Explore a variety of free XLS templates designed for mortgage payment comparison. This specific template helps you analyze different mortgage options by comparing interest rates, loan amounts, and terms side-by-side. With built-in formulas, you can easily calculate your monthly payments and total interest paid, ensuring you make informed financial decisions.

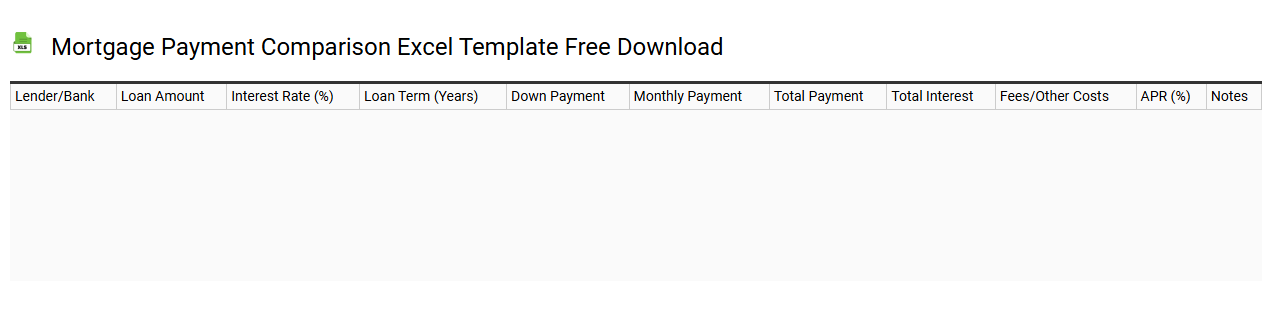

Mortgage payment comparison Excel template free download

💾 Mortgage payment comparison Excel template free download template .xls

A Mortgage Payment Comparison Excel template allows you to analyze and compare different mortgage options effectively. This tool typically includes features such as input fields for loan amounts, interest rates, loan terms, and additional costs like insurance and property taxes. It calculates monthly payments and visualizes the overall cost of each mortgage option over time, helping you make informed financial decisions. You can easily adjust parameters to simulate various scenarios, catering to both basic mortgage calculations and more advanced analyses, such as amortization schedules or interest cost over the life of the loan.

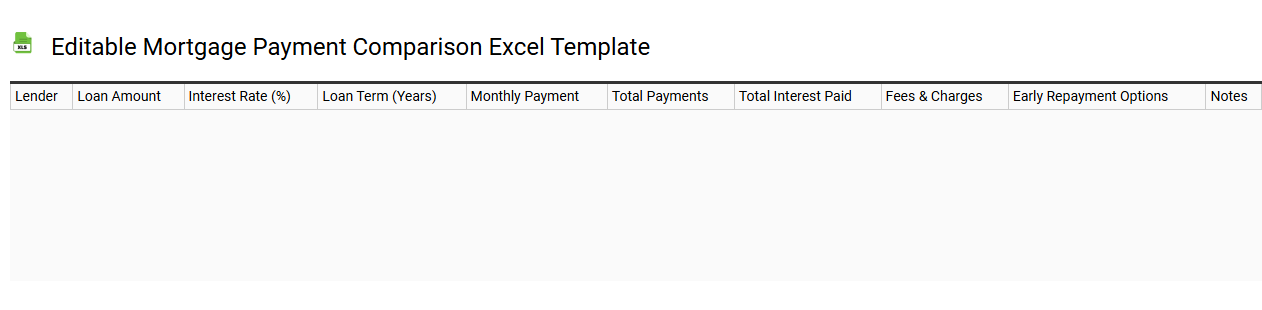

Editable mortgage payment comparison Excel template

💾 Editable mortgage payment comparison Excel template template .xls

An editable mortgage payment comparison Excel template is a customizable spreadsheet designed to help you analyze and compare different mortgage loan options. This template typically includes fields for interest rates, loan amounts, terms, and monthly payments, allowing you to see how changes in these variables impact your financial obligations. Graphs and charts may also be included for visual representation, helping in understanding amortization schedules and total interest paid over the loan's lifetime. You can use this tool to make informed decisions based on your specific financial situation and long-term goals, while potential advanced features can include adjustable scenarios, tax implications, and investment comparisons.

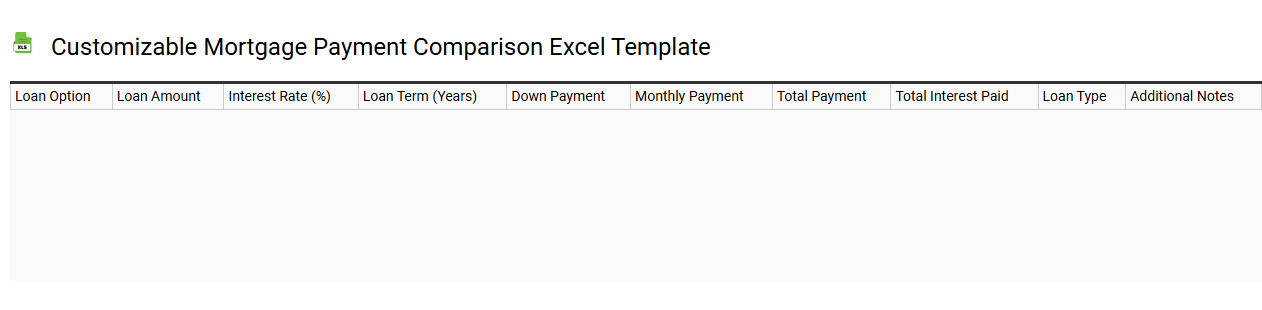

Customizable mortgage payment comparison Excel template

💾 Customizable mortgage payment comparison Excel template template .xls

A customizable mortgage payment comparison Excel template is a versatile tool designed to help you analyze different mortgage options systematically. It allows for easy input of various loan parameters such as interest rates, loan amounts, and terms, giving you a clear visual representation of monthly payments and total costs. By manipulating these variables, you can assess how changes impact your financial commitments and overall affordability. This template can serve as a foundational resource for basic calculations or be adapted for more complex scenarios like varying interest rates, amortization schedules, and tax implications.

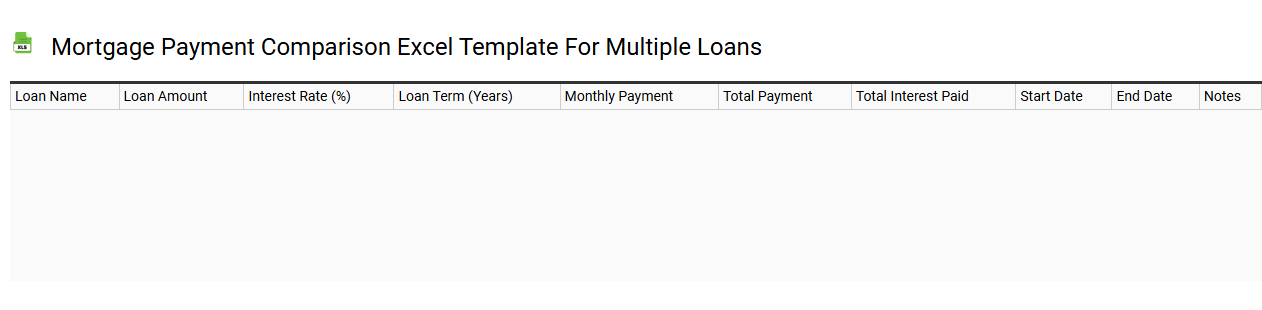

Mortgage payment comparison Excel template for multiple loans

💾 Mortgage payment comparison Excel template for multiple loans template .xls

A mortgage payment comparison Excel template for multiple loans allows you to evaluate and contrast the monthly payments of different mortgage options side by side. You can input key data such as loan amounts, interest rates, loan terms, and any additional fees, giving you a clear view of the financial implications of each choice. Visual elements like graphs and charts enhance understanding, allowing you to quickly identify which loan is more favorable based on total cost and payment structure. This tool can be further enhanced with complex financial calculations, such as amortization schedules and sensitivity analysis for varying interest rates or payment frequencies.

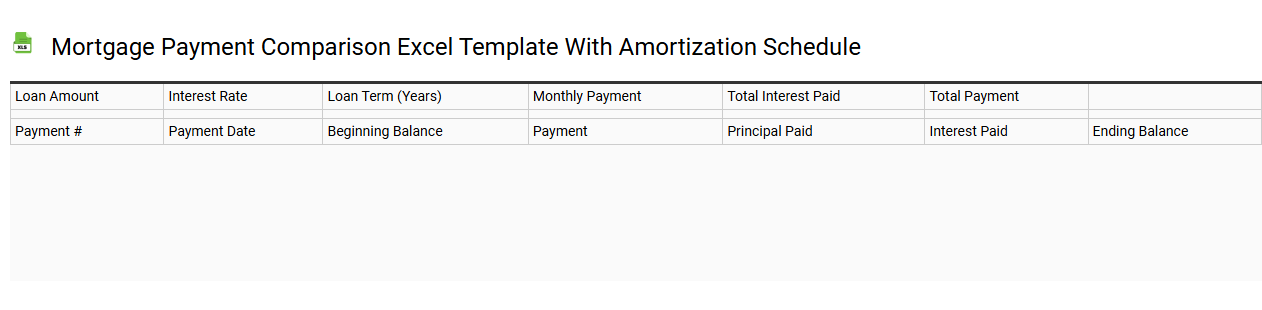

Mortgage payment comparison Excel template with amortization schedule

💾 Mortgage payment comparison Excel template with amortization schedule template .xls

A Mortgage payment comparison Excel template with an amortization schedule allows you to evaluate different mortgage options side by side. This template typically includes columns for loan amounts, interest rates, loan terms, and monthly payment calculations. Amortization schedules provide a clear breakdown of principal and interest payments over the life of the loan, helping you visualize how your balance decreases over time. You can enhance your analysis by incorporating additional features, such as adjusting payment frequency, tax implications, or comparing fixed versus adjustable-rate mortgages.

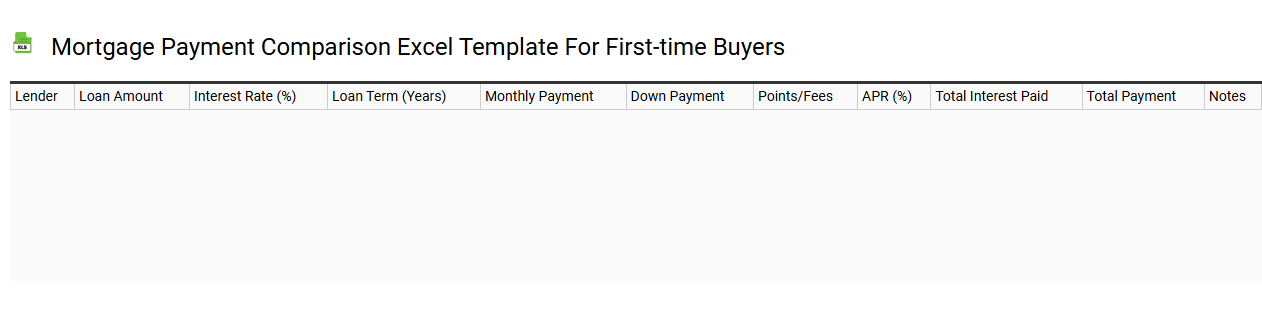

Mortgage payment comparison Excel template for first-time buyers

💾 Mortgage payment comparison Excel template for first-time buyers template .xls

A Mortgage payment comparison Excel template for first-time buyers serves as a practical tool to evaluate different mortgage options easily. This template typically allows you to input various parameters such as loan amounts, interest rates, and loan terms, generating clear breakdowns of monthly payments, total interest, and amortization schedules. You can visually compare multiple mortgage scenarios side-by-side, making informed decisions about which mortgage aligns with your financial goals. For basic usage, you can customize it to track your current mortgage options, while advanced users may integrate features like tax implications and future cash flow projections.

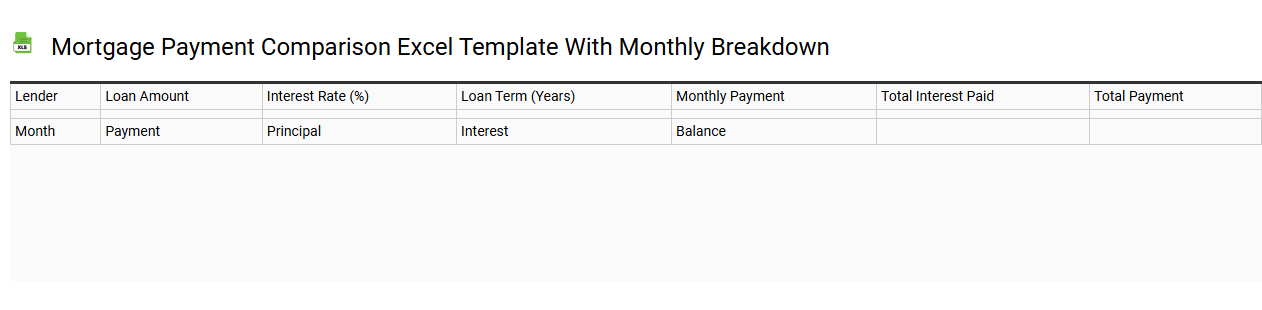

Mortgage payment comparison Excel template with monthly breakdown

💾 Mortgage payment comparison Excel template with monthly breakdown template .xls

A Mortgage payment comparison Excel template offers a detailed analysis of various mortgage options, highlighting monthly payments, interest rates, loan terms, and total repayment amounts. Users input different loan scenarios, and the template generates a clear breakdown of your monthly obligations, allowing you to compare the cost-effectiveness of each option at a glance. The visual charts and graphs enhance understanding by displaying how payments adjust over time, including principal and interest portions. This tool not only assists in basic mortgage decision-making but also addresses advanced financial strategies such as refinancing, equity building, and amortization schedules.

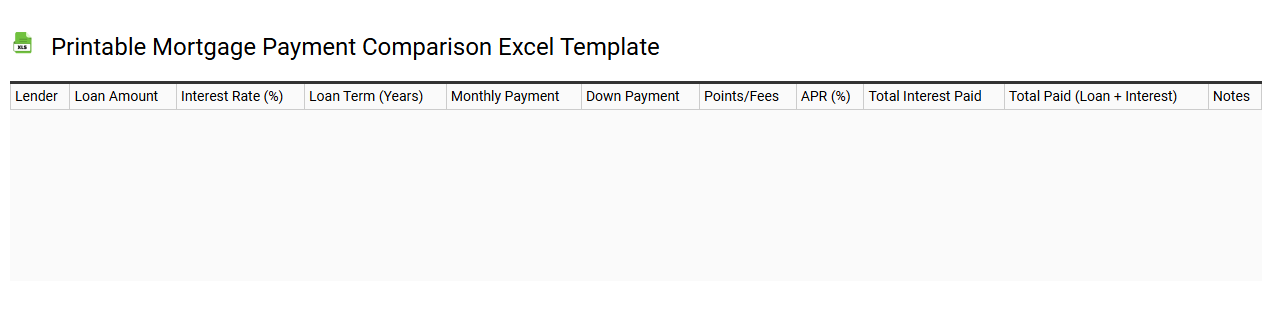

Printable mortgage payment comparison Excel template

💾 Printable mortgage payment comparison Excel template template .xls

A printable mortgage payment comparison Excel template is a user-friendly tool designed to help you analyze various mortgage options easily. This template allows you to input different loan amounts, interest rates, and term lengths, automatically calculating monthly payments for each scenario. Visual aids, such as graphs and charts, present the data clearly, enabling you to see how different factors influence your overall payment. You can use this resource for basic mortgage calculations or expand its potential by including advanced financial metrics, like amortization schedules and total interest paid over the loan term.

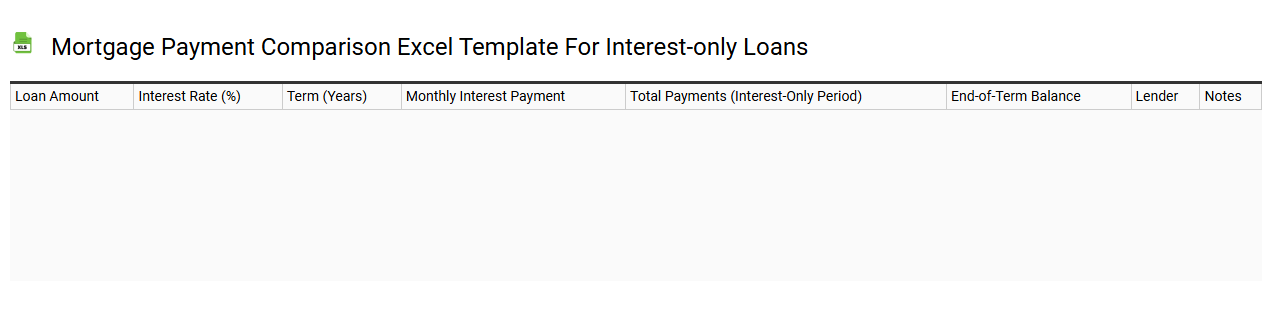

Mortgage payment comparison Excel template for interest-only loans

💾 Mortgage payment comparison Excel template for interest-only loans template .xls

A Mortgage payment comparison Excel template for interest-only loans provides a structured way to analyze payment options for mortgage borrowers. This tool allows users to input variables such as loan amount, interest rate, and loan term to compare different interest-only mortgage scenarios, helping you visualize the long-term financial impact. Key features typically include amortization schedules, total interest paid over the loan term, and the ability to switch between fixed and variable interest rates. This template can be useful for simplifying complex financial decisions and can evolve to include advanced functions like cash flow forecasting or incorporating taxes and insurance estimates.