Discover a collection of free Excel templates tailored for your financial needs, especially the Mortgage Penalty Calculator. This user-friendly template allows you to input key variables such as mortgage amount, interest rate, and remaining term, giving you instant insights into potential penalties. By breaking down complex calculations, it empowers you to make informed decisions regarding your mortgage agreements and potential refinancing options.

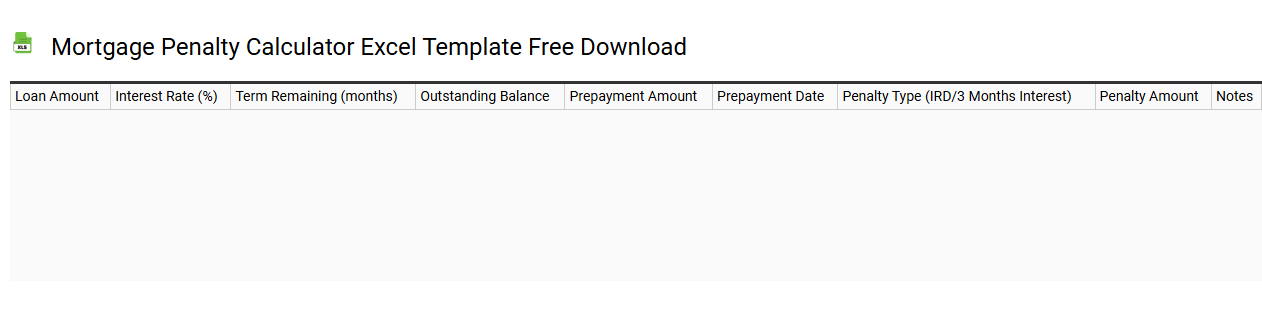

Mortgage penalty calculator Excel template free download

💾 Mortgage penalty calculator Excel template free download template .xls

A Mortgage Penalty Calculator Excel template helps you estimate the fees associated with breaking your mortgage early. You can input key variables such as your remaining balance, interest rate, and term to generate potential penalties from your lender. This tool lets you visualize various scenarios, providing clarity on how different choices impact your financial obligations. You may use this template for quick assessments or deeper financial planning, allowing you to evaluate further needs like pre-payment options or refinancing strategies.

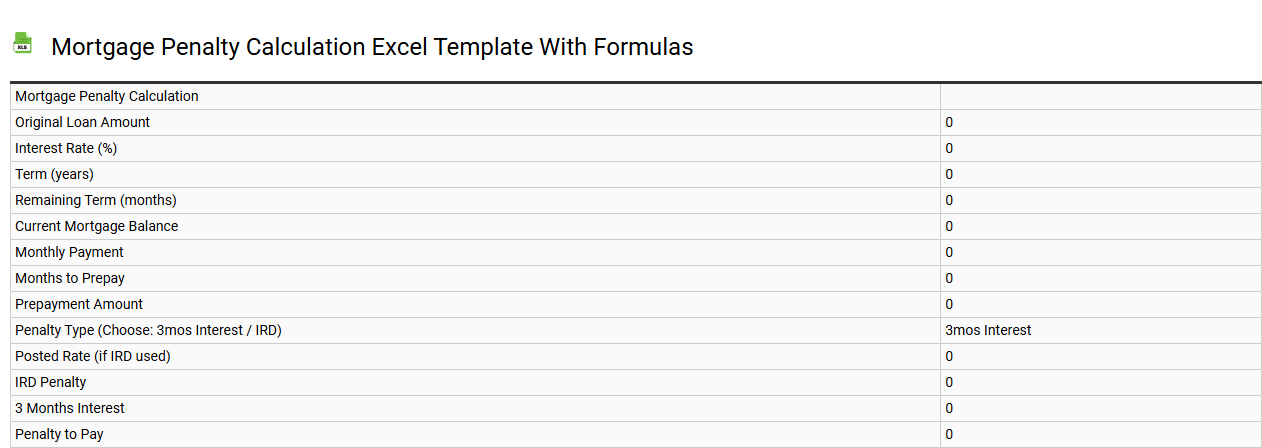

Mortgage penalty calculation Excel template with formulas

💾 Mortgage penalty calculation Excel template with formulas template .xls

A Mortgage penalty calculation Excel template simplifies your understanding of potential penalties for breaking a mortgage agreement early. Key components of the template include inputs for your original mortgage amount, interest rate, remaining time on the term, and the current market interest rates. Calculations may utilize formulas such as: 1. **Interest Rate Differential (IRD)**: `(Current Mortgage Rate - Comparable Rate) x Remaining Balance x Remaining Term in Years` 2. **Three Months' Interest**: `(Annual Mortgage Payment / 12) x 3` These outputs help you estimate your penalty, guiding sound financial decisions. Understanding these foundational principles opens doors to further exploration of amortization schedules, net present value computations, and more advanced risk assessment techniques.

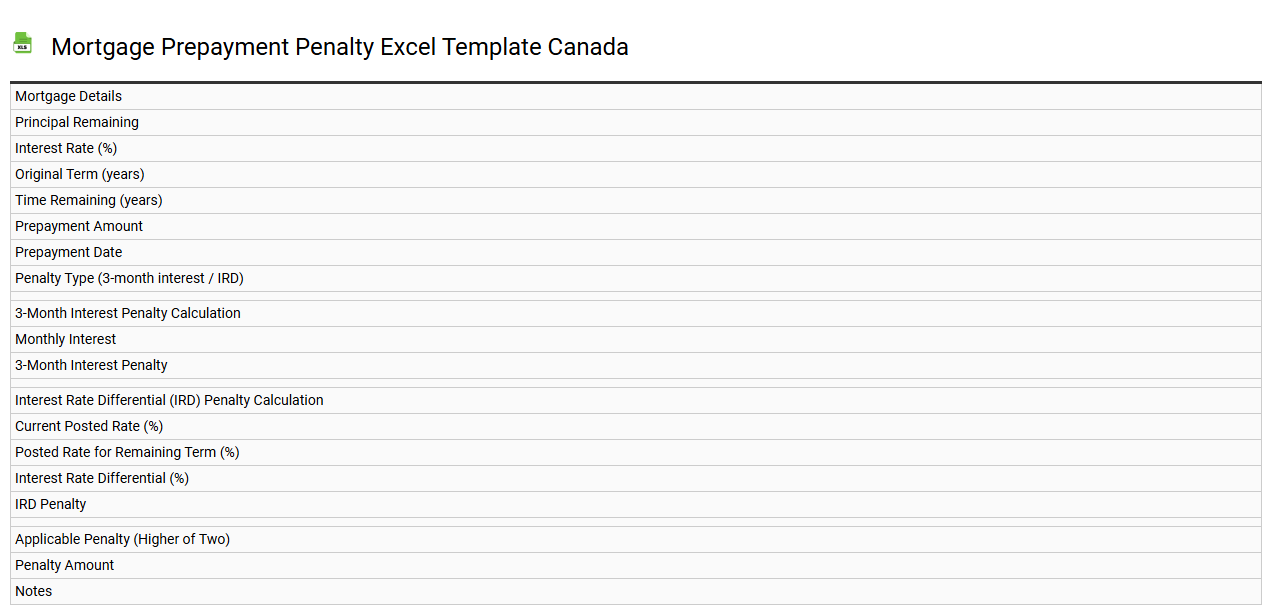

Mortgage prepayment penalty Excel template Canada

💾 Mortgage prepayment penalty Excel template Canada template .xls

A Mortgage prepayment penalty Excel template in Canada is a useful financial tool that helps you calculate the costs associated with paying off a mortgage early. This template typically includes fields for entering your loan amount, interest rate, remaining term, and the potential date of prepayment. By using the template, you can easily visualize how much you may incur in penalties, allowing for informed financial decisions. Understanding this concept is crucial for homeowners considering early mortgage repayment, whether in terms of budgeting for payment strategies or exploring refinancing options. You can also expand this template to integrate advanced features like amortization schedules or scenarios to assess impacts on overall financial health.

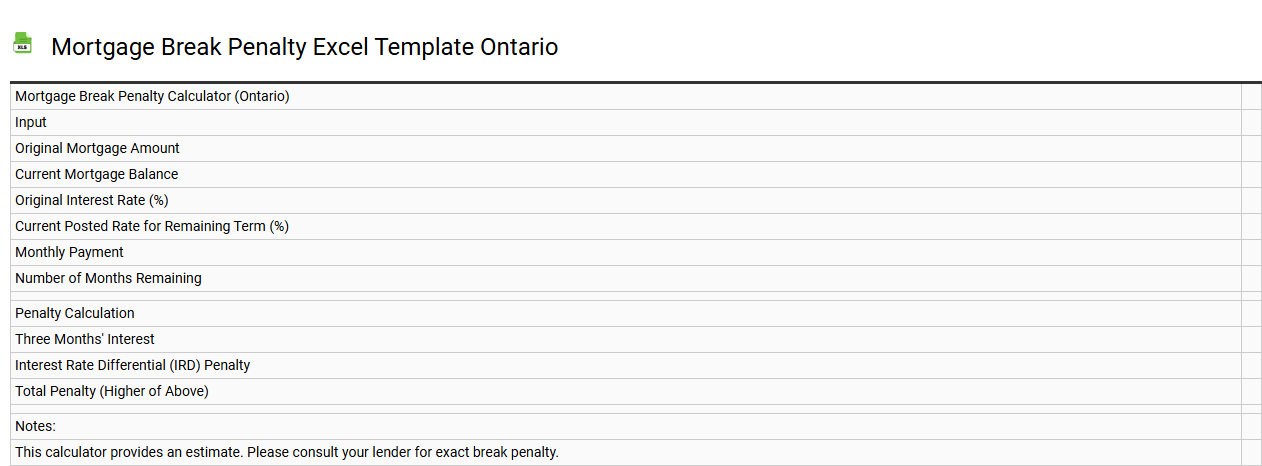

Mortgage break penalty Excel template Ontario

💾 Mortgage break penalty Excel template Ontario template .xls

A Mortgage Break Penalty Excel template for Ontario is a specialized tool designed to calculate the penalties that may arise when breaking a mortgage agreement early. This template allows users to input specific mortgage details, such as loan amount, interest rate, and remaining term, to estimate potential costs associated with early termination. It incorporates the parameters set by financial institutions in Ontario, considering various calculation methods like the Interest Rate Differential (IRD) or the three-month interest penalty. This template serves not only to clarify immediate financial implications but can also support advanced forecasting for potential refinancing or investment decisions in real estate.

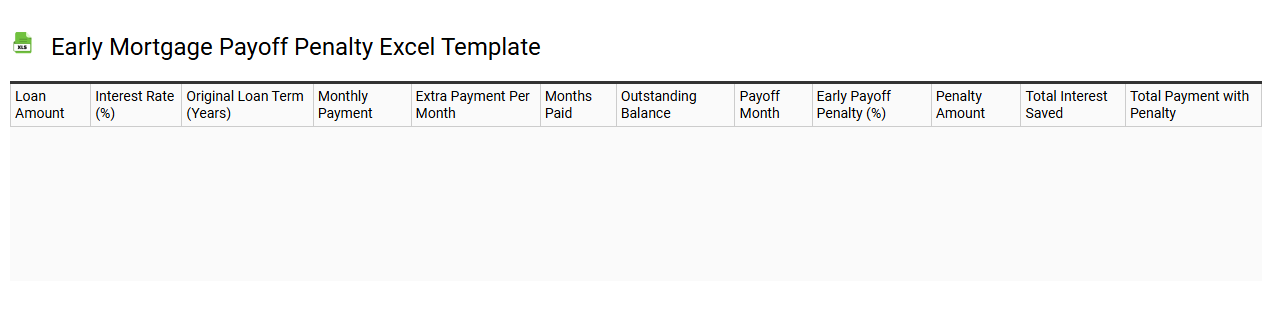

Early mortgage payoff penalty Excel template

💾 Early mortgage payoff penalty Excel template template .xls

An Early Mortgage Payoff Penalty Excel template helps you calculate potential penalties associated with paying off your mortgage before the scheduled term ends. This template typically includes fields for your loan amount, interest rate, remaining balance, and the specific penalty terms set by your lender. Users can easily input their mortgage details to visualize how early repayment might incur additional costs or savings. You can utilize this tool to plan your finances, whether you're exploring refinancing options, assessing the benefit of paying off your loan early, or evaluating the potential for avoiding or minimizing penalties through strategic planning. Advanced uses may incorporate amortization schedules or financial forecasting models to optimize your mortgage strategy.

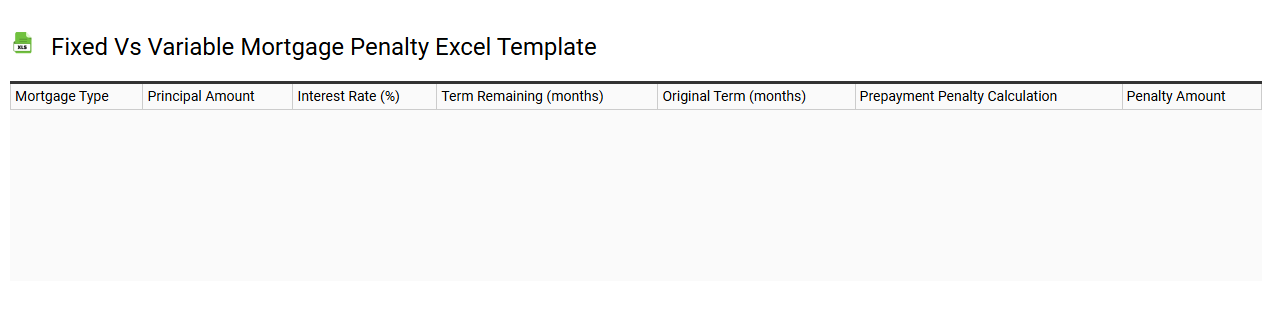

Fixed vs variable mortgage penalty Excel template

💾 Fixed vs variable mortgage penalty Excel template template .xls

A Fixed vs Variable Mortgage Penalty Excel template allows you to compare the potential penalties associated with both fixed-rate and variable-rate mortgages when you decide to pay off the loan early. This user-friendly tool helps you input key data such as loan amount, interest rates, and remaining term to calculate the penalties, making it easier to visualize financial implications. You will find segmented sections for easy data entry that drives real-time calculations, allowing quick adjustments to explore different scenarios. As you use this template, consider how it can help determine your optimal mortgage strategy, and further explore advanced metrics like net present value (NPV) and internal rate of return (IRR) for deeper financial insights.

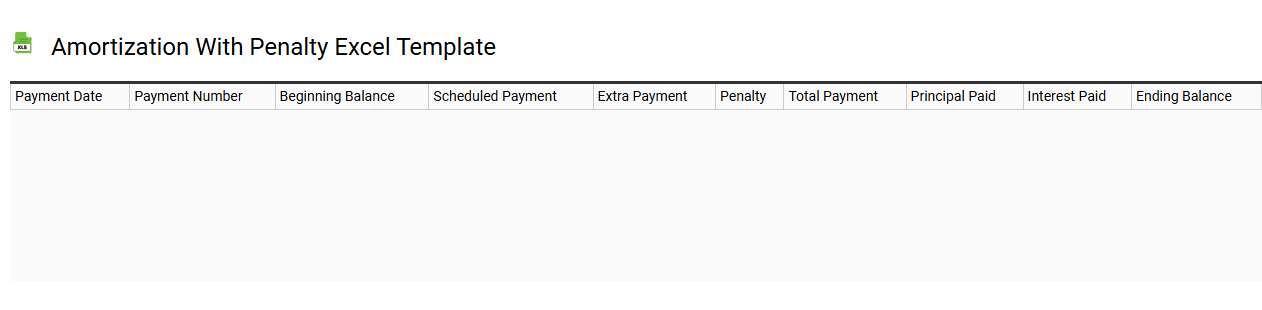

Amortization with penalty Excel template

💾 Amortization with penalty Excel template template .xls

Amortization with penalty involves calculating loan payments while considering additional fees imposed for late payments or other violations of the loan agreement. An Excel template for this purpose typically includes sections for the loan amount, interest rate, payment frequency, and penalty conditions. Each payment period outlines the principal, interest, total payment, and any penalties applied, providing a clear structure to visualize the impact of penalties on the total loan repayment. For your financial planning, using this template can aid in understanding not only the basic amortization calculations but also more sophisticated concepts such as prepayment penalties and varying interest rates.

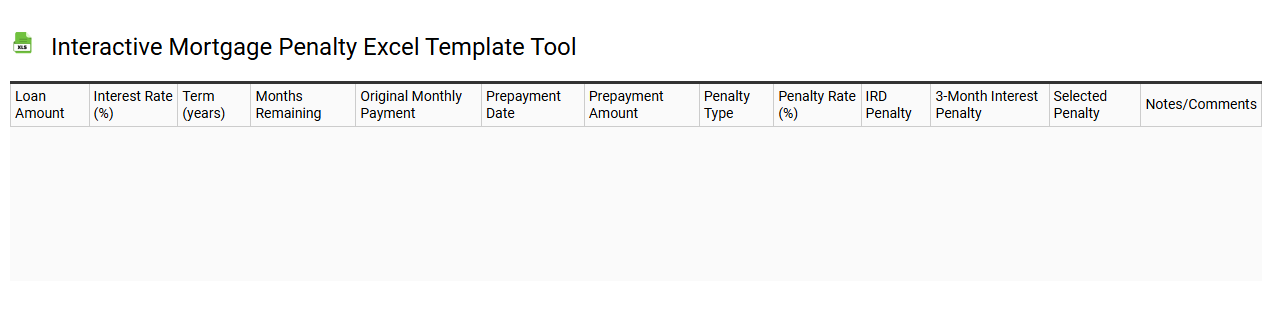

Interactive mortgage penalty Excel template tool

💾 Interactive mortgage penalty Excel template tool template .xls

An interactive mortgage penalty Excel template tool is a customizable spreadsheet designed to help you calculate potential penalties associated with mortgage early payouts or refinancing. This tool allows users to input specific mortgage details such as remaining principal balance, interest rate, and time left on the mortgage. It generates real-time calculations of penalties based on various lender policies, providing clarity on the financial implications of early payoff options. Such a template can also serve as a foundation for more advanced financial modeling, including amortization schedules and long-term cash flow projections.

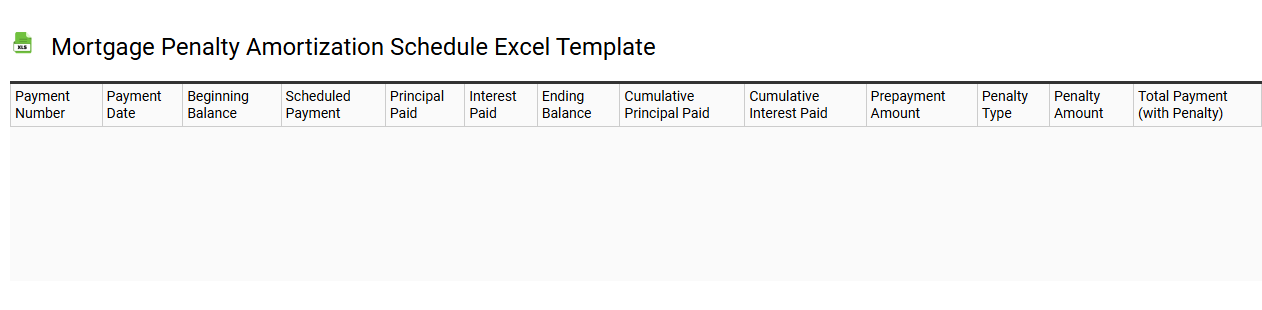

Mortgage penalty amortization schedule Excel template

💾 Mortgage penalty amortization schedule Excel template template .xls

A Mortgage Penalty Amortization Schedule Excel template provides a structured way to understand the financial implications of early mortgage repayment, particularly any penalties involved. This template typically includes sections for principal balance, interest rates, monthly payment amounts, and a detailed breakdown of the penalties incurred over time. Users can input their specific mortgage details and view how various prepayment scenarios affect their overall costs and timelines. With such tools, you can explore the intricacies of mortgage penalties, amortization periods, and the potential for refinancing or adjusting payment strategies to minimize costs effectively.

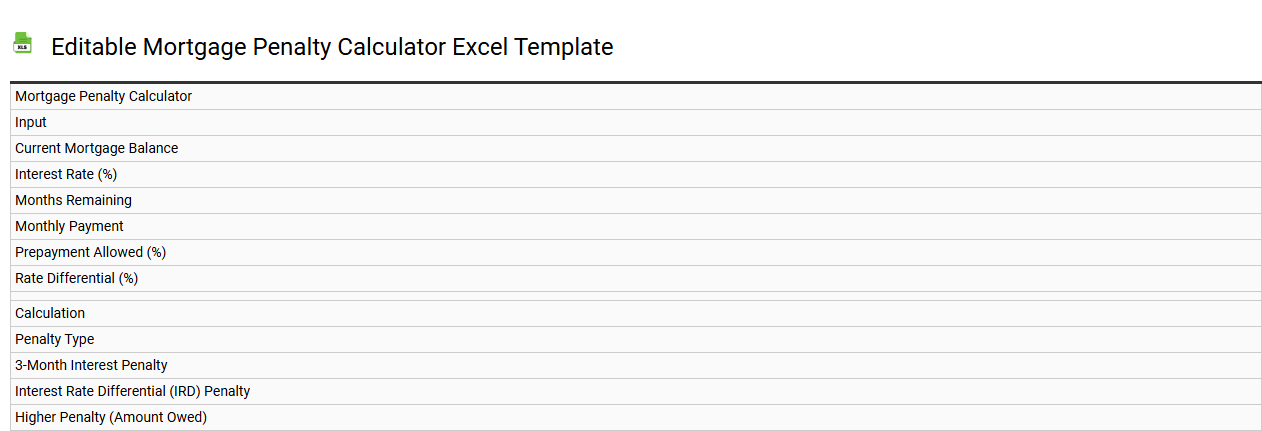

Editable mortgage penalty calculator Excel template

💾 Editable mortgage penalty calculator Excel template template .xls

An editable mortgage penalty calculator Excel template is a dynamic tool designed to help homeowners and potential buyers estimate the penalties incurred when breaking a mortgage contract early. This template typically features input cells for crucial data such as your mortgage balance, interest rate, remaining term, and the current market rates, allowing for personalized calculations. With user-friendly formulas, it simplifies complex calculations, making it easier for you to understand potential financial repercussions. Beyond basic calculations, this template can be adapted for advanced financial scenarios, including varying interest rates or different penalty structures.

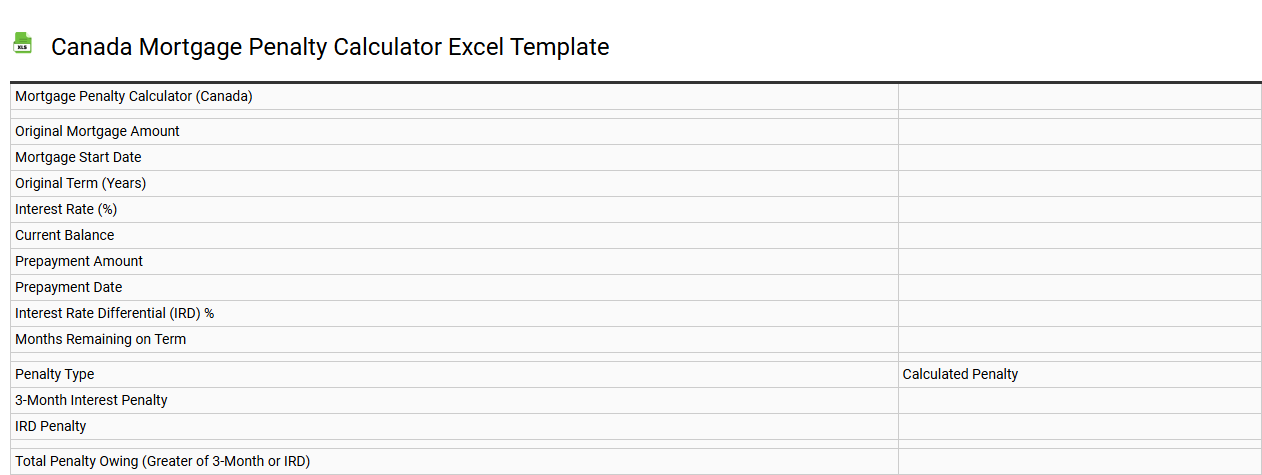

Canada mortgage penalty calculator Excel template

💾 Canada mortgage penalty calculator Excel template template .xls

A Canada mortgage penalty calculator Excel template is a tool designed to help homeowners estimate the penalties incurred for breaking a mortgage contract early. This template typically includes fields for inputting mortgage details, such as the remaining balance, interest rate, term left, and the type of mortgage product. Users can easily manipulate these figures to calculate potential penalties associated with prepayment or refinancing scenarios. The tool not only aids in understanding immediate financial implications but also serves as a foundation for more complex analyses involving advanced concepts like yield maintenance or prepayment risk.

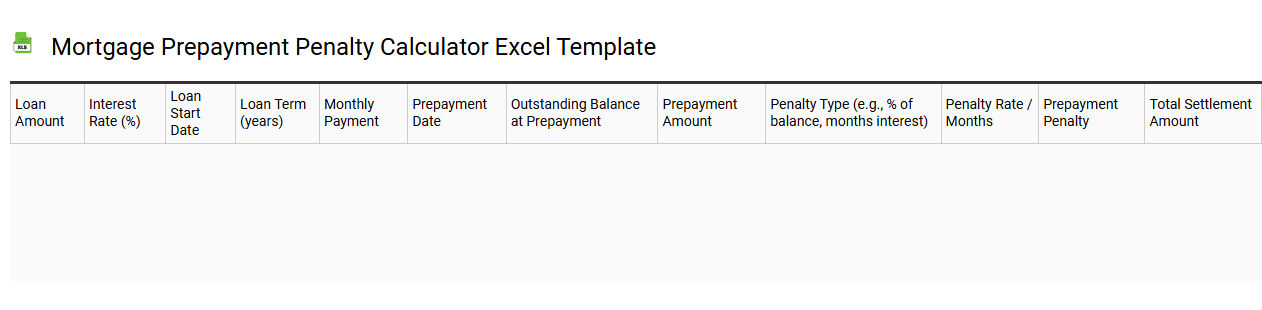

Mortgage prepayment penalty calculator Excel template

💾 Mortgage prepayment penalty calculator Excel template template .xls

A Mortgage prepayment penalty calculator Excel template is a specialized tool designed to help homeowners and prospective borrowers assess the financial implications of paying off their mortgage early. This template typically includes fields for entering loan details, such as principal balance, interest rate, and prepayment penalty terms based on lender guidelines. Users can manipulate various scenarios to see how different prepayment amounts and timelines affect overall costs and savings. Understanding these calculations aids in making informed decisions about refinancing, selling a home, or budgeting for accelerated payments, including advanced analytics for amortization schedules and net present value assessments.

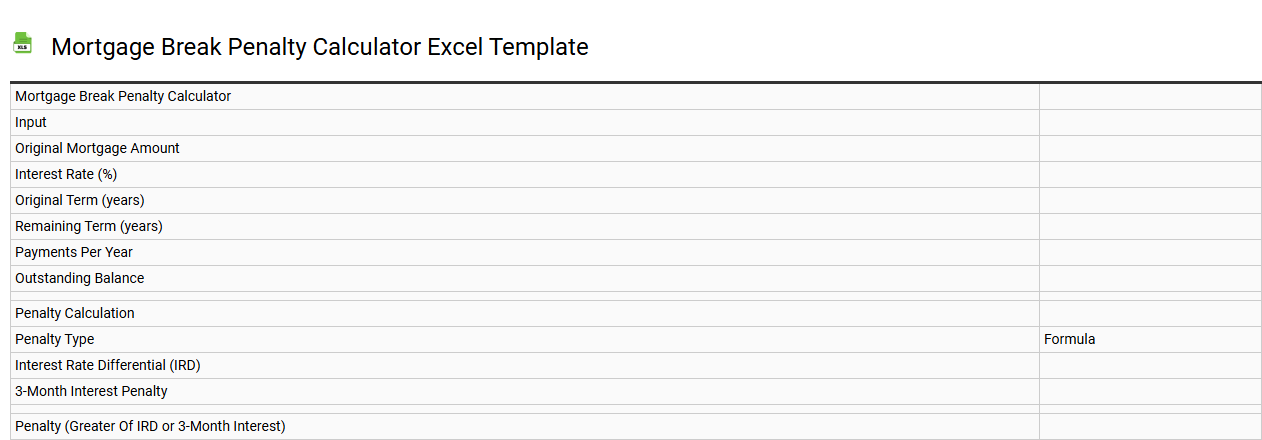

Mortgage break penalty calculator Excel template

💾 Mortgage break penalty calculator Excel template template .xls

A Mortgage break penalty calculator Excel template is a financial tool designed to help borrowers estimate the costs associated with breaking a mortgage agreement early. It typically includes fields for inputting details such as the original mortgage amount, remaining term, interest rate, and any applicable prepayment penalty percentages. The template calculates potential penalties based on your provided information, allowing you to visualize the financial impact of breaking your mortgage before its maturity date. For your further needs, this template can be tailored to include complex variables like interest differential calculations and forecasted interest rate trends.

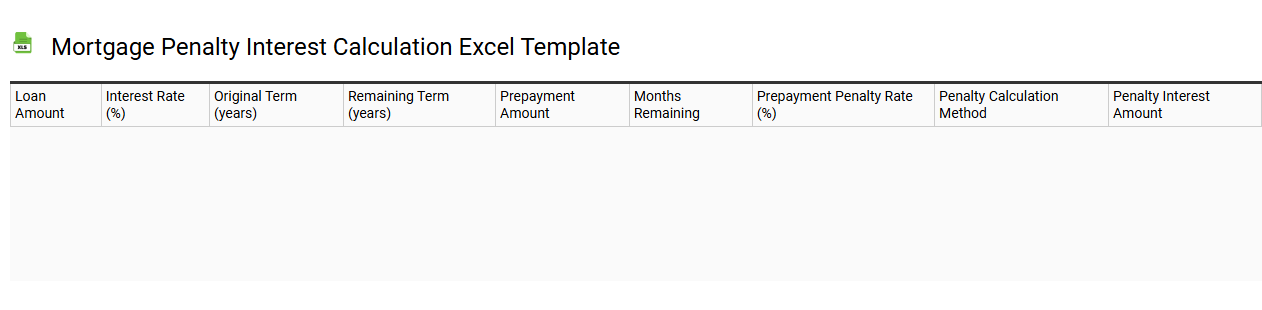

Mortgage penalty interest calculation Excel template

💾 Mortgage penalty interest calculation Excel template template .xls

A Mortgage penalty interest calculation Excel template serves as a valuable tool for homeowners evaluating the financial implications of breaking a mortgage contract early. This template typically includes sections for inputting specific mortgage details, such as the original loan amount, interest rate, remaining term, and prepayment options. Formulas within the template automatically calculate the penalty based on your mortgage agreement, presenting a clear breakdown of the costs involved. Users can customize the template to suit varying scenarios, allowing for more informed decision-making regarding potential refinance or sale options, alongside advanced concepts like blended penalties or alternative lending strategies.

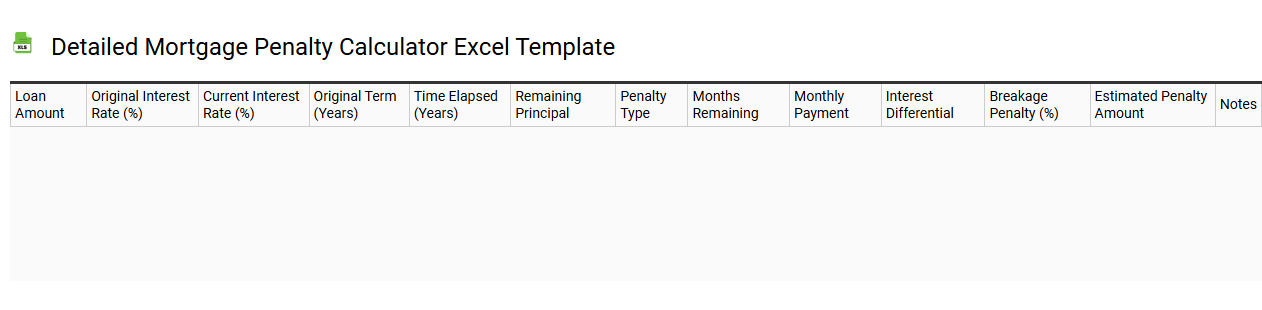

Detailed mortgage penalty calculator Excel template

💾 Detailed mortgage penalty calculator Excel template template .xls

A detailed mortgage penalty calculator Excel template helps homeowners estimate the financial penalties associated with paying off their mortgage early. This customizable tool includes fields for inputting mortgage details, such as the remaining loan balance, interest rate, and the time left on the mortgage term. The template factors in various penalty structures, such as prepayment penalties or interest rate differentials, to provide an accurate calculation of potential costs. You can use the template to analyze different scenarios, enabling better decisions around mortgage refinancing or early repayment while considering advanced financial strategies like yield curve analysis or amortization schedules.

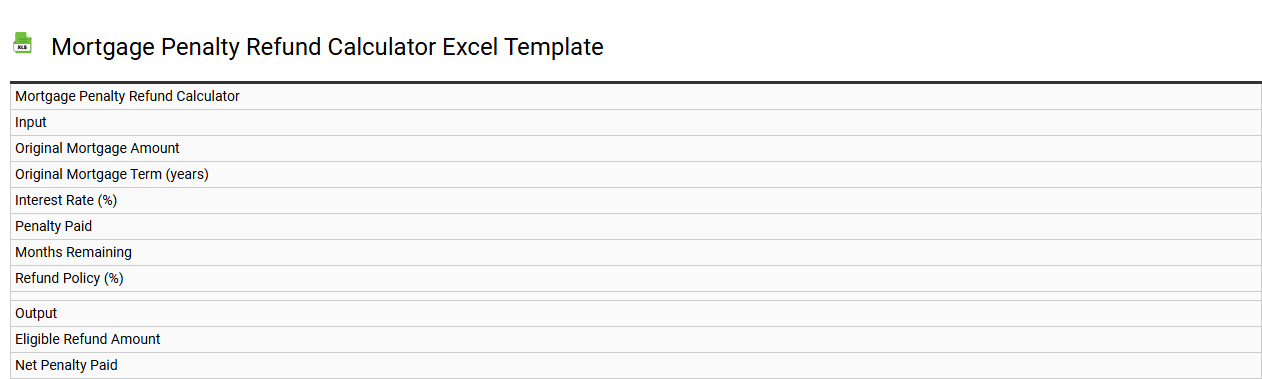

Mortgage penalty refund calculator Excel template

💾 Mortgage penalty refund calculator Excel template template .xls

A Mortgage Penalty Refund Calculator Excel template is a specialized tool designed to help homeowners estimate potential penalties incurred from breaking a mortgage agreement early. This template allows you to input key variables such as the outstanding balance, interest rates, and remaining term, generating precise calculations based on the lender's policies. You can easily modify the Excel sheet to accommodate different mortgage terms and scenarios, ensuring that the financial impact of your decisions is clearly understood. For those exploring further insights, advanced features like scenario analysis and amortization breakdowns can enhance your understanding of mortgage penalties.

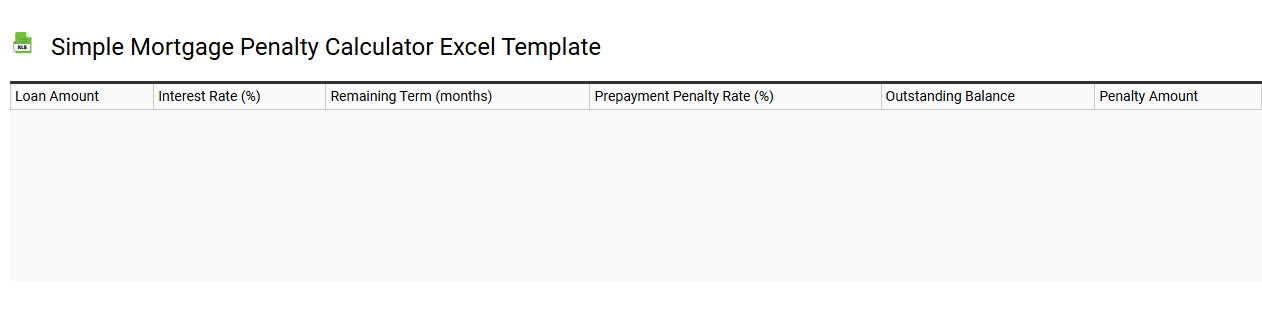

Simple mortgage penalty calculator Excel template

💾 Simple mortgage penalty calculator Excel template template .xls

A Simple Mortgage Penalty Calculator Excel template is a user-friendly tool designed to help homeowners estimate prepayment penalties associated with their mortgage loans. This template typically includes fields for inputting details such as loan amount, interest rate, remaining term, and specific lender penalty clauses. Users can easily plug in their information to calculate potential fees if they decide to pay off their mortgage early. Understanding these penalties can aid in making informed financial decisions regarding your mortgage, with the option to explore more sophisticated financial modeling techniques and predictions.

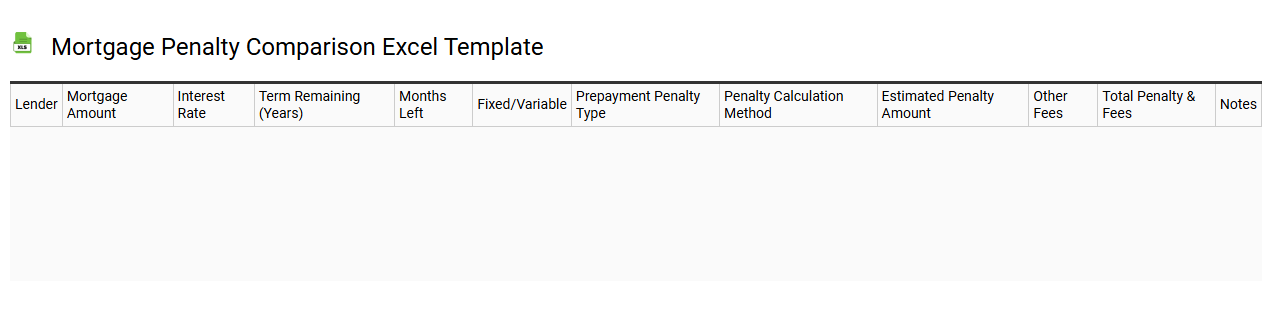

Mortgage penalty comparison Excel template

💾 Mortgage penalty comparison Excel template template .xls

A Mortgage Penalty Comparison Excel template facilitates easy analysis of various mortgage penalties from different lenders. This tool allows you to input details such as the remaining balance, interest rate, and the specific prepayment policies of each lender. You can visualize how penalties might change based on varying payment strategies, giving you insights to make informed financial decisions. Perfect for understanding basic penalties, this template can also be adapted for complex scenarios involving variable-rate mortgages or calculating potential penalties based on early loan terminations.