Discover a range of free XLS templates designed specifically for tracking loan accounts. These templates offer customizable features, allowing you to input your loan details, payment schedules, and interest rates effortlessly. With clear layouts and built-in formulas, managing your loan repayments and outstanding balances becomes simple and efficient, ensuring you stay on top of your finances.

Loan account tracker Excel template free download

![]()

💾 Loan account tracker Excel template free download template .xls

A Loan Account Tracker Excel template simplifies the management of your loans by allowing you to record and monitor various details in one place. This tool typically includes features such as loan amounts, interest rates, payment due dates, and a repayment schedule. Users can visualize their payment progress with dynamic charts and summary tables, making it easier to understand your financial obligations. Such templates can accommodate basic loan tracking needs and have the potential for advanced functionalities, such as integrating amortization calculations and forecasting future payments.

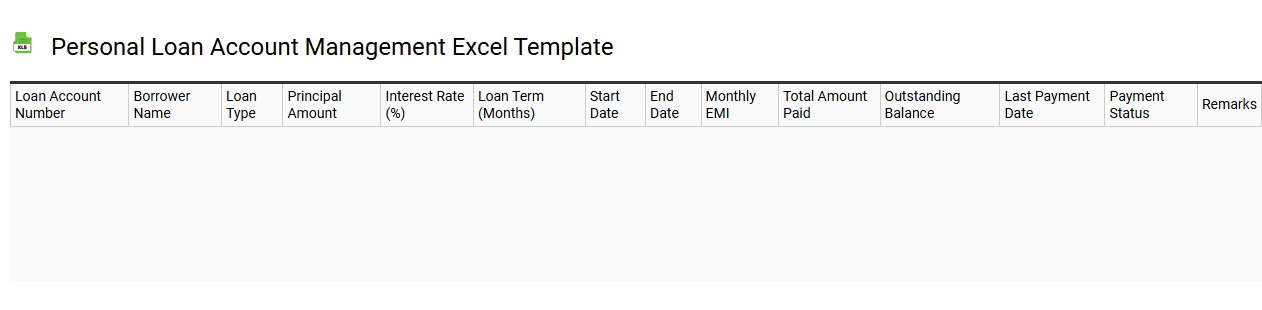

Personal loan account management Excel template

💾 Personal loan account management Excel template template .xls

A Personal Loan Account Management Excel template serves as a structured tool to track and manage your personal loans efficiently. It typically includes sections for loan details such as principal amount, interest rate, payment schedule, and remaining balance. You can monitor your payment history, calculate interest, and visualize your repayment progress through charts. This template can be utilized not only for basic loan tracking but also expanded to include more complex features such as amortization scheduling and variance analysis to optimize your financial management.

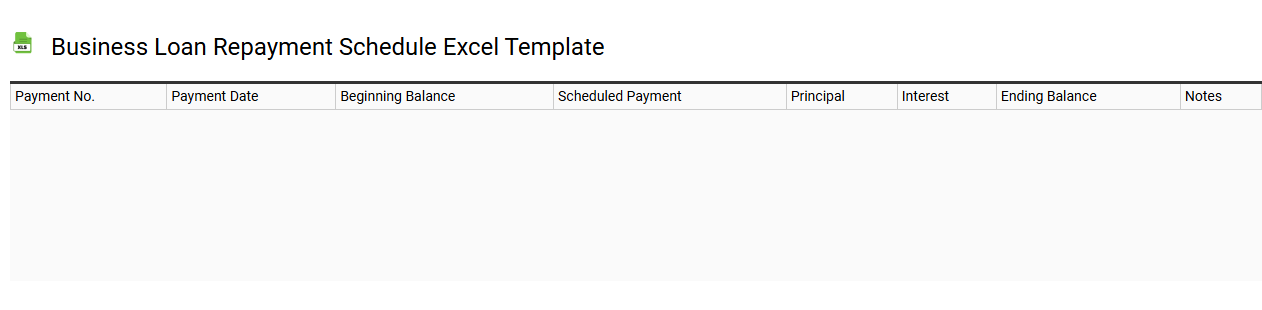

Business loan repayment schedule Excel template

💾 Business loan repayment schedule Excel template template .xls

A Business loan repayment schedule Excel template is a structured tool designed to help businesses track the repayment of loans over time. This spreadsheet typically outlines essential details such as loan amount, interest rate, payment frequency, and repayment duration, assisting you in managing cash flow more effectively. Each row usually represents an individual payment, displaying the breakdown of principal and interest, as well as the remaining balance after each payment. By employing this template, you can simplify the tracking process and cater to more advanced financial needs, such as comparing different loan scenarios or incorporating prepayment options.

Loan EMI tracker Excel template with formulas

![]()

💾 Loan EMI tracker Excel template with formulas template .xls

A Loan EMI tracker Excel template helps you manage your loan repayments by calculating the Equated Monthly Installment (EMI) you need to pay each month. This tool typically includes fields for loan amount, interest rate, loan tenure, and calculations that display the EMI amount due. It can also track your payment history, showing outstanding balances and any additional costs such as processing fees. By using various formulas like PMT for EMI calculations, you can tailor your template to suit your specific financial landscape and future potential needs such as budgeting for larger expenses or investments.

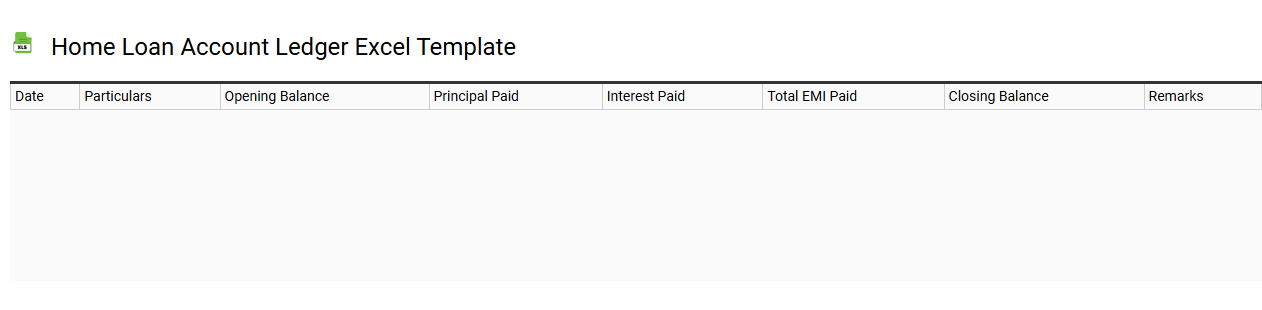

Home loan account ledger Excel template

💾 Home loan account ledger Excel template template .xls

A Home Loan Account Ledger Excel template is a financial tracking tool specifically designed for managing home loan details. This template typically includes columns for payment dates, principle amounts, interest rates, and remaining balances, allowing you to monitor your loan progress and repayment schedule easily. It assists in organizing financial records, helping you visualize how much you've paid versus the total amount due. You can customize this template further for more advanced needs, such as including amortization schedules or tracking additional expenses related to homeownership.

Multiple loan account tracker Excel template

![]()

💾 Multiple loan account tracker Excel template template .xls

A Multiple Loan Account Tracker Excel template is a specialized spreadsheet designed to manage and monitor multiple loans simultaneously. This template typically includes sections for inputting loan amounts, interest rates, payment schedules, and due dates, enabling you to visualize your financial obligations clearly. You can track payments made, outstanding balances, and any accrued interest with ease, ensuring you stay organized and informed. Such a template is fundamental for personal finance management, and with more advanced features like pivot tables or conditional formatting, you can gain deeper insights into your borrowing habits and optimize repayment strategies.

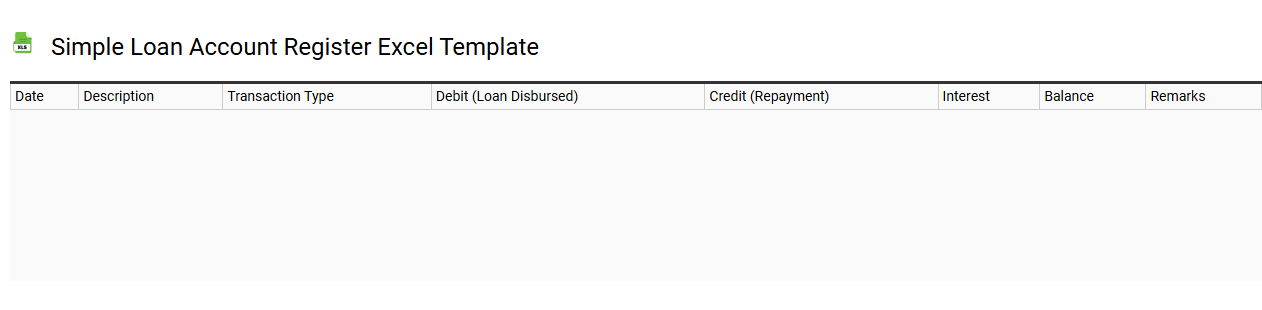

Simple loan account register Excel template

💾 Simple loan account register Excel template template .xls

A Simple Loan Account Register Excel template tracks loans efficiently, offering a structured way to manage repayments, interest rates, and loan balances. This template typically includes fields for loan dates, borrower details, principal amounts, and payment schedules. Users can easily update payment statuses and monitor remaining balances, simplifying financial management. With basic usage, you can record regular payments, while further potential needs may involve integrating advanced functions like amortization schedules or financial forecasting tools.

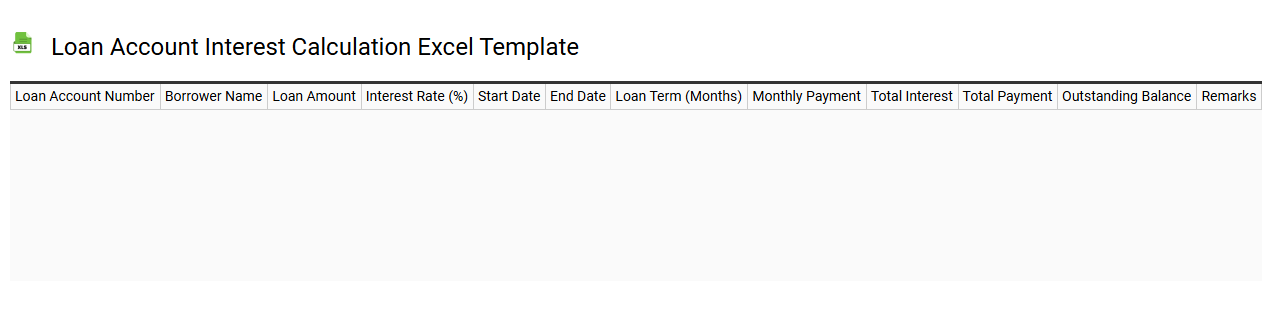

Loan account interest calculation Excel template

💾 Loan account interest calculation Excel template template .xls

A Loan Account Interest Calculation Excel template is a pre-designed spreadsheet to help you easily track and calculate loan interest over time. It typically includes fields for principal amount, interest rate, loan term, and payment frequency, enabling you to see how interest accumulates based on these variables. The template may also feature dynamic charts and summary tables that provide visual insights into the loan balance and interest paid over the life of the loan. For basic usage, you can utilize formulas for simple interest calculations, but advanced features could incorporate amortization schedules and scenario analysis.

Debt and loan account tracker Excel template

![]()

💾 Debt and loan account tracker Excel template template .xls

A Debt and Loan Account Tracker Excel template is a structured spreadsheet designed to help you monitor and manage your debts and loans efficiently. This template typically includes fields for loan amounts, interest rates, payment due dates, and remaining balances, allowing for easy tracking of multiple accounts at once. With visually clear charts and tables, it provides insights into your financial commitments, making it straightforward to see progress towards repayment goals. You can customize it according to your needs, expanding its capabilities to include advanced features like automated payment reminders or detailed amortization schedules for deeper financial analysis.

Car loan payment tracker Excel template

![]()

💾 Car loan payment tracker Excel template template .xls

A Car loan payment tracker Excel template is a detailed tool designed to help you monitor and manage your car loan payments efficiently. This template typically includes essential fields such as loan amount, interest rate, monthly payment, remaining balance, and payment due dates. It offers a structured layout for tracking each payment, enabling you to see how much principal and interest you have paid over time. As you input your payment data, the template can automatically update, providing insights into your loan progression and helping you identify potential early payoff opportunities or repayment strategies. Basic usage of this template can greatly enhance your budgeting skills, while advanced features may include amortization schedules, charts for payment analysis, and sensitivity analyses on interest rate changes.