrics such as Value at Risk (VaR), Sharpe ratios, and various scenarios analysis to project potential outcomes based on market fluctuations. Users can track individual asset performances and overall portfolio volatility, allowing for informed decision-making. This template serves as a foundational tool for basic portfolio management, with the potential to integrate advanced analytics like Monte Carlo simulations and scenario modeling for more sophisticated risk assessments.

Portfolio risk tracker Excel template with asset allocation

![]()

💾 Portfolio risk tracker Excel template with asset allocation template .xls

A Portfolio Risk Tracker Excel template is a sophisticated tool designed to help investors monitor and analyze the risk associated with their investment portfolios. It enables you to visualize the performance of various assets, including stocks, bonds, and alternative investments, while providing a comprehensive breakdown of asset allocation across different categories. The template typically includes features like risk metrics, correlation coefficients, and historical performance charts, allowing for informed decision-making. Basic usage includes tracking performance and assessing diversification, while further potential needs may involve advanced analytics, such as Value at Risk (VaR) or Monte Carlo simulations.

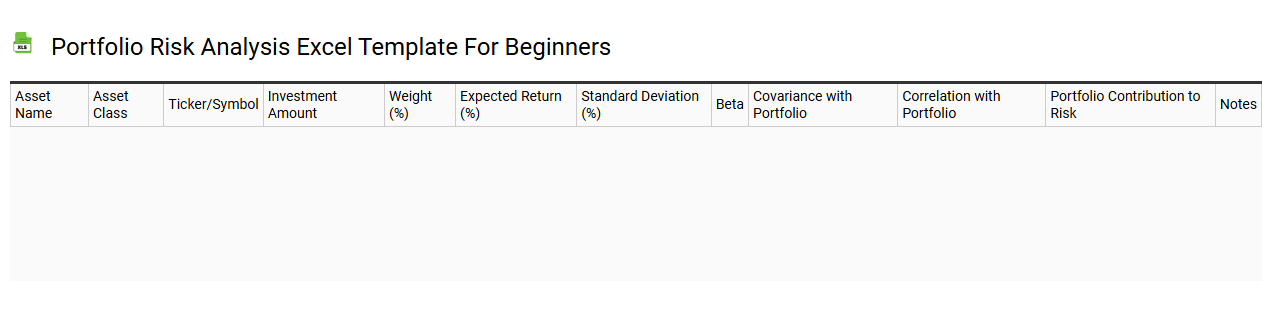

Portfolio risk analysis Excel template for beginners

💾 Portfolio risk analysis Excel template for beginners template .xls

A Portfolio risk analysis Excel template provides a structured way to evaluate the risk associated with different investments within a portfolio. It typically includes sections for asset allocation, risk metrics such as volatility and beta, and visual representations like charts and graphs to illustrate potential performance outcomes. By using this template, you can easily calculate and compare the expected returns against potential risks, empowering you to make informed investment decisions. Basic usage involves inputting data on your assets and analyzing the results, while further potential includes advanced techniques like Monte Carlo simulations and Value at Risk (VaR) assessments.

Diversified portfolio risk tracker Excel template

![]()

💾 Diversified portfolio risk tracker Excel template template .xls

A diversified portfolio risk tracker Excel template is a financial tool designed to help investors monitor and assess the risk associated with their investment portfolios. This template typically includes features for inputting data on various asset classes, such as stocks, bonds, and real estate, allowing you to analyze diversification levels and their impact on overall portfolio risk. It offers visual aids, like graphs and charts, to depict the risk-return profile clearly, making it easier to make informed investment decisions. You can enhance your tracking by adding advanced features like Value at Risk (VaR) calculations and Monte Carlo simulations to gauge potential future volatility and drawdown scenarios.

Portfolio risk tracker Excel template for mutual funds

![]()

💾 Portfolio risk tracker Excel template for mutual funds template .xls

A Portfolio Risk Tracker Excel template for mutual funds enables you to monitor and assess the risk associated with your investment portfolio. It typically includes features such as performance metrics, asset allocation breakdowns, and risk assessments based on volatility and correlation with market indices. Graphs and charts may visualize risk exposure and trends, helping you make informed decisions about your investments. This tool can also serve as a foundation for deeper analysis using advanced metrics like Value at Risk (VaR) or Sharpe Ratio, tailoring further to your strategic financial objectives.

Portfolio risk tracker Excel template with VaR calculation

![]()

💾 Portfolio risk tracker Excel template with VaR calculation template .xls

A Portfolio Risk Tracker Excel template with Value at Risk (VaR) calculation helps investors monitor and quantify the risk associated with their investment portfolios. This template typically includes sections for asset allocation, historical returns, and individual asset risks, allowing you to analyze potential losses over a specific time frame and confidence level. By using formulas embedded within the spreadsheet, you can quickly compute VaR, providing insight into risk exposure and enabling informed decision-making. This tool not only serves basic tracking needs but can also be expanded for advanced risk management techniques, such as stress testing and scenario analysis.

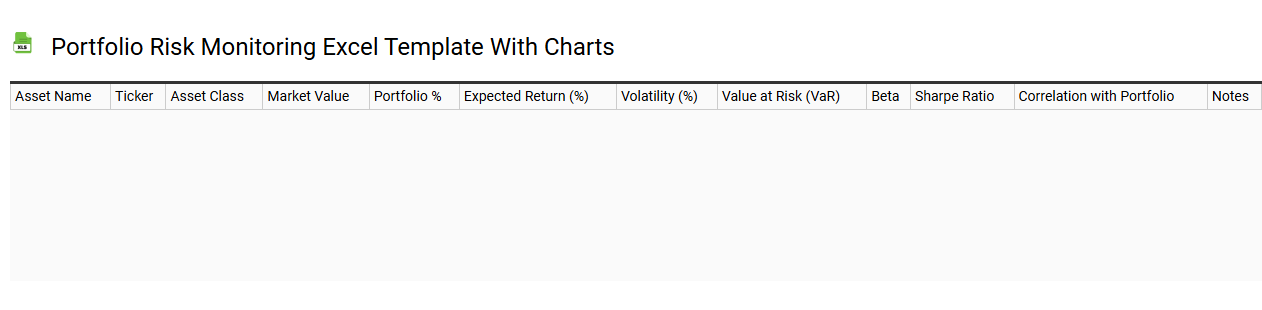

Portfolio risk monitoring Excel template with charts

💾 Portfolio risk monitoring Excel template with charts template .xls

A Portfolio Risk Monitoring Excel template with charts is a powerful tool designed to help you assess and track the risk levels of your investment portfolio. This template typically includes various charts, such as risk-return scatter plots, value-at-risk (VaR) graphs, and correlation matrices, which visualize key metrics and enable you to easily identify potential vulnerabilities. By integrating your financial data, the template can calculate volatility, drawdown, and exposure metrics, providing a comprehensive overview of your portfolio's performance and risk profile. For more advanced analysis, consider incorporating techniques like Monte Carlo simulations or stress testing, which can further enhance your risk management strategies.

Portfolio risk tracker Excel template for cryptocurrency

![]()

💾 Portfolio risk tracker Excel template for cryptocurrency template .xls

A Portfolio Risk Tracker Excel template for cryptocurrency provides a structured way to monitor and assess the risks associated with your digital asset investments. It typically includes features for inputting various cryptocurrencies along with their respective quantities, current prices, and historical performance data. By calculating metrics such as volatility, correlation, and potential loss scenarios, the tracker helps you identify high-risk assets in your portfolio. You can also utilize advanced features like value-at-risk (VaR) analysis and stress testing to further refine your investment strategy and manage potential losses effectively.