Explore a variety of free Excel templates designed for loan tenure calculation. These templates feature user-friendly layouts, allowing you to easily input loan amounts, interest rates, and repayment periods. Detailed formulas within the sheets automatically generate monthly payments and total interest, providing you with clear insights into your financial commitments.

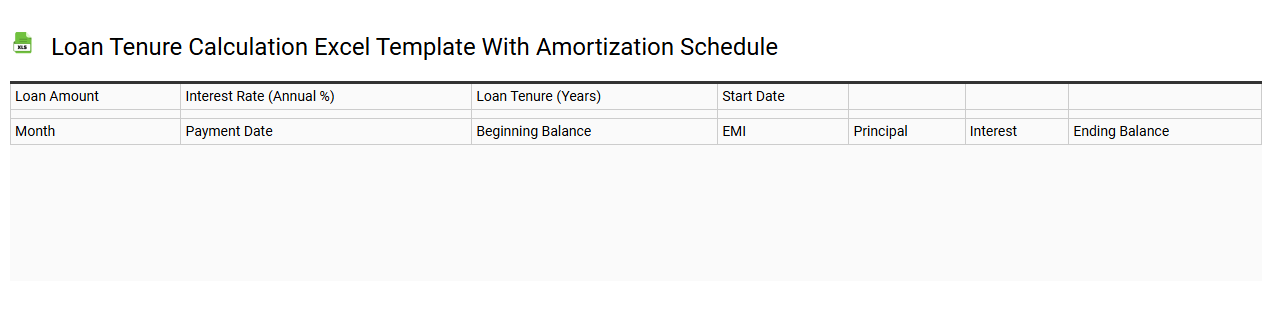

Loan tenure calculation Excel template with amortization schedule

💾 Loan tenure calculation Excel template with amortization schedule template .xls

A Loan tenure calculation Excel template with an amortization schedule is an organized tool designed to help you manage loan repayments. This template typically includes fields for principal loan amount, interest rate, repayment frequency, and duration of loan tenure. As you input the necessary data, the template automatically generates a detailed amortization schedule, breaking down each payment into principal and interest components. You can utilize this schedule to visualize the total interest paid over the life of the loan and assess potential early repayment strategies, enhancing your financial planning with advanced concepts like present value and future cash flow analysis.

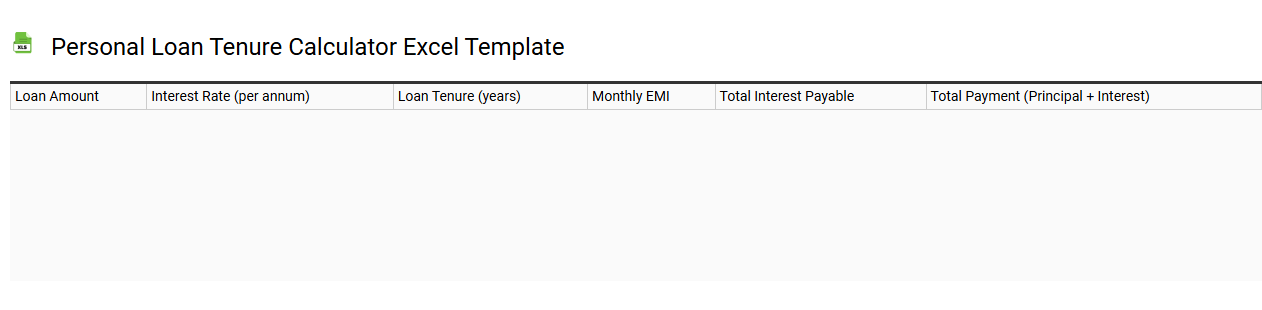

Personal loan tenure calculator Excel template

💾 Personal loan tenure calculator Excel template template .xls

A Personal Loan Tenure Calculator Excel template is a financial tool designed to help individuals determine the optimal duration for repaying a personal loan. This template typically includes fields for loan amount, interest rate, and monthly payment, allowing users to see various repayment scenarios. By manipulating these variables, you can visualize how changing the loan tenure affects overall interest costs and monthly payments. Mastering this basic tool can lead to deeper explorations of amortization schedules and debt management strategies to meet your financial goals.

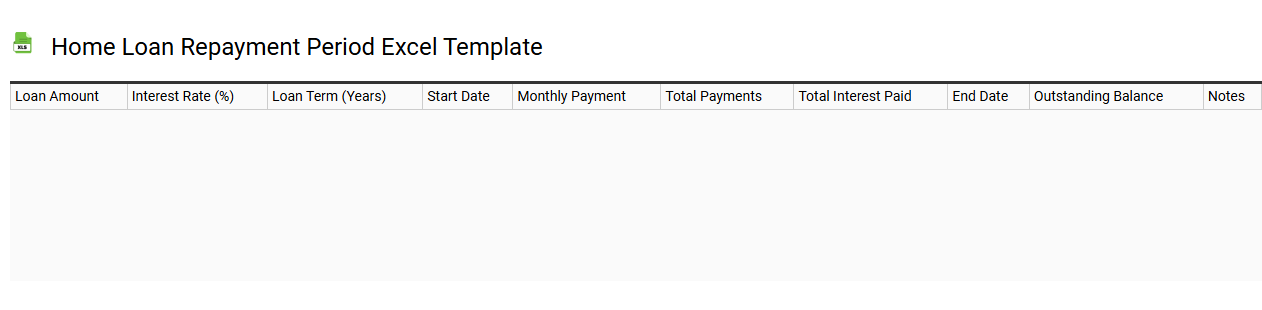

Home loan repayment period Excel template

💾 Home loan repayment period Excel template template .xls

A Home Loan Repayment Period Excel template is a structured spreadsheet designed to help you manage and visualize the repayment schedule of your home loan. It typically includes essential data fields such as loan amount, interest rate, monthly payment, and loan tenure, allowing you to calculate total interest paid and remaining balance over time. This template often features graphs for visual representation of payment progress, making it easier for you to track your loan status at a glance. Basic usage includes managing standard loan repayments, while advanced features might involve calculating amortization schedules or incorporating various repayment scenarios.

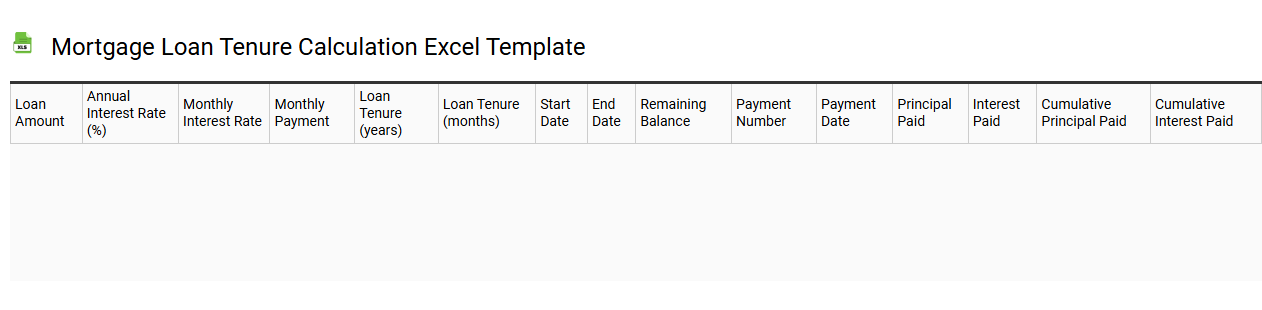

Mortgage loan tenure calculation Excel template

💾 Mortgage loan tenure calculation Excel template template .xls

A Mortgage loan tenure calculation Excel template allows users to efficiently compute the duration needed to repay a mortgage based on variables such as loan amount, interest rate, and monthly payment. This template typically includes predefined formulas, enabling you to adjust figures easily; as you modify the loan amount or interest rate, the projected tenure updates automatically. You can visualize the amortization schedule, which details principal and interest breakdowns over time, helping you better understand payment structure. Such a template not only aids in assessing current mortgage plans but can also accommodate complex scenarios like prepayments or variable interest rates for future financial strategies.

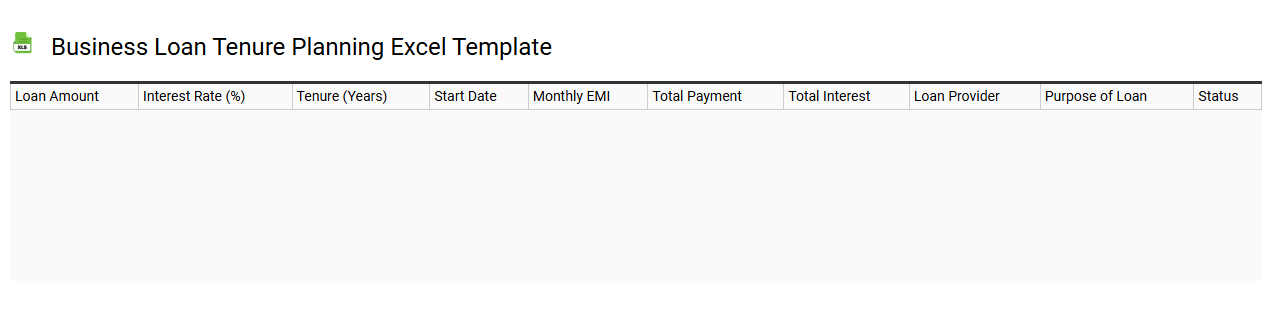

Business loan tenure planning Excel template

💾 Business loan tenure planning Excel template template .xls

A Business Loan Tenure Planning Excel Template is a structured spreadsheet designed to assist businesses in managing their loan repayment schedules effectively. This template typically includes input fields for the loan amount, interest rate, repayment period, and monthly payment calculations, providing a clear overview of your financial obligations. Users can visualize the amortization schedule, which details the breakdown of each payment into principal and interest components over time. This tool can help you assess the financial impact of your loan and make informed decisions about budgeting and cash flow management, while its advanced features can further support financial forecasting and scenario analysis for robust strategic planning.

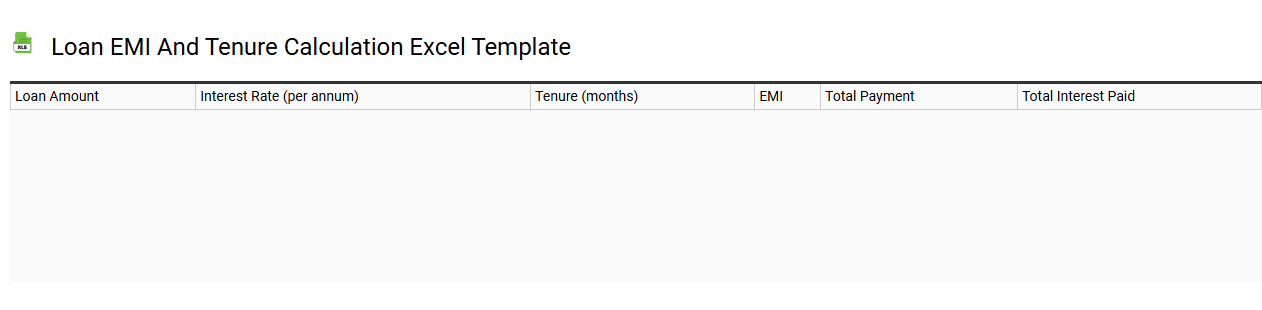

Loan EMI and tenure calculation Excel template

💾 Loan EMI and tenure calculation Excel template template .xls

Loan EMI (Equated Monthly Installment) calculation involves determining the fixed monthly payment that borrowers must make to repay a loan over time. In an Excel template designed for this purpose, key inputs such as loan amount, interest rate, and tenure are arranged in a user-friendly layout, allowing you to easily manipulate values to see how changes affect your payments. Formulas embedded in the cells compute EMI based on the reducing balance method or flat-rate method, ensuring precise calculations. This template can be expanded to include features like amortization schedules, total interest paid, and graphical representations of your payment journey, meeting both basic and advanced financial planning needs.

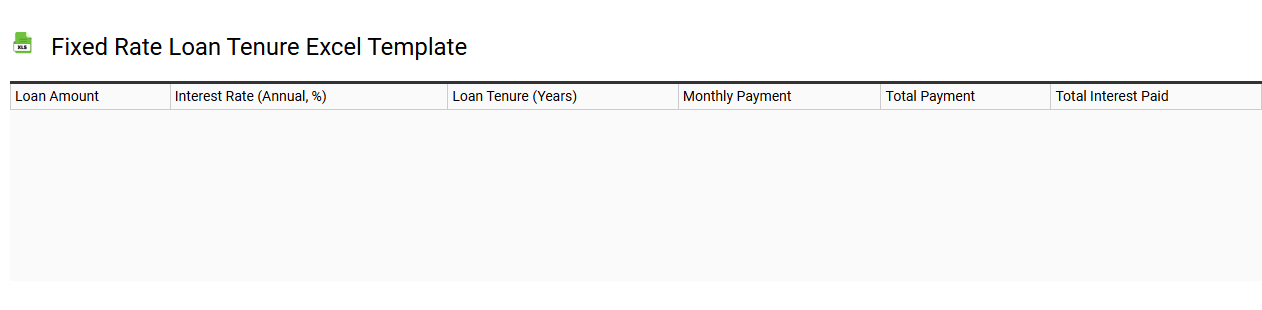

Fixed rate loan tenure Excel template

💾 Fixed rate loan tenure Excel template template .xls

A Fixed Rate Loan Tenure Excel template is a structured spreadsheet designed to help you calculate and visualize the repayment schedule of a fixed-rate loan. It typically includes fields for loan amount, interest rate, loan tenure, and monthly payment calculations, providing a clear overview of how much you will pay each month. This template often features amortization tables, showing how each payment contributes to interest and principal over time, helping you understand your financial commitments better. For users seeking more advanced analysis, functionalities could include sensitivity analyses or integration with financial forecasting tools to project future payments under varying scenarios.

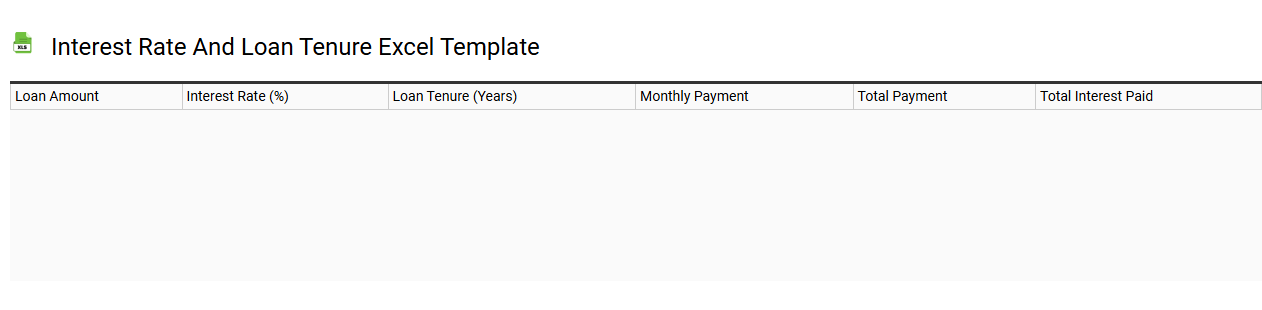

Interest rate and loan tenure Excel template

💾 Interest rate and loan tenure Excel template template .xls

An Interest Rate and Loan Tenure Excel template is a financial tool designed to help you calculate and analyze the effects of different interest rates and loan durations on your monthly payments. By inputting the loan amount, interest rate, and tenure, the template generates detailed breakdowns of your monthly repayment obligations and total interest paid over the life of the loan. You can visualize options like varying interest rates or loan terms, allowing for informed financial decisions tailored to your budget. This basic-use tool can also be expanded to include advanced features such as amortization schedules and sensitivity analyses to optimize your borrowing strategy.

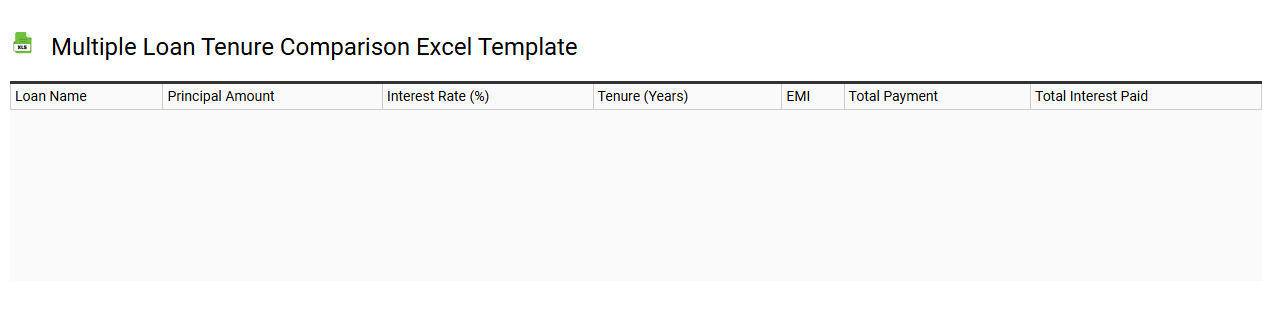

Multiple loan tenure comparison Excel template

💾 Multiple loan tenure comparison Excel template template .xls

A Multiple Loan Tenure Comparison Excel template provides a structured way to evaluate various loan options side by side. You can input essential loan parameters, such as loan amount, interest rate, and tenure, allowing for a straightforward comparison of total payments for different scenarios. This tool is designed to help you understand how variations in tenure affect monthly installments and total interest paid. You may find this template useful for making informed financial decisions, especially when considering potential refinances, variable interest rates, or amortization schedules.

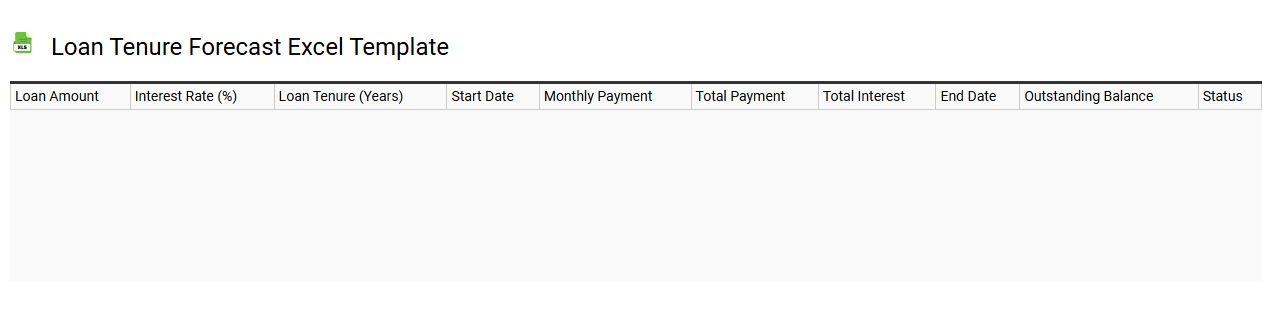

Loan tenure forecast Excel template

💾 Loan tenure forecast Excel template template .xls

A Loan Tenure Forecast Excel template is a structured spreadsheet designed to help borrowers calculate and visualize their loan repayment period based on various parameters. It typically includes fields for inputting the loan amount, interest rate, and monthly repayment options, enabling you to see the impact of different scenarios on the duration of the loan. The template may feature dynamic charts that illustrate how changes in repayment amounts or interest rates can affect the overall tenure, providing clear insights for financial planning. Beyond basic calculations, this template can be expanded to incorporate advanced financial models like amortization schedules, sensitivity analyses, and cash flow projections, enhancing its usability for comprehensive financial management.