Discover a selection of free Excel templates specifically designed for loan reconciliation statements. Each template offers structured layouts that make it easy to enter your loan details, including principal amounts, interest rates, and payment schedules. With built-in formulas, these templates provide instant calculations, helping you track your loan status and ensure your records are accurate and up-to-date.

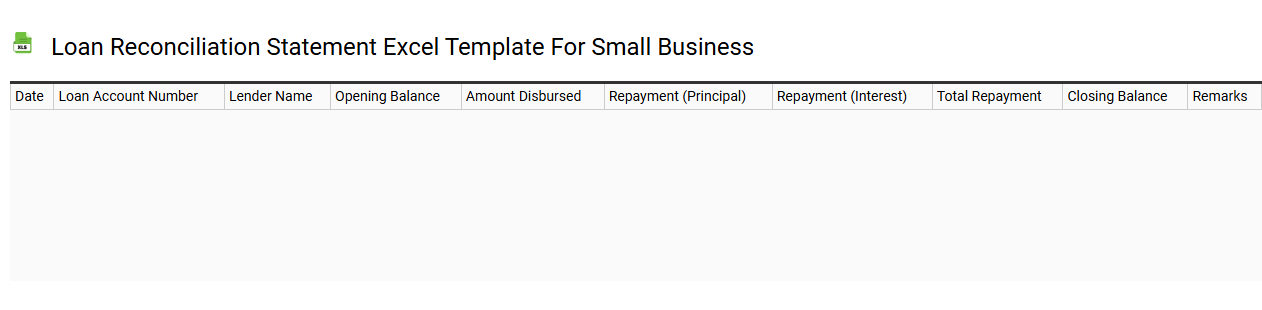

Loan reconciliation statement Excel template for small business

💾 Loan reconciliation statement Excel template for small business template .xls

A Loan Reconciliation Statement Excel template for small businesses is a customized spreadsheet tool designed to track and manage loan payments accurately. It typically includes sections for loan details, payment dates, principal amounts, interest rates, and outstanding balances. This template allows you to compare your actual loan payments against your records, helping you identify discrepancies easily. You can further enhance this template by incorporating advanced financial analysis tools, like amortization schedules or cash flow projections, to better forecast your future financial needs.

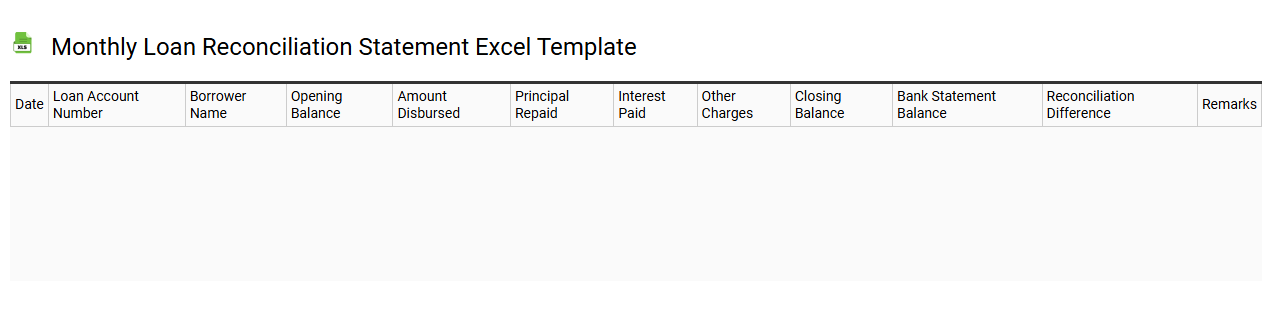

Monthly loan reconciliation statement Excel template

💾 Monthly loan reconciliation statement Excel template template .xls

A Monthly Loan Reconciliation Statement Excel template allows you to systematically track and manage your loan payments. This template includes sections for loan details, payment dates, amounts due, and any accrued interest, making it easy to visualize your financial obligations. You can customize it to suit various types of loans, including mortgages, personal loans, or business financing. This tool not only helps in maintaining accurate records but also offers potential for advanced financial analysis using formulas and macros for more intricate reconciliation processes.

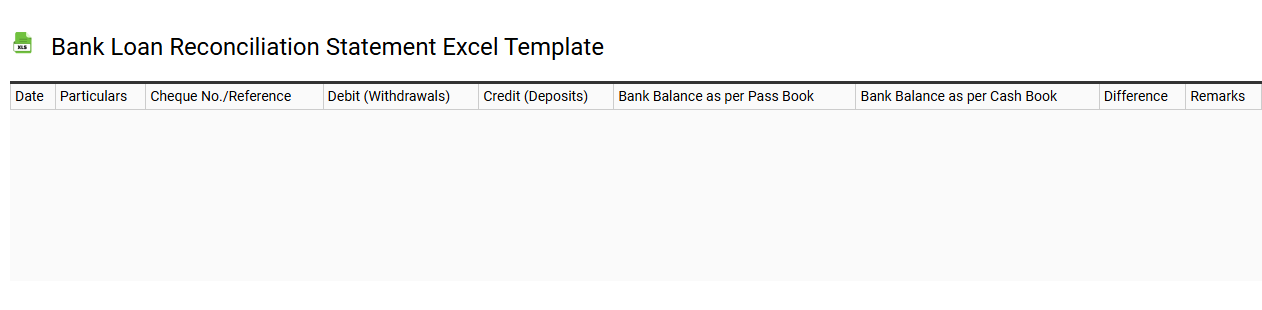

Bank loan reconciliation statement Excel template

💾 Bank loan reconciliation statement Excel template template .xls

A bank loan reconciliation statement Excel template is a structured tool designed to align your financial records with your bank statements for loans. This template typically includes sections for recording loan amounts, interest calculations, payment schedules, and outstanding balances. Clear columns for date, transaction details, and amounts help ensure accurate tracking and help you identify discrepancies between your records and the bank's figures. While this basic template addresses immediate needs, more advanced versions can incorporate features like automated interest calculations, payment reminders, and integration with accounting software for comprehensive financial management.

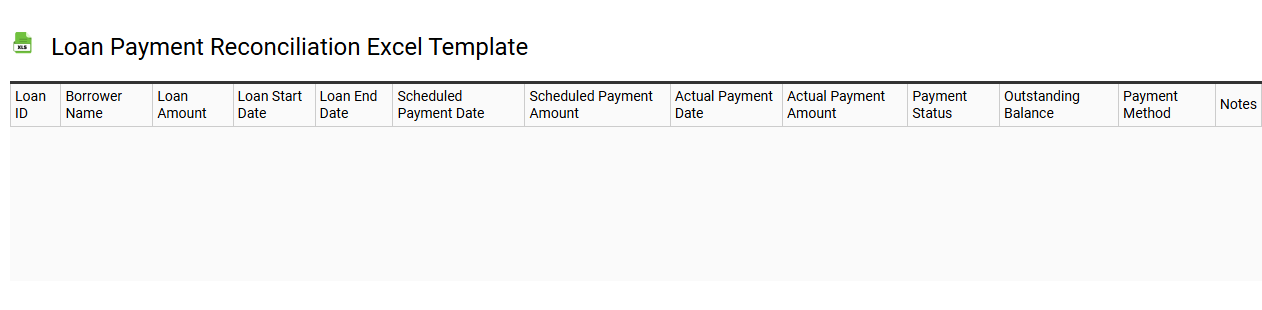

Loan payment reconciliation Excel template

💾 Loan payment reconciliation Excel template template .xls

A Loan Payment Reconciliation Excel template is a structured spreadsheet designed to track and verify loan payments against the lender's records. This tool provides detailed columns for payment dates, amounts, interest calculations, and outstanding balances, promoting accurate financial management. You can easily input and update data, helping you identify discrepancies between your records and the lender's statements. This template can grow with your needs, from basic tracking of monthly payments to incorporating advanced financial metrics like amortization schedules and cash flow analysis.

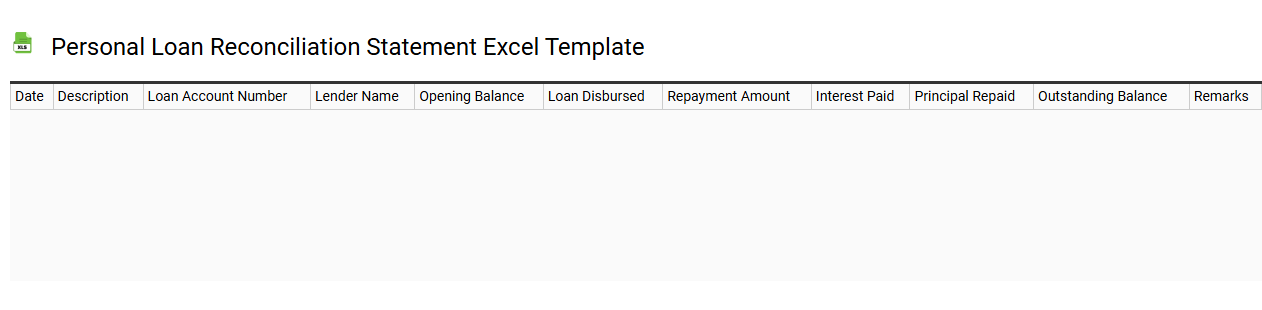

Personal loan reconciliation statement Excel template

💾 Personal loan reconciliation statement Excel template template .xls

A Personal Loan Reconciliation Statement Excel template is a structured spreadsheet used for tracking and comparing your personal loan transactions against your records. This template typically includes fields for loan amounts, interest rates, payment dates, and remaining balances, allowing you to monitor your repayment progress effectively. You can easily input your loan details and monthly payments, assisting you in identifying discrepancies between your bank statements and your own records. For enhanced financial management, consider utilizing functions for calculating amortization schedules, interest accrual, and total repayment costs as your needs evolve.

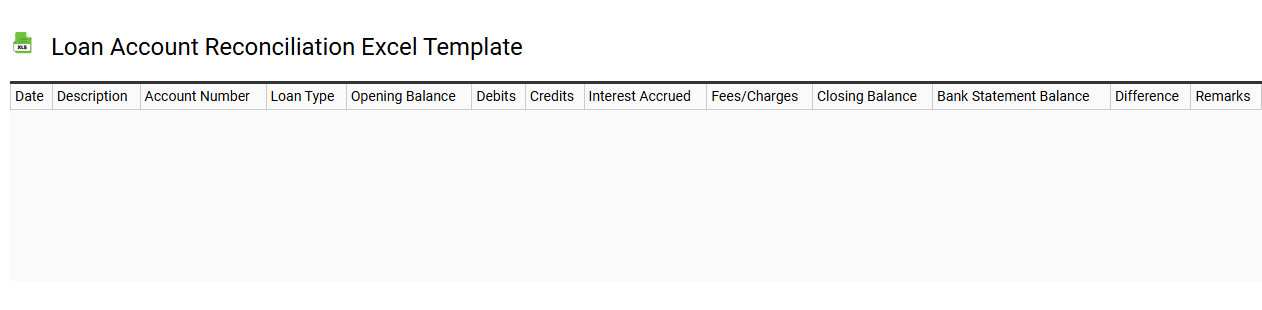

Loan account reconciliation Excel template

💾 Loan account reconciliation Excel template template .xls

A Loan Account Reconciliation Excel template serves as a structured tool to compare and align loan account records between two sources, such as a lender's statement and your own financial records. This template typically includes sections for listing loan details, payment dates, amounts disbursed, interest accrued, and outstanding balances. Users can easily input their financial data and highlight discrepancies, facilitating error identification and resolution. By employing this template, you can enhance your understanding of loan transactions while also promoting accurate reporting for tax purposes, budgeting, or future loan applications. You might explore advanced features like pivot tables, macros, or integrated financial modeling to further streamline your reconciliation process.

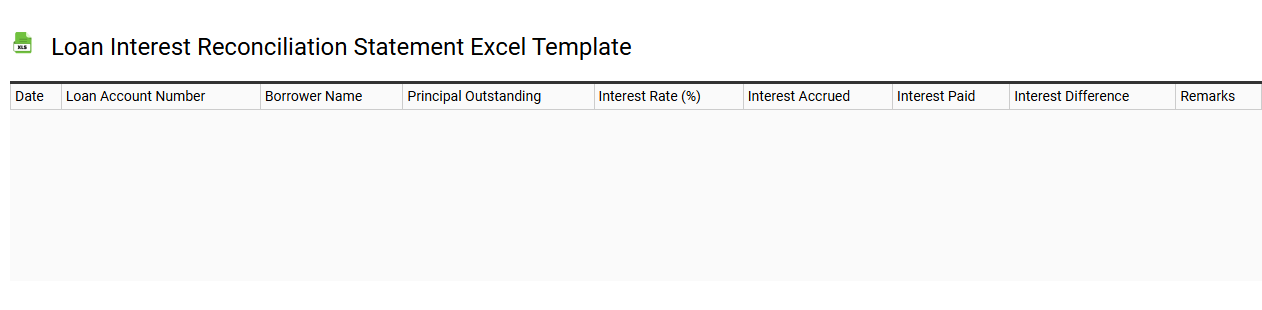

Loan interest reconciliation statement Excel template

💾 Loan interest reconciliation statement Excel template template .xls

A Loan Interest Reconciliation Statement Excel template is a structured document designed to help individuals or organizations efficiently track and reconcile loan interest payments against their financial records. This template typically includes sections for entering loan details, interest rates, payment schedules, and the actual interest paid, enabling clear comparisons and calculations. You can customize formulas to automatically compute outstanding balances or accrued interest, fostering accuracy in financial reporting. Such templates not only assist in managing current loans but also pave the way for advanced financial analytics, such as cash flow forecasting or debt servicing calculations.

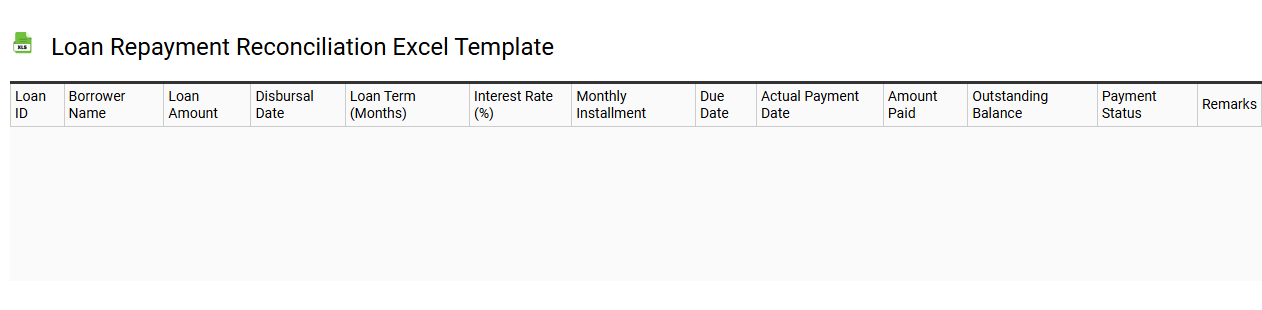

Loan repayment reconciliation Excel template

💾 Loan repayment reconciliation Excel template template .xls

A loan repayment reconciliation Excel template serves as a comprehensive tool to manage and track your loan repayments effectively. It typically includes columns for loan amounts, payment dates, interest rates, and any outstanding balances, allowing for clear visibility into your financial responsibilities. This template can help you ensure that all payments align with your records, reducing the chances of errors or missed payments. You can use this basic structure for personal loans, mortgages, or even investments, while customizing it further for more complex financial scenarios involving amortization schedules or multiple loan accounts.

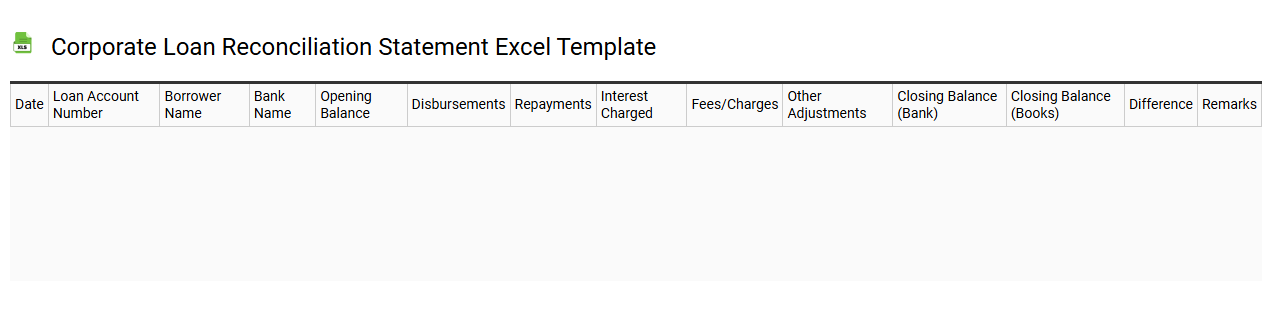

Corporate loan reconciliation statement Excel template

💾 Corporate loan reconciliation statement Excel template template .xls

A Corporate Loan Reconciliation Statement Excel template is a structured spreadsheet designed to help businesses track and reconcile their corporate loan transactions. This template typically includes sections for loan amounts, interest rates, payment dates, and outstanding balances, making it easier to monitor financial obligations. Users can input transaction data, compare it against bank statements, and ensure accuracy in their records. With its basic functionalities, this template can further support complex financial analyses, such as forecasting cash flows or evaluating debt service coverage ratios.

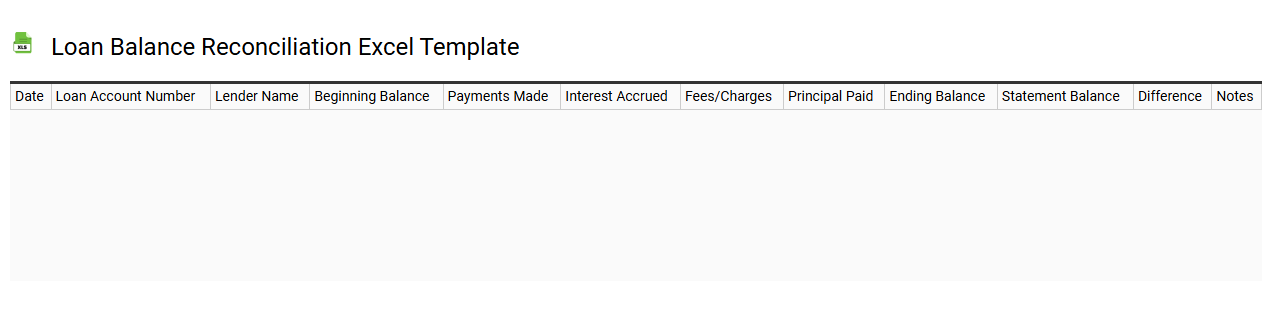

Loan balance reconciliation Excel template

💾 Loan balance reconciliation Excel template template .xls

A Loan Balance Reconciliation Excel template is a structured tool that helps borrowers and lenders to systematically track and compare loan balances. It includes columns for principal amounts, interest accrued, payment history, and outstanding amounts, allowing for clear visibility into the loan's financial status. This template simplifies the process of verifying that both parties agree on the current balance, facilitating a transparent communication channel. For your advanced financial analysis, this tool can further integrate features like amortization schedules or dynamic forecasting models.