Explore a wide array of free Excel templates designed specifically for small business loan planning. These templates simplify the process of tracking loan details, including interest rates, repayment schedules, and total costs, allowing you to make informed financial decisions. With user-friendly layouts and customizable fields, you can easily input your business information and generate clear, organized reports to guide your loan management effectively.

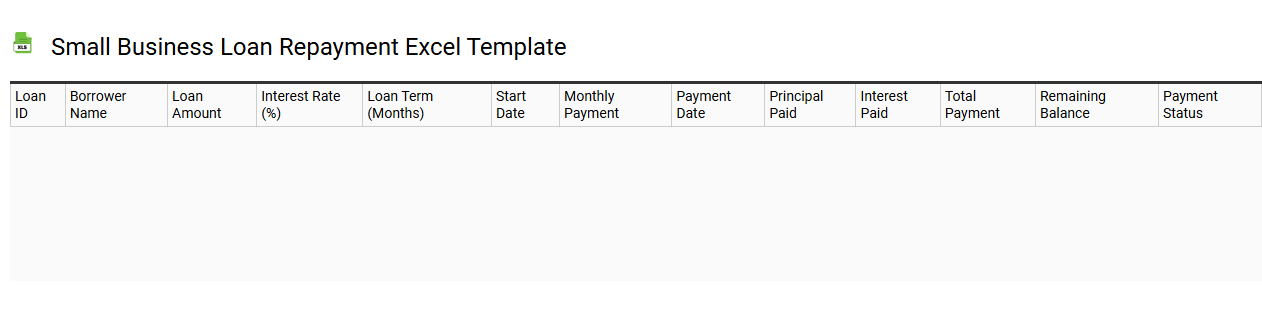

Small business loan repayment Excel template

💾 Small business loan repayment Excel template template .xls

A Small Business Loan Repayment Excel template provides a structured way to track and manage loan repayments for small businesses. This template typically includes fields for the loan amount, interest rate, repayment frequency, and the total number of payments. You can easily calculate monthly payments using built-in formulas, allowing for a clear overview of upcoming due dates and remaining balances. Such templates can be essential for maintaining financial health and can evolve into advanced forecasting tools for cash flow management and financial projections.

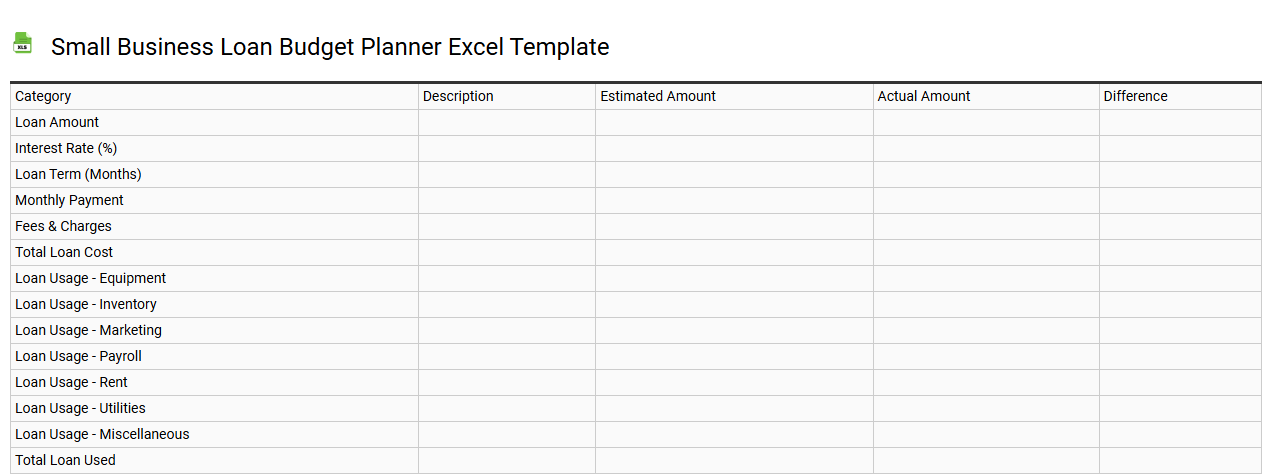

Small business loan budget planner Excel template

💾 Small business loan budget planner Excel template template .xls

A Small Business Loan Budget Planner Excel template is a financial tool designed to assist small business owners in organizing and managing their loan budgets effectively. This template typically includes sections for income projections, expense tracking, repayment schedules, and interest calculations. By inputting your financial data, you can visualize your cash flow and assess your capacity to meet loan obligations without jeopardizing day-to-day operations. Its basic usage can evolve into more complex financial modeling, including scenario analysis and financial forecasting to optimize your business's growth potential.

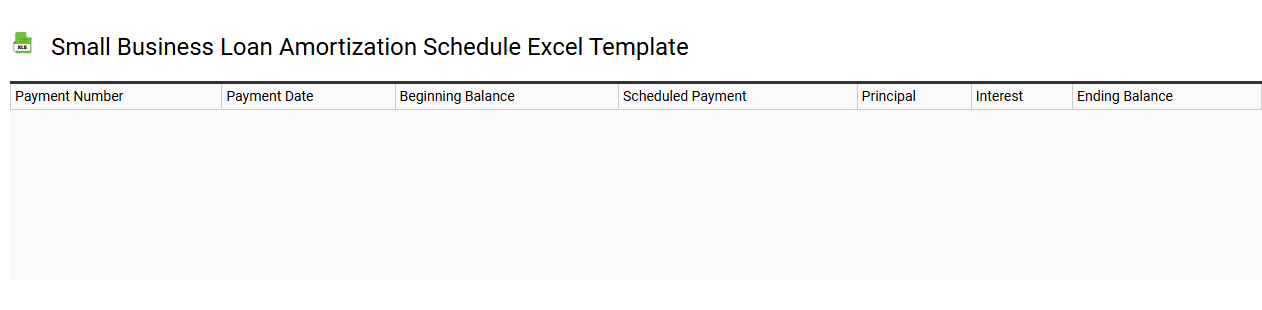

Small business loan amortization schedule Excel template

💾 Small business loan amortization schedule Excel template template .xls

A small business loan amortization schedule Excel template is a tool that helps you track the repayment of a loan over its term. This template typically includes key elements such as loan amount, interest rate, monthly payment, and loan duration, allowing you to visualize how each payment is split between principal and interest. You can easily see how your outstanding balance decreases over time, helping you manage your finances effectively. For basic usage, this template meets your early-stage loan tracking needs, while advanced features may include customizable payment frequencies or scenario analysis for varying interest rates.

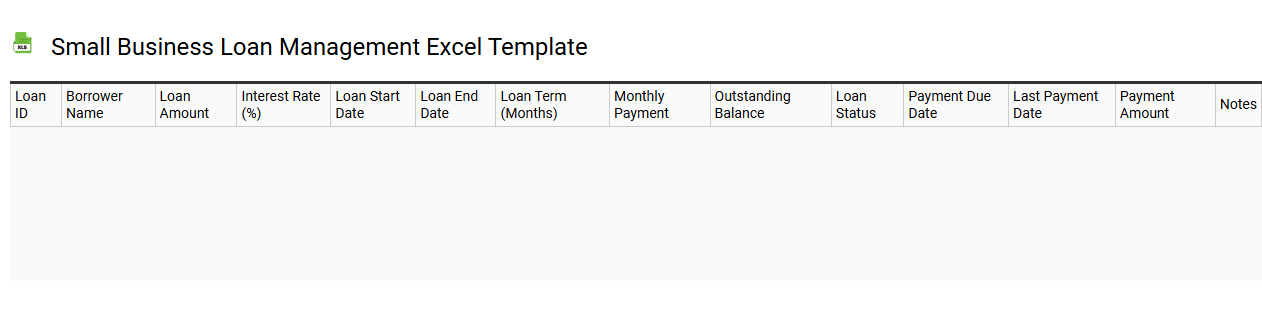

Small business loan management Excel template

💾 Small business loan management Excel template template .xls

A Small Business Loan Management Excel template is a structured tool designed to help entrepreneurs effectively track, manage, and analyze their business loans. This template typically includes sections for loan details, such as lender information, interest rates, repayment schedules, and outstanding balances. It often features built-in formulas to calculate total payments, remaining balances, and interest accrued over time, promoting financial clarity. You can customize this template to suit your specific needs, and it may serve as a stepping stone for more advanced financial software solutions as your business grows.

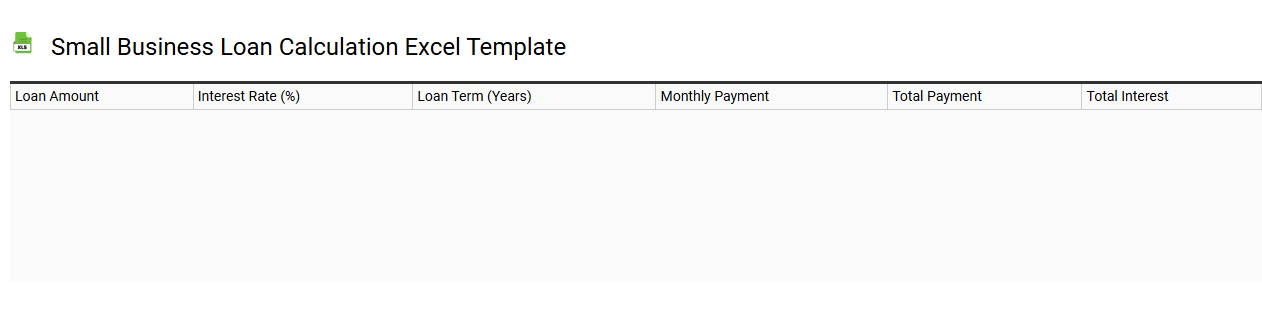

Small business loan calculation Excel template

💾 Small business loan calculation Excel template template .xls

A Small Business Loan Calculation Excel template is a tool designed to help business owners assess and manage their loan options effectively. It typically includes fields for inputting loan amount, interest rate, term length, and payment frequency, allowing you to calculate monthly payments and total interest paid over the lifespan of the loan. Such a template often features built-in formulas that provide instant results, which can help you visualize the financial impact of your borrowing decisions. You can also customize it to evaluate different loan scenarios or support more complex calculations involving amortization schedules and cash flow analysis to meet your potential needs.

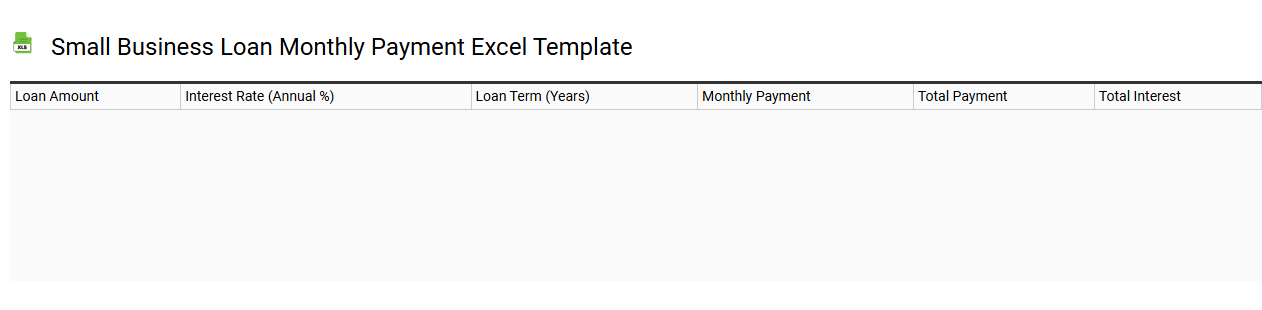

Small business loan monthly payment Excel template

💾 Small business loan monthly payment Excel template template .xls

A Small Business Loan Monthly Payment Excel template is a financial tool designed to help business owners calculate and manage loan payments. It typically includes fields for loan amount, interest rate, loan term, and payment frequency, allowing you to accurately determine your monthly payment. The template may also provide an amortization schedule, showing the breakdown of each payment between principal and interest over the loan's duration. This structured approach aids in budgeting, while serving as a foundation for understanding your cash flow and assessing potential future financing needs, including complex financial scenarios like variable interest rates or refinancing options.

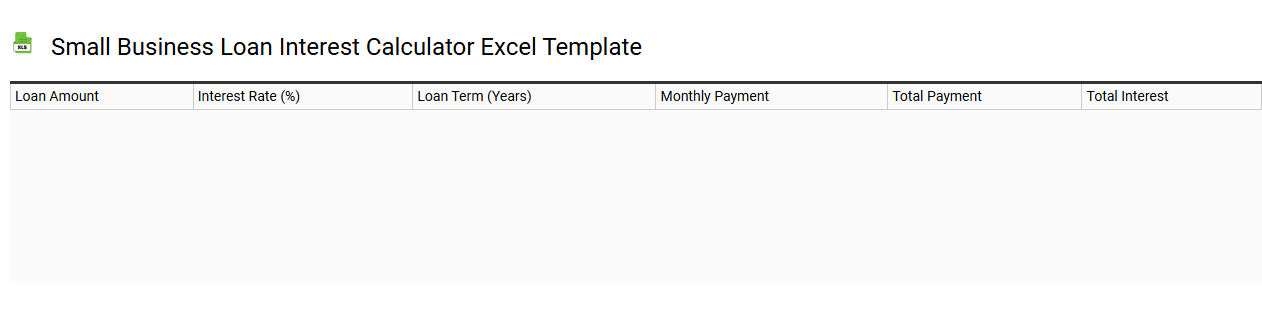

Small business loan interest calculator Excel template

💾 Small business loan interest calculator Excel template template .xls

A Small Business Loan Interest Calculator Excel template is a powerful tool designed to help entrepreneurs and business owners determine the interest costs associated with their loans. This template allows you to input various factors, such as loan amount, interest rate, and loan term, giving you a clear view of monthly payments and total interest paid throughout the life of the loan. With built-in formulas, it automatically calculates these figures, simplifying financial planning and helping you make informed decisions about borrowing. Understanding the results can aid in budgeting and assessing whether to pursue additional financing options or consider more advanced strategies like debt consolidation or cash flow optimization.

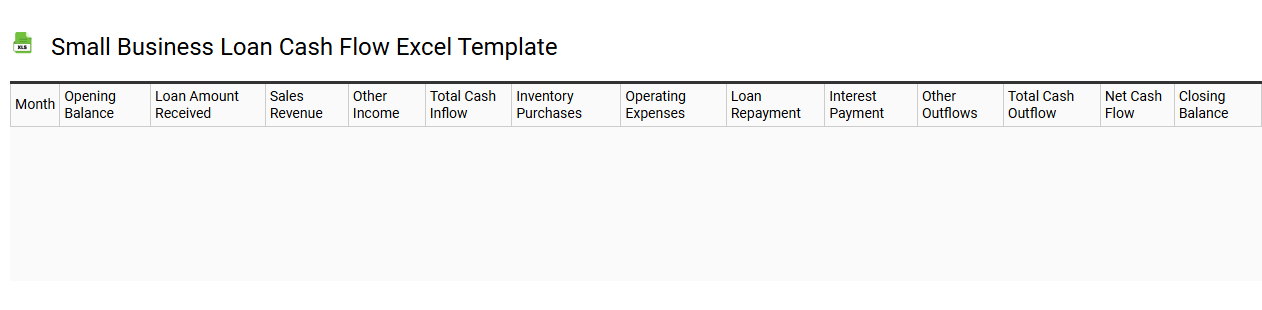

Small business loan cash flow Excel template

💾 Small business loan cash flow Excel template template .xls

A small business loan cash flow Excel template is a financial tool designed to help business owners manage their cash flow effectively. This template typically includes sections for tracking income, expenses, loan repayment schedules, and projected cash balance over time. With clear visual representations, such as graphs and charts, it enables you to analyze trends in your cash flow, making it easier to make informed financial decisions. Using such a template can assist in budgeting, forecasting future needs, and assessing the potential for growth in capital projects or inventory expansion.

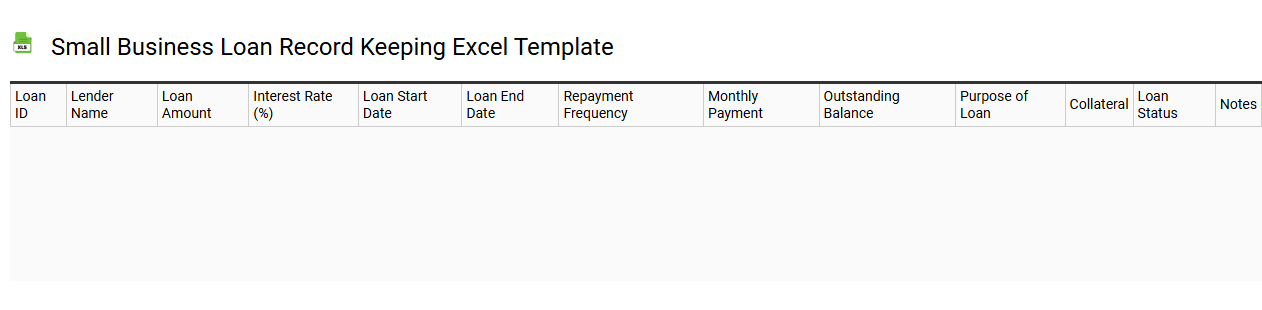

Small business loan record keeping Excel template

💾 Small business loan record keeping Excel template template .xls

A Small Business Loan Record Keeping Excel template is an organized spreadsheet designed to help business owners track loans effectively. This template typically includes sections for loan amounts, interest rates, payment due dates, and repayment schedules. You can also record relevant details about lenders, such as contact information and terms of the agreement. By using this template, you can simplify the management of your financial obligations and foresee your cash flow needs, whether for basic accounting or more complex financial modeling, including amortization schedules and debt-to-equity ratios.