A mortgage balance tracker Excel template allows you to efficiently monitor your mortgage payments and track the outstanding balance over time. With built-in formulas, you can easily input your payment amounts, interest rates, and payment dates to see how much you owe. This user-friendly template helps you visualize your progress towards paying off your mortgage, empowering you to stay on top of your financial goals.

Mortgage balance tracker Excel template free download

![]()

💾 Mortgage balance tracker Excel template free download template .xls

A Mortgage Balance Tracker Excel template is a comprehensive tool designed to help you manage and monitor your mortgage payments over time. This template typically includes features for inputting your loan amount, interest rate, monthly payments, and payment frequency. You can visualize your mortgage balance, track progress toward principal reduction, and identify how much interest you've paid. This essential tool not only aids in basic mortgage tracking but can also be tailored to project advanced financial strategies like refinancing or early repayment options.

Simple mortgage balance tracker Excel template

![]()

💾 Simple mortgage balance tracker Excel template template .xls

A Simple Mortgage Balance Tracker Excel template is an efficient tool designed to help homeowners manage and monitor their mortgage balances over time. It typically features sections for inputting important details such as loan amount, interest rate, monthly payment, and payment date. As you input your monthly payments, the template automatically calculates the remaining balance, interest paid, and overall savings, providing a clear picture of your financial progress. This template is particularly useful for tracking your mortgage over time but can also be enhanced with features like amortization schedules or scenario analysis for future refinancing considerations.

Home loan balance tracker Excel template

![]()

💾 Home loan balance tracker Excel template template .xls

The Home Loan Balance Tracker Excel template serves as an organized tool to monitor the remaining balance on your mortgage over time. With dedicated sections for inputting loan details, payment history, and interest rates, it helps you visualize your financial commitments clearly. You can update it regularly to reflect monthly payments, allowing you to see how your principal decreases while interest amounts fluctuate. This template not only provides insights into your current mortgage state but can also be tailored for advanced financial analysis, such as amortization schedules or refinancing scenarios.

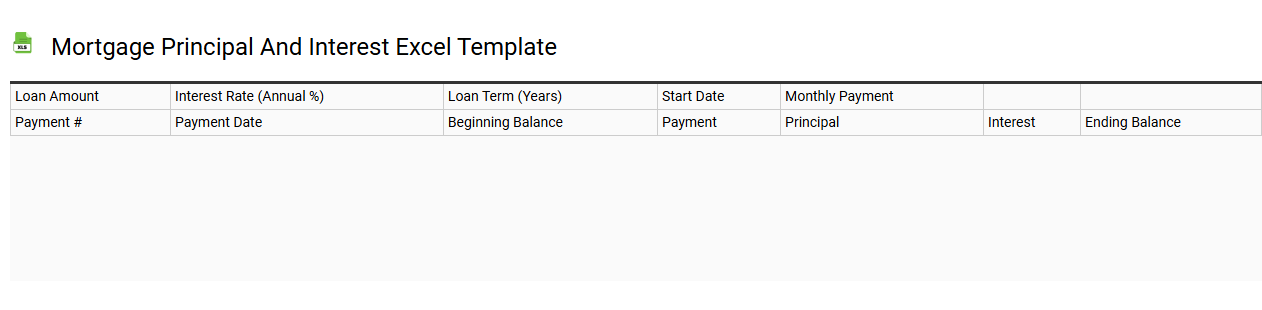

Mortgage principal and interest Excel template

💾 Mortgage principal and interest Excel template template .xls

A Mortgage Principal and Interest Excel template is a customizable spreadsheet designed to help you track and manage your mortgage payments. It typically includes sections for entering details like loan amount, interest rate, loan term, and payment frequency. With this template, you can visualize your monthly payments, seeing the breakdown of principal and interest amounts for each payment period. Such templates can also aid in planning for future financial needs, allowing you to explore advanced features like amortization schedules or prepayment analysis.

Mortgage amortization tracker Excel template

![]()

💾 Mortgage amortization tracker Excel template template .xls

A Mortgage Amortization Tracker Excel template is a customizable tool designed to help you record and manage your mortgage payments over time. It typically includes an amortization schedule that breaks down each payment into principal and interest components, allowing you to see how your balance decreases with each installment. Formulas within the template will automatically calculate remaining balances and payment totals, providing a clear overview of your mortgage journey. This tool can be beneficial for budgeting, planning extra payments, or exploring refinancing options in the future, potentially incorporating advanced concepts like loan-to-value ratio or payment recalculation strategies.

Biweekly mortgage balance tracker Excel template

![]()

💾 Biweekly mortgage balance tracker Excel template template .xls

A biweekly mortgage balance tracker Excel template is a financial tool designed to help you monitor your mortgage repayments made every two weeks. This spreadsheet allows you to input your loan amount, interest rate, and payment data, generating an interactive overview of your outstanding balance over time. You can visualize how additional payments accelerate equity buildup and reduce total interest paid, enhancing your financial planning. This basic tool can evolve into a more comprehensive model for projecting future payments and simulating various repayment strategies, incorporating advanced functions like IRR and NPV for detailed analysis.

Customizable mortgage balance tracker Excel template

![]()

💾 Customizable mortgage balance tracker Excel template template .xls

A customizable mortgage balance tracker Excel template enables users to monitor their mortgage payments, interest rates, and remaining balance over time. This user-friendly tool offers predefined fields for inputting loan details, such as principal amount, interest rate, loan term, and payment frequency. Real-time calculations provide insights into how extra payments or changes in interest rates impact your overall debt and payoff timeline. Perfect for personal finance management, this template can be further enhanced with advanced features like amortization schedules, scenario analysis, and financial forecasting tools.

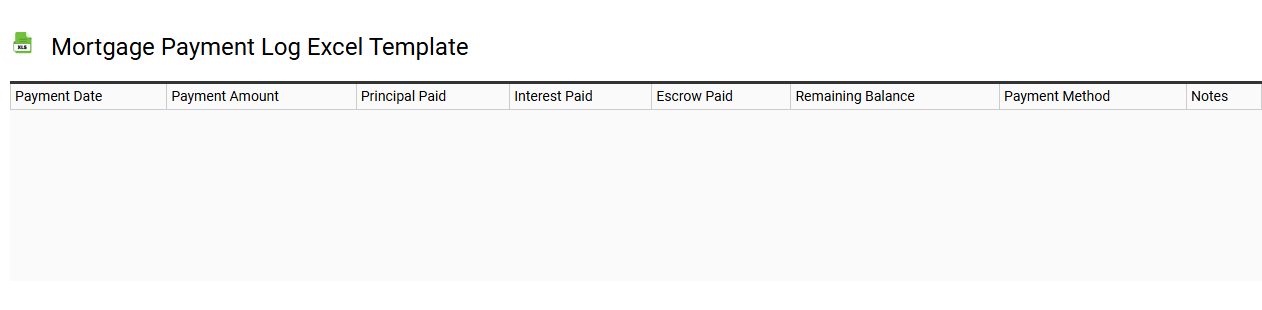

Mortgage payment log Excel template

💾 Mortgage payment log Excel template template .xls

A Mortgage Payment Log Excel template serves as a powerful tool for tracking your mortgage payments over time. It typically includes columns for the payment date, payment amount, principal paid, interest paid, and remaining balance. This structured overview allows you to monitor your mortgage progress, ensuring that you stay organized and informed about your financial commitments. You can utilize this template for basic payment tracking while also customizing it to address advanced needs such as amortization schedules or interest rate adjustments.

Personal mortgage balance tracking Excel template

![]()

💾 Personal mortgage balance tracking Excel template template .xls

A personal mortgage balance tracking Excel template is a customizable spreadsheet designed to help you monitor your mortgage payments, outstanding balance, and interest rates. This tool allows you to input loan details like principal amount, interest rate, and payment schedule, enabling you to visualize your financial trajectory over time. It typically includes features such as amortization schedules, monthly payment calculations, and graphs to illustrate your principal reduction. You can use this template not only for basic tracking of payments but also for further financial planning, assessing refinancing options, or evaluating potential prepayment strategies to save on interest costs.