Discover a range of free Excel templates designed for early loan repayment calculations. These templates help you track your loan details, including principal balance, interest rates, and repayment schedules. By utilizing these versatile tools, you can visualize the impact of making additional payments, allowing you to save on interest and pay off your loan faster.

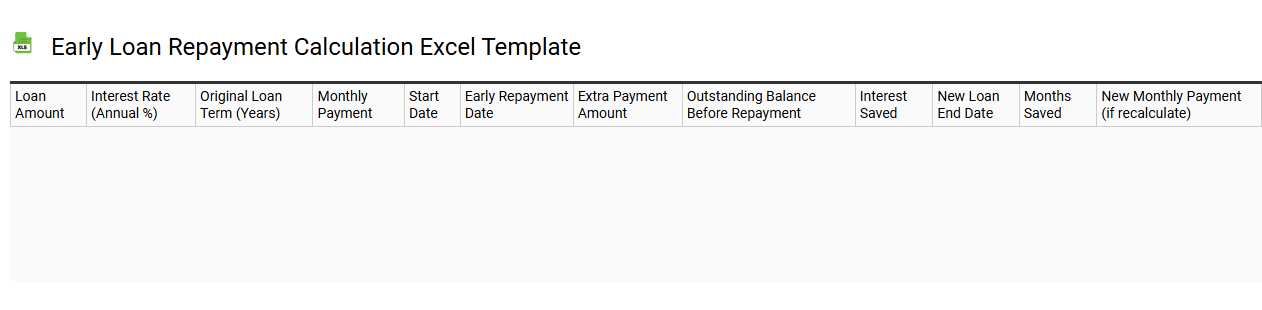

Early loan repayment calculation Excel template

💾 Early loan repayment calculation Excel template template .xls

An Early Loan Repayment Calculation Excel template is a functional tool designed to help borrowers understand the financial implications of paying off a loan ahead of schedule. It typically includes detailed fields for inputting the loan amount, interest rate, monthly payment details, and remaining balance, allowing users to visualize how additional payments could alter their total interest paid and the duration of the loan. This tool can dynamically update calculations to reflect variations in payment amounts or frequencies, enabling better financial planning and decision-making. You can further explore features like amortization schedules, interest savings, and advanced financial projections to maximize your repayment strategy.

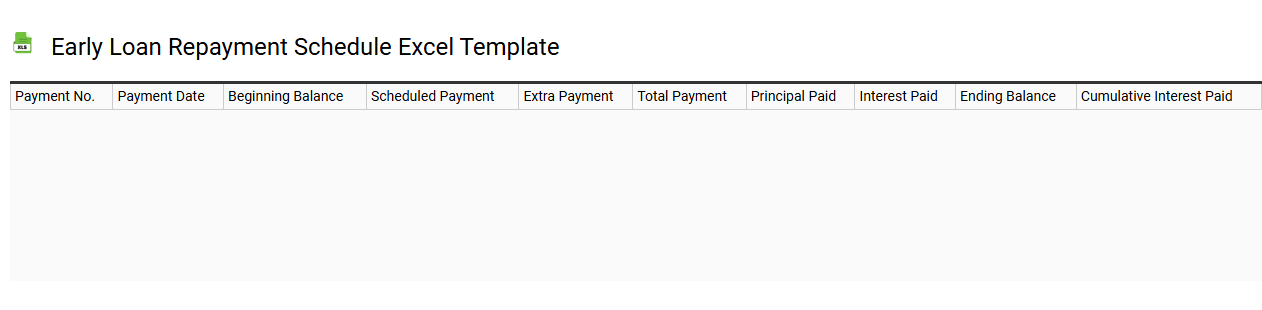

Early loan repayment schedule Excel template

💾 Early loan repayment schedule Excel template template .xls

An Early Loan Repayment Schedule Excel template is a financial tool designed to help you manage and visualize the impact of repaying loans before their maturity dates. This template typically includes a breakdown of each payment, including principal and interest components, along with updated remaining balances after each payment. By using this template, you can compare the total interest savings resulting from early repayments and adjust your budget accordingly. You may customize it to analyze various scenarios, such as changes in interest rates or additional payments, catering to more advanced financial planning or amortization strategies.

Early loan payoff tracker Excel template

![]()

💾 Early loan payoff tracker Excel template template .xls

The Early Loan Payoff Tracker Excel template is a financial tool designed to help you manage and visualize your loan repayment schedule. This spreadsheet allows you to input key details such as loan amount, interest rate, payment frequency, and any extra payments you plan to make. With its intuitive layout, you can easily track your progress towards paying off your loan ahead of schedule, providing you with insights into how much interest you could save over time. Understanding this tool can empower you to make informed decisions about your finances and explore further options like refinancing or investing your savings.

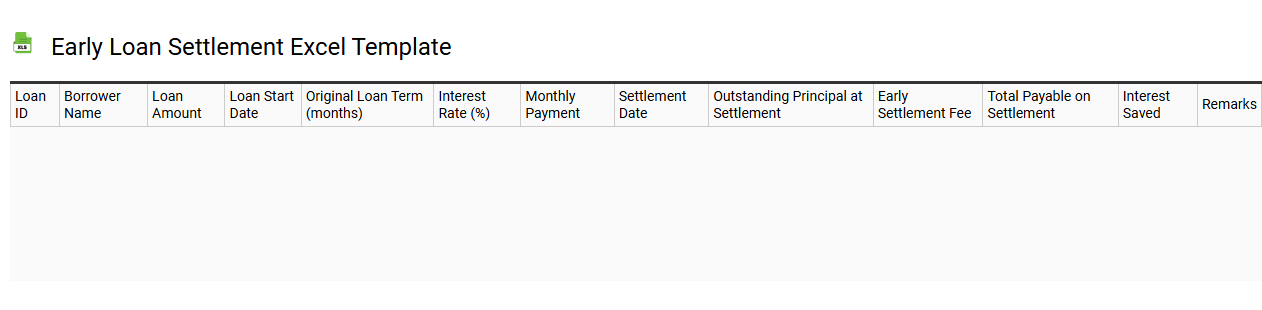

Early loan settlement Excel template

💾 Early loan settlement Excel template template .xls

An Early Loan Settlement Excel template is a tool designed to help individuals or businesses calculate the implications of settling a loan before its original term ends. It typically includes input fields for loan amount, interest rate, remaining balance, and any applicable fees or penalties for early repayment. By analyzing this data, the template provides visual outputs like graphs or charts that depict the total savings compared to continuing with regular payments. This template not only aids in making informed financial decisions but also serves as a foundation for more advanced financial modeling and forecasting needs, facilitating deeper assessments such as cash flow analysis and opportunity cost evaluations.

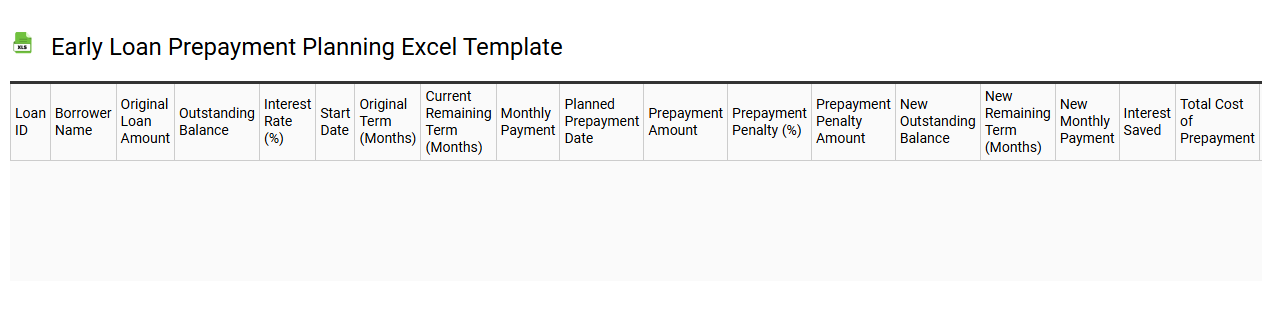

Early loan prepayment planning Excel template

💾 Early loan prepayment planning Excel template template .xls

An Early Loan Prepayment Planning Excel template is a financial tool designed to help individuals or businesses evaluate the benefits of paying off a loan ahead of schedule. This template typically includes sections for entering loan details such as principal amount, interest rate, loan term, and monthly payment calculations. Users can analyze different prepayment scenarios, assessing the impact on total interest savings and remaining loan balances over time. Such a template can also be tailored for varying loan types, enabling you to strategize not only for immediate savings but also for long-term financial planning and potential investment opportunities in your financial portfolio.

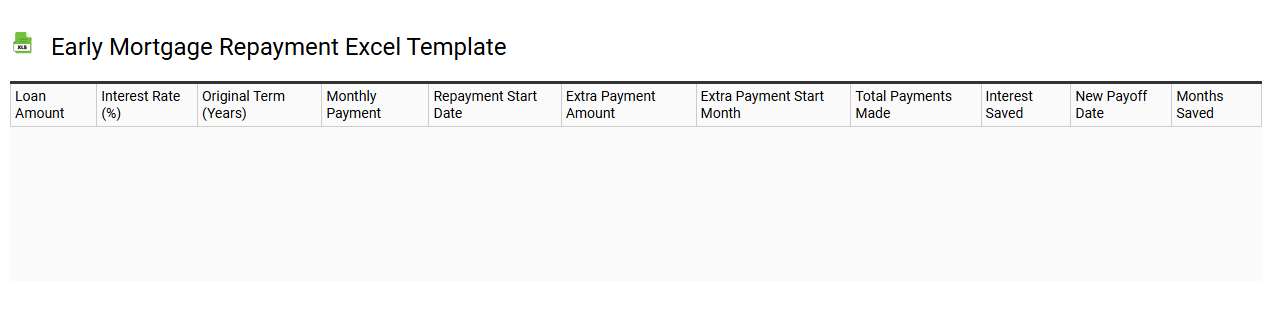

Early mortgage repayment Excel template

💾 Early mortgage repayment Excel template template .xls

An Early Mortgage Repayment Excel template is a financial tool designed to help borrowers analyze the impact of paying off their mortgage early. This template typically includes inputs for your mortgage balance, interest rate, term length, and potential extra payment amounts, allowing you to visualize how changes will affect the overall interest paid and loan duration. You can easily track your savings over time, evaluate various scenarios, and plan your budget accordingly. For those considering refinancing options, utilizing advanced calculations like present value or amortization schedules can further enhance your financial strategy.

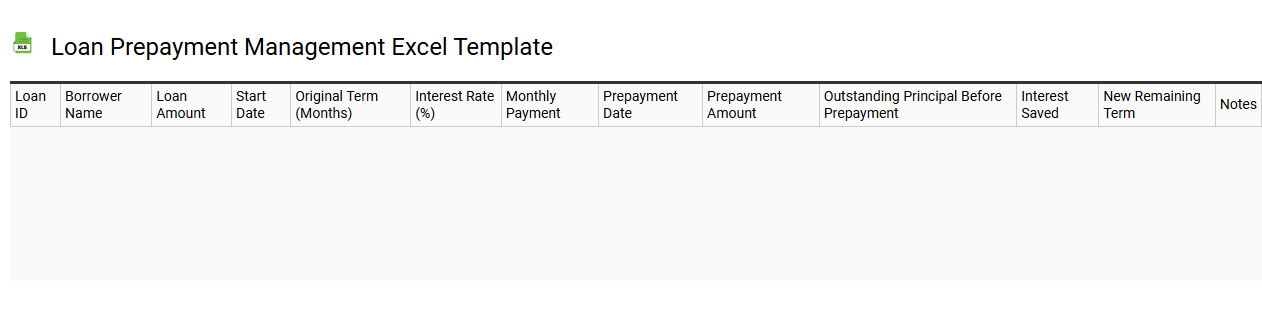

Loan prepayment management Excel template

💾 Loan prepayment management Excel template template .xls

Loan prepayment management Excel templates are tools designed to help you track and analyze loan prepayments effectively. These templates typically include sections for inputting loan details such as principal amount, interest rate, and loan term, along with prepayment amounts and dates. Visual aids like charts can highlight prepayment trends over time, offering insights into cash flow impacts and future financial planning. Beyond basic usage for monitoring current loans, advanced features may incorporate financial modeling and predictive analytics for optimizing portfolio performance under various scenarios.

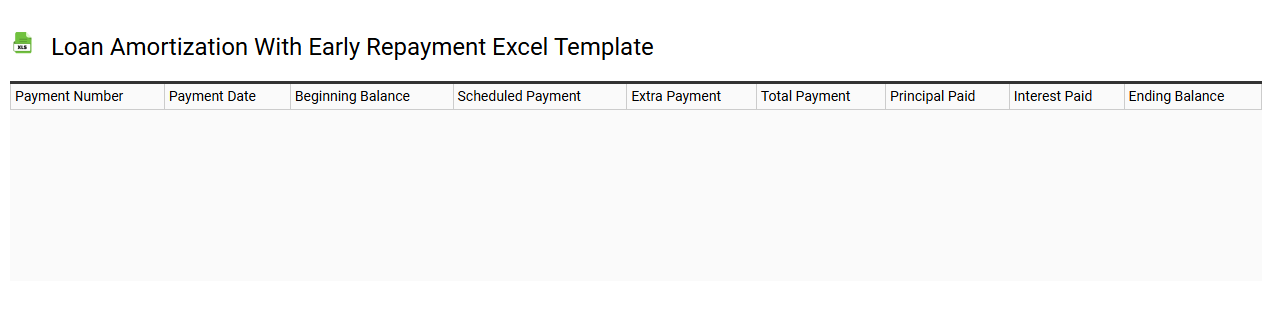

Loan amortization with early repayment Excel template

💾 Loan amortization with early repayment Excel template template .xls

Loan amortization refers to the process of paying off a debt over time through regular payments. An Excel template designed for loan amortization with early repayment allows you to track your loan balance, interest, and principal payments at any point during the loan term. Users can input their loan amount, interest rate, and term length, enabling automatic calculations that reflect the effect of making extra payments or settling the loan early. This tool helps you visualize your payment timeline and assess potential savings from early repayment scenarios while considering terms like principal reductions and total interest savings.

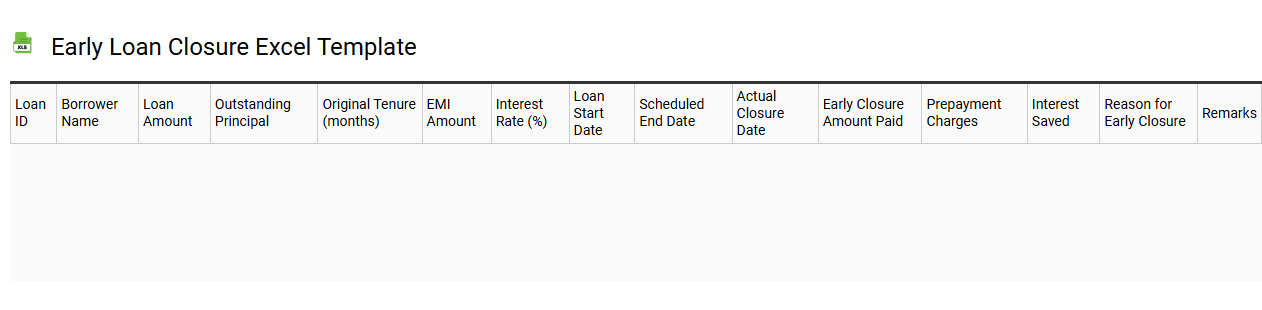

Early loan closure Excel template

💾 Early loan closure Excel template template .xls

An Early Loan Closure Excel template is a financial tool designed to help borrowers calculate the potential savings and costs associated with paying off a loan earlier than scheduled. This template typically includes fields for principal amount, interest rate, remaining term, and prepayment penalties if applicable. By inputting these variables, you can evaluate how different early payment amounts impact the overall interest paid over the life of the loan. This template can assist in making informed decisions about loan management and strategizing further financial investments or adjustments. Basic usage includes calculating early payments, while advanced applications may involve complex amortization schedules, tax implications, and comparative scenario analysis for multiple loans.

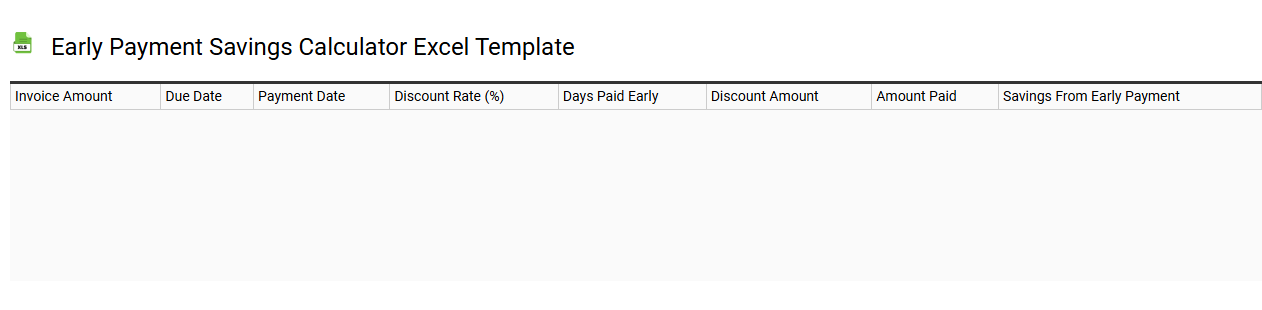

Early payment savings calculator Excel template

💾 Early payment savings calculator Excel template template .xls

An Early Payment Savings Calculator Excel template is a specialized tool designed to help businesses and individuals evaluate the financial benefits of making early payments on outstanding invoices or loans. This template typically includes fields for inputting invoice amounts, payment terms, discount rates, and due dates, allowing users to see potential savings from early payment discounts. With clear graphical representations and data analytical capabilities, it simplifies complex calculations and enhances decision-making related to cash flow management. You might find this template useful for optimizing your payment strategies, but further exploration can also include advanced forecasting and financial modeling techniques for more nuanced cash management solutions.