Explore a variety of free XLS templates designed specifically for accounts receivable audits. Each template features sections for tracking outstanding invoices, customer payment history, and aging reports, making it easy to manage and analyze your receivables. With customizable fields and formulas, these templates streamline the auditing process, ensuring accuracy and efficiency in your financial assessments.

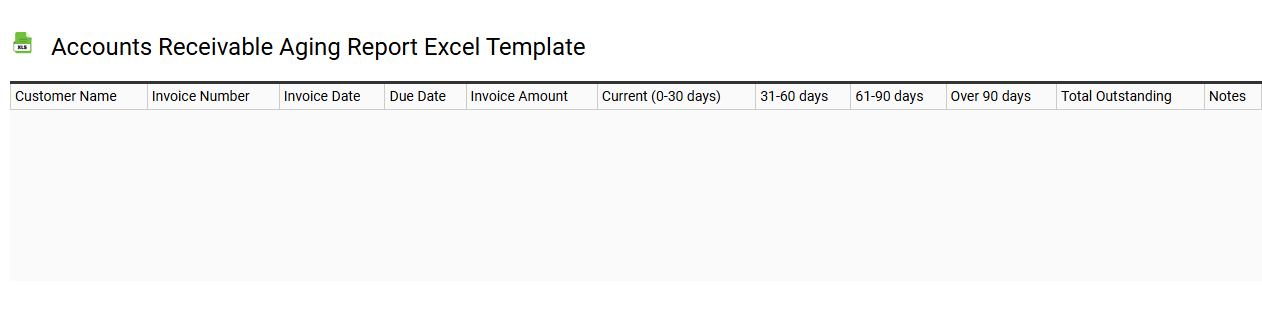

Accounts receivable aging report Excel template

💾 Accounts receivable aging report Excel template template .xls

An Accounts Receivable Aging Report Excel template is a structured financial tool that helps businesses monitor outstanding invoices and assess the creditworthiness of their customers. It categorizes receivables based on how long they have been overdue, typically broken down into intervals such as 0-30 days, 31-60 days, 61-90 days, and over 90 days. This report allows companies to prioritize collection efforts by highlighting debts that may pose a higher risk of default. You can leverage this template for basic tracking of overdue payments while also exploring advanced analytics, such as forecasting cash flow or assessing customer payment trends.

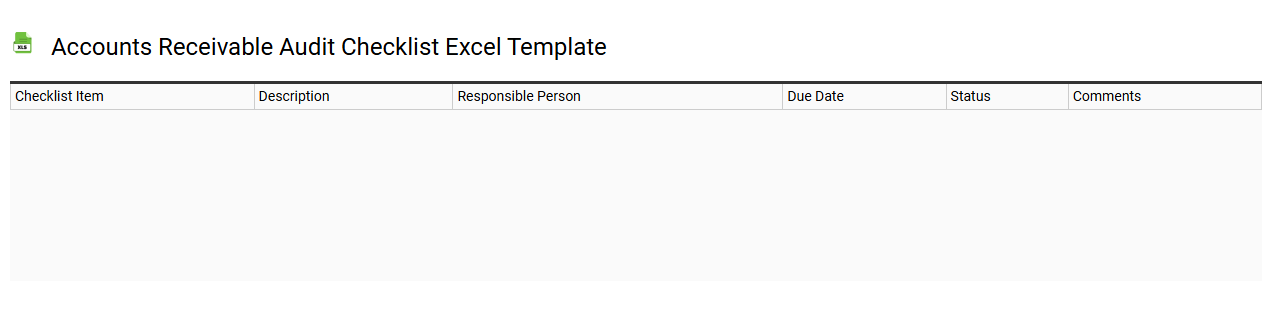

Accounts receivable audit checklist Excel template

💾 Accounts receivable audit checklist Excel template template .xls

An Accounts Receivable Audit Checklist Excel template is a structured tool designed to streamline the auditing process for accounts receivable entries. This template typically includes sections for verifying the accuracy of customer invoices, assessing the aging of receivables, and checking for discrepancies in payment records. You can customize fields to capture essential data points such as invoice numbers, due dates, and payment statuses, making it easier to track outstanding balances and overdue accounts. Leveraging this template not only enhances your auditing efficiency but also lays the groundwork for more advanced financial analytics and management reporting tools.

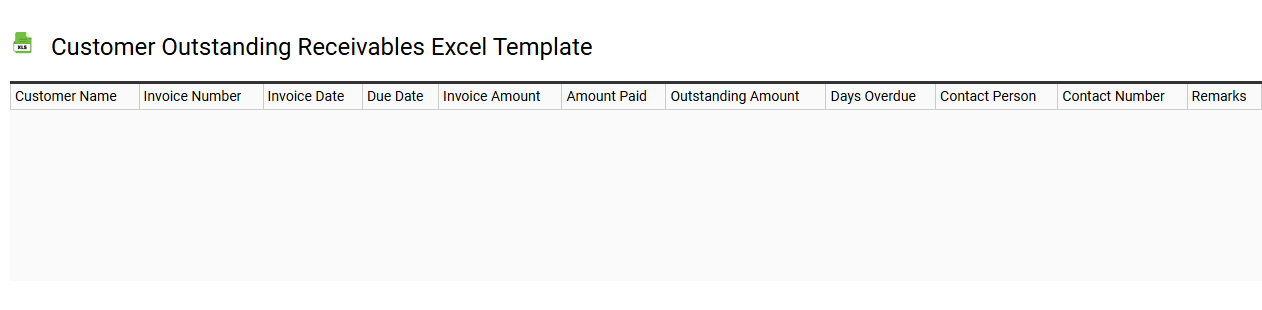

Customer outstanding receivables Excel template

💾 Customer outstanding receivables Excel template template .xls

Customer outstanding receivables Excel template is a structured spreadsheet designed to help businesses track and manage their accounts receivable. This tool typically includes columns for customer names, invoice numbers, amounts due, due dates, and payment statuses. Visual indicators, like color coding, can highlight overdue payments, making it easier to prioritize follow-ups. Utilizing this template aids in maintaining cash flow and can be expanded with advanced financial metrics like aging reports or predictive analytics for better financial forecasting.

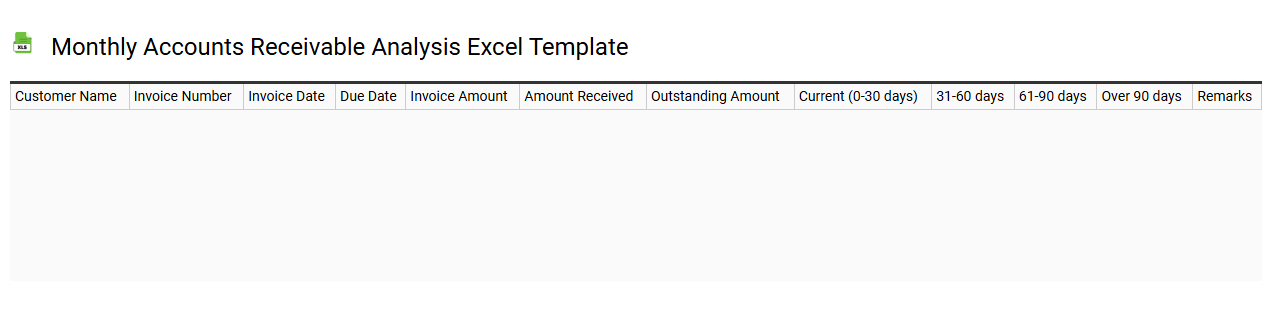

Monthly accounts receivable analysis Excel template

💾 Monthly accounts receivable analysis Excel template template .xls

A Monthly Accounts Receivable Analysis Excel template is a structured spreadsheet designed to help businesses track and evaluate their outstanding invoices over a specific month. This tool enables you to categorize accounts receivable by customer, due date, and payment status, providing clarity on cash flow and outstanding debts. By visually analyzing trends in payment behaviors, you can identify late payments and proactively manage collection efforts. This template serves basic invoicing functions while offering potential for advanced data analytics, such as predictive modeling for future receivables management.

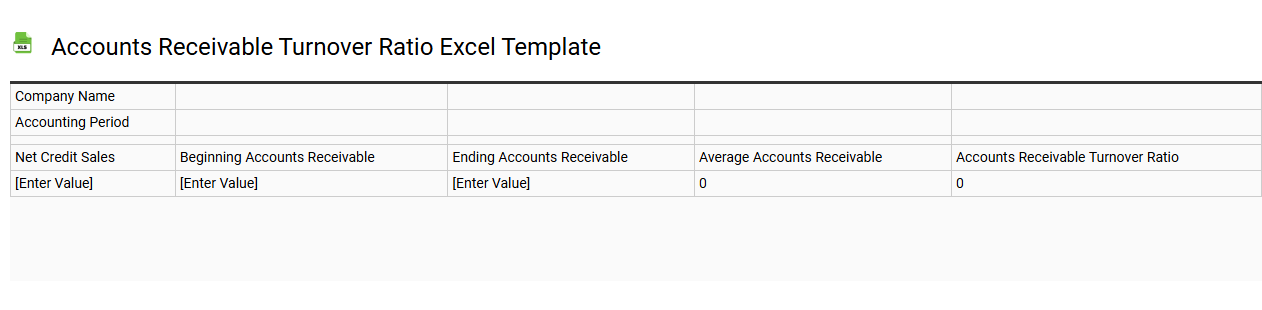

Accounts receivable turnover ratio Excel template

💾 Accounts receivable turnover ratio Excel template template .xls

The Accounts Receivable Turnover Ratio measures how efficiently a company collects cash from its credit sales. Calculated by dividing net credit sales by average accounts receivable, this ratio provides insights into cash flow management and customer payment behavior. An Excel template for this ratio allows you to easily input your sales data and automatic calculations, streamlining financial analysis. This tool is essential for monitoring liquidity, managing credit policies, and identifying potential cash flow issues while serving as a foundation for more advanced metrics, such as aged receivables analysis and days sales outstanding (DSO).

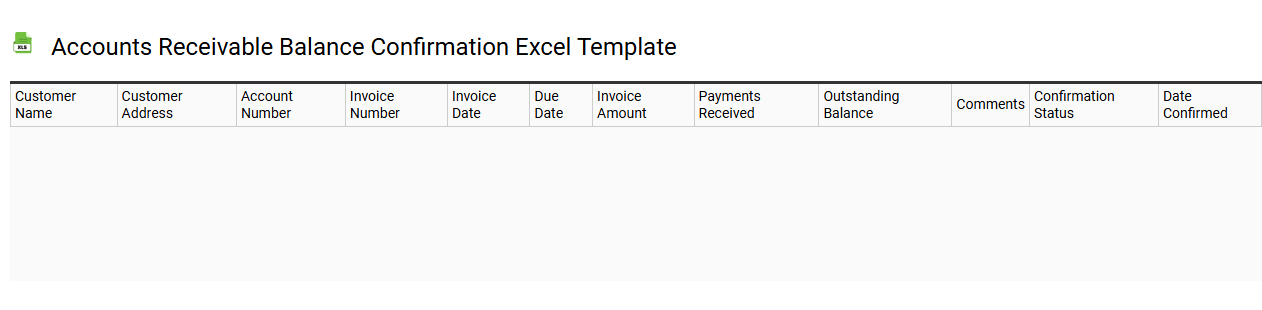

Accounts receivable balance confirmation Excel template

💾 Accounts receivable balance confirmation Excel template template .xls

An Accounts Receivable Balance Confirmation Excel template serves as a structured tool for businesses to verify outstanding customer invoices and ensure their accuracy. It typically includes fields for customer names, invoice numbers, amounts due, dates of issuance, and payment status, facilitating clear communication with clients regarding their outstanding balances. With this template, you can streamline your reconciliation process, identify discrepancies promptly, and maintain accurate financial records. This basic tool can evolve to include advanced features like automated reminders, data analysis for forecasting cash flow, and integration with accounting software for comprehensive financial management.

Detailed invoice tracking Excel template for accounts receivable audit

![]()

💾 Detailed invoice tracking Excel template for accounts receivable audit template .xls

A detailed invoice tracking Excel template for accounts receivable audit is a structured spreadsheet that monitors outstanding invoices, payment status, and customer details. Each entry typically includes invoice number, date issued, due date, amount, customer name, and notes on payment status. This template aids in identifying overdue accounts and maintaining cash flow, enhancing financial accuracy for your business operations. Proper usage of this template can extend to advanced data analysis techniques, such as pivot tables or VLOOKUP functions for comprehensive financial reporting.

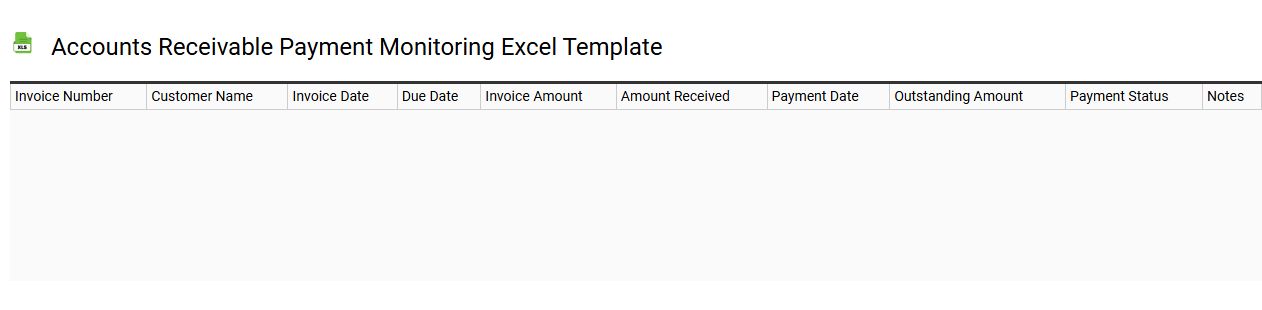

Accounts receivable payment monitoring Excel template

💾 Accounts receivable payment monitoring Excel template template .xls

An Accounts Receivable Payment Monitoring Excel template is a structured tool designed to track and manage outstanding invoices and incoming payments. This template typically includes columns for customer names, invoice dates, amounts due, payment statuses, and due dates, providing a clear overview of financial obligations. Visual elements like graphs and conditional formatting can enhance your understanding of payment patterns and trends. Utilizing this template can help you manage cash flow effectively while identifying further potential needs, such as automating reminders or integrating advanced accounting software.