Explore a wide variety of free XLS templates designed specifically for Balance Aging Reports, essential for tracking outstanding accounts receivable. These templates typically feature easy-to-use layouts that display customer names, invoice dates, amounts due, and aging categories, allowing you to quickly assess financial health. Customizable elements let you tailor reports to meet specific business needs, ensuring a clear understanding of your receivables' status.

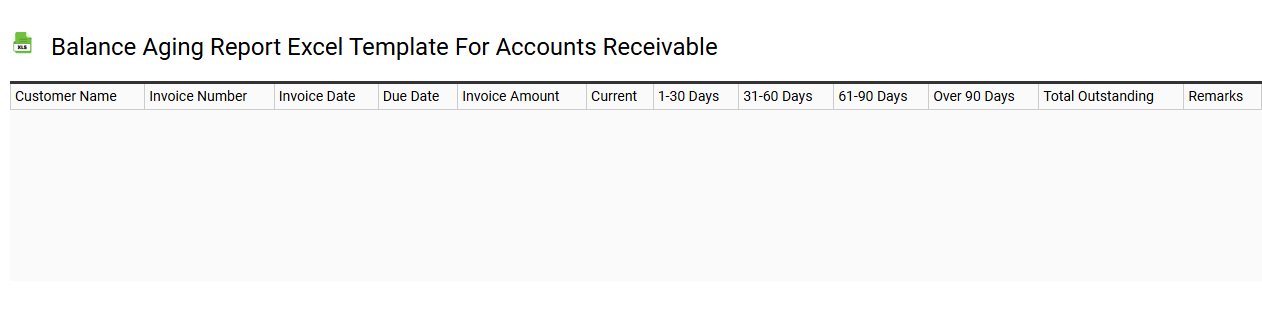

Balance aging report Excel template for accounts receivable

💾 Balance aging report Excel template for accounts receivable template .xls

A Balance Aging Report Excel template for accounts receivable is a financial tool used by businesses to track outstanding invoices and monitor customer payment behaviors. This template categorizes accounts receivable based on the length of time an invoice has remained unpaid, often segmented into intervals such as 0-30 days, 31-60 days, 61-90 days, and 91+ days. You can easily identify which customers are overdue and prioritize follow-ups accordingly, enhancing your cash flow management and decision-making processes. By utilizing this template, you can address immediate collection issues while also planning for more complex financial strategies and credit risk assessments.

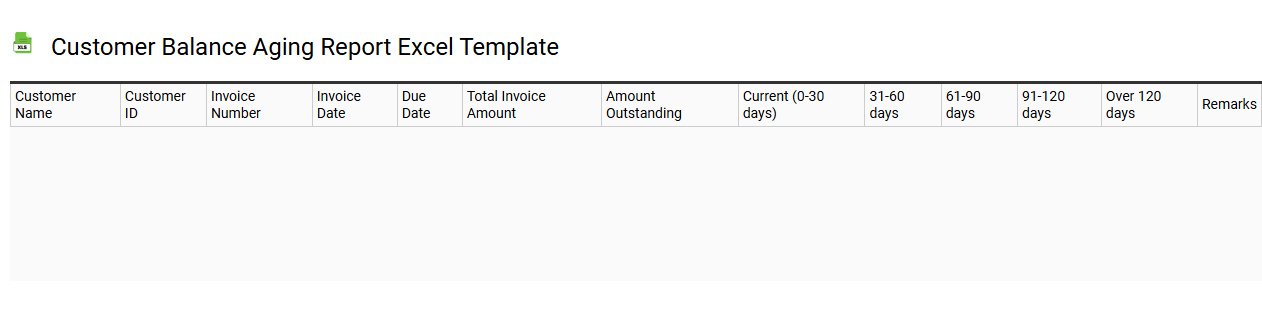

Customer balance aging report Excel template

💾 Customer balance aging report Excel template template .xls

A Customer Balance Aging Report Excel template is a powerful tool that helps businesses track and manage outstanding customer invoices. This template categorizes accounts receivable based on the length of time an invoice has been unpaid, typically segmented into intervals like 0-30 days, 31-60 days, and beyond. With clear visibility into overdue accounts, businesses can prioritize their collections efforts and improve cash flow management. This tool can evolve to include advanced analytics features, like predictive modeling or integration with accounting software, further enhancing financial oversight.

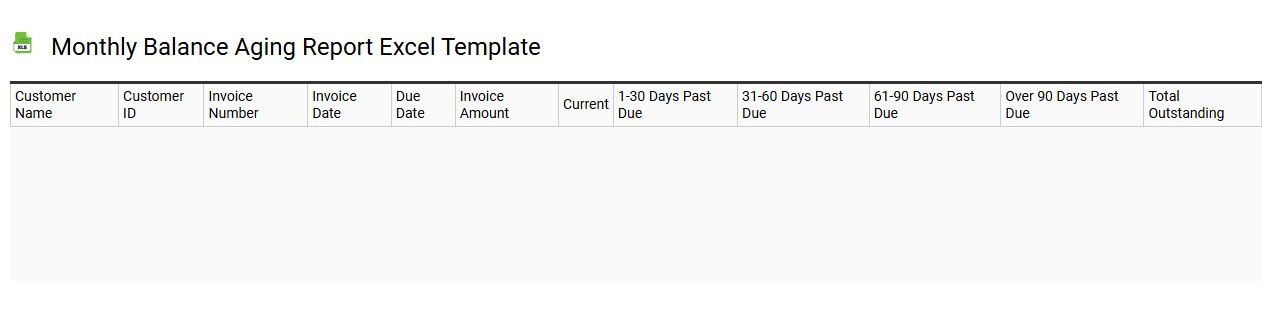

Monthly balance aging report Excel template

💾 Monthly balance aging report Excel template template .xls

A Monthly Balance Aging Report Excel template is a structured spreadsheet designed to help businesses track and manage their accounts receivable by categorizing outstanding invoices based on the length of time they have remained unpaid. This template typically includes columns for customer names, invoice numbers, amounts due, and aging categories such as current, 30 days, 60 days, and 90 days past due. It enables you to visualize the aging of receivables, making it easier to identify trends, assess credit risks, and prioritize follow-up actions on overdue accounts. By utilizing this template, you can streamline your collection process, thus enhancing cash flow management and financial forecasting, with further potential needs including integration with accounting software or advanced data analytics for predictive modeling.

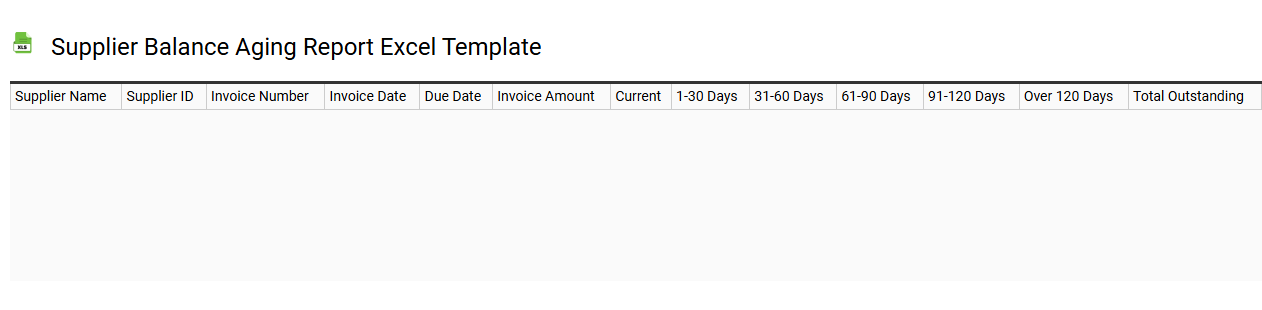

Supplier balance aging report Excel template

💾 Supplier balance aging report Excel template template .xls

A Supplier Balance Aging Report Excel template helps you track outstanding balances with suppliers over various time periods, such as 30, 60, or 90 days. This tool provides a clear overview of your payables, highlighting which suppliers need to be paid and when, ensuring better cash flow management. The template typically includes columns for supplier names, invoice dates, amounts due, and aging categories, making it easy to identify overdue payments. You can customize the template to suit your specific financial reporting needs, allowing for integration with more complex accounting systems or advanced analytics like predictive cash flow forecasting.

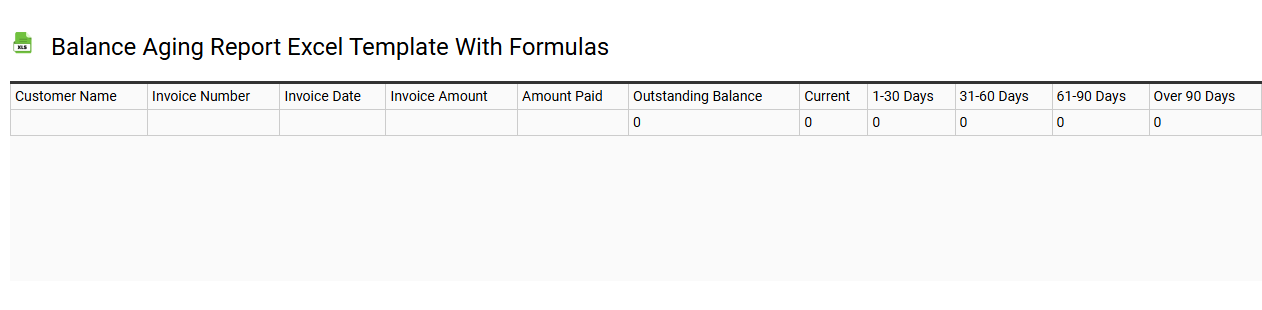

Balance aging report Excel template with formulas

💾 Balance aging report Excel template with formulas template .xls

A Balance Aging Report Excel template with formulas is designed to help businesses manage and analyze accounts receivable or payable by categorizing outstanding balances based on the time they have been due. The template typically includes columns for customer names, invoice numbers, invoice dates, due dates, and outstanding amounts. Formulas automate calculations, such as the aging categories--typically 0-30 days, 31-60 days, 61-90 days, and over 90 days. You can easily customize the template to suit your specific needs while leveraging basic functions to advanced Excel capabilities like pivot tables or VLOOKUP for more comprehensive data analysis.

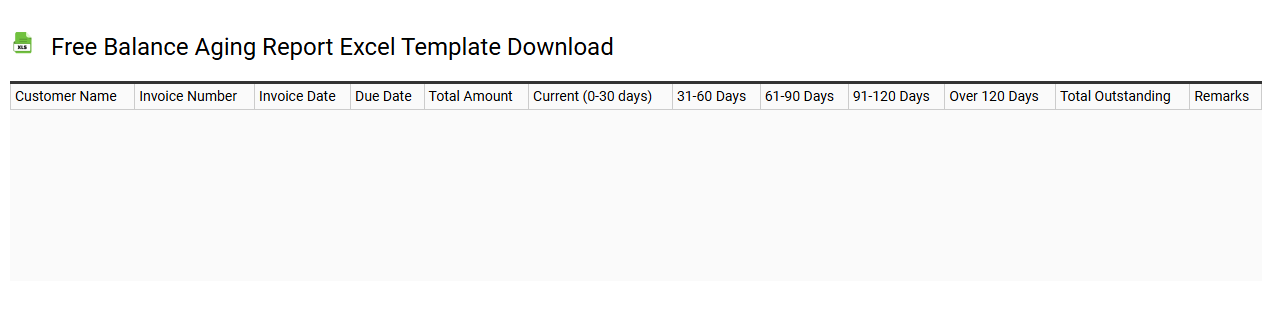

Free balance aging report Excel template download

💾 Free balance aging report Excel template download template .xls

A Free Balance Aging Report Excel template is a pre-designed spreadsheet that helps businesses track outstanding invoices and accounts receivable over a specified time frame. This template categorizes unpaid debts based on their age, allowing you to quickly assess which accounts are overdue, creating a comprehensive snapshot of your financial health. You can easily customize the template to fit your specific business needs by adding relevant columns for customer names, invoice numbers, and amounts due. Utilize this tool not only for routine monitoring of invoices but also for advanced financial analysis, cash flow forecasting, and optimizing collection strategies.

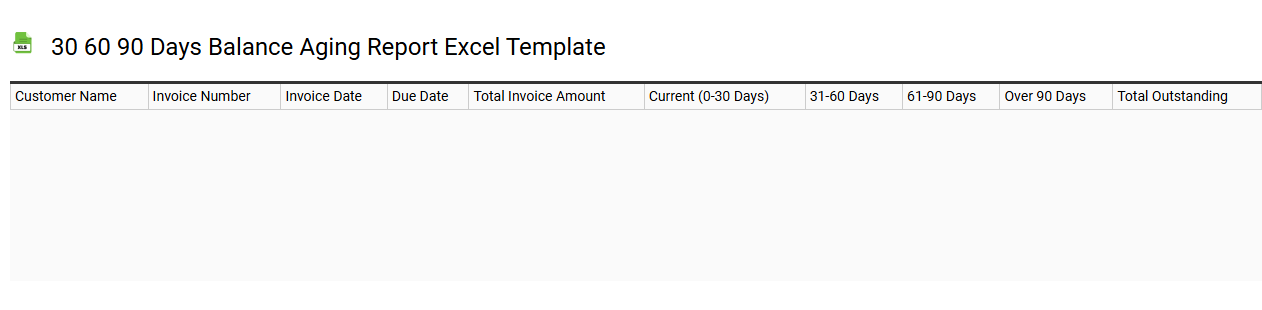

30 60 90 days balance aging report Excel template

💾 30 60 90 days balance aging report Excel template template .xls

A 30-60-90 days balance aging report Excel template is a financial tool that helps businesses monitor outstanding receivables categorized by the duration they have been overdue. This template typically divides accounts into three segments: amounts due within 30 days, those overdue between 31 to 60 days, and those overdue for 61 to 90 days. By visualizing this data, you can identify trends in customer payment behavior, prioritize collections, and strategically manage cash flow. You may also consider leveraging advanced features like pivot tables or conditional formatting for further analysis and insights into your accounts receivable.

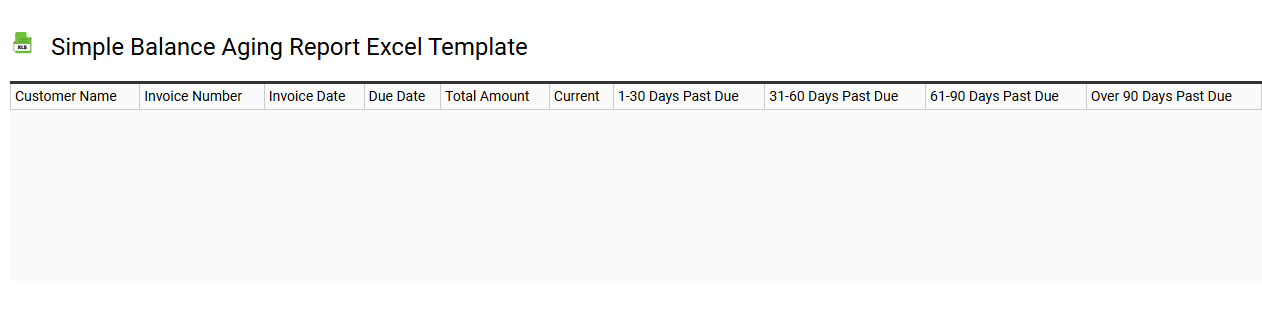

Simple balance aging report Excel template

💾 Simple balance aging report Excel template template .xls

A Simple Balance Aging Report Excel template is a tool designed to help businesses track outstanding customer invoices and prioritize collections effectively. The template typically features columns for invoice dates, amounts, and aging categories, allowing you to visualize receivables overdue by specific timeframes such as 30, 60, or 90 days. This organized layout streamlines the monitoring process, making it easier for you to manage cash flow and understand the overall health of your accounts receivable. Beyond basic tracking, you may customize the template to include more advanced analytics like aging ratios or customer payment trends for deeper insights.

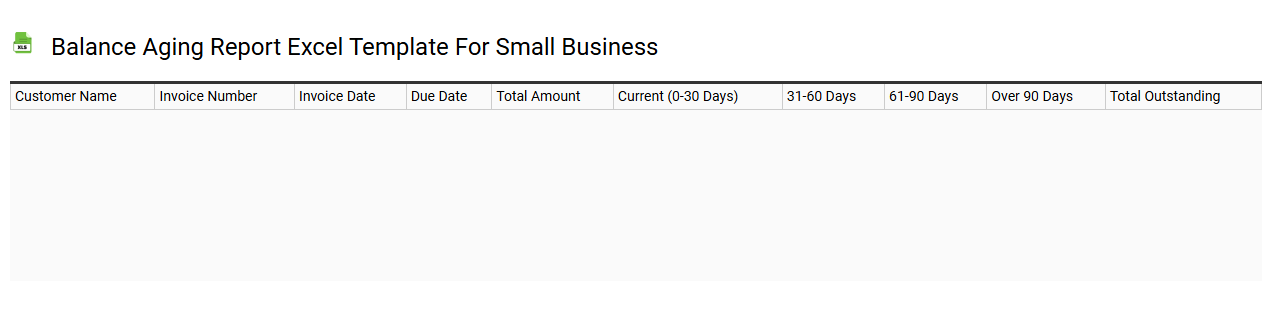

Balance aging report Excel template for small business

💾 Balance aging report Excel template for small business template .xls

A Balance Aging Report Excel template provides small businesses with a structured way to monitor accounts receivable. This report categorizes outstanding invoices based on the length of time they've been overdue, typically segmented into 30, 60, and 90 days or more. Through visual insights and data organization, you can identify which customers owe you money and how long their payments have been pending. Such a template can aid in cash flow management and the timely follow-up on overdue accounts, while advanced users may incorporate formulas for forecasting and predictive analytics.

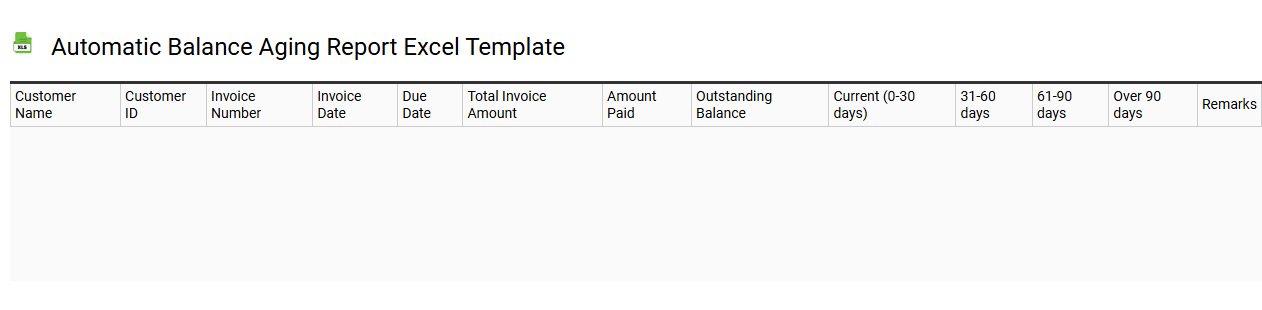

Automatic balance aging report Excel template

💾 Automatic balance aging report Excel template template .xls

An Automatic Balance Aging Report Excel template is a pre-designed spreadsheet that helps businesses track outstanding accounts receivable, categorizing them based on the age of the invoices. This template typically includes columns for customer names, invoice dates, due amounts, and aging buckets such as 30, 60, and 90 days past due. Users can easily input data, and the template automatically updates to reflect changes, making it easier to analyze financial health and manage cash flow efficiently. Your organization can utilize this tool for basic tracking of overdue payments, while more advanced needs might include integrating it with financial forecasting software or employing complex data visualization techniques.