Explore an array of free XLS templates specifically designed for comparing loans and savings. These templates offer customizable spreadsheets where you can input your financial data, such as interest rates, loan amounts, and savings goals. Utilize various charts and graphs embedded within these templates to visually analyze the impact of different financial scenarios on your savings and loan repayments, aiding in making informed decisions about your money management.

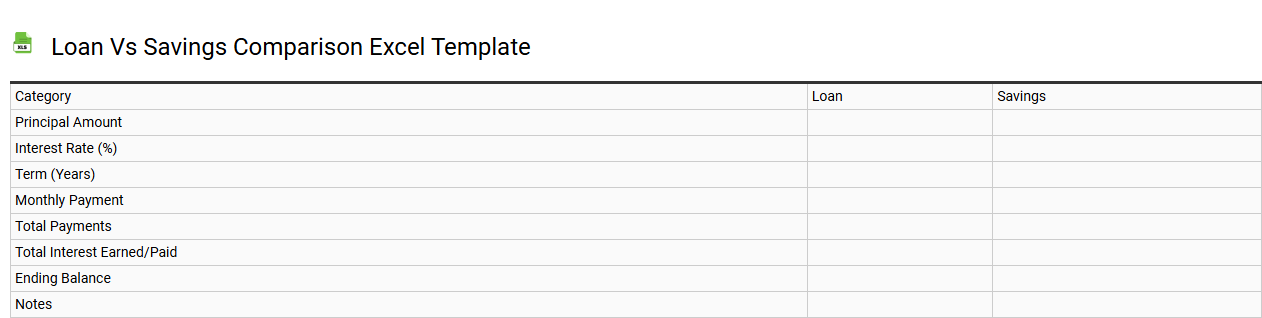

Loan vs savings comparison Excel template

💾 Loan vs savings comparison Excel template template .xls

A Loan vs Savings comparison Excel template provides a clear, structured way to analyze the financial impacts of taking out a loan versus saving for a purchase. This template typically includes sections for inputting loan amounts, interest rates, and repayment terms alongside savings goals, interest rates, and timeframes. By visualizing these variables, you can easily understand the cost of borrowing compared to the benefits of saving over time. Using this template, you can make informed financial decisions while also exploring advanced scenarios, such as amortization schedules or compound interest calculations.

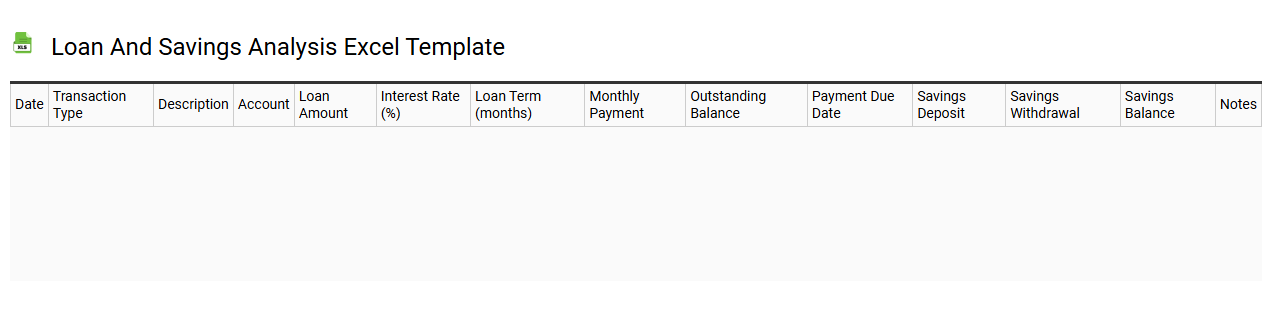

Loan and savings analysis Excel template

💾 Loan and savings analysis Excel template template .xls

A Loan and Savings Analysis Excel template serves as a powerful financial tool designed to help you evaluate your borrowing and saving options. This user-friendly template allows you to input various loan terms, interest rates, and savings scenarios, providing clear visual representations of your financial commitments and growth potential. By analyzing your current debts alongside your savings strategies, you can make informed decisions about budgeting, investing, and financial planning. For basic usage, it's useful in tracking monthly payments and savings contributions, while advanced features can include sensitivity analysis and predictive modeling for future financial scenarios.

Loan payoff vs savings tracker Excel template

![]()

💾 Loan payoff vs savings tracker Excel template template .xls

A Loan Payoff vs Savings Tracker Excel template helps you visualize your financial journey by comparing the total amount needed to pay off loans against your savings growth. This tool allows you to input interest rates, monthly payments, and remaining balances for various loans, immediately reflecting how much you'll save over time by paying off debts early. As you track your savings, graphs and charts within the template provide a clear overview of progress, making it easy to identify trends and adjust your financial strategies accordingly. You can use this template not only for basic budgeting but also to explore advanced financial concepts such as amortization schedules, compound interest effects, and opportunity costs associated with your financial decisions.

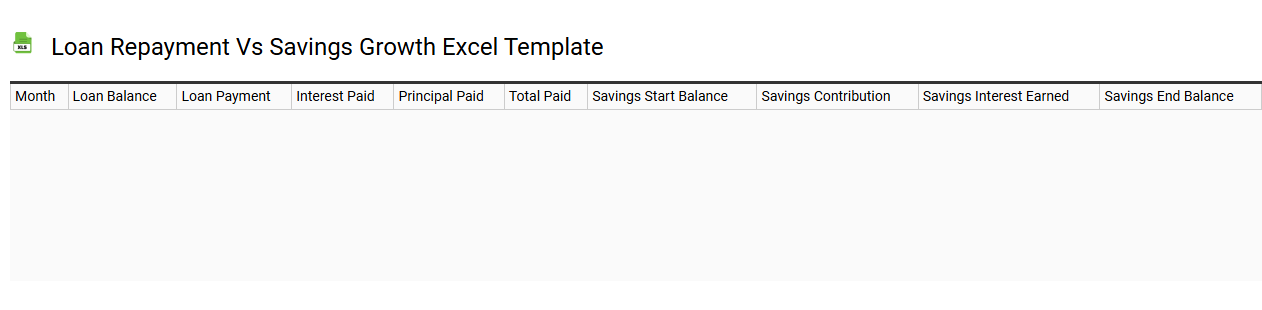

Loan repayment vs savings growth Excel template

💾 Loan repayment vs savings growth Excel template template .xls

A Loan Repayment vs. Savings Growth Excel template provides a structured way to compare the financial impact of paying off a loan versus investing in a savings account. This template typically includes parameters for loan amount, interest rates, monthly payments, and the duration of the loan, allowing you to visualize how different scenarios affect your overall financial health. It also incorporates savings factors such as the initial deposit, interest rate, and contribution frequency, helping you assess the growth potential of your savings over time. By analyzing this data, you can make informed decisions about whether to prioritize loan repayment or savings growth, while considering future financial needs, such as retirement planning or major purchases.

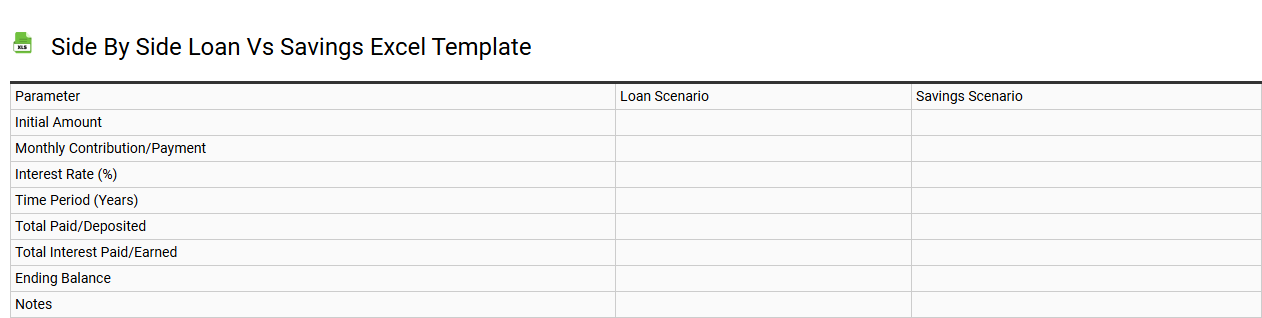

Side by side loan vs savings Excel template

💾 Side by side loan vs savings Excel template template .xls

A Side by Side Loan vs Savings Excel template is a powerful financial tool designed to help you visualize and compare the benefits of taking out a loan against saving for a particular purchase or investment. This template typically features two columns: one detailing the loan terms, including interest rates and monthly payments, while the other outlines the projected savings growth over time based on your contributions and potential interest earned. Each section includes formulas to dynamically calculate totals, offering a clear snapshot of your financial situation. This resource can be invaluable for evaluating your decision-making, balancing needs, and long-term financial strategies; you might even explore advanced topics like compound interest or amortization schedules for deeper analysis.

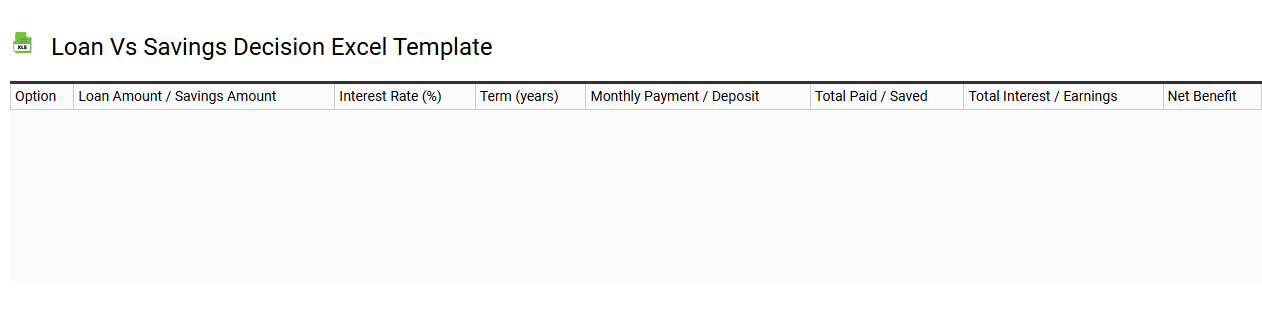

Loan vs savings decision Excel template

💾 Loan vs savings decision Excel template template .xls

A Loan vs. Savings decision Excel template allows you to analyze the financial implications of taking out a loan versus saving for a particular goal. This template typically includes various input fields, such as loan amount, interest rate, loan term, and your savings interest rate. You can visualize different scenarios through built-in charts that illustrate how long it will take to save for a purchase compared to paying off a loan. This tool can help you make informed decisions about your financial future, reflecting both immediate and long-term impacts on your budget and cash flow, as well as advanced considerations like opportunity costs and amortization schedules.

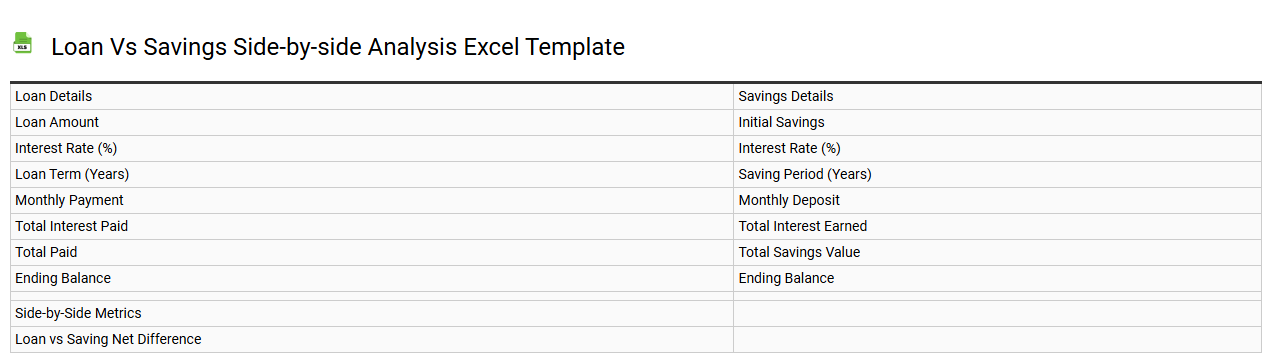

Loan vs savings side-by-side analysis Excel template

💾 Loan vs savings side-by-side analysis Excel template template .xls

A Loan vs. Savings side-by-side analysis Excel template serves as an invaluable tool for personal finance management. This template allows you to compare essential metrics such as interest rates, monthly payments, loan terms, and total costs associated with different loans against the potential gains from various savings accounts or investment opportunities. You can visualize how your money would grow over time in savings compared to the financial obligations of loan repayments. Understanding this comparison can help you make informed decisions regarding borrowing and saving strategies, whether you're considering a personal loan or optimizing your savings for long-term wealth accumulation. Advanced features like amortization schedules and future value calculations can further enhance your insights.

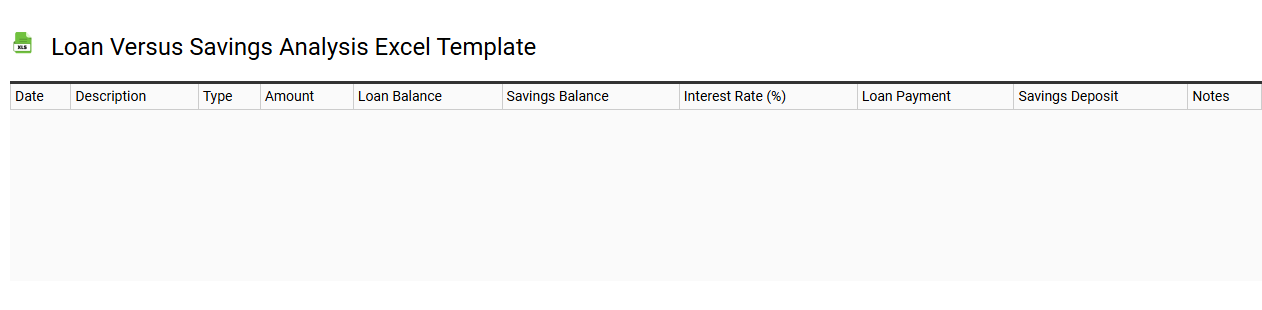

Loan versus savings analysis Excel template

💾 Loan versus savings analysis Excel template template .xls

A Loan versus Savings Analysis Excel template provides a clear comparison between the costs associated with loans and the benefits of savings. This template typically includes key variables such as interest rates, loan terms, and savings growth rates, allowing you to input specific financial figures. You can visualize the long-term impact of choosing a loan over saving, revealing potential savings from interest accrued and total debt costs. You may find this template helpful for basic budgeting, and further uses can involve complex scenarios like investment projections or refinancing analysis.

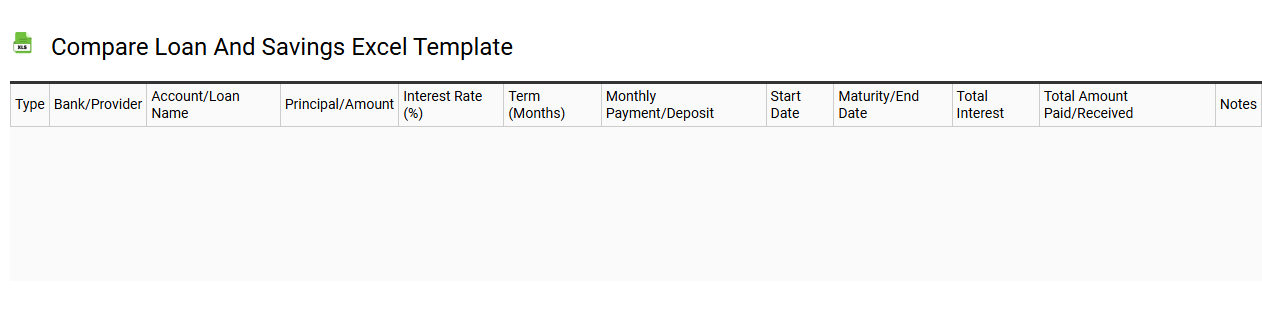

Compare loan and savings Excel template

💾 Compare loan and savings Excel template template .xls

The Compare Loan and Savings Excel template offers a straightforward way to analyze and compare different loan options against savings accounts. Users can input various parameters like interest rates, loan terms, and payment frequencies to visualize the impact on finances over time. The template typically features clear tables and charts, allowing you to quickly interpret how much interest you would pay on a loan compared to the interest you might earn on savings. Understanding this comparison can help guide your financial decisions and potentially refine your approach to investments and debt management, such as exploring options like amortization schedules or the time value of money.

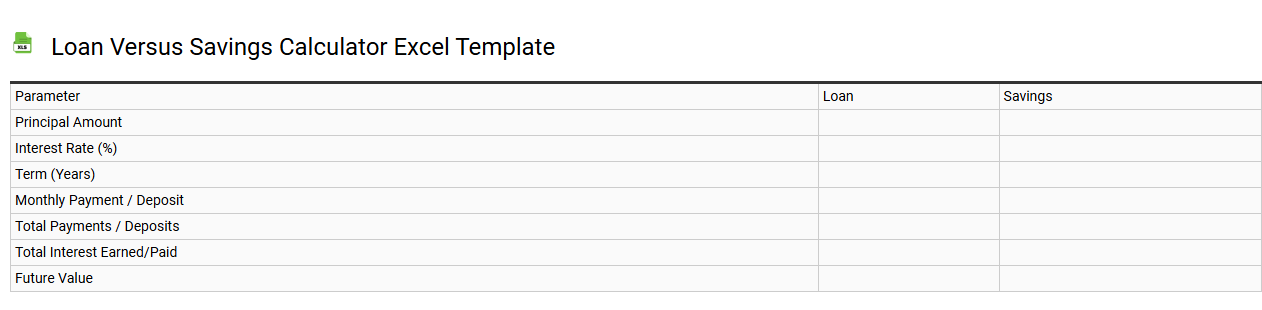

Loan versus savings calculator Excel template

💾 Loan versus savings calculator Excel template template .xls

A Loan versus Savings Calculator Excel template helps you evaluate the financial implications of borrowing money compared to saving for a purchase. This tool allows you to input variables such as loan amount, interest rates, and repayment terms to compare the total cost of the loan with the potential growth of savings over time. You can visualize payments, interest accrued, and the final balance in a user-friendly format, guiding your financial decisions effectively. Basic usage involves assessing loans for personal or business purposes, while more advanced needs might include investment analysis or retirement planning scenarios.

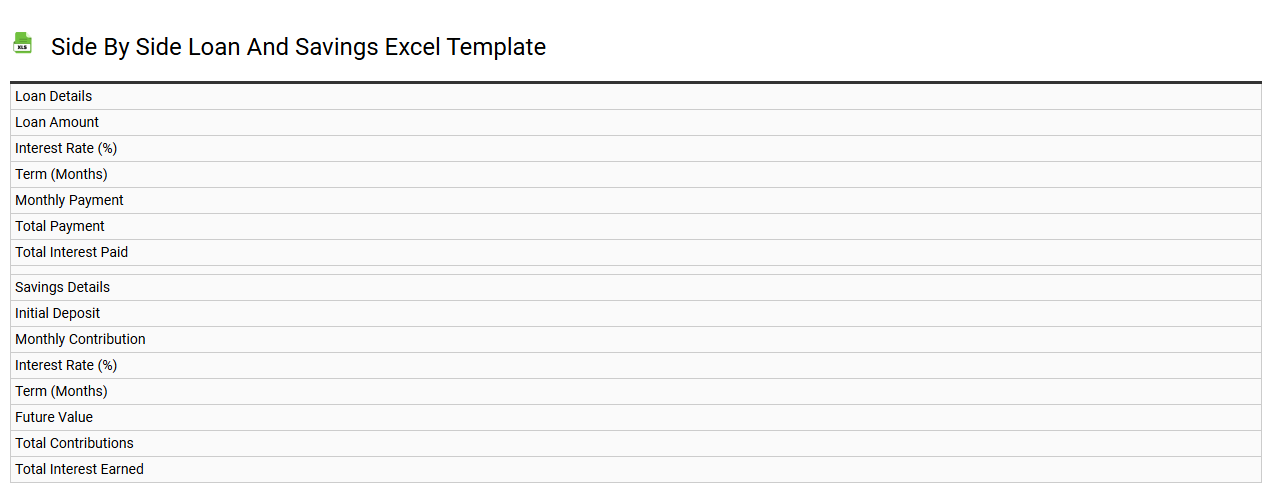

Side by side loan and savings Excel template

💾 Side by side loan and savings Excel template template .xls

A Side by Side Loan and Savings Excel template is a versatile financial tool designed to help you compare and analyze your loan payments alongside your savings growth. This template typically features interactive cells where you can input loan details such as interest rates, payment schedules, and principal amounts. Simultaneously, it allows you to visualize savings contributions, interest accrued, and time frames, assisting in making informed financial decisions. By effectively managing your money, you can explore various scenarios involving budgeting, interest calculations, and investment analysis for more advanced scenarios like cash flow forecasting.

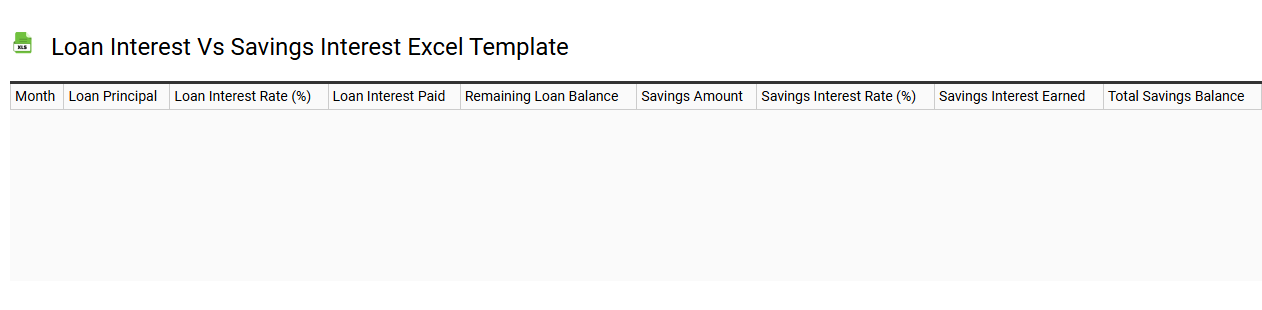

Loan interest vs savings interest Excel template

💾 Loan interest vs savings interest Excel template template .xls

A Loan Interest vs Savings Interest Excel template is a tool designed to help you compare the costs of borrowing versus the benefits of saving. This template typically includes functional tables where you can input your loan amounts, interest rates, and duration to generate comprehensive calculations of total interest paid over the term. In contrast, it allows you to input savings amounts, interest rates, and periods to visualize potential earnings from saving. Understanding these figures can provide insight into your financial strategy, supporting decisions on loan borrowing or investing in savings accounts, with potential applications in risk assessment and investment forecasting.

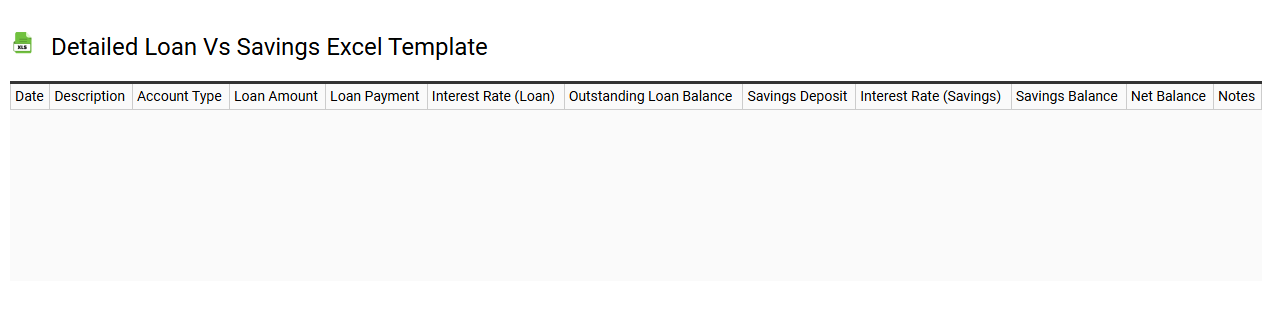

Detailed loan vs savings Excel template

💾 Detailed loan vs savings Excel template template .xls

A detailed loan vs savings Excel template provides a comprehensive analysis of the financial implications of taking a loan versus saving money. This tool typically includes various inputs such as loan amount, interest rate, loan term, and savings interest rate, allowing you to see how much interest you would pay over time versus how much you could earn through savings. The template often features charts and graphs to visually represent the comparison, making it easier to understand the trade-offs involved. You can use this resource for basic budgeting, while further potential needs may involve advanced financial modeling or scenario analysis.

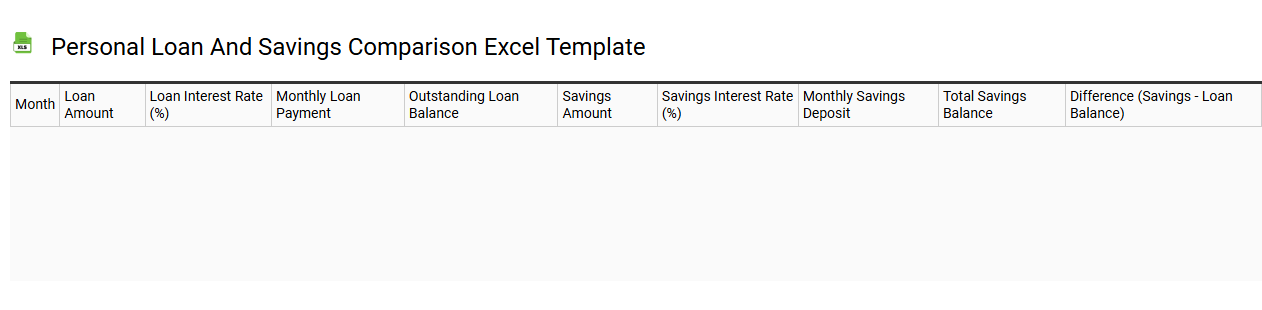

Personal loan and savings comparison Excel template

💾 Personal loan and savings comparison Excel template template .xls

A Personal Loan and Savings Comparison Excel template provides a structured way to evaluate different loan options and savings accounts side by side. This tool allows you to input various parameters such as loan amounts, interest rates, loan terms, and monthly payments, while simultaneously tracking potential savings through different accounts or investment options. By visually comparing the outcomes, you can make informed financial decisions regarding borrowing versus saving. Basic usage includes straightforward calculations, but it can also be enhanced with advanced features like data visualization and scenario analysis for more comprehensive financial planning.