A line of credit tracking Excel template helps you monitor your borrowing and repayment activities effectively. This template typically includes sections for recording the initial credit limit, current balance, interest rates, and payments made. You can also track your due dates, remaining balances, and any fees associated with your line of credit for better financial management. Free XLS templates are widely available online and can be customized to fit your specific needs. These templates often come with built-in formulas to automatically calculate remaining credit and interest accrued, making it easier for you to stay on top of your finances. Utilizing a well-structured template ensures that you maintain a clear overview of your credit usage and financial obligations.

Line of credit tracking Excel template

![]()

💾 Line of credit tracking Excel template template .xls

A Line of Credit Tracking Excel template is a financial management tool designed to help individuals or businesses monitor and manage their borrowed funds. It typically includes columns for tracking the credit limit, outstanding balance, interest rates, and payment due dates. You can enter transaction details, such as amounts drawn and repaid, providing a clear picture of your borrowing activities. This streamlined approach ensures you stay organized and can analyze your credit usage, which is essential for budgeting and assessing future financing needs, including advanced options like cash flow forecasting and risk assessment strategies.

Credit line usage tracker Excel template

![]()

💾 Credit line usage tracker Excel template template .xls

A Credit Line Usage Tracker Excel template is a tool designed to help individuals or businesses monitor and manage their available credit lines. You can input various details such as credit limit, current balance, and payment history, allowing you to visualize your credit utilization over time. This template often includes charts and conditional formatting to highlight when usage approaches limits, helping you stay informed about your financial position. Beyond basic tracking, this template can be adapted for more advanced needs, such as integrating cash flow forecasts and analyzing utilization ratios.

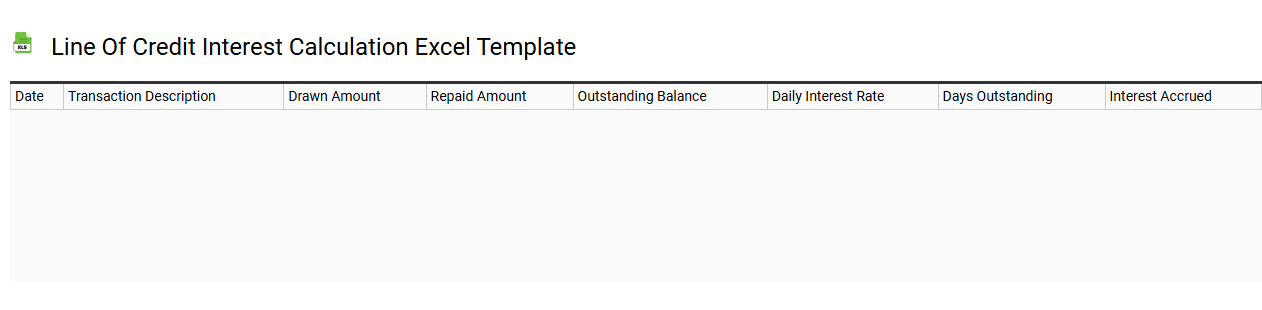

Line of credit interest calculation Excel template

💾 Line of credit interest calculation Excel template template .xls

A Line of Credit Interest Calculation Excel template is a financial tool designed to help you manage and calculate interest on a line of credit. This template typically includes fields for inputting the principal amount, interest rate, and repayment terms, automatically adjusting calculations based on your entries. Formulas within the spreadsheet compute interest accrued over specific periods, allowing you to visualize your debt growth and potential costs. Such a template can be essential for individuals or businesses to track their borrowing and make informed decisions about repayments or future financing, expanding to include features like amortization schedules or cash flow projections.

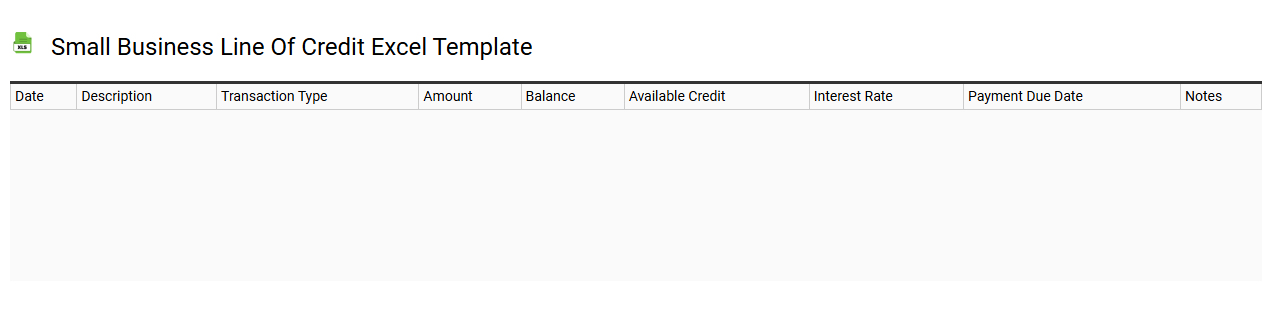

Small business line of credit Excel template

💾 Small business line of credit Excel template template .xls

A Small Business Line of Credit Excel template serves as a structured tool to effectively manage your business's borrowing capabilities. It allows you to track available credit, outstanding balances, interest rates, and payment schedules in a clear and organized manner. With designated columns for each category, you can easily input your financial data, enabling you to assess your credit utilization and plan future borrowing needs. This template is essential for monitoring cash flow and identifying more advanced financial strategies such as leverage ratios and credit optimization.

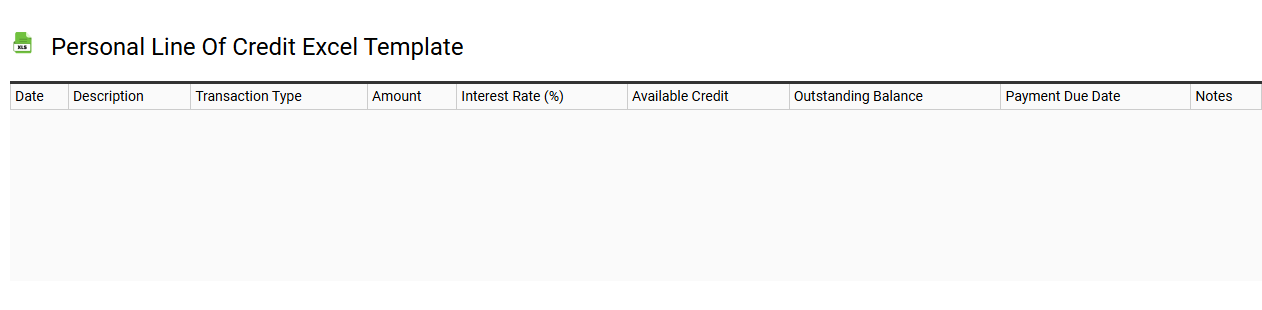

Personal line of credit Excel template

💾 Personal line of credit Excel template template .xls

A personal line of credit Excel template serves as a financial tool that allows you to manage and track your credit utilization, payments, and overall account balance. This template typically includes sections for entering your credit limit, current balance, interest rates, and payment due dates. With organized columns and formulas, it helps you visualize your spending habits and repayment schedules, ensuring you stay on top of your financial obligations. You can further customize this template to include features such as payment forecasts and budgeting for specific expenses like emergencies or vacations.

Line of credit balance tracking Excel template

![]()

💾 Line of credit balance tracking Excel template template .xls

Line of credit balance tracking Excel templates help you monitor the usage and repayment of credit lines effectively. These templates often feature sections to record the opening balance, withdrawals, repayments, and calculate the current balance automatically. You can customize them by adding categories for different expenses or lenders, making it easier to gauge your financial health at a glance. Such tools serve basic needs but can evolve into complex financial management systems, incorporating advanced formulas, charts, or multi-currency tracking as your financial situation grows.

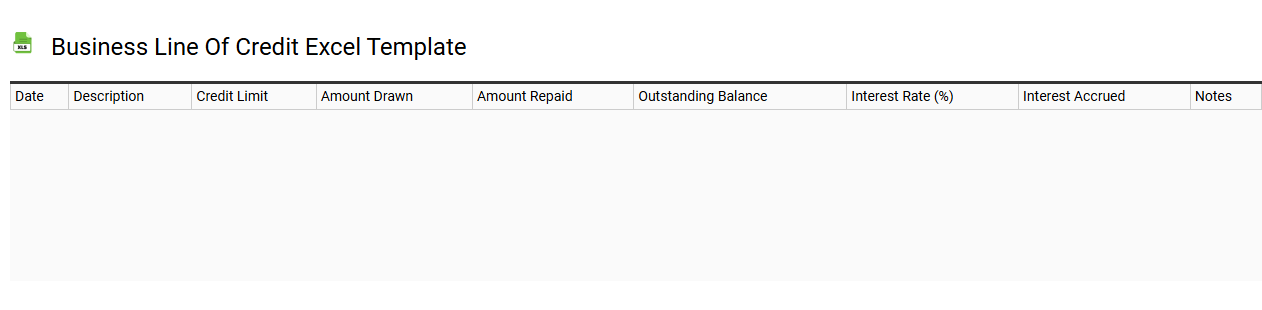

Business line of credit Excel template

💾 Business line of credit Excel template template .xls

A Business Line of Credit Excel template serves as a structured tool for managing and tracking your credit activities. It typically includes sections for inputting your credit limit, draw amounts, repayment schedules, and interest rates. You can easily visualize your financial data through charts and graphs, providing insights into your business's cash flow over time. This template may also accommodate advanced features such as scenario analysis and forecasts, allowing you to strategize your borrowing options to optimize cash management in perpetuity.

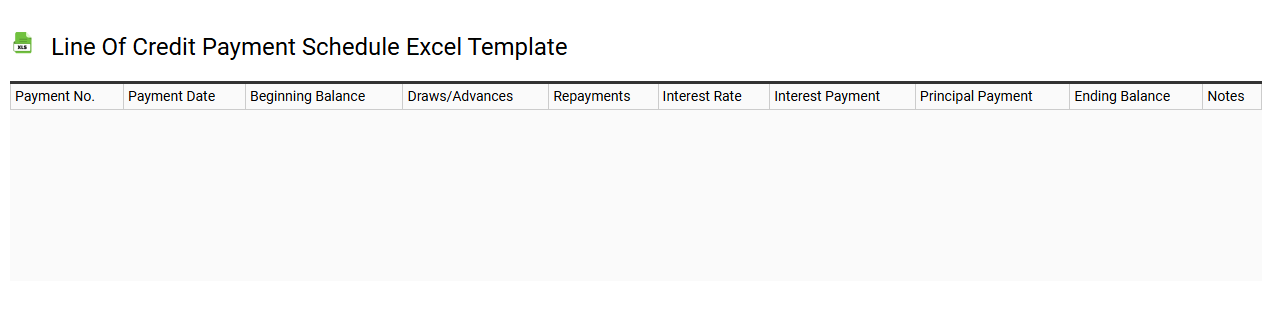

Line of credit payment schedule Excel template

💾 Line of credit payment schedule Excel template template .xls

A Line of Credit Payment Schedule Excel template is a user-friendly tool designed to help you manage and track your line of credit repayments. This template typically features columns for each payment date, principal amount, interest charged, and remaining balance, allowing for easy monitoring of your financial obligations. With automatic calculations, you can quickly assess how changes in your payment strategy impact overall debt and interest costs. This essential resource not only aids in managing current payments but also supports complex financial planning, including amortization schedules and advanced cash flow analysis.

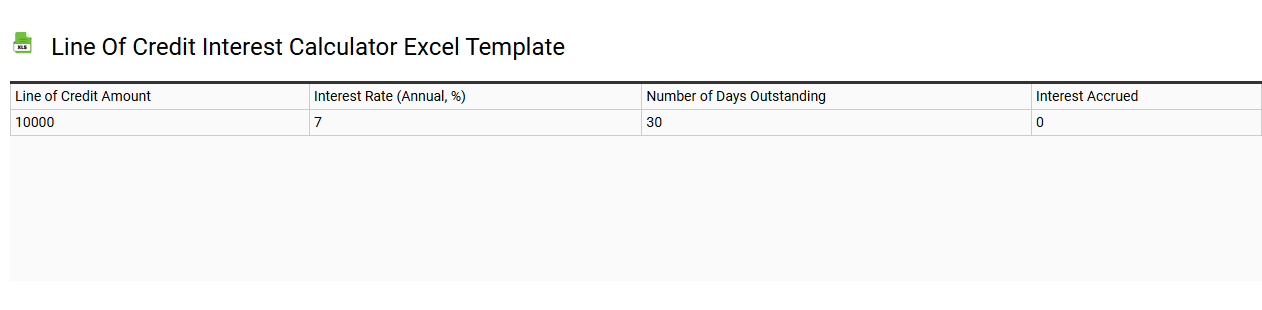

Line of credit interest calculator Excel template

💾 Line of credit interest calculator Excel template template .xls

A Line of Credit Interest Calculator Excel template helps you assess the interest costs associated with a line of credit. It allows you to input your credit limit, drawn amount, interest rate, and repayment terms, automatically calculating the interest expenses. You can visually track costs over time, as the template often includes features for different scenarios and payment schedules. For home equity lines or business financing, this tool can inform your financial decisions, aiding in basic calculations while paving the way for advanced forecasting models.

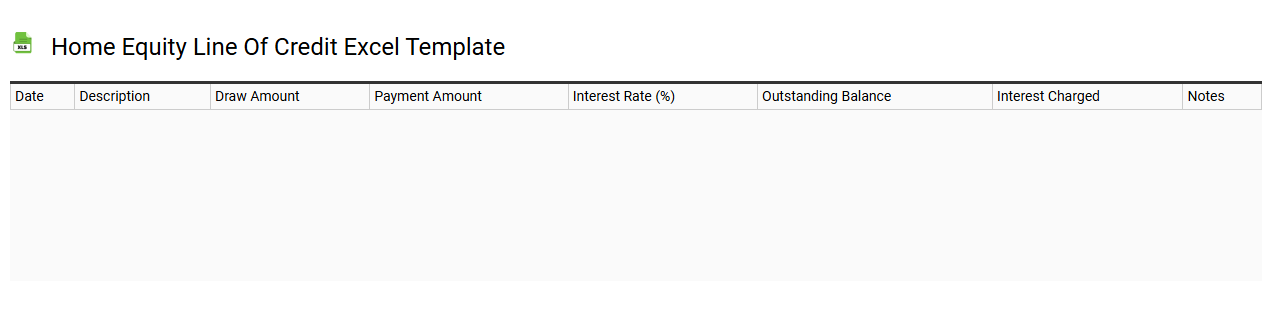

Home equity line of credit Excel template

💾 Home equity line of credit Excel template template .xls

A Home Equity Line of Credit (HELOC) Excel template is a financial tool designed to help you manage and track your HELOC. This template typically includes sections for entering your loan amount, interest rates, utilization rates, and payment schedules. You can also input your monthly expenses and income to monitor your cash flow, ensuring you achieve an optimal balance between borrowing and repayment. As you become comfortable with these basic functionalities, you may explore more advanced features such as amortization schedules and scenario analysis for better financial planning.

Line of credit balance tracker Excel template

![]()

💾 Line of credit balance tracker Excel template template .xls

A Line of Credit Balance Tracker Excel template is a financial tool designed to help you monitor and manage your line of credit effectively. The template typically includes sections for recording your opening balance, new transactions, payments, and interest charges, allowing you to visualize your current outstanding balance. You can customize the template to reflect specific terms of your credit line, set payment reminders, and generate monthly reports to assess your financial health. This basic template can evolve into a comprehensive financial management system with features like cash flow forecasting and advanced analytics if your financial needs grow.

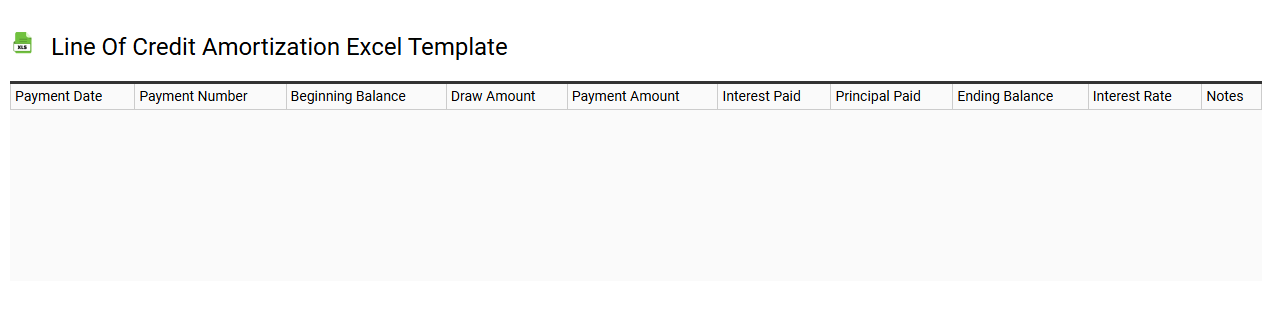

Line of credit amortization Excel template

💾 Line of credit amortization Excel template template .xls

A Line of Credit Amortization Excel template is a structured spreadsheet designed to help you manage and visualize the repayment schedule of a line of credit. This tool typically includes input fields for your credit limit, interest rate, withdrawal amounts, and repayment terms. You can easily track your outstanding balance, interest accrued, and principal payments over time, allowing for better financial planning. By using this template, you can assess your repayment strategy while exploring advanced financial concepts like cash flow modeling and scenario analysis for future credit utilization.

Small business line of credit tracking Excel template

![]()

💾 Small business line of credit tracking Excel template template .xls

A Small Business Line of Credit Tracking Excel template serves as a financial management tool designed to help you monitor and manage your line of credit effectively. This customizable spreadsheet typically includes sections for tracking the principal amount, interest rates, payment due dates, and outstanding balances, ensuring that you stay informed about your credit utilization. Users can input transaction details, including draws and repayments, making it easier to see how credit impacts cash flow and overall financial health. Understanding this tool can also pave the way for more advanced financial modeling and forecasting needs, such as analyzing cash flow projections or assessing borrowing capacity.

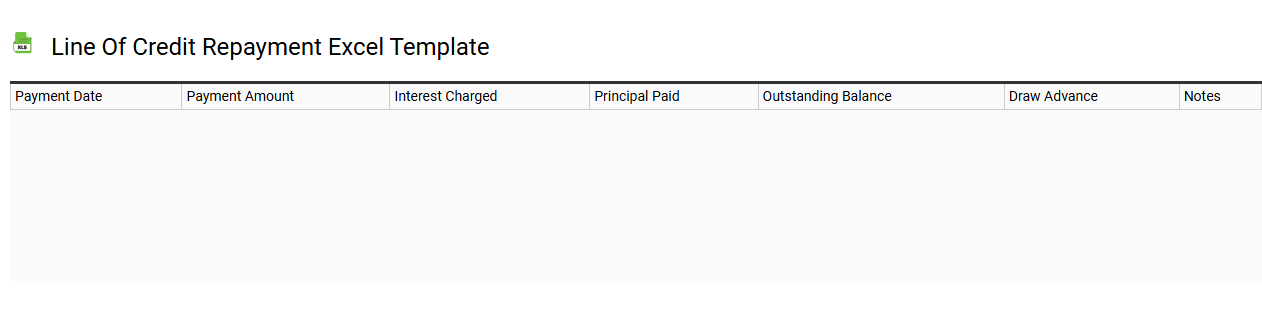

Line of credit repayment Excel template

💾 Line of credit repayment Excel template template .xls

A Line of Credit Repayment Excel template is a structured spreadsheet designed to help you track and manage the repayment of borrowed funds through a line of credit. It typically includes sections for the principal amount, interest rates, payment schedules, and remaining balances. The template may also feature formulas that automatically calculate monthly payments, as well as a summary of total interest paid over the life of the loan. By utilizing this tool, you can effectively monitor your repayment progress and ensure timely payments, accommodating both basic financial tracking and more complex needs such as forecasting future borrowing scenarios.