Explore diverse free XLS templates specifically designed for Loan Portfolio Management. These templates streamline the tracking of loan details, such as borrower names, loan amounts, interest rates, and payment schedules. With user-friendly layouts, you can easily monitor your investments and assess portfolio performance, all while ensuring that your data remains organized and accessible.

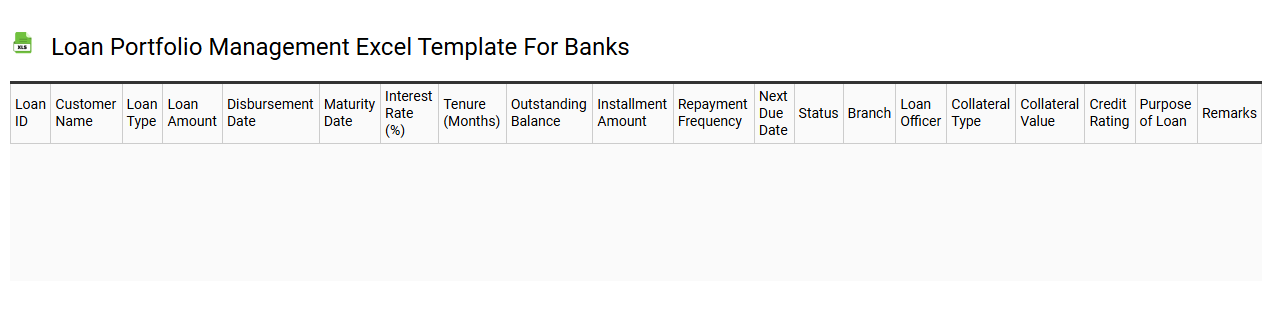

Loan portfolio management Excel template for banks

💾 Loan portfolio management Excel template for banks template .xls

A Loan portfolio management Excel template is a structured tool designed to help banks and financial institutions track and analyze their lending activities. This template typically includes various sheets where you can input details such as loan amounts, interest rates, borrower information, and repayment schedules. Users can visualize portfolio performance through charts and dashboards, making it easier to identify trends in delinquency rates or loan concentrations. Beyond basic tracking, the template can also adapt to include advanced analytics like predictive modeling or risk assessment frameworks tailored to specific lending strategies.

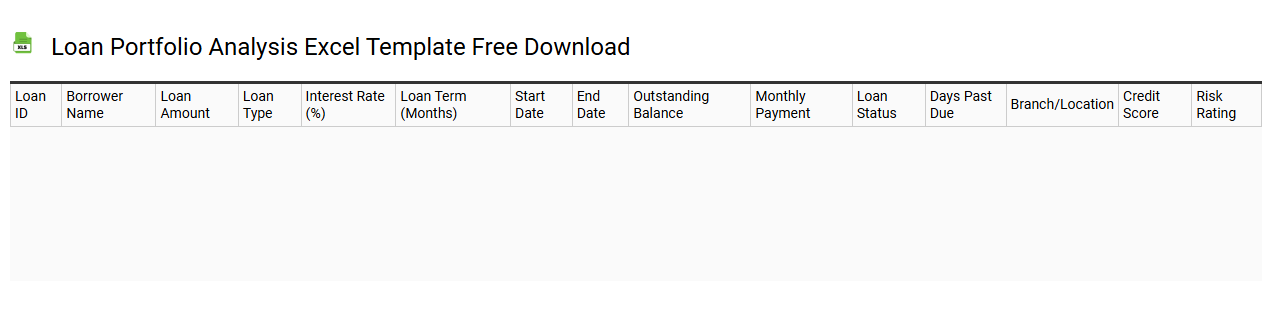

Loan portfolio analysis Excel template free download

💾 Loan portfolio analysis Excel template free download template .xls

A Loan Portfolio Analysis Excel template enables users to evaluate and manage various aspects of a loan portfolio efficiently. This template typically includes sections for tracking loan types, interest rates, payment schedules, and borrower information. Visual representations such as graphs and charts can provide insights into loan performance and risk levels. Understanding this framework allows you to gauge your portfolio's health and anticipate the need for advanced tools like predictive analytics or risk modeling for comprehensive assessments.

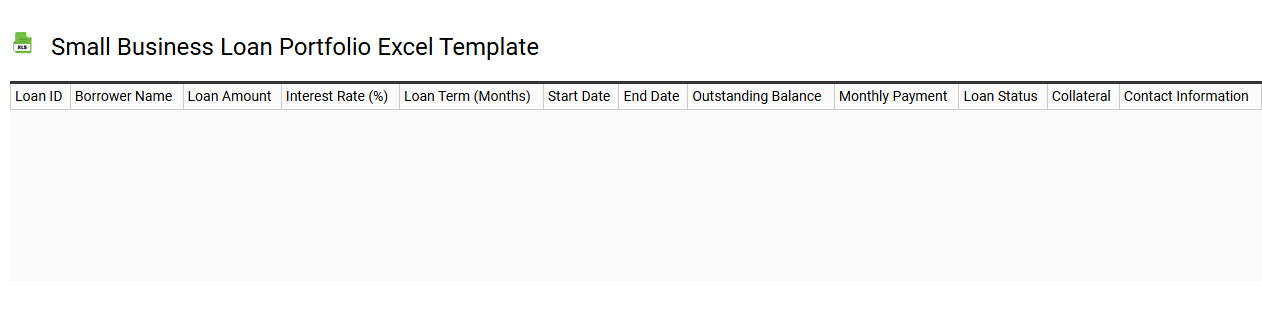

Small business loan portfolio Excel template

💾 Small business loan portfolio Excel template template .xls

A Small Business Loan Portfolio Excel template offers a structured way to manage and track loans for small businesses. This template typically includes sections for borrower information, loan amounts, interest rates, repayment schedules, and outstanding balances, making it easy to assess your overall loan performance. You can customize it to reflect specific metrics important to your financial analysis, including default rates and revenue forecasts. This foundational tool supports basic portfolio management while allowing for potential enhancements like integration with financial modeling tools or advanced analytics features.

Real estate loan portfolio tracking Excel template

![]()

💾 Real estate loan portfolio tracking Excel template template .xls

A real estate loan portfolio tracking Excel template is a structured spreadsheet designed for monitoring and managing loans related to real estate investments. This tool allows you to input essential loan details, such as property addresses, loan amounts, interest rates, and payment schedules. Users can analyze financial performance through built-in formulas that calculate total interest paid, outstanding balances, and amortization schedules. Such a template can help you stay organized and informed while also providing valuable insights for advanced metrics like debt service coverage ratios and loan-to-value comparisons.

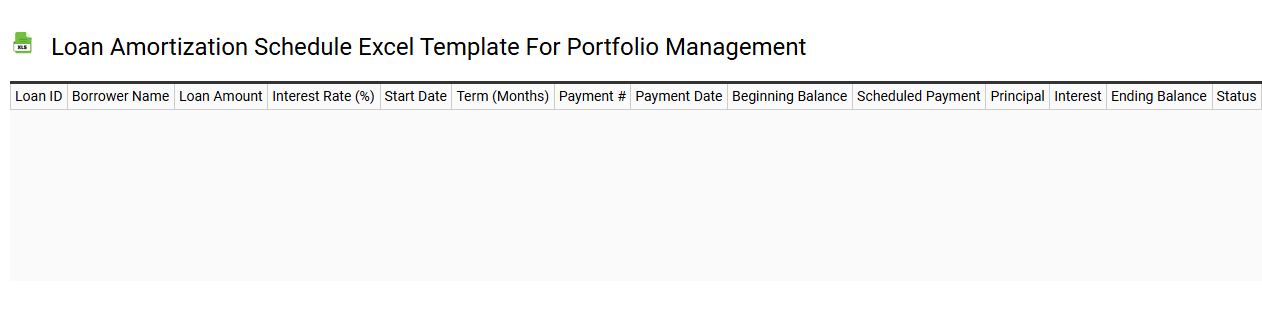

Loan amortization schedule Excel template for portfolio management

💾 Loan amortization schedule Excel template for portfolio management template .xls

A Loan amortization schedule Excel template is a structured tool designed to help you track and manage loan repayments over time. It provides a detailed breakdown of each payment, specifying how much goes towards interest and how much reduces the principal balance. Your cash flow can be optimized as the template helps visualize payment timelines and outstanding balances, allowing for more informed financial decisions. With features such as formatting to highlight upcoming payments and potential additional payment scenarios, this template supports both basic loan tracking and advanced analyses, like scenario comparisons or interest rate fluctuation impacts.

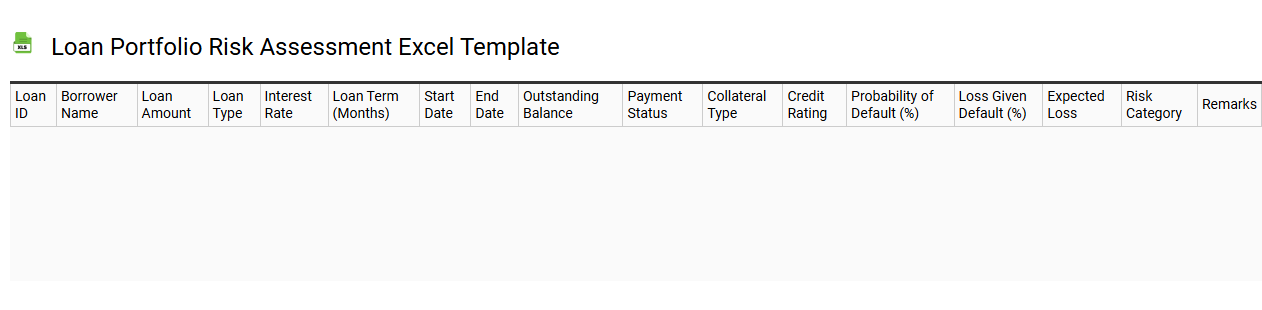

Loan portfolio risk assessment Excel template

💾 Loan portfolio risk assessment Excel template template .xls

A Loan Portfolio Risk Assessment Excel template is a structured spreadsheet designed to evaluate and manage the risk associated with a financial institution's loan portfolio. It includes various components such as borrower credit scores, loan types, interest rates, and historical repayment data. You will find features that allow for the calculation of risk metrics like default probabilities and loss given default. This tool not only aids in understanding current risk exposure but also helps in strategizing for potential risks through advanced analytics, including stress testing and scenario analysis.

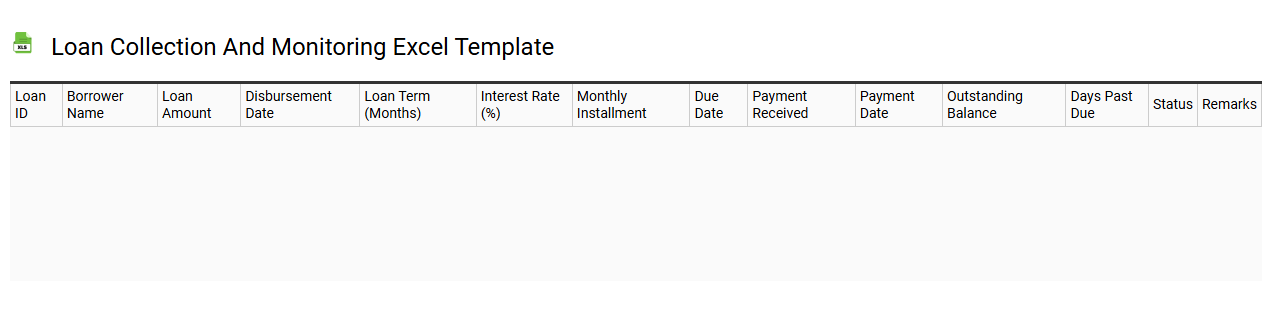

Loan collection and monitoring Excel template

💾 Loan collection and monitoring Excel template template .xls

A Loan collection and monitoring Excel template is a comprehensive tool designed to help individuals or organizations track loan repayments efficiently. This template typically includes features such as borrower details, loan amounts, payment schedules, outstanding balances, and interest calculations. Utilizing this template, you can easily identify late payments, manage deadlines, and generate reports to assess the financial health of your lending operations. For more complex financial management, consider integrating advanced functionalities like dynamic dashboards or automated reminders to streamline processes further.

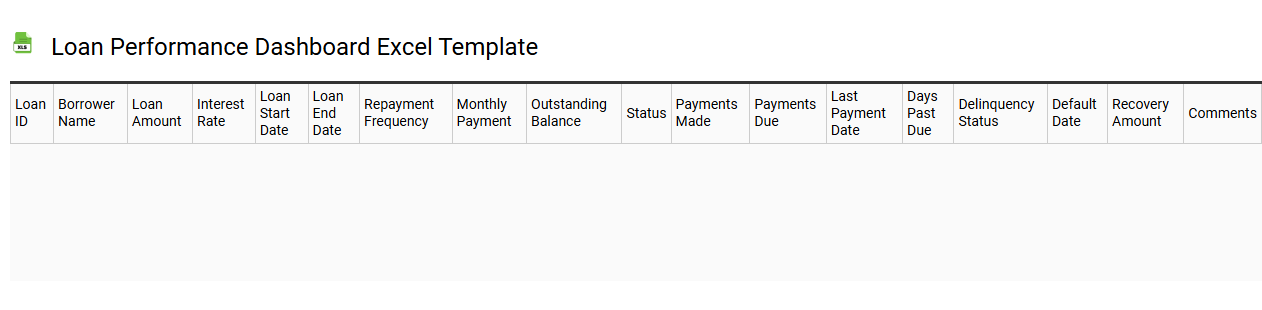

Loan performance dashboard Excel template

💾 Loan performance dashboard Excel template template .xls

A Loan Performance Dashboard Excel template is a customizable spreadsheet designed to track and analyze the performance of various loan portfolios. It features visual representations, such as charts and graphs, to provide quick insights into key performance indicators like default rates, payment delinquencies, and loan origination volumes. This tool allows users to assess trends over time, identify underperforming loans, and optimize lending strategies based on real-time data analysis. You can further enhance this dashboard by incorporating advanced features like predictive analytics or machine learning algorithms for more sophisticated forecasting of loan performance.

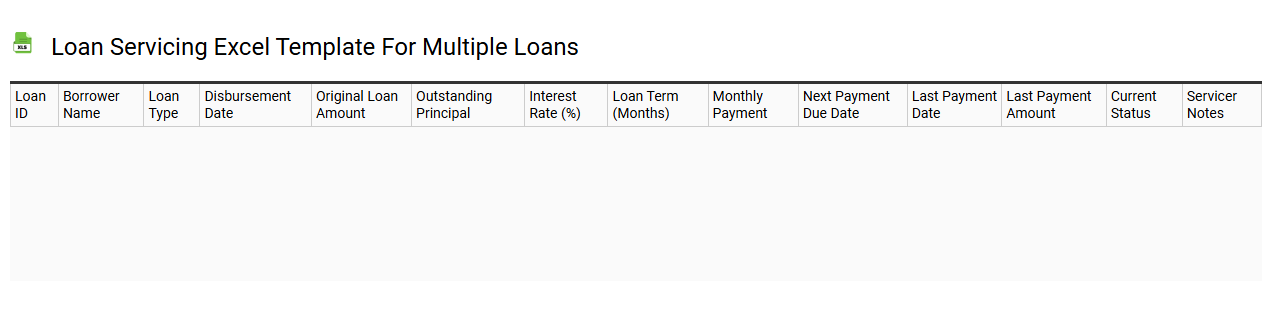

Loan servicing Excel template for multiple loans

💾 Loan servicing Excel template for multiple loans template .xls

A Loan servicing Excel template for multiple loans is a structured spreadsheet designed to help individuals or financial professionals manage several loan accounts efficiently. It typically includes columns for loan amounts, interest rates, payment schedules, and due dates, enabling you to track payments and remaining balances. This template may also feature formulas to calculate principal and interest portions of payments, ensuring accurate records and projections. For more advanced needs, you might consider integrating features like amortization schedules and forecasting tools tailored to specific loan types or investment strategies.