Track fluctuations in interest rates effortlessly with the Interest Rate Change Tracker Excel template. This user-friendly template allows you to input different rates, making it easy to visualize trends over time through clear charts and graphs. With customizable fields, you can tailor the template to your specific financial needs, keeping your data organized and accessible.

Interest rate change tracker Excel template for mortgages

![]()

💾 Interest rate change tracker Excel template for mortgages template .xls

An Interest Rate Change Tracker Excel template for mortgages is a specialized spreadsheet designed to monitor fluctuations in interest rates over time, particularly for mortgage loans. It enables users to input current rates, track historical changes, and visualize trends through charts or graphs. This tool can assist you in assessing the potential impact of rate changes on monthly payments and overall loan costs. You can also expand its capabilities to include advanced features like predictive modeling, scenario analysis, or automated alerts for when rates hit a specific threshold.

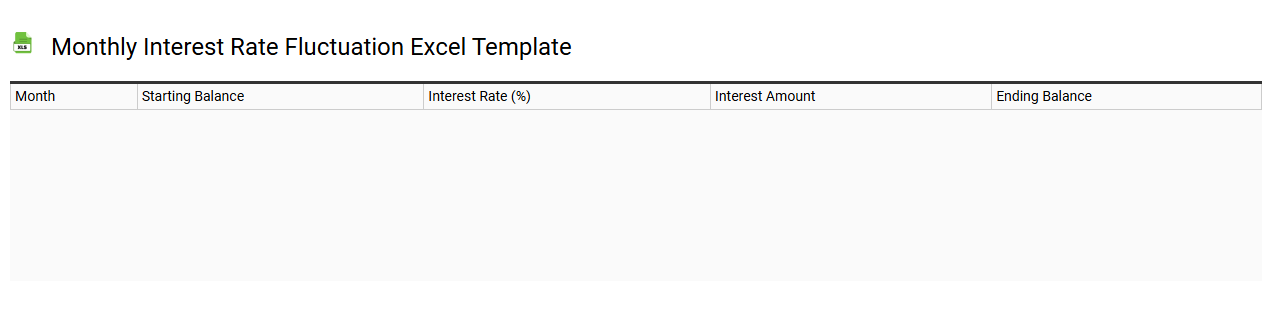

Monthly interest rate fluctuation Excel template

💾 Monthly interest rate fluctuation Excel template template .xls

A Monthly Interest Rate Fluctuation Excel template provides a structured way to track and analyze changes in interest rates over a given period. It typically includes sections for inputting initial interest rates, monthly variations, and the resulting calculations of accrued interest. Users can visualize trends through charts, which makes identifying patterns and forecasting easier. This template proves useful for both personal finance tracking and more complex financial modeling needs, including risk assessment and investment strategy optimization.

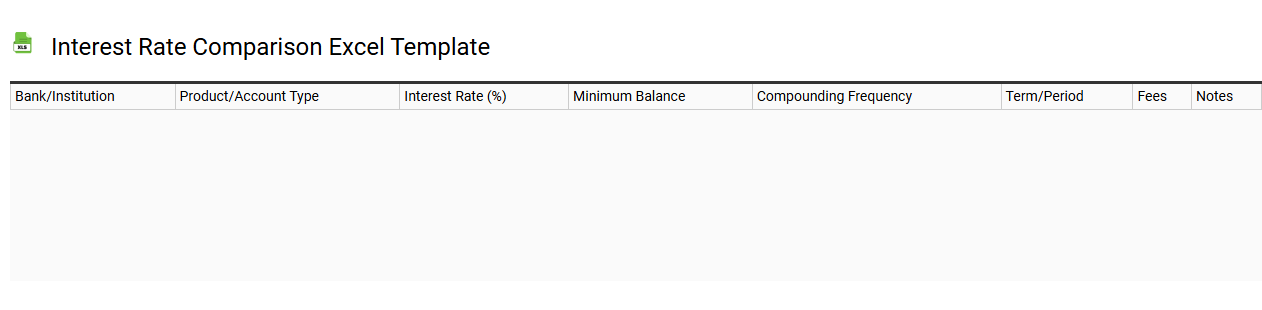

Interest rate comparison Excel template

💾 Interest rate comparison Excel template template .xls

An Interest Rate Comparison Excel template serves as a tool to analyze and compare different interest rates across various financial products, such as loans, savings accounts, or credit cards. Users can input diverse data points, including principal amounts, interest rates, and loan terms, to easily visualize potential costs or earnings over time through charts and tables. This template empowers you to make informed financial decisions by illustrating how rate variations impact overall expenses or returns. Basic usage includes simple calculations, while advanced needs might involve incorporating amortization schedules, net present value calculations, or sensitivity analyses to enhance your financial modeling.

Bank interest rate tracking Excel template

![]()

💾 Bank interest rate tracking Excel template template .xls

A Bank interest rate tracking Excel template serves as a dynamic tool to monitor and analyze various interest rates over time. You can input different bank rates, such as savings accounts, loans, and mortgages, enabling you to visualize trends and make informed financial decisions. This template typically includes features such as graphs, automatic calculations, and comparison sections for different institutions. Basic usage can be expanded to incorporate advanced functionalities like dynamic financial modeling or predictive analytics based on historical data.

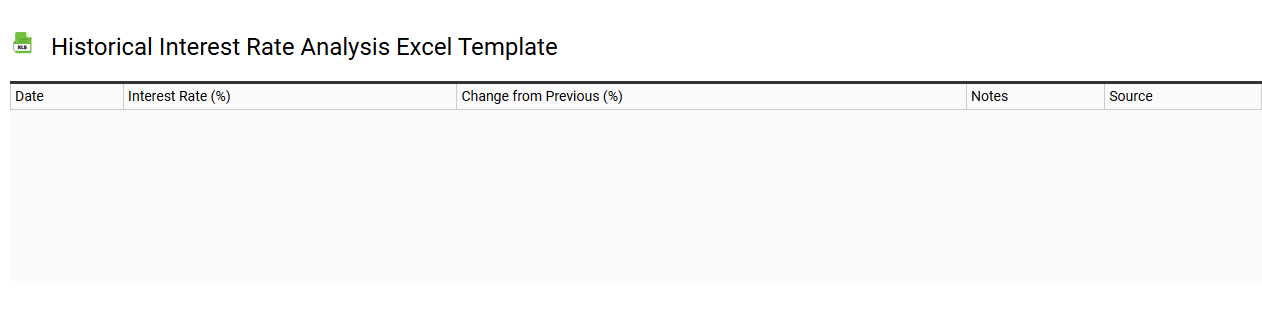

Historical interest rate analysis Excel template

💾 Historical interest rate analysis Excel template template .xls

A Historical Interest Rate Analysis Excel template serves as a powerful tool for tracking and evaluating past interest rates over a specified period. It typically includes a structured format for entering various rates, such as central bank rates, mortgage rates, and bond yields, allowing you to visualize trends and fluctuations. Users can analyze data through comprehensive charts and graphs, enabling them to identify patterns that may influence future financial decisions. This template can cater to basic needs, while its advanced functionalities may encompass predictive modeling and scenario analysis for in-depth financial forecasting.

Personal loan interest rate tracker Excel template

![]()

💾 Personal loan interest rate tracker Excel template template .xls

A Personal Loan Interest Rate Tracker Excel template allows you to monitor and manage your loan's interest rates effectively. This tool typically features columns for loan types, principal amounts, interest rates, payment schedules, and total interest paid. You can quickly visualize how fluctuations in interest rates affect your overall payment, making it easier to identify the best refinancing options. Understanding how to utilize this template can help you make informed financial decisions and consider advanced strategies like amortization calculations or rate trend analysis.

Credit card interest rate change tracker Excel template

![]()

💾 Credit card interest rate change tracker Excel template template .xls

A Credit Card Interest Rate Change Tracker Excel template is a useful tool designed to help you monitor fluctuations in interest rates across different credit cards. This template allows you to input various details such as card issuer, current interest rates, and any announced changes, enabling you to keep precise records over time. You can visually track trends and compare rates side by side, which can assist you in making informed financial decisions. Beyond basic tracking, you might explore advanced features like forecasting potential costs and analyzing the impact of varying rates on your overall debt repayment strategy.

Adjustable rate mortgage interest tracking Excel template

![]()

💾 Adjustable rate mortgage interest tracking Excel template template .xls

An Adjustable Rate Mortgage (ARM) interest tracking Excel template is a financial tool designed to help you monitor and manage the interest rates and payments associated with an ARM. This template typically includes sections for entering your loan details, current interest rates, payment schedules, and projections for future rate adjustments. Users can visualize changes in monthly payments based on fluctuating interest rates, which provides valuable insights for financial planning. Such a template can serve basic tracking needs while offering advanced features like scenario analysis or integration with mortgage amortization tables for comprehensive management.

Daily interest rate change tracker Excel template

![]()

💾 Daily interest rate change tracker Excel template template .xls

A Daily Interest Rate Change Tracker Excel template is a specialized tool designed to help you monitor fluctuations in interest rates on a day-to-day basis. This template typically includes columns for the date, interest rates, and any accompanying notes about changes or market conditions. It allows you to visualize trends over time, making it easier to analyze how shifting rates may impact your financial decisions, such as loans or investments. Beyond basic tracking, you can expand its functionality to incorporate statistical analyses or predictive modeling, enabling more sophisticated financial forecasting or risk assessment strategies.

Adjustable interest rate tracker Excel template

![]()

💾 Adjustable interest rate tracker Excel template template .xls

An Adjustable Interest Rate Tracker Excel template allows you to monitor and analyze variable interest rates over time. This user-friendly platform displays crucial data, including rates, payment schedules, and amortization details, helping you understand how adjustments affect your financial commitments. You can customize the template by inputting specific loan terms, interest rate caps, and payment frequency, thereby tailoring it to your unique situation. Understanding the basics of this template opens doors for advanced financial modeling, such as sensitivity analysis and cash flow projections for varying interest rate scenarios.

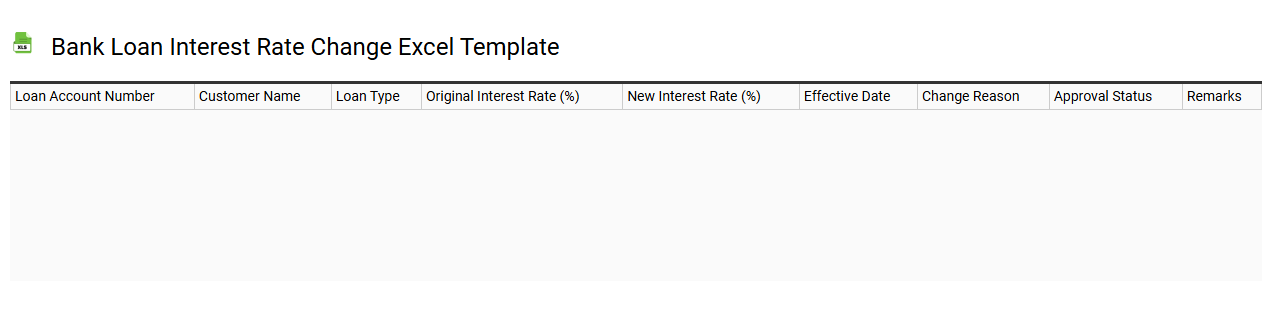

Bank loan interest rate change Excel template

💾 Bank loan interest rate change Excel template template .xls

A Bank loan interest rate change Excel template allows users to calculate and analyze the effects of varying interest rates on loan repayments. This template can include input fields for principal amount, loan term, current interest rate, and potential future rates. You can visualize the changes through charts that display monthly payments, total interest paid, and amortization schedules. This tool is invaluable for managing your financial planning and forecasting, especially when considering future adjustments and understanding complex concepts like amortization and loan refinancing options.

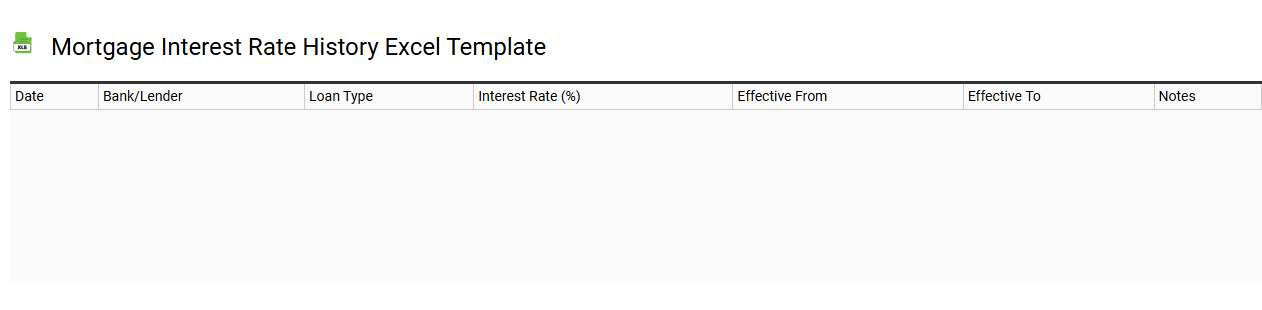

Mortgage interest rate history Excel template

💾 Mortgage interest rate history Excel template template .xls

A Mortgage Interest Rate History Excel template serves as a powerful tool for analyzing fluctuations in mortgage rates over time. This customizable spreadsheet includes columns for date, mortgage type, interest rates, and average values, allowing you to track trends and perform in-depth analysis. You can visualize the data through graphs or charts, enhancing your ability to identify patterns relevant to your financial decisions. By maintaining this comprehensive record, you can better navigate your current mortgage choices and consider future options such as refinancing or investment strategies involving advanced financial instruments like adjustable-rate mortgages (ARMs) or high-leverage mortgage products.

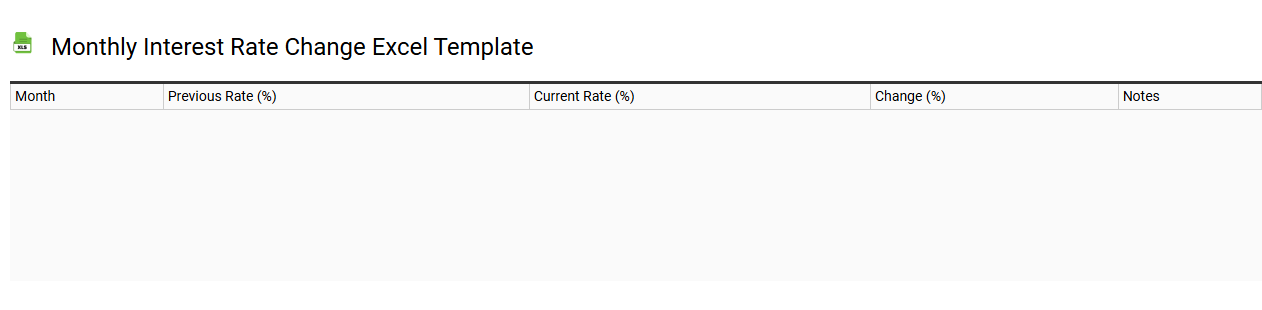

Monthly interest rate change Excel template

💾 Monthly interest rate change Excel template template .xls

The Monthly Interest Rate Change Excel template is a versatile tool designed to help you track and analyze fluctuations in interest rates over a specified period. Users can input different interest rates and view how these changes impact loan payments or investment returns. This template allows for easy visualization through graphs, displaying the trend and enabling informed financial decisions. You can utilize the template for basic rate tracking or explore advanced analytics such as sensitivity analysis and scenario modeling for comprehensive financial assessments.

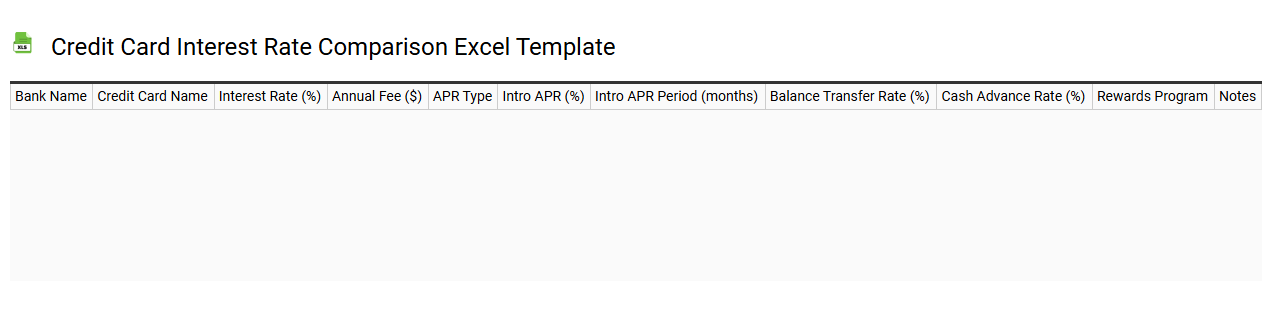

Credit card interest rate comparison Excel template

💾 Credit card interest rate comparison Excel template template .xls

A Credit Card Interest Rate Comparison Excel template is a tool designed to help users analyze and compare the interest rates of various credit cards easily. It typically includes columns for the card issuer, annual percentage rate (APR), fees, rewards, and other relevant features, allowing for a clear side-by-side comparison. You can input your spending habits and payment preferences to see how different cards would impact your overall financial situation. This tool not only aids in selecting the best credit card but also serves as a foundation for advanced financial planning, such as calculating total interest costs or optimizing your credit strategy with options like balance transfers or rewards maximization.

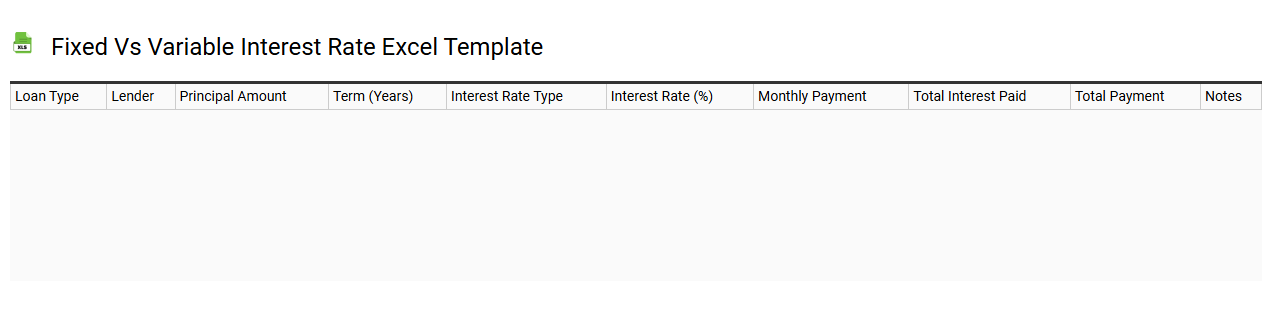

Fixed vs variable interest rate Excel template

💾 Fixed vs variable interest rate Excel template template .xls

A Fixed vs Variable Interest Rate Excel template provides a structured framework to analyze and compare fixed and variable interest rates on loans or investments. This template typically includes sections for inputting initial loan amounts, interest rates, and loan durations, allowing you to visualize payment schedules and total interest paid over time. You can adjust variables to see how changes in interest rates impact overall financial commitments and see clear charts that illustrate potential savings or costs. Understanding these distinctions helps you manage your finances, with basic usage suitable for budgeting and further potential for complex financial modeling with advanced metrics like net present value and amortization schedules.

Savings account interest rate tracker Excel template

![]()

💾 Savings account interest rate tracker Excel template template .xls

A Savings Account Interest Rate Tracker Excel template is a tool designed to help you monitor and analyze interest rates on various savings accounts over time. It typically includes columns for bank names, account types, interest rates, and the duration of each rate, allowing for easy comparison. This template enables you to visualize trends in interest rates, helping you make more informed decisions about where to store your savings. Beyond basic tracking, you may find advanced features such as forecasting, scenario analysis, and visual graphs to enhance your financial strategy.

Historical interest rate trend Excel template

💾 Historical interest rate trend Excel template template .xls

A Historical Interest Rate Trend Excel template captures and visualizes the fluctuations in interest rates over time. It allows you to input data for various types of interest rates, such as mortgage rates, federal funds rates, or savings account rates, providing an organized way to track changes. Graphical representations, such as line charts, enhance your understanding of trends and patterns, showcasing periods of stability or volatility. This template can meet basic financial analysis needs while also serving as a foundation for more advanced tasks, such as econometric modeling or predictive analytics.