Explore a range of free Excel templates designed specifically for calculating home equity loans. These templates provide user-friendly interfaces where you can input your home value, outstanding mortgage balance, and desired loan amount to determine monthly payments and interest rates. Benefit from tools that help you visualize your financial obligations and potential savings, making it easier to make informed decisions about your home equity options.

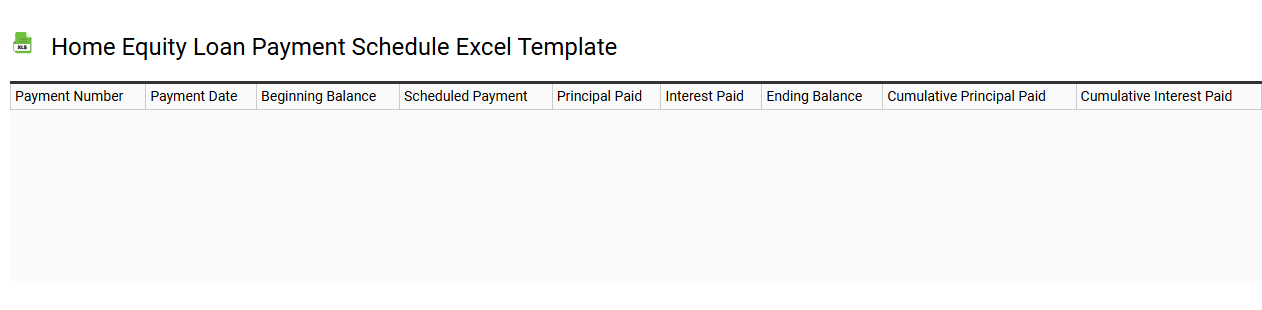

Home equity loan payment schedule Excel template

💾 Home equity loan payment schedule Excel template template .xls

A Home Equity Loan Payment Schedule Excel template is a structured spreadsheet designed to help homeowners manage and track their home equity loan payments. This template typically includes sections for the loan amount, interest rate, term, monthly payment calculations, payment dates, and remaining balance over time. Users can input relevant loan details, allowing the spreadsheet to automatically compute payment schedules and visualize the amortization process. This tool assists you in understanding your financial obligations and planning for future payments, including consideration for refinancing or leveraging for additional investments in property or other endeavors.

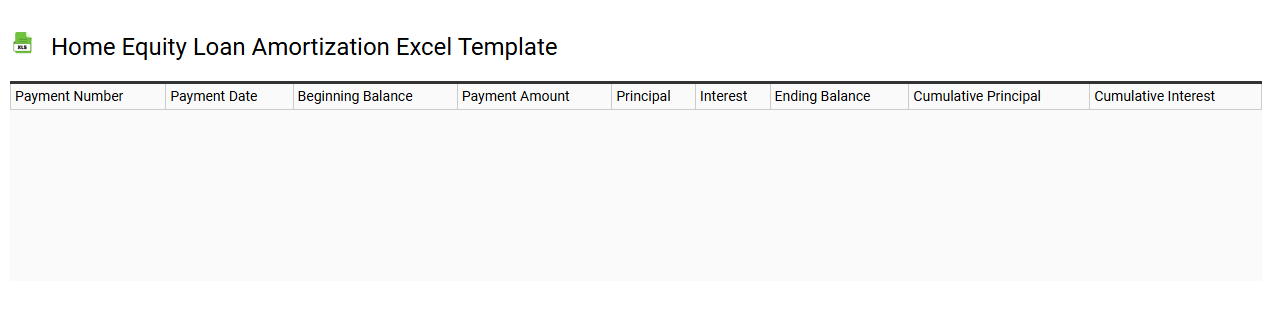

Home equity loan amortization Excel template

💾 Home equity loan amortization Excel template template .xls

A Home Equity Loan Amortization Excel template is a structured spreadsheet designed to help you calculate and visualize the repayment schedule of a home equity loan. It typically features key elements such as loan amount, interest rate, loan term, and monthly payment calculations. You can easily input your specific loan details and see how much you'll pay in principal and interest each month, alongside a full amortization table showing the breakdown over time. This handy tool can assist in planning your budget and managing your finances, while also accommodating advanced calculations, like early payoff scenarios or tax implications on interest deductions.

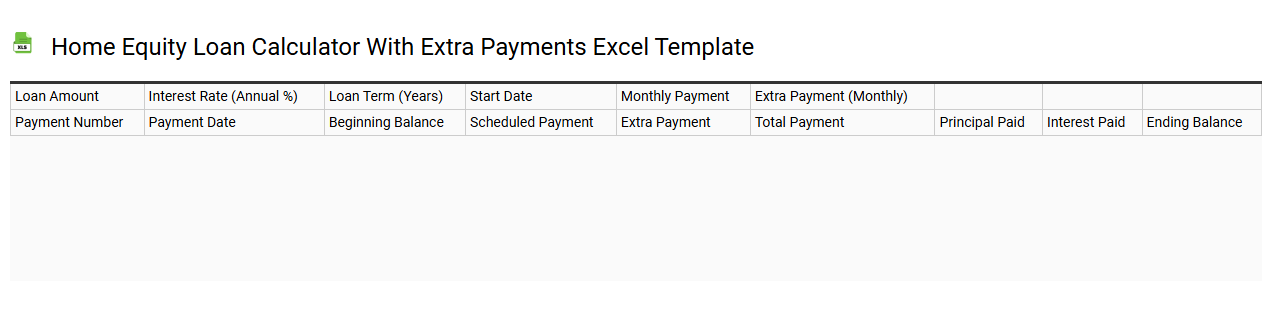

Home equity loan calculator with extra payments Excel template

💾 Home equity loan calculator with extra payments Excel template template .xls

A Home Equity Loan Calculator with extra payments Excel template is a financial tool designed to help homeowners assess the impact of taking out a home equity loan. This template allows you to input your loan details, including the principal amount, interest rate, and term length, while also factoring in any extra payments you plan to make. This feature enables you to see how additional payments can reduce the overall interest paid and shorten the loan term. By visualizing various payment scenarios, you gain insights into the potential savings and allocate your budget effectively, which is beneficial for both current needs and long-term financial planning involving amortization schedules or refinancing options.

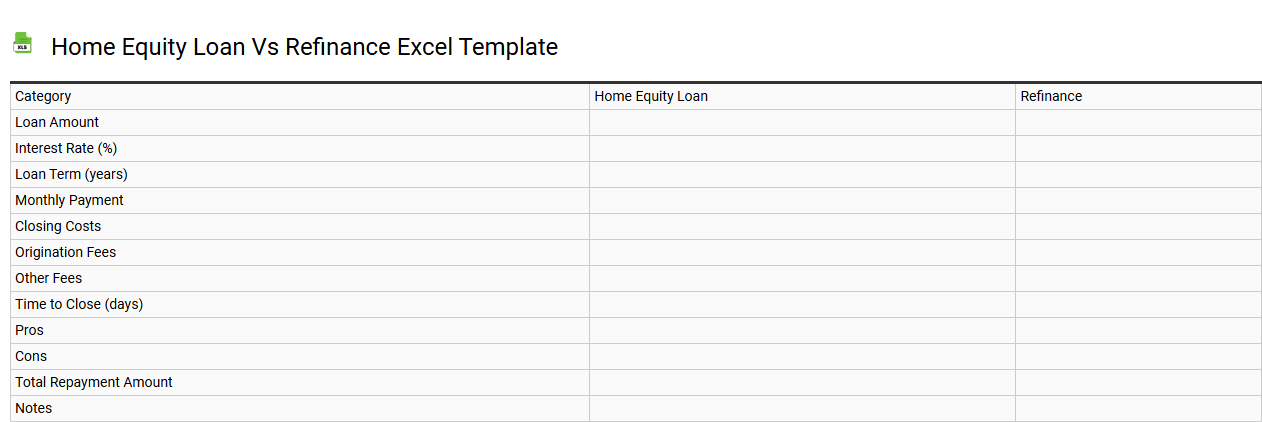

Home equity loan vs refinance Excel template

💾 Home equity loan vs refinance Excel template template .xls

A Home Equity Loan allows you to borrow against the equity built up in your home, providing a lump sum of cash that can be used for various purposes, such as home improvements, debt consolidation, or education expenses. In contrast, refinancing replaces your existing mortgage with a new loan, potentially lowering your interest rate or changing the loan term to reduce monthly payments. The Excel template for comparing these options typically includes calculations for interest rates, monthly payment amounts, closing costs, and overall costs throughout the loan period. You can utilize this template to evaluate your financial situation and determine the most beneficial option, whether seeking immediate cash or long-term savings on your mortgage payments.

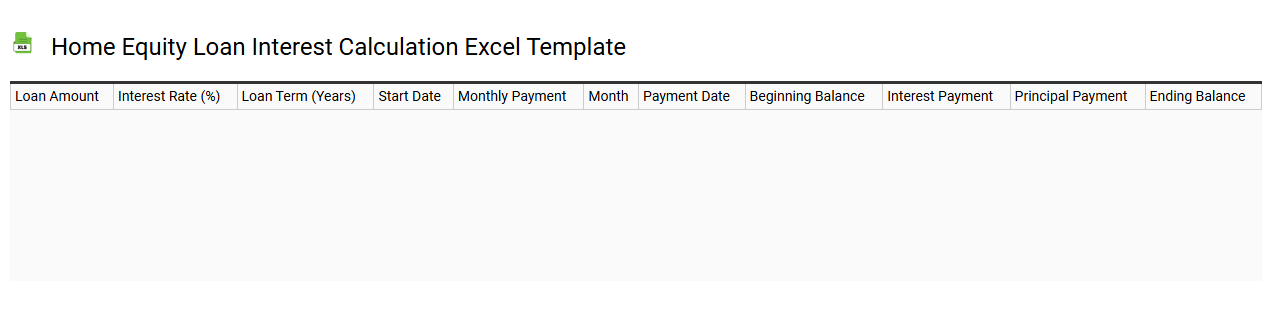

Home equity loan interest calculation Excel template

💾 Home equity loan interest calculation Excel template template .xls

A Home Equity Loan Interest Calculation Excel template serves as a valuable tool for homeowners looking to manage their finances effectively. This template typically includes fields for loan amount, interest rate, loan term, and repayment frequency, allowing your calculations to adapt to various scenarios. With this structured format, you can easily visualize the total interest paid over the life of the loan and understand the impact of different interest rates on monthly payments. By using this template, you can also explore more complex financial strategies, such as tax implications and amortization schedules, to fully leverage your home equity for future investments or renovations.

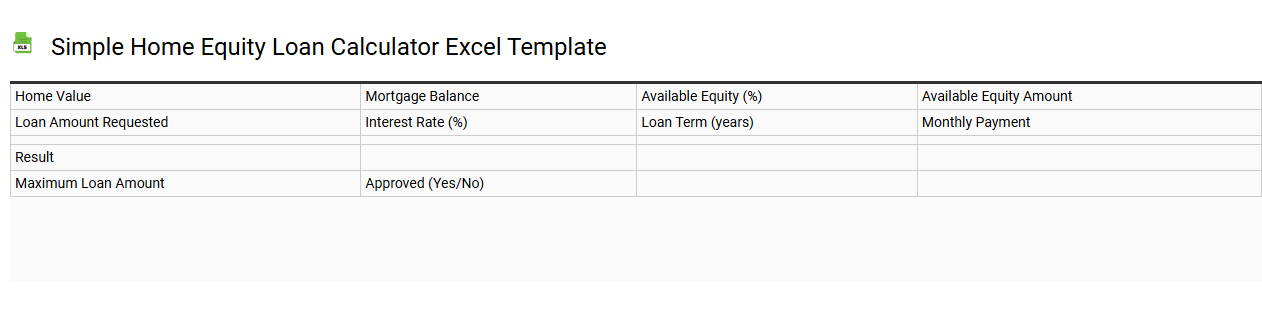

Simple home equity loan calculator Excel template

💾 Simple home equity loan calculator Excel template template .xls

A Simple Home Equity Loan Calculator Excel template is a user-friendly spreadsheet designed to help homeowners determine the potential loan amount they can access against their home's equity. Using basic inputs such as home value, existing mortgage balance, and desired loan terms, the calculator displays key figures including available equity and monthly payments. This tool simplifies the complex calculations involved in assessing home equity loans, making it accessible for anyone considering borrowing against their property. For further potential needs, this template can be expanded to include advanced features like interest rate fluctuations, amortization schedules, or tax implications.

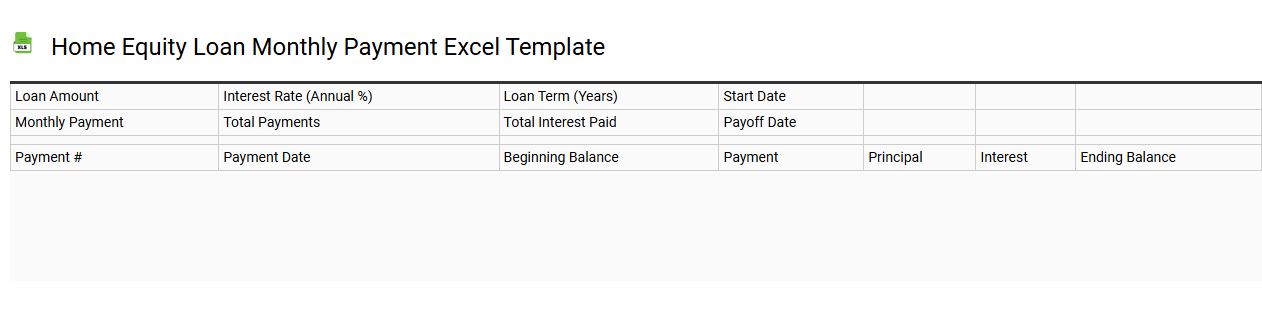

Home equity loan monthly payment Excel template

💾 Home equity loan monthly payment Excel template template .xls

A Home Equity Loan Monthly Payment Excel template simplifies the process of calculating your monthly payments. This tool typically includes inputs for the loan amount, interest rate, and loan term in years, allowing for immediate results in the form of a scheduled payment. Graphs and tables may display total interest paid over the life of the loan and principal repayment, offering a clear financial overview. You can use this template for basic calculations but may expand it for advanced financial modeling involving varying interest rates or additional fees.

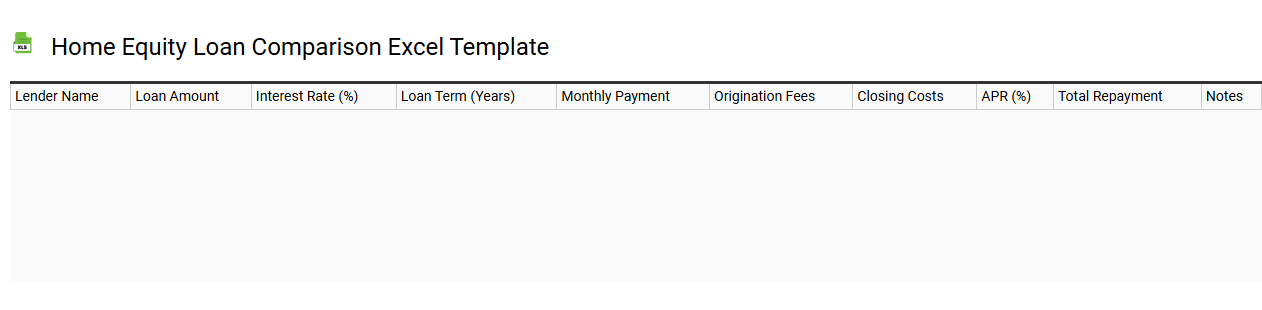

Home equity loan comparison Excel template

💾 Home equity loan comparison Excel template template .xls

A Home Equity Loan Comparison Excel template allows you to evaluate different home equity loan options by organizing and comparing key financial metrics. This tool typically includes columns for loan amounts, interest rates, monthly payments, and terms, enabling easy visual comparisons. You can adjust variables to forecast different scenarios, helping you determine which loan best meets your financial needs. Whether you're seeking basic insights or deeper analysis involving amortization schedules and tax implications, this template can enhance your decision-making process.

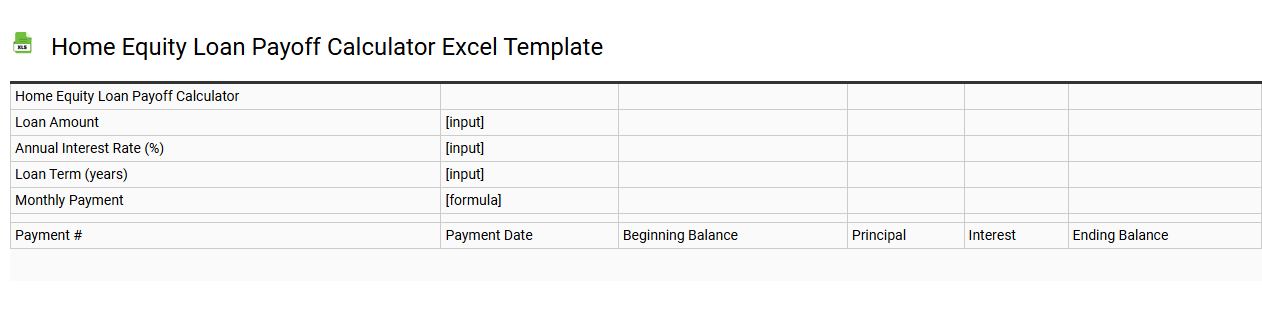

Home equity loan payoff calculator Excel template

💾 Home equity loan payoff calculator Excel template template .xls

A Home Equity Loan Payoff Calculator Excel template provides a structured way to estimate how long it will take to pay off a home equity loan. Users can input their loan details, including the principal amount, interest rate, and monthly payment, to see how much interest will accumulate and when the balance will reach zero. The template often includes visual graphs to illustrate the amortization schedule, enabling you to track your progress over time. This tool proves essential for budgeting and understanding your financial commitments, while advanced users may benefit from integrating scenarios for variable interest rates or additional payments.