Small business payroll Excel templates offer essential features to simplify your payroll management. These templates typically include fields for employee information, hours worked, hourly rates, and tax deductions, ensuring accurate calculations each pay period. You can easily customize these templates to fit your specific needs, saving you time and reducing errors in payroll processing.

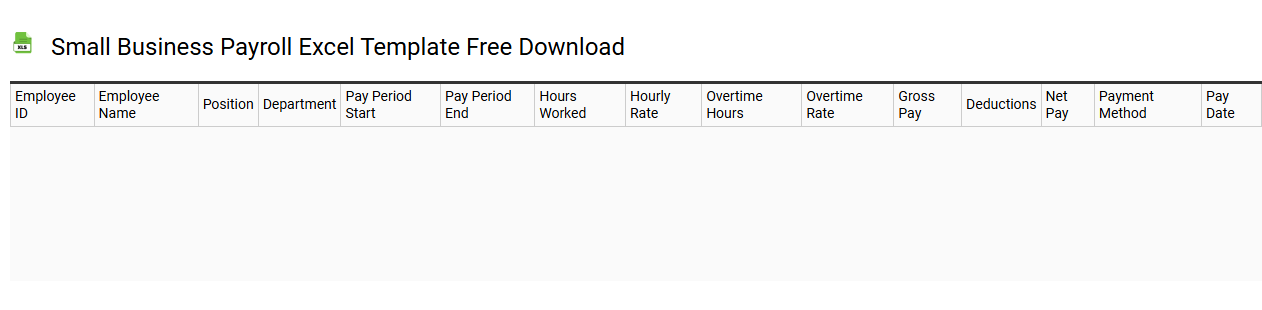

Small business payroll Excel template free download

💾 Small business payroll Excel template free download template .xls

A Small Business Payroll Excel template offers a user-friendly solution for managing employee payroll efficiently. This spreadsheet typically includes fields for employee names, hours worked, pay rates, deductions, and tax calculations, streamlining the entire payment process. Designed for small business owners, it allows you to maintain accurate records while ensuring compliance with labor laws. Basic usage covers tracking regular payments, while advanced needs might involve integrating features like automated tax calculations or report generation for financial audits.

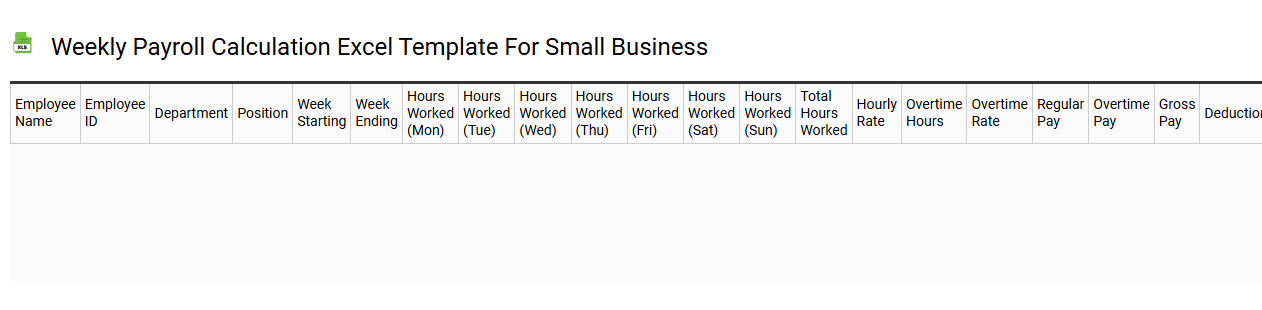

Weekly payroll calculation Excel template for small business

💾 Weekly payroll calculation Excel template for small business template .xls

A weekly payroll calculation Excel template for small businesses simplifies the salary management process by organizing employee data in a structured format. The template typically includes sections for employee names, hours worked, hourly rates, gross wages, deductions, and net pay, allowing for quick and accurate financial calculations. You can also incorporate formulas to automate the computations, reducing the likelihood of manual errors. This basic tool can evolve into more advanced systems to track overtime, bonuses, or various tax implications as your business grows.

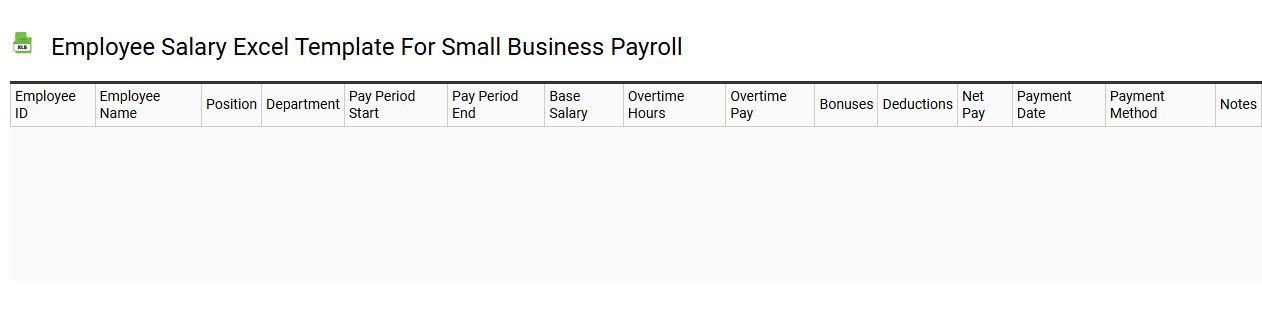

Employee salary Excel template for small business payroll

💾 Employee salary Excel template for small business payroll template .xls

An Employee Salary Excel template for small business payroll organizes essential employee information, including names, roles, and payment rates. This template typically features columns for hours worked, overtime, deductions, and net pay calculations, allowing for comprehensive payroll management. Customization options enable tracking various payroll elements, such as bonuses, commissions, and other benefits specific to your business needs. While this template serves as a practical solution for basic payroll management, advanced users may explore integrating formulas, creating pivot tables, or incorporating macros for enhanced functionality and automation.

Small business payroll tracker Excel template

![]()

💾 Small business payroll tracker Excel template template .xls

A Small Business Payroll Tracker Excel template is designed to help small business owners manage employee salaries, deductions, and hours worked efficiently. It typically includes features like columns for employee names, job titles, hourly rates, total hours worked, and calculated gross pay. Many templates also allow for easy tracking of taxes, benefits, and deductions, ensuring accurate payroll calculations. This tool simplifies payroll management, helping you maintain compliance and prepare for potential reporting requirements such as W-2s or 1099s.

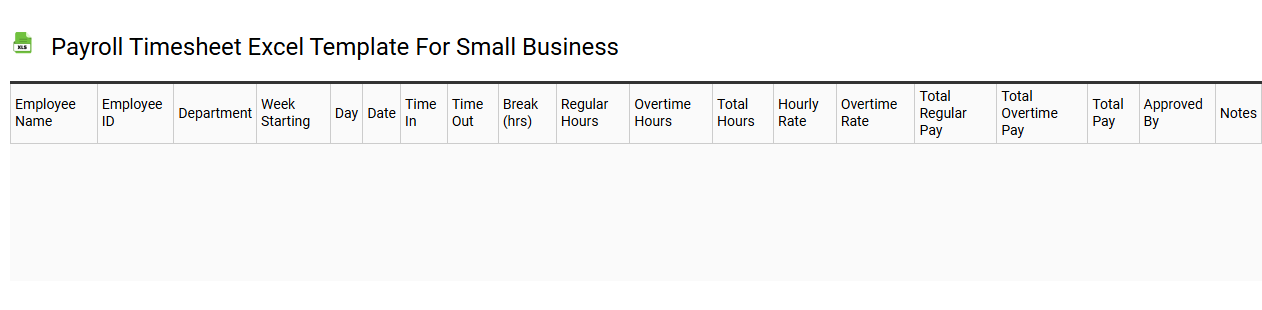

Payroll timesheet Excel template for small business

💾 Payroll timesheet Excel template for small business template .xls

A Payroll timesheet Excel template for small business is a structured spreadsheet designed to track employee hours worked, overtime, and wages for payroll processing. This template typically includes columns for employee names, hours worked per day, total hours, and applicable pay rates, making it easy to calculate total earnings. By utilizing such a template, you can streamline your payroll process, reduce errors, and ensure compliance with labor regulations. Basic usage includes entering weekly worked hours, while further potential needs could involve integrating advanced features like automated tax calculations and data analysis tools for forecasting labor costs.

Printable payroll slip Excel template for small business

💾 Printable payroll slip Excel template for small business template .xls

A printable payroll slip Excel template designed for small businesses simplifies the management of employee salary details. This customizable template allows you to input essential information such as employee names, identification numbers, and payment periods. You can calculate total earnings, deductions, and net pay, ensuring accuracy and ease of documentation. Your business benefits from keeping detailed records, which can be tailored further into advanced analytics for payroll forecasting and budget planning as your team grows.

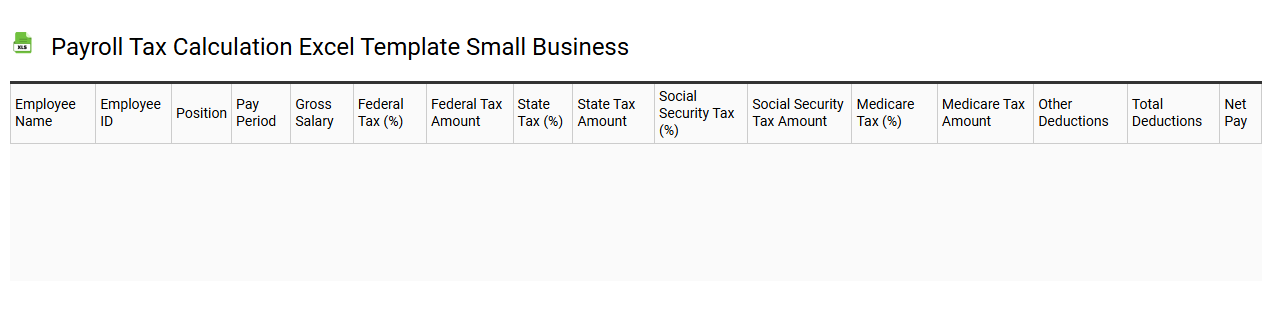

Payroll tax calculation Excel template small business

💾 Payroll tax calculation Excel template small business template .xls

A Payroll tax calculation Excel template for small businesses streamlines the process of tracking employee wages, benefits, and associated tax obligations. It typically includes sections for employee details, hours worked, gross pay, deductions, and net pay, ensuring accuracy in financial management. Formulas automate calculations for federal and state taxes, Social Security, and Medicare, helping you stay compliant. This versatile tool can adapt to various payroll needs, supporting basic calculations or advanced functions like overtime rates, employee bonuses, and multi-state tax regulations.

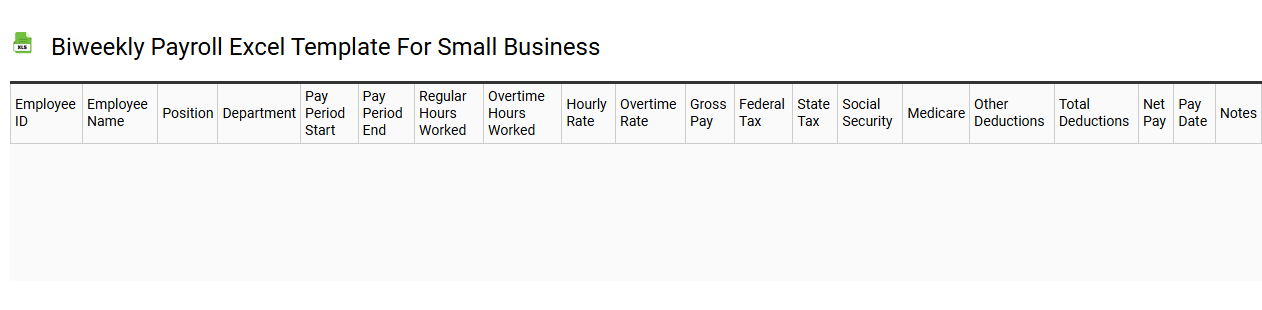

Biweekly payroll Excel template for small business

💾 Biweekly payroll Excel template for small business template .xls

A biweekly payroll Excel template for small businesses streamlines the process of calculating employee wages, tax deductions, and payroll expenses every two weeks. It typically includes sections for employee details, hours worked, pay rates, and applicable deductions for taxes and benefits. This template allows you to generate clear and organized paychecks, making it easier to maintain accurate records of employee compensation. Understanding how to utilize basic formulas in Excel can help enhance your payroll process, while advanced applications may involve integrating payroll software for real-time analytics and compliance tracking.

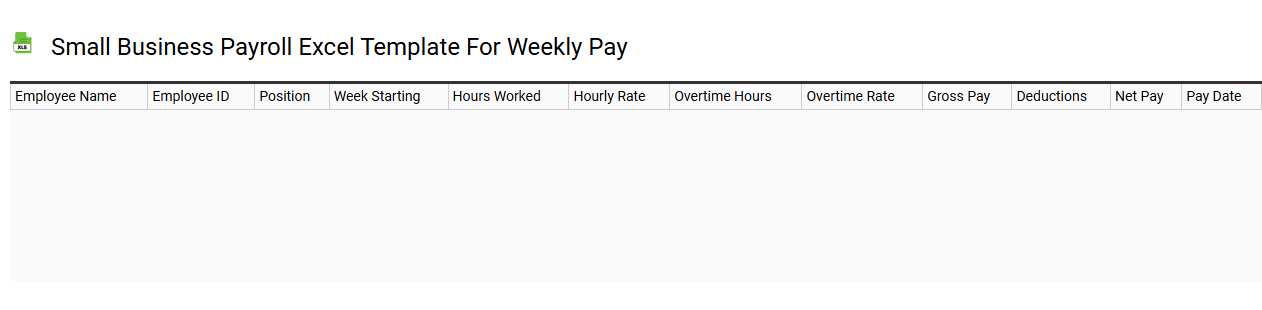

Small business payroll Excel template for weekly pay

💾 Small business payroll Excel template for weekly pay template .xls

A Small Business Payroll Excel template for weekly pay serves as a structured tool for managing employee compensation on a weekly basis. This template typically includes essential fields such as employee names, hours worked, hourly rates, gross pay, deductions, and net pay. It ensures accurate calculations, allowing for tracking of payroll expenses and simplifying tax compliance. You can modify these templates to include more complex features, such as overtime calculations and benefit management, catering to your evolving business needs.

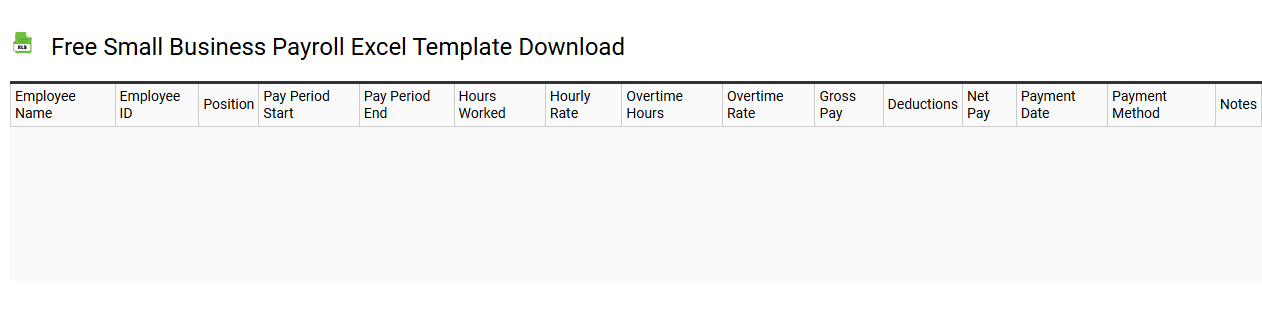

Free small business payroll Excel template download

💾 Free small business payroll Excel template download template .xls

Free small business payroll Excel templates provide a streamlined solution for managing employee compensation within a small organization. These templates typically include essential fields such as employee names, hours worked, wage rates, and total earnings, making it easy to calculate payroll accurately. You can customize these templates to suit specific business needs, allowing for adjustments in tax rates or inclusion of benefits like healthcare and retirement contributions. Mastering this basic payroll system can also open doors for integrating advanced tools like automated payroll software or cloud-based solutions to enhance efficiency and compliance.

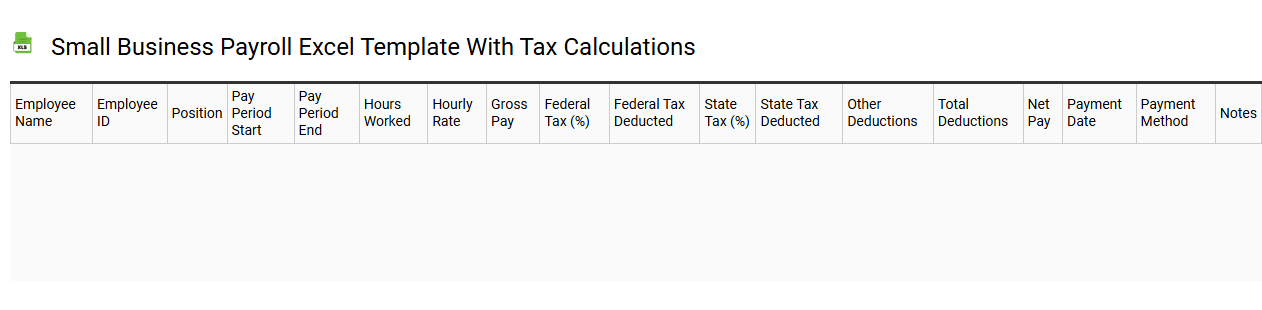

Small business payroll Excel template with tax calculations

💾 Small business payroll Excel template with tax calculations template .xls

A Small Business Payroll Excel Template with tax calculations is a specialized spreadsheet designed to streamline payroll processing and ensure accurate tax compliance for small businesses. This template typically includes sections for employee information, hours worked, pay rates, and deductions, allowing you to easily input and track essential data. Built-in formulas automate the calculation of gross pay, net pay, and applicable taxes, saving you time and reducing the risk of errors. These templates can serve as a foundation for basic payroll needs while offering potential for advanced features like integration with accounting software and customized reporting.

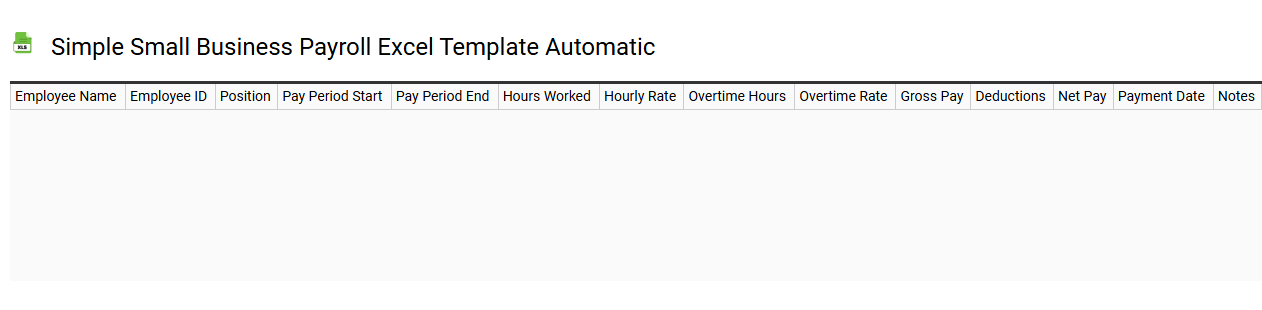

Simple small business payroll Excel template automatic

💾 Simple small business payroll Excel template automatic template .xls

A Simple Small Business Payroll Excel Template allows you to manage employee payroll efficiently using a user-friendly spreadsheet. This customizable tool typically includes columns for employee names, hours worked, pay rates, deductions, and total earnings, making calculations straightforward. You can automate vital functions like overtime calculations and tax withholding, simplifying compliance and accuracy. As your business grows, you might consider integrating more advanced features such as automated tax calculations or linking with accounting software for streamlined financial management.

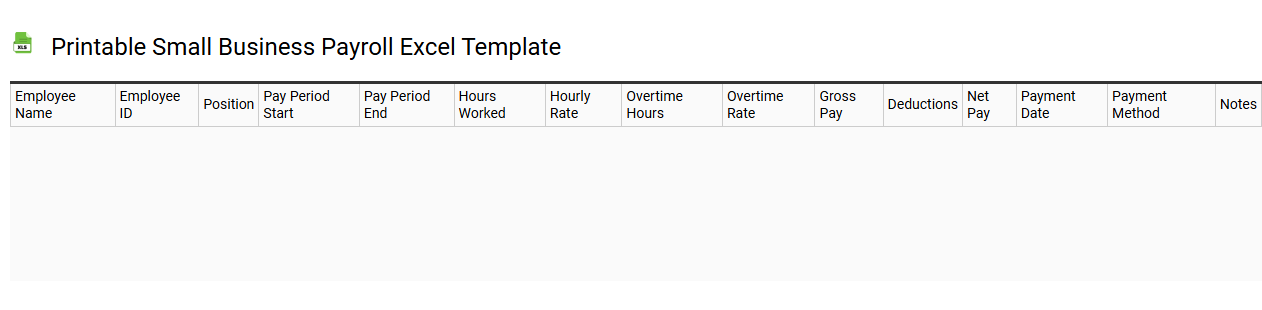

Printable small business payroll Excel template

💾 Printable small business payroll Excel template template .xls

A Printable small business payroll Excel template serves as a structured spreadsheet designed to streamline the payroll process for small businesses. This template typically includes dedicated sections for employee information, hours worked, pay rates, and total wages, making it easy to calculate payroll amounts. Designed for easy customization, it allows you to input specific data relevant to your business, ensuring accuracy and compliance with local labor laws. This basic tool can later evolve into more advanced payroll solutions integrating features like tax calculations, benefits tracking, and automated reporting.

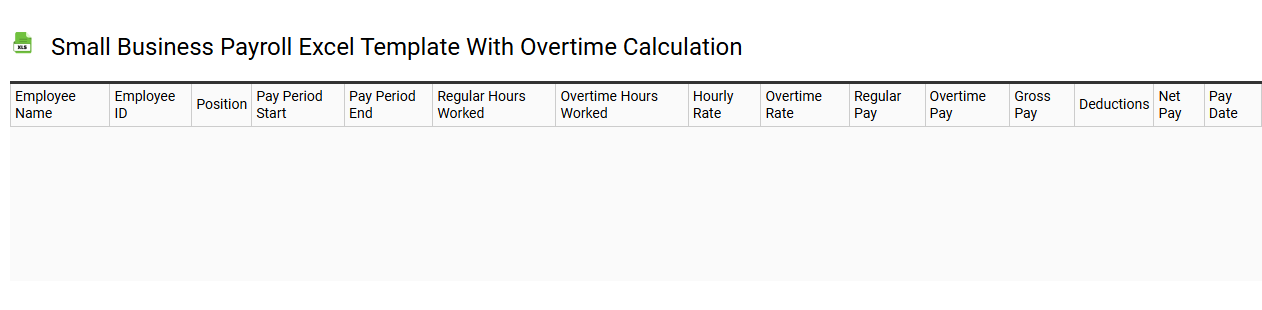

Small business payroll Excel template with overtime calculation

💾 Small business payroll Excel template with overtime calculation template .xls

A Small Business Payroll Excel Template with overtime calculation is a pre-designed spreadsheet that helps business owners manage employee payroll efficiently. This tool typically includes columns for employee names, hours worked, regular pay rates, and specific formulas to calculate overtime wages based on the hours exceeding the standard workweek. You can customize the template to suit your unique payroll needs, ensuring accurate and timely payments. Such templates provide a foundational solution for payroll management, but may also require advanced features such as tax computations, benefit deductions, or integration with accounting software for more complex payroll scenarios.

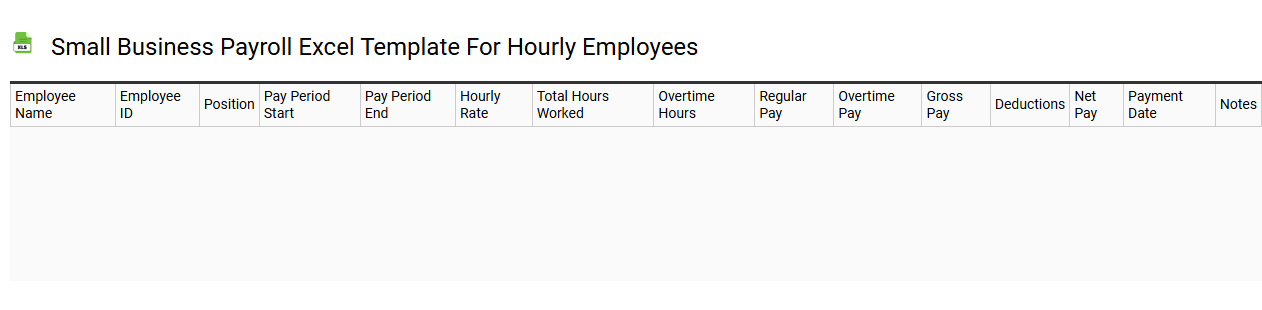

Small business payroll Excel template for hourly employees

💾 Small business payroll Excel template for hourly employees template .xls

A Small Business Payroll Excel template for hourly employees simplifies the process of tracking wages, hours worked, and deductions. This customizable spreadsheet typically includes sections for employee details, hourly rates, time entries, and calculated totals for gross pay. Features often encompass automatic calculations for overtime, taxes, and any benefits, enabling you to efficiently manage payroll without extensive software. For your growing business needs, consider potential enhancements like integrating tax compliance and reporting functionalities or transitioning to advanced payroll software.

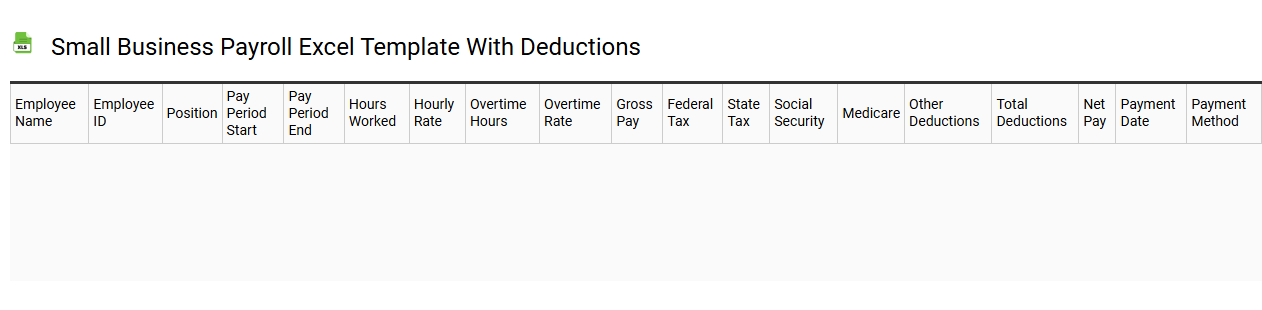

Small business payroll Excel template with deductions

💾 Small business payroll Excel template with deductions template .xls

A Small Business Payroll Excel template with deductions simplifies the process of managing employee payments while ensuring compliance with tax regulations. This user-friendly spreadsheet typically features sections for employee names, hours worked, wages, benefits, and various deductions such as federal taxes, state taxes, Social Security, and health insurance contributions. You can customize the template to include additional fields relevant to your business, making it adaptable for varying payroll scenarios. This tool not only assists in tracking payroll but also provides a foundation for potential integration with more sophisticated payroll software or human resources information systems for advanced data analysis and reporting.

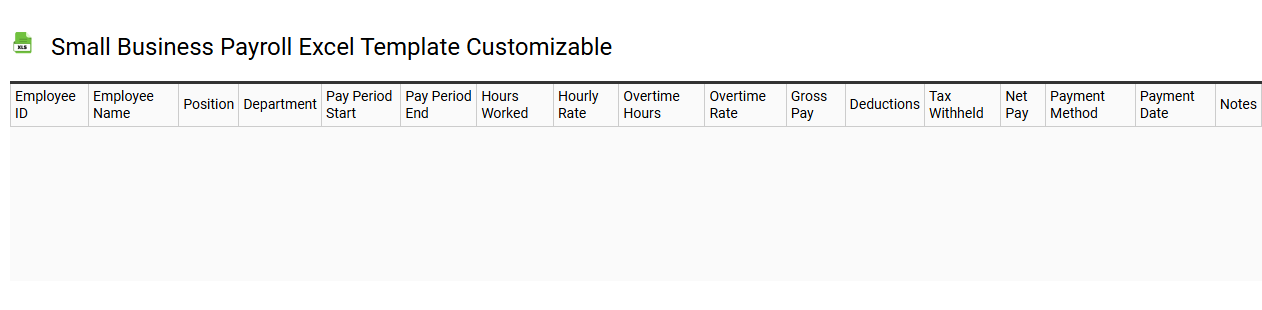

Small business payroll Excel template customizable

💾 Small business payroll Excel template customizable template .xls

A Small Business Payroll Excel template offers a user-friendly solution for managing employee compensation, tax calculations, and tracking work hours within a structured spreadsheet format. You can easily input employee details, including names, positions, and hourly rates, facilitating organized record-keeping. Features often include automatic calculations for gross pay, deductions, and net pay, significantly reducing errors and saving time on payroll processing. These customizable templates cater to basic payroll needs while allowing for further enhancements like integrating complex tax algorithms or compliance with specific labor regulations.

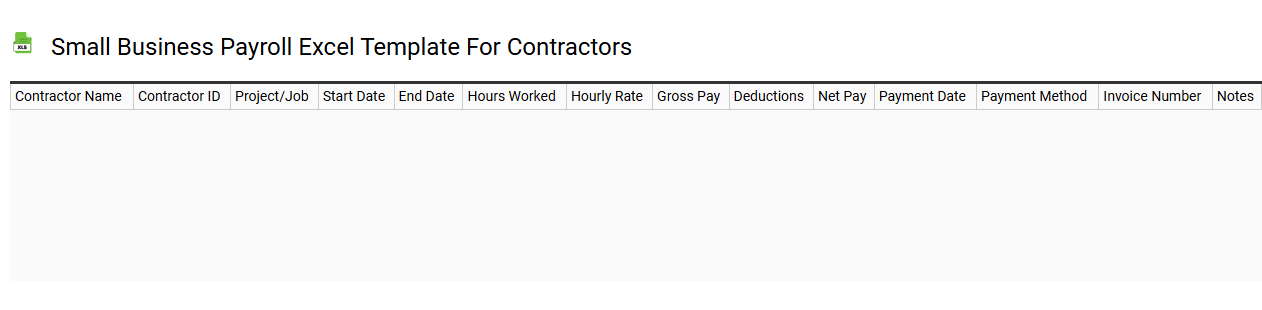

Small business payroll Excel template for contractors

💾 Small business payroll Excel template for contractors template .xls

A Small Business Payroll Excel template for contractors simplifies the payroll process by providing a structured format to track payments, deductions, and hours worked. This template typically includes sections for employee details, payment rates, and the total amount due, ensuring accurate calculations. Users can customize the fields to accommodate unique contractor agreements and tax requirements, making it versatile for various industries. While this tool is great for managing routine payroll tasks, advanced users may explore integrating it with accounting software or utilizing macros to automate calculations for larger workforces.