Explore a range of free Excel templates designed specifically for tracking loan repayments. These templates often feature customizable fields for principal amounts, interest rates, payment dates, and remaining balances, allowing you to tailor them to your personal or business needs. With clear layouts and easy-to-use formulas, managing your loan details becomes efficient, helping you stay organized and informed about your financial obligations.

Loan repayment tracking Excel template

![]()

💾 Loan repayment tracking Excel template template .xls

A Loan repayment tracking Excel template is a structured spreadsheet designed to help individuals or businesses manage and monitor their loan payment schedules. This template typically includes essential fields such as loan amount, interest rate, repayment term, monthly payment, and outstanding balance. Users can easily input their payments, allowing for real-time updates on their remaining debt, payment history, and interest accrued over time. This tool is invaluable for maintaining financial discipline and can be further enhanced with complex formulas or visual aids like graphs to project future payment scenarios and analyze repayment strategies.

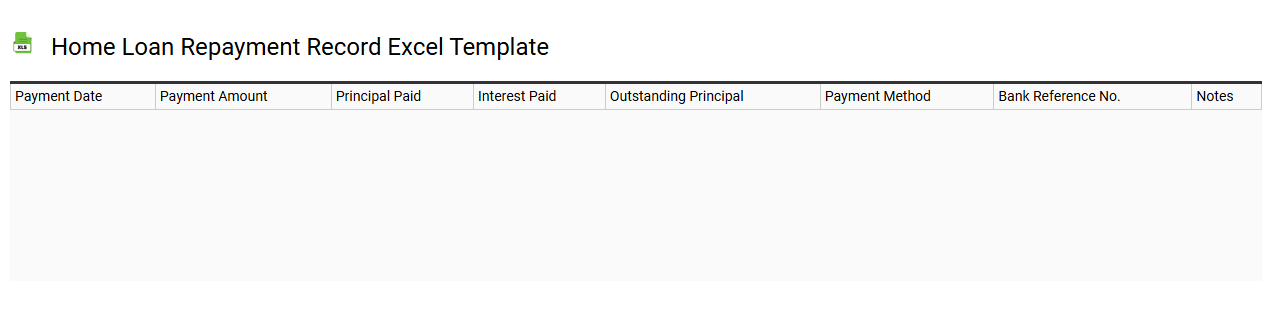

Home loan repayment record Excel template

💾 Home loan repayment record Excel template template .xls

A Home Loan Repayment Record Excel template is a structured spreadsheet designed to help you track your home loan payments over time. Each entry typically includes essential details such as the payment date, the amount paid, interest accrual, and remaining balance. This tool allows for easy monitoring of your repayment schedule, ensuring that you stay on top of each installment and understand your financial progress. You can customize it for basic tracking or expand its features to include detailed amortization schedules and payment forecasts as your needs evolve.

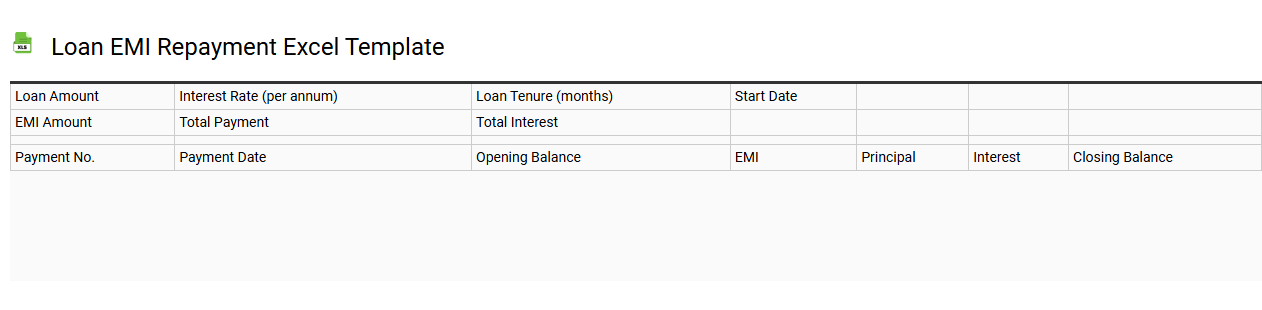

Loan EMI repayment Excel template

💾 Loan EMI repayment Excel template template .xls

A Loan EMI repayment Excel template is a structured spreadsheet designed to help you calculate and manage your equated monthly installment (EMI) payments for loans. It allows you to input key variables such as the loan amount, interest rate, and loan tenure, automatically generating a detailed amortization schedule. This schedule displays monthly payments, principal and interest components, and the outstanding balance after each payment period. Such a tool not only simplifies basic EMI calculations but can also be customized for advanced financial analysis like comparing multiple loan scenarios or incorporating prepayment options to optimize your loan management strategy.

Business loan repayment tracking Excel template

![]()

💾 Business loan repayment tracking Excel template template .xls

A Business Loan Repayment Tracking Excel template simplifies the process of monitoring loan payments, ensuring you stay organized and punctual with your financial commitments. This customizable spreadsheet typically includes columns for the loan amount, interest rate, payment schedule, due dates, and remaining balance. Users can input payment amounts as they are made, providing a clear overview of outstanding debts and upcoming obligations. This tool is essential for maintaining financial health and can be adapted for more complex financial management needs, including forecasting cash flow and analyzing interest accrual.

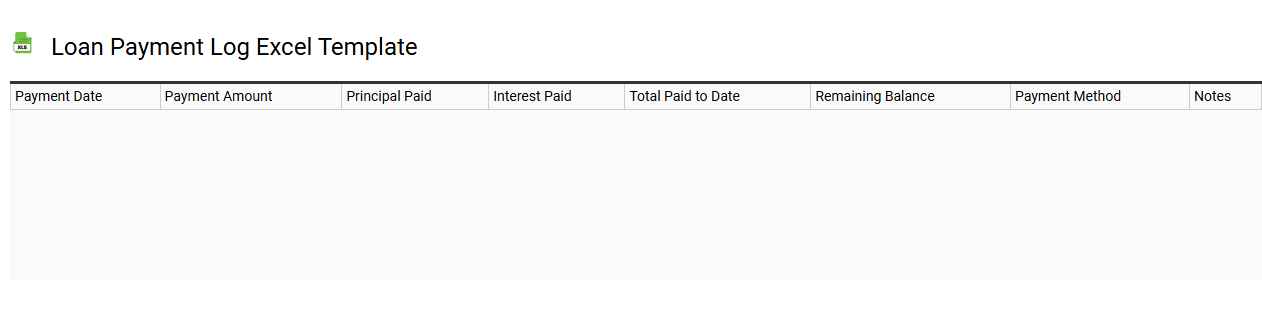

Loan payment log Excel template

💾 Loan payment log Excel template template .xls

A Loan Payment Log Excel template is a structured spreadsheet designed to track and manage loan payments systematically. It typically includes essential columns such as payment dates, amounts paid, principal balance, interest allocated, and remaining balance. This template helps you monitor your payment progress, calculate interest over time, and visualize your financial commitment. You can adapt the log for various loan types, from personal loans to mortgages, and as your needs evolve, consider integrating advanced formulas or linking it with budgeting tools for comprehensive financial management.

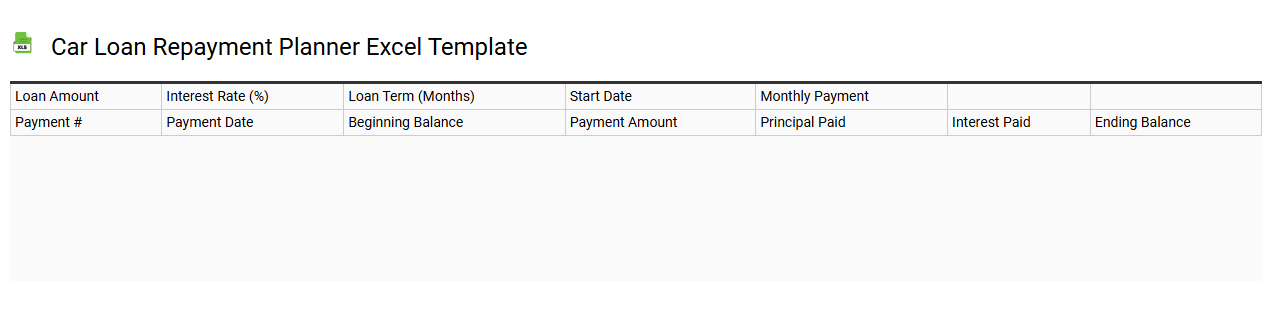

Car loan repayment planner Excel template

💾 Car loan repayment planner Excel template template .xls

A Car loan repayment planner Excel template is a spreadsheet tool designed to help you track and manage your car loan payments. It typically includes features like loan amount, interest rate, payment frequency, and amortization schedule. This tool allows you to visualize your repayment process, calculate total interest paid, and evaluate options for early payoff. You can tailor this template to your specific loan details, enabling you to explore advanced scenarios such as refinancing or adjusting payment strategies.