Explore a range of free Excel templates designed specifically for loan management registration. These templates often include sections to track loan amounts, interest rates, payment schedules, and outstanding balances, allowing for efficient monitoring of your loan data. By easily customizing these templates, you can create a tailored solution that fits your specific loan management needs, helping you stay organized and informed.

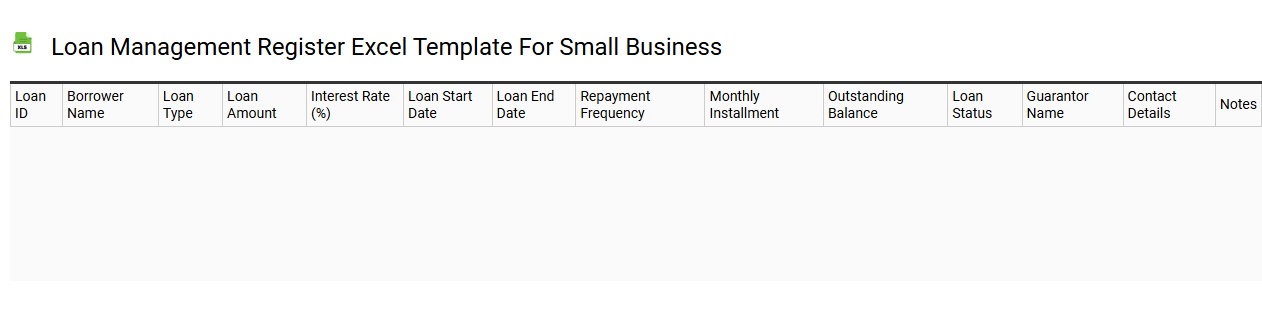

Loan management register Excel template for small business

💾 Loan management register Excel template for small business template .xls

A Loan Management Register Excel template is a customizable tool specifically designed to help small businesses track, manage, and maintain an overview of their loans. This template typically includes key information such as loan amounts, interest rates, repayment schedules, and due dates for each loan. It allows you to monitor your payment history, balance remaining, and any associated fees, promoting better financial planning and decision-making. Using this template not only facilitates the tracking of your current loans but also enables you to prepare for future financing needs, including exploring options like refinancing or expansion loans.

Personal loan tracking Excel template

![]()

💾 Personal loan tracking Excel template template .xls

A Personal Loan Tracking Excel template is a structured spreadsheet designed to help individuals manage and monitor their personal loans effectively. This template typically includes columns for loan amounts, interest rates, payment due dates, and outstanding balances, allowing you to easily visualize your repayment schedule. You can also track additional details such as monthly payment amounts and any fees associated with your loans. Beyond basic usage for personal finance management, this template has the potential to incorporate advanced calculations like amortization schedules and predictive analytics for future financial planning.

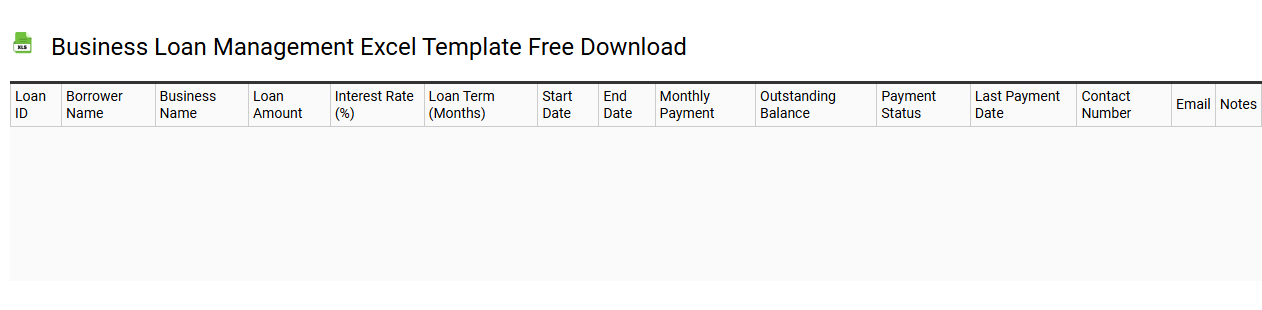

Business loan management Excel template free download

💾 Business loan management Excel template free download template .xls

A Business loan management Excel template is a structured tool designed to help you track and manage the details of your loans effectively. This template typically includes sections for loan amounts, interest rates, repayment schedules, and cash flow analysis, enabling you to maintain a clear overview of your financial commitments. You can easily customize it to fit your business needs, allowing for insights into cash flow and payment timelines. This template not only aids in basic loan tracking but can also support advanced financial modeling, risk assessment, and scenarios for cash flow forecasting.

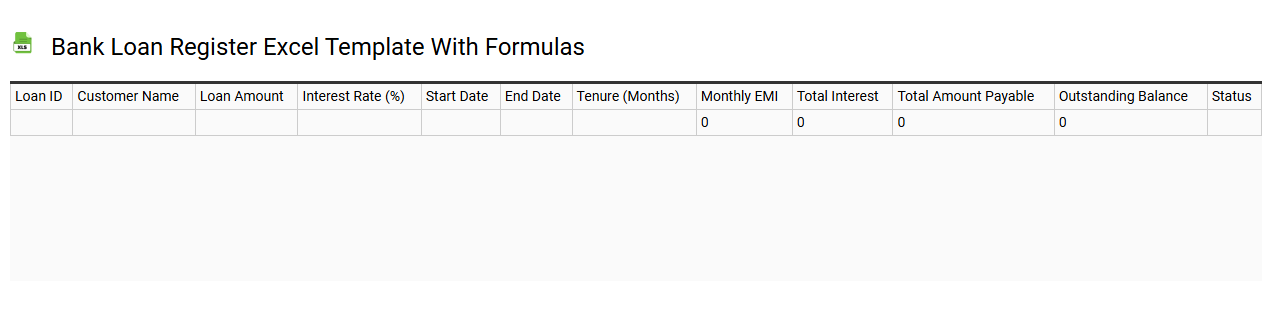

Bank loan register Excel template with formulas

💾 Bank loan register Excel template with formulas template .xls

A Bank Loan Register Excel template is a structured spreadsheet designed to help individuals or businesses track their loans and manage repayment schedules efficiently. This template typically includes columns for critical information such as loan amounts, interest rates, payment due dates, and remaining balances. Formulas embedded within the template can automatically calculate payment totals, interest accrued, and the current balance after each payment is made. This resource is vital for ensuring timely payments and maintaining financial health, while potentially being customized for many advanced calculations, such as amortization schedules or cash flow projections.

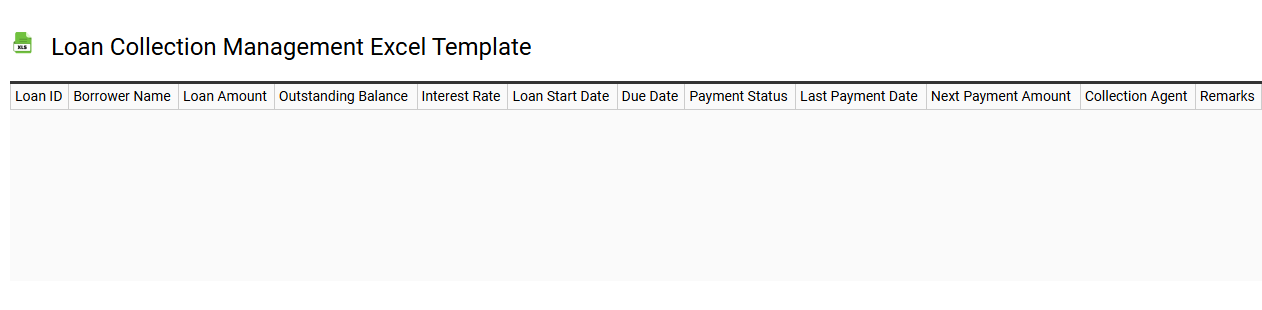

Loan collection management Excel template

💾 Loan collection management Excel template template .xls

A Loan collection management Excel template is a structured tool designed to streamline the tracking and management of loan repayments. It typically features organized columns for borrower information, loan amounts, payment due dates, and outstanding balances. You can easily update the template to reflect each payment received, helping maintain an accurate overview of all active loans. This basic setup can further evolve into more advanced features, such as automated reminders, charts for data visualization, and integration with other financial software for enhanced analysis and reporting.

Simple loan tracking Excel template for individuals

![]()

💾 Simple loan tracking Excel template for individuals template .xls

A simple loan tracking Excel template allows individuals to efficiently manage their personal loans by organizing essential data in one accessible location. Users can input details like loan amounts, interest rates, payment dates, and borrower information. The template typically includes functions to calculate outstanding balances and track payment schedules, ensuring you stay on top of your financial commitments. Ideal for basic usage, it can also be expanded with more advanced features such as amortization schedules, graphs, and alerts for upcoming payments or interest rate changes.

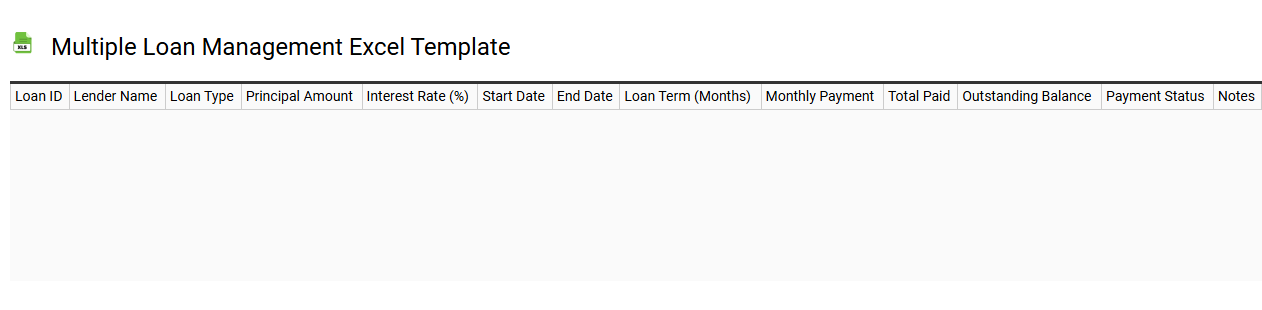

Multiple loan management Excel template

💾 Multiple loan management Excel template template .xls

A Multiple Loan Management Excel template streamlines the process of tracking and managing multiple loans in one comprehensive spreadsheet. Each loan entry can include essential details such as the lender's name, loan amount, interest rate, payment schedule, and outstanding balance, allowing for easy monitoring of finances. The template often features automated calculations for monthly payments and total interest paid over the life of each loan, enhancing your ability to make informed financial decisions. This tool is beneficial for personal budgeting, but it can also be tailored for advanced needs like analyzing amortization schedules or simulating loan payoff strategies.

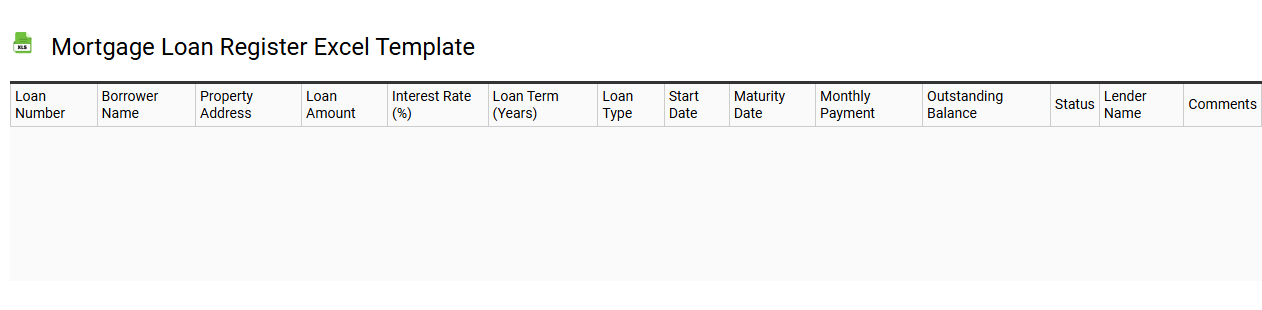

Mortgage loan register Excel template

💾 Mortgage loan register Excel template template .xls

A Mortgage Loan Register Excel template serves as a comprehensive tool for tracking mortgage loans. It typically includes columns for essential details such as borrower names, property addresses, loan amounts, interest rates, and repayment schedules. The template helps users manage loan information efficiently, ensuring timely payments and better oversight of financial commitments. You can customize it to meet basic needs, but it also has the potential to incorporate advanced features like amortization schedules and financial analysis tools.