Explore a collection of free Excel templates designed specifically for aging analysis charts. These templates offer clear visual representations of aging inventory, accounts receivable, or other time-sensitive data, allowing you to assess financial health easily. With user-friendly layouts and customizable features, you can tailor the charts to your specific needs, enhancing both clarity and insight into your data.

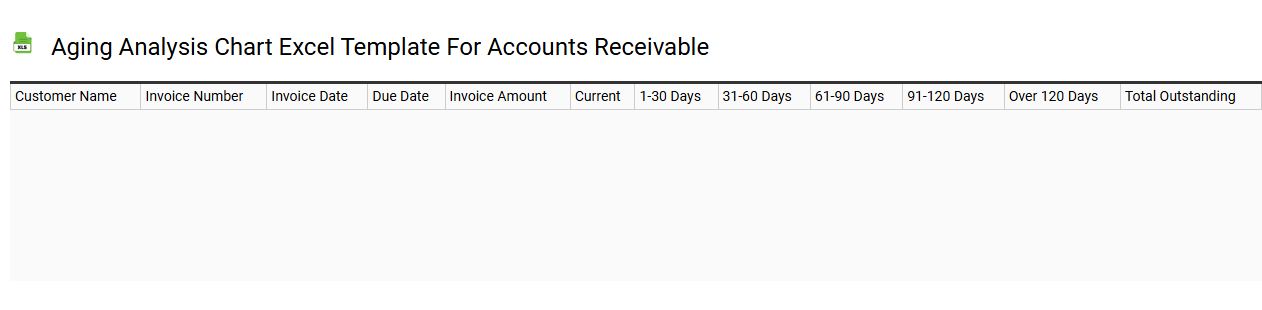

Aging analysis chart Excel template for accounts receivable

💾 Aging analysis chart Excel template for accounts receivable template .xls

An Aging Analysis Chart in Excel for accounts receivable categorizes outstanding invoices based on their due dates. This visual tool highlights overdue accounts, helping you track and manage collection efforts effectively. The chart typically segments receivables into categories such as current, 30 days, 60 days, and 90 days overdue, providing clear insights into cash flow and customer credit risk. You can utilize this template to monitor your financial health and assess the need for advanced financial forecasting or credit risk assessment models.

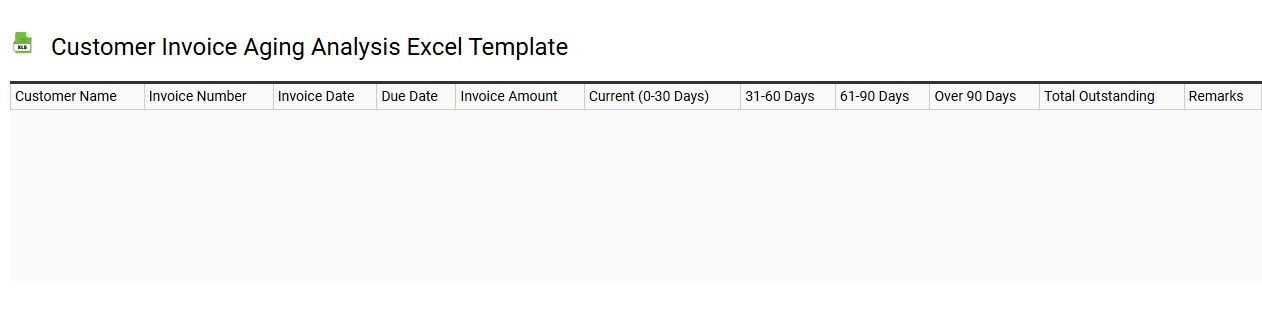

Customer invoice aging analysis Excel template

💾 Customer invoice aging analysis Excel template template .xls

A Customer invoice aging analysis Excel template provides a structured way to manage and evaluate outstanding invoices, helping businesses track how long they've been owed money. This template typically categorizes invoices by age brackets, such as 0-30 days, 31-60 days, and over 60 days, allowing for quick identification of overdue payments. You can easily input invoice details, customer information, and amounts owed to visualize your accounts receivable health. As your needs grow, you may explore advanced functionalities like dynamic dashboards, conditional formatting, or integration with accounting software for deeper financial insights.

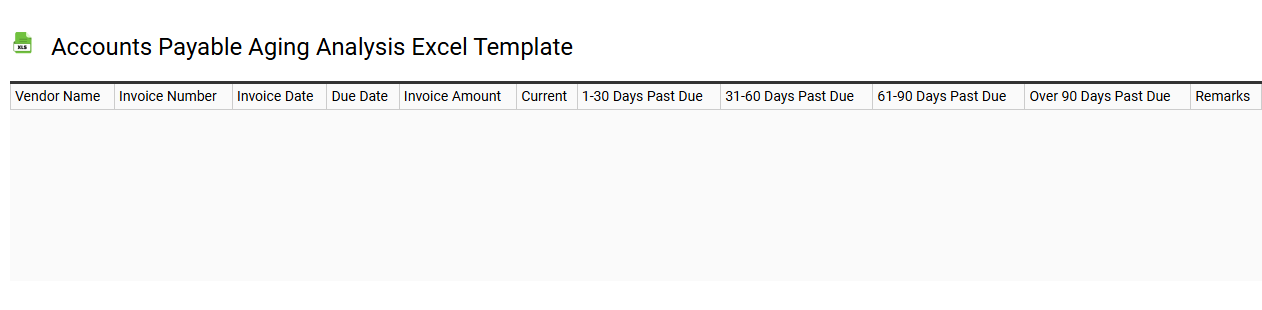

Accounts payable aging analysis Excel template

💾 Accounts payable aging analysis Excel template template .xls

An Accounts Payable Aging Analysis Excel template is a tool designed to help businesses manage their outstanding payables. This template typically categorizes unpaid invoices based on their due dates, allowing you to view amounts owed grouped by time frames, such as current, 30 days, 60 days, and 90 days overdue. You can easily track vendor balances, assess payment priorities, and identify potential cash flow issues. This tool not only enhances your organization's financial monitoring but also lays the groundwork for advanced functions like automated payment scheduling and integration with accounting software for streamlined processes.

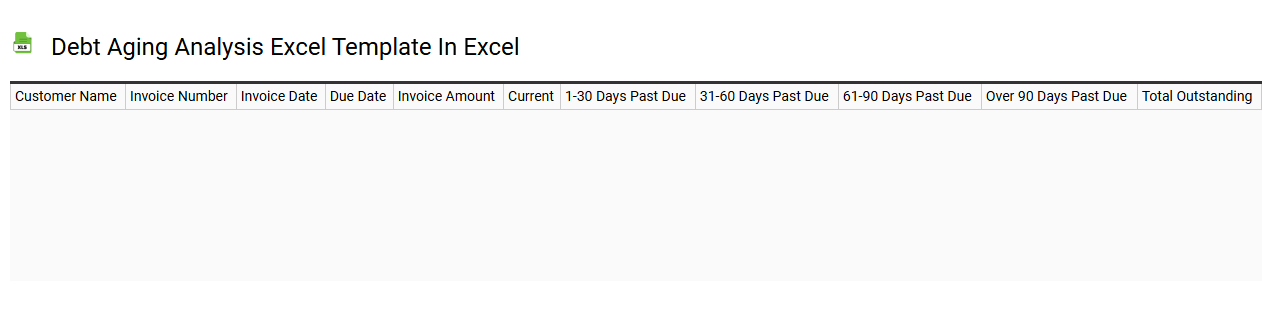

Debt aging analysis Excel template in Excel

💾 Debt aging analysis Excel template in Excel template .xls

Debt aging analysis in Excel is a powerful tool for businesses to track and manage their accounts receivable. The template categorizes outstanding debts based on how long they have been unpaid, typically grouping them into ranges such as 0-30 days, 31-60 days, 61-90 days, and 90+ days. This visual representation allows you to quickly identify overdue accounts and potentially problematic customers, streamlining collection efforts. Beyond basic usage for monitoring overdue payments, you can employ advanced concepts like predictive analytics to forecast cash flow and enhance your collections strategy.

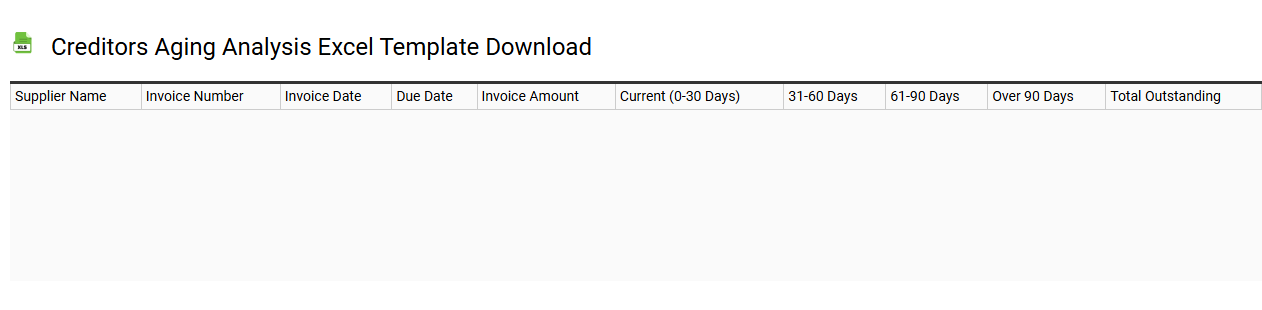

Creditors aging analysis Excel template download

💾 Creditors aging analysis Excel template download template .xls

Creditors aging analysis is a financial tool that details outstanding debts owed to suppliers and vendors, categorizing them based on how long they have been outstanding. This Excel template allows you to organize and visualize your company's payables, segmented by different time frames such as current, 30 days, 60 days, and 90 days overdue. By utilizing this template, you can effectively monitor cash flow, assess financial health, and prioritize payments, ensuring timely transactions and fostering strong vendor relationships. Beyond basic usage for tracking payables, this tool also supports complex financial forecasting and strategic decision-making, including debt restructuring and liquidity management.

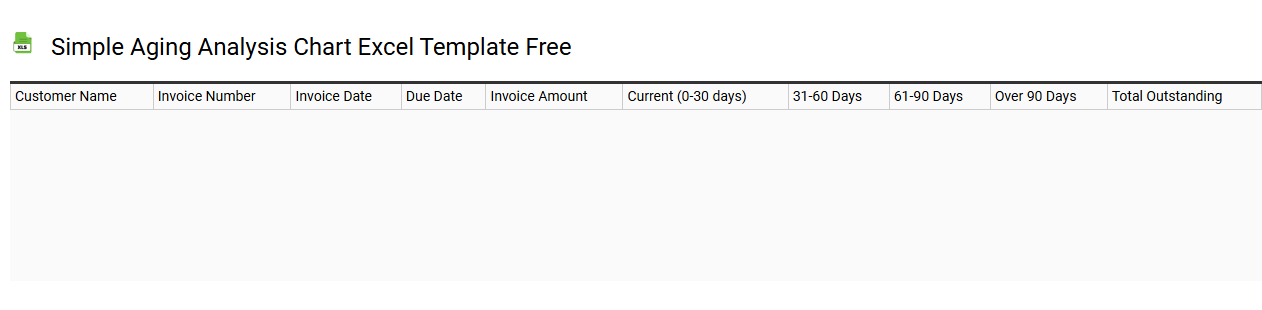

Simple aging analysis chart Excel template free

💾 Simple aging analysis chart Excel template free template .xls

A Simple Aging Analysis Chart Excel template provides a structured way to assess outstanding accounts receivable, helping businesses identify unpaid invoices based on their age. This template typically features categories like 0-30 days, 31-60 days, 61-90 days, and over 90 days, allowing for easy visual representation of debt recovery status. You can customize your chart to include details such as customer names, invoice amounts, and due dates, making it a practical tool for managing cash flow. This basic template is suitable for tracking payments, while advanced usage may involve integrating it with your accounting software or applying complex formulas for predictive analytics.

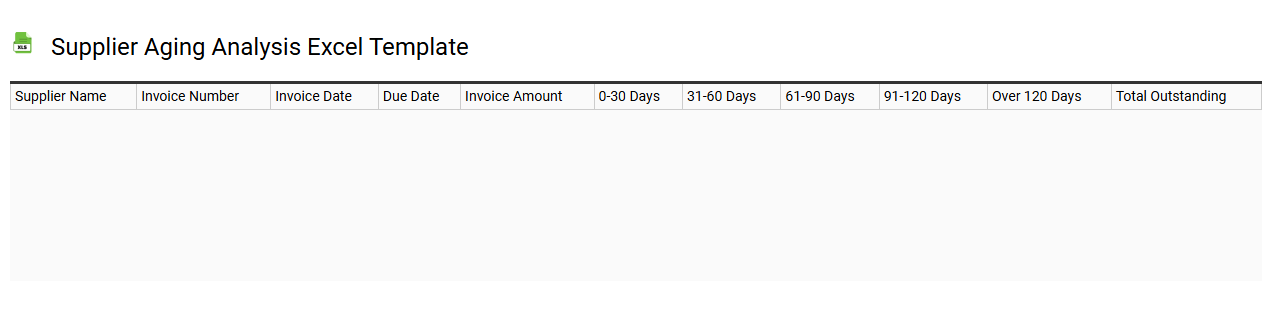

Supplier aging analysis Excel template

💾 Supplier aging analysis Excel template template .xls

Supplier aging analysis Excel templates are essential tools that help businesses assess and monitor their accounts payable, specifically revolving around the outstanding amounts owed to suppliers. This template typically includes key data such as invoice dates, amounts due, and payment statuses, organized in a manner that allows for quick identification of overdue payments. You can visualize payment trends and supplier performance by categorizing invoices into aging buckets, such as 30, 60, and 90 days. Such analysis not only assists with cash flow management but also informs future purchasing strategies, ensuring prompt payments to maintain favorable supplier relationships while facilitating further integration with advanced analytics or automation tools.

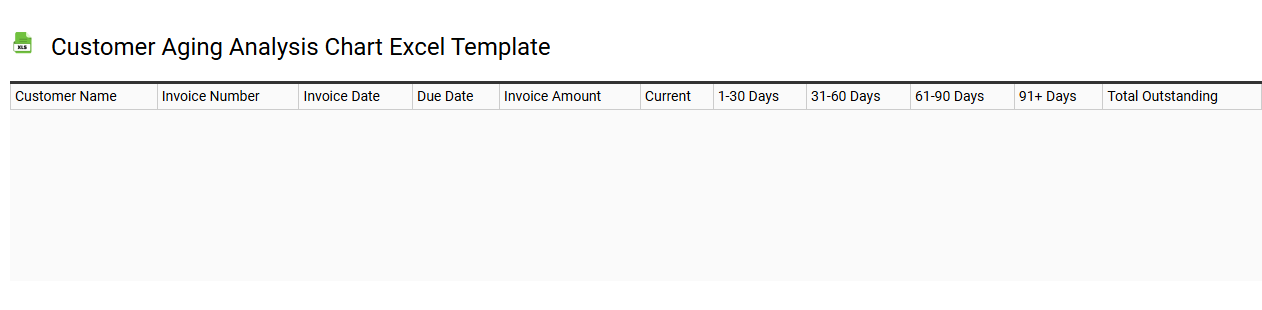

Customer aging analysis chart Excel template

💾 Customer aging analysis chart Excel template template .xls

A customer aging analysis chart in Excel visually represents outstanding accounts receivable, categorizing invoices based on how long they've been unpaid. It typically displays customer names alongside ageing buckets such as 0-30 days, 31-60 days, 61-90 days, and over 90 days, allowing for easy identification of late payments. This template aids your financial management by helping you pinpoint high-risk accounts and prioritize collections. Basic usage involves straightforward data entry for tracking payments, but further potential needs may include integration with advanced forecasting techniques or automated reporting systems.

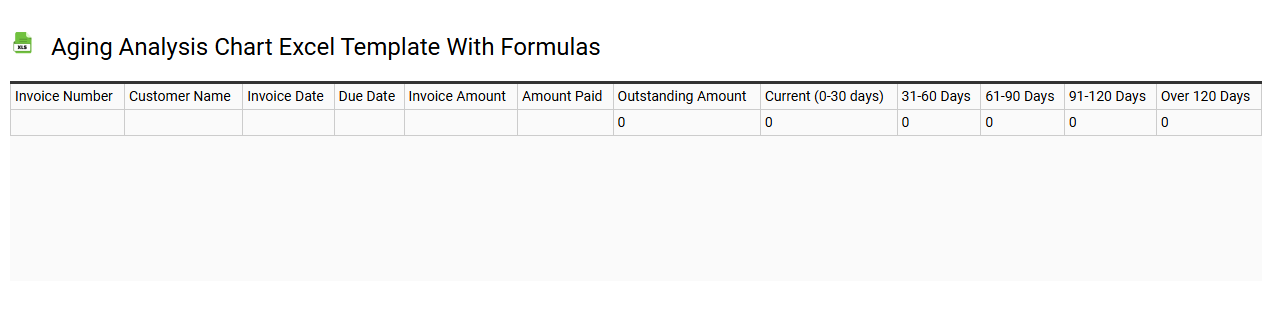

Aging analysis chart Excel template with formulas

💾 Aging analysis chart Excel template with formulas template .xls

An Aging Analysis Chart in Excel is a dynamic tool designed to help manage and monitor aging accounts receivable, enabling businesses to track outstanding invoices based on their age. This chart often includes categories such as "0-30 days," "31-60 days," "61-90 days," and "over 90 days," which allows for a clear visualization of overdue payments. By implementing formulas, such as SUMIFS or conditional formatting, it automatically calculates the amounts owed in each aging category, facilitating efficient financial management. Beyond basic tracking, you can customize it to include advanced features like predictive analytics and filtering options for deeper insights into customer payment behaviors.

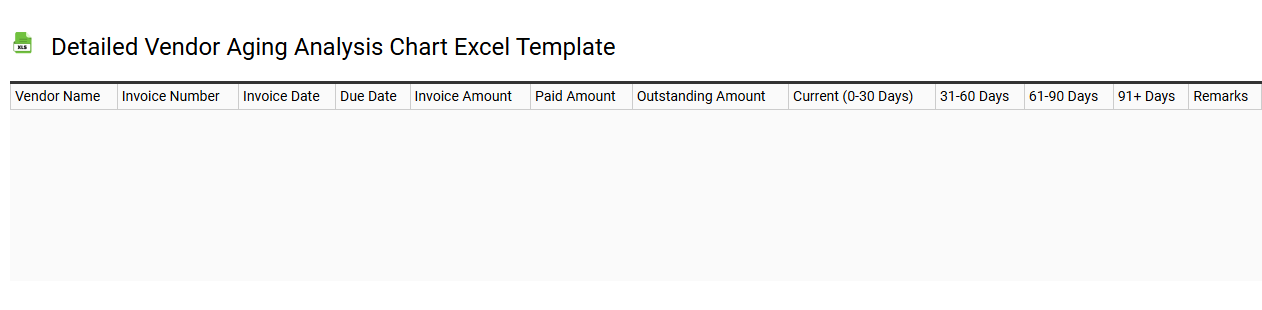

Detailed vendor aging analysis chart Excel template

💾 Detailed vendor aging analysis chart Excel template template .xls

A Detailed Vendor Aging Analysis Chart in Excel is a visual tool designed to help businesses assess their outstanding payables by categorizing them based on the length of time invoices have been unpaid. This chart typically includes various age buckets, such as 0-30 days, 31-60 days, and 61+ days, providing a clear overview of your liabilities. It allows you to identify which vendors require immediate attention, thus facilitating better cash flow management and informed decision-making. You can further enhance this template with advanced functionalities like conditional formatting, pivot tables, and trend analysis to optimize your financial tracking.

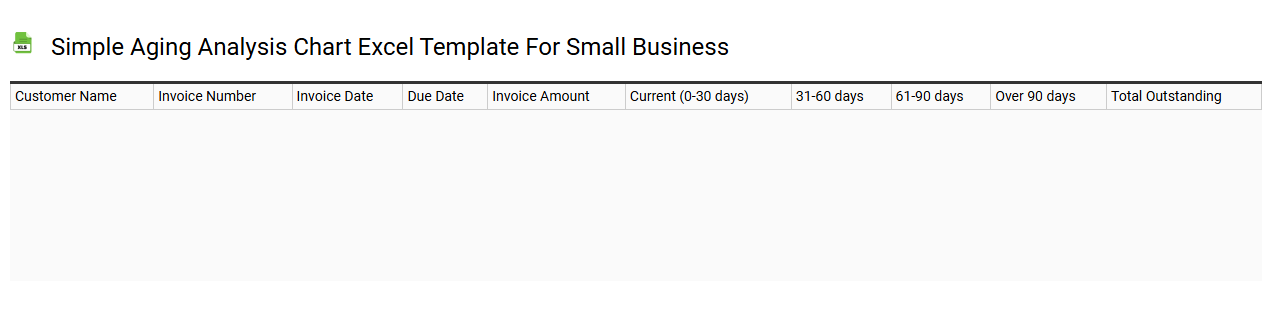

Simple aging analysis chart Excel template for small business

💾 Simple aging analysis chart Excel template for small business template .xls

A Simple Aging Analysis Chart Excel template helps small businesses monitor outstanding accounts receivable over time. This template typically categorizes invoices into distinct aging buckets, such as current, 1-30 days overdue, 31-60 days overdue, and 61+ days overdue. By visualizing this data through charts, you can quickly identify problem areas in cash flow and focus on collecting overdue accounts. The basic usage of the template can evolve into more advanced analytics, incorporating predictive modeling and trend analysis for comprehensive financial insights.

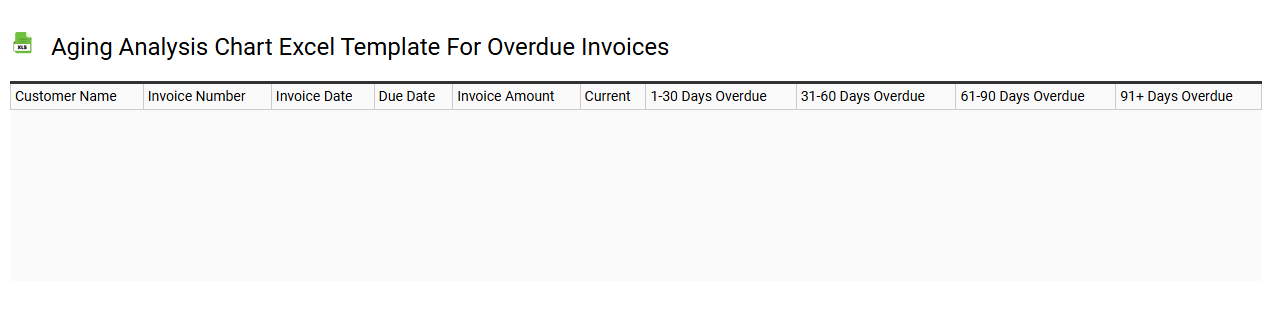

Aging analysis chart Excel template for overdue invoices

💾 Aging analysis chart Excel template for overdue invoices template .xls

An Aging Analysis Chart Excel template for overdue invoices visually categorizes outstanding receivables based on their age. This template typically divides invoices into groups, such as 0-30 days, 31-60 days, and 61+ days overdue, allowing for quick assessment of your outstanding payments. Each category is often represented with bar graphs or pie charts, making it easier to identify trends and prioritize collections. You can customize this template with your specific data, improving cash flow management and addressing potential long-term credit issues or operational adjustments.