Explore a selection of free XLS templates designed to help you efficiently manage your mortgage loan tracking. Each template provides a user-friendly layout, allowing you to input crucial information such as loan amounts, interest rates, and payment schedules, simplifying the monitoring process. These templates often include built-in formulas to automatically calculate remaining balances, interest accrued, and payment progress, giving you clear insights into your mortgage journey.

Amortization schedule Excel template for mortgage loan tracker

![]()

💾 Amortization schedule Excel template for mortgage loan tracker template .xls

An amortization schedule Excel template for a mortgage loan tracker provides a structured way to monitor your loan repayment details. This template outlines each payment's breakdown, detailing how much goes toward principal and interest over the life of the loan. You can view your remaining balance after each payment, making it easier to understand how your payments affect your overall loan. These tools can serve basic budgeting needs while also extending to complex financial scenarios such as refinancing calculations and investment analysis.

Mortgage loan payment tracker Excel template

![]()

💾 Mortgage loan payment tracker Excel template template .xls

A Mortgage Loan Payment Tracker Excel template is a financial tool that helps you organize and monitor your mortgage payments over time. This template typically includes sections for inputting loan details, such as interest rate, loan term, and monthly payment amounts, providing a clear visualization of your repayment schedule. Users can easily track principal and interest payments, as well as remaining balance, allowing for proactive financial planning. Such a template can also be adapted for advanced budgeting needs, incorporating features like additional payment tracking, amortization schedules, and interest rate adjustments.

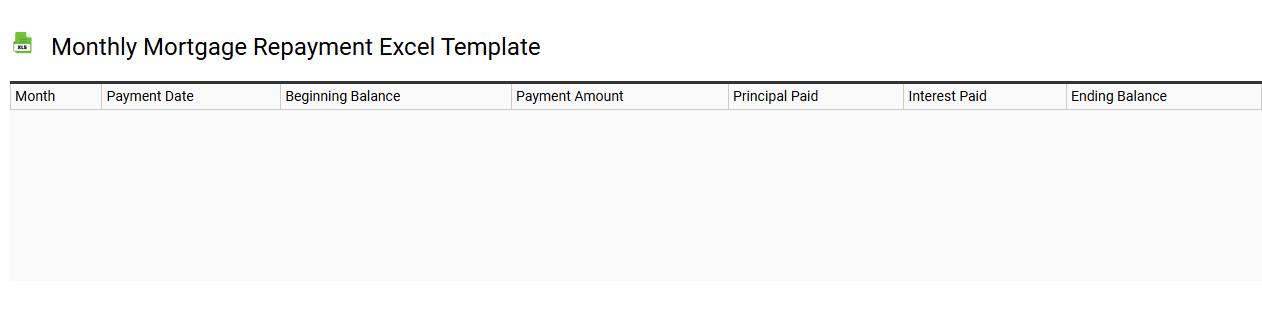

Monthly mortgage repayment Excel template

💾 Monthly mortgage repayment Excel template template .xls

A Monthly mortgage repayment Excel template is a financial tool designed to help you calculate your mortgage payments on a monthly basis. This template typically includes fields for inputting the loan amount, interest rate, loan term, and additional costs such as property taxes or insurance. With these inputs, the template generates a clear breakdown of your monthly payments, total interest paid over the life of the loan, and the principal remaining after each payment. Understanding these figures can assist you in budgeting effectively and exploring further strategies like early repayment or refinancing options.

Mortgage loan balance tracker Excel template

![]()

💾 Mortgage loan balance tracker Excel template template .xls

The Mortgage Loan Balance Tracker Excel template is a practical tool designed for homeowners to monitor the remaining balance on their mortgage over time. This customizable spreadsheet enables you to input your loan amount, interest rates, and monthly payment details. As you make payments, the template automatically calculates your outstanding balance, providing a clear visual representation of how much you've paid off versus what remains. You can utilize this tracker to assess your payoff timeline, consider refinancing options, or evaluate further financial strategies, such as accelerated payments or extra principal reductions.

Home loan payoff tracker Excel template

![]()

💾 Home loan payoff tracker Excel template template .xls

A Home Loan Payoff Tracker Excel template is a customizable spreadsheet designed to help you monitor and manage your home loan payments. It typically includes sections for inputting loan details such as principal amount, interest rate, payment frequency, and start date. You can visualize your remaining balance and track how much progress you have made towards paying off the loan over time. Utilizing this template effectively can lay the groundwork for advanced financial strategies, such as exploring amortization schedules or evaluating prepayment options.

Adjustable rate mortgage tracker Excel template

![]()

💾 Adjustable rate mortgage tracker Excel template template .xls

An Adjustable Rate Mortgage (ARM) Tracker Excel template is a powerful tool designed to help you monitor and analyze the details of your adjustable-rate mortgage over time. This template typically includes sections for inputting initial loan amounts, interest rates, adjustment periods, and detailed payment schedules, allowing you to visualize how your payments may fluctuate based on interest rate changes. With features such as charts and automatic calculations, you can anticipate your future payments and assess the overall impact on your financial strategy. For basic usage, this template can assist in budgeting; however, for advanced financial planning, you might need to look into features like sensitivity analysis or stress testing to understand various market scenarios.

Biweekly mortgage tracker Excel template

![]()

💾 Biweekly mortgage tracker Excel template template .xls

A biweekly mortgage tracker Excel template is a financial tool designed to help homeowners manage and monitor their mortgage payments on a biweekly schedule. This template allows you to input your loan details, such as the principal amount, interest rate, and loan term, dynamically calculating your payment amounts and the effects of biweekly payments on debt reduction. You can visualize the amortization schedule, track how much principal remains, and monitor interest savings over time by making payments every two weeks instead of monthly. You may find such a template helpful for optimizing your payment strategy and reducing the overall interest paid on your mortgage, with advanced features allowing for scenario analysis and financial projections.

Mortgage loan tracker Excel template with graphs

![]()

💾 Mortgage loan tracker Excel template with graphs template .xls

A Mortgage Loan Tracker Excel template offers a comprehensive tool for monitoring your mortgage payments, outstanding balance, and amortization schedule. It typically includes user-friendly graphs that visually represent your loan balance over time and highlight interest versus principal payments, helping you understand how much of your payment goes toward reducing the principal versus paying interest. By organizing your financial data, the template enables you to assess key metrics such as remaining term length, total interest paid, and potential savings from extra payments. Such a template can enhance your budgeting strategies while allowing for more advanced financial analyses, including scenario modeling and interest rate adjustments.

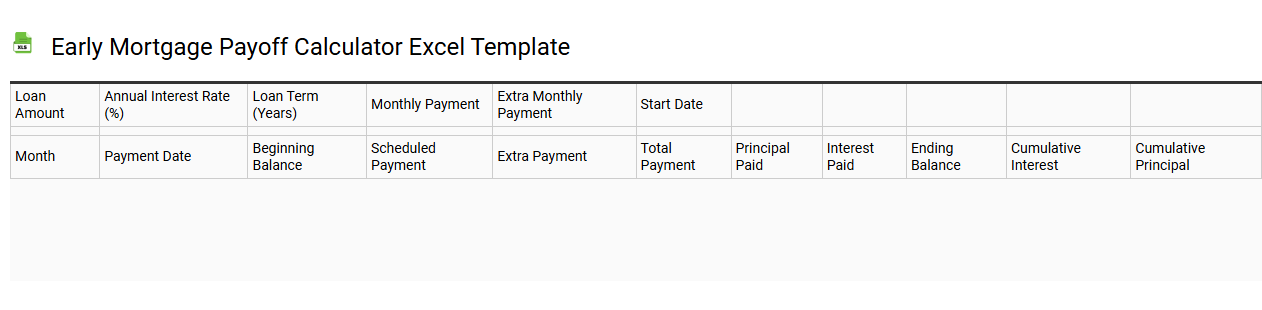

Early mortgage payoff calculator Excel template

💾 Early mortgage payoff calculator Excel template template .xls

An Early Mortgage Payoff Calculator Excel template helps you analyze the impact of making additional payments on your mortgage. This tool allows you to input your current loan balance, interest rate, and monthly payment, along with potential extra payments. It visually displays how much interest you can save and how significantly you can reduce the loan term. You can create scenarios for different payment amounts and frequency, such as weekly or bi-weekly, to optimize your mortgage strategy based on your financial goals and cash flow needs. For advanced analysis, consider integrating options for tax implications and investment comparisons to explore further financial strategies.