Explore a range of free XLS templates designed specifically for bank reconciliation in Excel. These templates provide structured layouts to help you easily compare your financial records against bank statements, ensuring accuracy in your account balances. With user-friendly formats, you can effortlessly input transaction data, spot discrepancies, and maintain clear oversight of your financial standing.

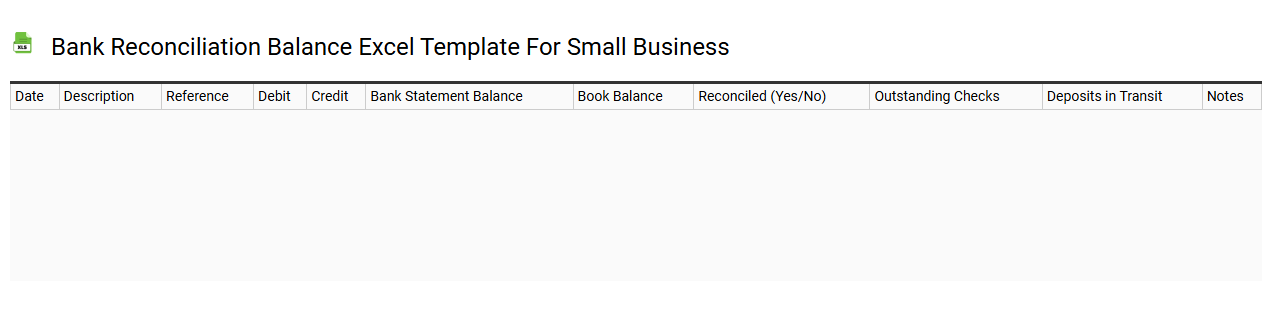

Bank reconciliation balance Excel template for small business

💾 Bank reconciliation balance Excel template for small business template .xls

A Bank reconciliation balance Excel template for small businesses serves as a crucial financial tool, enabling you to systematically compare your company's financial records with bank statements. This template typically consists of rows for transactions such as deposits and withdrawals, with corresponding columns for dates, amounts, and descriptions to ensure clarity and accuracy. By organizing this data, it allows for the easy identification of discrepancies, such as missed transactions or errors in record-keeping, thereby promoting better financial oversight. You may find that using this template not only streamlines your monthly reconciliations but also offers potential for more advanced financial analyses, such as cash flow forecasting or variance reporting.

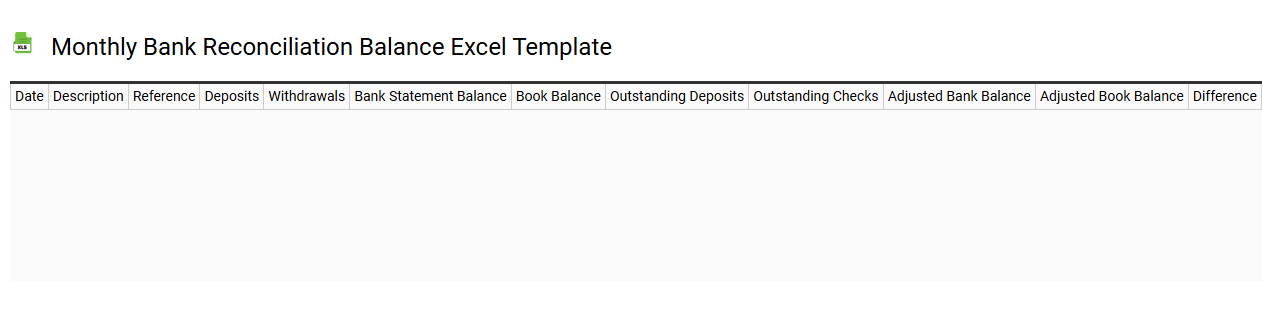

Monthly bank reconciliation balance Excel template

💾 Monthly bank reconciliation balance Excel template template .xls

A Monthly Bank Reconciliation Balance Excel template serves as a financial tool to help individuals and businesses ensure that their bank statement balances align with their own accounting records. This template typically includes columns for transaction descriptions, dates, amounts, and a space to mark discrepancies. You can efficiently track your deposits, withdrawals, and any bank fees, allowing for a clear understanding of your financial position. This foundational tool sets the stage for more advanced financial analysis and auditing processes, enhancing your overall financial management capabilities.

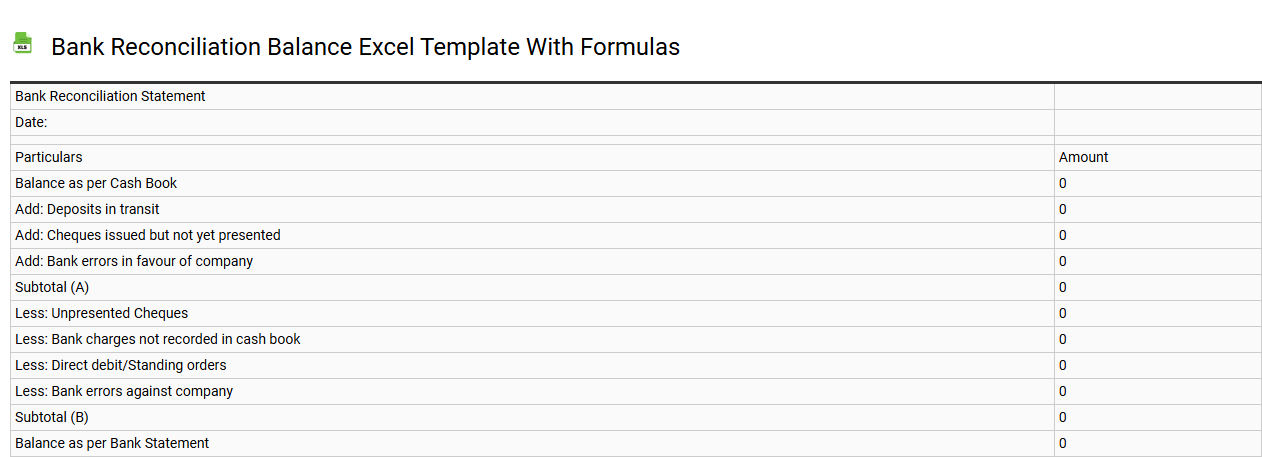

Bank reconciliation balance Excel template with formulas

💾 Bank reconciliation balance Excel template with formulas template .xls

A Bank Reconciliation Balance Excel template is designed to help you compare your financial records with your bank statement. It includes various sections for entries such as transactions, deposits, checks, and bank fees, all of which ensure accuracy in your financial reporting. Formulas within the template automatically calculate the differences between your records and the bank's, highlighting discrepancies for easy resolution. Such a template not only streamlines current reconciliation tasks but also lays the groundwork for more advanced financial management practices, like cash flow forecasting and variance analysis.

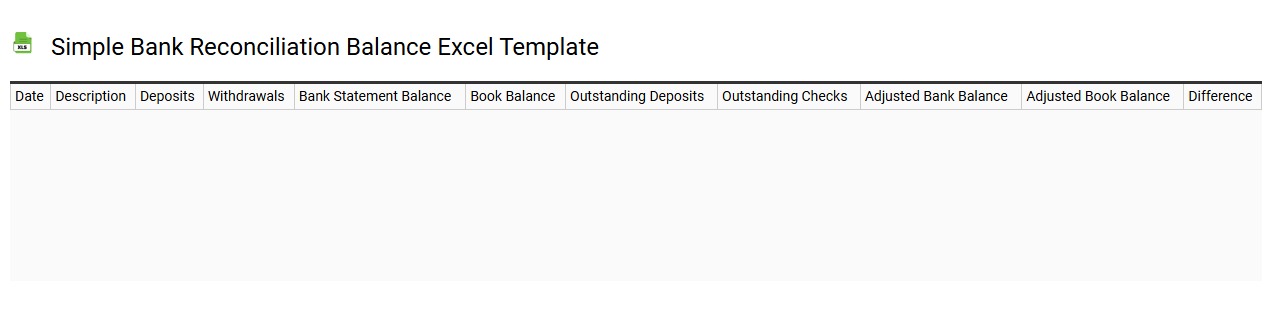

Simple bank reconciliation balance Excel template

💾 Simple bank reconciliation balance Excel template template .xls

A Simple Bank Reconciliation Balance Excel template provides a streamlined way to compare your financial records with bank statements, ensuring accuracy in your accounting. This template typically includes sections for recording deposits, withdrawals, and outstanding transactions, allowing you to easily identify discrepancies. Clear instructions guide you through entering your starting balance, while automated calculations quickly display your reconciled balance. For more advanced financial management, consider integrating features like macros for automation, pivot tables for detailed analysis, or creating dynamic dashboards for real-time insights.

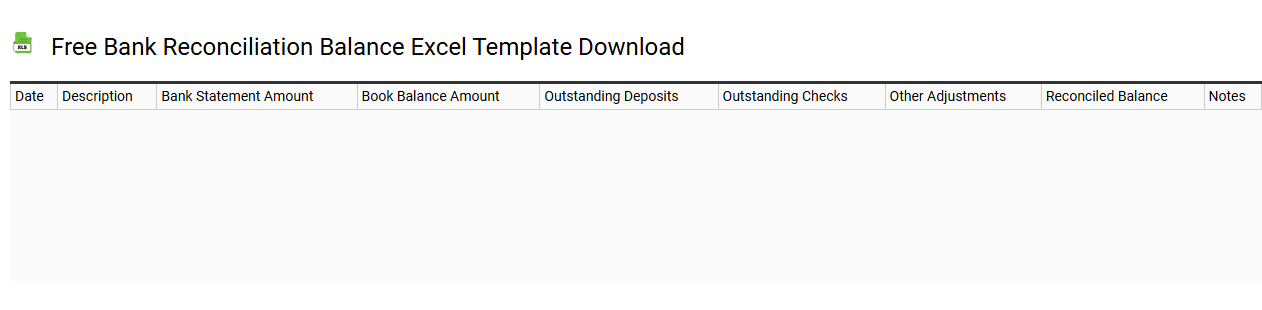

Free bank reconciliation balance Excel template download

💾 Free bank reconciliation balance Excel template download template .xls

A free bank reconciliation balance Excel template is a ready-to-use spreadsheet designed to help you match your bank statement against your accounting records. This user-friendly template includes pre-formatted sections for listing transactions, allowing for easy identification of discrepancies between your books and bank records. By utilizing formulas, it automatically calculates the differences, highlighting outstanding checks or deposits in transit, ensuring you maintain accurate financial records. For personal or business financial management, this tool serves a basic reconciliation purpose, but can also be adapted for more intricate accounting requirements like month-end closing processes or cash flow analysis.

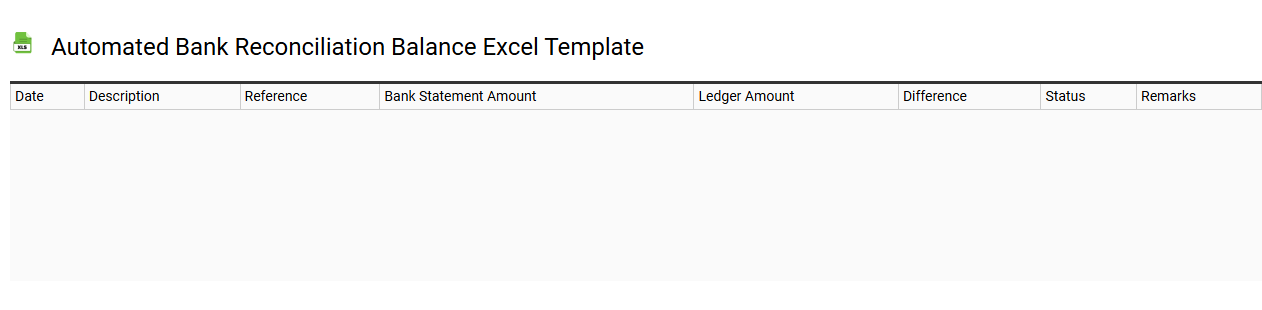

Automated bank reconciliation balance Excel template

💾 Automated bank reconciliation balance Excel template template .xls

An Automated Bank Reconciliation Balance Excel Template streamlines the process of comparing your bank statement with your accounting records. This template typically includes pre-configured formulas to identify discrepancies, automate calculations, and highlight unmatched transactions efficiently. You input your bank statement data and your company's transaction records, allowing the template to quickly flag inconsistencies. Beyond basic reconciliation, this tool can evolve to incorporate advanced features such as multi-currency support, real-time updates through APIs, and integration with other financial management systems.

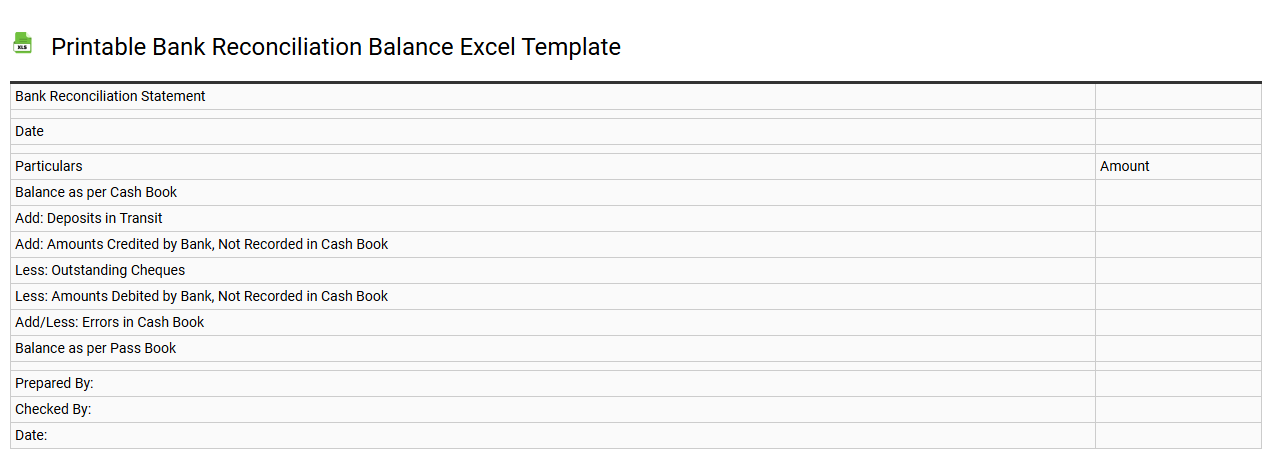

Printable bank reconciliation balance Excel template

💾 Printable bank reconciliation balance Excel template template .xls

A printable bank reconciliation balance Excel template is a structured spreadsheet tool that enables quick and efficient reconciliation of your bank statements with your financial records. This template typically includes columns for the transaction date, description, amount, and the bank balance, making it easy to identify discrepancies between your records and the bank's records. With clear formatting, it allows you to print for convenient manual cross-checking and documentation. You can use this template for basic reconciliation, while further potential needs may include complex analytics, automated data imports, or integration with accounting software.

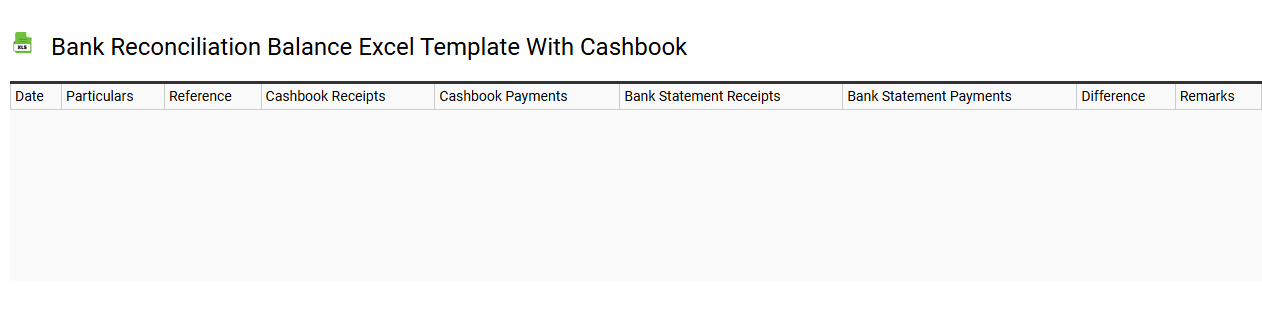

Bank reconciliation balance Excel template with cashbook

💾 Bank reconciliation balance Excel template with cashbook template .xls

A Bank reconciliation balance Excel template with a cashbook provides a systematic approach to compare and align your bank statement with your company's cashbook records. This template typically includes columns for transaction dates, descriptions, amounts, and various account balances, enabling you to identify discrepancies. You can easily track outstanding checks and deposits in transit, ensuring your financial reports remain accurate. Featuring built-in formulas, this tool not only streamlines basic reconciliations but also serves as a foundation for more advanced financial analysis, such as cash flow forecasting and audit preparation.

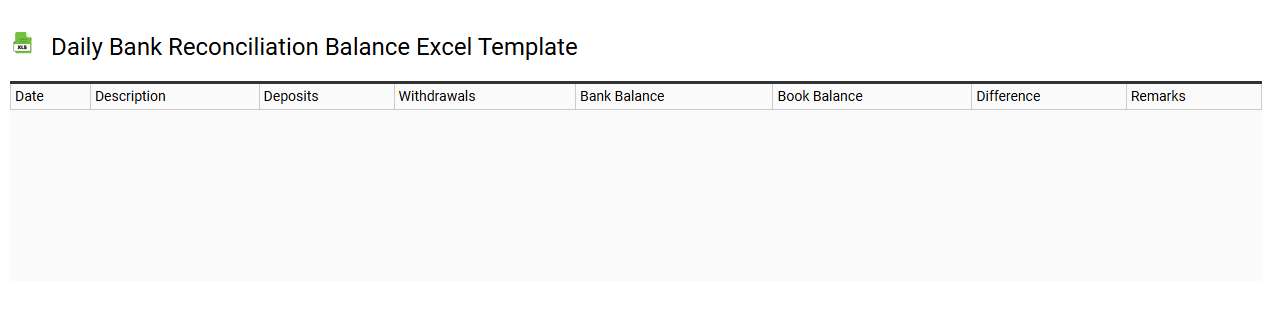

Daily bank reconciliation balance Excel template

💾 Daily bank reconciliation balance Excel template template .xls

A Daily Bank Reconciliation Balance Excel template is a structured spreadsheet designed to streamline the process of reconciling your bank statements with your financial records. This template typically features clear columns for recording the date, transaction details, deposits, withdrawals, and the running balance for accurate tracking. With built-in formulas, it automatically calculates discrepancies, making it easier for you to identify errors or unauthorized transactions. Beyond basic reconciliation needs, this template can be enhanced with features like automated alerts for unusual transactions, integration with accounting software, or advanced pivot table analyses for deeper financial insights.

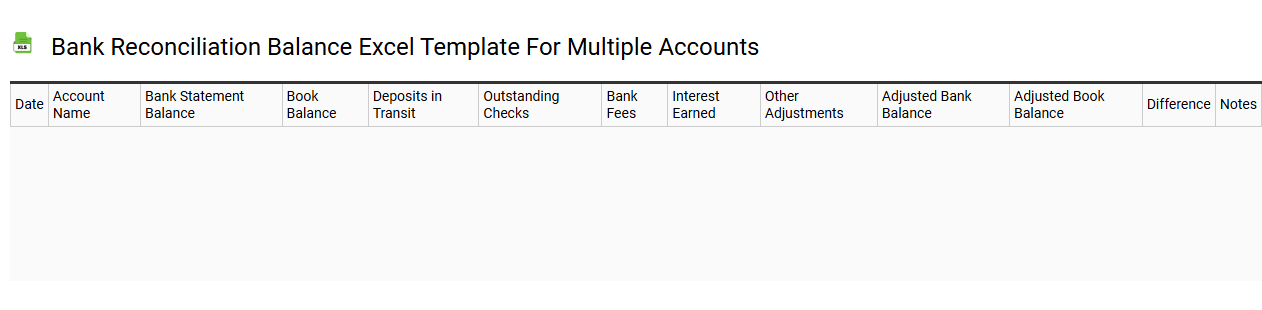

Bank reconciliation balance Excel template for multiple accounts

💾 Bank reconciliation balance Excel template for multiple accounts template .xls

A Bank reconciliation balance Excel template for multiple accounts is a structured tool designed to simplify the process of matching bank statements with company records across several accounts. This template typically includes columns for account numbers, transaction dates, descriptions, amounts, and balances, enabling clear visibility into discrepancies. Users can easily input data from bank statements alongside their cash books, promptly identifying unmatched transactions. This straightforward technique not only aids in maintaining accurate financial records but also paves the way for more advanced financial analysis, such as cash flow forecasting and variance analysis.