Explore a selection of free XLS templates designed for mortgage comparison, perfect for evaluating different loan options. Each template offers user-friendly fields to input mortgage data, such as interest rates, loan amounts, and terms, allowing for straightforward side-by-side comparisons. Analyze your potential financial commitments with clear visualizations, helping you make informed decisions about your mortgage choices.

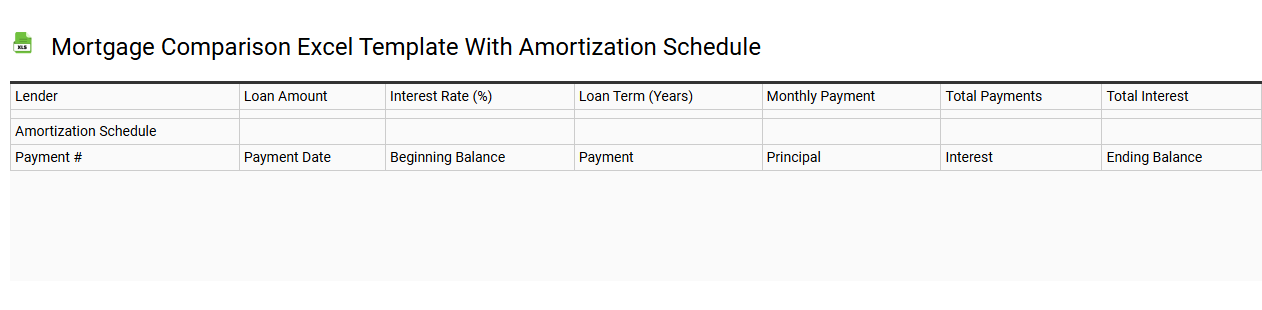

Mortgage comparison Excel template with amortization schedule

💾 Mortgage comparison Excel template with amortization schedule template .xls

A mortgage comparison Excel template with an amortization schedule is a powerful tool that allows you to evaluate different mortgage options side by side. You'll find input fields for loan amounts, interest rates, and terms, making it easy to compare monthly payments and total interest. The integrated amortization schedule breaks down each payment over the life of the loan, showcasing how principal and interest components change over time. This template can also adapt to more complex scenarios, including adjustable-rate mortgages or additional payments, enabling you to explore in-depth financial strategies.

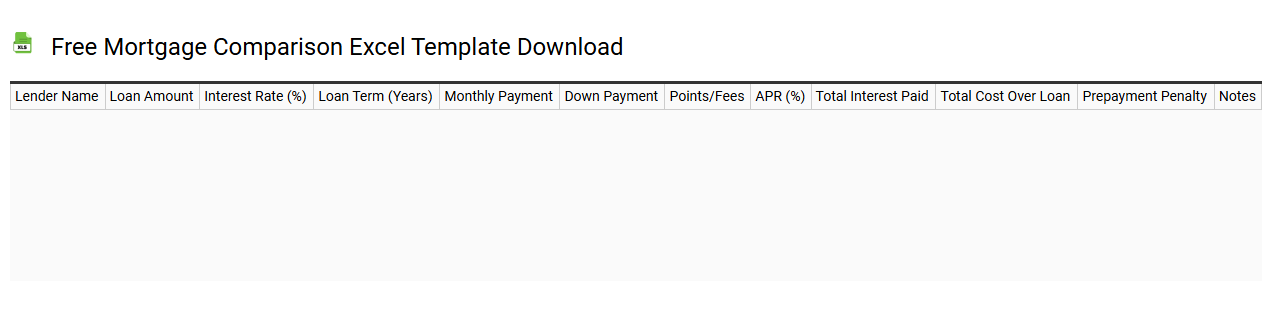

Free mortgage comparison Excel template download

💾 Free mortgage comparison Excel template download template .xls

A free mortgage comparison Excel template allows you to efficiently evaluate different mortgage options side by side. It typically includes fields to input details like loan amount, interest rates, loan terms, and monthly payments. Charts and tables within the template provide a clear visual comparison, helping you quickly identify the most cost-effective option. This tool is invaluable for informed decision-making about home financing, and you can expand its functionality by incorporating advanced financial metrics such as amortization schedules and total interest paid.

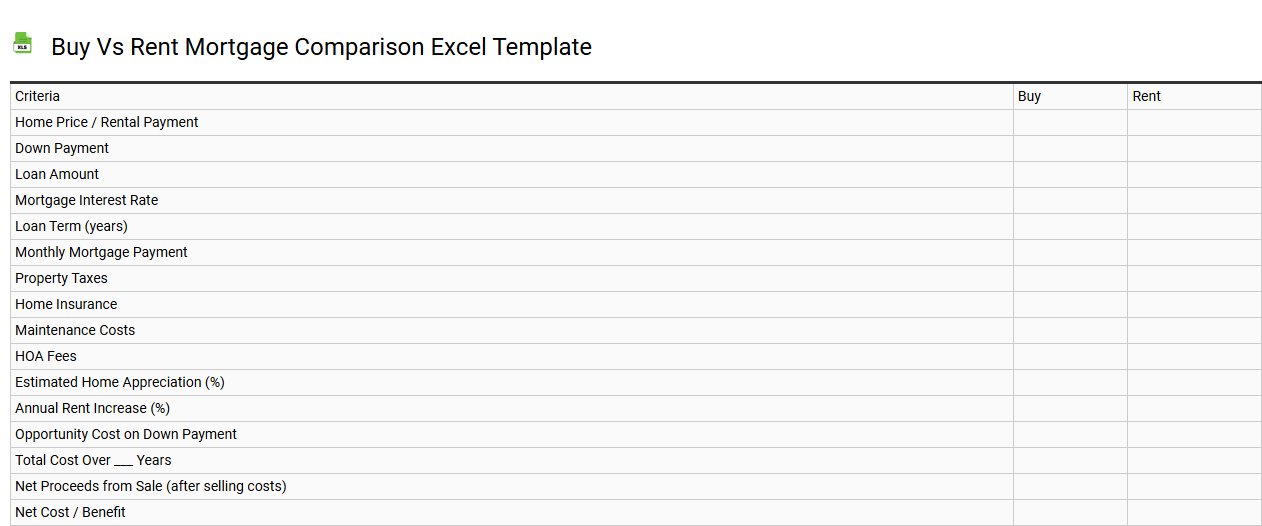

Buy vs rent mortgage comparison Excel template

💾 Buy vs rent mortgage comparison Excel template template .xls

A Buy vs Rent Mortgage Comparison Excel template is a powerful tool designed to help you evaluate the financial implications of purchasing a home versus renting one. This spreadsheet typically includes various financial metrics, such as initial costs, monthly payments, property appreciation, tax benefits, and potential investment growth. By inputting your specific data, you can visualize the long-term costs and savings associated with each option over time. This analysis can guide you in making informed decisions, whether you are considering purchasing a home or preferring the flexibility of renting while keeping in mind more advanced financial strategies such as cash flow analysis or IRR calculations.

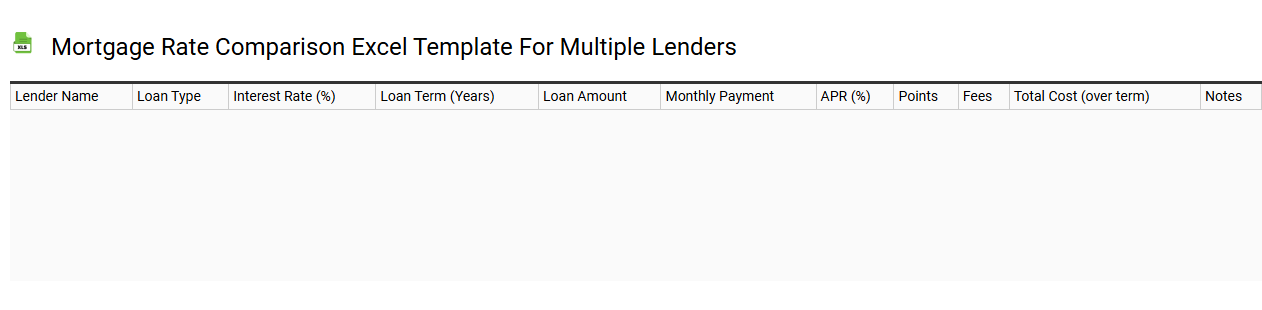

Mortgage rate comparison Excel template for multiple lenders

💾 Mortgage rate comparison Excel template for multiple lenders template .xls

A Mortgage Rate Comparison Excel template allows you to evaluate various mortgage rates offered by different lenders side by side. This tool typically features columns for lender names, interest rates, loan amounts, terms, monthly payments, and total costs over the loan's life. You can customize the template to input specific data, making it easy to visualize which option is best suited for your financial situation. This simplified analysis can reveal potential savings or highlight lenders with favorable terms, assisting you in making an informed decision about your mortgage. For further potential needs, consider integrating features for property taxes, insurance, or even comparing adjustable versus fixed-rate mortgages for a more comprehensive financial strategy.

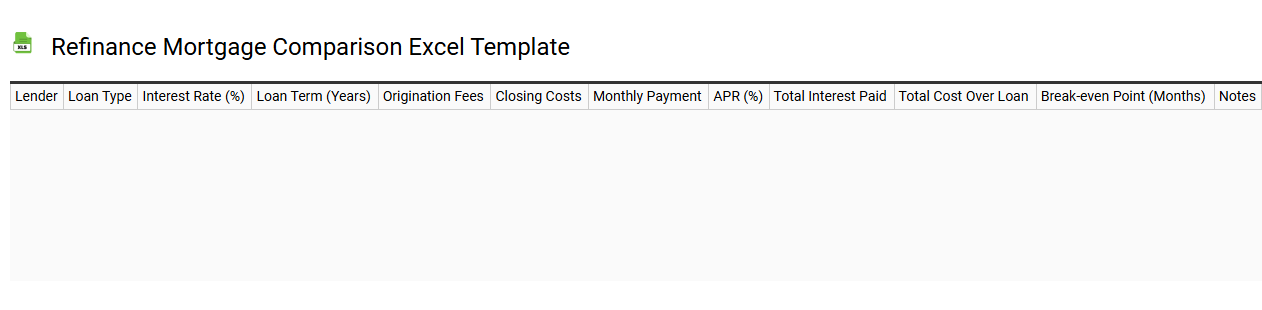

Refinance mortgage comparison Excel template

💾 Refinance mortgage comparison Excel template template .xls

A refinance mortgage comparison Excel template is a powerful tool designed to help you evaluate different mortgage refinance options side by side. It typically includes columns for key metrics such as interest rates, loan terms, monthly payments, and total interest paid over the life of the loan. You can easily input your current mortgage details and potential refinance offers to visualize potential savings or costs associated with each option. This template can also serve as a valuable resource for exploring more complex refinancing scenarios, including cash-out refinancing or adjustable-rate mortgages, helping you make informed financial decisions.

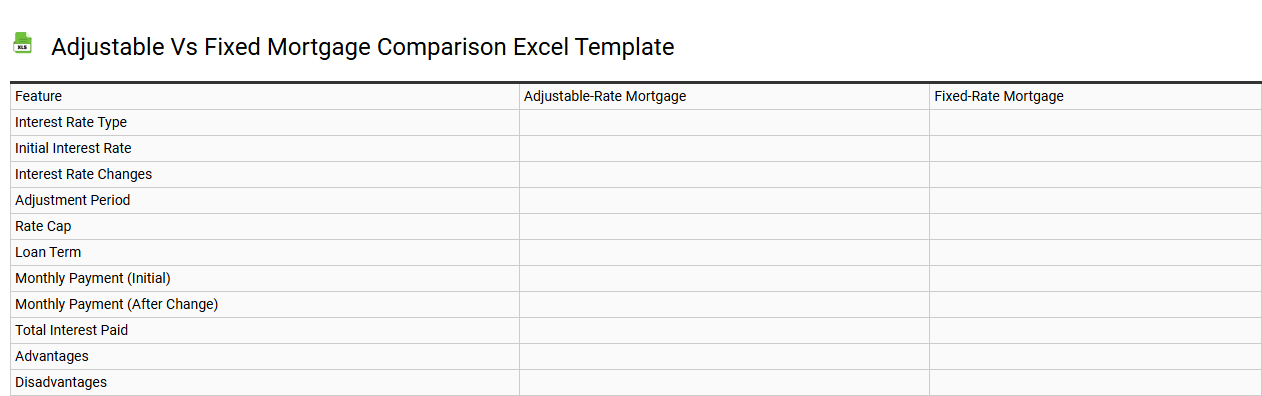

Adjustable vs fixed mortgage comparison Excel template

💾 Adjustable vs fixed mortgage comparison Excel template template .xls

An Adjustable vs Fixed Mortgage Comparison Excel template allows you to analyze and compare the financial implications of fixed-rate mortgages and adjustable-rate mortgages (ARMs). This template typically includes input fields for loan amount, interest rates, loan terms, and amortization schedules, providing detailed calculations of monthly payments and total interest paid over the loan's duration. You can visualize scenarios with charts and tables, helping you to grasp how fluctuating interest rates in ARMs could impact your payment schedule compared to the stability of fixed rates. This tool serves basic budgeting needs while offering advanced analytics features like net present value and sensitivity analysis for more in-depth financial planning.

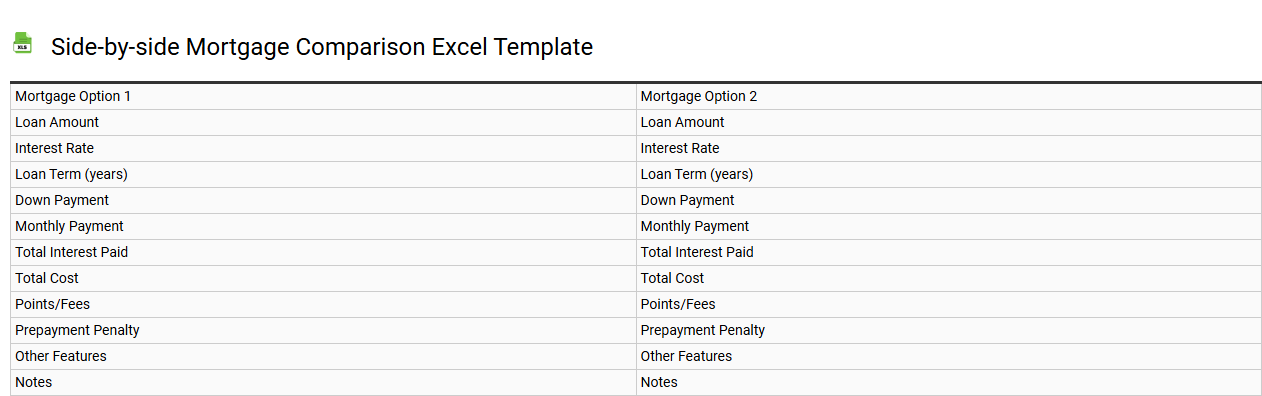

Side-by-side mortgage comparison Excel template

💾 Side-by-side mortgage comparison Excel template template .xls

A Side-by-Side Mortgage Comparison Excel template serves as a powerful tool for evaluating different mortgage options. This template allows you to input various mortgage details such as loan amounts, interest rates, loan terms, and monthly payments side by side for easy comparison. You can visualize how each option impacts your overall financial commitment, enabling informed decisions about your mortgage choices. For more advanced analysis, consider features like amortization schedules and total interest paid over the life of the loans, aligning them with your long-term financial goals.

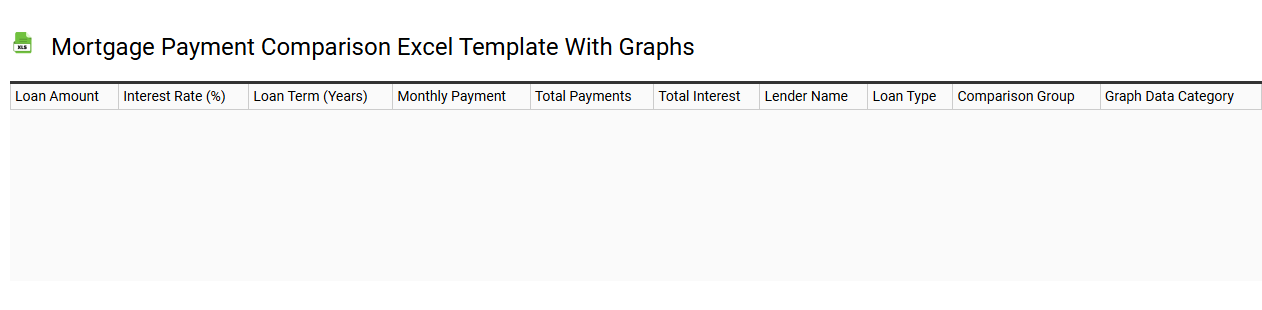

Mortgage payment comparison Excel template with graphs

💾 Mortgage payment comparison Excel template with graphs template .xls

A mortgage payment comparison Excel template provides you with a structured way to analyze different mortgage options side by side. It typically includes essential details such as loan amount, interest rates, loan terms, and monthly payment calculations. Graphs visually represent payment schedules, total interest paid, and principal balances over time, making it easier to see the impact of varying interest rates or loan lengths. This tool not only aids in immediate budgeting decisions but also facilitates advanced projections and cash flow analysis for future financial planning.

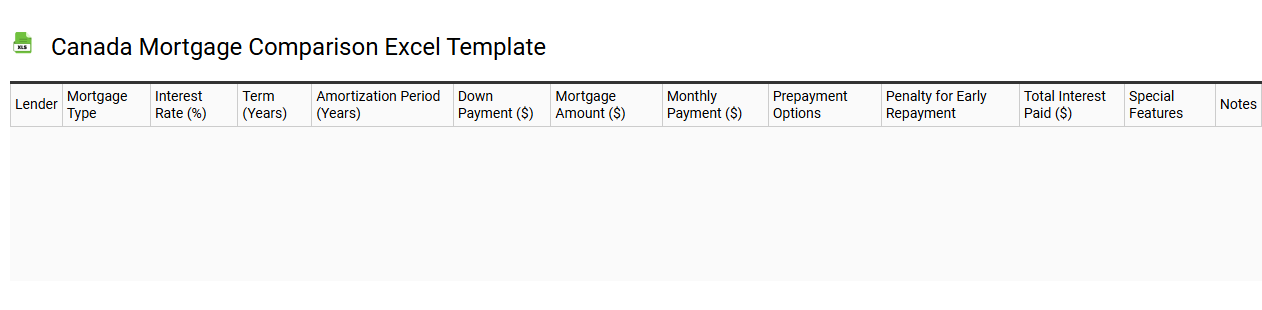

Canada mortgage comparison Excel template

💾 Canada mortgage comparison Excel template template .xls

A Canada mortgage comparison Excel template is a tool designed to help you evaluate various mortgage options available in Canada. This spreadsheet allows you to input different parameters such as loan amount, interest rates, amortization period, and payment frequency. You can effortlessly compare monthly payments, total interest paid, and loan balances over time for multiple mortgage products side by side. This practical tool is perfect for simplifying your decision-making process and can also be expanded to include more advanced calculations like total cost of the mortgage or refinancing scenarios.

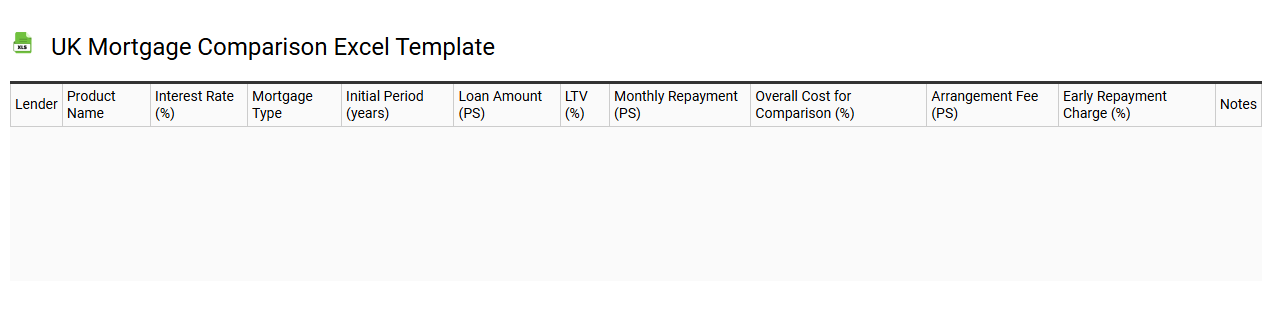

UK mortgage comparison Excel template

💾 UK mortgage comparison Excel template template .xls

A UK mortgage comparison Excel template is a structured spreadsheet designed to assist individuals and businesses in evaluating various mortgage options available in the UK market. This tool typically includes columns for key data such as lender names, interest rates, loan amounts, repayment terms, and monthly payments. Users can input specific mortgage options, facilitating side-by-side comparisons to identify the most favorable terms tailored to their financial situation. This template serves as a practical resource for initial evaluations, while also laying the groundwork for more complex analyses involving amortization schedules and interest rate fluctuation scenarios.