Mortgage affordability calculator Excel templates provide a user-friendly way to assess your financial capability to purchase a home. These templates typically include fields for entering your income, existing debts, and monthly expenses, calculating how much you can afford to borrow based on current interest rates and loan terms. By utilizing these resources, you gain a clear visual representation of your budget, empowering you to make informed decisions about your potential mortgage.

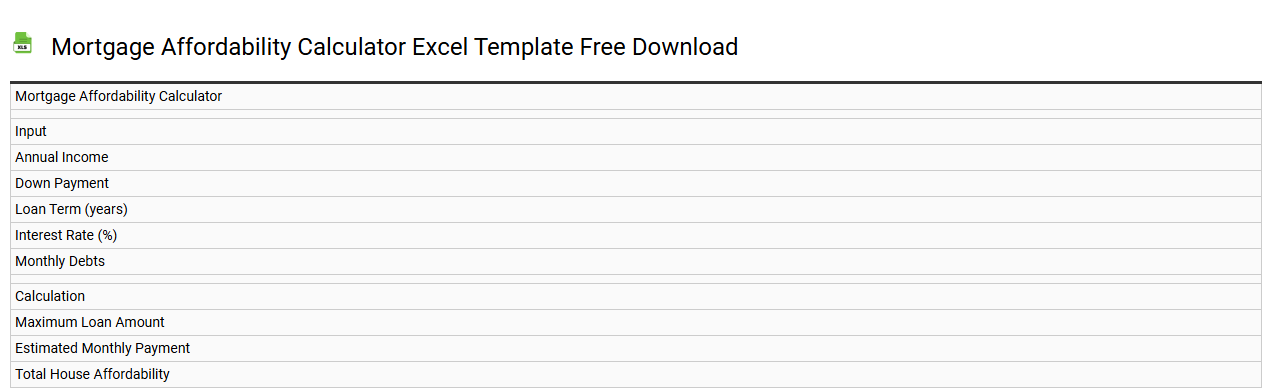

Mortgage affordability calculator Excel template free download

💾 Mortgage affordability calculator Excel template free download template .xls

Mortgage affordability calculator Excel templates enable you to assess your ability to afford a mortgage based on your financial situation. These templates typically include sections for entering your income, monthly expenses, down payment amount, and loan terms. By analyzing the data, the calculator generates estimated mortgage amounts you can handle without straining your finances. This tool provides a basic understanding of your borrowing capacity while also allowing for advanced calculations, such as interest rate fluctuations, amortization schedules, and total interest paid over the loan's life.

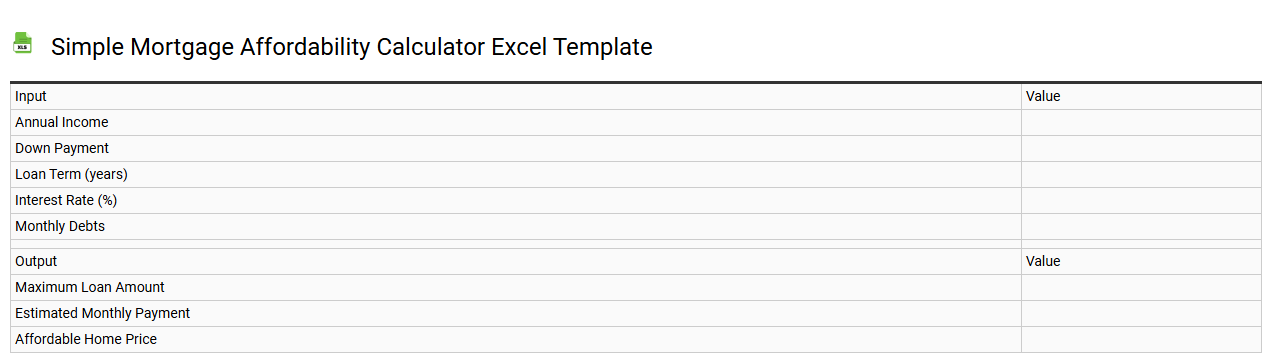

Simple mortgage affordability calculator Excel template

💾 Simple mortgage affordability calculator Excel template template .xls

A simple mortgage affordability calculator Excel template allows you to quickly assess how much you can afford to borrow for a mortgage based on your financial situation. It typically includes fields for inputting your income, monthly expenses, interest rates, and desired loan terms. You can easily manipulate the numbers to see how different factors affect your borrowing capacity. Understanding these financial metrics can help guide your home-buying decision, while more advanced features could involve amortization schedules and tax implications.

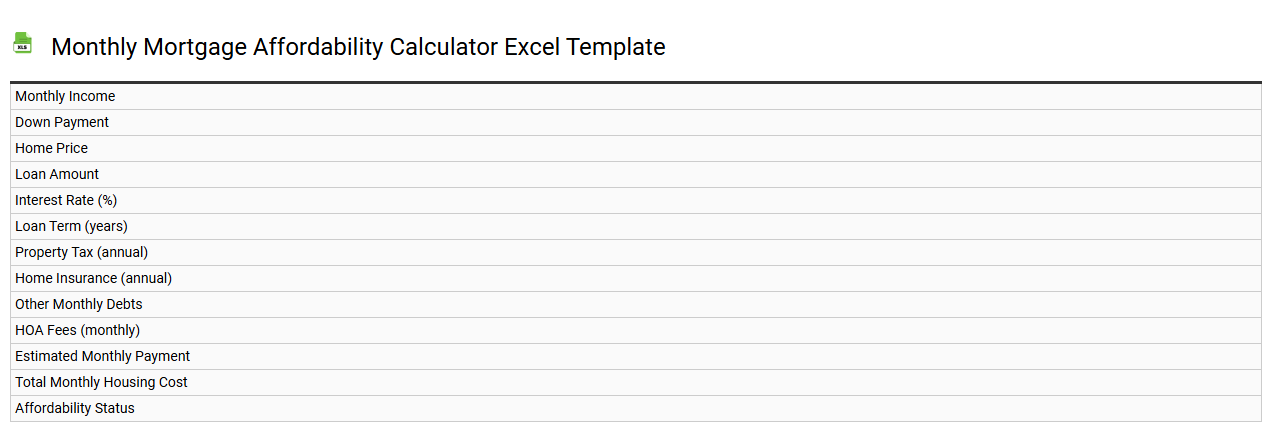

Monthly mortgage affordability calculator Excel template

💾 Monthly mortgage affordability calculator Excel template template .xls

A Monthly Mortgage Affordability Calculator Excel template is a user-friendly tool designed to help individuals assess their ability to afford a mortgage on a monthly basis. This template typically includes fields for you to input critical data such as loan amount, interest rate, term length, and additional expenses like property taxes and insurance. Results generated by the calculator provide a clear breakdown of your monthly payments and associated costs, offering insights into your financial readiness for homeownership. Beyond basic monthly calculations, this template can serve advanced needs, such as sensitivity analysis or scenario modeling for different loan conditions and payment strategies.

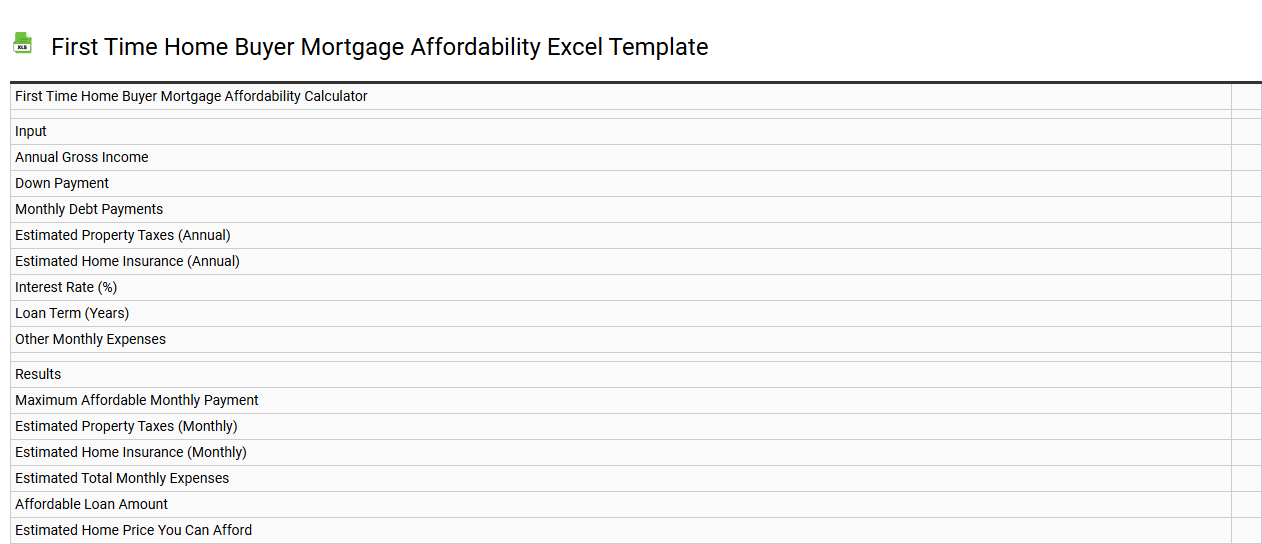

First time home buyer mortgage affordability Excel template

💾 First time home buyer mortgage affordability Excel template template .xls

A First-time Home Buyer Mortgage Affordability Excel template serves as a useful tool for calculating your potential mortgage affordability based on various financial inputs. This template incorporates factors such as your income, debt-to-income ratio, down payment amount, and prevailing interest rates to help you understand what price range you should consider when shopping for a home. You can easily customize the spreadsheet to enter your specific financial details, which will allow for real-time calculations of monthly payments and total loan costs. This simple yet effective tool lays the groundwork for more complex analyses, accommodating additional variables like PMI, property taxes, and homeowners insurance for comprehensive financial planning.

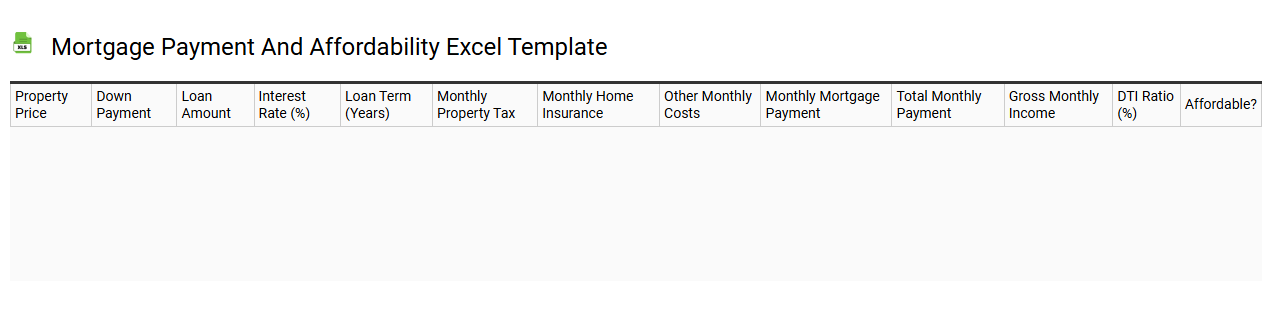

Mortgage payment and affordability Excel template

💾 Mortgage payment and affordability Excel template template .xls

A Mortgage payment and affordability Excel template is a customizable spreadsheet tool designed to help you calculate and assess your mortgage payments and overall affordability. This template typically includes fields for entering loan amount, interest rate, loan term, property taxes, and insurance costs, giving you a clear picture of monthly expenses. It provides a user-friendly interface to calculate not only principal and interest payments, but also comprehensive affordability analysis based on your income and financial obligations. This tool can further assist you in evaluating additional mortgage scenarios or investment pathways, as you explore concepts like amortization schedules and interest rate fluctuations.

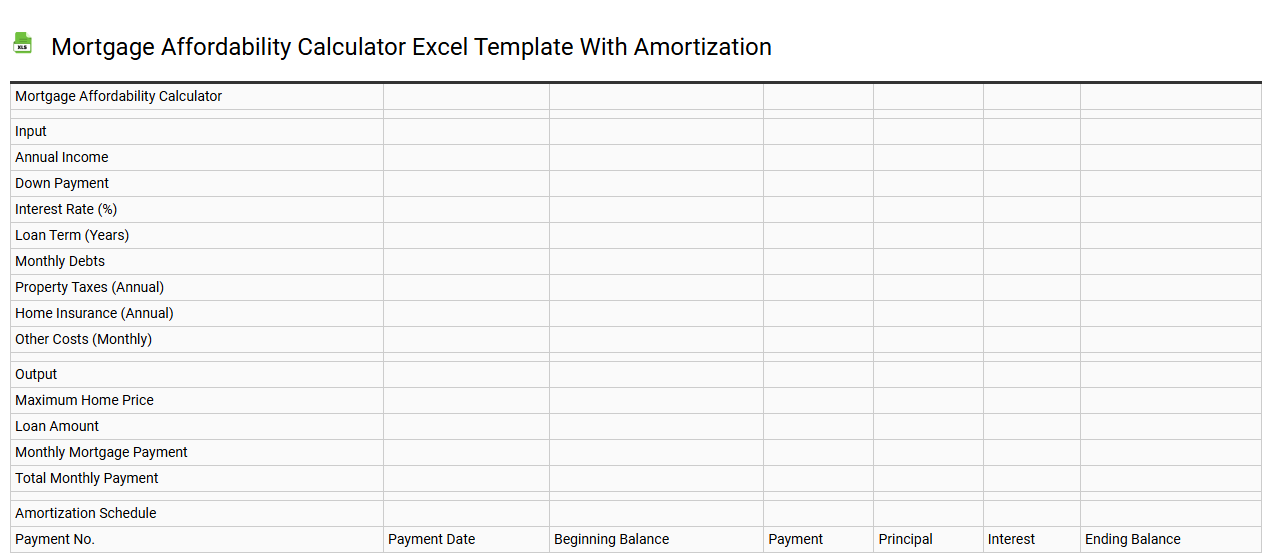

Mortgage affordability calculator Excel template with amortization

💾 Mortgage affordability calculator Excel template with amortization template .xls

A Mortgage affordability calculator Excel template with amortization is a practical tool that helps individuals assess their ability to finance a mortgage. This template typically includes input fields for key variables such as loan amount, interest rate, loan term, and monthly income. It calculates monthly payments, provides an amortization schedule, and forecasts how payments affect the principal balance over time. You can use this template to gain insights into your financial situation and explore advanced features like tax implications and potential investment returns.

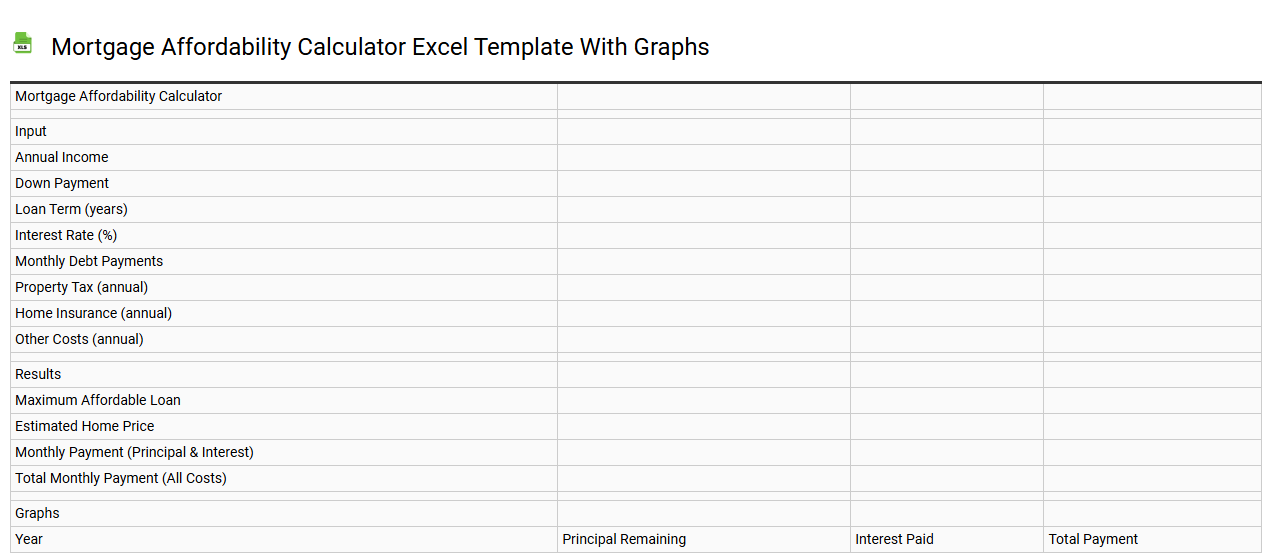

Mortgage affordability calculator Excel template with graphs

💾 Mortgage affordability calculator Excel template with graphs template .xls

A Mortgage affordability calculator Excel template enables you to assess your financial readiness for homeownership by estimating monthly payments based on various factors. This tool typically includes input fields for loan amount, interest rate, loan term, and your income, allowing for a personalized calculation of affordability. You can visualize data trends with graphs that represent payment schedules, interest versus principal over time, and total cost analysis. For further financial planning, consider expanding its functionality to include advanced metrics such as debt-to-income ratios and amortization breakdowns.

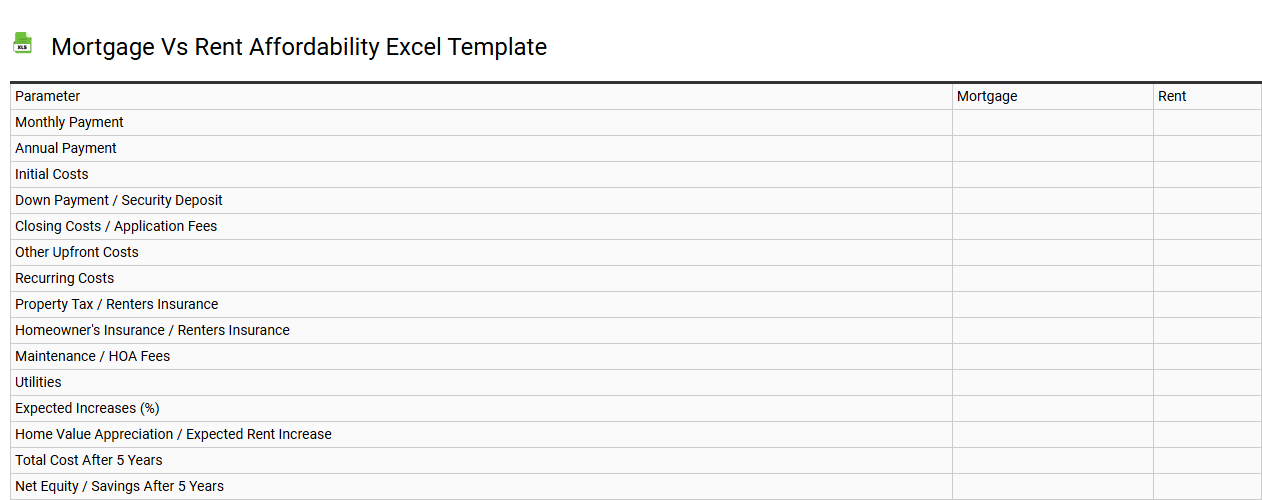

Mortgage vs rent affordability Excel template

💾 Mortgage vs rent affordability Excel template template .xls

A Mortgage vs Rent Affordability Excel template provides a structured way to compare the financial implications of renting versus purchasing a home. It typically includes inputs for current rental prices, mortgage rates, down payment amounts, property taxes, and maintenance costs. By calculating monthly expenses, this tool enables you to visualize long-term costs, equity growth, and potential tax benefits associated with home ownership. As you evaluate your living situation, this template can serve as a foundation for more advanced financial analyses, such as net present value (NPV) calculations and cash flow projections.

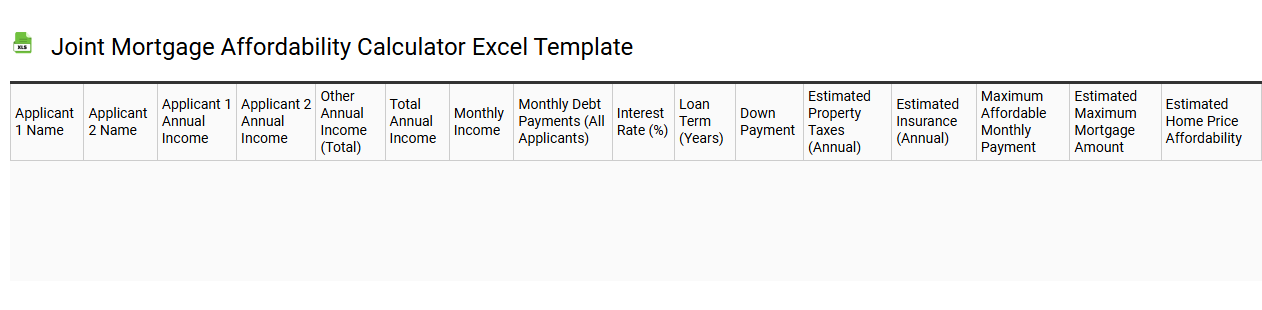

Joint mortgage affordability calculator Excel template

💾 Joint mortgage affordability calculator Excel template template .xls

A Joint Mortgage Affordability Calculator Excel template helps individuals or couples assess their ability to secure a mortgage together. This tool allows you to input various financial details, such as income, expenses, and debts, to calculate the total amount you can borrow. It also factors in interest rates and mortgage terms, providing a clear picture of monthly repayments. Understanding this information is crucial for making informed decisions about homeownership and planning for future financial obligations, including potential needs for more complex financial tools like amortization schedules or scenario analysis.

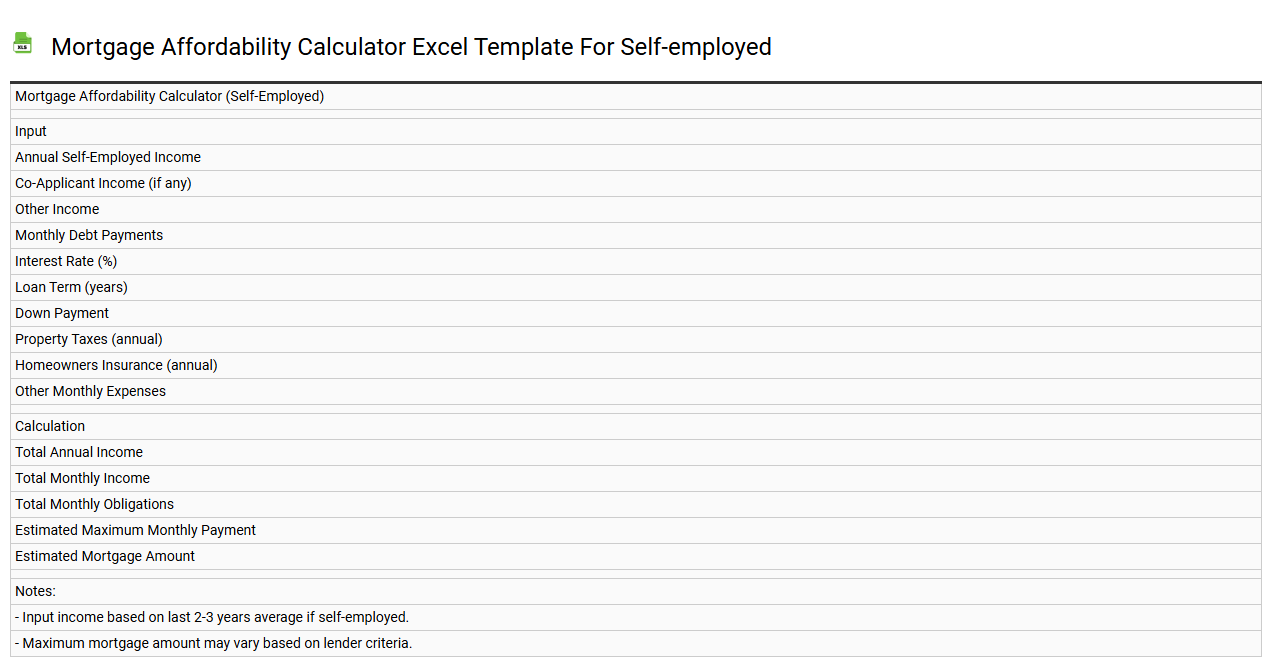

Mortgage affordability calculator Excel template for self-employed

💾 Mortgage affordability calculator Excel template for self-employed template .xls

A Mortgage Affordability Calculator Excel template for self-employed individuals is a financial tool designed to assess your borrowing capacity based on variable income patterns. It takes into account your gross income, existing debts, monthly expenses, and credit score to provide a clearer picture of your mortgage eligibility. This template simplifies complex calculations by incorporating formulas that automatically adjust for your income fluctuations, making it easier to gauge how much you can afford. You can customize it further to add additional scenarios such as varying interest rates or loan terms, enhancing your planning for future investment opportunities or refinancing options.