A mortgage summary Excel template simplifies tracking loan details, including principal, interest rates, and monthly payments. This customizable tool allows you to input your mortgage terms, providing a clear breakdown of what you owe over time. Access to free templates enhances your financial organization, helping you make informed decisions about your mortgage and potential refinancing options.

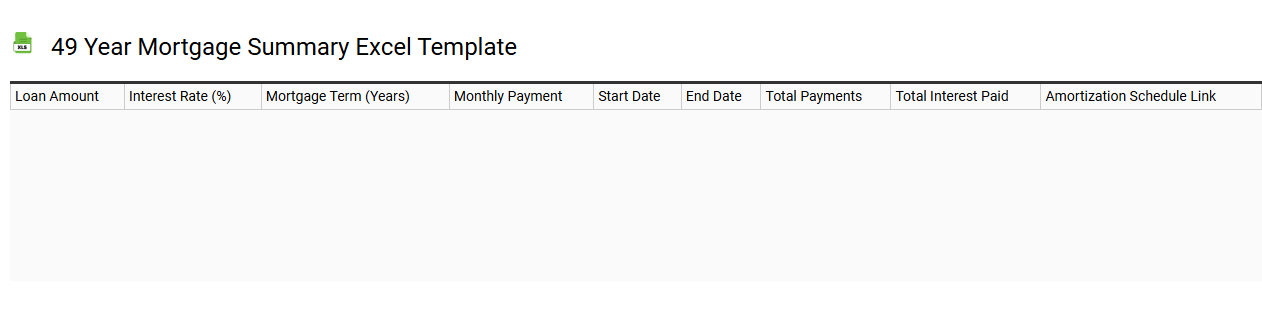

49 year mortgage summary Excel template

💾 49 year mortgage summary Excel template template .xls

A 49-year mortgage summary Excel template offers a streamlined way for homeowners and potential buyers to calculate and visualize their long-term mortgage commitments. The template typically includes essential data input fields such as loan amount, interest rate, and payment frequency. You can easily track monthly payments, interest over time, and remaining balances throughout the life of the loan. This tool provides insights into your financial landscape, making it easier to assess long-term budgeting needs or explore options for making additional payments or refinancing later on, enhancing your understanding of amortization and interest accumulation.

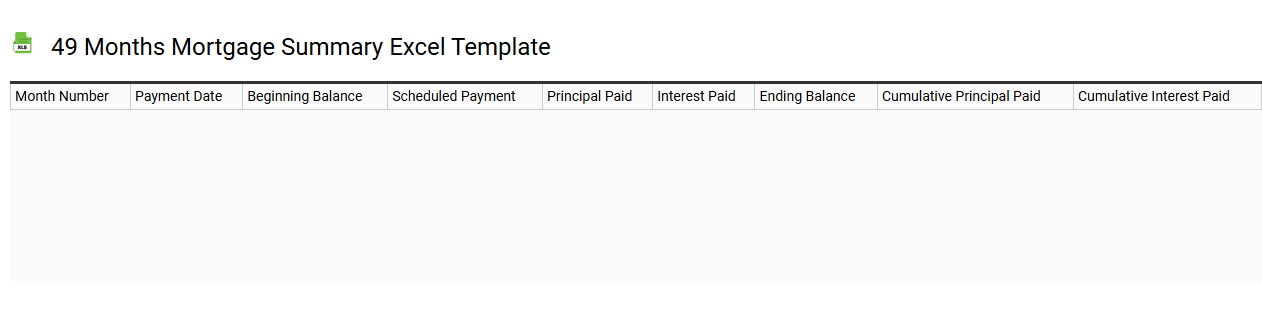

49 months mortgage summary Excel template

💾 49 months mortgage summary Excel template template .xls

A 49 months mortgage summary Excel template serves as an essential financial tool for effectively managing and tracking mortgage payments over a nearly four-year period. It typically includes key data such as the loan amount, interest rate, monthly payment, and total payments over the loan term. You can visualize amortization schedules, breaking down principal and interest components for each payment, which enhances your understanding of how your balance decreases over time. The template may also offer forecasting capabilities, allowing you to assess the impact of additional payments or changes in interest rates, catering to both basic mortgage management and complex financial strategies.

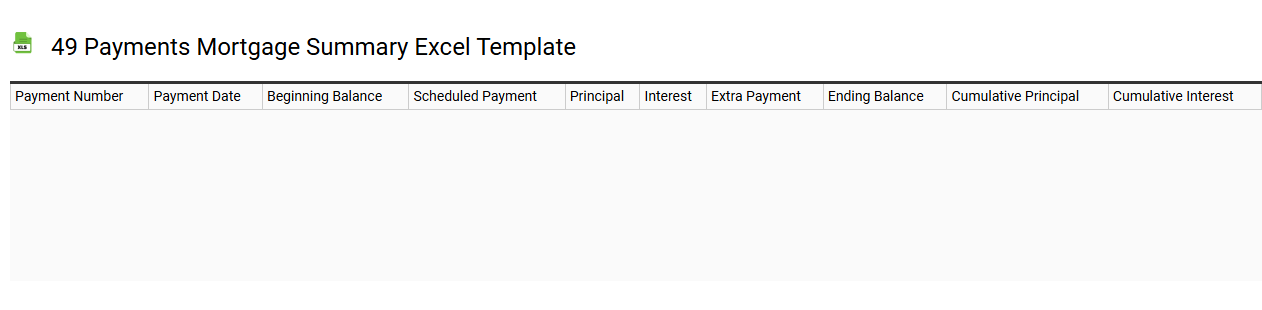

49 payments mortgage summary Excel template

💾 49 payments mortgage summary Excel template template .xls

The 49 payments mortgage summary Excel template is a tool designed to help individuals or financial professionals organize and analyze mortgage payment schedules. It provides a clear breakdown of each monthly payment, principal amounts, interest incurred, and the remaining balance throughout the term of the mortgage. By entering the loan amount, interest rate, and duration, users can effortlessly track financial commitments and assess long-term affordability. This template can be particularly useful for budgeting and planning, while offering advanced functionalities such as amortization calculations and visual performance graphs, accommodating your future financial analysis needs.

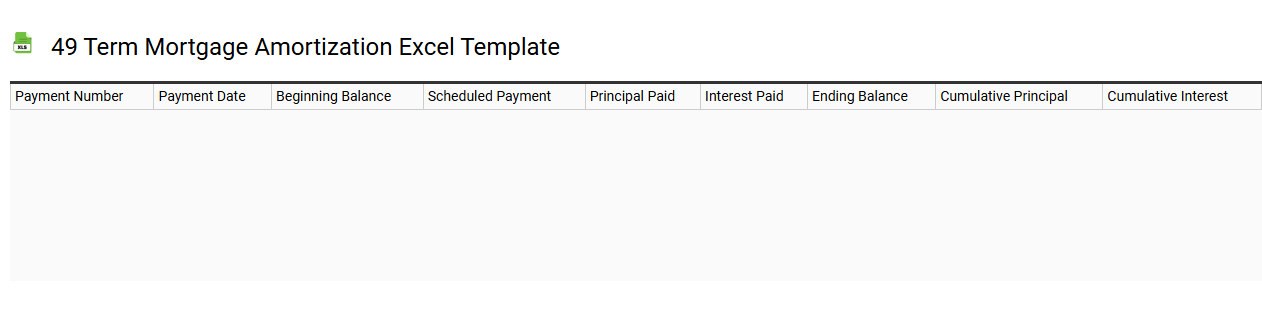

49 term mortgage amortization Excel template

💾 49 term mortgage amortization Excel template template .xls

A 49-term mortgage amortization Excel template serves as a financial tool to plan and manage long-term mortgage payments over a duration of 49 years. This template typically includes columns for the loan amount, interest rate, monthly payment amount, principal balance, and breakdown of each payment into interest and principal components. You can visualize how your mortgage balance decreases over time, making it easier to track progress and understand payment schedules. Whether you're analyzing basic mortgage terms or considering advanced refinancing strategies, this template can adapt to your evolving financial needs.

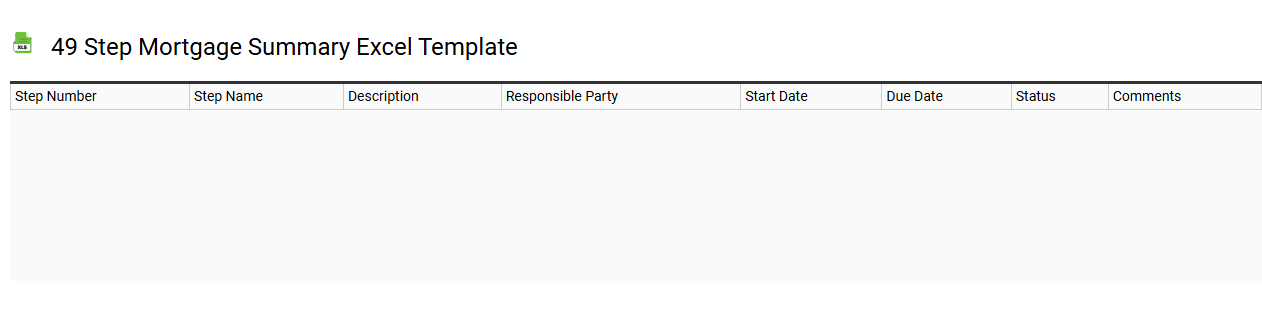

49 step mortgage summary Excel template

💾 49 step mortgage summary Excel template template .xls

The 49-step mortgage summary Excel template is a detailed financial tool designed to help you navigate the complex process of securing a mortgage. It typically includes sections for inputting personal information, loan specifics, and a breakdown of various costs associated with homebuying, such as interest rates, monthly payments, and closing costs. You can also find formulas that automatically calculate totals and visualize data through graphs, making it easy to compare different loan options. This template can serve not only as a foundational budgeting tool but also allows for more advanced analysis, such as amortization schedules and sensitivity analysis to assess how changes in interest rates might affect your payments.

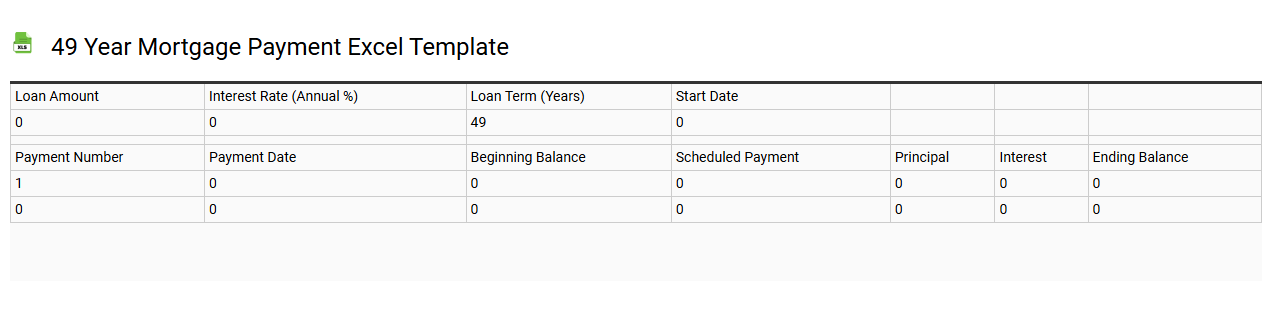

49 year mortgage payment Excel template

💾 49 year mortgage payment Excel template template .xls

A 49-year mortgage payment Excel template is a customizable spreadsheet designed to help you calculate monthly payments for a mortgage with a term of 49 years. This tool incorporates key variables such as loan amount, interest rate, and the frequency of payments, providing a clear overview of your financial commitment. You can visually track the amortization schedule, detailing how much of each payment goes towards interest versus principal over time. This template can be particularly useful for projecting long-term financial strategies and assessing affordability, guiding you in planning for potential upgrades or refinancing options in the future.

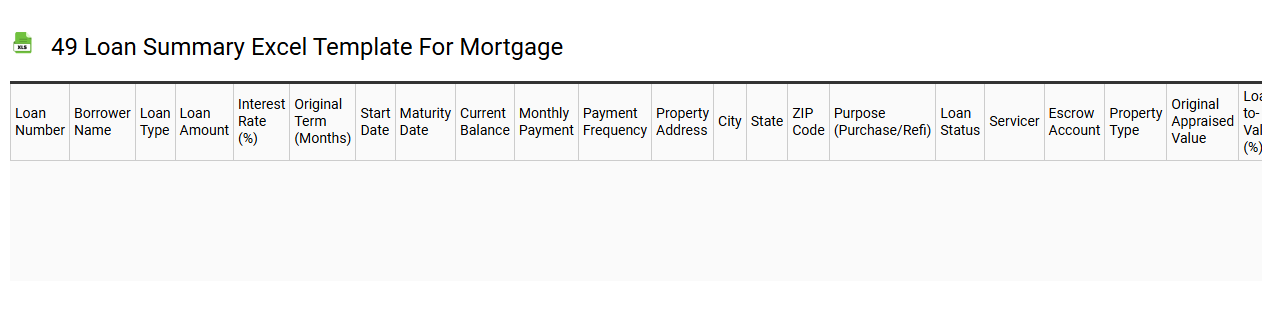

49 loan summary Excel template for mortgage

💾 49 loan summary Excel template for mortgage template .xls

The 49 loan summary Excel template for mortgage provides a comprehensive overview of your loans, featuring detailed sections for tracking principal amounts, interest rates, payment schedules, and remaining balances. Each loan entry allows you to input start dates, terms, and monthly payments, facilitating easy calculations of total costs and interest paid over time. The user-friendly layout includes customizable graphs to visualize your debt reduction progress and financial trajectory. You can utilize this template for basic mortgage tracking or expand its capabilities with advanced features like amortization schedules and payment calculators for more in-depth financial planning.

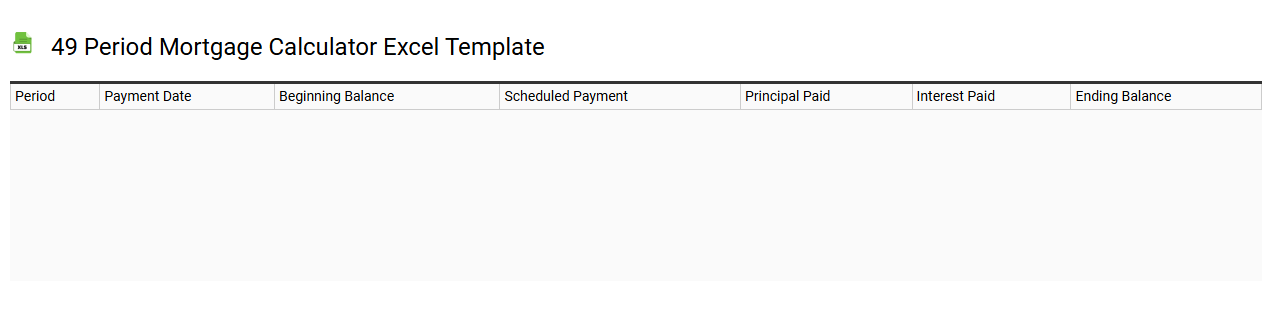

49 period mortgage calculator Excel template

💾 49 period mortgage calculator Excel template template .xls

A 49-period mortgage calculator Excel template is a tool designed for calculating mortgage payments over a 49-year term. You can input variables such as loan amount, interest rate, and payment frequency to derive monthly or bi-weekly payment figures. This template also includes built-in functions to analyze the amortization schedule, showing how principal and interest payments are distributed over time. Understanding this essential data can assist you in making informed financial decisions and projecting future investment needs, whether you're considering simple monthly payments or exploring more complex structures like adjustable-rate mortgages or investment properties.

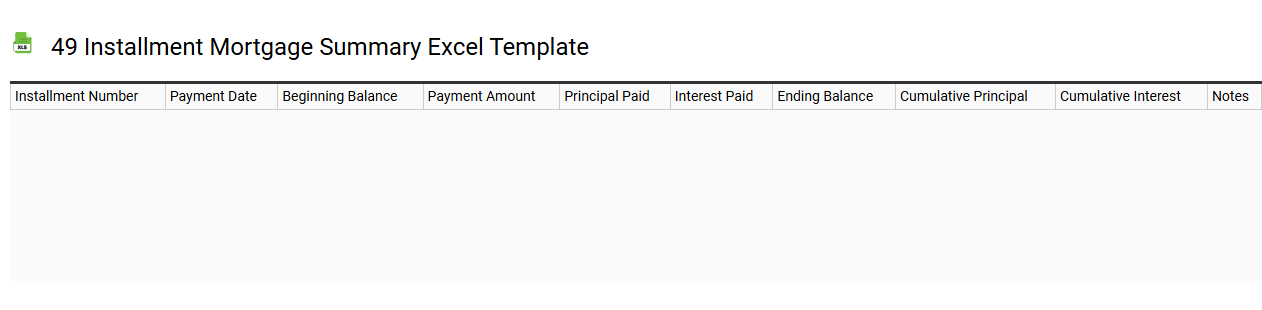

49 installment mortgage summary Excel template

💾 49 installment mortgage summary Excel template template .xls

A 49 installment mortgage summary Excel template provides a structured framework for tracking mortgage payments over a specified period. This easy-to-use spreadsheet typically includes sections for loan amount, interest rate, monthly payment, remaining balance, and total interest paid. It allows you to visualize your payment schedule, helping you understand how much equity you're building in your home over time. Whether you're managing a straightforward mortgage or planning for advanced strategies such as refinancing or additional principal payments, this template can adapt to meet your financial planning needs.

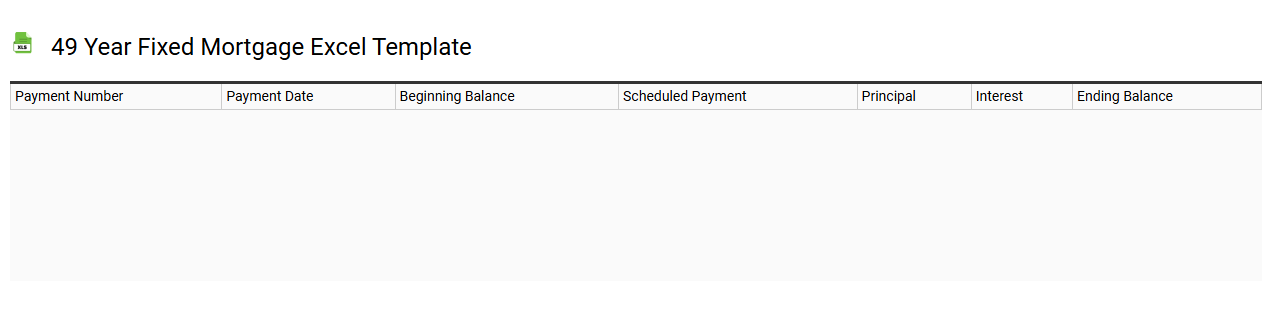

49 year fixed mortgage Excel template

💾 49 year fixed mortgage Excel template template .xls

A 49-year fixed mortgage Excel template is a financial tool designed to help you visualize and manage a long-term mortgage repayment plan. This template typically includes fields for inputting loan amount, interest rate, and start date, automatically calculating monthly payments, total interest paid, and remaining balance over time. Key features often encompass an amortization schedule, showcasing how payments are allocated between principal and interest, along with a cumulative interest cost chart for a comprehensive perspective. You can tailor this template to fit various scenarios, which can be beneficial for advanced planning, such as considering bi-weekly payments or evaluating the impact of additional principal repayments on your long-term financial strategy.