Evaluate your housing choices with a Mortgage vs. Rent Analysis Excel template designed to simplify financial comparisons between renting and owning. This user-friendly template allows you to input crucial data like monthly rent, mortgage payments, property taxes, and maintenance costs, enabling clear insights into long-term financial implications. Visual graphs and straightforward formulas guide your decision-making process, ensuring you can easily identify which option is more cost-effective for your unique situation.

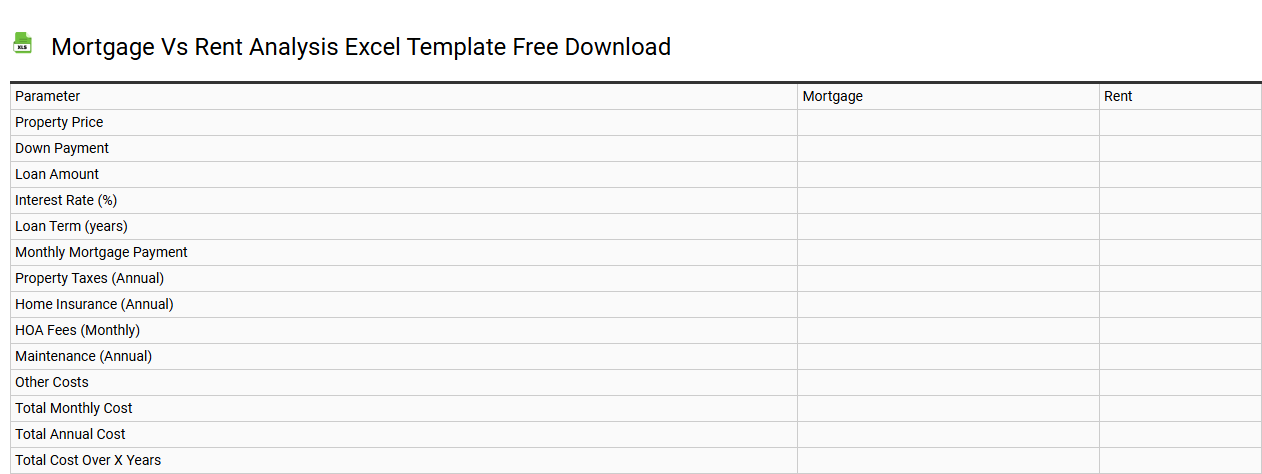

Mortgage vs rent analysis Excel template free download

💾 Mortgage vs rent analysis Excel template free download template .xls

A Mortgage vs Rent analysis Excel template allows you to compare the financial implications of renting versus purchasing a home. The template typically includes customizable fields for inputting monthly rent amounts, prospective mortgage payments, down payments, property taxes, and maintenance costs. This analysis helps you visualize long-term costs and potential equity accumulation over time, enabling informed decision-making for your housing options. The basic version focuses on initial costs and monthly payments, while more advanced templates may delve into investment growth, tax considerations, and market appreciation.

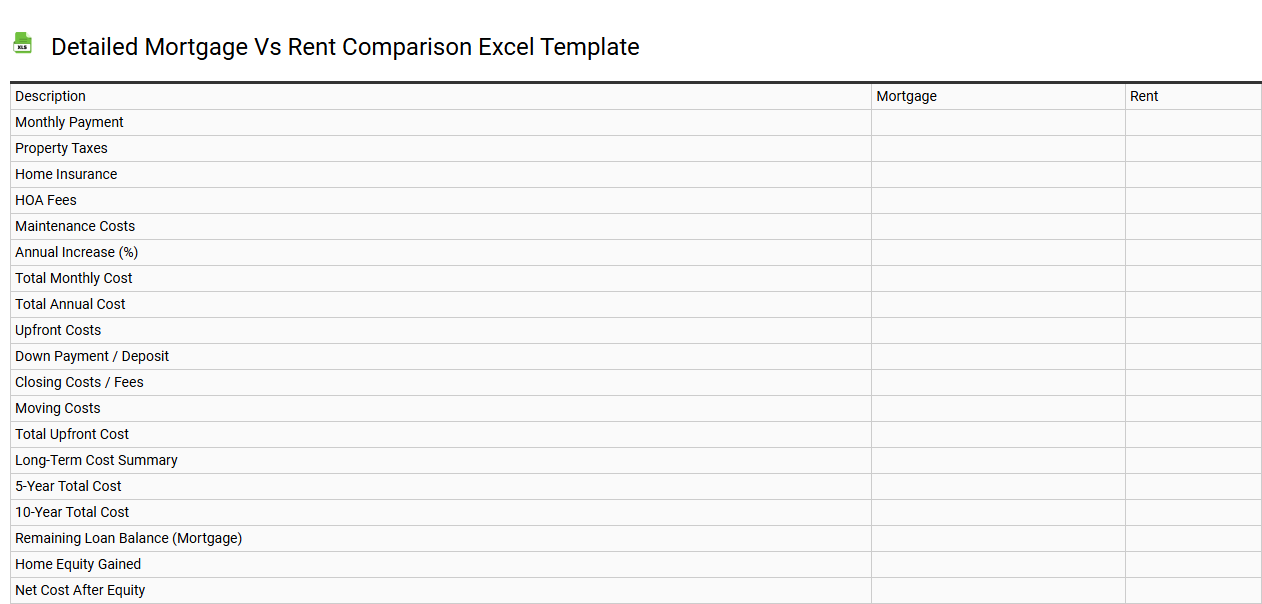

Detailed mortgage vs rent comparison Excel template

💾 Detailed mortgage vs rent comparison Excel template template .xls

A Detailed Mortgage vs Rent Comparison Excel template offers a structured way to evaluate financial decisions regarding housing. This template includes comprehensive sections for monthly mortgage payments, property taxes, insurance, and maintenance costs, alongside monthly rent amounts and associated fees. You can input variables such as down payment, interest rates, and rental increases to visualize the long-term financial impact of each choice. Such a tool helps illuminate your total cost of ownership versus renting, guiding potential users through basic cost analysis while also allowing for advanced functions like cash flow projections and investment growth estimations.

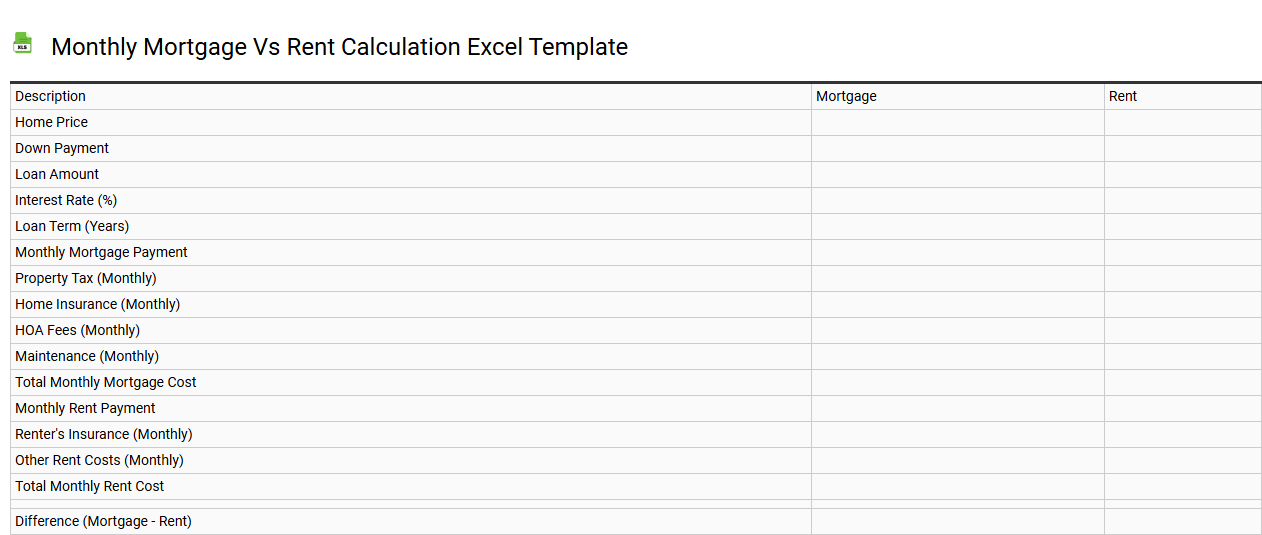

Monthly mortgage vs rent calculation Excel template

💾 Monthly mortgage vs rent calculation Excel template template .xls

A Monthly Mortgage vs. Rent Calculation Excel template provides a structured framework to compare the costs associated with renting a home versus purchasing one through a mortgage. This template usually includes fields for entering essential details like monthly rent, home price, down payment percentage, interest rates, and loan term. It often highlights total monthly costs, including principal, interest, property taxes, and insurance, alongside rental expenses. By using this tool, you can easily visualize the financial implications of your housing options and plan for further investment opportunities or budget adjustments in the future.

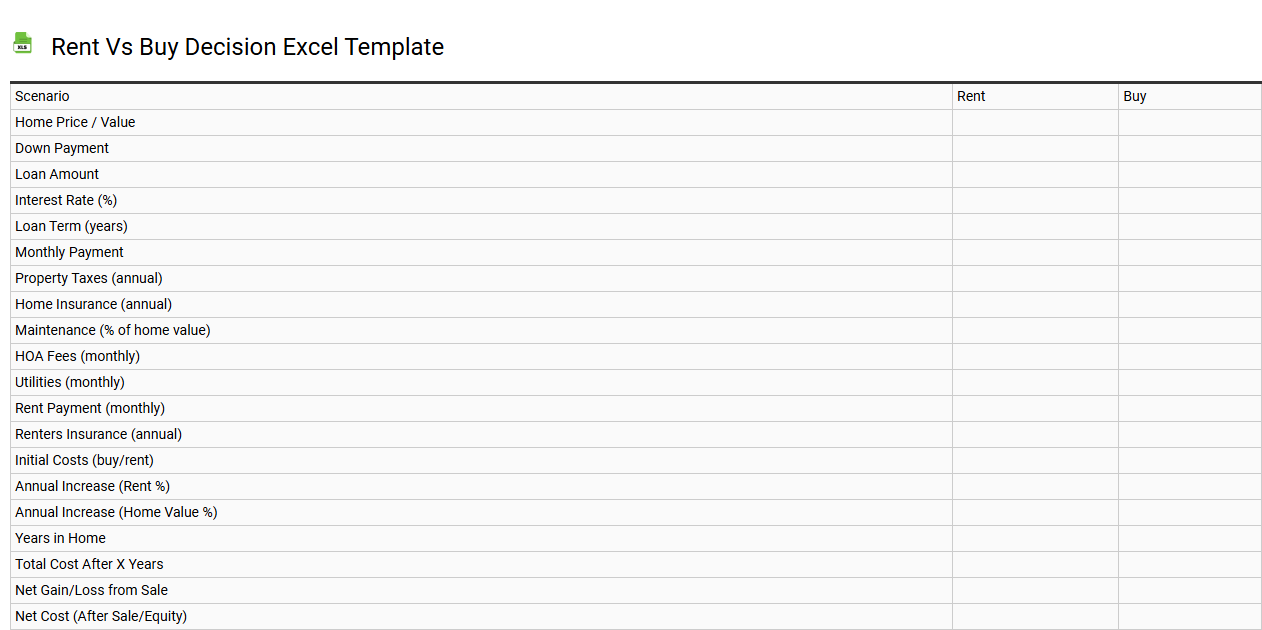

Rent vs buy decision Excel template

💾 Rent vs buy decision Excel template template .xls

A Rent vs Buy decision Excel template serves as a valuable analytical tool for evaluating the financial implications of renting versus purchasing a home. This template typically includes detailed cost comparisons, such as monthly mortgage payments, property taxes, maintenance expenses, and rental costs, allowing you to visualize and assess long-term financial impacts. Customizable graphs can illustrate how costs accumulate over time, clarifying your potential gains or losses. This basic template can evolve into a sophisticated financial analysis tool, incorporating advanced metrics such as internal rate of return (IRR) and net present value (NPV) for comprehensive decision-making.

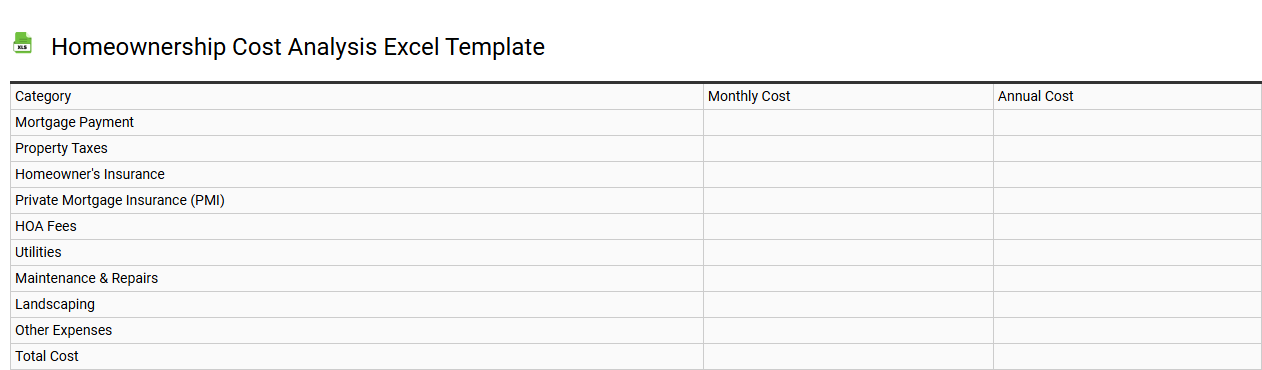

Homeownership cost analysis Excel template

💾 Homeownership cost analysis Excel template template .xls

A Homeownership Cost Analysis Excel template is a structured tool designed to help individuals or families evaluate the financial implications of purchasing a home. It typically includes detailed categories such as mortgage payments, property taxes, insurance, utilities, maintenance, and potential renovations. You can input various scenarios to see how different factors, like interest rates and home prices, affect your overall expenses. This template serves as a foundational guide for managing your homeownership costs while also providing insights for advanced financial modeling, such as net present value calculations and equity analysis.

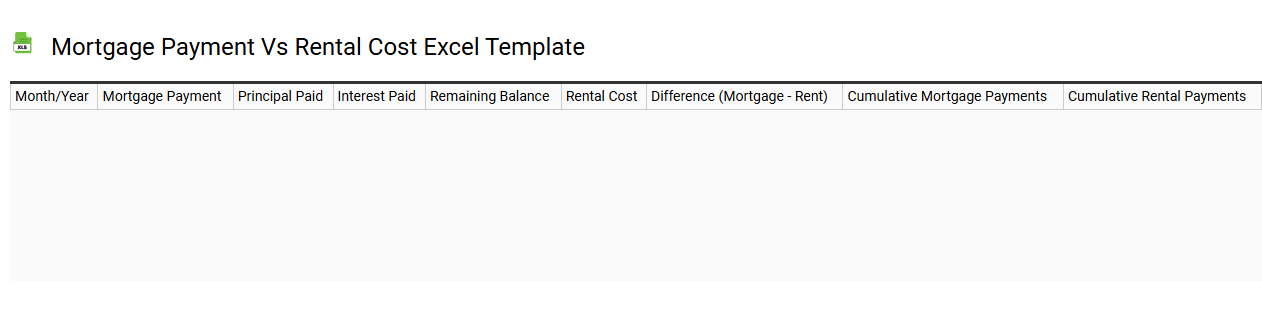

Mortgage payment vs rental cost Excel template

💾 Mortgage payment vs rental cost Excel template template .xls

A Mortgage payment vs rental cost Excel template provides a side-by-side comparison of monthly mortgage payments against rental expenses. This template typically includes input fields for property price, down payment, loan term, interest rate, and monthly rent. It offers clear visualizations, such as graphs or charts, illustrating the differences in costs over time. You can easily adjust variables to see how changes impact financial outcomes, helping you make informed decisions regarding homeownership versus renting, while considering advanced metrics like loan amortization and equity build-up.

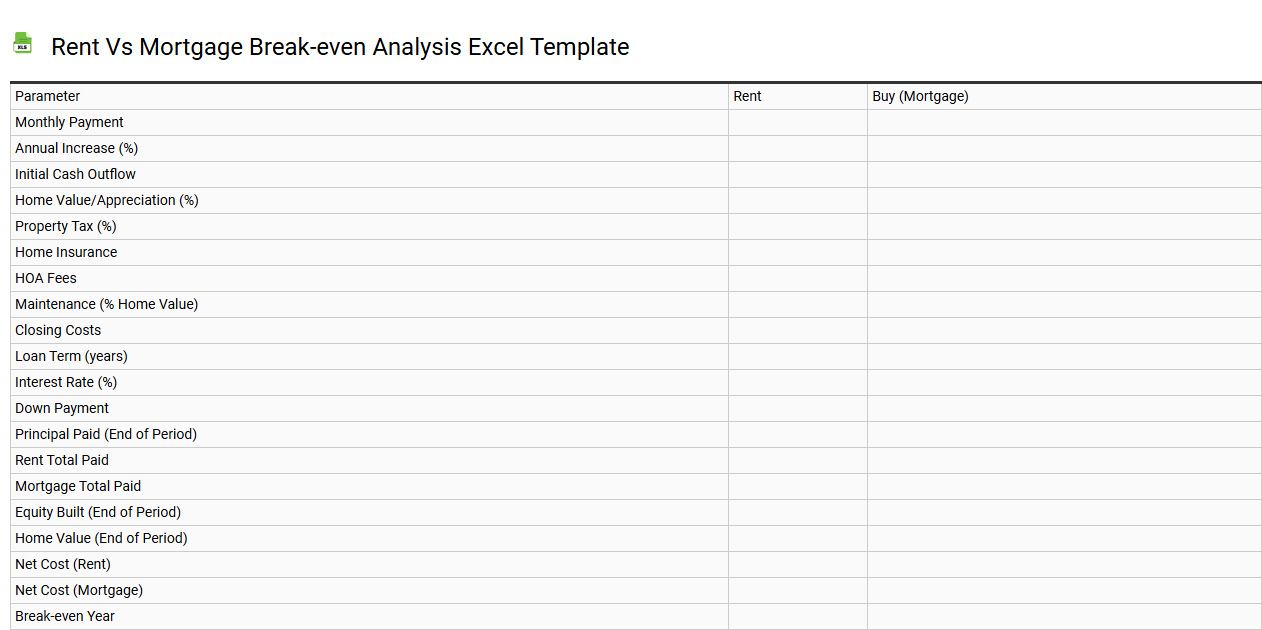

Rent vs mortgage break-even analysis Excel template

💾 Rent vs mortgage break-even analysis Excel template template .xls

A Rent vs. Mortgage Break-Even Analysis Excel template is a powerful tool designed to help individuals determine whether renting or buying a home is more financially advantageous. It typically includes input fields for essential variables such as monthly rent, mortgage payment, property taxes, maintenance costs, and potential home appreciation. By visualizing these costs and comparing them side by side, you can easily identify the break-even point where the total costs of renting equal the costs of homeownership. This template is invaluable for financial decision-making, but you can also expand its capabilities to include advanced financial metrics like net present value (NPV) and internal rate of return (IRR) for deeper insights.

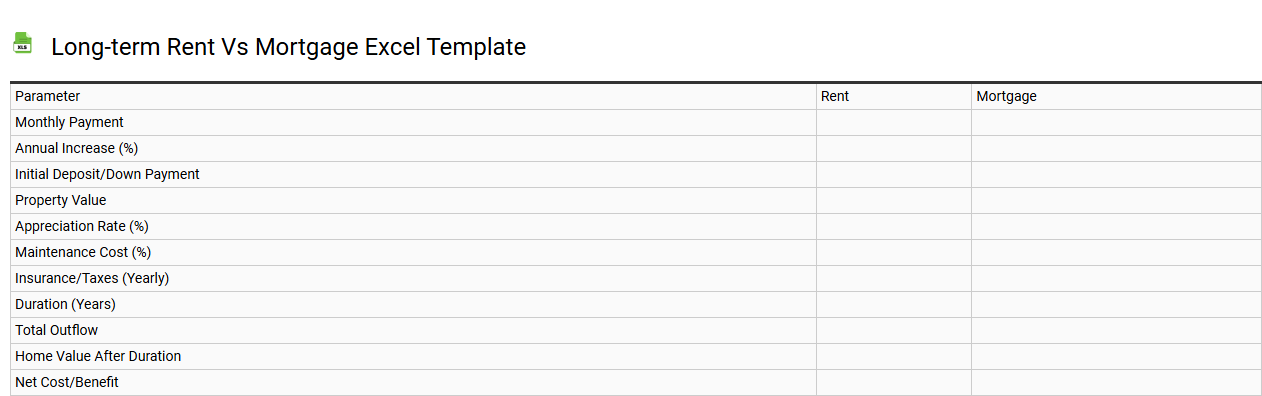

Long-term rent vs mortgage Excel template

💾 Long-term rent vs mortgage Excel template template .xls

A Long-term rent vs mortgage Excel template provides a comprehensive comparison between renting and buying a home over an extended period. It allows you to input variables such as monthly rent, mortgage rates, maintenance costs, and potential appreciation or depreciation of property value. Your calculations will illustrate how total housing costs differ and can guide you in understanding the financial implications of each option. This tool can serve as a foundational analysis, with advanced features like net present value (NPV) calculations and cash flow projections to enhance your decision-making process.

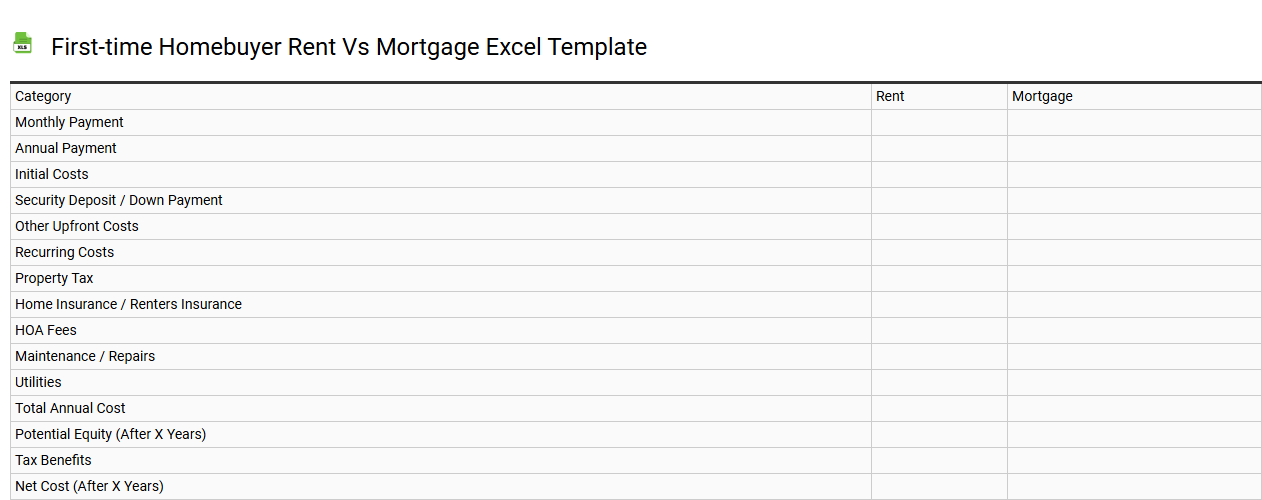

First-time homebuyer rent vs mortgage Excel template

💾 First-time homebuyer rent vs mortgage Excel template template .xls

The First-time Homebuyer Rent vs. Mortgage Excel template is a practical tool designed to help you evaluate the financial implications of renting versus purchasing a home. This template typically includes sections for calculating monthly rent, mortgage payments, property taxes, insurance costs, and potential appreciation of home value. You can input your specific data to see how long it will take for buying to become more cost-effective compared to renting in your unique situation. For basic usage, it provides clear visuals and comparisons, while advanced functionalities could include variables for investment growth, maintenance costs, and long-term financial planning scenarios.