Explore a variety of free Excel templates tailored for calculating extra mortgage payments. Each template allows you to input loan amounts, interest rates, and monthly payments, providing a clear breakdown of your mortgage repayment schedule. You can easily customize these templates to reflect your financial situation, helping you visualize the impact of additional payments on your loan balance and overall interest savings.

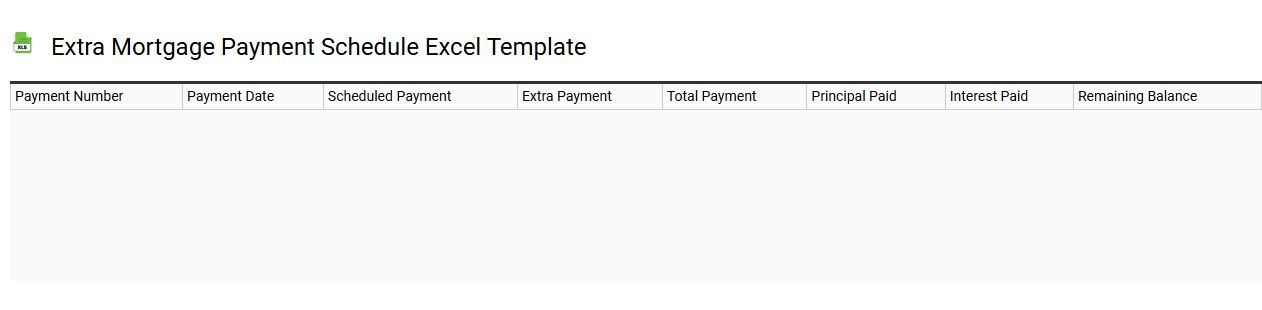

Extra mortgage payment schedule Excel template

💾 Extra mortgage payment schedule Excel template template .xls

An Extra Mortgage Payment Schedule Excel template is a valuable tool for homeowners looking to optimize their mortgage repayment strategy. This customizable spreadsheet allows you to input details such as loan amount, interest rate, term length, and any extra payments you plan to make. It visually represents the impact of these extra payments on your overall interest savings and loan duration, helping you make informed financial decisions. By using this template, you can easily track your mortgage progress and explore advanced techniques like amortization schedules or refinancing scenarios to further enhance your financial outcomes.

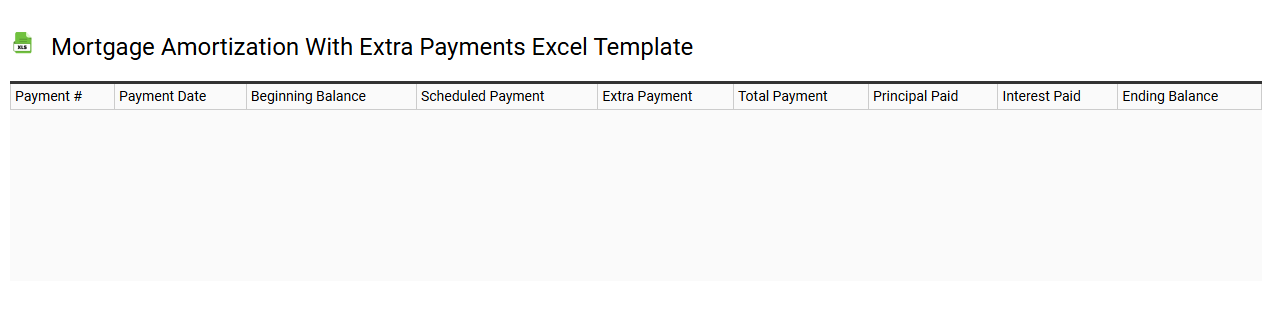

Mortgage amortization with extra payments Excel template

💾 Mortgage amortization with extra payments Excel template template .xls

Mortgage amortization with extra payments Excel template helps you visualize and manage mortgage repayment schedules more effectively. It allows you to input your loan amount, interest rate, term length, and any additional payments you plan to make. As you update these fields, the template automatically recalculates your monthly payment, total interest paid, and payoff date, giving you a clear picture of how extra payments can shorten your loan term and reduce interest costs. This customizable tool serves as a foundational resource for homebuyers while offering advanced options for scenario planning, including different payment schedules and interest rate changes.

Mortgage loan tracker with extra payments Excel template

![]()

💾 Mortgage loan tracker with extra payments Excel template template .xls

A Mortgage Loan Tracker with Extra Payments Excel template is a powerful tool designed to help you manage and monitor your mortgage payments. This template allows you to input key financial information, such as loan amount, interest rate, and monthly payment schedule, providing you with a clear overview of your mortgage status. By including sections for extra payments, you can see how additional contributions impact your total loan balance and interest savings over time. Tracking these payments not only offers immediate insights but also lays the groundwork for further financial planning through advanced features like amortization schedules and financial forecasts.

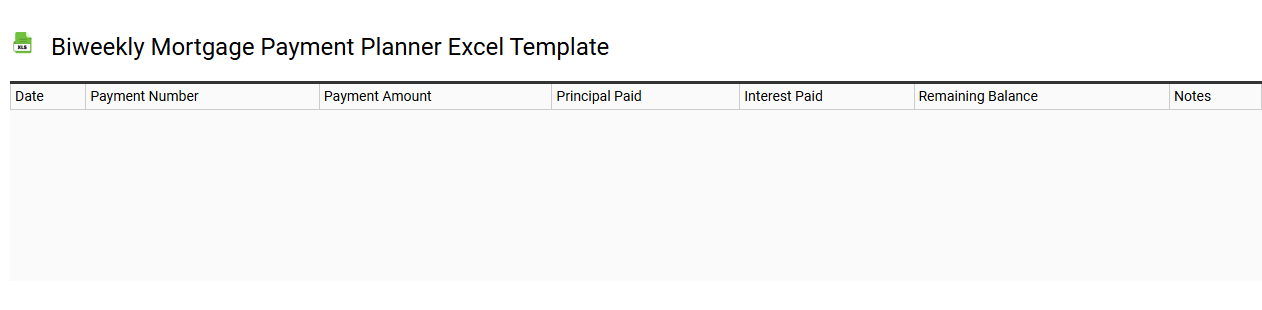

Biweekly mortgage payment planner Excel template

💾 Biweekly mortgage payment planner Excel template template .xls

A biweekly mortgage payment planner Excel template is a financial tool designed to help homeowners manage their mortgage payments efficiently. This template allows users to input their loan amount, interest rate, and term length to calculate biweekly payments instead of the traditional monthly structure. By making payments every two weeks, you can significantly reduce the total interest paid over the life of the loan and pay off your mortgage faster. This template can also be customized to explore potential additional payments or adjustments in interest rates, helping you analyze more complex mortgage strategies for future financial planning.

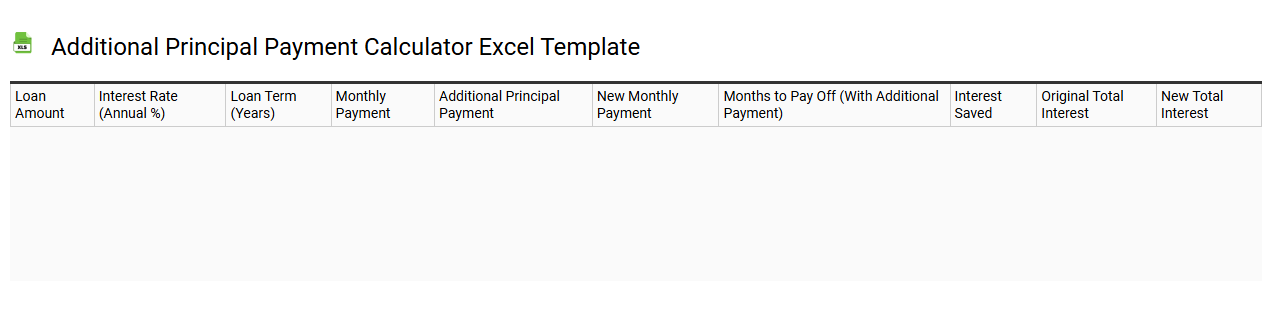

Additional principal payment calculator Excel template

💾 Additional principal payment calculator Excel template template .xls

An Additional Principal Payment Calculator Excel template is a tool designed to help manage mortgage or loan payments more effectively. This template allows users to input their loan details, including the original loan amount, interest rate, and monthly payment. It calculates how additional payments toward the principal can shorten the loan's duration and reduce total interest paid over time. You can customize this template to explore various scenarios, such as increased payment schedules or lump sum contributions, and consider the benefits of advanced payment strategies like bi-weekly payments or refinancing options.

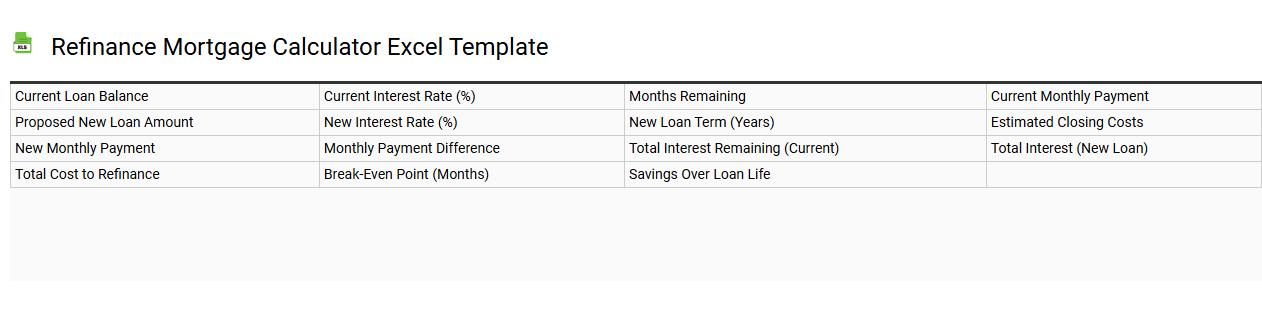

Refinance mortgage calculator Excel template

💾 Refinance mortgage calculator Excel template template .xls

A refinance mortgage calculator Excel template allows you to evaluate the financial impact of refinancing your current mortgage. This tool typically includes input fields for your current loan amount, interest rate, remaining term, and the new loan rate you're considering. It can calculate potential monthly payments, total interest savings, and break-even points, helping you to make informed decisions about mortgage refinancing. Such templates cater to basic needs and can be expanded to include sophisticated analyses like net present value and amortization schedules for advanced financial planning.

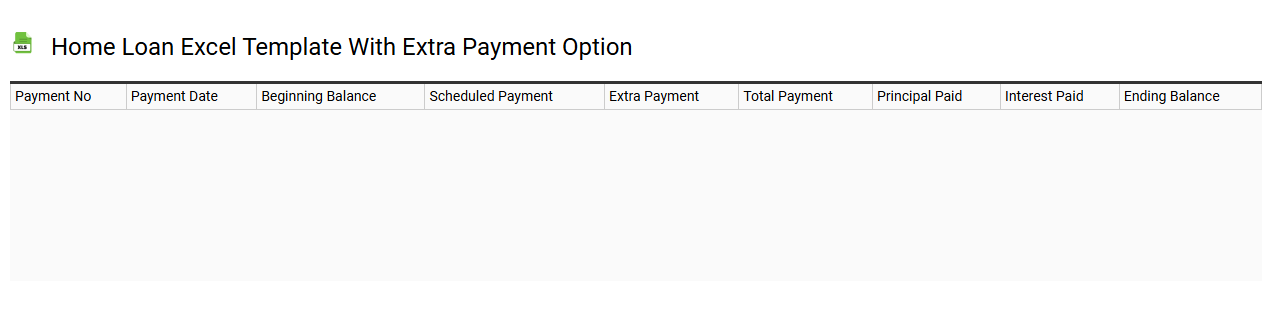

Home loan Excel template with extra payment option

💾 Home loan Excel template with extra payment option template .xls

A Home Loan Excel template with an extra payment option is a financial tool that helps you analyze and manage your home mortgage. This template allows you to input your loan details, such as the principal amount, interest rate, loan term, and any additional payments you plan to make. By simulating various scenarios, it provides a clear picture of how extra payments impact the loan's total interest paid and the overall repayment timeline. You can gain insights into how making regular or occasional extra payments can substantially reduce the financial burden of your mortgage over time, enhancing your budgeting strategy or future investment plans.

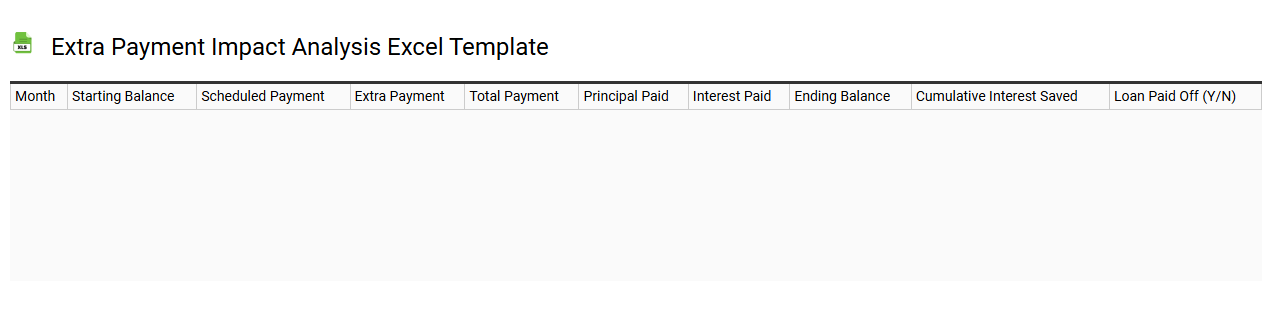

Extra payment impact analysis Excel template

💾 Extra payment impact analysis Excel template template .xls

The Extra Payment Impact Analysis Excel template is a powerful tool designed for financial professionals and analysts. This template allows you to evaluate how additional payments on a loan or mortgage affect overall financial obligations and repayment timelines. It provides a structured way to project savings in interest, shortened payment periods, and changes in total financial costs based on various payment scenarios. By using this template, you can gain insights into budgeting strategies and long-term financial planning, enhancing your ability to make informed decisions on debt management or investment opportunities. For more advanced usage, consider integrating macros for scenario modeling or utilizing pivot tables for dynamic reporting.

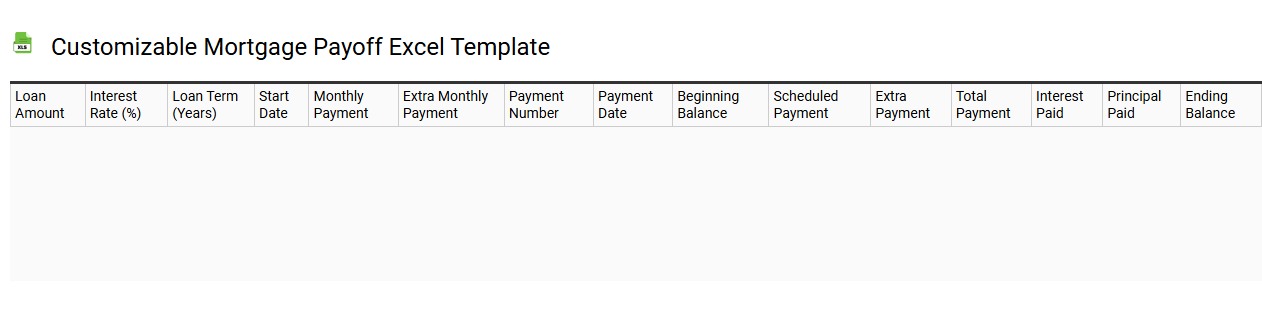

Customizable mortgage payoff Excel template

💾 Customizable mortgage payoff Excel template template .xls

A customizable mortgage payoff Excel template allows homeowners to easily track and analyze their mortgage payments, providing a clear visual of remaining balances and potential payoff dates. You can input specific loan terms such as interest rates, original loan amounts, and payments to customize projections. This template often features dynamic charts that illustrate how additional payments impact total interest paid and payoff time. With basic usage for budgeting and planning, your advanced needs may include incorporating amortization schedules or comparing multiple loan scenarios.