Explore a range of free XLS templates specifically designed for payroll adjustments in Excel. These templates simplify the process of recalculating employee salaries, accommodating changes in deductions, bonuses, or any discrepancies. Each template often includes user-friendly features such as pre-formatted fields, automated calculations, and comprehensive summaries to ensure accuracy in payroll management.

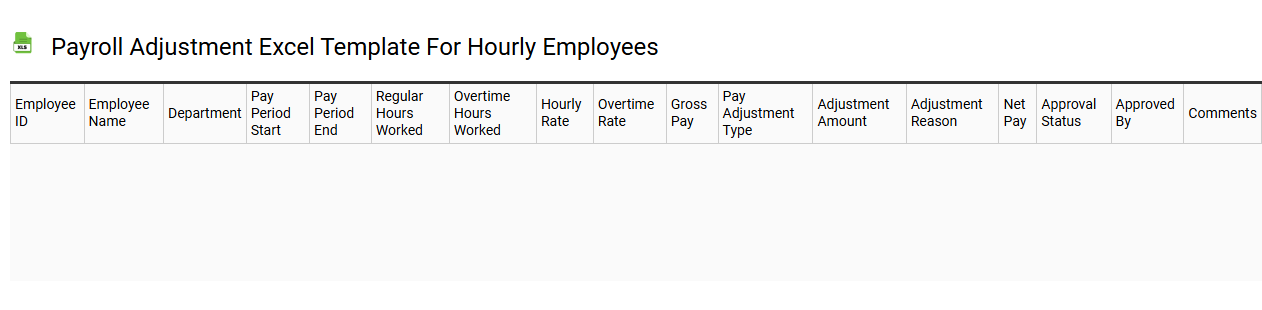

Payroll adjustment Excel template for hourly employees

💾 Payroll adjustment Excel template for hourly employees template .xls

A Payroll Adjustment Excel template for hourly employees is designed to streamline the process of calculating, documenting, and managing payroll changes. It typically includes sections for employee names, hours worked, overtime calculations, tax withholdings, and adjustments for benefits or deductions. The template allows for input of varying hourly rates and custom allowances, making it adaptable to different payroll scenarios. As your needs evolve, incorporating advanced functions like pivot tables or macros can further enhance this template for reporting and efficiency.

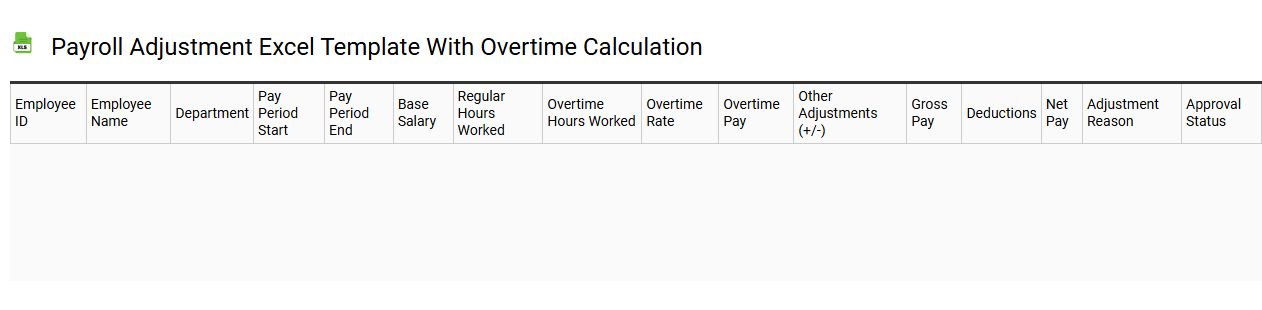

Payroll adjustment Excel template with overtime calculation

💾 Payroll adjustment Excel template with overtime calculation template .xls

A Payroll adjustment Excel template with overtime calculation simplifies the management of employee wages by allowing for easy tracking and adjustments of hours worked. This template typically includes sections for regular hours, overtime hours, pay rates, and total earnings, thereby ensuring an accurate calculation of payroll. You can input data quickly and see real-time updates, making it user-friendly even for those with minimal Excel experience. Such templates can serve as a foundational tool for your payroll needs, while further potential expansions could include integration with advanced payroll software or analytics for performance tracking.

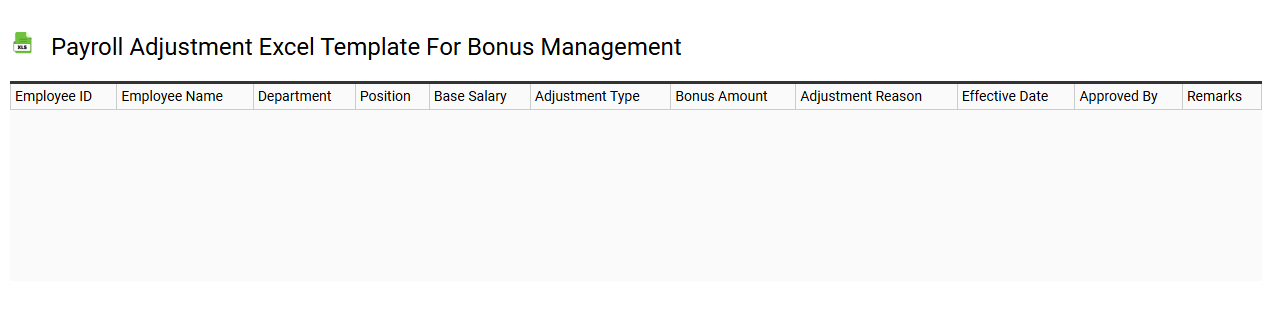

Payroll adjustment Excel template for bonus management

💾 Payroll adjustment Excel template for bonus management template .xls

A Payroll Adjustment Excel template designed for bonus management streamlines the process of calculating and distributing employee bonuses. This spreadsheet typically includes sections for employee names, identification numbers, performance metrics, and bonus amounts, ensuring transparency and accuracy in calculations. You can customize formulas to automatically compute totals based on predefined criteria, facilitating real-time adjustments. This tool not only simplifies bonus allocation but also lays the groundwork for more advanced payroll analytics, such as forecasting future bonuses, integrating tax implications, and generating detailed reports.

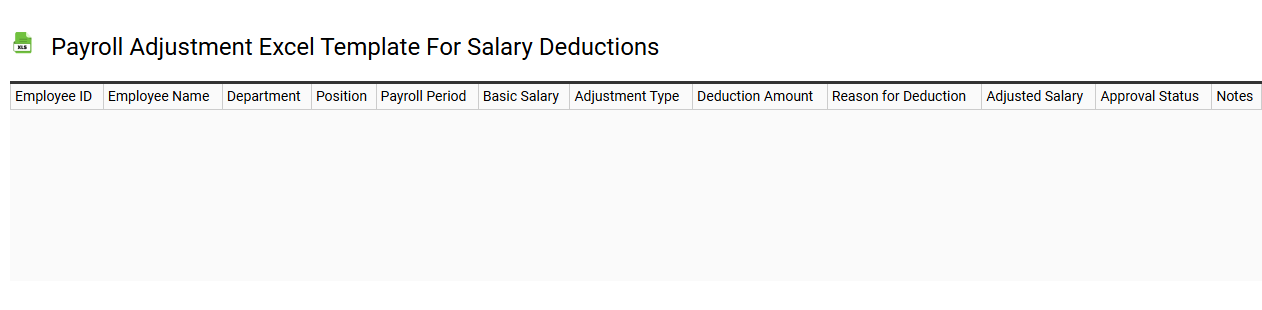

Payroll adjustment Excel template for salary deductions

💾 Payroll adjustment Excel template for salary deductions template .xls

A Payroll Adjustment Excel template for salary deductions serves as a structured tool designed to help you manage employee salary calculations effectively. This template typically includes columns for employee names, identification numbers, gross salary, specific deductions, and final net pay calculations. The flexibility of Excel allows for easy customization, meaning you can adjust formulas or add additional data fields to reflect various factors like bonuses or overtime pay. You can leverage this template for basic payroll management while exploring future enhancements such as automating calculations or integrating with payroll software for comprehensive financial oversight.

Payroll adjustment Excel template for back pay tracking

![]()

💾 Payroll adjustment Excel template for back pay tracking template .xls

A Payroll adjustment Excel template for back pay tracking assists in managing and documenting adjustments made to employee paychecks due to previously underpaid wages. You can input essential employee information such as names, ID numbers, and pay periods affected, alongside the calculated back pay amounts owed. The template often includes formulas that automatically compute totals, ensuring precise calculations, helping avoid errors during payroll processing. You can customize it to incorporate various adjustments like overtime pay, bonuses, or corrections, alongside advanced features like pivot tables for summarizing complex payroll data.

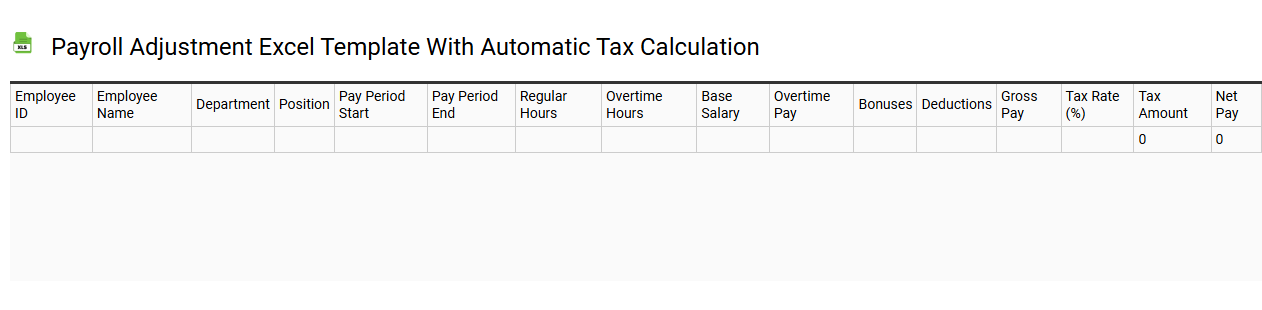

Payroll adjustment Excel template with automatic tax calculation

💾 Payroll adjustment Excel template with automatic tax calculation template .xls

A Payroll adjustment Excel template with automatic tax calculation simplifies the payroll process by providing a structured format for calculating employee wages, bonuses, and deductions. This template typically features predefined formulas that automatically compute federal, state, and local taxes based on current rates, ensuring accuracy and compliance. Rows for employee details, hours worked, and pay rates facilitate easy data entry, while built-in functions reduce manual calculations and errors. Beyond basic payroll processing, you can explore advanced functionalities like linking to specific accounting software systems or generating detailed tax reports for compliance audits.

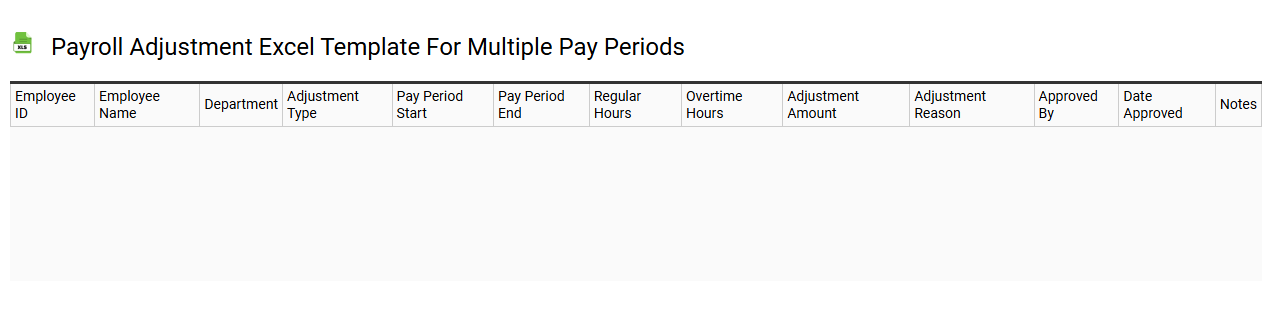

Payroll adjustment Excel template for multiple pay periods

💾 Payroll adjustment Excel template for multiple pay periods template .xls

A Payroll adjustment Excel template for multiple pay periods is a structured spreadsheet designed to facilitate accurate payroll calculations across various time frames. This template typically includes fields for employee names, identification numbers, hours worked, overtime, deductions, and bonuses, allowing for precise adjustments based on specific needs. Users can easily input and modify data for each pay period, ensuring that payroll records remain up-to-date and compliant with regulations. Effective utilization of this template can enhance payroll accuracy, streamline reporting processes, and accommodate advanced requirements such as tax adjustments and benefit calculations.

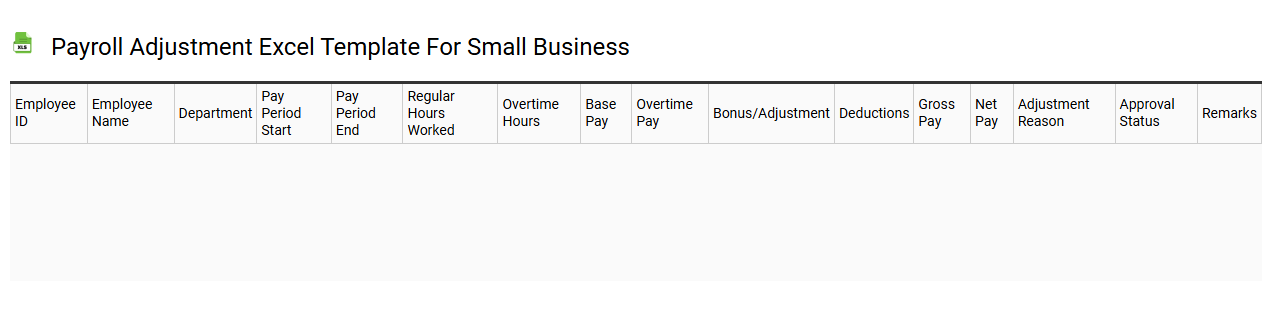

Payroll adjustment Excel template for small business

💾 Payroll adjustment Excel template for small business template .xls

A Payroll Adjustment Excel template for small businesses is a structured spreadsheet designed to track and manage changes in employee payroll records. This template allows you to input data such as hours worked, overtime, bonuses, deductions, and other adjustments in a clear and organized manner. It includes built-in formulas to automatically calculate net pay and ensure compliance with tax regulations. You can customize it to meet your specific business needs, with potential further applications including integration with accounting software and more complex payroll management systems.

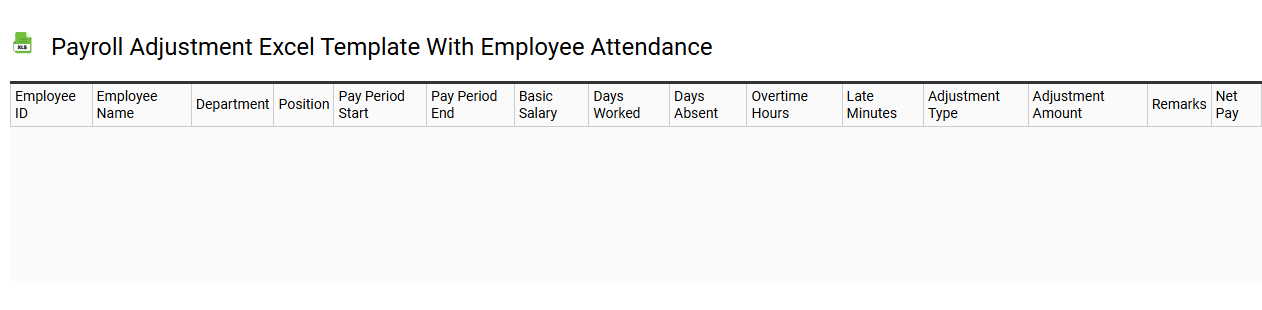

Payroll adjustment Excel template with employee attendance

💾 Payroll adjustment Excel template with employee attendance template .xls

A Payroll adjustment Excel template with employee attendance offers a streamlined method to manage payroll processing while incorporating attendance data. This template typically includes sections for employee names, hours worked, attendance records, overtime, deductions, and adjustments for any discrepancies in pay. With features like automatic calculations and customizable fields, you can quickly assess each employee's contributions and remuneration. This tool not only facilitates accurate payroll management but also supports future analysis of patterns, integrating advanced metrics like labor cost per department or productivity rates for enhanced decision-making.

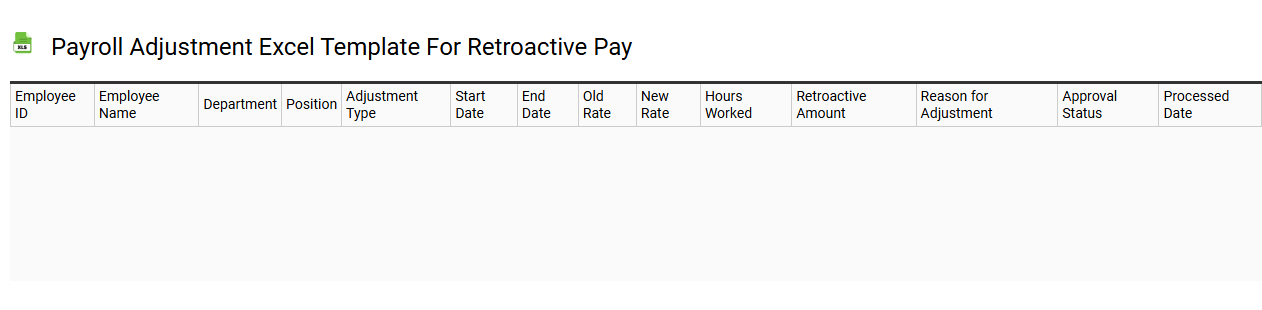

Payroll adjustment Excel template for retroactive pay

💾 Payroll adjustment Excel template for retroactive pay template .xls

A Payroll Adjustment Excel template for retroactive pay allows you to systematically calculate and record any necessary changes to employee compensation that apply to past pay periods. This template typically includes essential fields such as employee identification, initial pay rate, adjusted pay rate, and the total retroactive amount owed. Carefully inputting accurate historical hours worked, along with the corresponding wage adjustments, ensures precise calculations. Proper utilization of such templates can facilitate straightforward tracking of pay corrections and may scale to more complex scenarios involving back pay, tax recalculations, or overtime adjustments in the future.