Explore a diverse collection of free XLS templates designed to simplify your financial planning. The Debt to Income Ratio Calculator Excel template allows you to easily assess your financial health by comparing your monthly debt payments to your gross monthly income. It features user-friendly fields for entering your income and expenses, ensuring accurate calculations and a clear understanding of your debt management capacity.

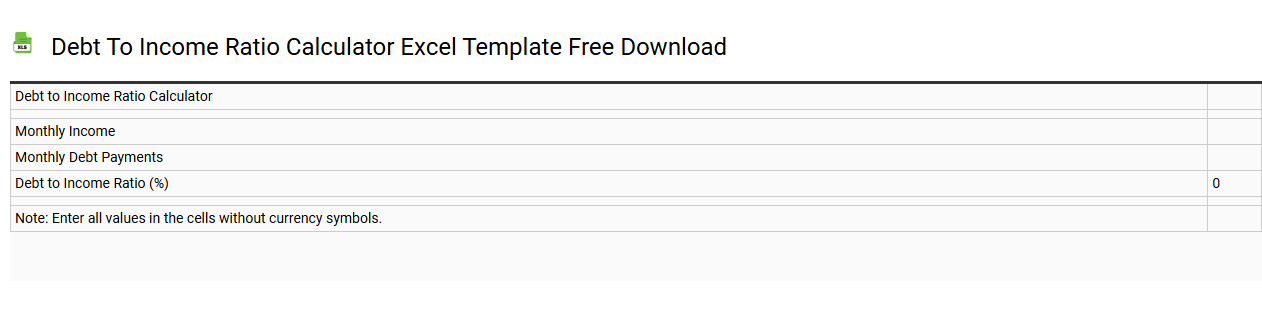

Debt to income ratio calculator Excel template free download

💾 Debt to income ratio calculator Excel template free download template .xls

A Debt to Income (DTI) ratio calculator in Excel format is a valuable tool for assessing an individual's financial health by comparing monthly debt payments to gross monthly income. This template typically includes fields where you can input your monthly debt obligations, such as mortgage or rent, credit card payments, and personal loans, alongside your total income. The calculator automatically computes your DTI ratio, providing insights into your budgeting capabilities and loan eligibility. You can use this basic template for personal finances, or explore more advanced features like scenario analysis or long-term financial projections.

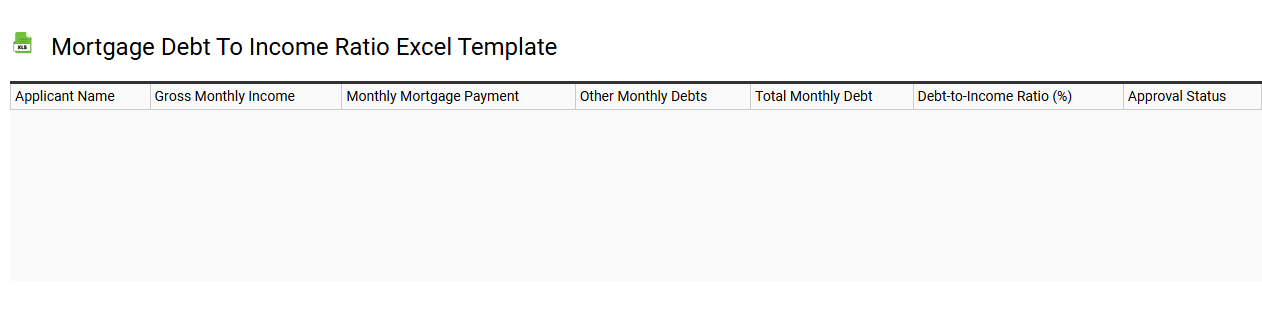

Mortgage debt to income ratio Excel template

💾 Mortgage debt to income ratio Excel template template .xls

A Mortgage Debt-to-Income (DTI) Ratio Excel template is a valuable financial tool that helps you calculate and analyze your DTI ratio, which is crucial when assessing your eligibility for a mortgage. This template typically includes sections for inputting your monthly income, fixed monthly debts, and housing-related expenses, allowing you to quantify your financial standing. The DTI ratio is expressed as a percentage, indicative of your total monthly debt obligations relative to your gross monthly income. Understanding this metric can guide your budgeting decisions and improve your mortgage application strategy, while advanced needs might involve integrating predictive analytics for future debt forecasts or comparing multiple loan scenarios.

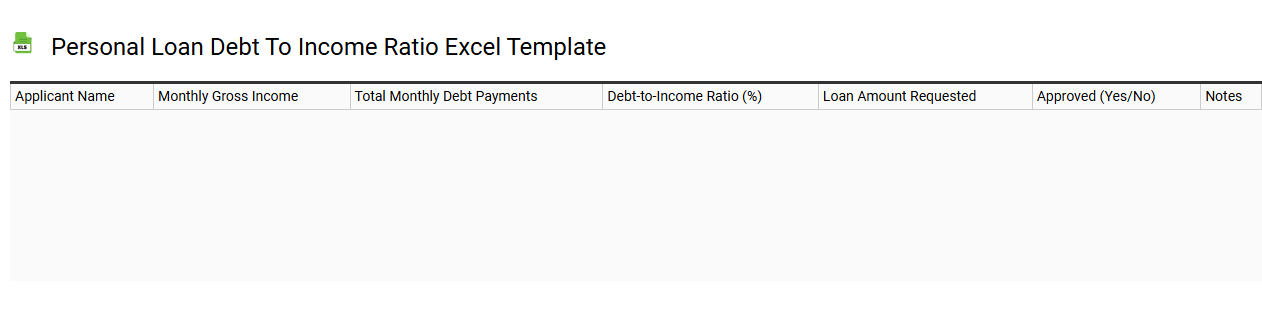

Personal loan debt to income ratio Excel template

💾 Personal loan debt to income ratio Excel template template .xls

A Personal Loan Debt to Income Ratio Excel template is a tool designed to help you assess your financial situation by analyzing your debt in relation to your income. It typically includes sections for inputting your total monthly income, all sources of debt payments, and the calculated ratio that reveals your financial health. Using this template can guide you in understanding how much of your income goes towards paying off debts, which is crucial for making informed borrowing decisions. Beyond basic usage for personal loans, you could adapt this template for more advanced financial analyses like mortgage qualification or investment property purchases.

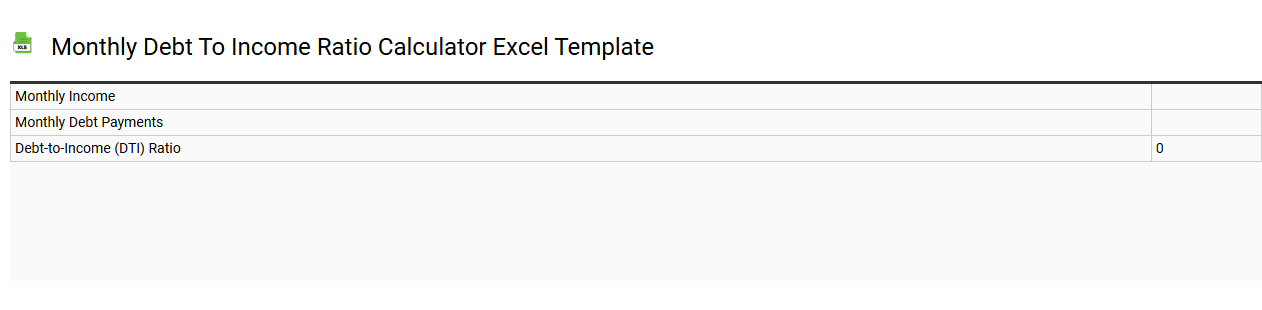

Monthly debt to income ratio calculator Excel template

💾 Monthly debt to income ratio calculator Excel template template .xls

A Monthly Debt to Income Ratio Calculator Excel template is a practical tool designed to help you determine your financial health by analyzing your monthly debts relative to your income. This template typically allows you to input various forms of income, such as salary or bonuses, alongside all monthly debt obligations, including loans, credit cards, and mortgages. By calculating the ratio, it provides insight into your capacity to manage debt effectively and can aid in budgeting decisions or loan applications. Understanding this ratio can also guide you in financial planning, investment decisions, or even determining eligibility for more complex financial products like refinance options or investment loans.

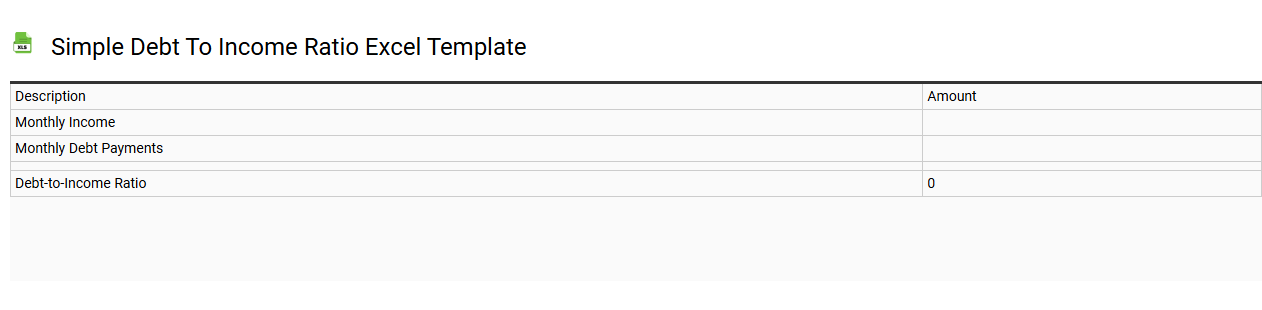

Simple debt to income ratio Excel template

💾 Simple debt to income ratio Excel template template .xls

A Simple Debt-to-Income Ratio Excel template is a structured spreadsheet designed to help individuals evaluate their financial health by comparing monthly debt payments to gross monthly income. This template typically includes separate sections for listing various debts, such as loans, credit cards, and mortgages, along with the total monthly payments associated with each. It also features a calculation area that automatically computes the debt-to-income ratio, giving a quick snapshot of financial obligations relative to income level. Understanding this ratio aids in budgeting decisions and can highlight areas for improvement in personal finance management or loan eligibility evaluations. The template can evolve with advanced features like dynamic calculations, scenarios for future income changes, and integration with personal finance tracking tools.

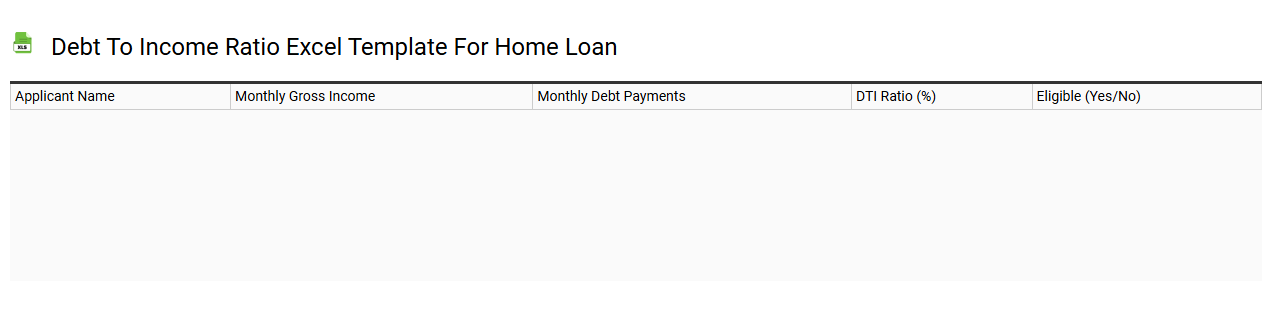

Debt to income ratio Excel template for home loan

💾 Debt to income ratio Excel template for home loan template .xls

A Debt to Income (DTI) ratio Excel template helps you assess your financial health by comparing your monthly debt payments to your gross monthly income. It organizes your debts, such as mortgage, credit cards, and personal loans, alongside your income to calculate the percentage of your income that goes towards these debts. By inputting your financial figures into the template, you can easily visualize your DTI ratio and determine if you're in a healthy range for securing a home loan. This template can also be adapted for advanced calculations, such as considering variable income streams or estimating potential loan amounts based on desired DTI thresholds.

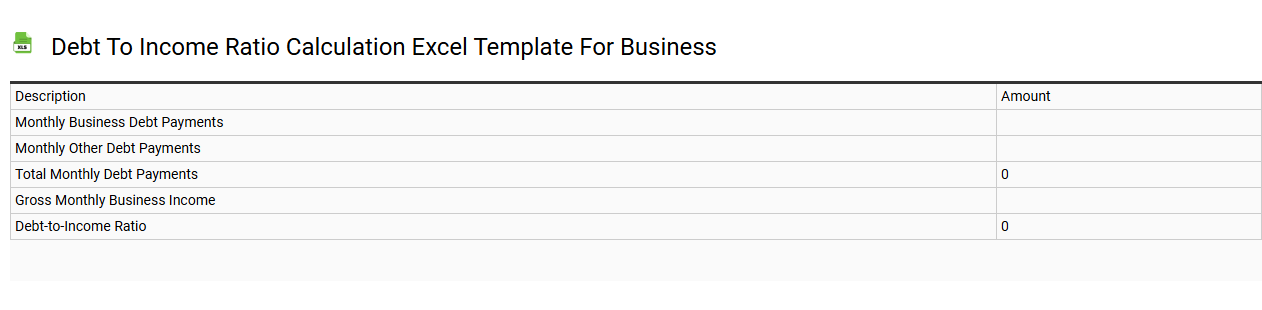

Debt to income ratio calculation Excel template for business

💾 Debt to income ratio calculation Excel template for business template .xls

A Debt to Income (DTI) ratio calculation template in Excel for business evaluates financial health by comparing total debt obligations to income. This essential tool allows you to input monthly debt payments, such as loans or credit obligations, alongside monthly gross income. Formulas within the template automatically calculate the DTI percentage, providing a clear view of financial sustainability. This straightforward framework can be adapted for more complex financial analyses, such as predictive modeling or cash flow forecasting.

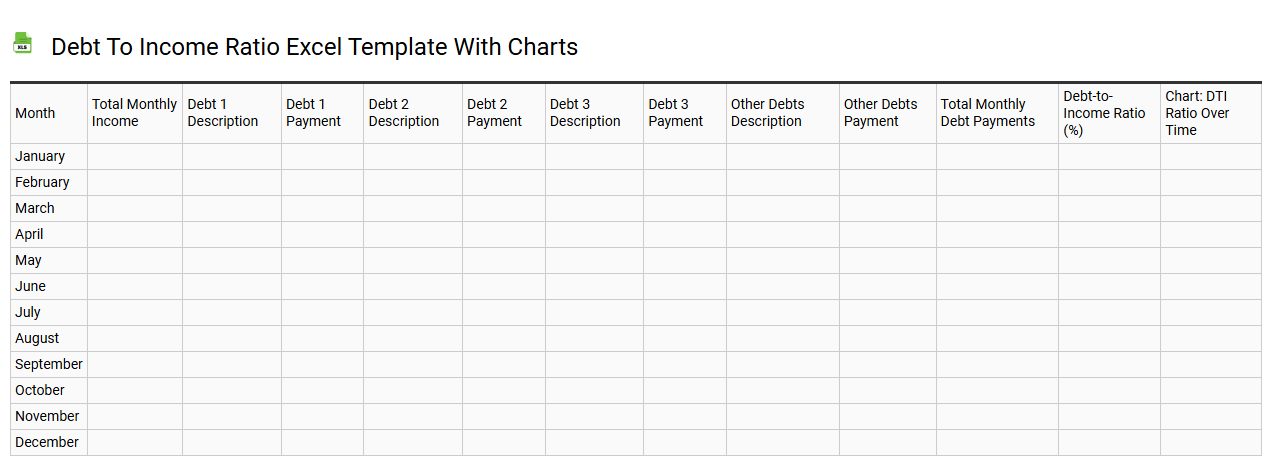

Debt to income ratio Excel template with charts

💾 Debt to income ratio Excel template with charts template .xls

A Debt to Income (DTI) ratio Excel template serves as a practical tool for analyzing your financial health by comparing your monthly debts to your gross monthly income. This template typically features predefined data entry sections for inputting income sources and various debt obligations, such as mortgages, credit card payments, and personal loans. Integrated charts visually represent your DTI ratio trends over time, helping you identify fluctuations and make informed decisions regarding financial planning. Beyond basic usage, this template can be adapted for advanced financial modeling by incorporating predictive analytics and scenario simulations to assess potential future financial obligations.

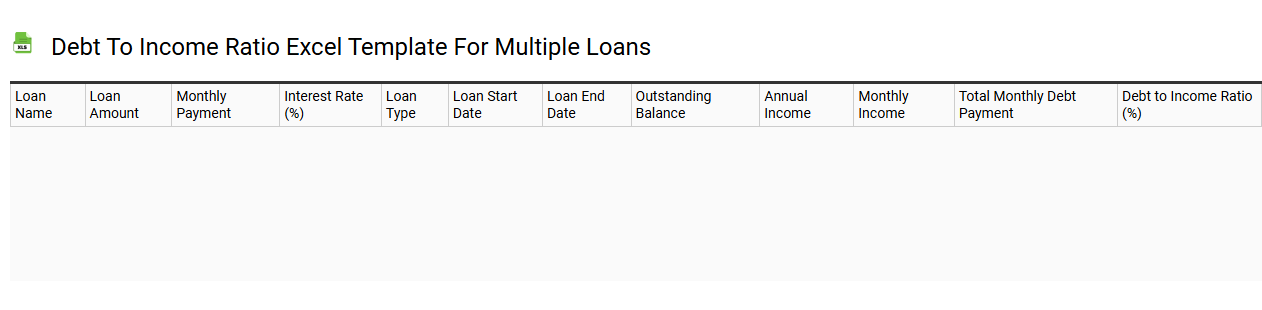

Debt to income ratio Excel template for multiple loans

💾 Debt to income ratio Excel template for multiple loans template .xls

The Debt to Income (DTI) ratio Excel template is designed to help you calculate and analyze your financial health, especially when managing multiple loans. This template allows you to input various income sources and different debt obligations, providing a clear view of your financial situation. Users can easily track monthly payments, interest rates, and loan details, enabling a thorough evaluation of how much of your income goes toward debt repayment. Understanding your DTI ratio can assist in making informed decisions regarding borrowing, budgeting, and future financial planning, such as considering debt consolidation or refinancing options for improved terms.

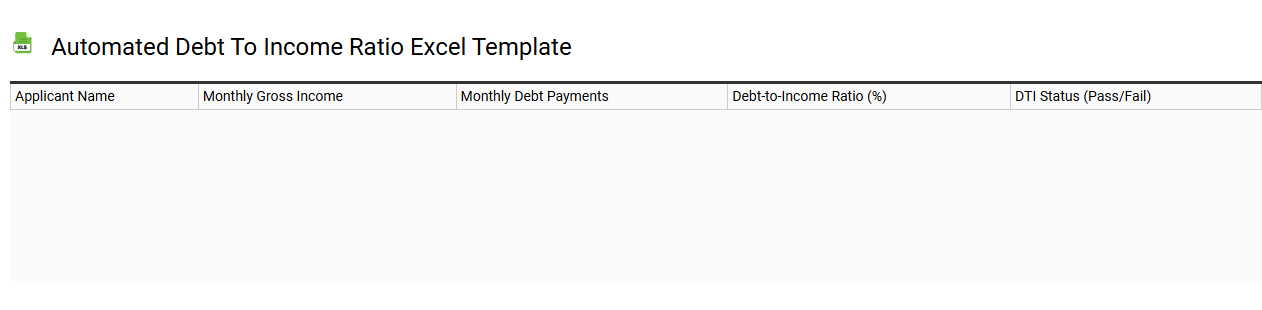

Automated debt to income ratio Excel template

💾 Automated debt to income ratio Excel template template .xls

An Automated Debt to Income Ratio Excel template simplifies the process of calculating your debt-to-income (DTI) ratio, which is a vital metric for assessing financial health. This template typically includes fields for entering your monthly income, fixed debts like loans and credit payments, and variable expenses, allowing for real-time calculations. By using formulas, the template provides an automatic update of your DTI based on the inputs you provide, ensuring accuracy and efficiency. As you explore this basic tool, consider how advanced functionalities like dynamic charts or scenario analysis could further enhance your financial planning.